Asia Pacific Ice Cream Market Research Report – Segmented By Product (Cartons, Tubs, Cups, Cones, Bars), By Type, By Flavor, Distribution Channel, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Ice Cream Market Size

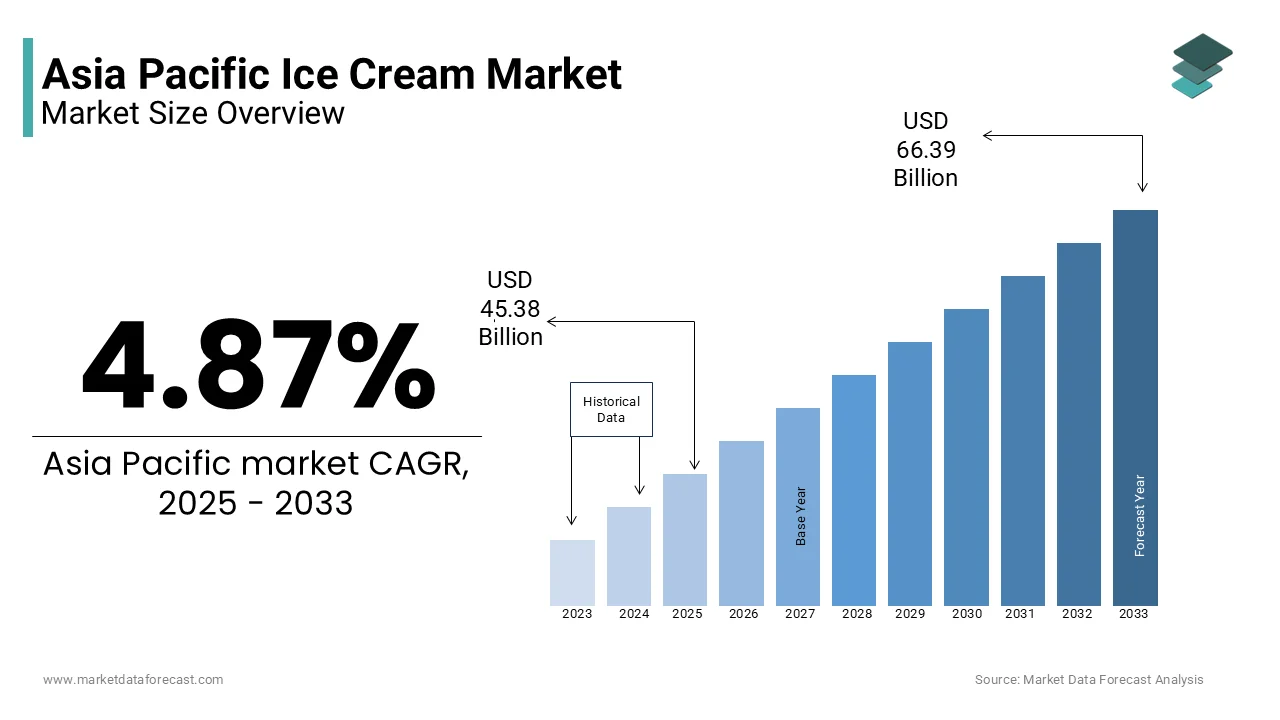

Asia Pacific Ice Cream market size was valued at USD 43.27 billion in 2024, and the market size is expected to reach USD 66.39 billion by 2033 from USD 45.38 billion in 2025. The market's promising CAGR for the predicted period is 4.87% during the forecast period.

MARKET DRIVERS

Rising Urbanization and Changing Lifestyles

Rising urbanization and evolving lifestyles are pivotal drivers propelling the Asia Pacific ice cream market forward, particularly among younger demographics. This pattern is especially pronounced in countries like China and India, where rapid urbanization has led to busier lifestyles and a growing preference for quick, hassle-free indulgences. For instance, ice cream sales in metropolitan cities like Mumbai and Delhi have surged in recent years, driven by dual-income households and the influence of Western culture. Moreover, innovations such as localized flavors and healthier ingredient options have further boosted demand. A study by the Australian Institute of Food Science and Technology highlights that low-sugar and plant-based ice creams now account for a significant portion of total sales in urban markets. These dynamics shows how urbanization and lifestyle changes continue to fuel the dominance of ice cream in the region.

Growing Popularity of Premium and Artisanal Variants

The growing popularity of premium and artisanal ice cream variants serves as another major driver for the Asia Pacific ice cream market, driven by consumer willingness to splurge on indulgent experiences. This current wave is particularly evident in affluent markets like Japan and South Korea, where exposure to global food trends through social media and streaming platforms has reshaped dining preferences. Additionally, collaborations between food brands and celebrity chefs have further amplified this trend. Another significant factor is the rise of themed cafes and dessert festivals, which have normalized artisanal ice cream as a mainstream indulgence.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

Fluctuating raw material costs present a significant restraint to the Asia Pacific ice cream market, impacting production timelines and profitability. The reliance on key ingredients like milk, sugar, and cocoa makes the industry vulnerable to price volatility, especially in regions prone to supply chain disruptions. These inconsistencies translate into higher retail prices, deterring price-sensitive consumers in emerging markets. Additionally, import tariffs and trade barriers further complicate cross-border movement of raw materials, resulting in financial losses for exporters. Such challenges not only inflate production costs but also limit market penetration in high-demand areas, threatening the market's ability to sustain growth amidst rising consumer expectations.

Limited Accessibility in Rural Areas

Limited accessibility in rural areas poses a significant restraint to the Asia Pacific ice cream market, particularly in underdeveloped regions where cold chain infrastructure remains inadequate. This gap creates a significant barrier to market expansion, as rural populations represent a substantial untapped consumer base. In addition, the lack of refrigeration facilities in remote areas restricts product availability, further stifling demand. For instance, traditional beliefs associating ice cream with luxury deter regular consumption, particularly among older generations. Additionally, logistical inefficiencies lead to spoilage rates of up to 10% in rural distribution channels, exacerbating financial losses for manufacturers.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion into emerging markets offers a lucrative opportunity for the Asia Pacific ice cream market, driven by untapped consumer bases and evolving purchasing power. Countries like Vietnam, Indonesia, and the Philippines present fertile ground for growth, with their expanding middle-class populations increasingly gravitating toward indulgent and Western-inspired desserts. Companies investing in localized distribution networks stand to capture significant market share, particularly through partnerships with small retailers and cooperatives. Moreover, government initiatives promoting agribusiness in Southeast Asia have facilitated the establishment of new cold storage facilities, ensuring a steady supply of high-quality raw materials. For instance, Vietnam’s recent focus on modernizing its food processing sector has led to an increase in ice cream production over the past three years.

Innovation in Health-Conscious Offerings

Innovation in Health-Conscious Offerings

Innovation in health-conscious ice cream offerings represents a transformative opportunity for the Asia Pacific ice cream market, enabling brands to differentiate themselves and attract diverse consumer segments. As consumer preferences evolve, there is a growing appetite for value-added variants such as low-sugar, plant-based, and functional ice creams tailored to specific dietary needs. This shift has spurred companies to experiment with formulations like keto-friendly and vegan ice creams, catering to niche markets seeking specialized nutrition. Moreover, the introduction of eco-friendly packaging, such as biodegradable cartons and reusable containers, has resonated strongly with environmentally conscious buyers, boosting brand loyalty in urban areas. Innovations in freezing techniques, such as liquid nitrogen freezing, have also enhanced product quality, preserving natural flavors while extending shelf life.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a significant challenge to the Asia Pacific ice cream market, as numerous players vie for dominance in an increasingly saturated landscape. The entry of multinational corporations alongside local brands has fragmented the market, leading to aggressive pricing wars and eroding profit margins. This proliferation forces smaller players to either consolidate or exit the market, as they struggle to match the marketing budgets and distribution networks of larger conglomerates. Brand differentiation has become increasingly difficult, with consumers often prioritizing cost over loyalty. Additionally, counterfeit products and unauthorized imports exacerbate the issue. Without strategic innovations or collaborations, companies risk being overshadowed by competitors, making market saturation a persistent obstacle to sustainable growth.

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the Asia Pacific ice cream market, impacting production timelines and distribution efficiency. The reliance on imported raw materials like cocoa and dairy makes the industry vulnerable to logistical bottlenecks, especially in regions prone to extreme weather events and geopolitical tensions. Like, typhoons and monsoon floods caused a reduction in cold chain logistics capacity in Southeast Asia during 2021, leading to shortages and increased operational costs. These disruptions are exacerbated by inadequate infrastructure in rural farming areas, where transportation networks often struggle to meet the demands of large-scale production. Such inefficiencies not only inflate operational expenses but also limit market penetration in high-demand areas. While investments in cold chain logistics and warehousing are underway, progress remains uneven, particularly in less-developed economies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.87% |

|

Segments Covered |

By Product, Type, Flavor, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Nestle SA, General Mills Inc., Appolo Ice Cream Co Ltd, Unilever PLC, Yili Group, CAMPINA ICE CREAM INDUSTRY Tbk., Diamond Food Indonesia, Dairy Bell Ice Cream, PT. United Family Food, and Froneri International Limited, and others |

SEGMENTAL ANALYSIS

By Product Insights

The tubs segment prevailed in the Asia Pacific ice cream market by capturing a 40.7% of the total product portion. This is because of their versatility, affordability, and widespread use in both households and foodservice establishments. A key factor fueling this dominance is the growing trend of family-sized indulgences in urban areas. Additionally, tubs are priced lower than premium formats like cones or bars, appealing to price-sensitive consumers in emerging markets like India and Indonesia. Another contributing factor is the rise of e-commerce platforms, which have amplified accessibility. These dynamics ensure that tubs remain the cornerstone of the ice cream market in the region.

The ice cream bars are predicted to grow at a CAGR of 10.5%. This quick development is caused by the increasing popularity of portion-controlled, on-the-go snacks among younger demographics. One of the primary drivers of this growth is the rising demand for convenience foods. Similarly, the number of millennials experimenting with snackable desserts has increased in urban areas over the past five years, with ice cream bars serving as a gateway to indulgent yet portable treats. Another key aspect is the influence of social media trends, which have amplified the appeal of these products.

By Type Insights

The dairy and water-based ice creams segment spearheaded the Asia Pacific ice cream market. This position in market is underpinned by their affordability, widespread availability, and cultural acceptance across diverse consumer demographics. A critical factor driving this dominance is the strong tradition of dairy consumption in the region. According to the Food and Agriculture Organization (FAO), dairy remains a staple ingredient in diets across countries like India and China, making dairy-based ice creams a natural choice for most consumers. A different factor contributing is the extensive distribution networks of major brands like Amul and Nestlé, which ensure extensive shelf space in supermarkets and convenience stores.

The segment of vegan ice creams are projected to grow at a CAGR of 12.8%. This rapid expansion is fueled by the increasing adoption of plant-based diets and health-conscious lifestyles. One of the primary drivers of this growth is the rising awareness of lactose intolerance and dietary restrictions. Another significant factor is the influence of global wellness trends, which have amplified the demand for clean-label and sustainable products.

By Flavor Insights

The chocolate segment commanded the Asia Pacific ice cream market by capturing a 45.6% of the total flavor category in 2024. This is influenced by its universal appeal and indulgent taste profile, making it a perennial favorite among consumers. A key factor fueling this dominance is the growing preference for rich and decadent flavors in urban areas. Additionally, an important factor is the influence of seasonal promotions, particularly during festivals like Diwali and Christmas.

The fruit-flavored ice creams are projected to grow at a CAGR of 9.5%, emerging as the fastest-growing flavor segment in the Asia Pacific ice cream market. This rapid expansion is fueled by the increasing demand for healthier and lighter dessert options. One of the primary drivers of this growth is the rising health consciousness among consumers. Also, fruit-flavored ice creams are perceived as a guilt-free indulgence, with sales growing notably in urban areas like Jakarta and Bangkok. Moreover, another crucial factor is the influence of social media trends, which have amplified the visibility of fruit-based desserts.

By Distribution Channel Insights

The retail segment dominated the Asia Pacific ice cream market by holding a 60% share in 2024. This is underpinned by its extensive reach and ability to cater to diverse consumer demographics, from urban professionals to rural households. A critical factor driving this dominance is the strategic placement of ice cream products in prominent aisles, enhancing visibility and impulse purchases. Additionally, the integration of private-label ice creams by major retailers like Woolworths in Australia and Big Bazaar in India has further strengthened this segment's position. c Another contributing factor is the growing trend of bulk purchasing, particularly in rural areas.

The foodservice segment is the fastest-growing distribution channel in the Asia Pacific ice cream market, with a projected CAGR of 8.5%. This is fueled by the increasing popularity of themed cafes and dessert parlors across the region. One of the primary drivers of this surge is the growing trend of experiential dining, particularly among younger demographics. Like, the number of dessert-themed cafes in urban areas has increased notably over the past five years, with ice cream being a central menu item. Moreover, a significant factor is the influence of social media marketing. Data indicates that influencer-driven campaigns promoting dessert experiences have increased foot traffic by 50% in markets like Thailand and Malaysia.

REGIONAL ANALYSIS

India is experiencing significant growth in the Asia-Pacific ice cream market by accounting for a 25.8% of regional revenue in 2024. The country's vast population and rising disposable incomes make it a natural hub for consumption. A key driving factor is the government's push for modernizing food processing industries, with initiatives encouraging the adoption of Western dietary habits. Urbanization has also spurred demand, particularly in cities like Mumbai and Delhi, where ice creams are increasingly viewed as a year-round indulgence.

China is expected to continue generating the most revenue in the region. The country's youthful population and growing exposure to global cuisines drive demand for ice creams, particularly in metropolitan cities. Like, ice cream sales in urban areas like Shanghai and Beijing have surged since 2020, fueled by dual-income households and the influence of Western culture. Additionally, the rise of e-commerce platforms has amplified accessibility, with online sales growing in the last few years.

Japan is exhibiting a robust and growing trajectory which is benefiting from its aging population's reliance on convenience foods. Ice creams have become a staple due to their ease of preparation and variety, with urban areas witnessing a annual growth in demand. Government initiatives promoting sustainable agriculture have further expanded availability, enhancing market penetration.

Australia is showing consistent growth with its emphasis on fitness and wellness positioning ice creams as essential for indulgent snacking.

South Korea is experiencing a positive trajectory in the Asia Pacific ice cream market. The regional market is driven by its tech-savvy population and booming e-commerce sector. Urban centers like Seoul witness a notable growth in online ice cream sales, fueled by influencer-driven campaigns and subscription models.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Nestle SA, General Mills Inc., Appolo Ice Cream Co Ltd, Unilever PLC, Yili Group, CAMPINA ICE CREAM INDUSTRY Tbk., Diamond Food Indonesia, Dairy Bell Ice Cream, PT. United Family Food, and Froneri International Limited are playing a dominating role in the Asia Pacific ice cream market.

The Asia Pacific ice cream market is characterized by intense competition, with numerous players vying for dominance in an increasingly saturated landscape. Established global brands like Unilever and Nestlé compete alongside regional leaders such as Amul, each striving to differentiate themselves through unique value propositions. While multinational corporations leverage their extensive distribution networks and marketing budgets to capture urban markets, local players focus on affordability and cultural relevance to appeal to broader demographics. The entry of private-label products from major retailers further intensifies the rivalry, pressuring branded manufacturers to innovate continuously. Sustainability and health consciousness have emerged as key battlegrounds, with companies investing in eco-friendly packaging and clean-label formulations to gain a competitive edge. Additionally, the rise of e-commerce has leveled the playing field, enabling smaller brands to challenge incumbents by reaching consumers directly.

TOP PLAYERS IN THE MARKET

Unilever (Through its brand Ben & Jerry’s)

Unilever, through its iconic Ben & Jerry’s brand, is a dominant player in the Asia Pacific ice cream market, known for its indulgent flavors and commitment to sustainability. The company has significantly contributed to the global market by introducing innovative products that align with consumer preferences for premium and eco-friendly options. Its focus on ethical sourcing and carbon-neutral initiatives has strengthened its reputation, making it a preferred choice among environmentally conscious buyers. Unilever’s strategic partnerships with foodservice establishments and e-commerce platforms have further solidified its presence in urban markets across the region.

Nestlé (Through its brand Häagen-Dazs)

Nestlé has carved a niche in the Asia Pacific market by focusing on luxury and high-quality ice creams. The company’s emphasis on clean-label ingredients and unique flavor profiles resonates with consumers seeking premium indulgence. By aligning with local distributors and promoting fair trade practices, Nestlé has fostered trust and loyalty among its customer base.

Amul

Amul is a regional leader that leverages its deep understanding of local consumer preferences to tailor its ice cream offerings. The company’s strong distribution network and collaborations with supermarkets and convenience stores have enabled it to penetrate both urban and rural markets effectively. Amul’s efforts to promote affordable and culturally relevant flavors have expanded its appeal beyond traditional consumers to mainstream buyers.

TOP STRATEGIES USED BY KEY PLAYERS

Localized Flavor Offerings

Key players in the Asia Pacific ice cream market are increasingly focusing on localized flavor offerings to cater to diverse consumer preferences. This strategy not only enhances brand acceptance but also strengthens their competitive edge in a crowded marketplace. Collaborations with local chefs and culinary experts further amplify the authenticity of these offerings, driving consumer engagement and loyalty.

Sustainability Initiatives

Sustainability has become a cornerstone of market strategies, with companies emphasizing eco-friendly practices to appeal to environmentally conscious buyers. From adopting recyclable packaging to promoting sustainable sourcing of raw materials, key players are investing in initiatives that reduce their environmental footprint. These efforts not only align with global trends toward green consumption but also position brands as responsible corporate citizens.

Digital Marketing and E-commerce Expansion

To strengthen their position, leading companies are leveraging digital marketing and expanding their e-commerce presence. Social media campaigns, influencer collaborations, and targeted advertisements are being used to reach tech-savvy consumers, particularly in urban areas. Simultaneously, investments in online platforms and subscription models ensure seamless accessibility and convenience.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Unilever launched a series of limited-edition ice cream flavors infused with locally sourced fruits from Southeast Asia. This move was aimed at appealing to regional taste preferences and expanding its product portfolio in urban markets.

- In June 2023, Nestlé partnered with local dairy farmers in Vietnam to source sustainable ingredients for its Häagen-Dazs line. This initiative reinforced the company’s commitment to ethical sourcing and enhanced its reputation among eco-conscious buyers.

- In August 2023, Amul introduced biodegradable packaging for its entire ice cream range. This shift toward sustainable packaging aligned with global environmental trends and strengthened its market positioning.

- In October 2023, Unilever collaborated with food influencers across Australia and New Zealand to promote its low-sugar ice cream variants as guilt-free indulgences. This campaign boosted brand visibility and engagement among health-conscious consumers.

- In February 2024, Nestlé expanded its e-commerce operations by partnering with major online retailers in India and Indonesia. This strategic move increased accessibility and tapped into the growing demand for online purchases of frozen desserts in these regions.

MARKET SEGMENTATION

This research report on the Asia Pacific ice cream market has been segmented and sub-segmented based on the following categories.

By Product

- Cartons

- Tubs

- Cups

- Cones

- Bars

By Type

- Dairy & Water-based

- Vegan

By Flavor

- Chocolate

- Vanilla

- Fruit

- Others

By Distribution Channel

- Foodservice

- Retail

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is the market size of the Asia Pacific ice cream market?

The Asia Pacific ice cream market was valued at USD 43.27 billion in 2024 and is projected to reach USD 66.39 billion by 2033, growing at a CAGR of 4.87% from 2025 to 2033.

2. What factors are driving the growth of the ice cream market in Asia Pacific?

Growth is driven by rising disposable incomes, changing consumer lifestyles, increasing urbanization, and a strong preference for indulgent and innovative frozen desserts.

3. Which countries contribute most to the Asia Pacific ice cream market?

China, India, Japan, South Korea, and Indonesia are key markets due to their large populations, growing middle class, and expanding retail infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com