Asia Pacific Helicopter Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Weight, Application, Point of Sale, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Helicopter Market Size

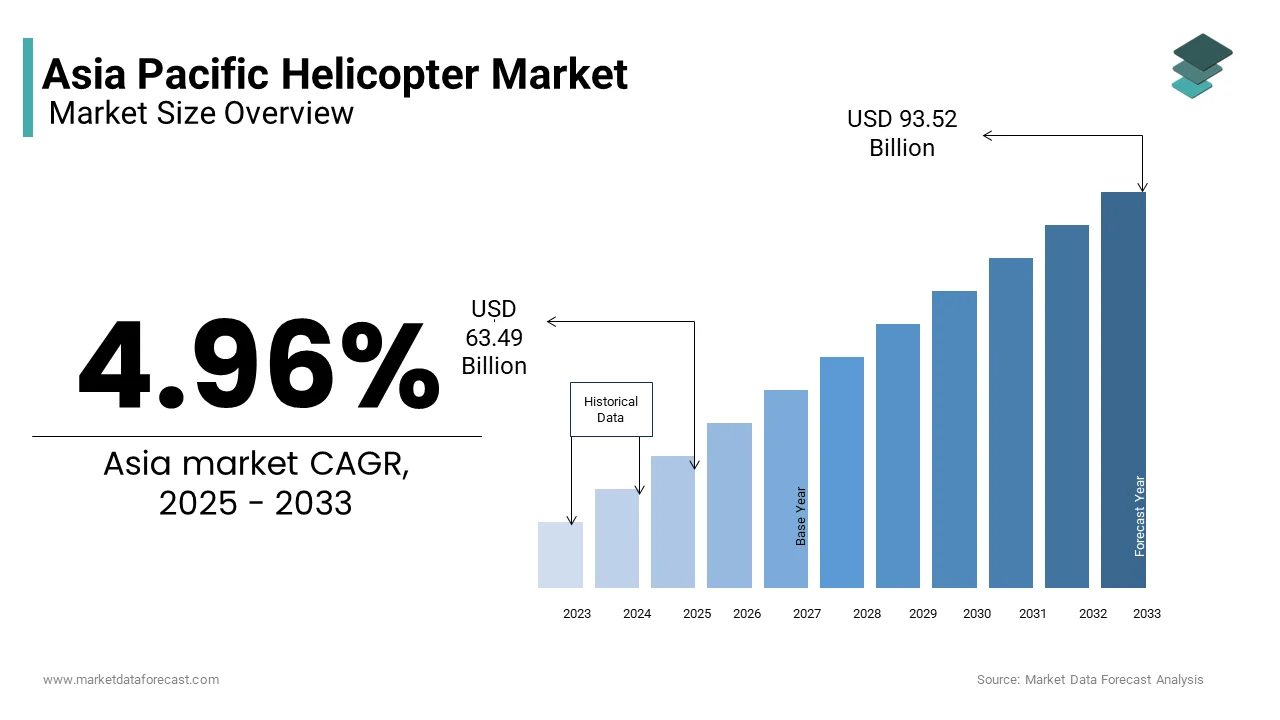

The Asia Pacific helicopter market was valued at USD 60.49 billion In 2024 and is anticipated to reach USD 63.49 billion in 2025 from USD 93.52 billion by 2033, growing at a CAGR of 4.96% during the forecast period from 2025 to 2033.

Current Scenario of the Asia Pacific Helicopter Market

The Asia Pacific helicopter market is a dynamic sector that plays a pivotal role in both civil and military aviation ecosystems across the region. This market encompasses a wide spectrum of applications, including emergency medical services, search and rescue operations, offshore oil and gas support, tourism, and law enforcement. The region's unique geography, characterized by vast archipelagos, mountainous terrains, and dense urban centers, has fostered a reliance on helicopters for connectivity and specialized services. Helicopters are also instrumental in disaster-prone areas such as Japan and the Philippines, where natural calamities like typhoons and earthquakes necessitate rapid response capabilities. Furthermore, advancements in technology have enhanced helicopter performance, making them more fuel-efficient and capable of operating in challenging environments.

MARKET DRIVERS

Rising Demand for Emergency Medical Services (EMS)

Emergency medical services represent one of the most significant growth drivers for the Asia Pacific helicopter market. With densely populated urban centers and remote rural regions, timely access to medical care remains a challenge. Helicopters, equipped with advanced medical facilities, provide a lifeline in critical situations. In countries like India, where road infrastructure often hampers ambulance response times, air ambulances have gained prominence. According to the World Health Organization, road traffic accidents in India accounts for a 10% of global road crash fatalities, emphasizing the need for rapid evacuation systems. Similarly, in Japan, which experiences frequent earthquakes, air ambulances play a crucial role in post-disaster relief efforts.

The demand for EMS helicopters is further fueled by increasing healthcare expenditure in the region. For instance, China’s healthcare spending reached approximately $1 trillion in 2022, according to Deloitte’s Global Healthcare Outlook. This surge in investment has led to the procurement of state-of-the-art helicopters equipped with life-saving technologies. Also, public-private partnerships are emerging as a key enabler, with governments collaborating with private operators to expand EMS networks.

Expansion of Offshore Oil and Gas Operations

The burgeoning offshore oil and gas industry in the Asia Pacific region serves as another major driver for helicopter demand. Countries like Malaysia, Indonesia, and Australia possess vast reserves in offshore locations, necessitating reliable transportation solutions for personnel and equipment. According to BP’s Statistical Review of World Energy, the Asia Pacific region holds a major share of global proven oil reserves and natural gas reserves, showing its significance in energy production. Helicopters are indispensable for these operations, ensuring safe and efficient crew rotations and supply deliveries. The ongoing exploration activities in the South China Sea further amplify this demand. For instance, Vietnam and the Philippines have intensified their offshore drilling projects. In addition, technological advancements in rotorcraft design, such as extended range and payload capacity, make helicopters more suitable for these demanding environments.

MARKET RESTRAINTS

High Operational Costs and Economic Constraints

One of the primary restraints impeding the growth of the Asia Pacific helicopter market is the high operational costs associated with helicopter usage. These costs encompass fuel expenses, maintenance, pilot training, and regulatory compliance, all of which pose significant financial burdens. For example, aviation turbine fuel prices in the region have surged significantly since 2021, as per the International Air Transport Association. This increase disproportionately affects smaller operators who lack the financial resilience of larger corporations, limiting their ability to expand fleets or adopt newer technologies.

Economic disparities within the region further exacerbate this issue. While developed nations like Japan and Australia can absorb these costs through robust fiscal policies, emerging economies such as Bangladesh and Myanmar face budgetary constraints. According to the Asian Development Bank, many Southeast Asian countries allocate less than 2% of their GDP to infrastructure development, leaving limited resources for aviation-related expenditures.

Stringent Regulatory Frameworks

Another significant restraint is the stringent regulatory environment governing helicopter operations in the Asia Pacific region. Aviation authorities impose rigorous safety standards, licensing requirements, and environmental regulations, which can delay project timelines and inflate operational costs. For instance, Australia’s Civil Aviation Safety Authority mandates comprehensive safety audits and recurrent training programs for pilots, as stated by the agency itself. While these measures ensure safety, they also act as deterrents for new entrants seeking to establish helicopter services.

Moreover, cross-border operations are complicated by varying regulatory frameworks across countries. A study by the International Civil Aviation Organization notes that inconsistent rules regarding airspace management and customs clearance create logistical hurdles for multinational operators. This fragmentation is particularly evident in Southeast Asia, where collaboration among ASEAN member states to harmonize regulations remains a work in progress.

MARKET OPPORTUNITIES

Urban Air Mobility (UAM) Revolution

Urban air mobility presents a transformative opportunity for the Asia Pacific helicopter market, driven by rapid urbanization and congestion in metropolitan areas. Cities like Tokyo, Singapore, and Mumbai are grappling with traffic gridlocks, prompting governments and private entities to explore alternative modes of transportation. According to the United Nations Department of Economic and Social Affairs, the Asia Pacific region is home to 17 of the world’s 31 megacities, each housing over 10 million residents. Electric vertical takeoff and landing (eVTOL) aircraft, which are hybrid cousins of traditional helicopters, are being actively developed to address these challenges.

Singapore has already initiated trials for eVTOL operations, partnering with companies like Volocopter, as announced by the Civil Aviation Authority of Singapore. These initiatives demonstrate the potential for helicopters and eVTOLs to complement existing public transport systems, reducing travel times and emissions. Furthermore, investor interest in UAM is surging, with Morgan Stanley projecting the global UAM trade to reach $1.5 trillion by 2040.

Tourism and Adventure Travel

The flourishing tourism industry in the Asia Pacific region offers another compelling opportunity for helicopter operators. With breathtaking landscapes ranging from New Zealand’s fjords to Nepal’s Himalayas, helicopters are increasingly used for sightseeing tours and adventure travel. Like, the tourism sector contributed substantially to the region’s economy in 2022, underscoring its economic importance. Helicopter tours provide tourists with unparalleled access to remote and picturesque locations, enhancing their travel experiences.

Countries like Thailand and Indonesia are capitalizing on this trend by promoting helicopter-based ecotourism initiatives. For instance, Bali has introduced helicopter rides over its iconic rice terraces, attracting affluent travelers. Apart from these, corporate incentives and wedding packages incorporating helicopter transfers are gaining popularity among high-net-worth individuals.

MARKET CHALLENGES

Environmental Concerns and Sustainability Pressures

Environmental concerns represent a formidable challenge for the Asia Pacific helicopter market, as heightened awareness of climate change prompts stricter emission regulations. Helicopters, traditionally powered by fossil fuels, contribute significantly to carbon dioxide emissions, drawing scrutiny from environmental watchdogs. Similarly, aviation accounts for notable share of global CO2 emissions, with helicopters contributing a notable share within the sector. This environmental impact has led to calls for greener alternatives, pressuring manufacturers to innovate or risk losing market relevance.

Governments in the region are responding by introducing carbon pricing mechanisms and incentivizing sustainable practices. Transitioning to cleaner technologies, such as hydrogen fuel cells or biofuels, requires substantial investment and research, posing financial and technical challenges for stakeholders. Furthermore, public perception of helicopters as environmentally unfriendly could deter consumer adoption, particularly in urban settings where noise pollution is an additional concern.

Infrastructure Limitations in Remote Areas

Another pressing challenge is the inadequate infrastructure in remote and underdeveloped regions, which hinders helicopter operations. While helicopters excel in reaching inaccessible areas, the absence of proper helipads, maintenance facilities, and refueling stations limits their effectiveness. This scarcity forces operators to invest in makeshift infrastructure, increasing operational risks and costs.

Besides, weather conditions in certain regions, such as monsoon rains in South Asia, exacerbate infrastructure vulnerabilities. Flooded runways and damaged helipads disrupt services, impacting industries like mining and emergency response.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.96% |

|

Segments Covered |

By Type, Weight, Application, Point of Sale and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Airbus S.A.S (Netherlands), Textron Inc. (U.S.), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (U.S.), The Boeing Company (U.S.), Rostec (Russia), The Robinson Helicopter Company (U.S.), Aviation Industry Corporation of China (China), Kawasaki Heavy Industries Ltd. (Japan), Hindustan Aeronautics Limited. (India). |

SEGMENTAL ANALYSIS

By Type Insights

The civil and commercial helicopter segment dominated the Asia Pacific helicopter market by commanding a 65.7% of the total market share in 2024. This dominance is supported by the region’s reliance on helicopters for urban connectivity, emergency services, and offshore operations. One key factor fueling this growth is the expansion of tourism in countries like Thailand and Indonesia, where helicopters are used for sightseeing tours over iconic landscapes such as Bali’s rice terraces and Bangkok’s skyline. According to the World Travel and Tourism Council, tourism in the Asia Pacific region generated significant revenue in 2022, with helicopter operators capitalizing on premium travel experiences.

Another critical driver is the increasing adoption of air ambulance services. Helicopters equipped with advanced life-support systems are becoming indispensable for emergency response, particularly in rural areas with poor road infrastructure. Apart from these, corporate entities in metropolitan cities like Singapore and Hong Kong are utilizing helicopters for executive transport, further strengthening the segment's leadership in the market.

The military helicopters segment is projected to grow at a CAGR of 7.8% during the forecast period. This quick expansion is fueled by escalating geopolitical tensions and defense modernization programs across the region. For instance, India has allocated $10 billion for helicopter procurement under its Defense Acquisition Plan, as stated by the Indian Ministry of Defense. These investments are aimed at enhancing border surveillance and counter-insurgency operations, particularly along contested regions like the Line of Control with Pakistan.

Another significant factor is the growing emphasis on maritime security. With China’s increasing assertiveness in the South China Sea, neighboring nations like Vietnam and the Philippines are also procuring military helicopters to bolster their naval capabilities.

By Weight Insights

The light helicopters accounted for a 55.7% of the Asia Pacific helicopter market in 2024 which is driven by their versatility and cost-effectiveness. These aircraft are widely used for applications such as law enforcement, pilot training, and short-distance transport. A key factor propelling their dominance is the affordability they offer compared to medium and heavy helicopters.

Another driving force is the rise in demand for search and rescue operations in disaster-prone areas. Japan, which experiences frequent earthquakes and typhoons, relies heavily on light helicopters for rapid evacuations due to their agility and ability to land in confined spaces. Also, the proliferation of private aviation clubs in affluent regions like Singapore and Australia has boosted sales of light helicopters for recreational use, further cementing their position as the largest segment.

The medium helicopters segment is expected to grow at a CAGR of 9.2% which is fueled by their adaptability for both civil and military applications. A major driver of this growth is their suitability for offshore oil and gas operations. Malaysia and Indonesia, two of the largest producers of liquefied natural gas in the region, depend on medium helicopters to transport personnel and equipment to remote drilling platforms. Another factor is the increasing deployment of medium helicopters for humanitarian missions. Governments and NGOs are increasingly turning to medium helicopters for their balance of payload capacity and operational flexibility, ensuring timely aid delivery in crisis situations.

By Application Insights

The emergency medical services segment represented the largest application by accounting for a 28.4% of the Asia Pacific helicopter market in 2024. This prominence is propelled by the region’s high incidence of road accidents and natural disasters. For example, Vietnam records over 11,000 traffic fatalities annually, as reported by the National Traffic Safety Committee, highlighting the urgent need for efficient medical evacuation systems. Helicopters equipped with advanced life-support systems play a crucial role in reducing mortality rates by providing swift access to trauma care.

Apart from these, the aging population in countries like Japan is increasing the demand for air ambulances. According to the Japanese Ministry of Health, Labour and Welfare, a high percentage of the population is aged 65 or above, leading to a surge in age-related medical emergencies. EMS helicopters are uniquely positioned to address these challenges, offering unparalleled speed and accessibility in densely populated urban centers and remote rural areas alike.

The segment of urban air mobility is predicted to advance at a staggering CAGR of 15.6% and is driven by rapid urbanization and technological advancements. Cities like Tokyo and Mumbai, plagued by chronic traffic congestion, are exploring eVTOL aircraft and helicopters as viable alternatives for urban commuting. According to the United Nations Department of Economic and Social Affairs, the Asia Pacific region houses 17 megacities, each with populations exceeding 10 million, amplifying the need for innovative transportation solutions. Investments in UAM infrastructure are accelerating this growth. Singapore has partnered with Volocopter to establish dedicated vertiports. Furthermore, corporate incentives such as helicopter-based business travel packages are gaining traction among high-net-worth individuals, contributing to the segment’s rapid expansion.

By Point of Sale Insights

The new helicopters commanded the Asia Pacific market by capturing a substantial share of total sales in 2024. This preference stems from the availability of cutting-edge technologies and warranty-backed reliability. A key factor driving this trend is the growing emphasis on safety standards. For instance, Australia’s Civil Aviation Safety Authority mandates rigorous inspections and certifications for new aircraft, as outlined in its regulatory framework. Operators are willing to invest in new helicopters to ensure compliance and minimize risks.

Another driver is the increasing adoption of environmentally friendly models. According to Airbus Helicopters, a significant portion of new purchases in the region are for fuel-efficient variants designed to reduce carbon emissions. This shift aligns with regional sustainability goals, particularly in developed economies like Japan and South Korea, where environmental regulations are stringent.

The pre-owned helicopters segment is experiencing a CAGR of 12.3%. This control over the market is supported by budget constraints and the availability of high-quality refurbished aircraft. Emerging economies like Indonesia and Thailand are leveraging second-hand helicopters for cost-sensitive applications such as tourism and agriculture. Besides, the rise of helicopter leasing companies is facilitating access to affordable pre-owned models.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China held the largest market share at 28.5%. This is propelled by its booming economy and extensive industrial landscape. The country’s offshore oil and gas sector is a major contributor, with companies like CNOOC relying on helicopters for crew rotations. According to the Chinese Ministry of Natural Resources, offshore oil production reached 50 million tons in 2022, exhibiting the critical role of helicopters in supporting energy operations.

India is a lucrative market. It is propelled by its defense modernization initiatives. The Indian Air Force is procuring 15 Light Combat Helicopters, as announced by Hindustan Aeronautics Limited, to enhance combat readiness. Also, the government’s push for domestic manufacturing under the “Make in India” program is boosting local helicopter production.

Japan is key market which is primarily due to its focus on disaster management. The Japan Coast Guard operates a fleet of helicopters for tsunami relief, as highlighted by the National Police Agency.

Australia holds a significant position and is driven by its mining industry. Rio Tinto utilizes helicopters for site surveys and personnel transport. The country’s vast mineral reserves make helicopters vital for operational efficiency.

South Korea accounts for smaller share and is supported by its robust defense sector. The Korean Aerospace Industries is developing next-generation military helicopters. These efforts align with the nation’s commitment to strengthening its armed forces.

KEY MARKET PLAYERS

Airbus S.A.S (Netherlands), Textron Inc. (U.S.), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (U.S.), The Boeing Company (U.S.), Rostec (Russia), The Robinson Helicopter Company (U.S.), Aviation Industry Corporation of China (China), Kawasaki Heavy Industries Ltd. (Japan), Hindustan Aeronautics Limited. (India). Are the market players that are dominating the Asia Pacific helicopters market.

Top Players In The Market

Airbus Helicopters

Airbus Helicopters is a dominant player in the Asia Pacific market, renowned for its innovative rotorcraft designs and robust service offerings. The company has made significant contributions to global aviation by developing versatile helicopters that cater to both civil and military applications. Airbus Helicopters’ strong after-sales support network ensures customer satisfaction, enabling it to maintain a leadership position in the region.

Bell Textron

Bell Textron is another key player, widely recognized for its cutting-edge technology and reliability. The company’s focus on urban air mobility (UAM) has positioned it as a pioneer in next-generation helicopter solutions. By collaborating with governments and private entities across the Asia Pacific, Bell Textron has successfully integrated its aircraft into emergency medical services and offshore operations.

Leonardo S.p.A.

Leonardo S.p.A. stands out for its advanced military and commercial helicopters, which are integral to defense modernization efforts in the region. The company’s ability to customize rotorcraft for specific missions, such as search and rescue or maritime patrol, has earned it a loyal customer base. Leonardo’s dedication to research and development ensures that its helicopters remain at the forefront of technological advancements, contributing significantly to its global reputation.

Top Strategies Used by Key Market Participants

Strategic Partnerships and Collaborations

Leading players in the Asia Pacific helicopter market have prioritized partnerships with local governments and private entities to expand their reach. For instance, companies like Airbus Helicopters have teamed up with national aviation authorities to develop infrastructure for urban air mobility, enhancing their market presence.

Focus on Sustainability and Innovation

To address growing environmental concerns, key players are investing heavily in sustainable technologies. This includes developing fuel-efficient engines, hybrid-electric systems, and biofuel-compatible aircraft. By adopting eco-friendly practices, companies not only comply with stringent regulations but also appeal to environmentally conscious customers, thereby strengthening their competitive edge.

Expansion of After-Sales Services

Providing comprehensive after-sales support has become a cornerstone strategy for market leaders. This includes establishing maintenance hubs, offering spare parts, and conducting regular training programs for operators. Such initiatives ensure high operational uptime for customers, fostering long-term loyalty and reinforcing the players’ dominance in the market.

COMPETITION OVERVIEW

The Asia Pacific helicopter market is characterized by intense competition, driven by the presence of both established global giants and emerging regional players. Companies are vying for market share by leveraging their technological expertise, extensive service networks, and strategic alliances. The region’s diverse applications—from emergency medical services to offshore oil and gas operations—create multiple entry points for competitors. However, the market is also marked by high barriers to entry due to stringent regulatory requirements and the need for substantial capital investment. To stay ahead, leading players are focusing on innovation, sustainability, and localization strategies. Collaborations with local stakeholders and investments in R&D further intensify the rivalry.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Airbus Helicopters signed a Memorandum of Understanding with the Civil Aviation Authority of Singapore to develop vertiports for urban air mobility. This initiative aims to position Singapore as a hub for eVTOL operations and enhance Airbus' presence in the region.

- In June 2023, Bell Textron partnered with the Indian Ministry of Defence to establish a helicopter manufacturing facility in Hyderabad. This collaboration supports India’s “Make in India” initiative while bolstering Bell's footprint in South Asia.

- In September 2023, Leonardo S.p.A. launched a training academy in Australia to provide advanced pilot certification programs. This move addresses the growing demand for skilled personnel in the Asia Pacific helicopter industry.

- In November 2023, Sikorsky, a Lockheed Martin company, delivered its first S-92 helicopter to an offshore oil and gas operator in Malaysia. This delivery underscores Sikorsky's commitment to serving the energy sector in Southeast Asia.

- In January 2024, Robinson Helicopter Company introduced a leasing program for light helicopters in Thailand. This flexible financing option targets small businesses and tourism operators, expanding Robinson's customer base in the region.

MARKET SEGMENTATION

This research report in the Asia Pacific helicopter market is segmented and sub-segmented into the following categories.

By Type

- Civil & Commercial

- Military

By Weight

- Light

- Medium

- Heavy

By Application

- Emergency Medical Service

- Corporate Service

- Search And Rescue Operation

- Oil & Gas

- Defense

- Homeland Security

- Others

By Point of Sale

- New

- Pre-Owned

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the primary factors driving the increasing demand for helicopters in the Asia Pacific region?

Explore regional needs such as disaster response, offshore oil & gas operations, medevac services, and border surveillance, along with economic growth in emerging markets.

How are government policies and defense modernization programs influencing helicopter procurement trends?

Analyze how military spending, procurement transparency, and national security concerns shape demand across countries like India, Australia, and Southeast Asia.

What is the role of civil and parapublic applications in shaping the regional helicopter fleet composition?

Look into market share expansion through applications in law enforcement, firefighting, VIP transport, and air ambulance services.

How is the Asia Pacific region adapting to new technologies such as hybrid-electric propulsion and autonomous flight systems?

Evaluate readiness and adoption trends among fleet operators, regulators, and OEMs toward sustainable aviation technologies.

What are the key operational and infrastructure challenges affecting helicopter deployment in remote or high-density urban areas?

Examine obstacles such as helipad availability, airspace regulation, pilot training deficits, and MRO (Maintenance, Repair, Overhaul) infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]