Asia Pacific Fluoropolymer Films Market Research Report – Segmented By End User Industry (Electrical and Electronics Industry, Industrial and Machinery Industry) Sub Resin Type and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis( 2025 to 2033).

Asia Pacific Fluoropolymer Films Market Size

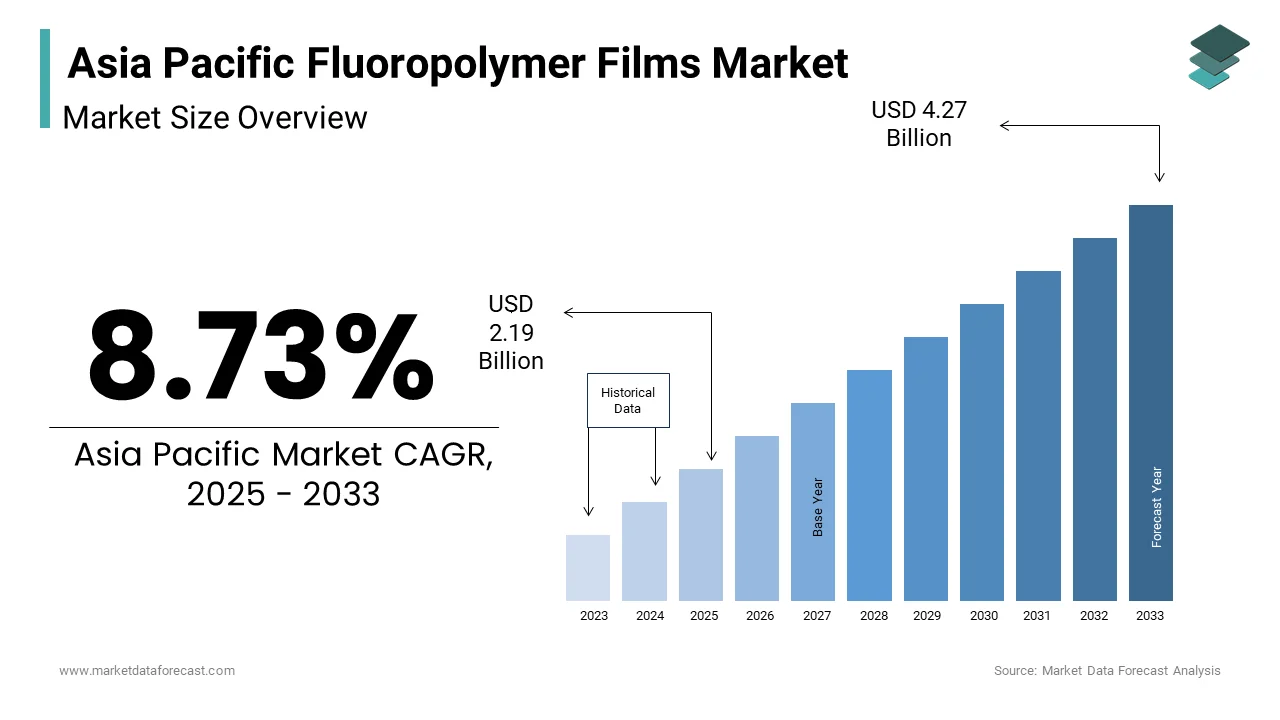

The Asia Pacific Fluoropolymer Films Market Size was valued at USD 2.01 billion in 2024. The Asia Pacific Fluoropolymer Films Market Size is expected to have 8.73 % CAGR from 2025 to 2033 and be worth USD 4.27 billion by 2033 from USD 2.19 billion in 2025.

Fluoropolymer films are high-performance materials known for their exceptional thermal stability, chemical resistance, and low surface energy. These films are primarily derived from fluorinated polymers such as polytetrafluoroethylene (PTFE), polyvinylidene fluoride (PVDF), and ethylene tetrafluoroethylene (ETFE). Due to these properties, they find extensive use in industries requiring durable and long-lasting protective layers, particularly in electrical insulation, aerospace components, semiconductor manufacturing, and medical devices.

In the Asia Pacific region, fluoropolymer films have become integral to the growth of advanced manufacturing and high-tech industries.

Moreover, as per data compiled by the Indian Electronics and Semiconductor Association, India's expanding electronics manufacturing sector has also started integrating fluoropolymer films in printed circuit board lamination and heat-resistant components. Similarly, in Australia, the mining and defense sectors rely on fluoropolymer films for cable insulation and corrosion protection in harsh operating conditions.

With rising investments in clean energy technologies, especially in solar panel backsheet applications, the market is witnessing a shift toward sustainable deployment of fluoropolymer films.

MARKET DRIVERS

Expansion of the Semiconductor and Electronics Manufacturing Sector

The rapid expansion of semiconductor and electronics manufacturing in the Asia Pacific is a primary driver for the fluoropolymer films market. These films are extensively used in wafer processing, chip packaging, and component insulation due to their excellent dielectric strength and resistance to extreme temperatures and corrosive chemicals.

As reported by the Korea Electronics Association, PVDF and PTFE-based films are now standard in cleanroom environments where contamination control and thermal management are critical. Also, in Japan, fluoropolymer films are increasingly being adopted in next-generation semiconductor lithography tools, which require ultra-pure and non-reactive materials.

This sustained investment in electronics infrastructure across the region directly correlates with increased demand for fluoropolymer films.

Rising Demand in Renewable Energy Applications

Fluoropolymer films are playing an essential role in the renewable energy sector, particularly in solar photovoltaic (PV) modules and wind turbine components. Their superior UV resistance, weatherability, and electrical insulation properties make them ideal for protecting solar panels against environmental degradation over long service life. According to the International Renewable Energy Agency (IRENA), the Asia Pacific region accounted for a significant portion of global solar PV installations in 2023, with China and India leading the deployment.

Fluoropolymer films are widely used as backsheets in these modules to prevent moisture ingress and ensure long-term performance.

Beyond solar, fluoropolymer films are also used in wind turbines for insulating generator components and protecting blades from erosion. As the transition to clean energy accelerates across the region, the fluoropolymer films market is poised for continued growth.

MARKET RESTRAINTS

High Raw Material and Production Costs

One of the key constraints affecting the growth of the fluoropolymer films market in the Asia Pacific is the elevated cost associated with raw materials and production processes. Fluoropolymer resins, such as PTFE and PVDF, are derived from fluorine-based chemicals, which require complex synthesis methods and specialized handling due to their reactive nature.

Additionally, the manufacturing process for fluoropolymer films involves high-temperature extrusion, biaxial orientation, and controlled cooling—steps that necessitate capital-intensive machinery and skilled labor. Like, production costs for fluoropolymer films were nearly double those of polyester or polyimide films, limiting their adoption in cost-sensitive applications.

Small and medium-sized enterprises (SMEs) in emerging markets such as Thailand and the Philippines often struggle to integrate fluoropolymer films due to financial limitations. While large multinational corporations can absorb these costs through economies of scale, smaller manufacturers face significant barriers to entry. This pricing challenge remains a major deterrent to widespread adoption across various industrial segments in the region.

Regulatory and Environmental Concerns

Environmental regulations and concerns surrounding the production and disposal of fluoropolymer films pose another significant restraint in the Asia Pacific market. Fluoropolymers are often synthesized using perfluorooctanoic acid (PFOA) and other persistent organic pollutants, which have raised health and environmental alarms globally. Several national regulatory bodies in the region have imposed restrictions on the use of such substances. For example, according to the Chinese Ministry of Ecology and Environment, the use of PFOA in fluoropolymer manufacturing was effectively phased out by the end of 2023, compelling producers to seek alternative processing aids.

Compliance with these evolving regulations increases production complexity and cost, as manufacturers must invest in cleaner synthesis methods and waste treatment systems.

These regulatory pressures not only slow down product development cycles but also increase operational expenditures.

MARKET OPPORTUNITIES

Growth in the Aerospace and Defense Industries

The aerospace and defense sectors in the Asia Pacific region are emerging as key growth avenues for fluoropolymer films, driven by increasing defense spending and aircraft manufacturing activities. These films are widely used in aircraft wiring insulation, radar components, and interior sealing systems due to their high temperature resistance, low flammability, and excellent dielectric properties.

India’s Ministry of Defence has been actively modernizing its air force fleet and supporting domestic aircraft manufacturing programs such as the Tejas Light Combat Aircraft and Advanced Medium Combat Aircraft (AMCA). As reported by the Society of Indian Aerospace Technologies & Industries, fluoropolymer films are now a standard material in avionics insulation and flight control system components due to their reliability under extreme conditions.

Similarly, in Japan, Mitsubishi Heavy Industries and Kawasaki Aerospace are incorporating fluoropolymer films in next-generation jet fighters and unmanned aerial vehicles (UAVs). With increasing regional geopolitical tensions and ongoing investments in military aviation and space exploration, the demand for fluoropolymer films in aerospace applications is set to expand significantly in the coming decade.

Increasing Adoption in Medical Device Manufacturing

The medical device industry in the Asia Pacific is rapidly adopting fluoropolymer films due to their biocompatibility, sterilization resistance, and non-stick characteristics. These films are used in surgical drapes, catheter linings, diagnostic equipment housings, and implantable device coatings.

South Korea’s Ministry of Food and Drug Safety has approved several fluoropolymer-based materials for Class II and III medical devices, encouraging manufacturers to enhance product durability and patient safety. Companies like Samsung Biomedical and LG Life Sciences are integrating fluoropolymer films into dialysis machines, imaging equipment, and wearable health monitors.

Japan, being a global leader in precision medical devices, continues to drive innovation in this space. This growing integration in healthcare manufacturing presents a strong opportunity for fluoropolymer film suppliers across the Asia Pacific.

MARKET CHALLENGES

Complexity in Recycling and End-of-Life Disposal

One of the most pressing challenges facing the fluoropolymer films market is the difficulty associated with recycling and environmentally responsible disposal. Unlike conventional thermoplastics, fluoropolymers exhibit high thermal stability and chemical inertness, making them resistant to traditional mechanical and chemical recycling methods. According to the International Union of Pure and Applied Chemistry (IUPAC), only a small share of fluoropolymer waste generated in the Asia Pacific region undergoes formal recycling, with most ending up in landfills or incineration facilities.

In response to growing sustainability concerns, regulatory bodies in several Asia Pacific countries are pushing for extended producer responsibility (EPR) policies that mandate proper waste collection and treatment. However, the lack of standardized recycling protocols and limited availability of specialized recovery technologies pose significant hurdles.

Moreover, companies engaged in fluoropolymer production face mounting pressure to develop circular economy models. Some players are experimenting with pyrolysis and solvolysis techniques to break down fluoropolymer waste, but these methods remain costly and technically challenging.

Supply Chain Vulnerabilities and Feedstock Availability

The fluoropolymer films industry in the Asia Pacific faces ongoing supply chain disruptions and feedstock availability issues that threaten production continuity. Fluoropolymer resins depend heavily on fluorspar, hydrofluoric acid, and other specialty chemicals, which are subject to fluctuating global prices and geopolitical tensions.

Furthermore, the production of fluorinated intermediates requires highly specialized chemical plants, many of which are concentrated in a few regions. Similar bottlenecks have occurred in Japan and South Korea due to maintenance delays at refining units.

Transportation logistics also play a crucial role. With increased scrutiny on hazardous chemical shipments, customs clearance times for fluoropolymer precursors have lengthened, causing production delays.

Given the reliance on a limited number of suppliers and the technical complexity involved in sourcing raw materials, ensuring a stable supply chain remains a persistent challenge for fluoropolymer film producers in the Asia Pacific.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.73 % |

|

Segments Covered |

By End User Industry, Sub Resin Type and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

3M, Afton Plastics, AGC Chemicals, AGRU Kunststofftechnik GmbH, Arkema Group |

SEGMENTAL ANALYSIS

By End User Industry Insights

The electrical and electronics industry is the largest end-user segment for fluoropolymer films in the Asia Pacific, accounting for 34% of total market demand in 2024. This dominance is due to the extensive use of fluoropolymer films in printed circuit boards (PCBs), flexible flat cables, semiconductor manufacturing equipment, and insulation materials.

These films are favored for their high dielectric strength, thermal resistance, and chemical inertness—qualities essential for maintaining performance under extreme conditions.

In Japan, the Ministry of Economy, Trade and Industry reported that fluoropolymer films are increasingly used in advanced packaging substrates for AI chips and 5G communication modules.

Additionally, India’s electronics manufacturing sector has seen rising adoption of fluoropolymer films in solar inverters and LED lighting components. With continuous investments in smart infrastructure and semiconductor assembly, this segment remains central to the growth of the fluoropolymer films market across the region.

The industrial and machinery segment is emerging as the fastest-growing application area for fluoropolymer films in the Asia Pacific, projected to expand at a CAGR of 9.7%. This growth is fueled by increasing demand for durable and chemically resistant coatings in industrial processing equipment, valves, pumps, and conveyor systems.

One key driver is the expansion of chemical processing plants across Southeast Asia, where corrosion-resistant linings are critical for operational efficiency. Moreover, these films offer superior resistance to acids, solvents, and high temperatures, making them ideal for demanding industrial environments.

Another factor contributing to growth is the increasing integration of fluoropolymer films in food processing machinery. With ongoing industrialization and automation across the Asia Pacific, this segment is set to maintain robust momentum.

By Sub Resin Type Insights

Polytetrafluoroethylene (PTFE) held the largest share of the Asia Pacific fluoropolymer films market, capturing a 38.4% of total resin-type consumption in 2024. Known for its exceptional non-stick properties, low coefficient of friction, and high-temperature resistance, PTFE films are widely used in aerospace, electronics, and industrial applications.

According to the Japan Plastics Industry Federation, PTFE films continue to be the material of choice for gaskets, seals, and electrical insulation in high-performance engineering sectors. In Japan, where precision manufacturing is a priority, over 45% of all fluoropolymer film imports were PTFE-based in 2023.

China, the world’s largest producer and consumer of fluoropolymer films, relies heavily on PTFE for wire and cable insulation in its rapidly expanding electronics and automotive industries. The China Fluoropolymer Industry Association reported that domestic PTFE film production exceeded 18,000 metric tons in 2023, with significant exports to Southeast Asian markets.

India’s growing investment in pharmaceutical and chemical processing also contributes to PTFE demand. Given their versatility and broad applicability, PTFE films remain the cornerstone of the fluoropolymer films market in the Asia Pacific.

Polyvinylidene Fluoride (PVDF) is the fastest-growing sub-resin type in the Asia Pacific fluoropolymer films market, anticipated to grow at a CAGR of 10.3%. This rapid ascent is attributed to its increasing adoption in lithium-ion battery separators, photovoltaic module backsheets, and architectural coatings.

A major growth driver is the electric vehicle (EV) boom in countries like China and South Korea. According to the China Association of Automobile Manufacturers, China produced over 9 million EVs in 2023, representing a year-on-year increase of 33%. PVDF films are extensively used as binders and separators in battery electrodes due to their electrochemical stability and mechanical strength.

In addition, the renewable energy sector is fueling PVDF demand. PVDF-based backsheets are preferred for their UV resistance and long-term durability, enhancing solar panel efficiency.

Japan is also witnessing increased usage of PVDF films in architectural membranes and building exteriors. As sustainability and performance become key priorities across industries, PVDF films are gaining prominence in diverse applications across the Asia Pacific.

COUNTRY LEVEL ANALYSIS

China held the largest share of the Asia Pacific fluoropolymer films market, contributing a 35.5% of total regional demand in 2024. As the world’s largest electronics and chemical manufacturing hub, China's dominance is driven by its extensive industrial base and government-backed initiatives promoting high-tech manufacturing.

According to the China Fluoropolymer Industry Association, domestic fluoropolymer film production reached 25,000 metric tons in 2023, supported by strong demand from the electronics, automotive, and renewable energy sectors. The country's leadership in solar PV manufacturing has particularly boosted PVDF film consumption, with a significant GW of installed solar capacity reported by the National Energy Administration.

Furthermore, China's push toward self-reliance in semiconductor production has led to increased adoption of fluoropolymer films in wafer fabrication and chip packaging. With sustained investments in clean technology and industrial automation, China continues to lead the fluoropolymer films market in the Asia Pacific.

Japan is distinguished by its focus on high-end applications and advanced material development. The country maintains a strong presence in aerospace, medical devices, and semiconductor manufacturing—all of which rely heavily on fluoropolymer films for insulation, coating, and contamination control.

As reported by the Japan Plastics Industry Federation, Japanese manufacturers such as Daikin Industries and Asahi Glass Company have been at the forefront of developing ultra-thin and high-purity fluoropolymer films tailored for precision electronics and optical components.

The healthcare sector is another key growth driver. According to the Japan Medical Device Association, fluoropolymer films are now integral to catheter linings, sterilizable pouches, and diagnostic imaging equipment due to their biocompatibility and heat resistance. Despite slower economic growth compared to emerging economies, Japan remains a vital innovator in the fluoropolymer films space, leveraging its technological expertise to maintain a competitive edge.

South Korea is a key player in the market, driven by its globally recognized electronics and automotive industries. Companies like Samsung and LG are among the largest consumers of fluoropolymer films, particularly for insulation in semiconductors, flexible displays, and lithium-ion batteries.

The automotive sector is also contributing significantly. Hyundai and Kia have incorporated fluoropolymer films into wiring harnesses and sensor components to enhance durability and thermal resistance. With continued innovation in consumer electronics and electric mobility, South Korea is solidifying its position as a key player in the fluoropolymer films market across the Asia Pacific.

India is experiencing rapid growth due to expanding industrial activity and policy-driven investments in electronics and renewable energy. The country's Make in India initiative has spurred domestic manufacturing across multiple sectors, including semiconductors, solar power, and medical devices.

In addition, the pharmaceutical and food processing industries are adopting fluoropolymer films for anti-adhesive and sterile surfaces. The Indian Chemical Manufacturers Association notes that fluoropolymer-lined reactors and filtration membranes are becoming standard in large-scale drug manufacturing units. With rising infrastructure spending and a growing middle class driving demand for advanced products, India is poised for continued expansion in fluoropolymer film consumption.

Australia and New Zealand collectively characterized by niche but high-value applications in mining, defense, and medical equipment manufacturing. Both countries emphasize quality, compliance, and longevity in industrial materials, making fluoropolymer films a preferred choice despite their higher cost.

According to the Australian Institute of Packaging, fluoropolymer films are widely used in pharmaceutical blister packs and high-barrier food packaging due to their excellent moisture and gas barrier properties.

New Zealand’s agricultural and dairy processing sectors are increasingly integrating fluoropolymer films for corrosion-resistant conveyors and hygiene-critical surfaces. The New Zealand Plastics Packaging Group reports that fluoropolymer-based materials are preferred for their ease of cleaning and durability in food handling environments. While not a volume-driven market, Australia and New Zealand represent a stable and technically sophisticated consumer base for fluoropolymer films in the Asia Pacific region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Overview of Competition in the Asia Pacific Fluoropolymer Films Market 3M, Afton Plastics, AGC Chemicals, AGRU Kunststofftechnik GmbH, Arkema Group, Covestro AG, Daikin Industries Ltd, Dongyue Group Limited, DowDuPont (DuPont), Gujarat Fluorochemicals Ltd, HaloPolymer OJSC, Honeywell International Inc., Kureha Corporation, Parker Hannifin Corp., Saint-Gobain, Shamrock Technologies, Simona AG

The competition in the Asia Pacific fluoropolymer films market is shaped by a blend of global giants and regional specialists vying to capture market share through technological differentiation, customer engagement, and localized service capabilities. While multinational corporations leverage their global expertise and R&D resources to maintain dominance, domestic manufacturers are increasingly gaining traction by offering cost-effective alternatives and faster response times. The market landscape is further influenced by the growing emphasis on sustainable material development, compliance with industry-specific regulations, and the need for high-performance films in mission-critical applications. As demand from sectors such as semiconductors, electric vehicles, and renewable energy continues to rise, companies are intensifying their efforts in product innovation and strategic expansion. This dynamic environment fosters continuous improvement in fluoropolymer film properties, application versatility, and environmental compatibility, ensuring the market remains highly responsive to evolving industrial needs and technological advancements.

Top Players in the Market

Daikin Industries, Ltd. (Japan)

Daikin Industries is a global leader in fluoropolymer production and holds a dominant position in the Asia Pacific fluoropolymer films market. The company offers a broad range of high-performance fluoropolymer films tailored for electronics, aerospace, and industrial applications. Daikin’s expertise lies in developing advanced PVDF and PTFE-based films that meet stringent performance and regulatory standards. Its strong R&D capabilities and strategic collaborations with key industries across Asia have reinforced its reputation as a reliable supplier of specialty materials.

Asahi Kasei Corporation (Japan)

Asahi Kasei plays a pivotal role in the fluoropolymer films sector by delivering innovative film solutions for medical devices, automotive components, and electronic insulation. The company's focus on sustainability and material science has enabled it to produce fluoropolymer films that offer superior durability and chemical resistance. Asahi Kasei’s localized manufacturing and technical support centers across Southeast Asia have enhanced its responsiveness to regional demand, strengthening its foothold in the Asia Pacific market.

Saint-Gobain Performance Plastics (France, with strong APAC presence)

Saint-Gobain Performance Plastics maintains a significant presence in the Asia Pacific through its extensive distribution network and application-specific fluoropolymer film offerings. The company specializes in high-purity PTFE and FEP films used in semiconductor manufacturing, aerospace, and life sciences. By establishing dedicated customer service hubs and investing in local partnerships, Saint-Gobain has effectively catered to the evolving needs of precision-driven industries in the region.

Top Strategies Used by Key Market Participants

One of the primary strategies adopted by leading players is product innovation and customization . Companies are focusing on developing specialized fluoropolymer films tailored for niche applications such as high-frequency electronics, electric vehicle components, and medical-grade coatings. This differentiation helps them address specific industry challenges while maintaining a competitive edge.

Another critical approach is expanding regional manufacturing and technical service infrastructure . Major firms are setting up localized production units and application development centers in emerging markets across Southeast Asia to reduce lead times, comply with local regulations, and provide hands-on support to customers.

Lastly, companies are actively pursuing strategic collaborations and joint ventures with end-use industry leaders and raw material suppliers. These alliances facilitate co-development of next-generation fluoropolymer solutions, accelerate technology adoption, and strengthen supply chain resilience across the Asia Pacific region.

RECENT HAPPENINGS IN THE MARKET

In February 2023, Daikin Industries expanded its fluoropolymer resin production capacity at its facility in Osaka to better serve rising demand in the electronics and automotive sectors across the Asia Pacific.

In July 2023, Asahi Kasei launched a new line of ultra-thin fluoropolymer films designed specifically for flexible printed circuit boards, targeting growth in high-end consumer electronics manufacturing in South Korea and China.

In November 2023, Saint-Gobain established a technical service center in Singapore to provide direct support to customers in Southeast Asia, enhancing its ability to deliver customized fluoropolymer film solutions for aerospace and medical applications.

In March 2024, Toray Industries entered into a joint development agreement with a leading Japanese semiconductor equipment manufacturer to create fluoropolymer films with ultra-low particle emission for cleanroom environments.

In October 2024, Solvay announced a collaboration with an Indian battery manufacturer to supply PVDF-based separator films for lithium-ion batteries, aligning with the country’s push toward electric mobility and energy storage systems.

MARKET SEGMENTATION

This research report on the asia pacific fluoropolymer films market has been segmented and sub-segmented into the following.

By End User Industry

- Electrical and Electronics Industry

- Industrial and Machinery Industry

By Sub Resin Type

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride (PVDF)

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What are fluoropolymer films and where are they used in the Asia Pacific region?

Fluoropolymer films are thin plastic films made from fluoropolymers, offering high chemical resistance, thermal stability, and non-stick properties. In Asia Pacific, they are used in electronics, solar panels, aerospace, automotive, and packaging industries.

What is driving the growth of the fluoropolymer films market in Asia Pacific?

Key growth drivers include rising demand from the electronics and solar energy sectors, rapid industrialization, technological advancements, and increasing applications in chemical processing and automotive industries.

Which countries in Asia Pacific are leading the demand for fluoropolymer films?

China, Japan, South Korea, and India are the top countries contributing to the regional demand due to their robust manufacturing sectors and growing electronics industries.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com