Asia Pacific Geopolymer Market Size, Share, Growth, Trends, And Forecasts Research Report, Segmented By Application, End-User And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Geopolymer Market Size

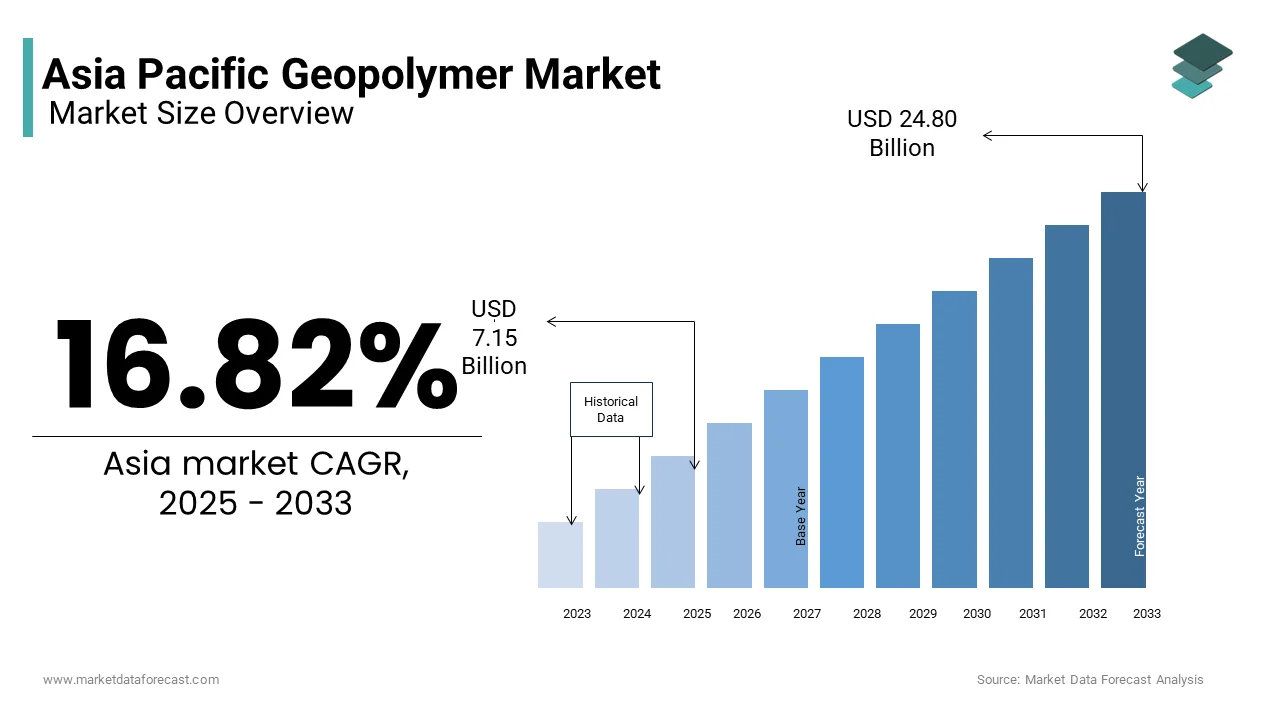

The Asia Pacific geopolymer market was valued at USD 6.12 billion in 2024 and is anticipated to reach USD 7.15 billion in 2025 from USD 24.80 billion by 2033, growing at a CAGR of 16.82% during the forecast period from 2025 to 2033.

The Asia Pacific geopolymer market refers to the production, development, and application of inorganic polymer materials formed through the reaction of aluminosilicate sources with alkaline activators. These materials are increasingly used as sustainable alternatives to conventional Portland cement in construction, infrastructure, and industrial applications due to their low carbon footprint, high durability, and resistance to extreme temperatures and chemicals.

The market growth is driven by growing environmental awareness, government initiatives promoting green building materials, and increasing demand for durable and sustainable construction solutions. According to the United Nations Environment Programme, the construction industry accounts for nearly 40% of global carbon dioxide emissions by prompting countries across the Asia Pacific region to explore low-carbon material options such as geopolymers.

MARKET DRIVERS

Rising Demand for Sustainable Construction Materials

One of the primary drivers of the Asia Pacific geopolymer market is the rising demand for sustainable construction materials driven by environmental concerns and regulatory pressure to reduce carbon emissions from the building and infrastructure sectors. Geopolymers offer a viable alternative to traditional cement-based materials due to their significantly lower CO₂ footprint, up to 80% less than ordinary Portland cement, as they do not require calcination during production.

In Australia, the Green Building Council reported that over 40% of newly constructed commercial buildings in Sydney and Melbourne incorporated geopolymer-based materials in 2024. The University of New South Wales conducted extensive field trials demonstrating that geopolymer concrete could achieve compressive strengths exceeding 60 MPa while reducing lifecycle emissions. The demand for geopolymer materials is expected to rise significantly in both residential and commercial development, with governments across the region pushing for greener construction practices.

Growth in Industrial Infrastructure Requiring High-Performance Materials

Another major driver fueling the Asia Pacific geopolymer market is the expansion of industrial infrastructure projects requiring high-performance, chemically resistant, and thermally stable materials. Industries such as petrochemicals, power generation, and waste treatment facilities are increasingly turning to geopolymer-based products for linings, coatings, and structural components due to their superior mechanical properties and long-term durability.

As per the International Energy Agency, industrial electricity consumption in the Asia Pacific region increased by approximately 5% year-over-year in early 2024, which reflects heightened reliance on energy-intensive manufacturing processes. In China, the National Development and Reform Commission reported a surge in new chemical plant constructions in Zhejiang and Guangdong provinces, where corrosion-resistant materials like geopolymers are preferred for containment structures and flooring systems.

In India, the Department of Heavy Industries noted a significant increase in investments under the Production-Linked Incentive (PLI) scheme for electronics and pharmaceutical manufacturing, both of which require clean, non-reactive surfaces and fire-resistant materials. As per the Indian Institute of Technology Madras, geopolymer panels are being tested for use in modular cleanrooms due to their fire resistance and minimal outgassing properties.

MARKET RESTRAINTS

Limited Awareness and Technical Expertise Among Construction Professionals

A major restraint affecting the Asia Pacific geopolymer market is the limited awareness and technical expertise among architects, engineers, and construction professionals regarding the performance characteristics and application requirements of geopolymer materials. Unlike traditional cement-based systems, geopolymers require specific curing conditions, activation agents, and mixing techniques, which can pose challenges for widespread adoption without proper training and education.

According to the Asian Development Bank, only about 30% of construction firms in Bangladesh, Nepal, and Cambodia had received formal training on advanced material technologies in 2024. In Indonesia, the Center for Research and Application of Housing and Settlements found that less than 25% of surveyed contractors were familiar with geopolymer concretes or their compliance with local building codes.

Furthermore, professional institutions such as the Institution of Engineers Malaysia and the Australian Institute of Architects have gaps in curricula and continuing education programs related to novel construction materials. As per the National University of Singapore, improper mixing or inadequate curing of geopolymer concrete can lead to inconsistent strength development, discouraging repeat usage.

Supply Chain Constraints and Raw Material Availability

Another significant restraint on the Asia Pacific geopolymer market is the supply chain constraints and uneven availability of raw materials required for geopolymer synthesis, such as fly ash, slag, metakaolin, and alkali activators. While these materials are often sourced from industrial by-products, fluctuations in their availability due to changes in energy policies and industrial output affect the consistency of geopolymer production.

According to the International Energy Agency, coal-fired power generation in several Asian countries declined in 2024 due to policy shifts toward renewable energy, directly impacting the supply of fly ash, one of the most commonly used precursors in geopolymer manufacturing. In India, the Central Pollution Control Board recorded a 12% drop in fly ash availability compared to 2022 levels, leading to supply shortages for manufacturers reliant on this material.

MARKET OPPORTUNITIES

Expansion of Green Building Certification Programs

An emerging opportunity for the Asia Pacific geopolymer market lies in the rapid expansion of green building certification programs, which recognize the environmental benefits of using low-carbon construction materials. Countries such as Singapore, Japan, and South Korea have implemented national-level green building schemes that incentivize the use of geopolymer-based products through tax rebates, fast-track permitting, and public procurement preferences.

According to the World Green Building Council, over 60% of new commercial real estate projects in Singapore in 2024 pursued Green Mark certification, which awards points for the inclusion of innovative materials with reduced environmental impact. Moreover, in Australia, the Green Building Council reported that more than 1,200 buildings achieved Green Star certification in 2024, with many incorporating geopolymer concrete to meet embodied carbon reduction targets. As per the Commonwealth Scientific and Industrial Research Organisation, life cycle assessments showed that geopolymer-based structures could cut operational and embodied emissions by up to 65%. With governments and developers prioritizing sustainability, geopolymer adoption is well-positioned to benefit from expanding green certification frameworks across the Asia Pacific region.

Integration with Smart City and Resilient Infrastructure Projects

Another promising opportunity for the Asia Pacific geopolymer market is the integration of geopolymer materials into smart city and resilient infrastructure projects aimed at enhancing climate adaptability, energy efficiency, and disaster resilience. Governments across the region are investing heavily in future-ready cities that emphasize sustainability, digital connectivity, and long-lasting infrastructure.

According to Frost & Sullivan’s 2024 Smart Cities Outlook, over 50 smart city projects were either underway or planned in India, China, and Southeast Asia in 2024 alone. In India, the Ministry of Housing and Urban Affairs promoted the use of geopolymer concrete in road pavements and drainage systems under the Smart Cities Mission due to its high compressive strength and rapid setting properties.

In China, the Ministry of Science and Technology included geopolymer-based composites in its list of recommended materials for underground utility tunnels and flood-resilient infrastructure. As per Tongji University's Institute of Advanced Construction Materials, geopolymer concrete demonstrated superior resistance to sulfate attack and water ingress, making it ideal for use in coastal and high-humidity zones prone to degradation.

MARKET CHALLENGES

High Initial Cost and Lack of Standardized Regulations

One of the primary challenges facing the Asia Pacific geopolymer market is the relatively high initial cost compared to conventional construction materials, coupled with the absence of standardized regional regulations governing its use. While geopolymers offer long-term durability and environmental benefits, their current production and application costs remain higher than those of traditional Portland cement and concrete.

According to the Asian Development Bank, the unit cost of geopolymer concrete in China and India was estimated to be 25–30% higher than ordinary concrete in 2024 due to the additional processing steps involved in activating aluminosilicate sources. This price differential makes it difficult for small and medium-sized construction firms to justify adoption, especially in budget-sensitive public works projects.

Additionally, the lack of uniform standards for geopolymer mix design, testing procedures, and structural engineering guidelines complicates large-scale deployment. As per the Japan Society of Civil Engineers, the absence of a unified regulatory framework has slowed project approvals in several ASEAN countries. The Bureau of Indian Standards also acknowledged delays in establishing national specifications for geopolymer concrete, limiting its inclusion in mainstream building codes. Until cost efficiencies improve and regulatory clarity is established, the adoption of geopolymer materials will remain constrained in the broader construction sector.

Fluctuating Supply of Industrial By-Products Used in Geopolymer Production

Another significant challenge confronting the Asia Pacific geopolymer market is the fluctuating supply of industrial by-products such as fly ash, ground granulated blast furnace slag (GGBFS), and rice husk ash as key feedstocks for geopolymer synthesis. These materials are largely dependent on coal-fired power plants, steel mills, and agricultural residue collection systems, all of which are subject to policy shifts and economic cycles.

Furthermore, in Indonesia and the Philippines, seasonal variations in rice production affect the availability of rice husk ash, adding another layer of unpredictability to raw material sourcing. As per the ASEAN Sustainable Materials Forum, inconsistent feedstock supply increases production risk and hampers economies of scale, making it difficult for geopolymer manufacturers to maintain competitive pricing and consistent output. Unless alternate or synthetic sources of aluminosilicates are developed, this supply volatility will continue to hinder market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.82% |

|

Segments Covered |

By Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Betolar Plc, Kiran Geopolymer, Kuttuva Silicates Private Limited, Mangla Redimix Pvt. Ltd, Milliken & Company, MITSUI & CO., LTD, NTPC (National Thermal Power Corporation), SLB (Schlumberger Limited), Wagners, Zeobond Pty Ltd. |

SEGMENTAL ANALYSIS

By Application Insights

The cement and concrete application segment was the largest and held 58.3% of the Asia Pacific geopolymer market share in 2024. One major driver behind this dominance is the environmental benefits offered by geopolymer concrete, including its ability to reduce carbon emissions by up to 80% compared to traditional cement production. According to the International Energy Agency, the building and construction sector in the Asia Pacific region accounted for nearly 40% of global energy-related CO₂ emissions in early 2024, which is prompting governments and developers to seek low-carbon material solutions. The Chinese Society of Civil Engineering noted that more than 70 infrastructure projects in Guangdong and Zhejiang provinces used geopolymer concrete for roadways and bridge decks due to its high compressive strength and durability in aggressive environments.

The composites segment is swiftly emerging with a CAGR of 11.2% from 2025 to 2033. This rapid growth is fueled by the rising demand for lightweight, durable, and chemically resistant materials in aerospace, automotive, and marine industries. A key factor driving this trend is the integration of geopolymer composites with reinforcing fibers such as basalt, carbon, and glass to produce structural components with superior thermal stability and mechanical properties. As per the Japan Aerospace Exploration Agency, Japanese aircraft manufacturers have begun using geopolymer-based composites in non-load-bearing cabin structures due to their fire resistance and low outgassing characteristics.

By End-Use Industry Insights

The building construction industry segment accounted in holding 52.3% of the Asia Pacific geopolymer market share by making it the largest end-use segment. This is largely due to the urgent need for sustainable building materials amid rising urbanization, stricter emissions norms, and a surge in green building certifications across countries like Singapore, China, and Australia.

According to the World Green Building Council, over 60% of new commercial developments in Singapore in 2024 pursued Green Mark certification, which encourages the use of geopolymer-based concrete and paneling systems. In China, the Ministry of Housing and Urban-Rural Development introduced revised standards allowing greater inclusion of geopolymer binders in residential and commercial buildings. As per Tongji University's Institute of Advanced Construction Materials, geopolymer concrete demonstrated a 20% improvement in compressive strength and a 35% reduction in embodied carbon compared to ordinary Portland cement.

The industrial sector is likely to grow with a CAGR of 10.7% from 2025 to 2033. This growth is driven by the increasing need for heat-resistant linings, acid-proof coatings, and durable flooring in chemical processing, metallurgy, and energy-intensive manufacturing units.

One major factor contributing to this rise is the deployment of geopolymer-based refractories in petrochemical and steel plants where operational temperatures exceed 1,000°C. According to the Indian Institute of Chemical Technology, geopolymer linings demonstrated superior thermal shock resistance and lower spalling rates compared to alumina-based refractories in recent trials conducted in Gujarat’s industrial corridors.

COUNTRY ANALYSIS

China was the top performer in the Asia Pacific geopolymer market with a 35.4% share in 2024. China’s demand for sustainable and high-performance materials has positioned it as a key adopter of geopolymer technology. According to the Ministry of Housing and Urban-Rural Development, over 900 million square meters of new floor space were constructed in 2024, with a growing portion incorporating geopolymer-based concrete to meet national emissions reduction targets. The National Development and Reform Commission included geopolymer technology in its list of recommended materials for infrastructure resilience under climate change adaptation policies.

India was positioned second in the Asia Pacific geopolymer market by capturing 22.4% of the share in 2024. The country’s construction boom, coupled with government incentives for eco-friendly materials, has created substantial demand for geopolymer-based products in housing, roadways, and public infrastructure.

As per the Ministry of Housing and Urban Affairs, over 300 million square meters of new built-up area were developed under the Pradhan Mantri Awas Yojana and Smart Cities Mission in FY 2024. Moreover, the Indian Road Congress endorsed the use of geopolymer concrete in highway overlays and drainage systems due to its rapid setting time and durability. The Central Pollution Control Board also encouraged cement substitution through the Swachh Bharat Mission. The

The Japanese geopolymer market is growing with steady growth opportunities in the coming years. Unlike emerging economies, Japan’s demand is primarily driven by advanced engineering needs rather than volume-driven construction activity.

According to the Japan Society of Civil Engineers, geopolymer-based materials are increasingly used in seismic retrofitting, tunnel linings, and coastal protection structures due to their high tensile strength and chemical resistance. The Ministry of Land, Infrastructure, Transport and Tourism incorporated geopolymer concrete into several railway station platforms and underground water channels in Tokyo and Osaka due to its low shrinkage and long-term durability.

Australia's geopolymer market growth is primarily driven due to its robust green building certification system and early adoption of sustainable construction technologies. While not the largest volume consumer, Australia plays a strategic role in shaping best practices and technical standards for geopolymer utilization.

According to the Green Building Council of Australia, more than 1,200 buildings achieved Green Star certification in 2024, many of which specified geopolymer concrete to reduce embodied carbon. The Australian Research Council funded multiple university-industry collaborations to refine geopolymer mix designs for commercial and industrial floors in Melbourne and Sydney.

Moreover, in Queensland and New South Wales, several wastewater treatment plants adopted geopolymer-based pipes and tanks due to their resistance to sulfide corrosion. As per the Commonwealth Scientific and Industrial Research Organisation (CSIRO), life cycle assessments showed that geopolymer-based infrastructure could cut operational emissions by up to 65%. With strong institutional backing and progressive sustainability mandates, Australia remains a critical innovator in the Asia Pacific geopolymer market.

South Korea accounts for approximately 6% of the Asia Pacific geopolymer market, characterized by its reliance on advanced construction materials and smart city development strategies. The country’s well-developed infrastructure sector and focus on climate-adaptive construction make it an important player in the regional market.

According to the Ministry of Land, Infrastructure and Transport, over 45 smart city projects were either underway or planned in 2024, with geopolymer concrete being considered for roads, pedestrian pathways, and modular housing. The Korea Institute of Civil Engineering and Building Technology (KICT) actively promotes geopolymer-based precast elements due to their rapid curing and compatibility with prefabrication methods.

KEY MARKET PLAYERS

Betolar Plc, Kiran Geopolymer, Kuttuva Silicates Private Limited, Mangla Redimix Pvt. Ltd, Milliken & Company, MITSUI & CO., LTD, NTPC (National Thermal Power Corporation), SLB (Schlumberger Limited), Wagners, Zeobond Pty Ltd. are the market players that are dominating the polymeric market.

Top Players in the Market

Zeobond Pty Ltd.

Zeobond is a leading innovator in the geopolymer market and holds a strong presence in the Asia Pacific region. The company is known for its proprietary geopolymer concrete technology, which offers high durability, rapid setting, and significantly reduced carbon emissions compared to traditional cement. Zeobond actively collaborates with research institutions and government agencies across Australia, India, and Southeast Asia to promote sustainable construction practices. Its work has influenced policy frameworks on green infrastructure by making it a key contributor to the global shift toward low-carbon materials.

Fujita Corporation

Fujita Corporation plays a crucial role in the Asia Pacific geopolymer market through its integration of advanced materials into civil engineering and disaster-resilient infrastructure projects. Based in Japan, Fujita leverages geopolymer-based solutions for tunnel linings, seismic retrofitting, and coastal protection structures. With a focus on long-term performance and environmental sustainability, Fujita supports large-scale urban development initiatives that prioritize material efficiency and climate adaptability. Its involvement in pilot projects and technical standards development positions it as a trusted partner in promoting geopolymer adoption in high-risk infrastructure applications.

Solidia Technologies Inc.

Solidia Technologies is a global leader in sustainable building materials and has been expanding its footprint in the Asia Pacific region through strategic partnerships and localized production models. The company’s patented geopolymer and carbon-capture-enabled cement technologies align with regional decarbonization goals, particularly in China and South Korea. Solidia works closely with governments and industrial stakeholders to introduce scalable alternatives to Portland cement.

Top Strategies Used by Key Market Participants

One major strategy employed by leading players is product innovation and formulation customization. Companies are continuously developing new geopolymer blends tailored for specific applications such as structural concrete, fire-resistant panels, and acid-proof coatings. This helps them cater to diverse customer needs while maintaining technological dominance and meeting evolving regulatory expectations.

Another key approach is expanding regional presence through joint ventures and local manufacturing setups. Several firms have established collaborations with domestic construction companies and research institutes to ensure faster deployment and better alignment with regional standards. These alliances also facilitate knowledge exchange and improve access to emerging markets across the Asia Pacific region.

COMPETITION OVERVIEW

The competition in the Asia Pacific geopolymer market is shaped by the presence of well-established multinational corporations and a growing number of regional startups striving to capture market share through differentiation and strategic positioning. Global leaders such as Zeobond, Fujita Corporation, and Solidia Technologies leverage their technological expertise, extensive R&D capabilities, and strong brand recognition to maintain dominance in premium segments. At the same time, domestic producers in countries like China, India, and Thailand are gaining traction by offering cost-effective alternatives and localized service support. The market is witnessing intensified rivalry not only in pricing but also in product performance, formulation flexibility, and after-sales technical assistance. As demand from infrastructure, industrial construction, and smart city projects continues to evolve, companies are focusing on expanding production capabilities, enhancing product portfolios, and strengthening supply chain efficiencies. Regulatory changes, shifting consumer preferences, and sustainability concerns are further influencing competitive dynamics, prompting firms to adopt agile strategies that align with regional trends and industry standards.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Zeobond Pty Ltd. launched an expanded line of precast geopolymer elements designed specifically for use in marine and wastewater infrastructure. This initiative was aimed at addressing corrosion challenges in coastal and industrial environments, which is reinforcing Zeobond’s prominence in durable, low-carbon construction solutions.

- In June 2024, Fujita Corporation announced a collaboration with a leading Japanese university to develop next-generation geopolymer composites for earthquake-resistant housing and bridge structures. The partnership was intended to enhance material performance under extreme stress conditions and support Japan’s national resilience-building efforts.

- In September 2024, Solidia Technologies expanded its technical advisory team in South Korea to provide direct on-site support to construction firms and government agencies. This move was part of a broader effort to accelerate the adoption of geopolymer-based binders in public infrastructure and commercial buildings.

- In November 2024, Geopolymer Solutions India Pvt. Ltd. commissioned a new mobile casting unit in Hyderabad to enable on-site production of geopolymer-based precast components. The expansion was designed to reduce transportation costs and support rural infrastructure development under national sustainability programs.

- In March 2025, Jiangsu Zhongcheng New Material Co., Ltd. opened a dedicated geopolymer research center in Nanjing to advance alkali-activated cement formulations for high-sulfate environments. This initiative was aimed at supporting infrastructure projects in coastal zones and industrial areas where conventional materials degrade rapidly.

MARKET SEGMENTATION

This research report on the geopolymer market is segmented and sub-segmented into the following categories.

By Application

- Cement and Concrete

- Furnace and Reactor Insulators

- Composites

- Decorative Artifacts

By End Use Industry

- Building Construction

- Infrastructure

- Industrial

- Art and Decoration

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What’s driving the growth of geopolymer adoption in Asia-Pacific construction?

Stringent CO₂ reduction targets, green building codes, and infrastructure investments—especially in China, India, and Australia—are accelerating the shift from traditional cement to low-emission geopolymer binders.

How do geopolymers compare to Portland cement in performance and sustainability?

Geopolymers offer up to 80% lower CO₂ emissions, higher thermal stability, and superior chemical resistance, making them ideal for aggressive environments and sustainable construction.

What are the primary raw materials used in geopolymer production in APAC?

Fly ash, slag, and rice husk ash—readily available industrial by-products in countries like India, China, and Indonesia—are key feedstocks supporting cost-effective geopolymer manufacturing.

What are the key regulatory influences shaping the geopolymer market in APAC?

Policies like India’s GRIHA rating system and Australia’s Green Star program incentivize low-carbon materials, encouraging the use of geopolymers in public and private sector projects.

Which sectors are the largest adopters of geopolymer solutions in the region?

Construction, precast infrastructure, and fire-resistant coatings lead demand, with growing applications in marine structures and defense due to geopolymers’ chemical and thermal resilience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com