Asia Pacific Human Resource Technology Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Deployment, Enterprise, Industry, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Human Resource (HR) Technology Market Size

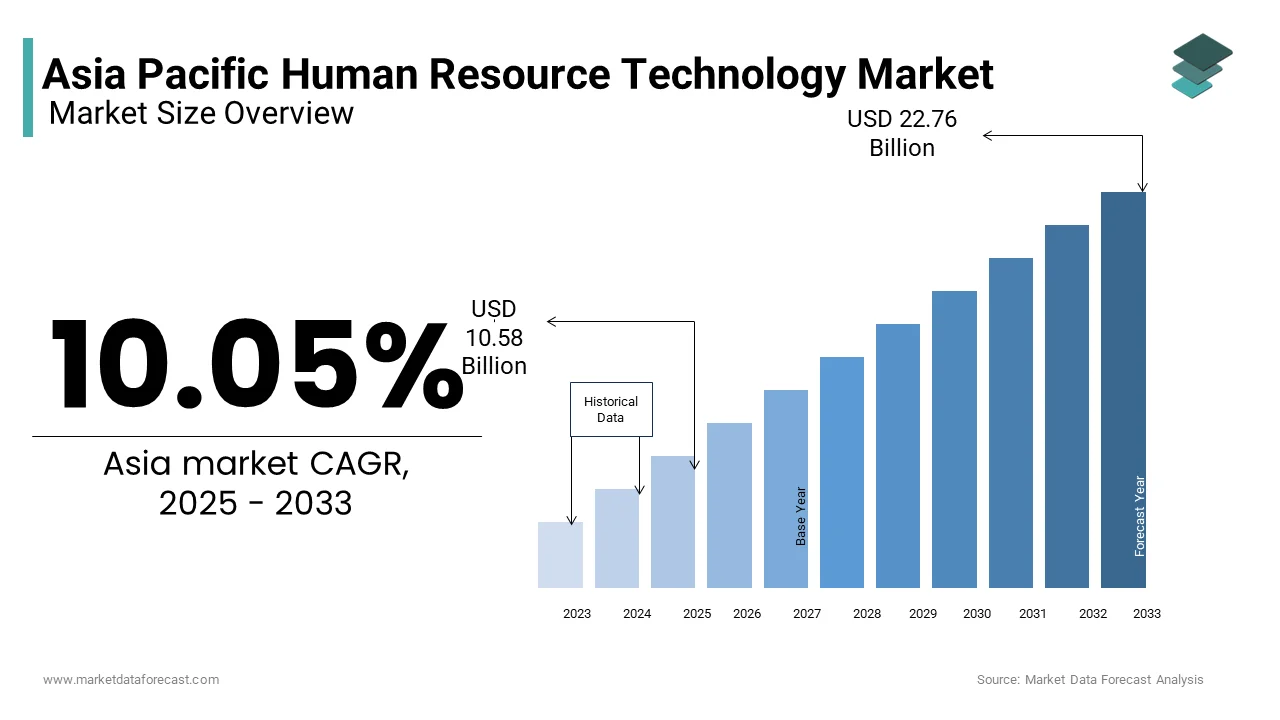

The Asia Pacific Human Resource (HR) technology market was valued at USD 9.61 billion in 2024 and is anticipated to reach USD 10.58 billion in 2025 from USD 22.76 billion by 2033, growing at a CAGR of 10.05% during the forecast period from 2025 to 2033.

Current Scenario of the Asia Pacific Human Resource Technology Market

HR technology encompasses solutions such as talent management, payroll systems, recruitment platforms, and performance analytics by enabling businesses to adapt to evolving workplace dynamics. According to Deloitte, over 60% of organizations in the region have adopted some form of HR technology to address challenges like skill shortages and employee retention. For instance, companies in Japan and Australia are integrating AI-driven platforms to automate repetitive tasks and improve decision-making processes. Additionally, the rise of remote work and hybrid models has amplified the need for scalable and secure HR solutions.

MARKET DRIVERS

Increasing Adoption of Remote Work Models

The growing prevalence of remote and hybrid work models is a significant driver of the HR technology market in the Asia Pacific. For example, companies in India and Singapore are leveraging cloud-based HR platforms to track productivity, ensure compliance with labor laws, and facilitate seamless communication across geographies. A study by Gartner revealed that enterprises using remote work-enabled HR technologies experienced a 25% reduction in administrative overheads by ensuring higher operational efficiency. Additionally, the integration of collaboration tools and virtual training modules has enabled businesses to maintain employee engagement and foster professional development, even in decentralized environments.

Rising Emphasis on Data-Driven Decision-Making

Another major driver is the increasing emphasis on data-driven decision-making in HR processes. Organizations are leveraging advanced analytics and AI-powered tools to gain actionable insights into workforce trends, employee performance, and talent acquisition strategies. For instance, financial institutions in South Korea and Malaysia use AI algorithms to analyze employee performance metrics and predict turnover risks by ensuring timely interventions. Additionally, the integration of real-time data insights enables HR leaders to align workforce strategies with business goals, improving overall organizational agility.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints facing the Asia Pacific HR technology market is the high cost associated with implementing advanced platforms for small and medium-sized enterprises (SMEs). Deploying enterprise-grade HR systems requires significant investments in hardware, software, and skilled personnel. According to Frost & Sullivan, the average upfront cost of setting up a comprehensive HR platform exceeds $100,000 for medium-sized organizations, which is making it prohibitive for smaller players with limited budgets. Additionally, the shortage of professionals proficient in managing HR technologies further compounds the issue.

Data Privacy and Security Concerns

Another significant restraint is the growing concern over data privacy and security, particularly as HR technologies rely heavily on sensitive employee information. The misuse of data or unauthorized access poses a threat to both individuals and organizations. According to the International Association of Privacy Professionals, over 50% of consumers in the Asia Pacific are hesitant to share personal data due to fears of breaches or misuse. For instance, hospitals in Vietnam and Indonesia reported incidents where employee records were compromised, undermining trust in digital tools. Additionally, fragmented regulatory frameworks across the region exacerbate the issue, as countries like India and Thailand lack comprehensive data protection laws. This inconsistency complicates compliance efforts, discouraging organizations from adopting HR technologies due to potential legal and reputational risks.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of emerging technologies such as blockchain and edge computing presents a transformative opportunity for the Asia Pacific HR technology market. Blockchain technology offers unparalleled transparency and security by creating immutable records of employee transactions, which is particularly valuable for industries like finance and healthcare. According to Deloitte, blockchain-enabled HR platforms can reduce fraud-related losses by up to 40%, which is making it highly attractive to organizations seeking to enhance trust and accountability. For example, banks in Singapore and South Korea are leveraging blockchain to ensure the authenticity of employee credentials while maintaining compliance with regulatory standards.

Expansion into Rural and Underserved Areas

Another promising opportunity lies in expanding HR technology solutions to rural and underserved areas within the Asia Pacific region. Countries like Vietnam, Indonesia, and the Philippines face significant disparities in access to advanced HR tools, creating a robust demand for innovative solutions that address inefficiencies. According to the World Bank, over 40% of rural populations in Southeast Asia lack access to reliable internet connectivity, amplifying the need for scalable platforms. For instance, startups in India are using mobile-based HR tools to optimize workforce management and improve supply chain visibility, ensuring continuity of essential services. Additionally, government-led initiatives promoting rural development have further bolstered the market, encouraging investments in cost-effective and sustainable technologies.

MARKET CHALLENGES

Shortage of Skilled Workforce

The scarcity of skilled professionals proficient in HR technology and data analytics poses a significant challenge to the market’s growth. Despite the rising demand for expertise in areas such as predictive modeling, machine learning, and statistical analysis, the talent pool remains insufficient. According to Cybersecurity Ventures, the global shortage of HR technology specialists is expected to reach 3 million unfilled positions by 2025, with the Asia Pacific accounting for nearly 40% of this deficit. In countries like Malaysia and Thailand, universities produce fewer than 500 HR technology graduates annually, far below industry requirements. This shortage forces organizations to either outsource critical functions or operate with understaffed teams, increasing the risk of inefficiencies and suboptimal outcomes. Additionally, the rapid evolution of HR technologies necessitates continuous upskilling, which many professionals struggle to achieve due to limited access to advanced training programs. For instance, a survey by EY revealed that only 25% of organizations in the region receive regular training updates. This skills gap undermines efforts to implement effective HR solutions, leaving enterprises vulnerable to missed opportunities.

Resistance to Digital Transformation Among Traditional Enterprises

Another pressing challenge is the resistance to digital transformation among traditional enterprises, particularly in rural and semi-urban areas. Many businesses underestimate the importance of adopting advanced HR technologies, viewing them as unnecessary or overly complex rather than as enablers of competitive advantage. According to Grant Thornton, over 60% of SMEs in the region do not integrate HR technologies into their operations. This complacency stems from a limited understanding of potential risks and the perceived complexity of implementation. For example, a study by the Asian Development Bank found that 70% of family-owned businesses in India were unaware of basic predictive analytics tools, making them easy targets for inefficiencies and outdated practices. Furthermore, the absence of dedicated IT departments in smaller organizations exacerbates the problem, as employees often lack the technical knowledge to identify and mitigate gaps. This lack of awareness not only hampers innovation but also undermines broader efforts to create a technologically advanced ecosystem, as excluded enterprises cannot contribute to or benefit from the digital transformation of industries.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.05% |

|

Segments Covered |

By Type, Deployment, Enterprise, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

SAP SE (Germany), Oracle Corporation (U.S.), Automatic Data Processing (ADP), Inc. (U.S.), Cornerstone OnDemand, Inc. (U.S.), Ceridian HCM Holding Inc. (U.S.), Workday, Inc. (U.S.), Infor, Inc. (U.S.), Cegid Group (France), Hi Bob Inc. (U.K.), The Access Group (U.K.). |

SEGMENTAL ANALYSIS

By Type Insights

The talent management segment was the largest and held 35.4% of the Asia Pacific HR technology market share in 2024 due to its role in addressing workforce challenges such as skill gaps, employee retention, and career development. According to the World Economic Forum, over 60% of enterprises in the region prioritize talent management solutions to align employee goals with organizational objectives. For example, companies in Japan and South Korea leverage AI-driven platforms to identify high-potential employees and design personalized development plans by ensuring higher engagement and productivity. Additionally, the growing emphasis on diversity and inclusion has amplified the need for tools that support equitable career progression.

Another driving factor is the increasing complexity of global supply chains. According to Deloitte, enterprises adopting talent management platforms report a 25% improvement in operational efficiency, which is enhancing their widespread adoption.

The workforce management segment is projected to grow at a CAGR of 22.3% during the forecast period. This rapid expansion is fueled by the growing demand for real-time monitoring and optimization of workforce performance. For instance, retailers in India and Australia are using IoT-enabled systems to track employee activities and enhance productivity, ensuring timely interventions. Another contributing factor is the integration of AI and machine learning into these platforms, enabling predictive analytics and automation.

By Deployment Insights

On-premise deployment segment dominated the Asia Pacific HR technology market share in 2024 with the widespread adoption of on-premise solutions among large enterprises, particularly in industries where data security and control are paramount. According to the International Data Corporation (IDC), over 70% of large organizations in the region prefer on-premise systems to manage sensitive employee data, ensuring compliance with stringent regulatory requirements. For instance, financial institutions in Japan and South Korea rely on on-premise platforms to maintain complete control over their data, mitigating risks associated with cyberattacks and breaches.

Another driving factor is the growing complexity of IT infrastructures. As organizations expand their digital footprints, they require adaptable solutions that can integrate seamlessly with existing systems. According to a study by Gartner, on-premise deployment modes reduce operational costs by 25%, which is making them highly attractive to businesses seeking secure and scalable solutions.

The cloud deployment segment is projected to grow with a CAGR of 24.5% in the coming years. This rapid expansion is fueled by the increasing affordability and scalability of cloud-based platforms, which enable HR teams to access real-time analytics without significant upfront investments. For instance, small and medium-sized enterprises (SMEs) in India and Southeast Asia are adopting cloud-based solutions to enhance payroll management and streamline recruitment processes.

By Enterprise Type Insights

The Large enterprises segment accounted for holding dominant share of the Asia Pacific HR technology market due to their ability to invest in advanced technologies and infrastructure, enabling them to leverage HR platforms effectively. According to the World Bank, over 50% of HR spending in the region is attributed to large enterprises, amplifying the demand for scalable and innovative solutions. For example, multinational corporations in China and Japan use predictive analytics to identify skill gaps and design personalized training programs, ensuring higher engagement and productivity. Another driving factor is the growing emphasis on employee experience and retention. According to PwC, enterprises adopting HR technology platforms report a 30% increase in employee satisfaction due to their widespread adoption.

The SMEs segment is projected to grow at the highest CAGR of 23.5% in the coming years. This rapid expansion is fueled by the increasing availability of cost-effective and user-friendly HR solutions tailored to the needs of smaller businesses. For instance, startups in Vietnam and Indonesia are leveraging mobile-based platforms to deliver localized and affordable HR tools, ensuring continuity of workforce management for underserved communities. According to the Asian Development Bank, over 40% of SMEs in Southeast Asia prioritize HR technology to enhance their operational efficiency.

By Industry Insights

The banking, financial services, and insurance (BFSI) industry dominated the Asia Pacific HR technology market with 40.4% of share in 2024, owing to the growing emphasis on compliance, risk management, and workforce optimization in high-stakes environments. According to the International Monetary Fund, over 60% of BFSI organizations in the region prioritize HR platforms to ensure adherence to labor laws and regulatory frameworks. For example, banks in Singapore and Malaysia use AI-driven tools to analyze employee performance metrics and predict turnover risks, ensuring timely interventions.

The healthcare industry is lucratively to grow with a CAGR of 24.5% during the forecast period. This rapid expansion is fueled by the increasing adoption of HR technology solutions to address challenges such as staff shortages and patient care quality. For instance, hospitals in Australia and Thailand are using digital platforms to streamline recruitment processes and enhance workforce management by ensuring timely interventions. Another contributing factor is the integration of IoT-enabled devices into HR platforms, enabling real-time monitoring of workforce performance. A report by Accenture revealed that healthcare organizations leveraging IoT-driven analytics experience a 30% improvement in operational efficiency.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China was the largest contributor of the Asia Pacific HR technology market with 35.5% of the total share in 2024. The country’s massive population and rapidly growing urbanization have created a fertile ground for HR platforms to thrive. Enterprises and government agencies in China are increasingly adopting advanced technologies like AI-driven analytics and blockchain to enhance workforce management. According to the National Bureau of Statistics of China, over 60% of large organizations have integrated HR technology into their operations, with its widespread adoption. Government initiatives promoting smart cities have further accelerated investments in scalable and innovative solutions will further promote the growth opportunities for the Asia Pacific Human Resource (HR) technology market.

Japan was next in leading the Asia Pacific human resource technology market share in 2024. With its advanced technological infrastructure and emphasis on precision positioning, it is a leader in adopting AI-driven HR solutions. Japanese corporations prioritize efficiency and innovation, particularly in industries like manufacturing and retail. According to the Japan External Trade Organization, over 70% of large enterprises use HR platforms to enhance operational efficiency and compliance. Additionally, the integration of robotics and automation into business processes has gained traction by enabling seamless and scalable solutions.

India’s booming IT sector and rapidly evolving startup ecosystem are major drivers of the Asia Pacific HR technology market. Indian enterprises are increasingly leveraging analytics tools to address challenges such as chronic disease management and rural access. According to the Ministry of Electronics and Information Technology, over 50% of tech startups in India have integrated AI-driven analytics into their offerings, reflecting its growing importance. Additionally, government-led initiatives promoting digital health have further bolstered the market by ensuring steady growth.

Australia’s strong emphasis on regulatory compliance and public health surveillance will escalate the growth of the market. Australian enterprises spend significant resources on managing EHRs, clinical trials, and population health trends. According to the Australian Digital Health Agency, over 40% of healthcare organizations use predictive models to monitor infectious disease outbreaks, which is improving preparedness and response times.

South Korea's HR technology market is likely to grow eventually, as the growing focus on innovation and digital transformation has driven the adoption of advanced HR technology platforms. South Korean enterprises, particularly in urban centers, rely on analytics tools to manage chronic diseases and enhance patient care. According to the Korea Chamber of Commerce and Industry, over 50% of large hospitals have implemented AI-driven systems to analyze imaging data for early disease detection by ensuring timely interventions.

KEY MARKET PLAYERS

SAP SE (Germany), Oracle Corporation (U.S.), Automatic Data Processing (ADP), Inc. (U.S.), Cornerstone OnDemand, Inc. (U.S.), Ceridian HCM Holding Inc. (U.S.), Workday, Inc. (U.S.), Infor, Inc. (U.S.), Cegid Group (France), Hi Bob Inc. (U.K.), The Access Group (U.K.). are the market players that are dominating the human resource technology market.

Top Players in the Market

SAP is a global leader in the HR technology market, renowned for its comprehensive suite of cloud-based solutions that cater to workforce management, talent acquisition, and payroll processing. The company’s flagship platform, SAP SuccessFactors, empowers enterprises to streamline HR operations while ensuring compliance with regional regulations. SAP’s focus on innovation and scalability has enabled it to address the unique needs of diverse industries across the Asia Pacific region.

Oracle offers robust HR technology platforms that provide end-to-end visibility across workforce processes, ensuring alignment with both regional and global standards. Enterprises leverage Oracle’s tools to optimize recruitment, performance management, and employee engagement strategies. Oracle has deepened its engagement in the Asia Pacific by tailoring its offerings to meet local needs, such as data privacy laws in Japan and Australia. Its emphasis on cutting-edge research and integration of emerging technologies like AI and blockchain positions it as a key innovator in the HR technology space.

Workday specializes in dynamic and interactive HR platforms that emphasize real-time data analytics and user-centric design. Its solutions cater to industries like retail, healthcare, and education, enabling organizations to enhance operational efficiency and employee satisfaction. Workday has strengthened its presence in the Asia Pacific by investing in AI-driven tools and fostering collaborations with startups and academic institutions.

Top Strategies Used By Key Players In The Market

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Leading players are increasingly incorporating AI and ML into their HR platforms to enhance functionality and adaptability. These technologies enable predictive analytics, real-time decision-making, and automation, addressing complex challenges in areas such as talent acquisition and workforce optimization. For instance, AI-driven systems can analyze employee performance metrics to predict turnover risks or recommend personalized training programs, improving operational efficiency and user satisfaction. This strategy not only differentiates vendors in a competitive market but also positions them as innovators in the HR technology space.

Expansion Through Strategic Partnerships

Strategic partnerships with local enterprises, governments, and industry bodies have become a cornerstone of success in the Asia Pacific HR technology market. Collaborations with public sector organizations help promote awareness campaigns and regulatory compliance initiatives, fostering trust among stakeholders. Additionally, partnerships with technology firms facilitate the integration of advanced tools, ensuring scalability and reliability. These alliances enable companies to expand their reach and influence across diverse markets, catering to the unique needs of industries such as BFSI, healthcare, and manufacturing.

Focus on Localization and Customization

Key players are prioritizing localization and customization to address the unique needs of businesses in the Asia Pacific region. By offering multilingual interfaces and region-specific features, vendors can cater to diverse consumer preferences. This approach not only enhances user experience but also fosters brand loyalty. Additionally, customization allows companies to adapt their solutions to specific industries, such as rural healthcare and telemedicine, ensuring relevance and applicability in diverse operational contexts.

COMPETITION OVERVIEW

The Asia Pacific HR technology market is characterized by intense competition, driven by a mix of global giants and regional innovators striving to capture market share. Established players like SAP, Oracle, and Workday bring extensive resources and technological expertise, enabling them to dominate key segments such as AI-driven analytics and cloud-based platforms. At the same time, regional companies leverage their deep understanding of local cultures and regulatory frameworks to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements, which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies, particularly in emerging markets. Additionally, the rise of digital transformation initiatives has created new opportunities for differentiation, as companies strive to offer seamless and scalable solutions. This interplay of innovation, localization, and strategic positioning ensures that the market remains vibrant and highly contested.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, SAP launched a new AI-powered module tailored to address the growing complexity of workforce management in Southeast Asia. This initiative aims to enhance its market presence by offering region-specific solutions that align with local regulatory frameworks.

- In June 2023, Oracle partnered with a leading retail chain in Australia to integrate its HR platform with the firm’s existing employee engagement systems. This collaboration seeks to streamline recruitment processes and improve operational efficiency for end-users.

- In September 2023, Workday introduced a blockchain-enabled feature to ensure tamper-proof records for employee transactions in India. This move strengthens its prominence in ethical governance practices and addresses growing concerns about transparency.

- In February 2024, SAP acquired a regional startup specializing in AI-driven predictive analytics for talent management. This acquisition allows SAP to expand its capabilities in proactive workforce planning, catering to the evolving needs of enterprises in the Asia Pacific region.

- In November 2023, Oracle collaborated with a government agency in Singapore to promote the adoption of HR technology tools among small and medium-sized enterprises (SMEs). This initiative aims to foster digital resilience and increase market penetration among underserved segments.

MARKET SEGMENTATION

This research report on the Asia Pacific HR technology market is segmented and sub-segmented into the following categories.

By Type

- Talent Management

- Workforce Management

- Recruitment

- Payroll Management

- Performance Management

- Others (Employee Collaboration & Engagement)

By Deployment

- Cloud

- On-premise

By Enterprise Type

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry

- BFSI

- IT and Telecommunication

- Government

- Manufacturing

- Retail

- Healthcare

- Others (Education)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the surge in demand for cloud-based HR platforms across the Asia-Pacific region post 2023?

With over 70% of APAC enterprises prioritizing hybrid and remote work models since the pandemic, cloud-native HR systems are gaining traction for their scalability, cost efficiency, and ease of deployment across multi-country operations. Additionally, IDC forecasts that by 2026, 60% of APAC HR departments will be fully cloud-integrated.

How is the rise of Gen Z and Millennial workers influencing HR Tech design and functionality in APAC?

Younger workers in APAC—especially in countries like India, Indonesia, and the Philippines—expect consumer-grade mobile HR experiences, real-time feedback loops, and gamified learning platforms. As of 2024, Millennials and Gen Z account for nearly 60% of the workforce in key APAC economies, pushing HR Tech toward more personalized and digital-first engagement tools.

Why are predictive workforce analytics becoming a strategic imperative for APAC HR leaders?

Faced with talent shortages in IT, healthcare, and logistics, APAC companies are turning to predictive analytics to forecast attrition, optimize workforce planning, and identify upskilling needs. A recent Deloitte study shows that 63% of large APAC enterprises plan to increase their investment in people analytics by the end of 2025.

What regulatory trends are shaping the future of HR Tech compliance in the Asia-Pacific region?

Governments in Asia-Pacific are tightening data residency and cross-border data flow laws. For example, China's PIPL, India's DPDP Act, and Australia’s revised Privacy Act mandate stricter consent and storage practices. This is forcing HR Tech providers to adopt localized compliance modules and region-specific data hosting strategies.

How are SMEs in APAC leveraging HR Tech to compete for talent with large enterprises?

Small and medium-sized businesses—especially in Vietnam, Thailand, and Malaysia—are adopting modular, AI-powered HR tools to streamline hiring, onboarding, and payroll. As per a 2024 SAP report, 45% of APAC SMEs now use at least one cloud-based HR solution, up from just 28% in 2021, signaling growing tech democratization.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]