Asia Pacific Immunohematology Market Size, Share, Growth, Trends, and Forecast Report – Segmented By Product Type (Analyzers & Systems, Reagents & Kits), Application, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis from 2025 to 2033

Asia Pacific Immunohematology Market Size

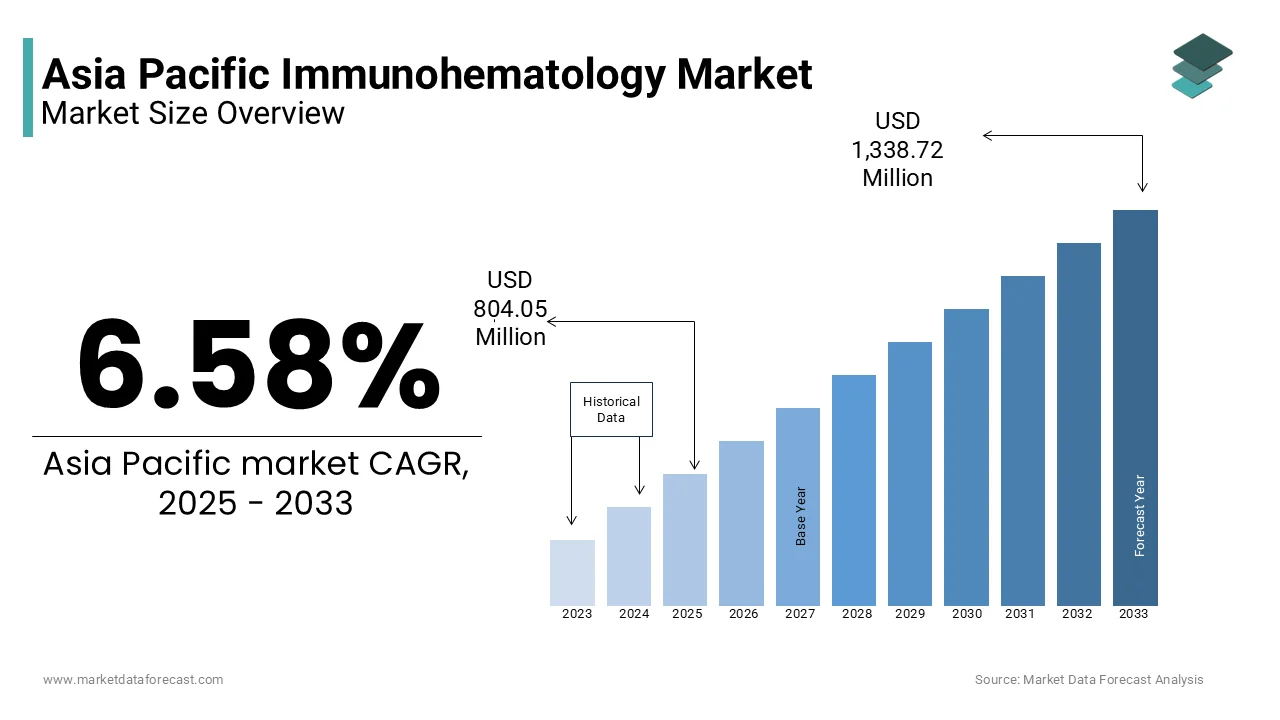

Asia Pacific Immunohematology market size was valued at USD 754.41 million in 2024, and the market size is expected to reach USD 1,338.72 million by 2033 from USD 804.05 million in 2025. The market's promising CAGR for the predicted period is 6.58%.

The immunohematology market is driven by the need for safe and effective blood transfusions which focuses on the study of immune responses related to blood components particularly the antigen-antibody interactions involving red blood cells. The Asia Pacific immunohematology market encompasses a range of products and services including automated analyzers, reagents, software solutions and manual testing kits used across hospitals, blood banks and diagnostic laboratories.

In the Asia Pacific region, the demand for immunohematology testing has grown due to rising blood transfusion requirements as well as increasing prevalence of chronic diseases necessitating hematological support and growing awareness about transfusion-related complications. Nearly 100 million units of blood are collected annually in the Asia Pacific region whereas significant disparities exist in screening and compatibility testing standards between high-income and low-income nations.

MARKET DRIVERS

Rising Demand for Safe Blood Transfusions

The rising demand for safe and compatible blood transfusions which is fueled by the growing number of surgical procedures, trauma cases and maternal healthcare needs is a key driver of the Asia Pacific immunohematology market. The National Blood Transfusion Council reports that more than 12 million units of blood are collected annually thereby necessitating robust immunohematology testing to prevent transfusion-related complications such as hemolytic reactions and alloimmunization. Australia’s Blood Service has implemented nationwide antibody screening programs while significantly reducing adverse transfusion events. Similarly, Japan mandates extended antigen typing for patients receiving multiple transfusions especially those with thalassemia and sickle cell disease. In South Korea, the Korean Red Cross has expanded its use of molecular immunohematology techniques to enhance antigen profiling accuracy.

Expansion of Automated Immunohematology Testing Systems

The increasing adoption of automated immunohematology analyzers is another key factor propelling market growth in the Asia Pacific region. Automation enhances efficiency, reduces human error and enables high-throughput testing while making it essential for large urban blood banks and tertiary care hospitals. Nearly 60.97% of blood banks in metropolitan areas of China and Singapore have transitioned from manual to automated platforms thereby improving turnaround times and test reliability. In Japan, major hospitals have integrated robotic immunohematology systems capable of processing thousands of samples daily where labor shortages in laboratory settings are a persistent concern. Automation has reduced pre-transfusion testing time by up to 40.18% thus enhancing patient safety and operational efficiency. In Australia, Sonic Healthcare has deployed AI-enabled analyzers that flag potential incompatibilities in real time and minimize the risk of mismatched transfusions. India has also witnessed a surge in automation particularly in corporate hospital chains such as Apollo and Fortis where immunohematology workflows are increasingly digitized.

MARKET RESTRAINTS

High Cost of Advanced Immunohematology Equipment and Reagents

High cost associated with advanced diagnostic equipment and consumables is one of the most significant constraints limiting the growth of the Asia Pacific immunohematology market. Fully automated immunohematology analyzers which offer high precision and throughput often require capital expenditures exceeding $150,000 per unit. This financial burden is particularly challenging for small blood banks and rural hospitals in low-to-middle-income countries such as Indonesia, the Philippines and Nepal. Only 18.73% of community-level blood centers in Southeast Asia could afford routine access to extended antigen typing or gel card-based assays. In Vietnam, many provincial hospitals continue to rely on conventional tube methods due to affordability issues despite rising blood transfusion volumes. Additionally, supply chain inefficiencies contribute to inflated costs in island nations where import duties and logistics add up to 30.07% to the final price of imported reagents. Inconsistent procurement policies and limited economies of scale further exacerbate these challenges. Without targeted subsidies or bulk purchasing frameworks many facilities struggle to adopt modern immunohematology solutions thus inhibiting market penetration.

Lack of Skilled Professionals and Training Programs

Another critical challenge hindering the Asia Pacific immunohematology market is the shortage of trained professionals capable of operating complex diagnostic systems and interpreting immunohematology results accurately. Immunohematology requires specialized knowledge in antigen-antibody interactions, blood group serology and compatibility testing which remain in short supply across much of the region. Fewer than 10.62% of medical laboratory technologists in the Philippines receive formal training in immunohematology before entering practice. In Indonesia, less than 20.47% of blood bank staff undergo structured certification in advanced compatibility testing. Even in more developed markets like India where blood banking infrastructure is expanding rapidly there are only 35.17% of medical colleges that offer dedicated postgraduate courses in transfusion medicine. Japan faces a different but equally pressing issue such as aging professionals and a declining pipeline of successors.

MARKET OPPORTUNITIES

Integration of Digital Platforms and AI in Immunohematology

The integration of digital platforms and artificial intelligence into immunohematology presents a transformative opportunity for the Asia Pacific market. There is a growing need for intelligent systems that can automate result interpretation, flag discrepancies and streamline workflow efficiencies with increasing reliance on data-driven decision-making in blood banks and hospital transfusion services. Companies are investing in AI-powered analyzers that can predict antigen profiles based on historical data thus reducing the need for extensive manual testing. For example, in Singapore, the Health Sciences Authority has collaborated with tech firms to develop machine learning models that optimize cross matching processes resulting in minimizing the risk of incompatible transfusions. Similarly, Japan’s SRL Inc has implemented cloud-connected immunohematology systems that allow remote monitoring of test results and inventory management thus enhancing operational efficiency. In Australia, pathology networks are piloting blockchain-based tracking systems for blood unit compatibility records thereby ensuring seamless data exchange between donors, laboratories and hospitals.

Expansion of Public Health Initiatives Promoting Blood Safety

Government-led public health initiatives aimed at strengthening blood safety and transfusion protocols provide a significant opportunity for the Asia Pacific immunohematology market. Many countries in the region are prioritizing universal blood screening and standardization of immunohematology testing to reduce transfusion-related adverse events. China has launched a national initiative to upgrade regional blood centers with automated immunohematology systems which is backed by a $150 million investment under the Ministry of Health’s Blood Safety Program. In India, the National AIDS Control Organization has mandated extended antibody screening for all voluntary blood donations which drives demand for advanced testing platforms. Thailand's Ministry of Public Health has introduced a nationwide competency framework requiring all blood banks to implement computerized immunohematology reporting by 2025.In addition, the Philippines has partnered with international organizations such as the WHO and AABB to introduce standardized immunohematology training modules for blood bank personnel.

MARKET CHALLENGES

Fragmented Regulatory Frameworks Across the Region

One of the foremost challenges confronting the Asia Pacific immunohematology market is the lack of harmonized regulatory frameworks governing blood safety, diagnostic device approvals and standardization of testing protocols. Europe and North America follow unified guidelines from organizations such as the International Society of Blood Transfusion (ISBT) and AABB unlike the Asia Pacific region which exhibits significant variation in regulatory requirements between countries. Only six out of the 22 countries in the region have well-established national immunohematology guidelines aligned with global best practices. In countries like Myanmar, Laos and Papua New Guinea regulatory oversight remains minimal thereby leading to inconsistent application of immunohematology principles in blood banks and transfusion centers. This fragmentation hampers the adoption of standardized testing methodologies and complicates market entry for multinational manufacturers seeking to deploy uniform product lines. Additionally, differences in approval timelines for novel immunohematology devices create delays in technology diffusion. For instance, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) allows rapid clearance of new diagnostic assays whereas similar products may take twice as long to gain approval in Indonesia or Vietnam.

Limited Awareness and Standardization of Extended Blood Group Typing

Limited awareness and standardization of extended blood group typing beyond the conventional ABO and Rh(D) systems remain significant challenges in many Asia Pacific countries despite advancements in immunohematology. This gap increases the risk of delayed hemolytic transfusion reactions and alloimmunization among patients requiring frequent transfusions such as those with thalassemia, sickle cell disease and chronic anemia. In Bangladesh and Cambodia, extended typing is largely unavailable outside major teaching hospitals while contributing to higher rates of transfusion-related complications. Nearly 15.76% of multi-transfused thalassemia patients developed alloantibodies due to incomplete antigen matching which represents the urgent need for broader implementation of extended typing. Public health messaging around the importance of immunohematology testing remains inconsistent in rural areas where awareness campaigns are limited. In the Philippines, only 30.76% of regional hospitals incorporate extended antigen screening into their protocols despite government-backed initiatives to promote safer transfusion practices.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.58% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Bio-Rad Laboratories, Immucor, Grifols, BD, Hologic, Siemens Healthineers, Thermo Fisher Scientific, Abbott Laboratories, Beckman Coulter, Ortho Clinical Diagnostics, F. Hoffmann-La Roche, Merck KGaA, Cardinal Health, CSL Limited, Danaher Corporation, MTC Invitro Diagnostics AG, Antisel, and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The reagents and kits segment dominated the Asia Pacific immunohematology market by capturing 58.71% of total market share in 2024. This dominance is primarily attributed to the consumable nature of reagents, which require frequent replenishment in blood banks, hospitals and diagnostic laboratories performing compatibility testing. One key driver is the high volume of blood transfusion activities across the region. More than 30 million blood units are transfused annually in India alone. Each unit requires immunohematology testing such as ABO typing, Rh(D) testing and antibody screening all of which consume a significant amount of reagents. In China, government-backed initiatives have led to standardized implementation of pre-transfusion testing protocols in public hospitals thereby increasing demand for diagnostic kits. Additionally, the expansion of automated immunohematology analyzers has bolstered reagent consumption.

Analyzers and systems segment is projected to witness the fastest CAGR of 13.7% in the Asia Pacific immunohematology market from 2025 to 2033 due to the technological advancements and the rising need for efficiency along with standardized testing processes. A key factor fueling this growth is the increasing adoption of automation in blood banks and hospital transfusion centers. Manual immunohematology testing is time-consuming and prone to human error especially in high-volume settings. Japan, known for its advanced healthcare infrastructure which has seen widespread deployment of robotic immunohematology platforms in major cities like Tokyo and Osaka.Automation has reduced turnaround times for crossmatching by up to 40.76% thus significantly improving patient safety and laboratory efficiency. Another driver is the growing emphasis on precision medicine and personalized transfusion therapy. In Australia, Sonic Healthcare has integrated AI-enabled analyzers that use predictive algorithms to detect potential incompatibilities before transfusion thus reducing adverse reactions. Similarly, private hospital chains in India such as Apollo and Fortis are investing heavily in digital immunohematology workstations to streamline workflow and enhance data management.

By Application Insights

The blood transfusion segment was the largest application segment in the Asia Pacific immunohematology market by capturing 62.8% of total market share in 2024. This is primarily due to the critical role of immunohematology in ensuring safe and compatible blood component administration particularly in emergency care, surgery and maternal health. One of the primary drivers is the substantial volume of blood transfusions performed across the region. Over 12 million units of blood are collected annually with each unit requiring immunohematology-based compatibility testing. Japan’s aging population has further intensified the need for safe transfusions among patients receiving chronic red cell support. Nearly 40.72% of blood usage in large hospitals involves multi-transfused patients thereby necessitating advanced immunohematology assessments to prevent immunization. Moreover, regulatory authorities in Australia and New Zealand enforce stringent pre-transfusion testing standards. The Australian Red Cross Blood Service mandates extended antigen typing for certain patient groups thereby increasing reliance on immunohematology services.

The disease diagnosis segment is estimated to register the fastest CAGR of 14.3% from 2025 to 2033. This uptick is driven by the expanding utility of immunohematology beyond traditional transfusion medicine into areas such as autoimmune disorders, hemolytic diseases and rare genetic conditions. A key driver is the rising prevalence of immune-mediated hemolytic anemias and related disorders. In India, cases of autoimmune hemolytic anemia have increased by 18.33% over the past five years which prompted greater use of direct antiglobulin tests (DAT) and other immunohematology assays for accurate diagnosis. Another significant growth catalyst is the integration of immunohematology into prenatal and neonatal care. Hemolytic disease of the fetus and newborn (HDFN) remains a critical concern in many parts of the Asia Pacific particularly in countries with high birth rates like Indonesia and the Philippines. HDFN contributes to nearly 5.7% of neonatal intensive care admissions thereby reinforcing the importance of early immunohematology screening during pregnancy.In addition, research institutions in South Korea and Singapore are leveraging immunohematology techniques to study novel immune responses in hematological malignancies.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific immunohematology market with 24.23% of share in 2024. The country's extensive network of hospitals and blood banks generates a high demand for immunohematology testing to ensure safe transfusion practices. Over 15 million blood units are collected annually with an increasing proportion undergoing extended antigen typing to reduce alloimmunization risks. In response, the government has allocated $150 million under the Blood Safety Program to modernize regional blood centers with automated immunohematology equipment. Private diagnostics firms such as KingMed Diagnostics and BGI Genomics are expanding their immunohematology service offerings thus further strengthening China’s position.

India was positioned second in holding the dominant share of the Asia Pacific immunohematology market and is driven by one of the highest volumes of blood transfusions in the world and a growing emphasis on safer transfusion practices. The country performs over 12 million transfusions annually with increasing awareness about the risks associated with incompatible blood transfers. Nearly 40.27% of urban blood banks now utilize semi or fully automated immunohematology systems thereby marking a significant shift from manual tube testing. Additionally, the National AIDS Control Organization mandates extended antibody screening for all voluntary donations thus enhancing the demand for advanced reagents and analyzers.

Japan’s immunohematology market growth is driven by its mature healthcare system, aging demographic profile and high adherence to international transfusion standards. Japan experiences a disproportionately high demand for red blood cell transfusions among patients with chronic anemia and hematologic cancers. Nearly 90.18% of all blood units issued undergo comprehensive immunohematology evaluation thereby including extended antigen typing for multi-transfused individuals. The Society of Japanese Blood Transfusion Medicine mandates strict compatibility testing guidelines thus promoting the use of automated analyzers and AI-assisted diagnostics.

Australia’s immunohematology market is likely to grow with healthy cagr in the next coming years which is characterized by its well-developed transfusion medicine framework, high healthcare expenditure and early adoption of digital immunohematology solutions. The country sets a benchmark for blood safety with the Australian Red Cross Blood Service enforcing stringent pre-transfusion testing requirements. Over 1.5 million blood components are transfused annually with a growing percentage incorporating extended immunohematology profiling. Moreover, national accreditation agencies mandate continuous professional development for immunohematology specialists thereby ensuring a highly skilled workforce.

South Korea’s immunohematology market growth is driven by its technologically advanced healthcare ecosystem, proactive regulatory policies and increasing focus on precision medicine. The country has been at the forefront of integrating automation and artificial intelligence into immunohematology workflows in major hospitals and university medical centers. Government initiatives such as the National Biobank Project are facilitating large-scale antigen mapping studies thereby supporting more precise donor-recipient matching. The Ministry of Food and Drug Safety plays a pivotal role in accelerating approvals for new immunohematology diagnostics while fostering domestic innovation and attracting foreign investment.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Asia Pacific immunohematology market are Bio-Rad Laboratories, Immucor, Grifols, BD, Hologic, Siemens Healthineers, Thermo Fisher Scientific, Abbott Laboratories, Beckman Coulter, Ortho Clinical Diagnostics, F. Hoffmann-La Roche, Merck KGaA, Cardinal Health, CSL Limited, Danaher Corporation, MTC Invitro Diagnostics AG, and Antisel.

The competition in the Asia Pacific immunohematology market is intensifying as global leaders and emerging domestic players vie for dominance through innovation, expanded geographic reach and differentiated offerings tailored to local healthcare infrastructures. Established multinational corporations such as Grifols, Bio-Rad Laboratories and Ortho Clinical Diagnostics maintain a strong foothold due to their advanced product portfolios as well as established distribution channels and deep-rooted relationships with national blood services and hospital networks. These firms are increasingly focusing on automation, digital pathology integration and AI-assisted diagnostics to enhance operational efficiency and clinical accuracy. At the same time, local manufacturers in countries like China and India are gaining traction by offering cost-effective alternatives and improving access in underpenetrated regions. The competitive landscape is further shaped by evolving regulatory frameworks thereby increasing demand for extended antigen typing and growing awareness about transfusion-related complications. Companies are differentiating themselves through technological advancements, strategic alliances and robust post-market support as healthcare providers increasingly prioritize patient safety and standardized blood banking protocols thus contributing to a dynamic and rapidly evolving market environment.

TOP PLAYERS IN THE MARKET

Grifols (Spain)

Grifols is a leading participant in the Asia Pacific immunohematology market and is known for its extensive portfolio of blood typing reagents, automated analyzers and compatibility testing systems. The company plays a vital role in advancing blood safety through innovative solutions that support accurate antigen-antibody detection and crossmatching. In the Asia Pacific region, Grifols has strengthened its presence by collaborating with national blood services and hospital transfusion centers to enhance diagnostic accuracy and process standardization.

Bio-Rad Laboratories (United States)

Bio-Rad Laboratories contributes significantly to the Asia Pacific immunohematology market with its advanced gel card technology, automated immunohematology analyzers and comprehensive antibody screening solutions. The company's focus on precision and reliability has made its products indispensable in major blood banks and hospitals across Japan, Australia and Singapore. Bio-Rad actively supports training programs and scientific collaborations to promote best practices in immunohematology diagnostics across the region.

Ortho Clinical Diagnostics (United States)

Ortho Clinical Diagnostics is a key player in the Asia Pacific immunohematology landscape which offers high-performance analyzers such as the ORTHO VISION and ORTHO AutoVue platforms that streamline pre-transfusion testing. The company’s commitment to automation and digital integration has enhanced efficiency in regional blood banks and hospital laboratories. Ortho strengthens its regional footprint through partnerships with healthcare institutions and continuous investment in localized customer support services tailored to the needs of diverse healthcare ecosystems.

TOP STRATEGIES USED BY KEY PLAYERS

One of the primary strategies employed by leading players in the Asia Pacific immunohematology market is product localization and customization where companies adapt their immunohematology platforms to meet regional disease profiles and regulatory standards. This includes developing antigen-specific assays aligned with prevalent blood group polymorphisms in different ethnic populations thus ensuring greater clinical relevance.

Expanding distribution and service networks through strategic partnerships with local distributors, hospital chains and public health agencies is another key approach. Companies improve accessibility and ensure seamless integration of complex immunohematology systems into existing workflows.

There is a strong emphasis on investing in education and training initiatives in emerging markets. Companies conduct workshops, sponsor certification programs and collaborate with academic institutions to build expertise in immunohematology among laboratory professionals thereby fostering long-term product adoption and sustainable market growth across the Asia Pacific region.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Grifols launched a new regional headquarters in Singapore focused on expanding its immunohematology product distribution and technical support across Southeast Asia.

- In April 2024, Bio-Rad Laboratories partnered with a leading Japanese university hospital to co-develop next-generation gel-based immunohematology assays tailored for the Asian population.

- In July 2024, Ortho Clinical Diagnostics introduced an AI-enabled immunohematology analyzer specifically designed for high-volume blood banks in India.

- In September 2024, Sysmex Corporation entered into a strategic agreement with an Australian pathology network to integrate its digital immunohematology platform into routine transfusion medicine workflows.

- In December 2024, Thermo Fisher Scientific acquired a local diagnostics distributor in Indonesia to expand its reach in the archipelago.

MARKET SEGMENTATION

This research report on the Asia Pacific immunohematology market has been segmented and sub-segmented based on the following categories.

By Product Type

- Analyzers & Systems

- Reagents & Kits

By Application

- Antibody Screening

- Blood Transfusion

- Disease Diagnosis

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key growth opportunities in the Asia Pacific immunohematology market?

Increasing demand for safe blood transfusions, expanding healthcare infrastructure, and rising prevalence of chronic diseases are driving growth in the region.

2. What trends are shaping the Asia Pacific immunohematology market?

Adoption of automated immunohematology analyzers, integration of AI in diagnostics, and the shift toward personalized medicine are key market trends.

3. What challenges does the Asia Pacific immunohematology market face?

Challenges include high costs of advanced diagnostic systems, limited access to skilled technicians, and regulatory variability across countries.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com