Asia Pacific Fitness Equipment Market Research Report – Segmented By Distribution Channel (Offline, Online), End-User, Type Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Fitness Equipment Market Size

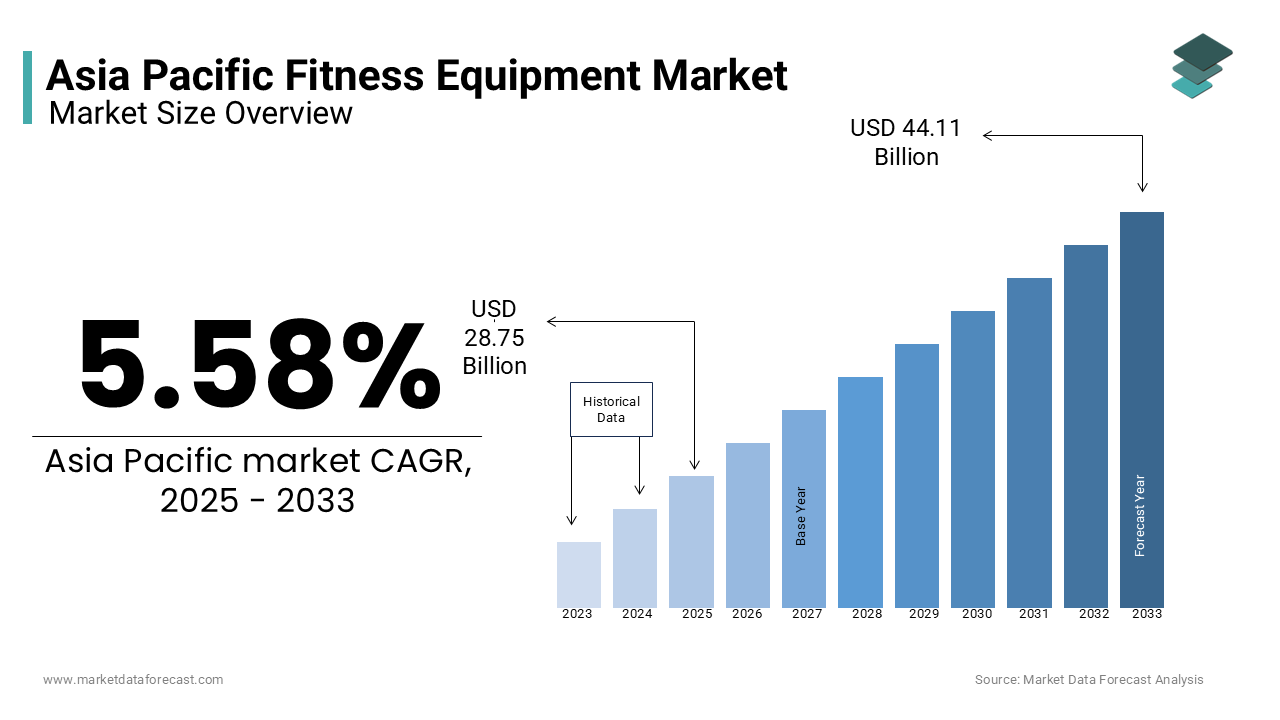

The Asia Pacific Fitness Equipment Market size was estimated at USD 27.22 billion in 2024 and is projected to reach USD 44.11 billion by 2033 from USD 28.75 billion in 2024, growing at a CAGR of 5.58% from 2025 to 2033.

The Asia Pacific fitness equipment market is experiencing robust growth, driven by rising health awareness and lifestyle changes. According to the World Health Organization, over 50% of adults in the region are either overweight or obese, prompting a surge in demand for fitness solutions. Urbanization has played a pivotal role in shaping the market landscape. The rise of digital fitness platforms, such as Peloton and Curefit, has further amplified demand, particularly during the post-pandemic era. Additionally, government initiatives promoting physical activity have bolstered adoption rates.

MARKET DRIVERS

Growing Health Awareness and Lifestyle Changes

A significant driver of the Asia Pacific fitness equipment market is the increasing focus on health and wellness. According to the Global Wellness Institute, the wellness economy in Asia Pacific with fitness being a key component. Rising disposable incomes, particularly in emerging economies like India and Indonesia, have enabled consumers to invest in personal health. For example, India’s middle-class population, expected to reach 600 million by 2030 as per McKinsey, is increasingly prioritizing fitness. This trend is reflected in the growing number of gyms and home workout setups. Furthermore, social media platforms like Instagram and YouTube have popularized fitness influencers, encouraging more individuals to adopt active lifestyles.

Rise of Home Fitness Solutions

The shift toward home-based fitness solutions has emerged as another major driver. In countries like South Korea and Singapore, where space constraints exist, compact and multifunctional equipment such as foldable treadmills and resistance bands gained popularity. For instance, Technogym reported a significant increase in sales of home fitness equipment in South Korea in 2022. Additionally, advancements in technology, such as AI-powered fitness mirrors and virtual coaching apps, have enhanced user engagement.

MARKET RESTRAINTS

High Costs of Premium Equipment

One of the primary restraints of the Asia Pacific fitness equipment market is the high cost of premium products, which limits accessibility for price-sensitive consumers. For instance, in India, over 70% of the population resides in rural areas where purchasing power remains low. Even in urban areas, affordability remains a challenge, with only a small percentage of households investing in high-end fitness solutions. This financial barrier restricts market penetration, particularly in lower-income demographics, limiting overall growth potential.

Space Constraints in Urban Areas

Another restraint is the limited availability of space in densely populated urban centers. According to the United Nations, cities like Tokyo and Manila are among the most densely populated globally, leaving little room for large fitness equipment. This issue is compounded by the prevalence of small apartments, particularly in Southeast Asia, where a significant portion of urban residents live in compact housing units. While compact equipment exists, it often lacks the functionality of larger models, deterring potential buyers. Besides, gym memberships remain a preferred alternative for many urban dwellers, reducing the demand for personal fitness equipment.

MARKET OPPORTUNITIES

Expansion of Digital Fitness Platforms

The integration of digital fitness platforms presents a significant opportunity for the Asia Pacific fitness equipment market. In China, platforms like Keep have amassed over 300 million users, creating a lucrative ecosystem for connected fitness equipment. For instance, Xiaomi’s collaboration with fitness app developers has resulted in smart treadmills that sync with mobile apps, enhancing user experience. Similarly, in Australia, virtual fitness classes have seen an increase in participation since 2021, as per Deloitte. These platforms not only drive equipment sales but also foster brand loyalty, positioning digital integration as a key growth avenue.

Government Initiatives Promoting Physical Activity

Government-led health campaigns offer another promising opportunity. For example, Australia’s “Move It AUS” initiative aims to encourage 5 million inactive Australians to engage in regular physical activity by 2025, as stated by the Department of Health. Similar programs exist in Japan, where the government promotes workplace fitness activities under its “Health Japan 21” strategy. Also, such initiatives can notably increase fitness equipment adoption in participating regions. Additionally, subsidies and tax incentives for fitness-related purchases, like those introduced in South Korea, further stimulate demand.

MARKET CHALLENGES

Intense Market Competition

The Asia Pacific fitness equipment market faces stiff competition, with both global brands and local manufacturers vying for market share. Price wars are common, particularly in price-sensitive markets like India and Indonesia, where profit margins are squeezed. For instance, in Vietnam, aggressive pricing strategies have led to a reduction in average equipment prices over the past two years, as reported by Reuters. Smaller players often lack the resources to match the scale and technological capabilities of established brands, limiting their ability to innovate or expand. This competitive pressure poses a significant challenge to long-term sustainability.

Supply Chain Disruptions

Another challenge is supply chain disruptions caused by geopolitical tensions and logistical bottlenecks. According to the International Chamber of Commerce, the global semiconductor shortage has impacted the production of smart fitness equipment, with Asia Pacific being particularly vulnerable due to its reliance on imported components. Additionally, fluctuations in raw material costs, such as steel and aluminum, have increased manufacturing expenses. Natural disasters, like typhoons in Southeast Asia, further exacerbate delays, disrupting project timelines and increasing operational risks. These challenges not only hinder timely deliveries but also strain relationships with clients, impacting brand reputation and customer loyalty.

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The offline distribution channel dominated the Asia Pacific fitness equipment market by capturing 65% of the total share in 2024. This control over the market is largely attributed to the preference for in-store experiences, particularly in developing economies like India and Indonesia, where consumers value physical product demonstrations before purchasing. For instance, large retail chains such as Decathlon and local gym equipment stores serve as trusted touchpoints for customers. Another key factor is the growing number of fitness centers and gyms across the region. Like, the number of gyms in Asia Pacific increased significantly between 2020 and 2022, fueling demand for commercial-grade equipment sold through offline channels. Also, partnerships between manufacturers and local distributors have strengthened the offline network. For example, Technogym’s collaboration with regional retailers in China has expanded its reach in tier-2 and tier-3 cities, reinforcing the segment’s leadership position.

The online distribution channel segment is the fastest-growing in the Asia Pacific fitness equipment market, with a projected CAGR of 12.5%. This rise is fueled by the increasing penetration of e-commerce platforms and shifting consumer preferences toward convenience. In countries like South Korea and Singapore, where internet penetration is very high, online sales of fitness equipment have surged significantly since 2020. In addition, the rise of digital fitness platforms has further accelerated this trend. For instance, Peloton’s integration with e-commerce portals like Amazon has streamlined access to home fitness solutions. Also, the post-pandemic shift toward home workouts has boosted online sales. A significant share of urban consumers in Australia and Japan now prefer purchasing fitness equipment online due to competitive pricing and doorstep delivery.

By End-user Insights

The fitness centers/gyms segment held the largest share of the Asia Pacific fitness equipment market i.e. 55.4% of the total revenue in 2024. This is caused by the proliferation of gyms and fitness centers in urban areas, particularly in countries like China and India. According to IHRSA, the number of gyms in Asia Pacific grew notably between 2018 and 2022, creating a robust demand for commercial-grade equipment. Government initiatives promoting physical activity have also contributed to the segment’s growth. For example, Japan’s “Health Japan 21” strategy encourages workplace fitness activities, driving investments in corporate gyms. Additionally, the rise of budget gyms like Snap Fitness and Anytime Fitness in Southeast Asia has expanded accessibility, attracting a broader customer base.

The home consumers segment is the swiftest advancing category, with a CAGR of 10.8%. This growth is propelled by the rising trend of home-based workouts, particularly in urban areas. For instance, in South Korea and Singapore, compact home fitness equipment sales grew considerably during the pandemic. Technological advancements have played a pivotal role in this expansion. Smart fitness mirrors and AI-powered equipment have gained popularity among tech-savvy consumers. According to PwC, over 40% of urban households in Australia and Japan own smart fitness devices, reflecting the segment’s rapid adoption. Moreover, the affordability of home equipment compared to gym memberships has attracted price-sensitive consumers.

REGIONAL ANALYSIS

China led the Asia Pacific fitness equipment market with a 40.8% of the total share in 2024. The country’s booming urban population drives demand for both commercial and home fitness solutions. Like, China’s middle-class population is expected to reach 600 million by 2030, boosting spending on health and wellness products. The rise of digital fitness platforms like Keep has further amplified equipment sales, with connected treadmills and bikes gaining traction. Government policies promoting physical activity, such as mandatory workplace fitness programs, also contribute to market growth.

India is accelerating in this market. The growing health awareness and urbanization are key aspects behind its development. A significant percentage of India’s urban population resides in metropolitan cities like Mumbai and Delhi, where gyms and fitness centers are proliferating. Similarly, initiatives like the Fit India Movement have increased fitness equipment adoption by 25% in urban areas. Besides, affordable home fitness solutions cater to price-sensitive consumers, ensuring sustained growth.

Japan remains a key player in the market and is driven by its aging population and emphasis on preventive healthcare. With major portion of the population residing in urban areas, compact home fitness equipment is in high demand. The government’s “Health Japan 21” strategy promotes workplace fitness activities, driving investments in corporate gyms.

Australia’ growth is fueled by its active lifestyle culture and government-led health campaigns, according to the Department of Health. The “Move It AUS” initiative aims to encourage 5 million inactive Australians to engage in regular physical activity by 2025. Urban centers like Sydney and Melbourne are hubs for fitness centers and home equipment sales.

South Korea held a notable share of the market, with a strong focus on technology and innovation. The country’s high internet penetration rate has driven the adoption of smart fitness solutions like AI-powered mirrors and virtual coaching apps. Government subsidies for fitness-related purchases further stimulate demand, ensuring steady growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Johnson Health Tech Co., Ltd. (Matrix Fitness), ICON Health & Fitness, Inc., Technogym S.p.A., Brunswick Corporation (Life Fitness), Precor Incorporated, Dyaco International Inc., Impulse Health Tech Co., Ltd., Cybex International Inc., Core Health & Fitness LLC, and Heinz Kettler GmbH & Co. KG. are some of the key market players.

The Asia Pacific fitness equipment market is highly competitive, driven by the presence of both global giants and regional players. Global leaders like Technogym and Life Fitness dominate through technological superiority and extensive distribution networks, while regional players focus on affordability and localized solutions. Price wars are common, particularly in price-sensitive markets like India and Indonesia, where smaller firms struggle to compete with established brands.

Government policies promoting physical activity have intensified rivalry, as companies race to capture contracts for government-led health initiatives. For instance, budget gyms in Southeast Asia have created a new battleground for affordable equipment suppliers. Additionally, the rise of e-commerce has shifted competition online, with brands vying for visibility on platforms like Amazon and Flipkart. Despite these challenges, the market remains dynamic, with innovation and strategic collaborations serving as key differentiators.

Top Players in the Asia Pacific Fitness Equipment Market

Technogym S.p.A.

Technogym is a global leader in fitness equipment, renowned for its innovative and high-quality products tailored to both home consumers and commercial gyms. The company has established a strong presence in Asia Pacific through strategic partnerships with local distributors and fitness centers. Additionally, the company opened new manufacturing facilities in Vietnam to cater to the growing demand for affordable yet advanced equipment. These initiatives have solidified its reputation as a pioneer in connected fitness.

Johnson Health Tech (JHT)

Johnson Health Tech is a key player in the Asia Pacific market, offering a diverse range of fitness equipment under brands like Horizon and Matrix. The company focuses on affordability and innovation, targeting price-sensitive markets like Indonesia and Thailand. It also partnered with regional fitness chains to supply commercial-grade equipment, expanding its footprint in urban areas.

Life Fitness

Life Fitness is a prominent name in the fitness industry, known for its premium gym equipment designed for commercial use. The company has strengthened its position in Asia Pacific by collaborating with luxury hotels and corporate wellness programs in Japan and Singapore. Life Fitness recently launched its “LF Connect” app, enabling users to track workouts seamlessly. Furthermore, it expanded its service network in India and Malaysia, ensuring better after-sales support.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific fitness equipment market employ diverse strategies to maintain their competitive edge. Innovation is central, with companies investing heavily in R&D to develop smart and AI-enabled equipment. Partnerships and collaborations are another critical strategy; Johnson Health Tech partners with regional fitness chains to supply affordable equipment, while Life Fitness collaborates with luxury hotels to offer premium solutions.

Expansion into emerging markets is also a priority. Companies are establishing manufacturing units and service centers in countries like Vietnam and Thailand to reduce costs and improve accessibility. Additionally, mergers and acquisitions play a pivotal role; Peloton’s acquisition of smaller digital fitness platforms has enabled it to consolidate its presence. Sustainability initiatives are gaining traction, with firms adopting eco-friendly materials and energy-efficient designs to align with government regulations.

RECENT MARKET DEVELOPMENTS

- In March 2023, Technogym launched its MyWellness app in India, integrating wearable devices with fitness equipment. This move aimed to enhance user engagement and expand its digital footprint in the region.

- In May 2023, Johnson Health Tech partnered with Decathlon in Thailand to supply affordable home fitness equipment. This collaboration helped JHT penetrate price-sensitive markets and strengthen brand recognition.

- In July 2023, Life Fitness opened a new service center in Malaysia, offering enhanced after-sales support for commercial clients. This initiative improved customer satisfaction and loyalty in Southeast Asia.

- In September 2023, Peloton acquired a local digital fitness platform in Australia to expand its reach in the home fitness segment. This acquisition bolstered its presence in the rapidly growing online fitness market.

- In November 2023, Precor introduced eco-friendly treadmills in Japan, featuring energy-efficient motors. This aligned with the country’s sustainability goals and positioned Precor as a leader in green fitness solutions.

MARKET SEGMENTATION

This research report on the Asia Pacific fitness equipment market is segmented and sub-segmented into the following categories.

By Distribution Channel

- Offline

- Online

By End-user

- Home Consumers

- Fitness Centers Gyms

- Others

By Type

- Cardiovascular Training Equipment

- Treadmills

- Stationary Cycles

- Elliptical Trainers & Others

- Strength Training Equipment

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the fitness equipment market in Asia Pacific?

The growth is primarily driven by increased health awareness, rising lifestyle-related diseases, growing urbanization, and the surge in home-based fitness post-COVID-19.

What are the major challenges faced by the market?

Challenges include high equipment costs, lack of awareness in rural areas, and competition from alternative fitness formats like yoga and outdoor training.

What is the future outlook for the Asia Pacific Fitness Equipment Market?

The market is expected to grow steadily over the next 5–10 years, driven by rising health awareness, smart fitness trends, and increasing demand for home and commercial equipment.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com