Asia Pacific Green Cement Market Size, Share, Trends & Growth Forecast Report By Product Type (Fly Ash-Based Green Cement, Silica Fume-Based Green Cement), Construction Sector, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Green Cement Market Size

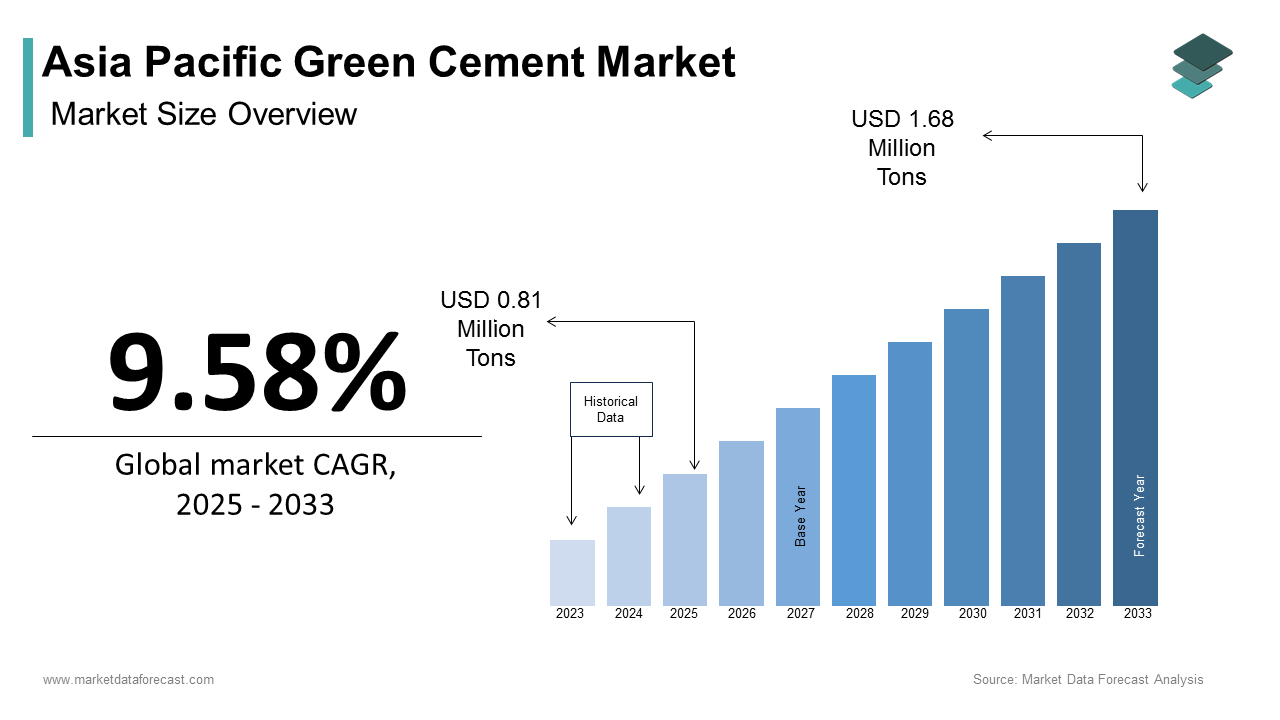

The Asia Pacific green cement market size was calculated to be USD 0.74 million tons in 2024 and is anticipated to be worth USD 1.68 million tons by 2033, from USD 0.81 million tons in 2025, growing at a CAGR of 9.58% during the forecast period.

Green cement, often referred to as eco-friendly or low-carbon cement, is redefining construction practices by utilizing alternative raw materials and advanced manufacturing processes that drastically cut carbon emissions and energy usage. This shift is particularly significant in the Asia Pacific region, which is witnessing rapid urbanization, population growth, and industrial expansion.

MARKET DRIVERS

Stringent Environmental Regulations and Carbon Emission Targets

The Asia Pacific green cement market is significantly propelled by the implementation of stringent environmental regulations aimed at reducing carbon emissions. Governments across the region, such as China, India, and Australia, have introduced policies mandating the use of low-carbon materials in construction projects. For instance, China’s 14th Five-Year Plan emphasizes achieving peak carbon emissions by 2030, with specific targets for reducing industrial emissions. Similarly, India’s Bureau of Energy Efficiency mandates energy-efficient practices in industries, including cement production. These regulations are creating a favorable environment for green cement adoption. Moreover, the Paris Agreement has influenced regional governments to align their climate action plans with global sustainability goals. This commitment is driving investments in sustainable infrastructure, thereby boosting demand for green cement. The growing emphasis on achieving net-zero emissions by mid-century further amplifies the urgency for eco-friendly alternatives, positioning green cement as a critical solution to meet these ambitious targets.

Rising Urbanization and Infrastructure Development

Urbanization in the Asia Pacific region is occurring at an unprecedented pace. This rapid urban expansion necessitates robust infrastructure development, creating a surge in demand for sustainable building materials like green cement. Similarly, China’s Belt and Road Initiative involves large-scale infrastructure projects across Asia, many of which prioritize sustainable materials to minimize environmental impact. This substantial investment underscores the potential for green cement to play a pivotal role in shaping sustainable urban landscapes. Furthermore, increasing consumer awareness about environmentally responsible construction practices is driving real estate developers to adopt green cement, enhancing its market penetration.

MARKET RESTRAINTS

High Production Costs and Limited Economies of Scale

One of the primary restraints hindering the growth of the Asia Pacific green cement market is the high production cost associated with manufacturing eco-friendly cement. Unlike traditional Portland cement, green cement requires advanced technologies and alternative raw materials, such as fly ash, slag, and recycled aggregates, which often come at a premium. Like, producing green cement can be up to 20-30% more expensive than conventional cement due to the additional processing and sourcing requirements. This cost disparity poses a significant challenge, particularly in price-sensitive markets like India and Southeast Asia, where affordability remains a key determinant for material selection. Furthermore, the limited economies of scale exacerbate the cost issue. The lack of widespread adoption and standardization of green cement technologies further compounds this challenge. While larger players may absorb higher costs, smaller manufacturers struggle to compete, limiting the overall supply and accessibility of green cement.

Insufficient Awareness and Technical Expertise

Another significant restraint is the insufficient awareness and technical expertise surrounding green cement among stakeholders in the construction ecosystem. Despite its environmental benefits, many builders, architects, and contractors remain unfamiliar with the applications and advantages of green cement. This knowledge gap creates hesitancy and skepticism about adopting eco-friendly alternatives, even when they are available. Additionally, the absence of standardized guidelines and certifications for green cement complicates its integration into construction projects. Without clear benchmarks, stakeholders often perceive green cement as unreliable or incompatible with existing construction methods. This perception is further reinforced by the lack of promotional campaigns and educational initiatives to highlight its long-term benefits. Consequently, the slow adoption rate stifles market growth, as potential users remain entrenched in traditional practices, favoring familiarity over innovation.

MARKET OPPORTUNITIES

Increasing Investment in Green Building Certifications

The proliferation of green building certifications presents a significant opportunity for the Asia Pacific green cement market. Certifications such as LEED (Leadership in Energy and Environmental Design) and Green Star require the use of sustainable materials, including green cement, to achieve higher ratings. This trend is particularly evident in countries like Singapore and Australia, where government incentives encourage developers to pursue green certifications. For instance, Singapore’s Building and Construction Authority mandates that all new buildings achieve at least the Green Mark certification, which prioritizes eco-friendly materials. Similarly, Australia’s Green Building Council promotes the use of low-carbon cement in commercial and residential projects. As more developers aim to meet certification standards, the demand for sustainable construction materials is expected to soar, positioning green cement as a key enabler of this transition.

Technological Advancements and Innovations

Technological advancements in cement production are unlocking new opportunities for the Asia Pacific green cement market. Innovations such as carbon capture and utilization (CCU) and geopolymer cement are revolutionizing the industry by significantly reducing the carbon footprint of cement manufacturing. According to the Global Cement and Concrete Association, CCU technologies can potentially reduce emissions, making them highly attractive for adoption in the region. Japan and South Korea are at the forefront of integrating these technologies, with several pilot projects demonstrating their feasibility and scalability. Moreover, research and development investments in sustainable construction materials have increased annually over the past decade. These investments are fostering breakthroughs in alternative binding agents, such as rice husk ash and volcanic ash, which enhance the performance and durability of green cement. The growing collaboration between academia, industry players, and governments is further accelerating the commercialization of these innovations.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

A significant challenge facing the Asia Pacific green cement market is the vulnerability of its supply chain to disruptions and the scarcity of essential raw materials. Green cement relies heavily on alternative materials like fly ash, slag, and silica fume, which are byproducts of industrial processes. However, according to the International Energy Agency, fluctuations in industrial activity—such as those caused by the COVID-19 pandemic—have led to inconsistent availability of these materials. For instance, the decline in coal-fired power generation in countries like India and China has reduced the production of fly ash, a critical component of green cement.

Furthermore, the geographic concentration of raw material sources creates logistical challenges, particularly in remote or underdeveloped regions. Transportation costs and delays further exacerbate the issue, making it difficult for manufacturers to maintain a steady supply of green cement. This instability not only increases production costs but also hampers the ability to meet growing demand.

Resistance to Change in Traditional Construction Practices

Resistance to change within the construction industry poses another formidable challenge to the Asia Pacific green cement market. Traditional construction practices are deeply entrenched, with contractors and builders often reluctant to adopt new materials due to perceived risks and uncertainties. Additionally, the lack of standardized testing and validation procedures for green cement creates skepticism among stakeholders. Without robust evidence of its durability and strength, many remain hesitant to incorporate it into large-scale projects. This resistance is further compounded by the absence of clear policy mandates requiring the use of green cement in public infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.58% |

|

Segments Covered |

By Product Type, Construction Sector, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

LafargeHolcim, HeidelbergCement AG, Anhui Conch Cement Company, CEMEX S.A.B. de C.V., Taiwan Cement Corporation, UltraTech Cement Ltd, ACC Limited, JSW Cement, Votorantim Cimentos, China National Building Material Company |

SEGMENTAL ANALYSIS

By Product Type Insights

The fly ash-based green cement segment dominated the Asia Pacific green cement market by capturing 45.8% of the total share in 2024. This segment’s position is driven by the abundant availability and cost-effectiveness of fly ash, a byproduct of coal-fired power plants, which aligns with the region's heavy reliance on coal for energy production. This accessibility has positioned fly ash-based cement as a preferred choice for sustainable construction projects. Another factor driving its dominance is the superior performance characteristics of fly ash-based cement. Also, this product type enhances the durability and strength of concrete while reducing water permeability, making it ideal for large-scale infrastructure projects. For instance, India’s National Highways Authority mandates the use of fly ash-based materials in road construction, contributing to its widespread adoption. In addition, government initiatives such as China’s "Green GDP" policy promote the recycling of industrial waste, further boosting demand.

The segment of silica fume-based green cement is the fastest-growing segment registering a CAGR of 12.8%. This rapid expansion is fueled by the material’s exceptional compressive strength and resistance to chemical corrosion, making it indispensable for high-performance applications. Like, silica fume-based cement is increasingly used in marine and offshore structures, where durability is paramount. The growing emphasis on urbanization and smart city development is another key driver. Silica fume-based cement meets these demands by offering superior load-bearing capacity and longevity. Furthermore, technological advancements in silica extraction have reduced production costs over the past five years making it more accessible.

By Construction Sector Insights

The Non-residential construction segment held the largest share of the Asia Pacific green cement market at 60.5% which is driven by the region’s focus on sustainable commercial and industrial infrastructure. Governments across the region are implementing policies to promote green building certifications, such as LEED and Green Star, which mandate the use of sustainable materials like green cement. For instance, Australia’s Green Building Council requires all new commercial buildings to achieve a minimum sustainability rating, boosting demand. Besides, the rise of mega-infrastructure projects is a significant factor. Projects like China’s Belt and Road Initiative and India’s Smart Cities Mission prioritize low-carbon materials, further propelling the segment’s growth.

The residential construction segment is the quickest advancing, with a CAGR of 10.5%. This is supported by rising urbanization and consumer awareness about sustainable living. This demographic shift is prompting real estate developers to adopt green cement to meet consumer preferences for environmentally responsible housing. Government incentives are another critical factor. Moreover, the affordability of green cement, which reduces long-term maintenance costs appeals to homeowners and builders alike.

REGIONAL ANALYSIS

China led the Asia Pacific green cement market with a dominant 35% share, reflecting its status as the world’s largest construction hub. The country’s aggressive push toward sustainability, driven by its commitment to achieving carbon neutrality by 2060, has spurred demand for eco-friendly materials. Government policies, such as the “Green GDP” initiative, incentivize industries to adopt low-carbon practices, boosting the market. Urbanization is another key driver. The Belt and Road Initiative further amplifies demand, with green cement being used in cross-border projects.

India is propelled by its rapid urbanization and government-led sustainability initiatives. Programs like the Smart Cities Mission and Pradhan Mantri Awas Yojana mandate the use of eco-friendly materials, including green cement, in construction projects. The availability of raw materials like fly ash, a byproduct of coal-fired power plants, also supports growth. Furthermore, India’s Bureau of Energy Efficiency promotes energy-efficient practices, driving the adoption of green cement.

Japan holds a considerable market share and is driven by its advanced technological capabilities and stringent environmental regulations. The construction sector, which contributes significantly to emissions, is a focal point for green cement adoption. Disaster resilience is another factor. This feature is critical in a country prone to natural disasters. Also, Japan’s prowess in carbon capture and utilization technologies has enabled the production of innovative green cement variants.

Australia commands a significant position, supported by its strong commitment to green building standards. The country’s strict environmental regulations, particularly in states like New South Wales and Victoria, mandate the use of low-carbon materials in construction. Urbanization and infrastructure development also play a role. In addition, Australia’s abundant reserves of alternative raw materials, such as slag and silica fume, provide a competitive advantage.

South Korea holds a smaller market share and is driven by its focus on smart cities and green technologies. This initiative has created a robust demand for green cement in both residential and non-residential construction. Technological innovation is another key factor. Additionally, South Korea’s Green Growth Strategy emphasizes reducing carbon emissions, aligning with the adoption of eco-friendly materials.

LEADING PLAYERS IN THE ASIA PACIFIC GREEN CEMENT MARKET

LafargeHolcim Ltd

LafargeHolcim is a global leader in sustainable building materials and plays a pivotal role in advancing green cement solutions in the Asia Pacific region. The company has pioneered innovations such as ECOPact, a low-carbon concrete alternative, which aligns with regional sustainability goals. LafargeHolcim’s commitment to reducing carbon emissions through circular economy practices has positioned it as a key contributor to the global market. By leveraging waste materials like slag and fly ash, the company promotes eco-friendly construction while maintaining high-performance standards.

Heidelberg Materials (formerly HeidelbergCement)

Heidelberg Materials is renowned for its focus on sustainability and innovation in the green cement sector. The company has actively invested in research and development to create advanced formulations that minimize environmental impact. Its emphasis on carbon-neutral production processes and resource efficiency has made it a trusted partner for large-scale infrastructure projects in the Asia Pacific. Heidelberg Materials’ adoption of alternative fuels and raw materials underscores its dedication to reducing the ecological footprint of cement production.

UltraTech Cement Ltd

UltraTech Cement, a flagship company of the Aditya Birla Group, is a dominant player in the Asia Pacific green cement market. The company has introduced innovative products like Portland Pozzolana Cement (PPC) and composite cement, which utilize industrial byproducts to reduce carbon emissions. UltraTech’s focus on sustainable practices, coupled with its extensive distribution network, enables it to cater to diverse markets across the region.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the Asia Pacific green cement market have prioritized forming strategic collaborations with governments, research institutions, and industry bodies to enhance their technological capabilities. These partnerships enable companies to co-develop innovative solutions tailored to regional needs, such as carbon capture technologies and alternative material sourcing.

Investment in Research and Development

Investing in R&D is a cornerstone strategy for leading companies aiming to differentiate themselves in the green cement market. By focusing on breakthroughs in low-carbon formulations and energy-efficient production methods, these players can offer superior products that meet stringent environmental standards. Continuous innovation not only enhances product performance but also addresses challenges related to scalability and cost-effectiveness, ensuring long-term market relevance.

Expansion of Production Facilities

To meet the growing demand for green cement, companies are expanding their manufacturing capacities across key regions in the Asia Pacific. Establishing localized production units allows players to reduce logistical costs, ensure timely supply, and cater to specific market requirements.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asian Pacific green cement market include LafargeHolcim, HeidelbergCement AG, Anhui Conch Cement Company, CEMEX S.A.B. de C.V., Taiwan Cement Corporation, UltraTech Cement Ltd, ACC Limited, JSW Cement, Votorantim Cimentos, China National Building Material Company

The Asia Pacific green cement market is characterized by intense competition, driven by the presence of both global giants and regional players striving to establish dominance. Companies are increasingly focusing on differentiation through innovation, sustainability, and customer-centric solutions. The market landscape is shaped by a blend of traditional cement manufacturers transitioning to greener alternatives and niche players specializing in advanced formulations. Regulatory pressures and consumer demand for eco-friendly materials have intensified rivalry, prompting firms to adopt aggressive strategies such as mergers, acquisitions, and partnerships. Additionally, the race to achieve economies of scale and reduce production costs has further heightened competitive dynamics. As sustainability becomes a core priority, players are investing heavily in branding and marketing to position themselves as leaders in the green cement revolution.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, LafargeHolcim launched its ECOPact green cement range in India, targeting urban infrastructure projects. This move expanded its product portfolio and reinforced its commitment to sustainable construction in the region.

- In March 2024, Heidelberg Materials partnered with a leading renewable energy provider in Australia to power its production facilities with solar energy. This initiative underscored its dedication to reducing the carbon footprint of its operations.

- In May 2024, UltraTech Cement announced the acquisition of a slag processing plant in Thailand, enhancing its ability to produce low-carbon cement variants and meeting rising demand in Southeast Asia.

- In July 2024, ACC Limited, a subsidiary of Holcim, introduced a mobile app in India to educate builders and contractors about the benefits of green cement, boosting awareness and adoption among end-users.

- In September 2024, Taiheiyo Cement Corporation collaborated with a Japanese university to develop geopolymer-based cement, aiming to commercialize this technology for marine infrastructure projects across the Asia Pacific.

MARKET SEGMENTATION

This research report on the Asia Pacific green cement market has been segmented and sub-segmented based on product type, construction sector, and region.

By Product Type

- Fly Ash-Based Green Cement

- Silica Fume-Based Green Cement

By Construction Sector

- Non-Residential Construction

- Residential Construction

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. How is the demand for green cement evolving in the Asia Pacific region?

The demand is increasing due to growing environmental regulations, rising awareness of sustainable construction, and government initiatives promoting low-carbon infrastructure development.

2. What are the key factors driving the demand for green cement in the Asia Pacific region?

The demand is driven by increasing construction activities, government regulations on emissions, rising environmental awareness, and the push for sustainable building practices.

3. Who are the key players in the Asia Pacific green cement industry?

Key players include LafargeHolcim, HeidelbergCement AG, Anhui Conch Cement Company, CEMEX S.A.B. de C.V., and UltraTech Cement Ltd.

4. Which segment holds the largest share in the green cement market by application?

The residential and commercial construction segments hold the largest share due to the rising demand for sustainable buildings and urban development initiatives.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]