Asia Pacific Healthcare AI Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Technology, Application, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Healthcare AI Market Size

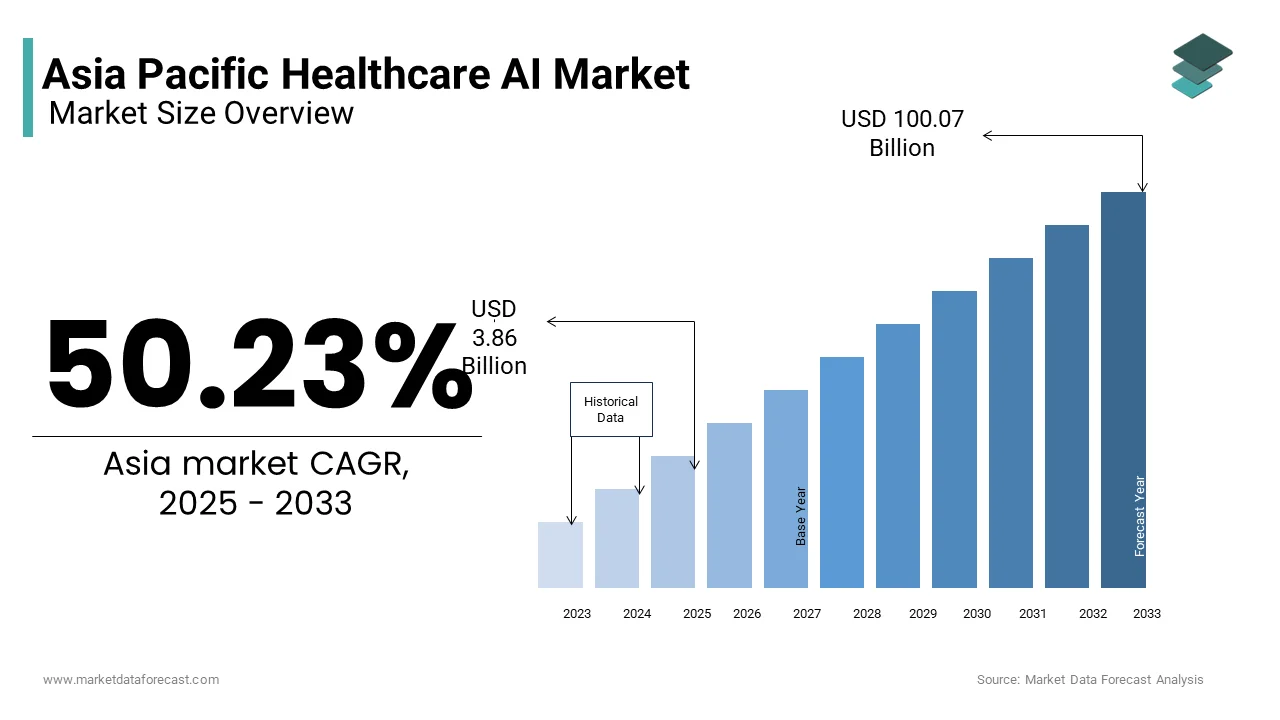

The Asia Pacific healthcare AI market was valued at USD 2.57 billion in 2024 and is anticipated to reach USD 3.86 billion in 2025, from USD 100.07 billion by 2033, growing at a CAGR of 50.23% during the forecast period from 2025 to 2033.

The Asia Pacific healthcare AI market is a rapidly evolving domain and is characterized by the integration of artificial intelligence technologies into medical systems and processes. It encompasses applications such as predictive analytics, robotic surgeries, virtual health assistants, drug discovery, and personalized medicine. The region is witnessing an unprecedented surge in demand for advanced healthcare solutions due to its vast population base, aging demographics, and rising prevalence of chronic diseases. AI is being increasingly adopted to address these challenges by enhancing diagnostic accuracy, reducing operational costs, and improving patient outcomes.

MARKET DRIVERS

Rising Burden of Chronic Diseases

The escalating prevalence of chronic illnesses, such as cardiovascular diseases, diabetes, and cancer, serves as a significant driver for the adoption of AI in the Asia Pacific healthcare sector. According to the Global Burden of Disease Study, chronic diseases account for a large share of all deaths in the region, with ischemic heart disease and stroke being the leading causes. This growing burden necessitates innovative solutions to manage patient care efficiently. AI-powered platforms, such as machine learning algorithms for predictive diagnostics, are proving instrumental in identifying at-risk populations and enabling timely interventions. For example, a study conducted by Stanford University revealed that AI models could predict heart failure risks with a high accuracy rate, significantly higher than traditional methods. Additionally, the increasing affordability of wearable devices equipped with AI capabilities has empowered patients to monitor their health in real-time, fostering preventive healthcare practices. Like, the adoption of wearable health technologies grew notably in the Asia Pacific between 2020 and 2022, driven by consumer awareness and government initiatives promoting digital health literacy.

Government Initiatives and Funding

Government-led initiatives and substantial funding allocations are pivotal in driving the proliferation of AI in healthcare across the Asia Pacific. Countries like China, Japan, and South Korea are at the forefront of this movement, investing billions in AI research and development. Similarly, Japan’s "AI Hospital" initiative aims to integrate AI systems into hospitals to streamline operations and enhance patient care. These efforts are complemented by public-private partnerships, which have accelerated the deployment of AI tools in clinical settings. Moreover, regulatory frameworks supporting AI adoption, such as Australia’s AI Ethics Framework, have created a conducive environment for innovation. The availability of grants and subsidies has further incentivized startups and SMEs to develop cutting-edge AI applications, thereby fueling market growth.

MARKET RESTRAINTS

Data Privacy Concerns

Data privacy remains a critical restraint in the adoption of AI within the Asia Pacific healthcare sector. The sensitive nature of medical data, coupled with varying data protection regulations across countries, poses significant challenges. For example, as per a report by the Asian Development Bank, only a limited share of nations in the region have comprehensive data protection laws, leaving a substantial gap in safeguarding patient information. This lack of uniformity creates hesitancy among healthcare providers and patients alike, limiting the widespread implementation of AI systems that rely on vast datasets for training and analysis. In addition, high-profile data breaches have heightened public apprehension. According to Verizon’s Data Breach Investigations Report, the healthcare sector accounted for a notable share of all cybersecurity incidents in the Asia Pacific in 2022, making it the second most targeted industry. Such incidents not only erode trust but also increase compliance costs for organizations striving to meet stringent data security standards.

High Implementation Costs

The substantial financial investment required for implementing AI technologies acts as a significant restraint, particularly for smaller healthcare institutions in the Asia Pacific. This financial burden is exacerbated by the need for continuous updates and maintenance, which further escalates expenses. Rural and underdeveloped areas face even greater challenges, as they often lack the infrastructure and technical expertise necessary to support AI systems. A survey by the Asian Hospital Federation revealed that a major share of rural healthcare facilities in Southeast Asia do not possess the resources to invest in advanced technologies. This disparity widens the urban-rural divide in healthcare access, impeding the equitable distribution of AI benefits. Moreover, the return on investment (ROI) for AI implementations is often uncertain, deterring risk-averse stakeholders. Like, only a small fraction of AI projects in healthcare achieve their projected ROI within the first three years.

MARKET OPPORTUNITIES

Telemedicine Expansion

The rapid expansion of telemedicine presents a lucrative opportunity for AI integration within the Asia Pacific healthcare sector. With the COVID-19 pandemic accelerating the adoption of remote healthcare services, telemedicine has emerged as a cornerstone of modern healthcare delivery. AI plays a pivotal role in enhancing telemedicine platforms by enabling features such as symptom analysis, virtual consultations, and remote monitoring. The integration of natural language processing (NLP) allows AI systems to interpret patient queries and provide tailored recommendations, improving the overall user experience. In addition, governments are actively promoting telemedicine adoption; for example, India’s National Digital Health Mission aims to connect 1.3 billion citizens through digital health records and AI-enabled teleconsultations.

Personalized Medicine

Personalized medicine represents another significant opportunity for AI in the Asia Pacific healthcare market. By leveraging AI algorithms to analyze genetic data, lifestyle factors, and medical histories, healthcare providers can deliver highly individualized treatment plans. According to a study published in The Lancet Digital Health, AI-driven personalized medicine has reduced treatment failure rates in oncology cases across the region. For instance, GenomeAsia 100K, a collaborative project involving researchers from Singapore and South Korea, utilizes AI to map genetic variations among Asian populations, enabling more precise drug prescriptions. This approach is particularly beneficial in addressing the unique genetic profiles of ethnic groups in the Asia Pacific, which often differ from those in Western populations. Moreover, advancements in AI-powered genomics have reduced sequencing costs over the past five years, making personalized medicine more accessible. Companies like BGI Genomics are capitalizing on this trend by offering affordable AI-driven genomic testing services in China and neighboring countries.

MARKET CHALLENGES

Ethical Dilemmas

Ethical dilemmas surrounding the use of AI in healthcare pose a formidable challenge to its widespread adoption in the Asia Pacific. One of the primary concerns is the potential for bias in AI algorithms, which can lead to unequal treatment outcomes. This issue is particularly pronounced in the Asia Pacific, where cultural and linguistic diversity complicates the creation of inclusive datasets. Also, the delegation of critical decisions, such as treatment plans or triage protocols, to AI systems raises questions about accountability. According to a survey conducted by the Asia-Pacific Medical Ethics Network, a large percentage of healthcare professionals expressed discomfort with fully autonomous AI decision-making, citing ethical concerns about patient autonomy and informed consent. Another challenge is the potential misuse of AI for profit-driven purposes, such as prioritizing expensive treatments over cost-effective alternatives. As per a report by the World Economic Forum, a considerable portion of consumers in the region fear that AI may prioritize corporate interests over patient welfare.

Lack of Skilled Workforce

The shortage of skilled professionals proficient in both healthcare and AI technologies presents a significant challenge to the growth of the Asia Pacific healthcare AI market. This skills gap is particularly acute in developing countries, where educational infrastructure lags behind technological advancements. This deficiency limits the ability of healthcare organizations to fully leverage AI tools, resulting in suboptimal outcomes. Furthermore, the rapid pace of AI innovation exacerbates the problem, as existing professionals struggle to keep up with evolving technologies. Also, job postings for AI-related roles in the healthcare sector increased significantly in the Asia Pacific between 2020 and 2022, yet qualified applicants remain scarce. For instance

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

50.23% |

|

Segments Covered |

By Technology, Application, End-user,a nd Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

International Business Machines (IBM) Corporation, Microsoft Corporation, Intel, Welltok Incorporation, iCarbonX, Entilic Incorporation, Alphabet Inc., Next IT Verint Corporation, NVIDIA Corporation, Oncora Medical. |

SEGMENTAL ANALYSIS

By Technology Insights

The deep learning method segment dominated the Asia Pacific weight management market by accounting for 60.6% of the total market share. This segment’s dominance is driven by its unparalleled ability to process vast datasets and deliver accurate insights into weight management strategies. One key factor propelling this leadership is the increasing prevalence of obesity in the region. Deep learning algorithms are adept at analyzing complex patterns in patient data, enabling personalized weight management plans that cater to individual needs. Another driving factor is the growing adoption of wearable devices equipped with AI capabilities. For instance, companies like Fitbit and Garmin utilize deep learning to provide real-time feedback to users, enhancing engagement and adherence to weight management programs. Furthermore, partnerships between healthcare providers and tech firms have accelerated the integration of deep learning into clinical workflows.

The querying method is the fastest-growing segment in the Asia Pacific weight management market, with a projected CAGR of 18.5% from 2025 to 2033. This rapid rise is fueled by the increasing demand for user-friendly platforms that allow individuals to access tailored weight management advice. One significant driver is the proliferation of mobile health applications. These apps empower users to input dietary preferences, track progress, and receive actionable recommendations, fostering a proactive approach to weight management. Another factor contributing to this growth is the rising emphasis on preventive healthcare. The Asian Development Bank reports that non-communicable diseases (NCDs) linked to obesity cost the region over $1.3 trillion annually. Governments are encouraging early intervention through AI-powered querying tools that educate users about healthy lifestyle choices. For example, Singapore’s Health Promotion Board launched an AI chatbot that uses querying methods to guide citizens on nutrition and exercise, achieving an increase in user engagement within six months. In addition, advancements in natural language processing (NLP) have enhanced the accuracy of these systems, making them more accessible to diverse populations.

By Application Insights

The preliminary diagnosis segment held the largest share of the Asia Pacific weight management market, capturing 55.7% of the total market in 2024. This segment’s dominance is attributed to the critical role of early detection in managing obesity-related complications. One driving factor is the escalating burden of chronic diseases in the region. According to the International Diabetes Federation, a considerable share of the global diabetic population resides in the Asia Pacific, with obesity being a major risk factor. AI-driven preliminary diagnosis tools enable healthcare providers to identify at-risk individuals and recommend timely interventions, reducing the long-term economic and health impact. Another factor is the integration of AI with electronic health records (EHRs). These systems analyze patient histories, genetic predispositions, and lifestyle factors to predict obesity risks with remarkable precision. Furthermore, government initiatives promoting digital healthcare infrastructure have bolstered the adoption of preliminary diagnosis technologies. South Korea’s Ministry of Health reported an increase in AI usage for obesity screening programs, highlighting the segment’s pivotal role in public health strategies.

The Dosage error reduction is the quickest accelerating application segment in the Asia Pacific weight management market, with a CAGR of 19.2%. This rise is driven by the increasing complexity of weight management medications and the need for precise dosing. One key factor is the rising incidence of medication errors in the region. AI-powered dosage optimization tools mitigate these risks by ensuring accurate prescriptions tailored to individual patient profiles. Another factor is the growing adoption of telemedicine platforms that integrate dosage error reduction features. Apart from these, pharmaceutical companies are investing in AI to improve drug formulation and delivery.

By End-User Insights

The pharmaceuticals and biotechnology companies segment commanded the Asia Pacific weight management market by holding a 65% market share in 2024. This performance is supported by the sector’s focus on developing innovative weight management solutions. One key factor is the increasing investment in research and development (R&D). Companies like Novo Nordisk and Pfizer have leveraged AI to accelerate the development of anti-obesity medications, addressing the growing demand for effective therapies. Another factor is the collaboration between pharmaceutical firms and AI startups. Apart from these, regulatory support has bolstered segment growth.

The segment of medical device companies is the rapidly moving ahead end-user segment in the Asia Pacific weight management market, with a CAGR of 21.3%. This surge is fueled by the rising adoption of AI-powered wearable devices and smart scales. One driving factor is the increasing consumer awareness of fitness and wellness. Companies like Xiaomi and Samsung have capitalized on this trend by integrating AI into their wearable devices, enhancing user experience and engagement. Another factor is the expansion of IoT-enabled healthcare ecosystems. For example, South Korea’s SK Telecom launched an AI-driven smart scale that syncs with mobile apps to provide comprehensive weight management analytics, achieving an increase in sales within a year. Furthermore, government incentives have spurred innovation in this segment.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China spearheaded the Asia Pacific healthcare AI market by commanding a 35.1% market share in 2024. The country’s progress is associated with its robust technological ecosystem and substantial government investments. One key factor is the widespread adoption of AI in tier-1 hospitals. A different factor is the booming startup landscape. Companies like Ping An Good Doctor and iCarbonX are pioneering innovations in personalized medicine and predictive analytics, further cementing China’s leadership.

India is quickly emerging in the market. The country’s position is bolstered by its large patient base and cost-effective AI solutions. One driving factor is the government’s Ayushman Bharat Digital Mission, which aims to create a unified digital health infrastructure. Further aspect is the rise of telemedicine platforms. Startups like Practo and mfine are leveraging AI to enhance accessibility and affordability, driving market growth.

Japan remains a significant player in the market. The country’s advanced healthcare system and aging population drive AI adoption. One key factor is the integration of AI in geriatric care. Companies like Fujitsu and NEC are at the forefront of developing cutting-edge AI solutions, reinforcing Japan’s prominence.

South Korea secures a decent market share. The country’s prowess is driven by its strong ICT infrastructure and proactive regulatory framework. One driving factor is the adoption of AI in public healthcare initiatives. A different factor is the collaboration between academia and industry. Companies like Samsung Medison and Lunit are pioneering advancements in imaging and diagnostics, contributing to market growth.

Australia and New Zealand are experiencing growth in the market. The region’s place is driven by its focus on research and ethical AI usage. One key factor is the adoption of AI in remote healthcare delivery. Another factor is the emphasis on ethical guidelines. Companies like ResApp Health and Orion Health are leading innovations in respiratory diagnostics and population health management, respectively, strengthening the region’s position.

KEY MARKET PLAYERS

International Business Machines (IBM) Corporation, Microsoft Corporation, Intel, Welltok Incorporation, iCarbonX, Entilic Incorporation, Alphabet Inc., Next IT Verint Corporation, NVIDIA Corporation, Oncora Medica, are the market players Asia Pacific health care AI market.

Top Players in the Market

Ping An Good Doctor (China)

Ping An Good Doctor is a leading player in the Asia Pacific healthcare AI market, renowned for its AI-driven telemedicine platform. The company has revolutionized patient care by integrating AI chatbots and virtual assistants to provide real-time consultations and health management services. Its contributions to the global market include pioneering advancements in predictive diagnostics and chronic disease management. By leveraging machine learning algorithms, Ping An Good Doctor has set benchmarks in personalized healthcare delivery, enhancing accessibility and affordability for millions of users worldwide.

Fujitsu Limited (Japan)

Fujitsu Limited is a prominent player driving innovation in the Asia Pacific healthcare AI landscape. The company focuses on developing AI-powered imaging solutions and precision medicine tools that cater to both urban and rural populations. Globally, Fujitsu’s emphasis on ethical AI frameworks and collaboration with research institutions has strengthened its reputation as a leader in sustainable healthcare technologies.

IBM Watson Health (Australia & New Zealand)

IBM Watson Health has established itself as a major player in the Asia Pacific region by offering AI-driven platforms for data analytics and clinical decision support. The company’s innovations in natural language processing (NLP) have transformed how healthcare providers interpret patient data and streamline workflows. On a global scale, IBM Watson Health has been instrumental in promoting interoperability and standardization of AI tools, enabling seamless integration into existing healthcare systems.

Top Strategies Used by Key Market Participants

Strategic Partnerships

Key players in the Asia Pacific healthcare AI market are increasingly forming strategic partnerships with hospitals, research institutions, and tech firms to co-develop innovative solutions. These collaborations enable companies to leverage complementary expertise, accelerate product development, and expand their reach. For instance, partnerships with academic institutions often focus on refining AI algorithms using diverse datasets, ensuring robustness and inclusivity in healthcare applications.

Investment in R&D

Investing heavily in research and development is another dominant strategy adopted by market leaders. Companies are prioritizing the creation of cutting-edge AI tools tailored to regional needs, such as addressing chronic diseases or improving rural healthcare access.

Expansion of Service Portfolios

To strengthen their market position, companies are diversifying their service portfolios by incorporating AI into various healthcare domains, including telemedicine, diagnostics, and personalized medicine.

COMPETITION OVERVIEW

The Asia Pacific healthcare AI market is characterized by intense competition, driven by the presence of both global giants and regional innovators. Established players like IBM Watson Health and Fujitsu compete alongside emerging startups such as Ping An Good Doctor and Lunit, creating a dynamic ecosystem. The competitive landscape is shaped by rapid technological advancements, increasing demand for cost-effective healthcare solutions, and supportive government policies. Companies are striving to differentiate themselves through unique value propositions, such as proprietary AI algorithms, user-friendly interfaces, or specialized applications in oncology and cardiology. Additionally, the race to secure intellectual property rights and comply with stringent data privacy regulations further intensifies rivalry.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Ping An Good Doctor launched an AI-powered mental health platform in collaboration with several Asian universities. This initiative aimed to address the rising prevalence of mental health issues by providing accessible counseling services via virtual assistants.

- In June 2023, Fujitsu Limited partnered with Japan’s National Cancer Center to develop an AI-based diagnostic tool for early cancer detection. This move was designed to enhance screening accuracy and improve patient outcomes in high-risk populations.

- In September 2023, IBM Watson Health expanded its operations in Australia by establishing a dedicated AI research hub in Sydney. This facility focuses on advancing clinical decision support systems tailored to the region’s healthcare needs.

- In November 2023, Lunit, a South Korean startup, secured approval from regulatory authorities across Southeast Asia to deploy its AI-driven imaging solution for tuberculosis diagnosis. This step marked a significant milestone in combating infectious diseases in resource-limited settings.

- In January 2024, Airdoc, a Chinese AI healthcare company, acquired a Singapore-based telemedicine firm to strengthen its foothold in Southeast Asia. This acquisition enabled Airdoc to integrate AI diagnostics with remote patient monitoring, offering end-to-end healthcare solutions.

MARKET SEGMENTATION

This research report on the Asia Pacific healthcare AI market is segmented and sub-segmented into the following categories.

By Technology

- Deep Learning Method

- Querying Method

- Context-Aware Processing

- Natural Language Processing

By Application

- Machine/Robot-Assisted Medical Procedures

- Clinical Trial & Drug Discovery/Development

- Preliminary Diagnosis

- Dosage Error Reduction

- Fraud Detection

- Others

By End-User

- Hospitals/Clinics/Healthcare Providers

- Pharmaceuticals & Biotechnology Companies

- Medical Devices Companies

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How is AI transforming diagnostic accuracy in Asia-Pacific healthcare systems?

AI-powered imaging, pathology, and triage tools are helping hospitals in countries like Japan, South Korea, and India reduce diagnostic errors and improve early disease detection, especially in oncology and radiology.

What are the biggest regulatory hurdles for deploying AI in clinical settings across APAC?

Varying data protection laws (e.g., Singapore’s PDPA, India’s DPDP, China’s PIPL) require region-specific AI compliance, including algorithm explainability and local data storage mandates.

Which APAC regions are leading in AI-driven healthcare investment and adoption?

China, Japan, and Singapore top the list due to government-backed health-tech initiatives, mature digital infrastructure, and strong R&D funding for AI medical applications.

How is AI being used to address healthcare workforce shortages in rural APAC areas?

AI chatbots, virtual health assistants, and telemedicine platforms are bridging the gap in underserved regions of India, Indonesia, and the Philippines by providing basic diagnostics and patient triage.

What role does natural language processing (NLP) play in healthcare digitization in APAC?

NLP tools are increasingly used for multilingual EHR documentation, clinical transcription, and doctor-patient communication in diverse linguistic markets like India and Southeast Asia.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]