Asia Pacific Gas Turbine Market Research Report – Segmented By Technology (Combined Cycle, Open Cycle), Design Type, End-User, Rated Capacity, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Gas Turbine Market Size

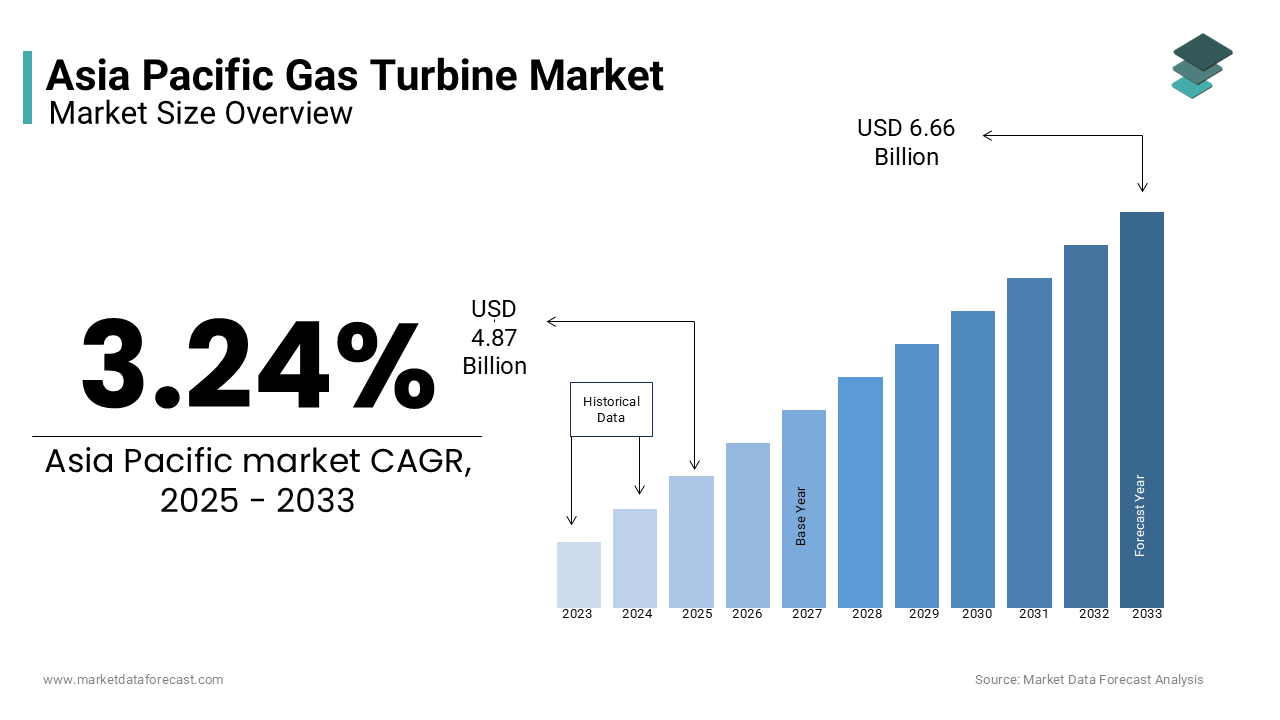

The Asia Pacific gas turbine market was worth USD 4.68 billion in 2024. The Asia Pacific market is expected to reach USD 6.66 billion by 2033 from USD 4.87 billion in 2025, rising at a CAGR of 3.24% from 2025 to 2033.

MARKET DRIVERS

Growing Demand for Cleaner Energy Solutions

One of the primary drivers of the Asia Pacific gas turbine market is the growing emphasis on cleaner energy solutions. According to the World Bank, carbon emissions from energy production in the Asia Pacific account for a significant portion of global emissions, prompting governments to transition from coal to natural gas. For example, India’s Ministry of Power aims to reduce coal dependency by 25% by 2030, creating a surge in gas turbine installations. Natural gas emits considerably less CO2 than coal, making it an attractive option for countries striving to meet international climate goals. China, the largest energy consumer in the region, has invested a substantial amount in natural gas infrastructure since 2020, as per the International Gas Union. This investment has led to an annual increase in gas-fired power plants, driving turbine demand. Furthermore, initiatives like Japan’s Green Growth Strategy promote LNG imports and domestic gas production, further accelerating adoption.

Industrialization and Urbanization

Rapid industrialization and urbanization are also key drivers of the gas turbine market. Industrial hubs like Guangdong in China and Maharashtra in India require uninterrupted electricity, which gas turbines efficiently provide. The Asian Development Bank estimates that industrial power demand will increase annually, creating a robust pipeline for turbine installations. Decentralized power generation is gaining traction, particularly in Southeast Asia, where grid infrastructure remains underdeveloped. Similarly, Vietnam’s industrial zones are adopting gas turbines to meet localized energy needs.

MARKET RESTRAINTS

High Initial Investment Costs

One of the major restraints of the Asia Pacific gas turbine market is the high initial investment required for installation and operation. This financial barrier limits adoption, particularly in developing economies like Bangladesh and Myanmar, where budget constraints are prevalent. For instance, a significant share of energy projects in Southeast Asia face funding challenges, delaying turbine installations. Small-scale utilities and private developers often find these costs prohibitive, hindering market penetration. While leasing models and financing options exist, they remain inaccessible to many stakeholders, particularly in rural or semi-urban areas.

Environmental Concerns and Methane Emissions

Another restraint is the environmental impact of methane emissions associated with natural gas extraction and transportation. According to the Environmental Defense Fund, methane has a global warming potential 84 times greater than CO2 over 20 years. In countries like Australia and Indonesia, where LNG production is a key economic driver, methane leaks during extraction have raised concerns among environmentalists. Regulatory bodies are increasingly scrutinizing these emissions. For example, Japan’s Ministry of Environment has introduced stricter methane monitoring requirements, increasing operational costs for gas turbine operators. Besides, public opposition to fossil fuel-based projects is growing, as per the International Renewable Energy Agency (IRENA).

MARKET OPPORTUNITIES

Integration with Renewable Energy Systems

The integration of gas turbines with renewable energy systems presents a significant opportunity for the Asia Pacific market. According to BloombergNEF, hybrid power plants combining gas turbines and solar/wind energy can improve grid stability and efficiency. For instance, India’s Solar Energy Corporation of India (SECI) has launched pilot projects integrating gas turbines with solar farms to ensure a consistent power supply during peak demand. This trend is supported by government incentives promoting hybrid solutions. South Korea’s Green New Deal allocates $65 billion for clean energy projects, including gas-renewable hybrids. Additionally, advancements in hydrogen-fueled turbines offer a pathway to decarbonization.

Expansion into Distributed Power Generation

Distributed power generation offers another promising opportunity, particularly in remote and underserved areas. Like, a substantial number of people in Asia Pacific lack access to reliable electricity, creating a strong demand for localized power solutions. Gas turbines, with their modular design and quick startup capabilities, are ideal for decentralized applications.

Countries like Indonesia and the Philippines are investing in distributed power projects to electrify rural communities. For example, Indonesia’s Ministry of Energy and Mineral Resources plans to deploy 5 GW of distributed gas-fired capacity by 2025, as stated by the Jakarta Post. Similarly, the Philippines’ Department of Energy has partnered with private firms to install microturbines in island provinces.

MARKET CHALLENGES

Competition from Renewable Energy Sources

One of the primary challenges facing the Asia Pacific gas turbine market is the growing competition from renewable energy sources. According to IRENA, solar and wind energy costs have decreased by 82% and 39%, respectively, over the past decade, making them more economically viable than gas-fired power in some regions. For instance, India’s Solar Energy Corporation achieved record-low tariffs of $0.03/kWh for solar projects in 2022, as reported by the Ministry of New and Renewable Energy. This shift is reshaping energy policies, with governments prioritizing renewables over fossil fuels. China, for example, plans to install 1,200 GW of solar and wind capacity by 2030, overshadowing investments in gas infrastructure. Apart from these, public pressure to adopt cleaner technologies is intensifying.

Supply Chain Disruptions and Geopolitical Risks

Another challenge is supply chain disruptions exacerbated by geopolitical tensions and logistical bottlenecks. Countries like Japan and South Korea, which rely heavily on LNG imports, faced increased operational costs, as reported by Reuters. Plus, natural disasters, such as typhoons in Southeast Asia, further disrupt supply chains, delaying project timelines and increasing operational risks. For example, Thailand’s Gulf Energy Development experienced a 15% delay in turbine installations due to flooding in 2022, as per the Bangkok Post. These challenges not only hinder timely deliveries but also strain relationships with clients, impacting brand reputation and customer loyalty.

SEGMENTAL ANALYSIS

By Technology Insights

The combined cycle segment spearheaded the Asia Pacific gas turbine market by capturing a 65.5% of the total share in 2024. This dominance is attributed to its superior efficiency, with thermal efficiencies higher, compared to those of open cycle systems. Similarly, combined cycle plants are increasingly preferred for large-scale power generation projects due to their ability to reduce fuel costs significantly. For instance, China’s National Energy Administration has mandated the adoption of combined cycle technology in over 40% of new power plants to meet carbon neutrality goals. Government policies promoting cleaner energy solutions further reinforce this trend. Additionally, the integration of advanced heat recovery steam generators (HRSGs) has improved operational flexibility, making combined cycle systems ideal for industrial hubs like Maharashtra in India.

The open cycle segment is the fastest-growing, with a projected CAGR of 7.8%. This progress is fueled by its quick startup capabilities, making it suitable for decentralized power applications. For example, Indonesia’s Ministry of Energy and Mineral Resources plans to deploy open cycle turbines in remote islands to address energy poverty, as per the Jakarta Post. In addition, the rise of distributed power generation is another key driver. Open cycle turbines, with their compact design and ease of installation, are ideal for such applications. Besides, advancements in materials and cooling technologies have improved their efficiency.

By Design Type Insights

The heavy-duty segment captured the largest share of the Asia Pacific gas turbine market, with a substantial share of the total revenue in 2024. This influence is attributed to its robust performance in large-scale power generation projects. According to the International Energy Agency, heavy-duty turbines are capable of generating up to 500 MW per unit, making them indispensable for industrial hubs like Guangdong in China and Gujarat in India.

Government initiatives promoting centralized power solutions further bolster this segment. Additionally, the durability and longevity of heavy-duty turbines, with lifespans exceeding 30 years, make them cost-effective for long-term investments.

The aeroderivative segment is quickly advancing, with a CAGR of 8.5%. This development is propelled by its lightweight design and rapid deployment capabilities, making it ideal for decentralized power applications. For example, Australia has adopted aeroderivative turbines for offshore oil and gas platforms. The increasing demand for mobile power solutions also drives adoption. Also, advancements in materials, such as titanium alloys, have enhanced their efficiency. These innovations position aeroderivative turbines as the fastest-growing segment in the market.

By End User Insights

The power generation segment was the front runner in the Asia Pacific gas turbine market with a 60.4% of the total share in 2024. This top spot is supported by the region’s growing electricity demand, projected to increase significantly by 2030. For instance, China’s National Development and Reform Commission has invested $200 billion in gas-fired power plants to meet urbanization needs. In addition, government policies promoting cleaner energy further reinforce this trend. Additionally, advancements in combined cycle technology have reduced operational costs, making gas turbines more attractive for large-scale power generation.

The oil & gas segment is accelerating, with a CAGR of 9.2%. This progress is fueled by the increasing adoption of gas turbines for upstream operations. Moreover, the rise of LNG production is another key driver. According to the International Gas Union, Asia Pacific’s LNG capacity is expected to grow by 40% by 2030, creating a robust pipeline for turbine installations. Additionally, advancements in hydrogen-compatible turbines offer a pathway to decarbonization.

By Rated Capacity Insights

The above 300 MW segment commanded the Asia Pacific gas turbine market by capturing a 55% of the total share in 2024. This prominence is propelled by its suitability for large-scale power generation projects, particularly in industrialized regions like China and Japan. Like, these turbines are capable of generating up to 500 MW per unit, making them indispensable for meeting urban energy demands.

Government mandates promoting centralized power solutions further reinforce this trend. Additionally, their high efficiency, with thermal efficiencies increasing higher, makes them cost-effective for long-term investments.

The 1–40 MW segment is moving quickly, with a CAGR of 10.5%. This growth is fueled by its suitability for decentralized power applications. For example, Indonesia’s Ministry of Energy and Mineral Resources plans to deploy 1–40 MW turbines in remote islands to address energy poverty. Moreover, the increasing demand for distributed power solutions also drives adoption. Additionally, advancements in materials and cooling technologies have improved their efficiency by 15%, as per Siemens Energy.

REGIONAL ANALYSIS

China stood as the largest contributor to the Asia Pacific gas turbine market i.e. 40.6% of the regional share in 2024. The country’s aggressive urbanization drive and industrialization are key drivers. China’s National Development and Reform Commission has mandated a shift from coal to natural gas, creating a robust pipeline for turbine installations. Additionally, advancements in combined-cycle technology have improved efficiency, with modern turbines achieving higher thermal efficiency. These factors ensure China’s dominance in the market.

India is a promising player in the market share, driven by its growing energy needs and government initiatives promoting cleaner energy solutions. Like, India plans to reduce coal dependency by 2030, boosting gas turbine adoption. The country’s Solar Energy Corporation of India (SECI) is integrating gas turbines with renewable energy systems, enhancing grid stability. Furthermore, decentralized power generation is gaining traction, particularly in rural areas, where gas turbines address energy poverty.

Japan has a strong emphasis on energy efficiency and sustainability. Natural disasters like earthquakes have increased demand for quick-start gas turbines, ensuring a reliable power supply during emergencies. Besides, Japan’s Green Growth Strategy promotes LNG imports and domestic gas production, further accelerating adoption. Mitsubishi Heavy Industries’ development of hydrogen-compatible turbines shows the country’s focus on innovation, positioning Japan as a leader in clean energy solutions.

The South Korea market is driven by its Green New Deal, which allocates $65 billion for clean energy projects. Gas turbines are integral to this initiative, particularly in replacing coal-fired plants. In addition, offshore oil and gas platforms in the Yellow Sea have adopted aeroderivative turbines for enhanced operational efficiency.

Australia & New Zealand had a focus on decentralized power solutions and LNG production. New Zealand’s commitment to renewable energy integration has spurred demand for hybrid systems combining gas turbines with wind and solar. Additionally, Australia’s booming LNG exports, projected to grow, create a strong demand for gas turbines. These dynamics position the region as a key player in the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

General Electric (GE), Siemens Energy, Mitsubishi Power, Kawasaki Heavy Industries, and Ansaldo Energia are some of the key market players in the Asia Pacific gas turbine market.

The Asia Pacific gas turbine market is highly competitive, driven by the presence of both global giants and regional players. Global leaders like GE, Siemens, and MHI dominate through technological superiority and extensive distribution networks, while regional players focus on affordability and localized solutions. Price wars are common, particularly in price-sensitive markets like India and Indonesia, where smaller firms struggle to compete with established brands.

Government policies promoting cleaner energy have intensified rivalry, as companies race to capture contracts for large-scale power projects. For instance, budget constraints in Southeast Asia have created a battleground for cost-effective solutions. Additionally, the rise of renewable energy sources poses a significant challenge, forcing gas turbine manufacturers to innovate or risk obsolescence. Despite these challenges, the market remains dynamic, with innovation and strategic collaborations serving as key differentiators. This competitive landscape ensures continuous improvement in product offerings and customer service, benefiting consumers while pushing companies to adapt to evolving energy policies and environmental regulations.

Top Players in the Asia Pacific Gas Turbine Market

General Electric (GE) Gas Power

GE Gas Power is a global leader in the Asia Pacific gas turbine market, renowned for its advanced heavy-duty and aeroderivative turbines. The company has strengthened its presence through strategic partnerships with utilities and industrial players. For instance, GE recently launched its HA-class turbines in India, offering industry-leading efficiency. Additionally, it collaborated with Petronas in Malaysia to deploy aeroderivative turbines for offshore platforms. These initiatives underscore GE’s commitment to innovation and customer-centric solutions.

Siemens Energy

Siemens Energy plays a pivotal role in the Asia Pacific market, offering cutting-edge technologies tailored to regional needs. The company focuses on sustainability, launching hydrogen-compatible turbines in Japan to support decarbonization goals. In Australia, Siemens partnered with LNG producers to enhance operational efficiency using aeroderivative models. Its R&D investments have improved thermal efficiencies, making it a preferred choice for large-scale projects.

Mitsubishi Heavy Industries (MHI)

MHI is a key player in the Asia Pacific market, leveraging its expertise in combined-cycle technology. The company has introduced hydrogen-fueled turbines in Japan, reducing emissions. MHI also collaborates with governments to develop hybrid power systems, integrating gas turbines with renewables. Its focus on innovation and sustainability ensures a strong market presence across the region.

Top Strategies Used by Key Market Participants (200 Words)

Key players in the Asia Pacific gas turbine market employ diverse strategies to maintain their competitive edge. Innovation is central, with companies investing heavily in R&D to develop hydrogen-compatible and high-efficiency turbines. Partnerships and collaborations are another critical strategy; Siemens Energy partners with LNG producers to enhance operational efficiency, while MHI collaborates with governments to integrate renewables.

Expansion into emerging markets is also a priority. Companies are establishing manufacturing units and service centers in countries like Vietnam and Thailand to cater to growing demand. Additionally, mergers and acquisitions play a pivotal role. Sustainability initiatives are gaining traction, with firms adopting eco-friendly materials and energy-efficient designs to align with government regulations.

RECENT MARKET DEVELOPMENTS

- In March 2023, GE Gas Power launched its HA-class turbines in India, offering industry-leading efficiency of 64%. This move aimed to strengthen its presence in the large-scale power generation segment.

- In May 2023, Siemens Energy partnered with Petronas in Malaysia to deploy aeroderivative turbines for offshore platforms. This collaboration enhanced operational efficiency and expanded Siemens’ footprint in the oil & gas sector.

- In July 2023, Mitsubishi Heavy Industries introduced hydrogen-fueled turbines in Japan, reducing emissions by 50%. This aligned with the country’s decarbonization goals and positioned MHI as a leader in green energy solutions.

- In September 2023, GE acquired a digital monitoring firm in Australia to enhance predictive maintenance capabilities. This acquisition improved customer satisfaction and loyalty in the region.

- In November 2023, Siemens Energy collaborated with the Indian government to develop hybrid power systems integrating gas turbines with renewables. This initiative supported sustainability goals and expanded its market reach.

MARKET SEGMENTATION

This research report on the Asia Pacific gas turbine market is segmented and sub-segmented into the following categories.

By Technology

- Combined Cycle

- Open Cycle

By Design Type

- Heavy Duty

- Aeroderivative

By End User

- Power Generation

- Oil & Gas

By Rated Capacity

- Above 300 MW

- 1–40 MW

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What challenges are faced by the Asia Pacific gas turbine market?

Challenges include high capital costs, competition from renewable energy sources, fuel supply issues, and regulatory constraints.

What is the outlook for the Asia Pacific Gas Turbine Market?

The outlook remains positive, with growth expected due to increased energy demand, modernization of power infrastructure, and a push for cleaner and efficient power generation technologies.

What is the current size of the Asia Pacific Gas Turbine Market?

The Asia Pacific Gas Turbine Market is growing steadily, with significant contributions from industrial and power generation sectors. The market size varies by source, but it is expected to expand due to increasing energy demand and urbanization.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com