Asia Pacific Identity and Access Management Market Size, Share, Trends & Growth Forecast Report By End Use (BFSI, Education), Component, Deployment, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Identity and Access Management Market Size

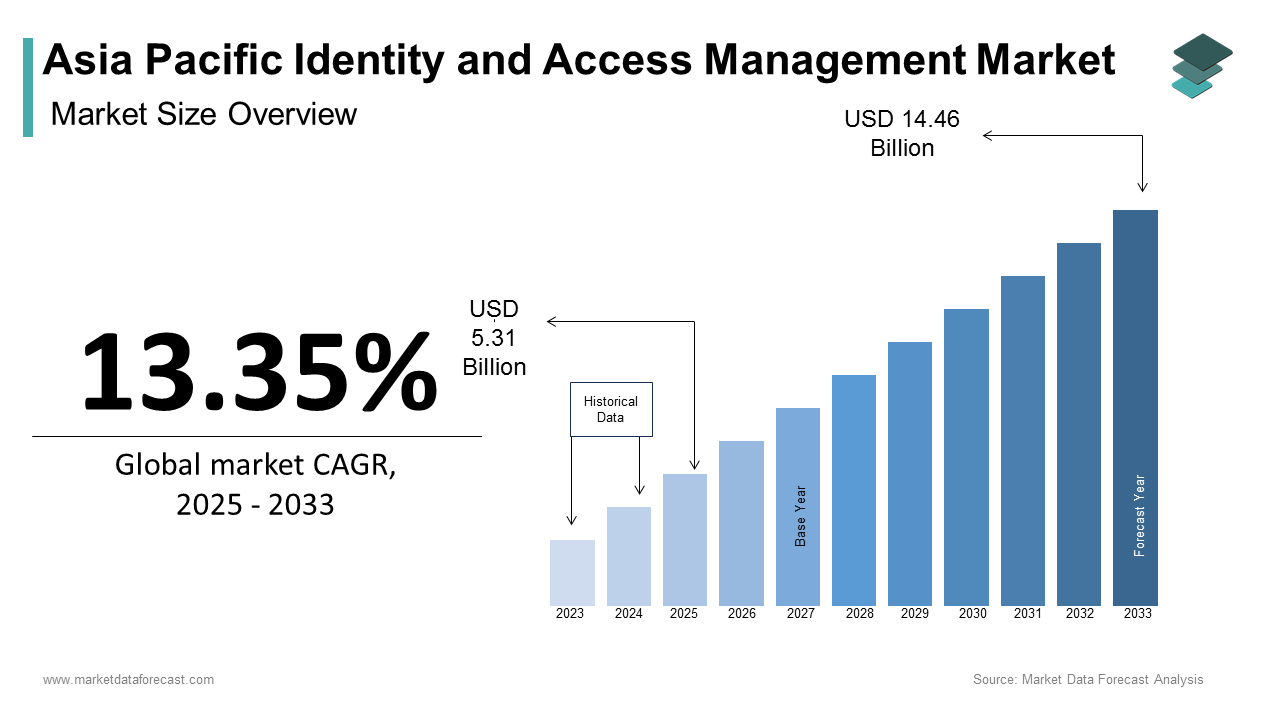

The Asia Pacific identity and access management market size was calculated to be USD 4.68 billion in 2024 and is anticipated to be worth USD 14.46 billion by 2033, from USD 5.31 billion in 2025, growing at a CAGR of 13.35% during the forecast period.

The Asia Pacific identity and access management (IAM) market is witnessing substantial growth, driven by digital transformation initiatives across industries. The proliferation of cloud-based services and remote work models has also fueled adoption, which is making IAM an integral component of enterprise security strategies in the region.

MARKET DRIVERS

Increasing Regulatory Compliance Requirements

Regulatory frameworks mandating data protection and privacy are acting as a major driver for the IAM market in the Asia Pacific. For example, the General Data Protection Regulation (GDPR)-inspired laws in countries like Japan and South Korea have obligated organizations to implement robust IAM systems. Additionally, the Reserve Bank of India mandates financial institutions to adopt biometric authentication for customer verification, creating a surge in IAM adoption. A study by PwC had revealed that companies investing in IAM solutions can reduce compliance-related risks by up to 40%.

Rising Adoption of Cloud-Based Solutions

Cloud computing’s rapid adoption is another key driver propelling the IAM market forward. This transition necessitates sophisticated IAM tools to manage user access across diverse platforms securely. As per a report by Microsoft, nearly 85% of organizations using cloud services have implemented IAM solutions to ensure seamless yet secure access management. Furthermore, the rise of remote work has amplified demand, with Australia witnessing a 25% increase in IAM deployments post-pandemic, according to the Australian Cyber Security Centre. The convergence of cloud adoption and remote work trends continues to fuel the IAM market's upward trajectory.

MARKET RESTRAINTS

High Implementation Costs

The significant upfront investment required for IAM solutions serves as a restraint for many small and medium-sized enterprises (SMEs) in the Asia Pacific. Licensing fees, integration complexities, and ongoing maintenance expenses can collectively exceed $500,000 for large-scale deployments, as noted by Ernst & Young. This financial burden is particularly challenging for businesses in developing economies like Indonesia and Vietnam, where budgets for IT security are often limited. Consequently, many organizations delay or forego IAM implementations hindering market growth.

Lack of Skilled Workforce

Another critical restraint is the shortage of skilled professionals capable of managing IAM systems effectively. As per a report by LinkedIn, there is a 35% gap between the demand and supply of cybersecurity experts in the Asia Pacific region. This talent deficit complicates the deployment and maintenance of IAM solutions, leading to operational inefficiencies. Without adequate expertise, businesses face challenges in optimizing IAM tools, which can result in suboptimal security outcomes and reduced return on investment which will further promote the growth of the market.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of IAM with emerging technologies like artificial intelligence (AI) and blockchain presents a significant opportunity for market expansion. According to Accenture, AI-driven IAM solutions can enhance threat detection accuracy by up to 50% by making them highly attractive to enterprises. For instance, in South Korea, AI-powered behavioral analytics is being used to monitor user activity patterns, which is reducing unauthorized access incidents by 30%. Similarly, blockchain-based IAM systems are gaining traction in Singapore, where the government has piloted decentralized identity verification projects.

Expansion into Untapped Markets

Emerging economies like Bangladesh and the Philippines offer untapped opportunities for IAM vendors. For example, in the Philippines, the Bangko Sentral ng Pilipinas has mandated secure authentication for online banking, which is boosting IAM demand.

MARKET CHALLENGES

Resistance to Change

Organizational resistance to adopting new IAM technologies poses a significant challenge. Many traditional enterprises in the Asia Pacific in sectors like manufacturing and retail, are reluctant to transition from legacy systems due to perceived risks and disruptions. This resistance not only slows market growth but also increases vulnerability to cyber threats, as outdated systems often lack the agility to counter evolving risks.

Fragmented Regulatory Landscape

The absence of unified regulatory standards across the Asia Pacific creates complexities for IAM implementation. According to EY, businesses operating in multiple countries must navigate over 20 different cybersecurity frameworks are leading to increased compliance costs and operational inefficiencies. For example, while Japan adheres to strict data localization laws, countries like India are still finalizing their regulatory frameworks. This fragmentation complicates cross-border IAM deployments. Enterprises face challenges in ensuring consistent compliance, which can deter investment in IAM solutions and hinder market development.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.35% |

|

Segments Covered |

By End Use, Component, Deployment, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

IBM Corporation, Microsoft Corporation, Oracle Corporation, Broadcom Inc., Amazon Web Services Inc., Google LLC, Cisco Systems Inc., NEC Corporation, Ping Identity Holding Corp., Okta Inc., SailPoint Technologies Holdings Inc., CyberArk Software Ltd., Dell Inc., Centrify Corporation, Delinea Inc., Fortra LLC, HID Global, IDEMIA, Entrust, Gemalto |

SEGMENTAL ANALYSIS

By End-use Insights

The BFSI (Banking, Financial Services, and Insurance) sector dominated the Asia Pacific identity and access management (IAM) market by accounting for 35.4% of the share in 2024 with the sector’s stringent regulatory requirements and the increasing frequency of cyberattacks. One key factor driving BFSI’s dominance is the rise in digital banking services. According to the Asian Development Bank, over 70% of banks in Southeast Asia have implemented mobile banking platforms by necessitating robust IAM systems to secure customer data. Additionally, regulations like the Reserve Bank of India’s mandate for biometric authentication further fuel demand. Another critical driver is the growing adoption of multi-factor authentication (MFA).

The education sector is lucratively growing with a projected CAGR of 18.3% from 2025 to 2033 with the increasing digitization of educational institutions and the need to secure sensitive student data.

One major factor propelling this growth is the surge in e-learning platforms. For example, in Australia, the Department of Education mandates secure IAM systems for all online learning portals, driving adoption rates. Another driving force is compliance with data protection laws. As per PwC, 75% of educational institutions in Japan have implemented IAM solutions to comply with the Act on the Protection of Personal Information (APPI), ensuring secure handling of student records.

By Component Insights

The directory services segment was accounted in holding 40.3% of the Asia Pacific IAM market share in 2024 due to its foundational role in managing user identities and access permissions across enterprises. A primary driver of directory service dominance is the widespread adoption of cloud-based enterprise directories. According to Deloitte, over 80% of large organizations in the region rely on cloud directories like Microsoft Active Directory to streamline user management. In South Korea, for instance, Samsung Electronics uses directory services to manage over 100,000 employee accounts by ensuring seamless access to internal systems. Another contributing factor is the integration of directory services with IoT devices.

The provisioning segment is anticipated to grow with a CAGR of 19.5% in the next coming years. This growth is fueled by the increasing complexity of IT environments and the need for automated user lifecycle management. One key driver is the rise of hybrid work models. For example, in Singapore, DBS Bank has implemented automated provisioning to manage access for over 20,000 remote workers, reducing manual errors by 40%. Another factor is the demand for real-time access updates.

By Deployment Insights

The on-premise deployment segment was the largest and held 55.3% of the Asia Pacific identity and access management market share in 2024 due to the preference for control and customization among large enterprises. One significant factor driving on-premise adoption is the need for data sovereignty. For instance, in India, the Reserve Bank mandates that all financial data must be stored locally, which is prompting banks to invest in on-premise IAM systems. Another driver is the high level of customization offered by on-premise solutions.

The cloud-based IAM solutions segment is swiftly emerging with CAGR of 21.2% in the next coming years. This growth is driven by the increasing adoption of cloud computing and the scalability it offers. A key factor is the cost-effectiveness of cloud IAM. For example, in Malaysia, over 50% of small businesses have transitioned to cloud-based IAM to manage user access without significant upfront investments. Another driver is the flexibility of cloud deployments.

REGIONAL ANALYSIS

India accounted in holding 15.4% of the Asia Pacific IAM market in 2024 owing to its rapidly digitizing economy and stringent regulatory frameworks. The Reserve Bank of India mandates secure IAM systems for financial transactions, which is leading to widespread adoption.

China's IAM market held 25.4% of the share in 2024. The country’s dominance is driven by its massive industrial base and government-led cybersecurity initiatives. For instance, the Cybersecurity Law mandates strict access controls, boosting IAM adoption. As per Deloitte, over 60% of Chinese enterprises have invested in IAM technologies to comply with these regulations.

Japan’s identity and access management market is likely to have prominent CAGR in the next coming years. The country’s strong emphasis on data privacy and cybersecurity drives IAM adoption. The Act on the Protection of Personal Information (APPI) requires businesses to implement robust IAM systems, which is leading to a surge in demand.

The Australian and New Zealand IAM market’s growth is attributed to its advanced IT infrastructure and stringent compliance requirements. For instance, the Privacy Act mandates secure IAM systems for protecting personal data by encouraging widespread adoption. According to PwC, over 75% of enterprises in the region have implemented IAM solutions to meet regulatory standards.

Singapore’s status as a global financial hub drives IAM adoption, with banks investing heavily in secure authentication systems. Over 80% of financial institutions in Singapore have adopted biometric IAM solutions to enhance security. Furthermore, the Smart Nation initiative has spurred innovation, with blockchain-based IAM systems gaining traction.

LEADING PLAYERS IN THE ASIA PACIFIC IDENTITY AND ACCESS MANAGEMENT MARKET

Okta

Okta has established itself as a leader in the Asia Pacific IAM market by offering cloud-based solutions tailored to enterprises undergoing digital transformation. The company’s Adaptive Multi-Factor Authentication (MFA) and Single Sign-On (SSO) platforms are widely adopted across industries like BFSI and healthcare. Okta has strengthened its presence through strategic partnerships, such as collaborating with AWS to enhance cloud security. In 2023, Okta launched its Identity Governance and Administration (IGA) solution in the region by addressing compliance needs and enabling automated access management for large-scale organizations.

IBM Security

IBM Security is a dominant player in the Asia Pacific IAM market, leveraging its expertise in AI-driven cybersecurity solutions. Its Verify Access platform integrates advanced analytics to detect anomalies and prevent unauthorized access. IBM has actively contributed to the market by aligning its offerings with regional regulations, such as Japan’s APPI. In 2023, IBM introduced its Zero Trust Architecture framework in collaboration with local partners, enhancing its appeal to enterprises prioritizing robust security measures.

Microsoft

Microsoft plays a pivotal role in the Asia Pacific IAM market through its Azure Active Directory (Azure AD) platform, which supports hybrid and multi-cloud environments. The company has expanded its footprint by integrating AI-powered threat detection into Azure AD by catering to the rising demand for secure remote work solutions. In 2022, Microsoft partnered with governments in India and Australia to deploy IAM systems for public sector digitalization projects. Additionally, its focus on compliance with regional data protection laws has bolstered its reputation as a trusted IAM provider across diverse industries.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific IAM market employ strategies like partnerships, product innovation, and regulatory alignment to strengthen their positions. Partnerships with cloud providers, such as AWS and Google Cloud, enable companies to offer integrated IAM solutions. Product innovation focuses on AI-driven features, such as behavioral analytics and adaptive authentication, to address emerging threats. Regulatory alignment ensures compliance with data protection laws like GDPR-inspired frameworks in Japan and South Korea. Acquisitions also play a critical role; for instance, acquiring niche IAM firms enhances capabilities.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific IAM market include IBM Corporation, Microsoft Corporation, Oracle Corporation, Broadcom Inc., Amazon Web Services Inc., Google LLC, Cisco Systems Inc., NEC Corporation, Ping Identity Holding Corp., Okta Inc., SailPoint Technologies Holdings Inc., CyberArk Software Ltd., Dell Inc., Centrify Corporation, Delinea Inc., Fortra LLC, HID Global, IDEMIA, Entrust, Gemalto

The Asia Pacific IAM market is highly competitive, characterized by the presence of global leaders and regional players striving for dominance. Global giants like Okta, IBM, and Microsoft leverage their technological expertise and extensive partner networks to cater to enterprise-level demands. Meanwhile, regional players focus on affordability and customization to attract SMEs. The competitive landscape is shaped by rapid technological advancements, with AI, blockchain, and cloud integration being key differentiators. Companies are also investing heavily in compliance solutions to align with stringent data protection laws. Strategic collaborations and mergers further intensify competition, as firms aim to expand their service portfolios. For instance, partnerships with local governments and financial institutions have become a focal point for gaining market traction.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Okta acquired Auth0, a cloud-based identity platform. This acquisition enabled Okta to expand its IAM offerings and enhance scalability for enterprise clients in the region.

- In July 2023, IBM launched its Zero Trust Architecture in collaboration with NTT Data. This move strengthened IBM’s position by addressing growing cybersecurity concerns among Japanese enterprises.

- In September 2022, Microsoft partnered with the Indian government to deploy Azure AD for secure citizen services. This initiative solidified Microsoft’s role in supporting digital transformation projects.

- In January 2024, Ping Identity introduced its AI-driven IAM solution in Singapore. This launch positioned Ping Identity as a leader in adaptive authentication technologies across Southeast Asia.

- In November 2023, ForgeRock announced a partnership with Alibaba Cloud to deliver localized IAM solutions in China. This collaboration enhanced ForgeRock’s ability to meet regional compliance requirements.

MARKET SEGMENTATION

This research report on the Asia Pacific identity and access management market has been segmented and sub-segmented based on end use, component, deployment, and region.

By End Use

- BFSI

- Education

By Component

- Directory Service

- Provisioning

By Deployment

- Cloud

- On-premise

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the Asia Pacific IAM market?

Key drivers include increasing cyber threats, digital transformation initiatives, cloud adoption, regulatory compliance needs, and the growing remote workforce.

2. Which countries are leading in IAM adoption in Asia Pacific?

China, Japan, India, South Korea, and Australia are among the leading adopters due to large enterprises, government regulations, and increasing digital infrastructure.

3. Who are the major players in the Asia Pacific IAM market?

IBM, Microsoft, Oracle, Broadcom, Amazon Web Services, Google, NEC, Okta, Ping Identity, and CyberArk are some of the key players.

4. How is cloud IAM different from traditional IAM?

Cloud IAM solutions are hosted and delivered over the Internet, offering better scalability, easier deployment, and cost-effectiveness compared to on-premise IAM systems.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]