Asia Pacific Induction Motor Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, End-User And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Induction Motor Market Size

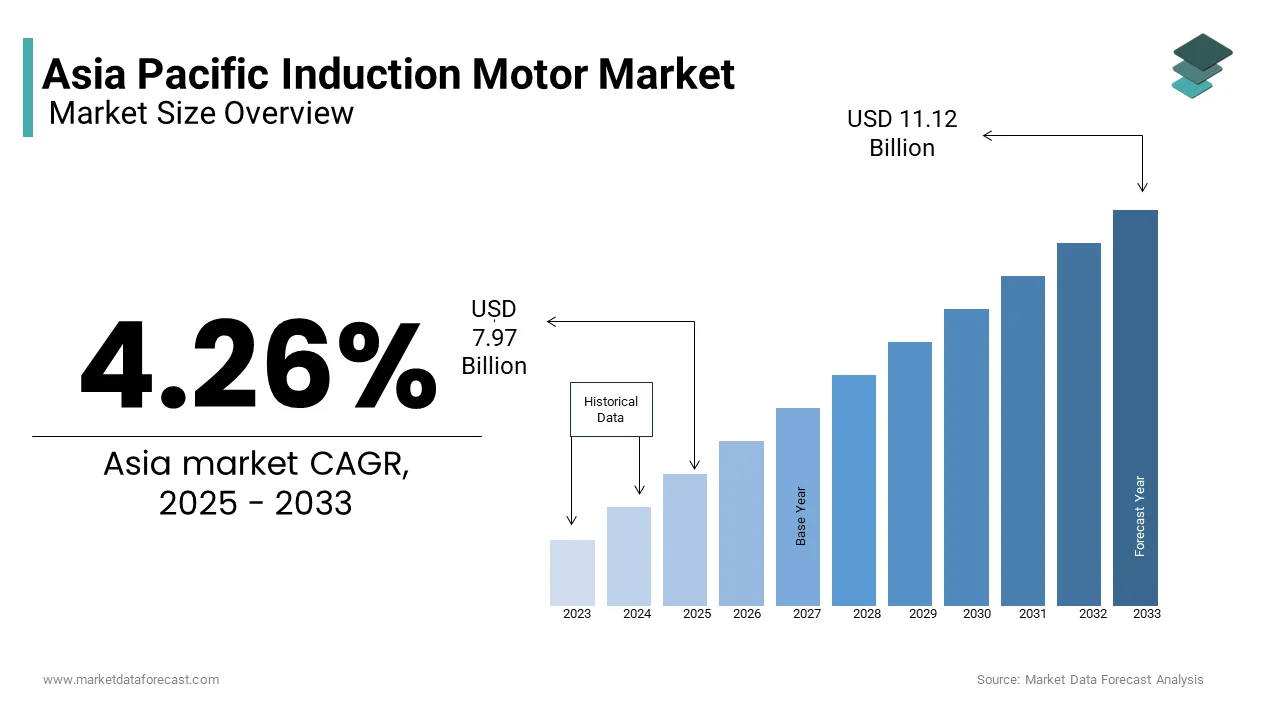

The Asia Pacific induction motor market size was valued at USD 7.64 billion in 2024 and is anticipated to reach USD 7.97 billion in 2025 from USD 11.12 billion by 2033, growing at a CAGR of 4.26% during the forecast period from 2025 to 2033.

Current Scenario of the Asia Pacific Induction Motor Market

Induction motors are favored for their durability, cost-effectiveness, and ability to operate efficiently under variable load conditions. The region’s rapid industrialization, coupled with increasing urbanization, has fueled demand for these motors. According to the International Energy Agency, electricity consumption in the Asia Pacific region is projected to grow by 3% annually until 2030, driven largely by industrial activity and infrastructure development. As per the Asian Development Bank, the region accounts for nearly 60% of global energy demand, with industrial applications consuming over 40% of this energy. Induction motors contribute significantly to this segment, owing to their adaptability and reliability. Moreover, the shift toward sustainable practices, including energy-efficient motor designs mandated by governments, has further propelled adoption. For instance, the Indian Ministry of Power mandates that all new industrial installations use energy-efficient motors compliant with standards like IE3 or higher. Meanwhile, China’s National Development and Reform Commission emphasizes the integration of advanced motor technologies to reduce carbon emissions by 18% by 2025.

MARKET DRIVERS

Industrial Growth and Automation

Industrial expansion remains one of the primary drivers of the Asia Pacific induction motor market. The region’s manufacturing sector, particularly in countries like China, India, and Vietnam, has witnessed exponential growth due to favorable government policies, foreign direct investment, and technological advancements. This industrial boom necessitates robust machinery, much of which relies on induction motors for operation. Furthermore, the rise of automation in manufacturing processes has amplified motor demand. Automation-driven industries require high-performance motors capable of delivering precise torque and speed control, making induction motors indispensable.

Urbanization and Infrastructure Development

Urbanization in the Asia Pacific region has surged, with the World Bank estimating that over 200 million people will migrate to urban areas by 2030. This demographic shift fuels demand for residential, commercial, and public infrastructure, all of which rely heavily on induction motors. For instance, HVAC systems, elevators, and water pumps are integral components of modern buildings, which are powered by these motors. Additionally, large-scale infrastructure projects such as airports, railways, and smart cities further drive demand.

MARKET RESTRAINTS

Rising Raw Material Costs

Fluctuations in raw material prices, particularly copper and aluminum, pose a significant challenge to the Asia Pacific induction motor market. Copper, a key component in motor windings, has experienced price volatility due to geopolitical tensions and supply chain disruptions. According to the London Metal Exchange, copper prices surged by over 25% in 2022, which is impacting production costs for motor manufacturers. Aluminum, another essential material, also saw a sharp increase, as per the International Aluminium Institute, with prices rising by 15% during the same period. These cost escalations translate into higher product prices, potentially reducing affordability for small and medium enterprises (SMEs).

Stringent Regulatory Compliance

Stringent environmental regulations and compliance requirements present another major restraint. Governments across the Asia Pacific region have implemented energy efficiency mandates, such as Minimum Energy Performance Standards (MEPS), to curb carbon emissions. While these regulations promote sustainability, they impose additional costs on manufacturers. For example, South Korea’s Ministry of Trade, Industry, and Energy requires all industrial motors to meet IE3 efficiency standards by 2023, necessitating costly upgrades for manufacturers. Similarly, Australia’s Greenhouse and Energy Minimum Standards Act mandates rigorous testing and certification processes, increasing operational burdens. Non-compliance can lead to penalties or market exclusion, further straining smaller players. As per the International Electrotechnical Commission, achieving compliance often involves redesigning products, which can take up to two years and cost manufacturers millions in research and development expenses.

MARKET OPPORTUNITIES

Adoption of IoT and Smart Technologies

The integration of Internet of Things (IoT) and smart technologies presents a transformative opportunity for the Asia Pacific induction motor market. IoT-enabled motors equipped with sensors and analytics capabilities allow real-time monitoring, predictive maintenance, and optimized performance. For instance, smart motors used in HVAC systems can adjust operations based on occupancy and ambient conditions, which reduces energy consumption by up to 30%, as per the U.S. Department of Energy. China, being a global leader in IoT adoption, has over 1 billion connected devices, according to the China Academy of Information and Communications Technology, creating vast opportunities for IoT-integrated motors. Additionally, India’s Digital India initiative, aimed at fostering technological innovation, supports the deployment of smart motor solutions in sectors like agriculture and manufacturing. This convergence of IoT and motor technology not only enhances efficiency but also opens new revenue streams for manufacturers.

Expansion into Renewable Energy Applications

The growing focus on renewable energy offers another significant opportunity for the Asia Pacific induction motor market. Wind turbines, solar tracking systems, and hydroelectric plants rely extensively on induction motors for power generation and distribution. According to the Global Wind Energy Council, Asia Pacific accounted for 60% of global wind energy capacity additions in 2022, with China leading the way. These initiatives create substantial demand for specialized motors designed for harsh operating environments. Furthermore, Australia’s Renewable Energy Target aims to ensure 33,000 GWh of electricity comes from renewables by 2030, driving motor innovations tailored to clean energy applications.

MARKET CHALLENGES

Intense Market Competition

The Asia Pacific induction motor market faces intense competition, with numerous local and international players vying for market share. This saturation intensifies pricing pressures and reduces profit margins, particularly for smaller manufacturers. In countries like India and Vietnam, domestic manufacturers often compete on price rather than innovation by leading to commoditization. For example, the Confederation of Indian Industry notes that nearly 60% of motor manufacturers in India operate on thin margins due to competitive pricing strategies. Additionally, multinational corporations leverage economies of scale to offer lower prices, which is squeezing local players. This competitive environment stifles investment in R&D, which is hindering technological advancements and slowing market evolution.

Supply Chain Disruptions

Supply chain vulnerabilities represent another pressing challenge for the Asia Pacific induction motor market. The region’s reliance on global trade networks exposes it to disruptions caused by geopolitical tensions, natural disasters, and pandemics. For instance, the Federation of Indian Chambers of Commerce and Industry reported that over 40% of Indian manufacturers faced delays in sourcing critical components during the pandemic. Similarly, typhoons in Southeast Asia frequently disrupt logistics, as noted by the Asian Disaster Preparedness Center, causing production delays. China’s zero-COVID policy, as per the Economist Intelligence Unit, led to port closures and shipping bottlenecks, affecting motor exports. These disruptions not only increase lead times but also escalate costs, forcing manufacturers to seek alternative suppliers or absorb additional expenses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.87% |

|

Segments Covered |

By Technology, Pollutant Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

ABB Ltd, Nidec Corporation, Siemens AG, Regal Rexnord Corporation, TMEIC, WEG SA, Fuji Electric Co., Ltd., Kirloskar Electric Company, SEALOCEAN. |

SEGMENTAL ANALYSIS

By Type Insights

The three-phase induction motors segment accounted in holding 62.1% of the Asia Pacific low voltage drives market share in 2024, owing to their widespread adoption across industrial and commercial applications due to their superior efficiency and reliability. One key factor propelling this segment’s dominance is its compatibility with variable frequency drives (VFDs), which are critical for energy-efficient operations. According to the U.S. Department of Energy, VFD-integrated three-phase motors can reduce energy consumption by up to 40% in industrial settings. Another driving factor is the robust infrastructure development in emerging economies.

The single-phase induction motors segment is projected to register a CAGR of 7.2% during the forecast period, owing to their increasing adoption in residential and small-scale commercial applications. A significant driver of this growth is urbanization, particularly in Southeast Asia. The World Bank estimates that over 200 million people will migrate to urban areas in the Asia Pacific by 2030, which is leading to a surge in demand for household appliances like air conditioners, refrigerators, and washing machines, all of which rely on single-phase motors. Another factor is the growing emphasis on energy efficiency in residential settings. Australia’s Greenhouse and Energy Minimum Standards Act mandates energy-efficient designs for home appliances, driving innovation in single-phase motor technology. Similarly, South Korea’s Ministry of Trade, Industry and Energy reports that over 60% of households now use energy-efficient appliances, further boosting demand.

By End-User Industry Insights

The chemical and petrochemical industry held the Asia Pacific low voltage drives market by accounting for 28.4% of the share in 2024. The expansion of chemical production facilities in the region. China, the world’s largest chemical producer, invested $100 billion in new petrochemical plants in 2022 alone, as per the Chinese Petroleum and Chemical Industry Federation. These facilities require robust motor systems to handle high-pressure and high-temperature operations, making low-voltage drives indispensable. Another factor is the increasing focus on process optimization and energy savings. Japan’s Ministry of Economy, Trade and Industry emphasizes the adoption of energy-efficient technologies in chemical plants, with low-voltage drives playing a crucial role in reducing operational costs.

The food and beverage industry segment is projected with a CAGR of 8.5% in the coming years, owing to the rising demand for processed and packaged foods, coupled with stringent hygiene and safety regulations. A key factor is the increasing consumption of packaged foods in urban areas. According to Nielsen, packaged food sales in Southeast Asia grew by 15% in 2022, with Indonesia and Thailand leading the trend. This surge necessitates advanced motor systems for conveyor belts, mixers, and packaging machinery, all of which rely on low-voltage drives. Another driver is the implementation of automation in food processing.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China was the top performer in the Asia Pacific induction motor market with a 45.5% share in 2024. One driving factor is the government’s push for energy efficiency. The National Development and Reform Commission mandates that all new industrial installations use IE3 or higher efficiency motors, driving innovation and adoption. Additionally, China’s renewable energy initiatives, such as wind and solar projects, create demand for specialized motors. Another factor is the Belt and Road Initiative, which promotes infrastructure development across Asia.

India's induction motor market was ranked second by holding 20.3% of the share in 2024. Smart Cities Mission requires advanced motor technologies for water management, HVAC systems, and transportation, which is quietly boosting the growth of the segment. Additionally, India’s Make in India initiative encourages domestic manufacturing, with the Ministry of Commerce reporting a 12% annual growth in industrial output. Another driver is the agricultural sector, which accounts for 18% of GDP, as per the Indian Ministry of Agriculture. Irrigation systems, powered by induction motors, are critical for crop production, especially in rural areas.

Japan's induction motor market growth is driven by its advanced manufacturing and technological prowess. One factor is the aging population, which increases demand for automated systems in healthcare and eldercare. According to Japan’s Ministry of Health, Labor and Welfare, over 28% of the population is aged 65 or above, which is creating opportunities for motor-driven medical devices and assistive technologies. Another factor is the country’s focus on sustainability. The Ministry of the Environment mandates energy-efficient solutions in industrial and commercial applications, driving innovation in motor design.

South Korea's induction motor market is likely to grow with the robust electronics and automotive industries. The Korea Electronics Association reports that the electronics sector contributes 30% to the country’s GDP, with motors playing a critical role in manufacturing processes. Another factor is the government’s Green Growth Strategy, which promotes renewable energy projects.

Australia’s focus on mining and renewable energy is likely to promote the growth of the Asia-Pacific induction motor market. The Minerals Council of Australia reports that the mining sector contributes 10% to GDP, with motors essential for extraction and processing equipment.

KEY MARKET PLAYERS

ABB Ltd, Nidec Corporation, Siemens AG, Regal Rexnord Corporation, TMEIC, WEG SA, Fuji Electric Co., Ltd., Kirloskar Electric Company, SEALOCEAN. Are the market players that are dominating the Asia Pacific industrial automation motor market?

Top Players in the Market

ABB Ltd.

ABB Ltd. is a global leader in industrial automation and electrification, with a strong presence in the Asia Pacific low-voltage drives market. The company’s contribution to the global market lies in its innovative drive solutions that cater to diverse industries, including manufacturing, utilities, and infrastructure. ABB’s emphasis on sustainability and energy efficiency has positioned it as a preferred partner for businesses seeking to reduce operational costs while meeting environmental standards. Its modular product designs and integration capabilities enable seamless adoption across applications by ensuring long-term value for customers.

Siemens AG

Siemens AG plays a pivotal role in advancing digitalization and automation in the Asia Pacific region. Known for its cutting-edge technologies, Siemens provides low-voltage drives that are integral to smart factories and renewable energy projects. The company’s focus on integrating IoT and AI into its offerings enhances operational efficiency and predictive maintenance capabilities. By fostering partnerships with regional governments and industries, Siemens continues to expand its footprint by contributing significantly to global advancements in motor control and energy management.

Schneider Electric SE

Schneider Electric SE is renowned for its commitment to energy-efficient solutions, making it a key player in the Asia Pacific low-voltage drives market. The company’s EcoStruxure platform enables intelligent motor management, empowering businesses to optimize energy usage and reduce downtime. Schneider’s dedication to innovation and customer-centric solutions has strengthened its global reputation.

Top Strategies Used by Key Players in the Market

Strategic Partnerships and Collaborations

Key players in the market frequently engage in partnerships with local governments, research institutions, and industry stakeholders to co-develop tailored solutions. These collaborations help companies address specific regional challenges, such as energy efficiency mandates or infrastructure development projects. Firms can enhance their product offerings and strengthen their market position.

Product Innovation and Customization

To meet the dynamic needs of end-users, companies invest heavily in R&D to introduce innovative and customized products. For instance, manufacturers are developing smart low-voltage drives equipped with IoT capabilities to support predictive maintenance and real-time monitoring. This focus on innovation not only differentiates brands but also aligns with the growing demand for sustainable and efficient solutions in the region.

Expansion into Emerging Markets

Players are increasingly targeting emerging economies within the Asia Pacific region, such as Vietnam, Indonesia, and Thailand, where industrialization and urbanization are driving demand. By establishing local manufacturing facilities and distribution networks, companies aim to reduce costs and improve accessibility.

COMPETITION OVERVIEW

The Asia Pacific low voltage drives market is characterized by intense competition, with both global giants and regional players vying for dominance. Global leaders like ABB, Siemens, and Schneider Electric leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements, with companies striving to integrate smart features and IoT capabilities into their products. Additionally, stringent regulatory frameworks promoting energy efficiency have compelled manufacturers to innovate continuously. Supply chain disruptions and raw material price volatility add complexity, forcing players to adopt agile strategies. As a result, the market fosters an environment of constant evolution, where differentiation through innovation, customer-centric approaches, and strategic expansion becomes critical for sustained success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, ABB Ltd. launched a new series of energy-efficient induction motors designed specifically for renewable energy applications in India. This move aimed to capitalize on the country’s growing focus on solar and wind power projects.

- In June 2023, Siemens AG partnered with a leading Australian utility provider to supply advanced induction motors for water treatment plants. This collaboration enhanced Siemens’ visibility in the region’s infrastructure sector.

- In September 2023, Schneider Electric SE acquired a local manufacturer in Vietnam to expand its production capabilities for low-cost induction motors. This acquisition enabled the company to better serve Southeast Asia’s burgeoning industrial market.

- In January 2024, WEG Group introduced a line of IoT-enabled induction motors tailored for smart factories in South Korea. This initiative aligned with the country’s push toward Industry 4.0 technologies.

- In November 2023, Toshiba Corporation signed an agreement with a Japanese robotics firm to develop specialized induction motors for automated systems. This partnership reinforced Toshiba’s prominence in precision motor technology.

MARKET SEGMENTATION

This research report on the Asia Pacific induction motor market is segmented and sub-segmented into the following categories.

By Type

- Single-Phase Induction Motor

- Three-Phase Induction Motor

By End-user Industry

- Oil & Gas

- Chemical & Petrochemical

- Power Generation

- Water & Wastewater

- Metal & Mining

- Food & Beverage

- Discrete Industries

- Other End-user Industries

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What key industries in Asia Pacific are driving long-term demand for induction motors, and how are their needs evolving?

Explores core sectors like manufacturing, HVAC, automotive, and infrastructure, and how automation, energy efficiency, and durability are reshaping motor requirements.

How are regional energy efficiency regulations and government initiatives impacting the adoption of high-efficiency induction motors?

Targets policy-driven shifts, such as IE2/IE3 standards, subsidies, or bans on outdated equipment, and their role in modernizing industrial motor fleets.

What are the technological differences between single-phase and three-phase induction motors in terms of regional application trends across Asia Pacific?

Delves into how usage patterns vary by country or sector, depending on electricity infrastructure, application scale, and energy priorities.

How is urbanization and infrastructure growth influencing demand for induction motors in applications like elevators, water pumps, and HVAC systems?

Connects regional construction booms with specific motor-driven applications, highlighting demand from residential and commercial sectors.

What are the primary challenges in supply chain, raw materials, or motor customization that manufacturers face in the Asia Pacific induction motor market?

Addresses operational constraints, localization issues, and how rising costs or lack of standardization can slow production or affect quality.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com