Asia Pacific Fertilizers Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Crop Type, Mode of Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Fertilizers Market Size

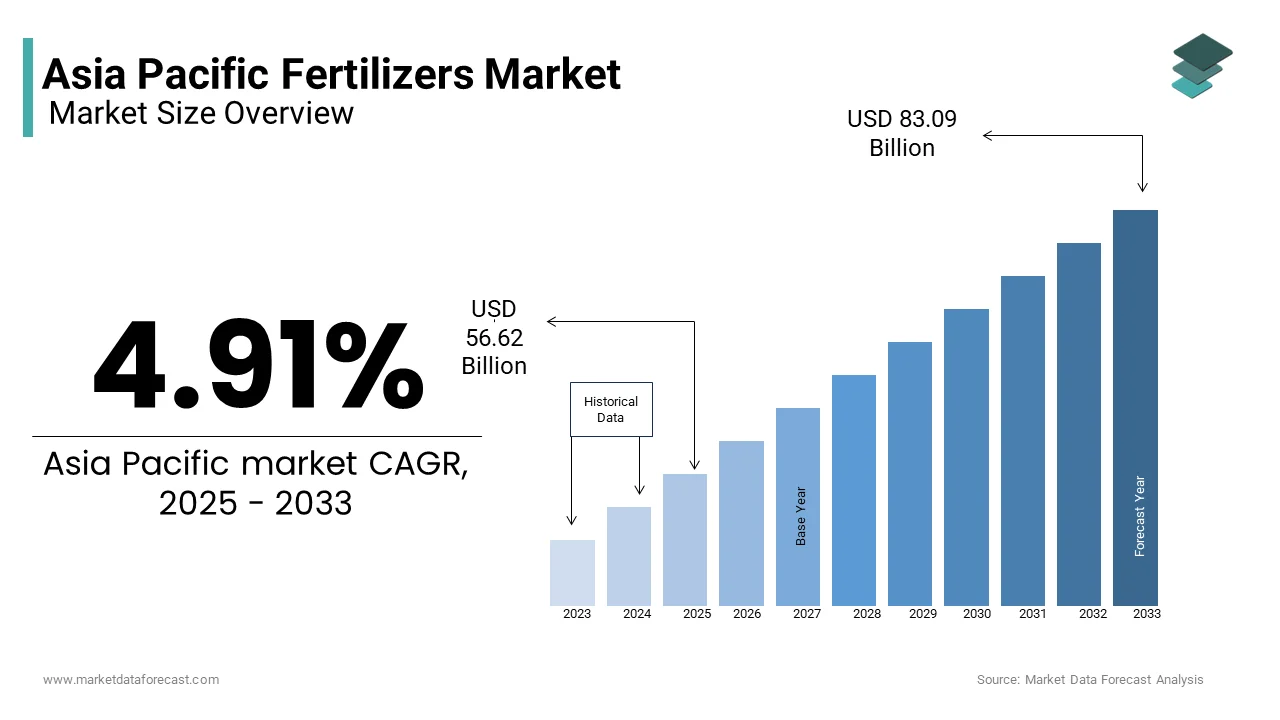

The Asia Pacific fertilizers market size was valued at USD 53.96 billion in 2024 and is anticipated to reach USD 56.62 billion in 2025 from USD 83.09 billion by 2033, growing at a CAGR of 4.91% during the forecast period from 2025 to 2033.

Current Scenario Of The Asia Pacific Fertilizer Market

Fertilizers play an indispensable role in enhancing soil fertility, boosting crop yields, and ensuring food security for a population that exceeds 4.3 billion people, according to the United Nations Population Division. The region's diverse agro-climatic zones, ranging from the fertile plains of India to the rice paddies of Southeast Asia, necessitate tailored fertilizer solutions to address varying soil and crop requirements.

MARKET DRIVERS

Rising Food Demand Due to Population Growth

The surging population in the Asia Pacific region is a primary driver of fertilizer demand, as agricultural productivity must keep pace with the needs of an expanding populace. This demographic shift necessitates higher crop yields, which can only be achieved through the judicious use of fertilizers.

Countries like Bangladesh and Vietnam have witnessed significant increases in agricultural output, directly linked to improved fertilizer application techniques. As per the International Rice Research Institute, Vietnam’s adoption of balanced fertilization practices has led to an increase in rice yields over the past decade. Governments are also playing a pivotal role by subsidizing fertilizers to make them affordable for smallholder farmers, thereby ensuring widespread adoption.

Government Support and Subsidy Programs

Government intervention in the form of subsidies and support programs is another key driver propelling the Asia Pacific fertilizer market. In countries like India, the government allocates substantial funds to ensure affordable access to fertilizers for millions of farmers. Such initiatives are crucial in regions where agriculture remains the primary livelihood for a significant portion of the population. China, too, has implemented policies to stabilize fertilizer prices. These measures include price controls and direct financial assistance to manufacturers, ensuring a steady supply of fertilizers even during periods of global volatility.

MARKET RESTRAINTS

Environmental Degradation and Regulatory Pressures

One of the most pressing restraints on the Asia Pacific fertilizer market is the environmental impact associated with excessive or improper fertilizer use. Runoff from nitrogen and phosphorus-based fertilizers often contaminates water bodies, leading to eutrophication and loss of aquatic biodiversity. According to the Asian Development Bank, a substantial portion of freshwater resources in the region are at risk of pollution due to agricultural runoff, posing a significant ecological challenge. This issue has prompted governments to introduce stringent regulations aimed at curbing overuse.

Dependence on Imported Raw Materials

Another significant restraint is the region’s heavy reliance on imported raw materials such as potash and phosphate rock, which are essential for fertilizer production. According to the United States Geological Survey, countries like Japan and South Korea lack domestic reserves of these critical inputs, forcing them to depend on imports from Canada, Morocco, and Russia. This dependency exposes the market to price fluctuations and geopolitical uncertainties, creating supply chain vulnerabilities.

MARKET OPPORTUNITIES

Adoption of Precision Agriculture Technologies

The integration of precision agriculture technologies presents a transformative opportunity for the Asia Pacific fertilizer market. These innovations enable farmers to apply fertilizers more efficiently, minimizing waste and maximizing crop yields. Tools such as GPS-guided tractors, soil sensors, and drone-based monitoring systems allow for targeted nutrient application, addressing specific soil deficiencies. According to the Consultative Group on International Agricultural Research, precision agriculture could reduce fertilizer overuse, significantly lowering environmental impacts while improving profitability. Countries like Australia and Japan are at the forefront of adopting these technologies, supported by government-funded research initiatives. For instance, the Australian Centre for Precision Agriculture has developed advanced mapping tools that help farmers optimize fertilizer distribution.

Growing Demand for Biofertilizers

The increasing popularity of biofertilizers represents another promising avenue for growth in the Asia Pacific market. Biofertilizers, derived from natural sources like bacteria, fungi, and algae, offer a sustainable alternative to chemical fertilizers. They enhance soil health, improve nutrient uptake, and reduce dependency on synthetic inputs. According to the Indian Council of Agricultural Research, the use of biofertilizers can increase crop yields by 10-25% by making them an attractive option for environmentally conscious farmers. India and China are leading the charge in biofertilizer adoption, driven by supportive policies and rising awareness of sustainable farming practices. For example, the

MARKET CHALLENGES

Price Volatility and Economic Uncertainty

Price volatility poses a significant challenge to the Asia Pacific fertilizer market, driven by fluctuating energy costs and geopolitical tensions. Fertilizer production is energy-intensive, with natural gas serving as a key input for nitrogen-based fertilizers. According to the International Energy Agency, the global spike in natural gas prices during 2022 led to a sharp increase in fertilizer costs, severely impacting affordability for farmers. This volatility creates uncertainty in the supply chain, making it difficult for stakeholders to plan and invest effectively. Smallholder farmers in low-income countries like Nepal and Cambodia are particularly vulnerable, as they lack the financial resilience to absorb sudden price hikes. Also, inflationary pressures exacerbate the situation, reducing purchasing power and dampening overall demand.

Limited Awareness and Training Among Farmers

A persistent challenge in the Asia Pacific fertilizer market is the limited awareness and training among farmers regarding optimal fertilizer usage. Many smallholder farmers rely on traditional methods, often applying fertilizers indiscriminately, which leads to inefficiencies and environmental harm. According to the International Fund for Agricultural Development, a significant number of farmers in Southeast Asia lack formal training on modern agricultural practices, leaving them ill-equipped to adopt advanced techniques. This knowledge gap is particularly pronounced in rural areas, where access to extension services and educational resources is limited. For instance, in Indonesia, the lack of trained agronomists has hindered the dissemination of best practices, as noted by the Indonesian Agency for Agricultural Research and Development.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.91% |

|

Segments Covered |

By Type, Crop Type, Mode Of Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

ICL (Israel), Yara (Norway), K+S Aktiengesellschaft (Germany), Nutrien (Canada), Mosaic (US), CF Industries Holdings, Inc. (US), Grupa Azoty (Poland), SQM S.A. (Chile), OCP (Morocco), Syngenta Group (Switzerland), Saudi Basic Industries Corporation (Saudi Arabia), Koch IP Holdings, LLC (US), Haifa Negev technologies LTD (Israel), EuroChem Group (Switzerland), Lallemand Inc (Canada), IPL Biologicals (India), BIONEMA (UK), Multiplex Group of Companies (India), Vise Organic (India), Kula Bio, Inc. (US), Switch Bioworks (US), AgroLiquid (US), Rovensa Next (Spain), AgriLife (India), Gênica (Brazil). |

SEGMENTAL ANALYSIS

By Type Insights

The chemical fertilizers segment prevailed in the Asia Pacific fertilizer market by holding a substantial portion of the total market share. This influence is propelled by their widespread adoption in high-yield agriculture, particularly for staple crops like rice, wheat, and maize. One key factor fueling this growth is the affordability and immediate nutrient availability of chemical fertilizers, which are critical for smallholder farmers operating on tight budgets. A further driving force is government intervention through subsidies and price stabilization programs. Apart from these, advancements in manufacturing technologies have reduced production costs, further strengthening the dominance of chemical fertilizers in the market.

The biofertilizers segment is projected to grow at a CAGR of 14.7% and is driven by increasing awareness of sustainable farming practices and environmental concerns. A major driver of this growth is the rising demand for organic produce, particularly among urban consumers in countries like Japan and South Korea. According to the Organic Agriculture Research Institute, sales of organic food in these nations grew in 2022, reflecting a shift toward eco-friendly agricultural inputs. Another significant factor is government support for green agriculture initiatives. In China, the Ministry of Agriculture and Rural Affairs has launched programs to promote microbial fertilizers, aiming to reduce chemical dependency by 20% by 2030. The segment’s rapid expansion is also fueled by investments in research and development, enabling manufacturers to enhance product efficacy and market penetration.

By Crop Type Insights

The cereals and grains represented the largest crop type by accounting for 60.4% of fertilizer consumption in the Asia Pacific region. This dominance is attributed to the region’s reliance on staple crops like rice, wheat, and maize, which form the dietary foundation for billions. Governments play a pivotal role in promoting fertilizer use for cereals, as highlighted by India’s Pradhan Mantri Krishi Sinchayee Yojana, which subsidizes fertilizers for grain farmers. Another driving factor is the shrinking availability of arable land, forcing farmers to maximize yields per hectare.

The fruits and vegetables segment is the rapidly advancing crop type, with a projected CAGR of 9.2%. This progress is influenced by changing consumer preferences, particularly the rising demand for fresh produce in urban areas. According to the World Health Organization, per capita fruit and vegetable consumption in the Asia Pacific has increased over the past five years, driven by health-conscious lifestyles. Farmers are responding by intensifying fertilizer use to meet market demands. Advancements in fertigation technologies are another key driver, enabling precise nutrient delivery for high-value crops. In Thailand, the Department of Agriculture reports that fertigation systems have improved mango and lychee yield.

By Mode of Application Insights

The soil application accounted for a substantial share of fertilizer usage in the Asia Pacific market and is supported by its simplicity and compatibility with conventional farming practices. One key factor behind its dominance is the widespread cultivation of field crops like rice and wheat, which rely heavily on soil-applied fertilizers for nutrient uptake. According to the Consultative Group on International Agricultural Research, soil application remains the most cost-effective method for large-scale agriculture, particularly in countries like Vietnam and Indonesia. Another contributing factor is the availability of mechanized equipment designed for soil fertilization.

The fertigation segment is the fastest-growing mode of application, with a CAGR of 12.8%, and is propelled by advancements in precision agriculture and the rising popularity of high-value crops. A major factor propelling this growth is the integration of irrigation systems with nutrient delivery, enabling farmers to optimize resource utilization. According to the Australian Centre for Precision Agriculture, fertigation can reduce fertilizer wastage, making it an attractive option for water-scarce regions like Australia and Central Asia. Government initiatives also play a crucial role in promoting fertigation. In Malaysia, the Department of Agriculture provides subsidies for drip irrigation systems, encouraging farmers to adopt fertigation for crops like durian and papaya.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China held the largest market share at 35.3%. It is driven by its status as the world’s largest producer and consumer of fertilizers. The country’s vast agricultural sector relies heavily on nitrogen and phosphate fertilizers to sustain cereal production, as outlined by the Chinese Ministry of Agriculture. Also, China’s strategic investments in fertilizer manufacturing facilities have enabled it to meet domestic demand while exporting surplus to neighboring countries.

India is an attractive market and is supported by robust government subsidies and a growing agricultural economy. The Indian government spends a substantial amount annually on fertilizer subsidies, ensuring affordability for millions of smallholder farmers. This financial backing, combined with initiatives like soil health cards, has cemented India’s position as a key player in the regional market.

Japan is viewed as a key player in the Asia Pacific market, which is characterized by a strong emphasis on sustainability and innovation. The Japanese Ministry of Agriculture promotes biofertilizers and organic farming practices, aligning with consumer preferences for eco-friendly produce. Its advanced fertigation technologies also contribute to its place in precision agriculture.

Australia is witnessing a descent growth in the market, which is driven by its focus on high-value crops like fruits and vegetables. The adoption of fertigation systems and precision agriculture tools has positioned Australia as a leader in efficient fertilizer application. The Australian government’s support for sustainable farming further bolsters its market standing.

Indonesia accounts for a smaller share of the market, which is supported by its extensive rice cultivation and dependence on chemical fertilizers. The Indonesian Agency for Agricultural Research and Development notes the critical role of fertilizers in boosting rice yields, showcasing their importance in the nation’s agricultural landscape.

KEY MARKET PLAYERS

ICL (Israel), Yara (Norway), K+S Aktiengesellschaft (Germany), Nutrien (Canada), Mosaic (US), CF Industries Holdings, Inc. (US), Grupa Azoty (Poland), SQM S.A. (Chile), OCP (Morocco), Syngenta Group (Switzerland), Saudi Basic Industries Corporation (Saudi Arabia), Koch IP Holdings, LLC (US), Haifa Negev technologies LTD (Israel), EuroChem Group (Switzerland), Lallemand Inc (Canada), IPL Biologicals (India), BIONEMA (UK), Multiplex Group of Companies (India), Vise Organic (India), Kula Bio, Inc. (US), Switch Bioworks (US), AgroLiquid (US), Rovensa Next (Spain), AgriLife (India)an Gênica (Brazil). are the market players that are dominating the Asia Pacific fertilizers market.

Top Players in the Market

Nutrien Ltd.

Nutrien Ltd. is a global leader in the fertilizer industry, with a significant presence in the Asia Pacific market. The company’s extensive product portfolio includes nitrogen, phosphate, and potash fertilizers, catering to diverse agricultural needs. Nutrien’s contribution to the global market lies in its ability to provide high-quality inputs while promoting sustainable farming practices.

Yara International ASA

Yara International is renowned for its cutting-edge research and development in fertilizer technology. The company focuses on producing eco-friendly fertilizers that align with global sustainability goals. Yara’s expertise in precision agriculture has enabled farmers in the Asia Pacific region to optimize nutrient use, reducing waste and environmental impact. By collaborating with governments and NGOs, Yara promotes knowledge-sharing initiatives, empowering farmers with best practices.

Coromandel International Ltd.

Coromandel International is a key player in the Asia Pacific fertilizer market, known for its tailored solutions for smallholder farmers. The company offers a wide range of fertilizers, including biofertilizers and water-soluble variants, addressing the specific needs of crops in diverse agro-climatic zones. Coromandel’s focus on affordability and accessibility has made it a trusted brand among farmers in India and neighboring countries.

Top Strategies Used by Key Market Participants

Sustainability Initiatives and Green Product Development

Leading players are prioritizing sustainability by developing eco-friendly fertilizers, such as biofertilizers and slow-release formulations. These products reduce environmental impact while meeting regulatory requirements. Companies are also adopting circular economy principles, recycling agricultural waste into nutrient-rich inputs.

Digital Transformation and Farmer Engagement

Digital tools and platforms are being leveraged to engage directly with farmers. Mobile applications and online portals provide personalized recommendations based on soil health and crop requirements. This approach improves customer satisfaction and fosters loyalty. Also, virtual training programs educate farmers on optimal fertilizer usage, ensuring higher adoption rates and better outcomes.

Strategic Partnerships and Joint Ventures

Collaborations with governments, research institutions, and local distributors are helping companies expand their reach and influence. Joint ventures enable firms to establish manufacturing facilities in emerging markets, reducing costs and improving supply chain efficiency.

COMPETITION OVERVIEW

The Asia Pacific fertilizer market is marked by intense competition, driven by the presence of multinational corporations and regional players vying for dominance. Global giants leverage their technological expertise and extensive distribution networks to maintain leadership, while local manufacturers focus on affordability and customization to meet specific regional demands. Environmental regulations and consumer preferences for sustainable products have intensified rivalry, pushing companies to innovate and differentiate themselves. The rise of digital platforms and e-commerce has further amplified competition, as firms strive to enhance online visibility and customer engagement. Strategic alliances with governments and NGOs play a crucial role in shaping the competitive landscape, enabling companies to align with regional sustainability goals.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Nutrien Ltd. partnered with the Indonesian Ministry of Agriculture to launch a nationwide campaign promoting sustainable fertilizer practices. This initiative aims to educate farmers on optimizing nutrient use while minimizing environmental impact.

- In May 2024, Yara International acquired a Singapore-based startup specializing in AI-driven precision agriculture tools. This acquisition enhances Yara’s ability to provide data-driven fertilizer solutions to farmers across the region.

- In July 2024, Coromandel International introduced a new line of biofertilizers tailored for organic farming in India. These products cater to the growing demand for eco-friendly agricultural inputs among environmentally conscious farmers.

- In September 2024, Haifa Group established a joint venture with the Thai government to build a state-of-the-art fertilizer production facility near Bangkok. This collaboration aims to address local supply chain challenges while supporting Thailand’s agricultural modernization efforts.

- In November 2024, ICL Group launched a mobile application offering real-time fertilizer recommendations for farmers in Vietnam. The app integrates soil testing data with advanced algorithms to provide actionable insights, enhancing customer satisfaction and loyalty.

MARKET SEGMENTATION

This research report on the Asia Pacific fertilizers market size is segmented and sub-segmented into the following categories.

By Type

- Chemical Fertilizers

- Bio Fertilizers

Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

Mode of Application

- Soil

- Foliar

- Fertigation

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How are changing crop patterns and soil health concerns shaping fertilizer demand across diverse Asia Pacific regions?

Targets the link between agricultural shifts, soil degradation, and region-specific nutrient requirements influencing product development and usage.

What impact are government subsidy policies and import-export regulations having on fertilizer pricing and farmer accessibility in the region?

Digs into how state interventions affect cost structures, local production incentives, and cross-border trade dynamics.

How are farmers in emerging Asia Pacific economies adopting specialty fertilizers like slow-release, water-soluble, or bio-based variants?

Explores the market’s shift from commodity fertilizers to high-efficiency alternatives due to climate concerns, education, or yield optimization goals.

What infrastructure and distribution challenges affect last-mile delivery of fertilizers to rural agricultural zones in Asia Pacific?

Highlights logistics bottlenecks, storage issues, and how supply chains vary across countries like India, Indonesia, and Vietnam.

How is climate change influencing fertilizer application practices and product innovation across monsoon-dependent and drought-prone regions?

Addresses how unpredictable weather patterns are forcing changes in formulation, timing, and frequency of application.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]