Asia Pacific Glycerol Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Source, Product, Application And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Glycerol Market Size

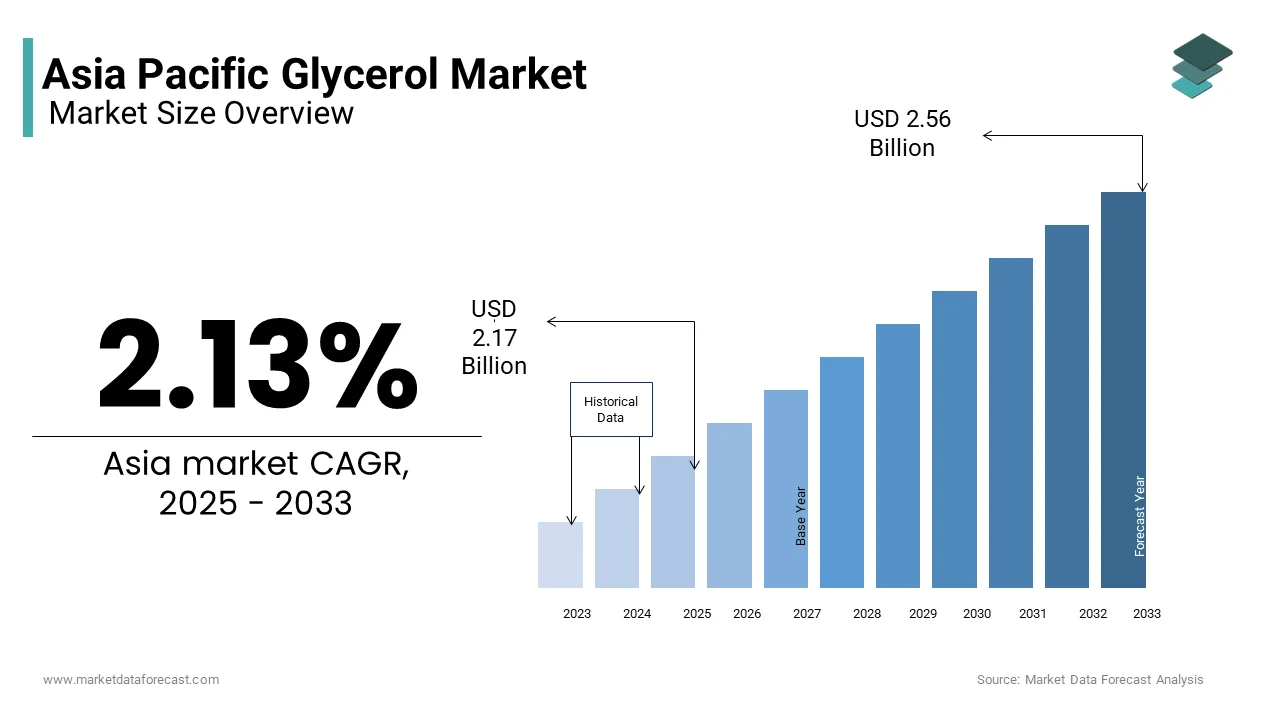

The Asia Pacific glycerol market size was valued at USD 2.12 billion in 2024 and is anticipated to reach USD 2.17 billion in 2025 from USD 2.56 billion by 2033, growing at a CAGR of 2.13% during the forecast period from 2025 to 2033.

Glycerol, a colorless, odorless, and viscous liquid, is a key byproduct of biodiesel production and natural fat saponification. In the Asia Pacific region, glycerol has evolved from a mere chemical intermediate into a versatile compound with applications across food, pharmaceuticals, cosmetics, and industrial sectors. The Asia Pacific glycerol market encompasses both crude and refined forms, sourced primarily from vegetable oils, animal fats, and synthetic methods.

MARKET DRIVERS

Expansion of Biodiesel Production in the Asia Pacific

One of the primary drivers fueling the Asia Pacific glycerol market is the extensive growth in biodiesel production across the region. Biodiesel, derived mainly from vegetable oils such as palm and soybean, generates crude glycerol as a major byproduct. For instance, Indonesia mandated a B40 biodiesel blend in diesel fuel by 2025, which has already led to a surge in palm oil-based biodiesel facilities. This expansion directly translates into increased glycerol availability, positioning it as a cost-effective raw material for downstream industries. Moreover, the Indian government’s National Policy on Biofuels aims to achieve a 20% blending target by 2030, further boosting domestic glycerol volumes. As per statistics from the Asian Clean Energy Forum, the rise in feedstock cultivation for biodiesel, especially in ASEAN nations, has created a surplus supply of crude glycerol, stimulating market growth.

Rising Demand from Pharmaceutical and Personal Care Sectors

The pharmaceutical and personal care industries in the Asia Pacific region represent another significant driver for the glycerol market. Glycerol serves as a critical ingredient in numerous formulations due to its humectant, emollient, and preservative properties. In tandem, the personal care industry in the region is experiencing robust growth, supported by changing lifestyles and rising disposable incomes. Glycerol, particularly in its refined form, is extensively used in skin care products, toothpaste, and oral medications. As per the Journal of Cosmetic Science, glycerin constitutes a major share of moisturizing creams and lotions in premium skincare lines, with demand expected to grow in Asia. Furthermore, regulatory approvals from agencies such as ANVISA (Brazil) and the Therapeutic Goods Administration (Australia) have streamlined the use of glycerol in medical-grade formulations.

MARKET RESTRAINTS

Fluctuating Prices and Supply Chain Instability for Crude Glycerol

A prominent restraint affecting the Asia Pacific glycerol market is the volatility in crude glycerol prices and instability in its supply chain. Since crude glycerol is a byproduct of biodiesel production, its availability and pricing are heavily influenced by fluctuations in feedstock costs, particularly palm and soybean oils. As a result, biodiesel producers adjusted their output levels, directly impacting the volume and cost of crude glycerol generated. Also, transportation bottlenecks and logistical constraints within the region have compounded these issues. Like, port congestion in key shipping hubs such as Singapore and Shanghai during the first half of 2024 delayed raw material deliveries, increasing inventory holding costs for glycerol refiners. These inconsistencies make it challenging for downstream manufacturers to maintain stable input costs or plan long-term procurement strategies.

Environmental and Regulatory Challenges in Crude Glycerol Disposal

Environmental concerns related to crude glycerol disposal pose a significant challenge for the Asia Pacific glycerol market. While glycerol itself is non-toxic, crude glycerol produced from biodiesel processes often contains impurities such as methanol, soap residues, and catalyst remnants. Improper handling and discharge of this waste stream can lead to severe ecological consequences, including water contamination and disruption of aquatic ecosystems. According to the United Nations Environment Programme (UNEP), improper glycerol waste management contributed to several environmental incidents in Southeast Asia between 2021 and 2023, prompting stricter enforcement of waste disposal regulations. In response, national governments have intensified scrutiny over biodiesel plants’ effluent treatment systems. Similarly, the Ministry of Environment in Thailand introduced new guidelines under the Cleaner Production Act mandating advanced purification measures before glycerol waste is released into the environment. These initiatives, while essential for environmental protection, impose additional compliance costs on biodiesel producers, who already operate on narrow profit margins. Thus, despite ample supply potential, stringent environmental norms continue to act as a drag on glycerol market growth across Asia Pacific.

MAJOR OPPORTUNITY

Increasing Utilization of Glycerol in Green Chemistry Applications

The growing application of glycerol in green chemistry represents a substantial opportunity for the Asia Pacific glycerol market. With increasing emphasis on sustainable industrial practices, glycerol has emerged as a promising platform chemical for producing eco-friendly derivatives such as epichlorohydrin, glycerol carbonate, and acrolein. Countries like Japan and South Korea are leading this transformation, leveraging glycerol as a feedstock for biodegradable polymers and solvents. In addition, the Australian Institute of Petroleum has observed a growing trend among petrochemical firms to integrate glycerol into refinery operations to produce glycerol ether and other oxygenated compounds that enhance combustion efficiency in fuels.

Advancements in Biorefinery Technologies Enhancing Glycerol Valorization

Technological advancements in biorefinery processes have significantly improved the economic viability of glycerol valorization in the Asia Pacific region. Modern fermentation techniques and catalytic conversion methods now allow for the efficient transformation of glycerol into high-value biochemicals such as succinic acid, lactic acid, and dihydroxyacetone. Like, biorefineries in Asia Pacific have adopted innovative microbial fermentation approaches that convert crude glycerol into bioethanol and biogas, thereby enhancing resource efficiency. Similarly, in 2024 that South Korean companies have achieved a glycerol-to-bioethanol yield exceeding 80%, using genetically engineered Escherichia coli strains tailored for industrial-scale operations. The Indian Institute of Chemical Technology (IICT) has also developed a proprietary process for converting crude glycerol into hydrogen-rich syngas, demonstrating feasibility in decentralized energy generation.

MARKET CHALLENGES

Limited Infrastructure for Glycerol Refining and Upgrading

A significant challenge facing the Asia Pacific glycerol market is the limited infrastructure for refining and upgrading crude glycerol into high-purity grades suitable for specialty applications. While glycerol production has surged due to expanded biodiesel output, many regions lack the requisite processing capacity to meet the quality demands of pharmaceutical, cosmetic, and food-grade industries. In Malaysia, where biodiesel production exceeds 6 billion liters annually smaller share of crude glycerol undergoes distillation or ion exchange treatments necessary for obtaining refined glycerin. The Indonesian Palm Oil Association (GAPKI) notes that despite being the world's largest palm oil producer, Indonesia imports a majority of its refined glycerol to fulfill industry requirements. This gap stems from high capital investment barriers for setting up purification plants, particularly among small and medium enterprises. Furthermore, inconsistent supply volumes from biodiesel plants add financial risk for investors.

Competition from Synthetic Glycerol and Alternative Humectants

The Asia Pacific glycerol market faces increasing competition from synthetic glycerol and alternative humectants, posing a challenge to the dominance of naturally derived glycerol. Synthetic glycerol, primarily produced from propylene feedstocks, has gained traction in industrial segments due to its consistent purity and lower production costs. Like, synthetic glycerol prices were lower than those of refined vegetable-based glycerol in 2024, making it more attractive for large-scale manufacturers. In China, where the petrochemical industry is highly developed, synthetic glycerol accounted for a major share of total glycerol consumption in the textile and paper sectors. Additionally, alternative humectants such as polyethylene glycol, sorbitol, and propylene glycol have found favor in cosmetic and personal care formulations due to their functional versatility and cost-effectiveness. Like, manufacturers substitute a notable share of glycerol content with these alternatives without compromising product performance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.13% |

|

Segments Covered |

By Source, Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Emery Oleochemicals, Kao Corporation, Oleon NV, Wilmar International Ltd., IOI Oleochemical, Musim Mas Group, Ecogreen Oleochemicals, KLK OLEO, Croda International, Procter and Gamble Chemicals. |

SEGMENTAL ANALYSIS

By Source Insights

The biodiesel-derived glycerol segment held the largest share in the Asia Pacific glycerol market by accounting for 45% of total production in 2024. This dominance is primarily attributed to the region’s aggressive expansion of biodiesel manufacturing capacities over the past decade. Countries such as Indonesia, Malaysia, and Thailand have emerged as major producers, leveraging their abundant palm oil resources to fuel renewable energy initiatives. Moreover, government mandates like Indonesia's B40 blending target and India's National Biofuel Policy are further driving biodiesel demand, which in turn supports glycerol supply. Also, the International Renewable Energy Agency (IRENA) notes that the increasing use of waste cooking oil and non-edible feedstocks in China and Japan is enhancing the sustainability profile of biodiesel-derived glycerol.

Among all sources, glycerol derived from fatty acid production processes is the fastest-growing segment in the Asia Pacific market, projected to expand at a CAGR of 7.8% through 2033. This rapid rise is driven by the expanding oleochemical industry, particularly in countries like Malaysia and China, where fatty acids serve as critical raw materials for surfactants, lubricants, and plasticizers. The Malaysian Palm Oil Board (MPOB) reported that in 2024, over 2 million metric tons of fatty acids were produced domestically, generating significant volumes of glycerol. Additionally, the Japanese Economic Research Institute noted a growing trend among cosmetic and food additive manufacturers to prefer fatty-acid-derived glycerol due to its high purity and bio-based origin.

By Product Insights

The crude glycerol remains the best-performing product segment in the Asia Pacific glycerol market by capturing 60.6% of total volume in 2024. This widespread availability and lower cost compared to refined glycerol make it highly attractive to industrial applications such as animal feed, wastewater treatment, and combustion fuels. The primary source of crude glycerol is the biodiesel industry, which has seen substantial growth across Southeast Asia and China. Meanwhile, in India, the National Dairy Development Board (NDDB) found that crude glycerol is increasingly being used as a fermentation substrate in biogas plants and livestock feed formulations. The low purification costs associated with crude glycerol utilization also encourage its adoption in decentralized industries.

The refined glycerol is emerging as the quickest-growing segment in the Asia Pacific glycerol market, registering a CAGR of 9.2% between 2025 and 2033. This accelerated expansion is largely caused by rising demand from high-value sectors such as pharmaceuticals, cosmetics, and food additives, where purity levels exceeding 99% are essential. Also, refined glycerol consumption in the country increased in 2024, driven by regulatory approvals for its use in Ayurvedic medicines and nutraceuticals.

By Application Insights

The industrial applications segment represented the largest application segment for glycerol in the Asia Pacific region by accounting for 35.7% of total consumption in 2024. This includes uses in paints and coatings, resins, explosives, and chemical synthesis. The demand is primarily driven by the region’s robust manufacturing base, especially in countries like China, India, and South Korea. The Indian Petrochemicals Association reported that glycerol consumption in industrial adhesives and sealants grew, supported by infrastructure development projects. The Australian Paint Manufacturers Federation also confirmed growing interest in bio-based coating solutions, where glycerol serves as an environmentally friendly alternative to synthetic plasticizers.

The pharmaceutical applications segment is the rapidly growing sector for glycerol in the Asia Pacific market, projected to expand at a CAGR of approximately 11.3%. This expansion is propelled by the increasing incorporation of glycerol in drug formulations, cough syrups, and topical ointments due to its excellent viscosity, stability, and biocompatibility. Moreover, the rise of contract manufacturing organizations (CMOs) in Southeast Asia has boosted API exports, indirectly increasing pharmaceutical glycerol consumption.

COUNTRY ANALYSIS

Top Leading Countries In the Market

China occupied the top position in the Asia Pacific glycerol market by accounting for 25.1% of the regional market share in 2024. As a key player in both biodiesel production and industrial glycerol utilization, the country benefits from a well-established chemical manufacturing ecosystem. The National Development and Reform Commission (NDRC) has prioritized glycerol valorization under its 14th Five-Year Plan, allocating significant funding to develop bio-based derivatives such as epichlorohydrin and polyols. Additionally, Shanghai and Guangdong provinces have emerged as major hubs for refined glycerol applications in the cosmetics and pharmaceutical sectors. With the government pushing for circular economy strategies, glycerol is increasingly being converted into value-added biochemicals, reinforcing China’s leadership in the regional glycerol market.

Indonesia holds a major portion of the regional share. The country’s dominance stems from its status as the world’s largest palm oil producer, making it a key supplier of crude glycerol derived from palm-based biodiesel operations. The Indonesian Palm Oil Association (GAPKI) reported that in 2023, national biodiesel production reached 6.2 billion liters, generating over 620,000 metric tons of crude glycerol. With the government mandating a B40 biodiesel blend by 2025, this figure is expected to rise substantially. However, despite high glycerol availability, Indonesia faces challenges in upgrading crude glycerol to refined grades due to limited downstream processing infrastructure. Also, local research institutions such as the Bandung Institute of Technology have developed microbial conversion technologies aimed at transforming crude glycerol into bioethanol and hydrogen.

India is a rapidly emerging market with strong industrial demand in the Asia Pacific glycerol market, which is positioning it as the third-largest contributor. The country’s glycerol industry is driven by dual streams—biodiesel production and soap manufacturing, both of which generate significant quantities of glycerol. The Ministry of New and Renewable Energy (MNRE) estimates that this figure will double by 2027 if current policy incentives are maintained. Moreover, the government’s push for decentralized energy projects has led to increased glycerol utilization in rural biogas generation.

Japan is technologically advanced in refining and high-value applications in the Asia Pacific glycerol market. It is distinguished by its focus on high-purity glycerol applications in pharmaceuticals, food additives, and advanced chemical synthesis. Unlike other markets dominated by crude glycerol, Japan exhibits a strong preference for refined glycerol, reflecting its mature chemical and healthcare industries. According to Japan’s Ministry of Economy, Trade, and Industry (METI), domestic glycerol refining capacity increased in 2024, with firms such as Mitsui Chemicals and Asahi Kasei investing heavily in purification technologies. In addition, Japan’s commitment to green chemistry has led to innovations in glycerol-based solvents and polymers.

South Korea is rising demand for specialty glycerol derivatives in the Asia Pacific glycerol market, with a notable emphasis on specialty glycerol derivatives and industrial applications. The country’s demand is primarily driven by its petrochemical and cosmetics sectors, where refined glycerol plays a crucial role in surfactant production and skincare formulations. Domestic companies such as LG Chem and SK Innovation are also exploring glycerol-based bio-solvents and green polymers as part of their sustainability commitments. Also, academic institutions like KAIST are advancing fermentation techniques to convert crude glycerol into bioethanol and hydrogen, enhancing resource efficiency.

KEY MARKET PLAYERS

Emery Oleochemicals, Kao Corporation, Oleon NV, Wilmar International Ltd., IOI Oleochemical, Musim Mas Group, Ecogreen Oleochemicals, KLK OLEO, Croda International, Procter and Gamble Chemicals. Are the market players that are dominating the Asia Pacific glycerol market?

Top Players in the Market

OQEMA Group

OQEMA Group is a leading chemical distributor with a strong presence in the Asia Pacific glycerol market. While headquartered in Germany, the company has established an extensive distribution network across key markets such as China, India, and Southeast Asia. OQEMA plays a critical role in connecting glycerol producers with end-users in industries ranging from pharmaceuticals to industrial chemicals. The company’s expertise in logistics and supply chain optimization ensures consistent availability of both crude and refined glycerol to its clients. OQEMA’s commitment to sustainability and quality compliance further enhances its market positioning.

Procter & Gamble Chemicals (P&G)

Procter & Gamble Chemicals is a major player in the glycerol space due to its deep integration into the personal care and soap manufacturing sectors. As part of P&G’s broader business, the company utilizes glycerol extensively in consumer products such as skincare items, detergents, and oral care formulations. With manufacturing facilities across Japan, South Korea, and China, P&G contributes significantly to regional glycerol demand. Its vertically integrated approach ensures efficient sourcing and utilization of glycerol obtained from internal production processes. The company's innovation-driven strategy focuses on green chemistry and sustainable sourcing, aligning with evolving environmental standards in the Asia Pacific region.

Emery Oleochemicals

Emery Oleochemicals is one of the largest global manufacturers of oleochemicals, including glycerol, with significant operations in Asia. The company operates major production facilities in Malaysia and Indonesia, where it leverages palm oil-based feedstocks for biodiesel and fatty acid production, both of which yield glycerol as a co-product. Emery Oleochemicals plays a pivotal role in refining and supplying high-purity glycerol to diverse applications, including polymers, lubricants, and personal care products. Its downstream processing capabilities enable it to cater to both domestic and international markets. The company continues to invest in R&D initiatives aimed at improving glycerol valorization and promoting sustainable industrial practices.

Top Strategies Used by Key Market Participants

One major strategy adopted by key players in the Asia Pacific glycerol market is vertical integration, where companies control multiple stages of the supply chain from raw material procurement to final product distribution. This approach allows firms to ensure a stable supply of glycerol while optimizing costs and maintaining quality consistency. Many manufacturers are also investing in biorefineries that convert crude glycerol into higher-value chemicals, enhancing profitability and sustainability. Additionally, partnerships and collaborations with research institutions are being pursued to develop innovative applications for glycerol in pharmaceuticals, biofuels, and specialty chemicals, thereby expanding market reach and strengthening competitive advantage.

COMPETITIVE OVERVIEW

The competition in the Asia Pacific glycerol market is characterized by a mix of large multinational corporations and regional players vying for dominance through strategic positioning and innovation. Given the commodity nature of glycerol, differentiation primarily stems from product purity, application-specific formulations, and reliability of supply chains. Companies are increasingly focusing on upgrading crude glycerol into value-added derivatives to improve margins and reduce dependency on volatile feedstock prices. The growing emphasis on sustainability is also driving firms to adopt greener production methods and promote bio-based glycerol applications.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Emery Oleochemicals announced the expansion of its glycerol refining capacity at its facility in Pasir Gudang, Malaysia, aiming to enhance the production of high-purity glycerol for pharmaceutical and food-grade applications. This move was intended to meet rising demand in the healthcare and nutraceutical sectors across Asia.

- In March 2024, OQEMA Group strengthened its supply chain infrastructure in India by establishing a new logistics hub in Mumbai dedicated to chemical intermediates, including glycerol. This initiative was designed to improve delivery efficiency and responsiveness to customer needs in one of the fastest-growing markets in the region.

- In June 2024, Procter & Gamble expanded its sustainability initiative by incorporating more glycerol sourced from renewable feedstocks into its personal care product lines manufactured in Japan and South Korea, reinforcing its commitment to eco-friendly formulations and reducing reliance on synthetic alternatives.

- In September 2024, KLK Oleosomes, a subsidiary of Kuala Lumpur Kepong Berhad, entered into a joint venture with a Singapore-based biochemical firm to develop novel fermentation-based technologies for converting crude glycerol into high-value biochemicals, targeting industrial and pharmaceutical customers throughout Asia.

- In November 2024, Cargill partnered with a Chinese biotech startup to scale up a pilot project focused on producing bio-based solvents using glycerol as a primary feedstock. The partnership aimed to support the growing demand for environmentally friendly industrial chemicals in China and other parts of the Asia Pacific region.

MARKET SEGMENTATION

This research report on the Asia Pacific glycerol market is segmented and sub-segmented into the following categories.

By Source

- Biodiesel

- Fatty Alcohols

- Fatty Acids

- Soap

By Product

- Crude

- Refines

By Application

- Food and beverages

- Pharmaceutical

- Nutraceutical

- Personal Care and Cosmetics

- Industrial

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What’s driving the growth of glycerol demand in Asia-Pacific’s oleochemical and personal care sectors?

Rising demand for natural-based cosmetics, soaps, and moisturizers in countries like India, China, and Indonesia is boosting glycerol use, especially as a byproduct of biodiesel and palm oil refining.

How does the dominance of biodiesel production affect glycerol supply in APAC?

The surge in biodiesel output, especially in Malaysia and Indonesia, results in an oversupply of crude glycerol, driving down prices but increasing availability for downstream applications.

What quality standards and purity grades are most in demand across APAC industries?

Pharmaceutical and food-grade glycerol is increasingly preferred in markets like Japan and South Korea, driven by strict regulatory frameworks and demand for high-quality ingredients.

How are glycerol applications evolving in APAC’s food and beverage industry?

Glycerol is increasingly used as a humectant, sweetener, and solvent in processed foods, beverages, and nutraceuticals, with growth fueled by rising urban consumption and lifestyle changes.

What are the key challenges to glycerol market stability in APAC?

Price volatility due to biodiesel policy shifts, raw material dependency, and competition from synthetic alternatives are key issues affecting long-term market predictability.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]