Asia Pacific Human Machine Interface Market Research Report – Segmented By Component (Hardware, Software, Services), Configuration, Technology Type, End-Use Industry, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Human Machine Interface Market Size

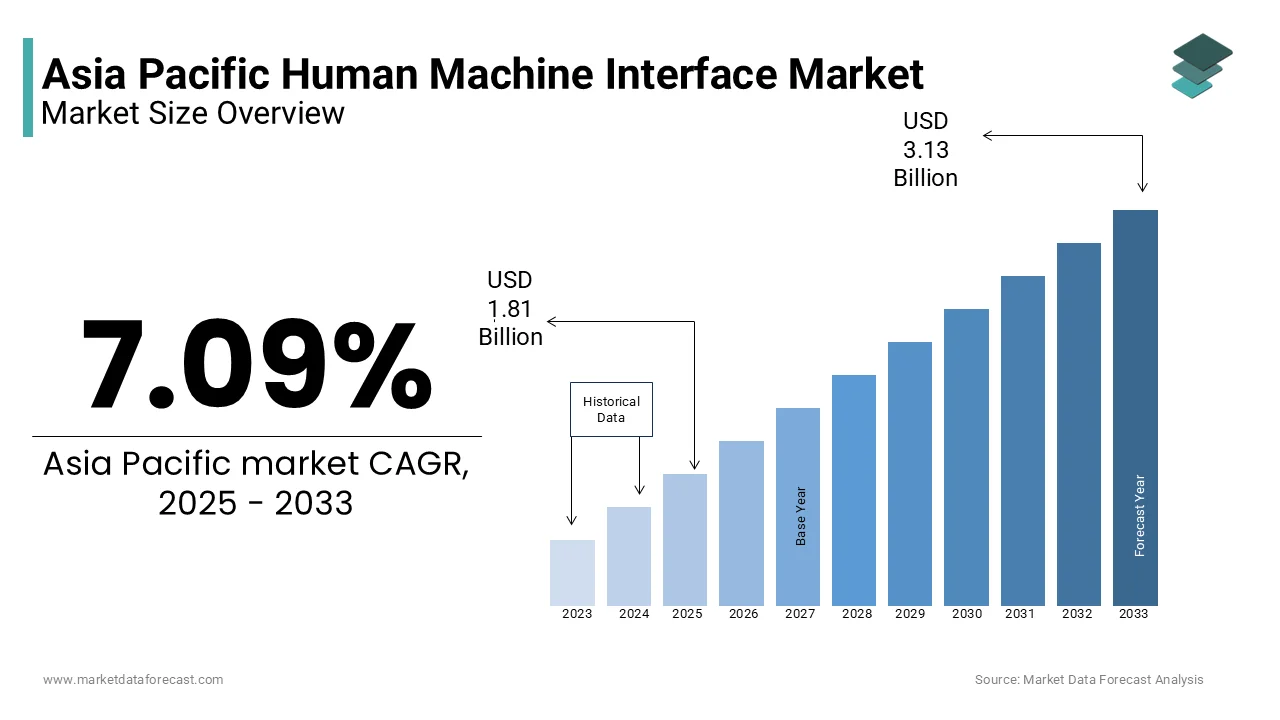

The Asia Pacific Human Machine Interface market size was valued at USD 1.69 billion in 2024, and the market size is expected to reach USD 3.13 billion by 2033 from USD 1.81 billion in 2025. The market's promising CAGR for the predicted period is 7.09%.

human machine interface (HMI) market growth is majorly propelled by rapid technological advancements and the region’s manufacturing prowess. Countries like China, Japan, and South Korea are leading adopters, with investments aimed at enhancing operational efficiency and user experience. Government initiatives play a critical role in shaping market conditions. Public-private partnerships have been instrumental in deploying smart factory solutions across the region. Additionally, regulatory mandates promoting Industry 4.0 technologies have accelerated adoption rates.

MARKET DRIVERS

Rising Adoption of Industrial Automation

A significant driver of the Asia Pacific human machine interface market is the widespread adoption of industrial automation across manufacturing sectors. For instance, as per Deloitte, companies in countries like China and South Korea are leveraging HMIs to enhance precision and reduce downtime, which is aligning with their focus on high-quality manufacturing. Another key factor is the emphasis on real-time monitoring and predictive maintenance. As per PwC, over 60% of factories in urban hubs like Tokyo and Shanghai have adopted HMIs equipped with IoT sensors to monitor equipment performance and prevent failures. These systems not only improve operational efficiency but also reduce maintenance costs by up to 30%, according to the World Economic Forum.

Growing Demand for Smart Devices and IoT Integration

Another major driver is the increasing demand for smart devices and IoT integration, which amplifies the need for intuitive human machine interfaces. According to McKinsey & Company, over 70% of households in urban areas of Japan and South Korea now use IoT-enabled appliances, driving the adoption of HMIs that simplify user interactions. For example, as per Deloitte, smart home devices like thermostats and security systems rely heavily on touchscreens and voice-activated HMIs, enhancing user convenience and accessibility.

Furthermore, as per the Asian Development Bank, the proliferation of wearable devices and connected health solutions has created new avenues for HMI applications. For instance, hospitals in Singapore and Australia are adopting HMIs to streamline patient monitoring and diagnostics, improving healthcare delivery. These innovations not only cater to tech-savvy consumers but also address the growing demand for interconnected ecosystems.

MARKET RESTRAINTS

High Implementation Costs

A significant restraint in the Asia Pacific human machine interface market is the high cost associated with implementing advanced HMI systems. For instance, as per Deloitte, small-scale manufacturers in countries like Indonesia and Thailand often lack the financial resources to integrate HMIs into their operations, which is limiting their ability to compete with larger players. Additionally, maintenance costs pose a further challenge. Without adequate funding or international aid, these financial barriers hinder widespread adoption in rural areas where infrastructure development is already lagging. This disparity limits the market’s inclusivity, creating uneven progress across the region.

Cybersecurity Vulnerabilities and Data Privacy Concerns

Another major restraint is the rising concern over cybersecurity vulnerabilities and data privacy issues associated with HMI systems. For example, as per PwC, a breach in a major automotive plant in South Korea exposed proprietary manufacturing processes, eroding trust in digital HMI solutions.

Furthermore, the absence of standardized data protection laws across the region exacerbates these risks, which is leaving systems vulnerable to exploitation. Governments and private stakeholders must invest in robust encryption protocols and compliance frameworks to mitigate these threats. However, as per Deloitte, the additional costs of implementing cybersecurity measures can deter adoption among small-scale operators. These concerns pose a significant barrier to the seamless expansion of HMI systems in the region.

MARKET OPPORTUNITIES

Integration with Smart Factory Initiatives

A significant opportunity in the Asia Pacific human machine interface market lies in its integration with broader smart factory initiatives. According to the United Nations Economic and Social. For instance, as per McKinsey & Company, cities like Shenzhen and Seoul are leveraging HMIs as part of their Industry 4.0 frameworks by enabling real-time data visualization and predictive analytics. These integrations not only enhance productivity but also reduce energy consumption by optimizing resource allocation. Furthermore, investments in IoT-enabled infrastructure have enabled HMIs to communicate with other smart utilities, such as robotics and supply chain management systems. This interconnected ecosystem fosters greater efficiency for manufacturers while generating valuable insights for decision-makers.

Expansion into Emerging Markets

Another promising opportunity is the expansion of HMI systems into emerging markets, where industrialization is gaining momentum. According to the World Bank, over 50% of manufacturing facilities in countries like India and Vietnam are located in semi-urban and rural regions, which is presenting untapped potential for HMI adoption. Additionally, as per PwC, the introduction of low-cost HMI solutions, such as cloud-based platforms and modular designs, has made it feasible to deploy systems in remote areas with limited power and communication infrastructure. These innovations not only bridge the urban-rural divide but also support regional economic growth by facilitating smoother industrial operations.

MARKET CHALLENGES

Interoperability Issues Across Systems

A pressing challenge for the Asia Pacific human machine interface market is the lack of interoperability between different HMI systems and industrial platforms. According to the Asian Development Bank, cross-industry collaborations in the ASEAN region face delays due to incompatible technologies and fragmented regulatory frameworks. For instance, as per Deloitte, factories operating in Thailand and Malaysia often encounter multiple HMI systems requiring separate configurations, which is disrupting supply chains and increasing operational costs.

Furthermore, as per the World Economic Forum, the absence of unified standards for HMI protocols complicates efforts to create seamless integration across industries. While initiatives like the ASEAN Digital Masterplan aim to address these gaps, progress remains slow due to varying levels of technological readiness among member states. These interoperability issues not only hinder regional trade but also undermine the efficiency gains promised by HMI systems by posing a significant obstacle to their widespread adoption.

Resistance to Behavioral Change Among Users

Another critical challenge is the resistance to behavioral change among users unfamiliar with advanced HMI systems. According to the International Transport Forum, over 40% of operators in rural areas of countries like Indonesia and Vietnam prefer manual controls due to mistrust or lack of awareness about HMI benefits. Additionally, as per Deloitte, the transition from traditional systems to digital platforms requires extensive training programs, which many organizations struggle to implement effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.09% |

|

Segments Covered |

By Component, Configuration, Technology Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

ABB Ltd, General Electric Company, Honeywell International Inc, Rockwell Automation, Inc, Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, Kontron S&T AG, Mitsubishi Electric Corporation, Advantech Co. Ltd, and others |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment was the largest and held 55.4% of the Asia Pacific human machine interface market of share in 2024. Hardware accounts for the majority of upfront investments in HMI systems in large-scale industrial projects like smart factories in China and Japan. A key driver is the growing emphasis on durability and precision. As per PwC, advancements in materials and engineering have extended the lifespan of hardware components by reducing long-term maintenance costs. Additionally, as per McKinsey & Company, partnerships with global manufacturers have ensured the availability of cutting-edge hardware, catering to diverse regional requirements.

The software segment is likely to gain huge traction with a CAGR of 16.8% from 2025 to 2033. The growth of the segment is fueled by the increasing complexity of industrial operations and the need for advanced analytics and real-time monitoring. As per Deloitte, software platforms are being deployed to analyze production data, optimize workflows, and ensure compliance with regulatory standards. A significant factor is the integration of AI and cloud computing into HMI software. According to PwC, over 60% of industrial facilities in urban areas like Tokyo and Melbourne have adopted AI-driven analytics to enhance operational efficiency.

By Configuration Insights

The embedded HMIs dominated the Asia Pacific human machine interface market share in 2024 due to their seamless integration into machinery and equipment by making them ideal for industries like automotive and electronics. According to Deloitte, over 70% of manufacturing hubs in countries like South Korea and Taiwan rely on embedded HMIs for real-time process control and automation. A key driver is the focus on compact and cost-effective solutions. As per PwC, advancements in semiconductor technology have enabled the development of smaller, more powerful embedded HMIs, catering to the demands of modern industries. Additionally, as per McKinsey & Company, government mandates promoting Industry 4.0 technologies have accelerated embedded HMI adoption by making it a cornerstone of smart manufacturing ecosystems.

The standalone HMIs segment is lucratively to grow with a CAGR of 18.5% from 2025 to 2033 owing to the increasing demand for flexible and customizable HMI solutions. For example, as per Deloitte, standalone HMIs are being adopted in industries like food and beverage, where modular designs facilitate easy reconfiguration and scalability. A significant factor is the rise of IoT-enabled devices, which leverage standalone HMIs for connectivity and user interaction. According to PwC, over 50% of standalone HMIs in urban areas are now integrated with IoT platforms by enabling remote monitoring and predictive maintenance. The investments in edge computing have enhanced the processing capabilities of standalone HMIs, which is making them indispensable for future-ready applications.

By Technology Type Insights

The tactile HMI segment was the largest and held 45.3% of the Asia Pacific human machine interface market share in 2024 with the widespread use of touchscreens and control panels in industrial and consumer applications. For instance, hospitals in Singapore and Australia have adopted tactile HMIs to streamline patient monitoring and diagnostics, which is improving healthcare delivery. A key driver is the affordability and versatility of tactile systems. As per PwC, the average cost of deploying tactile HMIs is 25% lower than alternative technologies by making them accessible for emerging economies.

The optical HMI segment is anticipated to register a CAGR of 20.3% from 2025 to 2033, which is propelled by the increasing demand for gesture-based and vision-enabled interfaces. For example, as per Deloitte, optical HMIs are being adopted in industries like robotics and augmented reality, where hands-free operation is critical for efficiency. A significant factor is the integration of AI and computer vision into optical systems. According to PwC, over 60% of optical HMIs in urban areas are now equipped with AI-driven recognition algorithms by enabling seamless interaction.

By End-Use Industry Insights

The automotive industry dominated the Asia Pacific human machine interface market by holding a 30% share in 2024 with the industry’s reliance on advanced HMIs for vehicle manufacturing and driver assistance systems. According to Deloitte, over 70% of automotive plants in countries like China and South Korea have integrated HMIs into their production lines, aligning with their focus on high-quality manufacturing. A key driver is the emphasis on user-centric design. As per PwC, advancements in touchscreen and voice-activated HMIs have improved driver experience by addressing growing consumer expectations. Government mandates promoting electric vehicles have accelerated HMI adoption by making it a cornerstone of modern automotive ecosystems.

The pharmaceuticals industry is projected to witness a CAGR of 19.2% from 2025 to 2033 with the increasing demand for automated processes and stringent regulatory compliance. For example, as per Deloitte, HMIs are being adopted in cleanroom environments to ensure precision and minimize contamination risks. A significant factor is the integration of IoT and AI into pharmaceutical HMIs. According to PwC, over 60% of pharmaceutical facilities in urban areas like Mumbai and Bangkok have adopted IoT-enabled HMIs for real-time monitoring and predictive maintenance.

REGIONAL ANALYSIS

China led the Asia Pacific human machine interface market by contributing 35.4% of share in 2024 with the country’s robust manufacturing sector and aggressive investments in smart factories. The government’s push for Industry 4.0 has resulted in universal adoption, with over 80% of factories leveraging HMIs for process optimization.

Japan was positioned second by holding 20.4% of share in 2024 due its expertise in robotics and advanced manufacturing. According to the International Federation of Robotics, Japan’s HMI penetration rate exceeds 90%, supported by subsidies and user-friendly policies.

South Korea is esteemed to have lucrative growth opportunities in the next coming years with advanced embedded HMIs and widespread adoption in the automotive sector. According to McKinsey & Company, South Korea’s HMI systems have reduced operational costs by 30% by setting a benchmark for industrial efficiency.

India human machine interface market is fueled by the Make in India initiative and investments in pharmaceuticals and automotive industries. According to Deloitte, India’s HMI adoption rate grew by 25% in 2023, driven by government incentives and private-sector investments.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

ABB Ltd, General Electric Company, Honeywell International Inc, Rockwell Automation, Inc, Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, Kontron S&T AG, Mitsubishi Electric Corporation, Advantech Co. Ltd are playing dominating role in the Asia Pacific human machine interface market.

The Asia Pacific human machine interface market is characterized by intense competition, driven by the presence of global giants like Siemens AG, Rockwell Automation, and Mitsubishi Electric, alongside regional players striving to carve out their niche. The competitive landscape is shaped by innovation, customization, and strategic collaborations, with companies vying to offer scalable and interoperable solutions. A key differentiator is the focus on sustainability, with firms adopting green technologies to align with environmental goals. Additionally, partnerships with local stakeholders and investments in digital tools are critical for addressing the unique demands of the region. Regulatory mandates promoting Industry 4.0 technologies further intensify competition, requiring participants to adopt agile strategies.

TOP PLAYERS IN THE MARKET

Siemens AG

Siemens AG is a leading player in the Asia Pacific human machine interface market, renowned for its innovative approach to industrial automation and smart manufacturing. The company’s contribution to the global market lies in its ability to deliver scalable and interoperable HMI solutions tailored to diverse industries. By integrating advanced technologies like AI and IoT into its offerings, Siemens has set benchmarks in operational efficiency and user experience. Its focus on sustainability ensures energy-efficient systems that align with global environmental goals. Through strategic partnerships and continuous R&D investments, Siemens continues to drive the adoption of cutting-edge HMIs across the region.

Rockwell Automation

Rockwell Automation stands out for its comprehensive portfolio of end-to-end HMI solutions, ranging from embedded systems to standalone platforms. The company’s global influence is evident in its ability to integrate predictive analytics and cloud computing into HMI frameworks. In the Asia Pacific market, Rockwell has strengthened its presence by offering customized solutions for industries like automotive and pharmaceuticals, aligning with regional smart factory initiatives. Its emphasis on user-centric design and seamless integration has earned it a reputation as a trusted partner for modern industrial ecosystems.

Mitsubishi Electric

Mitsubishi Electric is a key player in the Asia Pacific human machine interface market, known for its expertise in robotics and advanced manufacturing technologies. The company’s global impact stems from its ability to leverage tactile and optical HMIs to enhance precision and productivity. In the region, Mitsubishi has differentiated itself by focusing on compact and cost-effective solutions, catering to emerging markets. Its commitment to digital transformation and Industry 4.0 aligns with the growing demand for smart manufacturing solutions.

TOP STRATEGIES USED BY KEY PLAYERS

Focus on Technological Innovation

A major strategy adopted by key players is the continuous investment in technological innovation to enhance HMI capabilities. Companies are leveraging advancements in AI, IoT, and edge computing to improve real-time monitoring, predictive maintenance, and user experience. For instance, integrating gesture-based interfaces and voice-activated controls allows operators to interact seamlessly with machines, addressing evolving customer expectations.

Strategic Partnerships and Collaborations

Another significant strategy is forming strategic partnerships with governments, technology providers, and industry stakeholders. These collaborations enable companies to share expertise, access funding, and develop localized solutions that align with regulatory requirements. For example, partnering with local manufacturers facilitates customization and scalability by enhancing user adoption. Additionally, alliances with global tech firms ensure access to cutting-edge innovations, strengthening competitive positioning. Such partnerships are critical for scaling operations and addressing the diverse needs of the Asia Pacific region.

Emphasis on Sustainability and User-Centric Design

The third key strategy involves prioritizing sustainability and user-centric design to meet evolving customer expectations. Companies are developing eco-friendly HMIs that minimize energy consumption and carbon emissions, aligning with global environmental goals. Simultaneously, they are focusing on enhancing user convenience through features like intuitive touchscreens, modular designs, and real-time notifications.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, SS8 Networks, a provider of lawful interception solutions, partnered with European cybersecurity firm CyberShield to enhance its data monitoring capabilities. This collaboration is anticipated to strengthen SS8’s position in the European market by offering more robust compliance tools.

- In June 2023, Utimaco, a leading provider of encryption solutions, acquired a German-based lawful interception software developer. This acquisition enabled Utimaco to expand its portfolio and address growing demand for secure interception technologies.

- In September 2022, Verint Systems launched a new AI-driven analytics platform for lawful interception in Europe. This move was aimed at improving real-time data processing and enhancing investigative accuracy for law enforcement agencies.

- In January 2023, Cisco Systems integrated advanced lawful interception features into its networking solutions, targeting European telecom operators. This initiative reinforced Cisco’s dominance in providing secure communication infrastructure.

- In November 2022, Aqsacom, a provider of regulatory compliance solutions, signed a strategic agreement with a European government agency to deploy a nationwide lawful interception system. This project is expected to bolster Aqsacom’s presence in the region and set new standards for data security.

MARKET SEGMENTATION

This research report on the Asia Pacific human machine interface market has been segmented and sub-segmented based on the following categories.

By Component

- Hardware

- Basic HMI

- Advanced Panel-Based HMI

- Advanced PC-Based HMI

- Software

- On-Premise HMI

- Advanced Panel-Based HMI

- Advanced PC-Based HMI

- Services

By Configuration

- Embedded

- Standalone

By Technology Type

- Motion HMI

- Bionic HMI

- Tactile HMI

- Optical HMI

- Acoustic HMI

By End-Use Industry

- Packaging

- Food and Beverage

- Automotive

- Pharmaceuticals

- Utilities

- Metals and Mining

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is the market size of the Asia Pacific Human Machine Interface (HMI) market?

The Asia Pacific HMI market was valued at USD 1.69 billion in 2024 and is projected to reach USD 3.13 billion by 2033, growing at a CAGR of 7.09% from 2025 to 2033.

2. What is driving the growth of the HMI market in Asia Pacific?

The market is driven by industrial automation, increased adoption of Industry 4.0 technologies, demand for user-friendly interfaces, and the growth of manufacturing and automotive sectors.

3. Which countries lead in HMI adoption within the Asia Pacific region?

China, Japan, South Korea, and India are major contributors, owing to their large-scale manufacturing bases and investments in industrial modernization.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]