Asia Pacific Glass Packaging Market Size, Share, Growth, Trends, And Forecasts Report, By Product. Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Glass Packaging Market Size

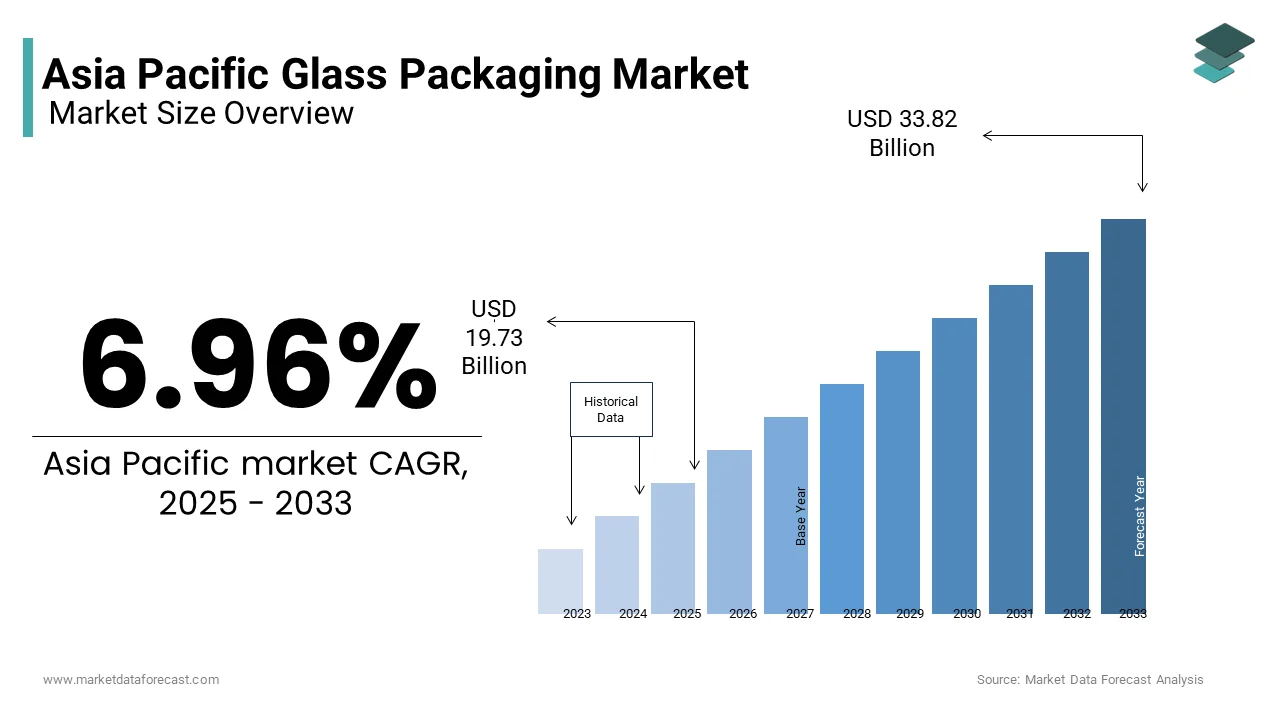

The Asia Pacific glass packaging market was valued at USD 18.45 billion in 2024 and is anticipated to reach USD 19.73 billion in 2025 from USD 33.82 billion by 2033, growing at a CAGR of 6.96% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Rising Demand for Sustainable Packaging Solutions

One of the primary drivers of the Asia Pacific glass packaging market is the escalating demand for eco-friendly packaging alternatives. As per the Ellen MacArthur Foundation, approximately 78 million tons of plastic packaging are produced globally each year, with only 14% being recycled. This alarming statistic has prompted consumers and businesses in the region to seek sustainable options like glass, which is 100% recyclable without loss of quality. In countries such as Australia and Japan, government initiatives promoting waste reduction and recycling have further propelled this trend. For instance, according to the Australian Packaging Covenant Organisation, the country aims to achieve a 70% recycling rate for all packaging materials by 2025, encouraging manufacturers to adopt glass packaging.

Growth of the Food and Beverage Industry

Another significant driver is the robust expansion of the food and beverage industry, particularly alcoholic beverages and premium packaged goods. Glass packaging is the preferred choice for these products due to its ability to preserve flavor and enhance shelf appeal. This growth directly translates into higher demand for glass bottles and jars. The rise of e-commerce platforms selling gourmet and artisanal products has also contributed to the surge in glass packaging usage, as it offers a premium and tamper-proof solution.

MARKET RESTRAINTS

High Production Costs and Energy Consumption

A significant restraint impacting the Asia Pacific glass packaging market is the high cost associated with production and energy consumption. Manufacturing glass involves melting raw materials at temperatures exceeding 1,500°C, a process that consumes substantial energy. This factor poses a challenge, especially in developing nations like India and Vietnam, where energy costs are rising due to limited infrastructure. Furthermore, as per a study by the Federation of Indian Chambers of Commerce & Industry, the cost of producing glass containers in India is approximately 20-25% higher than plastic alternatives, deterring small-scale manufacturers from adopting glass packaging. These economic barriers limit the market's growth potential in price-sensitive regions where affordability is a key consideration for businesses and consumers alike.

Fragility and Weight Concerns

Another critical restraint is the inherent fragility and weight of glass packaging, which increases transportation and handling costs. According to the World Bank, logistics costs in the Asia Pacific region account for 10-15% of the GDP, significantly higher than in developed regions like Europe or North America. Glass packaging, being heavier and more prone to breakage, exacerbates these costs, especially for long-distance shipments. For instance, as per DHL’s Logistics Trend Radar report, companies transporting fragile goods face up to 30% higher insurance premiums due to the risk of damage during transit. Additionally, the weight of glass containers limits their suitability for certain applications, such as lightweight portable products. This challenge is particularly evident in countries like Indonesia and Thailand, where inadequate road infrastructure and frequent handling further increase the likelihood of breakage, discouraging businesses from adopting glass packaging despite its environmental benefits.

MARKET OPPORTUNITIES

Increasing Adoption in the Pharmaceutical Sector

One promising opportunity for the Asia Pacific glass packaging market lies in the pharmaceutical industry, which is experiencing rapid growth due to an aging population and rising healthcare awareness. According to the United Nations Department of Economic and Social Affairs, the geriatric population in the region is expected to double by 2050, which is driving demand for medications and medical supplies. Glass packaging, particularly Type I borosilicate glass vials and ampoules, is widely preferred in this sector due to its chemical inertness and ability to maintain product sterility. This growth presents a lucrative opportunity for glass manufacturers to cater to the increasing demand for vaccine vials, injectables, and other sensitive formulations. Countries like India and China, with their thriving generic drug industries, are expected to be key contributors to this trend.

Expansion of E-commerce and Luxury Goods Packaging

Another significant opportunity arises from the booming e-commerce sector and the growing preference for luxury goods packaging. Glass packaging, known for its aesthetic appeal and ability to convey a sense of luxury, is increasingly being adopted by brands targeting affluent consumers. Additionally, the rise of direct-to-consumer (DTC) models has further boosted demand for tamper-proof and visually appealing packaging solutions. This trend is particularly prominent in markets like South Korea and Japan, where consumers prioritize quality and brand image, which is creating a favorable environment for glass packaging manufacturers to expand their offerings.

MARKET CHALLENGES

Intense Competition from Alternative Materials

One of the foremost challenges facing the Asia Pacific glass packaging market is the intense competition posed by alternative materials such as plastic and metal. Plastic packaging offers advantages such as lower production costs, lighter weight, and greater design flexibility by making it a preferred choice for many industries, including FMCG and personal care. In countries like Vietnam and Indonesia, where cost considerations heavily influence purchasing decisions, the penetration of plastic packaging has been particularly pronounced. Moreover, as per the Confederation of Indian Industry, the availability of multi-layered plastic films with enhanced barrier properties has further intensified competition for glass packaging.

Limited Recycling Infrastructure in Developing Economies

Another pressing challenge is the insufficient recycling infrastructure in several developing economies within the region, which undermines the sustainability advantage of glass packaging. India recycles only about 50% of its glass waste, while countries like Cambodia and Laos have virtually no formal recycling mechanisms in place. This limitation not only reduces the overall recyclability of glass but also increases the reliance on virgin materials by raising production costs. Additionally, the absence of consumer awareness campaigns and incentives for recycling further compounds the issue, which is hindering the market's ability to fully capitalize on its environmental benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.96% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Owens Illinois Inc., saint-Gobain, Ardagh, Gerresheimer, Vetropack, Amcor, Nihon Yamamura, Tamron Co., Ltd., Piramal Glass Limited |

SEGMENTAL ANALYSIS

By End-User Industry Insights

The beverage industry was the top performer in the Asia Pacific glass packaging market with 45.6% of share in 2024 with the region's robust consumption patterns of alcoholic and non-alcoholic beverages, coupled with the premiumization trend that favors glass packaging for its aesthetic appeal and recyclability. Glass bottles are the preferred choice for these products due to their ability to preserve flavor and enhance shelf presence. Another key factor is the rising popularity of craft beverages, which rely heavily on glass containers to convey authenticity and quality.

The pharmaceutical industry is swiftly emerging with a CAGR of 8.2% from 2025 to 2033 with ssthe increasing demand for Type I borosilicate glass vials and ampoules, which are essential for storing vaccines, injectables, and other sensitive formulations. The United Nations Department of Economic and Social Affairs projects that the geriatric population in the region will double by 2050, which is driving demand for medications and medical supplies. Glass packaging’s chemical inertness and ability to maintain product sterility make it indispensable for this sector.

By Product Type Insights

The bottles and jars category dominated the Asia Pacific glass packaging market with 55.4% of the share in 2024 with their widespread use across multiple industries, particularly beverages, food, and personal care. Additionally, the premiumization trend in the beverage industry has further amplified the dominance of glass bottles. Another key driver is the growing consumer preference for sustainable packaging solutions, as glass bottles and jars are 100% recyclable without loss of quality. As per the Australian Packaging Covenant Organisation, the country aims to achieve a 70% recycling rate for all packaging materials by 2025 by encouraging manufacturers to adopt glass packaging.

The vials segment is likely to witness a CAGR of CAGR of 9.1% from 2025 to 2033 owing to the expanding pharmaceutical and healthcare sectors, which rely heavily on glass vials for storing vaccines, injectables, and diagnostic reagents. The United Nations Department of Economic and Social Affairs estimates that the geriatric population in the region will double by 2050 by creating a surge in demand for medical supplies. Glass vials, particularly those made from Type I borosilicate glass, are favored for their chemical inertness and ability to maintain product sterility.

COUNTRY ANALYSIS

Top 5 Leading Countries in the Market

China was the largest contributor of the Asia Pacific glass packaging market with 60.5% of share in 2024 due to its massive industrial base and strong demand from key sectors such as beverages, food, and pharmaceuticals. Glass bottles remain the preferred packaging solution for both domestic consumption and exports, given their recyclability and premium appeal.

India was accounted in holding 15.4% of the Asia Pacific glass packaging market share in 2024 with country’s growth is propelled by its booming FMCG and pharmaceutical sectors. Moreover, the rise of e-commerce platforms selling artisanal and gourmet products has increased demand for glass jars and bottles. Government initiatives promoting waste reduction and recycling further support the adoption of glass packaging.

Japan glass packaging market growth is expecting to grow with a significant CAGR in the next coming years owing to its advanced healthcare and food industries. Additionally, the country’s aging population, which constitutes over 28% of the total population as per the United Nations, drives demand for medications packaged in glass vials. Japan’s stringent environmental regulations also favor recyclable materials, as seen in the Ministry of the Environment’s push for a circular economy.

South Korea is a key player in the Asia Pacific glass packaging market, known for its innovative approach to packaging design and sustainability. The K-beauty trend, which emphasizes natural and eco-friendly ingredients, has amplified demand for sustainable packaging solutions. Additionally, South Korea’s focus on reducing plastic waste aligns with its Green Growth Strategy, promoting the use of recyclable materials like glass.

Australia rounds out the top five leading countries in the Asia Pacific glass packaging market, with a strong emphasis on sustainability and premium products. The beverage industry, particularly wine and craft beer, is a major contributor to this trend. Additionally, the rise of health-conscious consumers has increased demand for organic and natural products, often packaged in glass jars and bottles.

KEY MARKET PLAYERS

Owens Illinois Inc., saint-Gobain, Ardagh, Gerresheimer, Vetropack, Amcor, Nihon Yamamura, Tamron Co., Ltd., Piramal Glass Limited. are the market players that are dominating the Asia Pacific glass packaging market.

Top Players In The Market

Owens-Illinois (O-I)

Owens-Illinois is a global leader in glass packaging, with a significant presence in the Asia Pacific region. The company has established itself as a pioneer in sustainable packaging solutions, leveraging its expertise to cater to diverse industries such as beverages, food, and pharmaceuticals. O-I’s commitment to innovation is reflected in its development of lightweight glass containers that reduce environmental impact while maintaining premium quality.

Ardagh Group

Ardagh Group is another key player contributing significantly to the Asia Pacific glass packaging market. Known for its high-quality glass containers, the company has built a reputation for delivering customized solutions tailored to the needs of its clients. Ardagh’s emphasis on design innovation allows it to create visually appealing packaging that enhances brand identity. The company actively collaborates with beverage and personal care companies to meet evolving consumer preferences for sustainability and luxury. Ardagh’s strategic partnerships with regional distributors have enabled it to expand its footprint and maintain a competitive edge in the market.

Piramal Glass

Piramal Glass is a prominent player in the Asia Pacific region, specializing in premium glass packaging for industries like cosmetics, perfumery, and pharmaceuticals. The company’s state-of-the-art manufacturing facilities ensure consistent quality and precision, catering to both domestic and international markets. Piramal Glass focuses on creating value-added products through cutting-edge technology and customer-centric approaches. Its ability to adapt to changing market trends, such as the rise of e-commerce and luxury goods, has positioned it as a trusted supplier for leading brands.

Top Strategies Used By Key Market Participants

Strategic Collaborations and Partnerships

Key players in the Asia Pacific glass packaging market have increasingly adopted strategic collaborations to enhance their market position. These partnerships also enable them to co-develop innovative solutions that cater to specific regional demands, such as lightweight glass containers or eco-friendly designs. For instance, collaborations with FMCG companies allow glass packaging manufacturers to align their offerings with sustainability goals by ensuring compliance with environmental regulations while meeting consumer expectations.

Investment in Sustainable Practices

Sustainability has become a cornerstone strategy for strengthening market presence. Leading players are investing heavily in green technologies and processes to reduce energy consumption and carbon emissions during production. Initiatives such as using recycled materials and developing closed-loop systems demonstrate their commitment to environmental stewardship. By adopting circular economy principles, these companies not only address regulatory requirements but also appeal to environmentally conscious consumers. This focus on sustainability helps differentiate their brands in a competitive landscape and fosters long-term loyalty among stakeholders.

Expansion of Manufacturing Facilities

To meet growing demand, key players are expanding their manufacturing capacities across the Asia Pacific region. Establishing new plants or upgrading existing facilities allows them to improve operational efficiency and reduce lead times. These expansions are strategically located near major industrial hubs to ensure proximity to key customers and raw material suppliers. Additionally, investments in automation and advanced machinery enhance production capabilities by enabling companies to deliver high-quality products at scale. Such infrastructure developments reinforce their dominance in the market and support sustained growth.

COMPETITION OVERVIEW

The Asia Pacific glass packaging market is characterized by intense competition, driven by the presence of both global giants and regional players vying for market share. Global leaders like Owens-Illinois, Ardagh Group, and Piramal Glass leverage their technological expertise and extensive distribution networks to maintain a strong foothold. Meanwhile, regional players focus on niche markets, offering cost-effective and localized solutions to cater to specific customer needs. The competitive landscape is shaped by factors such as sustainability, innovation, and customization, with companies striving to differentiate themselves through unique value propositions. Rising demand from end-user industries like beverages, pharmaceuticals, and personal care intensifies rivalry, pushing players to adopt aggressive strategies. These include forming strategic alliances, investing in R&D, and expanding production capacities. Moreover, the growing emphasis on recyclability and eco-friendly practices adds another layer of complexity, compelling companies to align with evolving consumer preferences.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Owens-Illinois launched a new line of lightweight glass bottles designed specifically for the craft beer industry in Australia. This initiative aims to enhance product appeal while reducing environmental impact.

- In June 2023, Ardagh Group announced a partnership with a leading Indian beverage manufacturer to develop custom-designed glass containers for premium alcoholic beverages by targeting the growing luxury segment.

- In February 2023, Piramal Glass expanded its manufacturing facility in Thailand, increasing capacity to meet rising demand from the cosmetics and pharmaceutical sectors across Southeast Asia.

- In September 2022, Owens-Illinois collaborated with a Japanese recycling firm to establish a closed-loop system for collecting and reusing glass waste by reinforcing its commitment to sustainability in the region.

- In November 2021, Ardagh Group introduced an automated inspection system in its South Korean plant to improve quality control and reduce production errors by enhancing overall efficiency.

MARKET SEGMENTATION

This research report on the Asia Pacific glass packaging market is segmented and sub-segmented into the following categories.

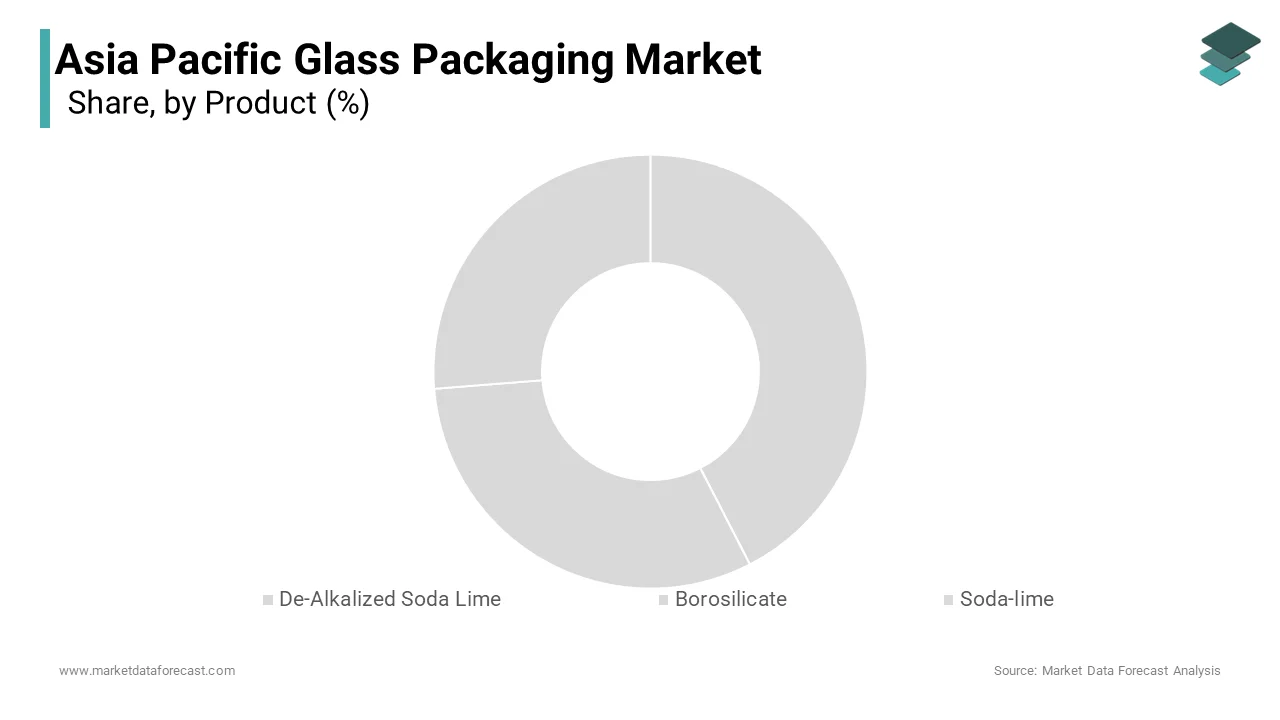

By Product

- De-Alkalized Soda Lime

- Borosilicate

- Soda-lime

By Application

- Food & Beverages

- Alcoholic Beverages

- Beer

- Pharmaceutical

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the demand for glass packaging in the Asia Pacific region?

Rising consumer preference for sustainable, non-toxic, and premium packaging—especially in the food, beverage, and cosmetics sectors—is fueling strong demand for glass packaging across Asia Pacific.

Which industries in Asia Pacific are the primary consumers of glass packaging?

Key end-use industries include alcoholic beverages, soft drinks, pharmaceuticals, and personal care, with growth in artisanal, organic, and luxury brands pushing demand for glass over plastic.

Which countries are leading glass packaging production and consumption in the region?

China and India are dominant due to their large beverage markets and growing pharmaceutical sectors, while Japan, South Korea, and Australia are seeing niche growth in premium and sustainable packaging formats.

What challenges does the Asia Pacific glass packaging market face?

Challenges include high transportation and handling costs, fragility of glass, and competition from lighter, cheaper alternatives like plastics and metal, especially in cost-sensitive markets.

What are the key trends shaping the future of this market?

Expect growth in recycled glass usage, lightweight glass packaging, digital printing for branding, and government-led sustainability initiatives promoting returnable and refillable glass formats.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]