Asia Pacific Flooring Market Research Report – Segmented By Product Types ( Ceramics and Vitrified (Porcelain) , Tiles luxury Vinyl Tiles (LVT)) , Applications and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific Flooring Market Size

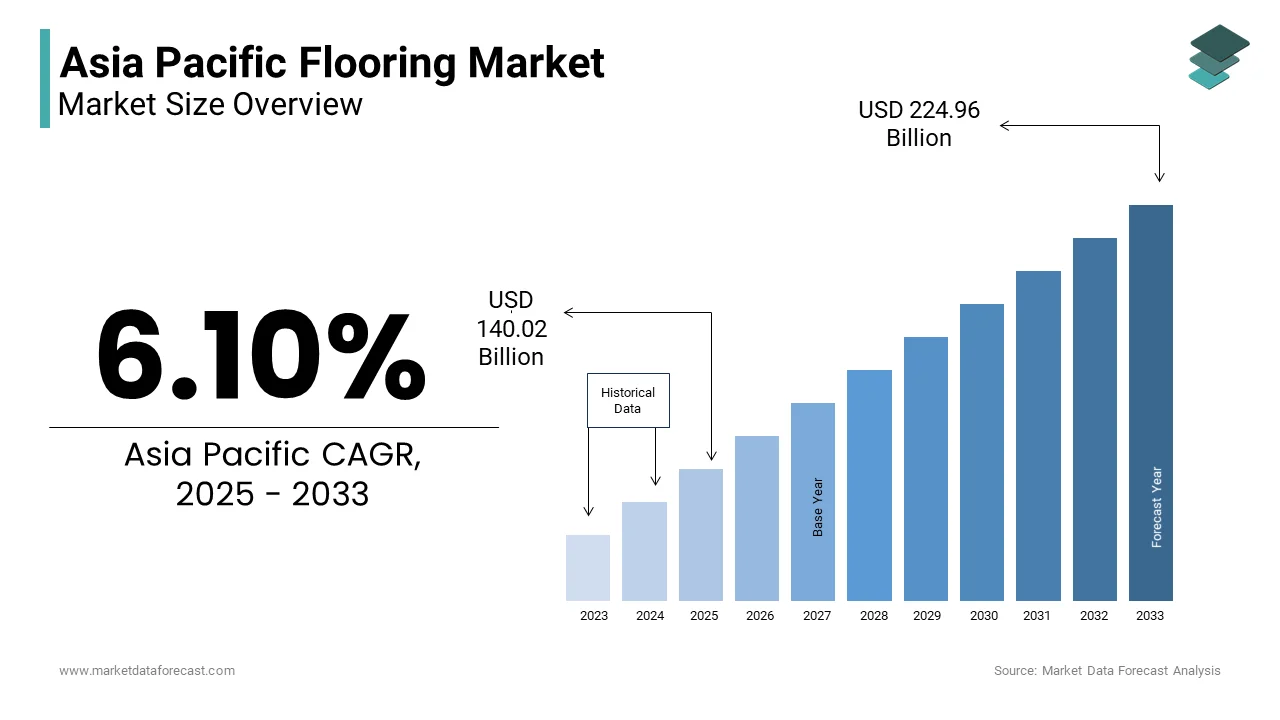

The Asia Pacific Flooring Market Size was valued at USD 131.97 billion in 2024. The Asia Pacific Flooring Market size is expected to have 6.10% CAGR from 2025 to 2033 and be worth USD 224.96 billion by 2033 from USD 140.02 billion in 2025.

Flooring evolved as an essential component of residential, commercial, and industrial spaces and encompasses a wide range of materials such as hardwood, tiles, carpets, vinyl, and laminates. The construction boom of Asia-Pacific, particularly in emerging economies like India, China, and Southeast Asian nations, has significantly bolstered demand for innovative and sustainable flooring solutions. The market is characterized by a blend of traditional craftsmanship and modern technology, catering to diverse climatic conditions and cultural aesthetics. As per the United Nations Department of Economic and Social Affairs, the Asia Pacific region is home to 60% of the global population, with urban areas projected to house over 2.3 billion people by 2035. This demographic shift underscores the growing need for durable and functional flooring options. Additionally, according to the International Energy Agency, energy-efficient buildings are gaining traction, propelling the adoption of eco-friendly flooring materials. Consumer awareness about sustainability and design versatility has further shaped purchasing patterns, making the Asia Pacific flooring market a pivotal player in the global construction ecosystem.

MARKET DRIVERS

Urbanization and Infrastructure Development in Asia-Pacific

Urbanization remains a one of the significant factors of the Asia Pacific flooring market growth. As per the World Bank, over 50% of the region's population will reside in urban areas by 2040, creating unprecedented demand for residential and commercial spaces. Cities like Mumbai, Shanghai, and Jakarta are witnessing a surge in high-rise apartments, shopping malls, and office complexes, all of which necessitate robust flooring solutions. For instance, the Indian government’s Smart Cities Mission aims to develop 100 smart cities, with projects valued at approximately $1.2 trillion. Such initiatives have catalyzed the adoption of premium flooring materials like engineered wood and luxury vinyl tiles. Moreover, infrastructure development programs, such as China’s Belt and Road Initiative, are fostering cross-border connectivity and urban expansion. For instance, Asia Pacific will account for nearly 60% of global infrastructure spending by 2030. This translates into increased demand for durable and aesthetically pleasing flooring options. Developers are prioritizing materials that balance cost-effectiveness with longevity, driving innovation in the flooring industry. The convergence of rapid urbanization and large-scale infrastructure projects positions flooring as a critical element in shaping the region’s built environment.

Rising Disposable Income and Consumer Preferences

The rise in disposable income across the Asia Pacific region has significantly influenced consumer behavior, particularly in the flooring sector. According to the Asian Development Bank, the middle class in the region is expected to grow from 1.2 billion in 2020 to 3.5 billion by 2030. This demographic shift has led to heightened demand for premium flooring products that align with modern lifestyles and aesthetic sensibilities. Homeowners are increasingly opting for materials like marble tiles and designer carpets, which reflect sophistication and personal style. Furthermore, e-commerce platforms have made high-quality flooring more accessible, enabling consumers to explore diverse options online. For example, Alibaba reported a 40% increase in flooring product sales through its platform in 2022, underscoring the digital transformation of the market. The growing preference for modular and customizable flooring solutions also reflects changing tastes. As consumers become more discerning, manufacturers are investing in research and development to offer innovative designs and textures. This trend highlights how economic prosperity and evolving preferences are reshaping the Asia Pacific flooring landscape.

MARKET RESTRAINTS

High Costs of Raw Materials and Production

One of the significant restraints impacting the Asia Pacific flooring market is the rising cost of raw materials, including timber, adhesives, and synthetic compounds used in manufacturing. According to the International Monetary Fund, global commodity prices surged by 40% between 2020 and 2022, placing immense pressure on flooring manufacturers. Timber, a primary material for hardwood flooring, has seen price escalations due to deforestation regulations and supply chain disruptions. For instance, Indonesia, a major exporter of tropical hardwood, implemented stricter export controls, leading to a 25% spike in regional timber costs, as stated by the Center for International Forestry Research. Additionally, the production process for advanced flooring materials like luxury vinyl tiles (LVT) involves significant energy consumption, which is subject to fluctuating fuel prices. The Federation of Indian Chambers of Commerce & Industry noted that energy costs account for nearly 30% of total production expenses in the flooring industry. These financial burdens are often passed on to consumers, resulting in higher retail prices and reduced affordability. Consequently, small and medium enterprises (SMEs) in the flooring sector face challenges in maintaining profitability, while larger companies struggle to innovate without compromising margins.

Environmental Regulations and Sustainability Concerns

Stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices are impeding the expansion of the Asia Pacific flooring market. Governments across the region are implementing policies to curb deforestation and limit the use of non-recyclable materials. For example, Australia’s National Construction Code mandates that all new buildings must meet specific sustainability benchmarks, including the use of eco-friendly flooring materials. While this fosters green innovation, it also increases compliance costs for manufacturers. Furthermore, as per the United Nations Environment Programme, the construction sector contributes to 39% of global carbon emissions, with flooring materials being a notable contributor. This has led to increased scrutiny of production processes, particularly in countries like China and India, where environmental enforcement is becoming stricter. A report by the Confederation of Indian Industry highlighted that nearly 40% of flooring manufacturers faced delays in obtaining environmental clearances in 2022. These regulatory hurdles not only slow down production timelines but also force companies to invest heavily in sustainable alternatives, which may not yet be cost-effective or widely accepted by consumers.

MARKET OPPORTUNITIES

Adoption of Smart Flooring Technologies

The integration of smart technologies into flooring is a significant opportunity for the Asia Pacific market. For instance, the demand for smart flooring is projected to grow significantly until 2030 owing to the advancements in Internet of Things (IoT) and sensor-based systems. In the Asia Pacific region, countries like Japan and South Korea are pioneering innovations such as pressure-sensitive flooring embedded with sensors that monitor foot traffic, detect falls, and regulate lighting. These features are particularly appealing in healthcare facilities, senior living communities, and smart homes. For instance, Panasonic Corporation introduced smart flooring solutions in Japan that integrate with home automation systems, allowing users to control appliances simply by stepping on designated zones. Similarly, South Korea’s Ministry of Land, Infrastructure, and Transport announced plans to incorporate smart flooring in public infrastructure projects, aiming to enhance safety and energy efficiency. The rising emphasis on smart cities in the region further amplifies the potential for such technologies. With urban planners increasingly prioritizing connectivity and convenience, smart flooring offers a lucrative avenue for manufacturers to differentiate themselves and capture emerging market segments.

Growth of Modular and Prefabricated Flooring Solutions

Modular and prefabricated flooring solutions are gaining traction in the Asia Pacific market due to their ease of installation, cost-effectiveness, and adaptability. For instance, modular construction methods are expected to account for 20% of new builds in the region by 2025, creating a ripple effect for complementary products like modular flooring. These solutions are particularly advantageous in densely populated urban areas where space optimization and rapid deployment are critical. For example, in Singapore, the Housing & Development Board (HDB) has mandated the use of prefabricated components in public housing projects, including flooring systems that can be installed within hours. This approach reduces labor costs by up to 30%, as reported by the Singapore Contractors Association Ltd. Additionally, modular flooring allows for seamless upgrades and replacements, catering to the growing trend of flexible workspaces and rental properties. Manufacturers leveraging this trend are focusing on lightweight, durable materials such as interlocking vinyl planks and carpet tiles, which align with the demands of modern architecture. This shift toward modular solutions not only enhances operational efficiency but also opens new revenue streams for the flooring industry.

MARKET CHALLENGES

Supply Chain Disruptions and Logistical Challenges

Supply chain disruptions remain a persistent challenge for the Asia Pacific flooring market, exacerbated by geopolitical tensions and natural disasters. For instance, logistics costs in the region account for 15-20% of GDP, significantly higher than the global average of 8%. This disparity is largely attributed to inadequate infrastructure and fragmented transportation networks, which hinder the timely delivery of raw materials and finished products. For instance, the 2021 Suez Canal blockage caused a backlog of container ships, delaying shipments of imported flooring materials like Italian marble and European laminates. Natural disasters further compound these issues. The Japan Meteorological Agency reported that typhoons and earthquakes affected over 30% of the country’s flooring supply chains in 2022, leading to production halts and inventory shortages. Similarly, flooding in Thailand disrupted the supply of rubber-based flooring products, as the country is a leading producer of natural rubber. These logistical bottlenecks not only inflate costs but also erode customer trust due to inconsistent availability. Addressing these challenges requires investment in resilient supply chain models and regional collaboration to mitigate risks.

Intense Market Competition and Price Wars

The Asia Pacific flooring market is highly competitive, with numerous players vying for market share through aggressive pricing strategies. According to Euromonitor International, the top five flooring manufacturers in the region collectively hold less than 30% of the market, indicating a fragmented landscape dominated by SMEs and local brands. This intense competition often leads to price wars, squeezing profit margins and discouraging investments in quality improvements or technological advancements. For example, in India, unorganized players offering low-cost ceramic tiles have undercut established brands, forcing them to lower prices to remain competitive. A study by the Associated Chambers of Commerce and Industry of India revealed that nearly 45% of flooring companies experienced a decline in profitability in 2022 due to unsustainable pricing pressures. Moreover, counterfeit products flooding the market exacerbate the problem, as they undermine brand reputation and consumer confidence. To navigate this challenge, companies must focus on value-added services, such as after-sales support and customization, to differentiate themselves and build long-term customer loyalty.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.10% |

|

Segments Covered |

By Product Types, Applications and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

TOLI Corporation, AHF, LLC., Forbo Flooring Systems, Interface |

SEGMENTAL ANALYSIS

By Product Types Insights

The ceramics and vitrified tiles segment captured the leading share of 45.5% of the regional market in 2024. The growth of the ceramics and vitrified tiles segment in the Asia-Pacific market is driven by its versatility, durability, and cost-effectiveness, making it the preferred choice for both residential and commercial applications. The affordability of ceramic and vitrified tiles plays a pivotal role in their widespread adoption. According to the International Trade Administration, ceramic tiles are priced 30-40% lower than premium alternatives like hardwood or natural stone, making them accessible to middle-income households. Additionally, vitrified tiles, particularly porcelain variants, are renowned for their resistance to moisture, scratches, and stains. In humid climates prevalent across Southeast Asia, this durability is a critical factor. For instance, Malaysia’s Ministry of Housing reported that over 60% of new housing projects utilize ceramic tiles due to their resilience against tropical weather conditions. Furthermore, advancements in digital printing technology have enabled manufacturers to offer aesthetically appealing designs at competitive prices, further boosting demand.

In addition, government-led infrastructure initiatives have significantly bolstered the ceramics and vitrified tiles segment. As per the Asian Development Bank, public infrastructure spending in the region is projected to reach $1.7 trillion annually by 2030. Countries like India and Indonesia are investing heavily in affordable housing schemes, such as India’s Pradhan Mantri Awas Yojana, which aims to construct 20 million homes by 2028. These projects prioritize cost-effective and low-maintenance flooring solutions, driving the demand for ceramics and vitrified tiles. Additionally, China’s Belt and Road Initiative has spurred construction activities across neighboring nations, further amplifying the segment’s growth trajectory.

On the other hand, the luxury Vinyl Tiles (LVT) segment is emerging as the fastest-growing segment in the Asia Pacific flooring market and is predicted to witness the fastest CAGR of 13.3% over the forecast period owing to the increasing consumer preference for stylish yet functional flooring options. LVT’s ability to mimic high-end materials like wood, marble, and stone, while offering superior functionality, has made it a favorite among interior designers and homeowners. According to a report by the Federation of Indian Chambers of Commerce & Industry, LVT sales in urban centers like Mumbai and Bangalore surged by 35% in 2022, driven by demand for customizable designs. The product’s water-resistant properties also make it ideal for bathrooms and kitchens, addressing a key consumer concern. Moreover, Japan’s Ministry of Economy, Trade, and Industry highlighted that LVT accounted for 20% of all flooring installations in commercial spaces in 2022, underscoring its growing popularity in professional settings.

In addition, innovations in LVT manufacturing, such as enhanced wear layers and antimicrobial coatings, have positioned it as a premium yet affordable option. As per the Korea Institute for Industrial Economics & Trade, investments in R&D for advanced flooring technologies increased by 15% in South Korea between 2020 and 2022. These advancements have expanded LVT’s application scope, from healthcare facilities to educational institutions. For example, Australia’s Green Building Council emphasized that LVT’s eco-friendly variants, which use recycled materials, align with sustainability goals, further propelling its adoption.

By Applications Insights

The residential flooring segment led the market by accounting for 61.6% of the Asia Pacific flooring market share in 2024 owing to the region’s booming real estate sector and rising urbanization rates. Urban migration is a key driver of residential flooring demand. For instance, the urban populations in the Asia Pacific will grow by 500 million people by 2030, necessitating millions of new housing units. Affordable housing projects, such as Indonesia’s One Million Homes Program, have prioritized durable and cost-effective flooring solutions like ceramic tiles and vinyl. According to Vietnam’s Ministry of Construction, over 70% of new residential developments in urban areas incorporate budget-friendly flooring materials, reflecting the segment’s alignment with demographic trends. Increased disposable income has enabled homeowners to invest in premium flooring options. As per the Asian Development Bank, the region’s middle class is projected to double by 2030, creating a robust consumer base for high-quality products. For instance, South Korea’s National Statistical Office reported a 25% increase in luxury flooring installations in suburban neighborhoods, driven by affluent millennials seeking modern aesthetics.

The commercial flooring segment is another major segment and is anticipated to register the fastest CAGR of 10.2% over the forecast period owing to the expansion of office spaces, retail outlets, and hospitality establishments. The proliferation of co-working spaces and tech startups has created a surge in demand for commercial flooring solutions. As per JLL Asia Pacific, flexible workspaces accounted for 20% of total office leasing activity in 2022. These spaces prioritize functional and visually appealing flooring, such as LVT and carpet tiles, to create dynamic environments. For example, India’s Economic Times reported that Bengaluru, a hub for IT companies, witnessed a 40% increase in commercial flooring installations in 2022, driven by corporate expansions. The retail and hospitality sectors are significant contributors to the growth of the commercial flooring segment. According to Euromonitor International, retail space expansions in Thailand and Malaysia grew by 15% in 2022, with hotels and shopping malls opting for durable and stylish flooring options. Singapore’s Tourism Board highlighted that luxury hotels in Marina Bay invested heavily in premium flooring materials to enhance guest experiences. This trend reflects how commercial flooring is evolving to meet the demands of diverse industries.

COUNTRY LEVEL ANALYSIS

China dominated the Asia Pacific flooring market by accounting for 33.9% of the regional market share in 2024. The dominance of China in the Asia-Pacific market is attributed to the large-scale urbanization and industrialization. The real estate sector of China is valued at $3 trillion, which is driving the demand for cost-effective flooring solutions like ceramics and laminates. The widespread use of ceramic tiles in residential and commercial projects in China is propelling the Chinese flooring market growth.

India is a promising market for flooring in the Asia-Pacific region. The rapid urbanization and government housing initiatives of India fuel flooring demand. For instance, affordable housing projects accounted for 60% of total flooring installations in 2022. Additionally, India’s Confederation of Indian Industry reported a 30% rise in LVT adoption, driven by its affordability and aesthetic appeal.

Japan is predicted to account for a notable share of the Asia-pacific flooring market over the forecast period due to the innovation and sustainability. The Ministry of Economy, Trade, and Industry noted that eco-friendly flooring solutions, such as bamboo and recycled materials, accounted for 25% of installations in 2022. Japan’s aging population also fuels demand for slip-resistant and easy-to-maintain flooring options, particularly in senior living facilities.

South Korea is estimated to witness a healthy CAGR in the Asia-Pacific flooring market over the forecast period, with a focus on smart flooring technologies. According to the Korea Institute for Industrial Economics & Trade, smart flooring systems integrated with IoT sensors grew by 20% in 2022. This trend aligns with the country’s emphasis on smart city development, particularly in Seoul and Busan.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific Concrete Admixtures Market are TOLI Corporation, AHF, LLC., Forbo Flooring Systems, Interface, Inc., Gerflor Group, RAK CERAMICS, Tarkett, Shaw Industries Group, Inc., Polyflor Ltd, Karndean, Carpet One Australasia Pty Ltd, Kajaria Ceramics Limited, Ceramiche Atlas Concorde S.p.A., Milliken & Company, EGGER, MOHAWK INDUSTRIES, INC.

The Asia Pacific flooring market is characterized by intense competition, driven by a mix of multinational giants and local players vying for dominance. Multinational corporations leverage their extensive R&D capabilities and global supply chains to introduce innovative products tailored to regional preferences. Meanwhile, local manufacturers focus on cost-effectiveness and deep market knowledge to capture niche segments. The fragmented nature of the market, coupled with rapid urbanization and infrastructure development, creates opportunities for differentiation. However, price wars and counterfeit products pose challenges, forcing companies to adopt unique strategies. Sustainability and digital transformation have emerged as key battlegrounds, with firms investing in eco-friendly solutions and smart technologies. The dynamic interplay between affordability, quality, and innovation defines the competitive landscape, compelling players to continuously evolve to maintain their edge.

Top Players in the Market

Mohawk Industries

Mohawk Industries is a global leader in flooring solutions and has a significant presence in the Asia Pacific market. The company specializes in a wide range of products, including carpet, hardwood, and luxury vinyl tiles (LVT). Its commitment to innovation and sustainability has enabled it to cater to diverse consumer preferences across the region. Mohawk’s focus on eco-friendly materials and advanced manufacturing technologies has strengthened its reputation as a premium provider. By collaborating with local architects and designers, Mohawk has tailored its offerings to meet regional aesthetic and functional demands, contributing significantly to its global market leadership.

Tarkett Group

Tarkett Group is renowned for its innovative and sustainable flooring solutions, making it a key player in the Asia Pacific market. The company emphasizes circular economy principles, offering recyclable and durable products like vinyl and linoleum. Tarkett’s modular flooring systems have gained traction in commercial spaces due to their flexibility and ease of installation. By investing in research and development, Tarkett continues to push boundaries in design and functionality, aligning with the region’s growing demand for modern and environmentally conscious flooring options. Its global presence is bolstered by its strong foothold in emerging markets.

Shaw Industries

Shaw Industries, a subsidiary of Berkshire Hathaway, is a dominant force in the flooring industry, particularly in carpet and resilient flooring. In the Asia Pacific market, Shaw has leveraged its expertise in creating high-performance products that cater to both residential and commercial sectors. The company’s emphasis on quality and customer-centric solutions has earned it a loyal client base. Shaw’s partnerships with local distributors and its adoption of digital tools for customization have enhanced its accessibility and appeal in the region. Its contributions to global flooring trends are evident through its innovative product lines.

Top Strategies Used by Key Market Participants

Product Innovation and Customization

Key players in the Asia Pacific flooring market prioritize innovation by introducing cutting-edge designs and functionalities. Companies invest heavily in R&D to develop products that align with evolving consumer preferences, such as antimicrobial coatings and smart flooring technologies. Customization options, including color, texture, and size variations, allow brands to cater to specific regional tastes and applications. This strategy not only enhances brand loyalty but also positions companies as leaders in technological advancements.

Strategic Partnerships and Collaborations

Collaborations with local architects, interior designers, and construction firms enable manufacturers to gain deeper insights into regional requirements. These partnerships facilitate co-creation of tailored solutions and streamline distribution channels. By working closely with stakeholders, companies can address logistical challenges and ensure timely delivery of products, thereby strengthening their market position.

Sustainability Initiatives

Sustainability has become a cornerstone of competitive strategies in the flooring industry. Leading players emphasize eco-friendly materials, recyclable products, and energy-efficient manufacturing processes. By adopting green practices, companies not only comply with stringent environmental regulations but also appeal to environmentally conscious consumers. This approach fosters trust and differentiates brands in an increasingly crowded marketplace.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Mohawk Industries launched a new line of eco-friendly luxury vinyl tiles (LVT) made from recycled materials. This move was aimed at addressing the growing demand for sustainable flooring solutions in the Asia Pacific region.

- In June 2024, Tarkett Group expanded its production facility in Vietnam to enhance its manufacturing capacity for modular flooring systems. This expansion was designed to cater to the rising demand in Southeast Asia's commercial real estate sector.

- In August 2024, Shaw Industries partnered with a leading e-commerce platform in India to offer customizable carpet solutions directly to consumers. This collaboration aimed to tap into the growing trend of online shopping for home improvement products.

- In October 2024, Armstrong Flooring acquired a local distributor in Australia to strengthen its distribution network and improve market penetration in Oceania. This acquisition aligned with the company’s strategy to enhance accessibility for its premium flooring products.

- In December 2024, Interface Inc. introduced a smart flooring solution integrated with IoT sensors in Japan, targeting smart city projects. This innovation positioned the company as a pioneer in technology-driven flooring solutions in the Asia Pacific market.

MARKET SEGMENTATION

This research report on the asia pacific flooring market has been segmented and sub-segmented into the following.

Product Types

- Ceramics and Vitrified (Porcelain) Tiles

- luxury Vinyl Tiles (LVT)

By Applications

- Residential Flooring

- commercial flooring

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

Which countries are leading in the Asia Pacific flooring market?

Key countries driving market growth include China, India, Japan, Indonesia, and Vietnam, due to rapid urbanization, population growth, and expanding construction activities .

What are the emerging trends in the Asia Pacific flooring market?

Notable trends include: Increased adoption of e-commerce platforms for flooring sales Integration of smart home technologies with flooring solutions Development of low-carbon and sustainable flooring materials.

What are the challenges faced by the flooring industry in this region?

Challenges include are Fluctuating raw material prices Environmental concerns and sustainability issues Intense competition among established and emerging players

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com