Asia Pacific Fumed Silica Market Research Report – Segmented By Type ( Hydrophilic Fumed Silica, Hydrophobic Fumed Silica), Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Fumed Silica Market Size

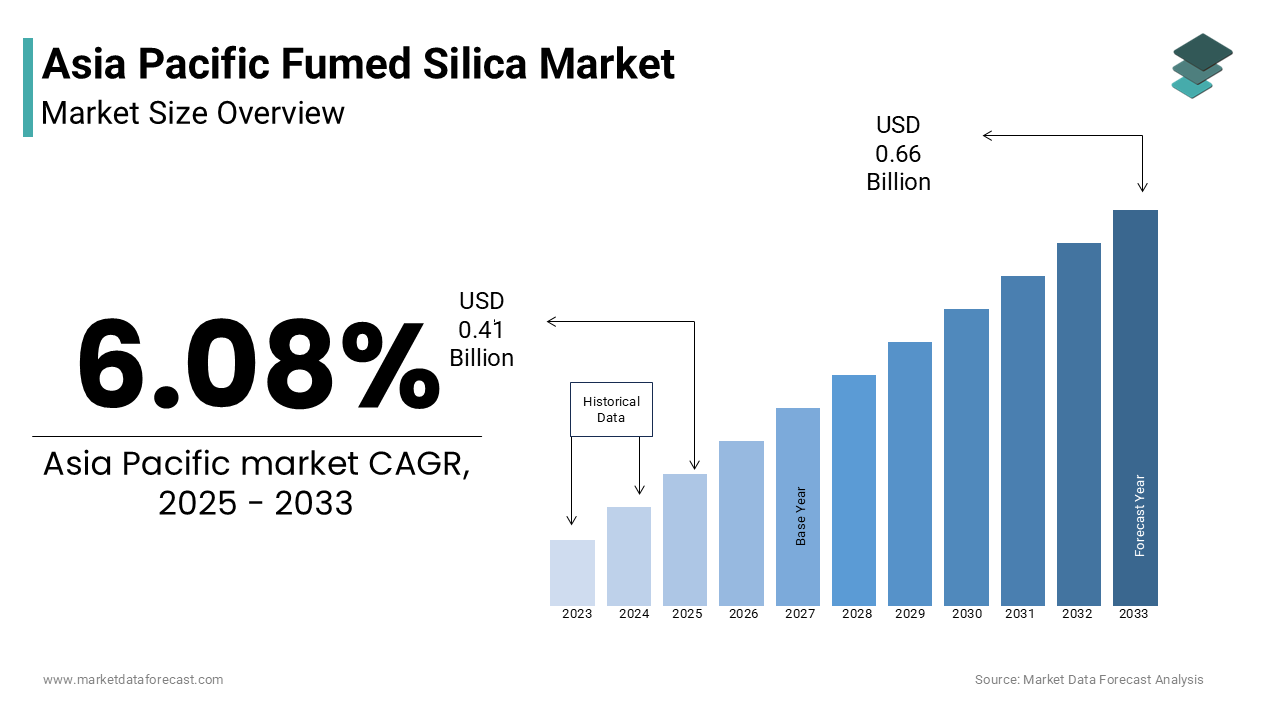

The Asia Pacific Fumed Silica Market was worth USD 0.39 billion in 2024. The Asia Pacific market is expected to reach USD 0.66 billion by 2033 from USD 0.41 billion in 2025, rising at a CAGR of 6.08% from 2025 to 2033.

Fumed silica, also known as pyrogenic silica, is a synthetic amorphous form of silicon dioxide produced through high-temperature hydrolysis of silicon tetrachloride in a flame. It is widely used as a thickening agent, anti-caking agent, and rheology modifier across various industries such as construction, electronics, pharmaceuticals, and coatings.

The Asia Pacific region has emerged as a critical hub for fumed silica consumption and production, driven by rapid industrialization, infrastructural expansion, and growing demand from end-use sectors. Countries like China, Japan, India, and South Korea are at the forefront of this growth trajectory.

Besides, government initiatives promoting advanced material usage in Japan and South Korea have reinforced the market's momentum.

The region’s expanding chemical manufacturing base, coupled with increasing R&D activities in nanotechnology and composite materials, continues to support the fumed silica ecosystem.

MARKET DRIVERS

Growth in the Electronics Industry Across Asia Pacific

One of the most significant drivers fueling the Asia Pacific fumed silica market is the rapid expansion of the electronics industry, particularly in countries such as China, South Korea, and India. Fumed silica plays a crucial role in semiconductor manufacturing, printed circuit boards (PCBs), and encapsulation resins due to its excellent thermal stability, dielectric properties, and ability to enhance mechanical strength. This surge directly correlates with heightened demand for fumed silica in electronic packaging applications.

Similarly, India’s push toward domestic semiconductor manufacturing under the Production-Linked Incentive (PLI) scheme has attracted foreign investment and spurred local production capacities. As miniaturization trends and high-performance electronics gain prominence, fumed silica remains indispensable in ensuring product reliability and longevity, thus serving as a key enabler of sustained growth in the regional electronics domain.

Expansion of the Construction and Infrastructure Sector in Developing Economies

Another pivotal driver of the Asia Pacific fumed silica market is the robust expansion of the construction and infrastructure sectors, especially in emerging economies like India, Indonesia, and Vietnam. Fumed silica is extensively used in sealants, adhesives, cementitious systems, and coatings due to its ability to improve viscosity, mechanical strength, and durability. As urbanization accelerates and governments prioritize infrastructure development, the demand for high-performance construction materials incorporating fumed silica has surged.

India, for instance, has committed over USD 1.8 trillion toward infrastructure development under its National Infrastructure Pipeline (NIP), aiming to boost transportation networks, housing, and smart cities by 2025. These developments necessitate the use of advanced materials such as fumed silica to ensure structural integrity and longevity.

With these trends gaining momentum, fumed silica is increasingly being adopted to meet evolving construction standards and environmental regulations across the Asia Pacific region.

MARKET RESTRAINTS

High Manufacturing and Raw Material Costs

One of the primary restraints affecting the Asia Pacific fumed silica market is the elevated cost associated with its production and raw material sourcing. Fumed silica is synthesized through energy-intensive processes involving the combustion of silicon tetrachloride in hydrogen-oxygen flames, which results in high operational expenditures. Moreover, the price volatility of key raw materials such as silicon metal and chlorine gas adds financial pressure on manufacturers.

According to a report published by S&P Global Commodity Insights, silicon metal prices in Asia increased in 2023 due to supply chain disruptions and rising energy costs, directly impacting the economics of fumed silica production.

In addition, stringent environmental regulations governing emissions from chemical manufacturing plants have compelled producers to invest in cleaner technologies and waste management solutions, further escalating capital outlays. For example, in China, where much of fumed silica is manufactured, the Ministry of Ecology and Environment implemented tighter emission norms in 2023, mandating upgrades to production facilities.

These cost-related challenges limit the scalability of operations for smaller players and discourage new entrants, thereby constraining market growth.

Limited Availability of Skilled Labor and Technical Expertise

A significant restraint impeding the growth of the Asia Pacific fumed silica market is the shortage of skilled labor and technical expertise required for both production and application-specific formulation. The manufacturing of fumed silica involves highly specialized chemical engineering processes that demand trained personnel capable of managing complex reactor systems and maintaining quality control standards. However, several countries in the region face acute skill gaps in the chemical manufacturing sector, which hampers productivity and innovation.

This mismatch between academic training and industry requirements limits the ability of manufacturers to scale up efficiently or introduce novel fumed silica-based formulations tailored for niche applications.

Moreover, downstream industries such as electronics and pharmaceuticals require precise handling and dispersion techniques for fumed silica, which often necessitates specialized knowledge. Without adequate training programs and institutional support, many small and medium enterprises (SMEs) struggle to implement best practices, resulting in inconsistent product quality and suboptimal performance.

MARKET OPPORTUNITIES

Rising Demand for Electric Vehicles (EVs) and Battery Technologies

A significant opportunity driving the Asia Pacific fumed silica market lies in the burgeoning electric vehicle (EV) industry and the corresponding advancements in battery technology. Fumed silica is extensively used in lithium-ion batteries as a binder and electrolyte additive, enhancing conductivity, thermal stability, and cycle life. With EV adoption accelerating across the region particularly in China, Japan, and South Korea the demand for high-performance battery components is witnessing exponential growth.

According to BloombergNEF, China’s lithium-ion battery production capacity is projected to surpass 3,000 GWh by 2025, creating substantial opportunities for fumed silica suppliers.

Similarly, South Korea has been aggressively investing in EV battery technology, with companies such as LG Energy Solution and Samsung SDI planning to significantly expand overseas and domestic production facilities. Japan, though slower in EV adoption compared to its neighbors, is focusing on solid-state battery development, where fumed silica plays a critical role in improving ionic conductivity and safety. With governments across the region implementing aggressive electrification policies and offering subsidies, the EV revolution is poised to significantly bolster the fumed silica market in the coming years.

Increasing Adoption in Renewable Energy Applications

The growing deployment of renewable energy technologies across the Asia Pacific region presents a compelling opportunity for the fumed silica market. Fumed silica is integral to the manufacturing of photovoltaic panels, wind turbine blades, and energy storage systems due to its reinforcing and insulating properties. As governments strive to reduce carbon emissions and transition toward sustainable energy sources, investments in solar and wind power infrastructure have surged.

Japan and South Korea are also advancing their green energy strategies, with both nations allocating substantial funds toward offshore wind and solar PV integration. Given fumed silica’s role in enhancing the durability and efficiency of renewable energy components, the market stands to benefit significantly from this clean energy transformation.

MARKET CHALLENGES

Regulatory and Environmental Compliance Pressures

One of the foremost challenges confronting the Asia Pacific fumed silica market is the tightening regulatory environment concerning chemical manufacturing and emissions. Governments across the region are increasingly enforcing stringent environmental norms aimed at reducing industrial pollution and promoting sustainable production practices. These regulations impose additional compliance burdens on fumed silica manufacturers, who must invest in cleaner production technologies, waste treatment systems, and emission control mechanisms.

In China, for example, the Ministry of Ecology and Environment introduced stricter air quality standards in 2023, targeting particulate matter emissions from chemical plants.

South Korea has also implemented rigorous chemical safety laws under the K-REACH (Korean Registration, Evaluation, Authorization, and Restriction of Chemicals) framework, requiring manufacturers to conduct extensive toxicity assessments and submit detailed dossiers for chemical substances.

These regulatory pressures not only elevate production costs but also slow down innovation cycles, as companies divert resources toward compliance rather than research and development.

Supply Chain Disruptions and Geopolitical Tensions

The Asia Pacific fumed silica market is increasingly vulnerable to supply chain disruptions and geopolitical tensions, which pose a significant challenge to consistent production and distribution. The industry relies heavily on a stable supply of raw materials such as silicon tetrachloride and hydrogen, which are sourced from a limited number of suppliers, many of whom are located in geopolitically sensitive regions. Any disruption in the availability of these inputs can lead to production delays and cost escalations.

For instance, in 2023, trade tensions between China and Western countries affected the export of critical chemical intermediates, including silicon-based compounds. According to the China Chemical Importers and Exporters Association, exports of silicon tetrachloride experienced a temporary decline during the first half of 2023 due to logistical bottlenecks and customs inspections. Similarly, the ongoing conflict in Eastern Europe impacted the global supply of industrial gases, including hydrogen, which is essential for fumed silica synthesis.

Moreover, the reliance on imported catalysts and specialized equipment for fumed silica production exposes manufacturers to risks associated with trade restrictions and fluctuating currency exchange rates. Companies based in ASEAN countries, which lack domestic production capabilities, are particularly susceptible to these external shocks.

SEGMENTAL ANALYSIS

By Type Insights

The hydrophilic fumed silica segment accounted for the largest market share, representing 62% of the total Asia Pacific fumed silica market in 2024. This dominance is primarily attributed to its extensive use in silicone-based formulations, coatings, and adhesives where moisture absorption and viscosity enhancement are critical performance attributes. Unlike hydrophobic variants, hydrophilic fumed silica does not undergo surface treatment, making it more cost-effective and suitable for a broader range of industrial applications.

One of the key drivers behind this segment’s leadership is its widespread adoption in the production of silicone elastomers across the construction and automotive sectors.

Besides, the electronics industry in South Korea and Japan continues to be a major consumer of hydrophilic fumed silica, particularly in encapsulation resins and thermal interface materials. These factors collectively underpin the continued dominance of the hydrophilic segment in the regional market.

The hydrophobic fumed silica segment is projected to grow at the fastest rate, with a CAGR of 7.8% between 2025 and 2033 in the Asia Pacific region. This accelerated growth is largely driven by increasing demand for high-performance materials in niche applications such as specialty coatings, pharmaceuticals, and food processing, where water resistance, dispersion stability, and enhanced mechanical strength are essential.

A primary factor fueling this growth is the rapid expansion of the pharmaceutical industry in India and China, both of which are emerging as global manufacturing hubs for generic drugs and biologics. Hydrophobic fumed silica is widely used as an anti-caking agent and flow aid in tablet production and powder formulations. This surge directly correlates with increased consumption of hydrophobic fumed silica, as per reports from the Indian Chemical Manufacturers Association.

Moreover, the paints and coatings sector in Southeast Asia, particularly in Vietnam and Thailand, is witnessing robust growth, driven by urban development and export-oriented industries. These combined factors are positioning hydrophobic fumed silica as the fastest-growing type segment in the Asia Pacific market.

By Application Insights

The silicone elastomers accounted for the largest market share, capturing 34.5% of the Asia Pacific fumed silica market in 2024. This segment’s dominance stems from the indispensable role of fumed silica in enhancing the mechanical strength, tear resistance, and thermal stability of silicone rubber, which is extensively used across industries such as automotive, electronics, healthcare, and construction.

China remains the epicenter of this demand, where the production of silicone elastomers surpassed 1.8 million metric tons in 2023, according to the China Silicone Industry Association. The country's automotive industry, one of the largest globally, consumes significant quantities of silicone rubber for gaskets, seals, and insulation components.

This broad-based application spectrum, coupled with technological advancements in material science, ensures that silicone elastomers remain the leading application segment for fumed silica in the Asia Pacific region.

The paints, coatings & inks segment is emerging as the fastest-growing application area in the Asia Pacific fumed silica market, registering a CAGR of 6.9%. This growth trajectory is fueled by increasing demand for high-performance coatings in the automotive, aerospace, and architectural sectors, where scratch resistance, leveling properties, and pigment suspension are critical.

One of the key growth catalysts is the booming automotive industry in Southeast Asia, particularly in countries like Thailand, Indonesia, and Vietnam. Automotive OEMs and aftermarket paint suppliers are increasingly incorporating fumed silica into coatings to improve durability and aesthetic finish.

Another major driver is the rise in green building initiatives across the region, especially in Australia, Singapore, and South Korea, where eco-friendly and long-lasting architectural coatings are being prioritized.

In addition, the printing ink industry in India is experiencing rapid expansion, driven by digital transformation and packaging demand. These diverse application trends underscore why the paints, coatings & inks segment is outpacing other areas in the Asia Pacific fumed silica market.

REGIONAL ANALYSIS

China held the largest share of the Asia Pacific fumed silica market, accounting for 38.1% in 2024. As the world's largest chemical producer and consumer, China’s dominance stems from its vast industrial base, particularly in electronics, automotive, and construction sectors. The country’s aggressive push toward self-reliance in semiconductor manufacturing has intensified demand for high-purity fumed silica in electronic packaging.

Simultaneously, the automotive industry remains a cornerstone of fumed silica consumption. Electric vehicle (EV) production, which constitutes nearly 40% of total automotive output, further drives demand for silicone-based components and battery materials requiring fumed silica.

Apart from these, the construction boom, supported by the government’s National Infrastructure Pipeline, has spurred demand for sealants, coatings, and insulation materials incorporating fumed silica. With strong domestic manufacturing capabilities and ongoing R&D in nanomaterials, China continues to set the pace for the regional market.

India’s expanding industrial landscape, supported by government policies promoting domestic manufacturing and sustainable infrastructure, has created fertile ground for growth in fumed silica consumption. The Make in India initiative has attracted substantial foreign investment in electronics, automotive, and pharmaceutical sectors, all of which are significant consumers of fumed silica. Coupled with a thriving construction sector and growing emphasis on renewable energy projects, India is rapidly emerging as a key player in the regional fumed silica market.

Japan is known for its high-value manufacturing capabilities, Japan integrates fumed silica extensively in electronics, automotive, and pharmaceutical applications where precision and reliability are paramount.

The electronics sector remains a major consumer, particularly in semiconductor packaging and flexible printed circuit boards.

In the automotive domain, Japanese automakers continue to lead in hybrid and electric vehicle (EV) innovations. Toyota and Honda, among others, incorporate silicone-based components reinforced with fumed silica for insulation and vibration damping.

Pharmaceuticals also play a crucial role, with Japan maintaining a strong presence in the global drug development space. With sustained innovation and strategic industry partnerships, Japan maintains a strong foothold in the Asia Pacific fumed silica market.

South Korea occupies a notable market share, driven by its cutting-edge technology industries and strategic investments in high-tech manufacturing. The country’s focus on semiconductor production, electric mobility, and advanced materials positions it as a key consumer of fumed silica across multiple high-value applications.

Semiconductor manufacturing remains the most prominent sector, with companies like Samsung Electronics and SK Hynix dominating global memory chip production.

Electric vehicle (EV) production is another major contributor, with Hyundai and Kia accelerating their electrification strategies. Battery manufacturers such as LG Energy Solution and Samsung SDI utilize fumed silica in electrolyte formulations and thermal interface materials to enhance safety and efficiency.

Moreover, South Korea’s chemical industry continues to innovate in high-performance coatings and adhesives, particularly for aerospace and electronics. With strong R&D initiatives and government-backed industrial policies, South Korea solidifies its position as a leading market for fumed silica in the Asia Pacific region.

Australia & New Zealand together account for a considerable share of the Asia Pacific fumed silica market in 2024, driven by their strong presence in high-value manufacturing, mining, and construction sectors. Although relatively smaller in scale compared to other regional powerhouses, these countries exhibit a growing appetite for advanced materials, particularly in specialty chemicals and industrial applications.

Australia’s construction industry has been a consistent driver of fumed silica demand, especially in sealants, adhesives, and high-performance concrete.

New Zealand, while smaller in economic size, has seen rising demand for fumed silica in the food processing and pharmaceutical industries. The New Zealand Food Safety Authority highlighted that domestic food manufacturers increasingly adopted hydrophobic fumed silica as an anti-caking agent in powdered products, aligning with international quality standards. Additionally, the country’s growing medical device sector has contributed to increased utilization of silicone-based components reinforced with fumed silica.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Evonik Industries, Cabot Corporation, Wacker Chemie AG, Tokuyama Corporation, OCI Company Ltd., and Dongyue Group are some of the key market players.

The competition in the Asia Pacific fumed silica market is characterized by a mix of global chemical giants and regional specialty material suppliers vying for dominance in a rapidly evolving industrial landscape. Established multinational corporations leverage their technological expertise, extensive distribution networks, and brand recognition to maintain a strong foothold. At the same time, regional players are increasingly investing in production upgrades and application-specific product development to capture market share. The market exhibits a moderate level of concentration, with a few dominant firms controlling a substantial portion of the supply chain. However, the entry of new manufacturers, particularly from China and India, has intensified price pressures and spurred innovation. Competitive differentiation is primarily driven by product quality, customization capabilities, and after-sales technical support. As industries across the region demand higher performance materials, companies are focusing on sustainable practices, process optimization, and strategic expansion to sustain growth and strengthen their market position.s

Top Players in the Asia Pacific Fumed Silica Market

Evonik Industries holds a strong presence in the Asia Pacific fumed silica market through its globally recognized brand AEROSIL®. The company offers a wide range of hydrophilic and hydrophobic fumed silica products tailored for applications in electronics, coatings, pharmaceuticals, and composites. With manufacturing facilities and distribution networks across China, Japan, and India, Evonik plays a pivotal role in setting industry benchmarks for product quality and innovation. Its continuous investment in R&D and strategic partnerships helps maintain a competitive edge in the region.

Cabot Corporation is another leading global player with a significant footprint in the Asia Pacific market. Known for its CAB-O-SIL® line of fumed silica products, Cabot serves diverse industries including rubber, plastics, adhesives, and electronics. The company has strategically expanded its production capabilities in China and strengthened its technical service centers to cater to growing regional demand. Cabot’s focus on sustainability and customer-specific solutions enhances its reputation as a reliable supplier in the Asia Pacific region.

Wacker Chemie AG is a key contributor to the fumed silica market in Asia, particularly in silicone-based applications. The company's expertise in silicone chemistry positions it strongly in markets such as construction, automotive, and electronics. Wacker has established a robust supply chain and technical support system across major Asian economies, enabling it to deliver high-performance materials efficiently. Its commitment to innovation and long-term customer relationships reinforces its leadership status in the region.

Top Strategies Used by Key Market Participants

One of the primary strategies adopted by key players in the Asia Pacific fumed silica market is expanding production capacities and establishing local manufacturing units. Companies are investing in new production lines and upgrading existing facilities in countries like China and India to reduce logistics costs and ensure a stable supply chain. These localized operations also help manufacturers comply with regional regulations and respond swiftly to evolving customer needs.

Another critical strategy is product innovation and customization. Leading firms are continuously developing advanced grades of fumed silica tailored for niche applications such as electric vehicle batteries, high-performance coatings, and pharmaceutical excipients. By offering specialized formulations, companies enhance their value proposition and secure long-term contracts with end-use industries that require high-performance materials.

Lastly, strategic partnerships and collaborations play a vital role in strengthening market position. Key players engage in joint ventures, technology licensing agreements, and co-development projects with research institutions and industrial partners. These alliances enable knowledge sharing, accelerate product development cycles, and improve access to emerging markets within the Asia Pacific region.

Top Major Actions Taken by Companies to Strengthen Their Position in the Asia Pacific Fumed Silica Market

- In February 2024, Evonik announced the expansion of its technical service center in Shanghai, aimed at providing localized support to customers in the electronics and automotive sectors. This initiative was designed to enhance formulation assistance and application development, reinforcing Evonik’s leadership in high-performance materials across Asia Pacific.

- In May 2024, Cabot Corporation launched a new line of surface-treated fumed silica products specifically developed for battery electrolytes and semiconductor packaging. Introduced during an industry expo in Tokyo, this product line was targeted at addressing the rising demand for thermal management and conductivity in next-generation electronic devices manufactured in the region.

- In August 2024, Wacker Chemie entered into a strategic collaboration with a leading Chinese silicone manufacturer to co-develop customized fumed silica solutions for construction sealants and insulation materials. This partnership was intended to align with the growing infrastructure investments in China and Southeast Asia.

- In November 2024, Tokuyama Corporation, a major Japanese chemical company, upgraded its fumed silica production facility in Yamaguchi to increase output capacity and improve energy efficiency. This move was part of a broader initiative to meet the rising domestic and export demand from the electronics and pharmaceutical sectors.

- In January 2025, OCI Materials, a South Korean specialty chemical firm, acquired a small-scale fumed silica producer based in Vietnam. This acquisition was aimed at expanding its regional footprint and enhancing its ability to serve fast-growing downstream industries such as paints and coatings, and adhesives in Southeast Asia.

MARKET SEGMENTATION

This research report on the Asia Pacific Fumed Silica Market is segmented and sub-segmented into the following categories.

By Type

- Hydrophilic Fumed Silica

- Hydrophobic Fumed Silica

By Application

- Silicone Elastomers

- Paints, Coatings & Inks

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Which type is growing the fastest in the Asia Pacific Fumed Silica Market?

Hydrophobic fumed silica is projected to grow at the fastest rate, driven by its use in pharmaceuticals, specialty coatings, and food processing. Its water-repellent properties make it ideal for high-performance formulations.

What factors are driving growth in the Asia Pacific Fumed Silica Market?

Market growth is fueled by rising demand for high-performance materials, expanding industrial applications, and rapid development in countries like China, India, and Southeast Asia. The pharmaceutical and automotive sectors are especially strong drivers.

Which country holds the largest share in the Asia Pacific Fumed Silica Market?

China leads the Asia Pacific fumed silica market due to its strong presence in manufacturing sectors such as automotive, electronics, and construction. The country also has a high demand for silicone-based products.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com