Asia Pacific Industrial Air Filtration Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product, MERV Rating, End-Use, Distribution Channel, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Industrial Air Filtration Market Size

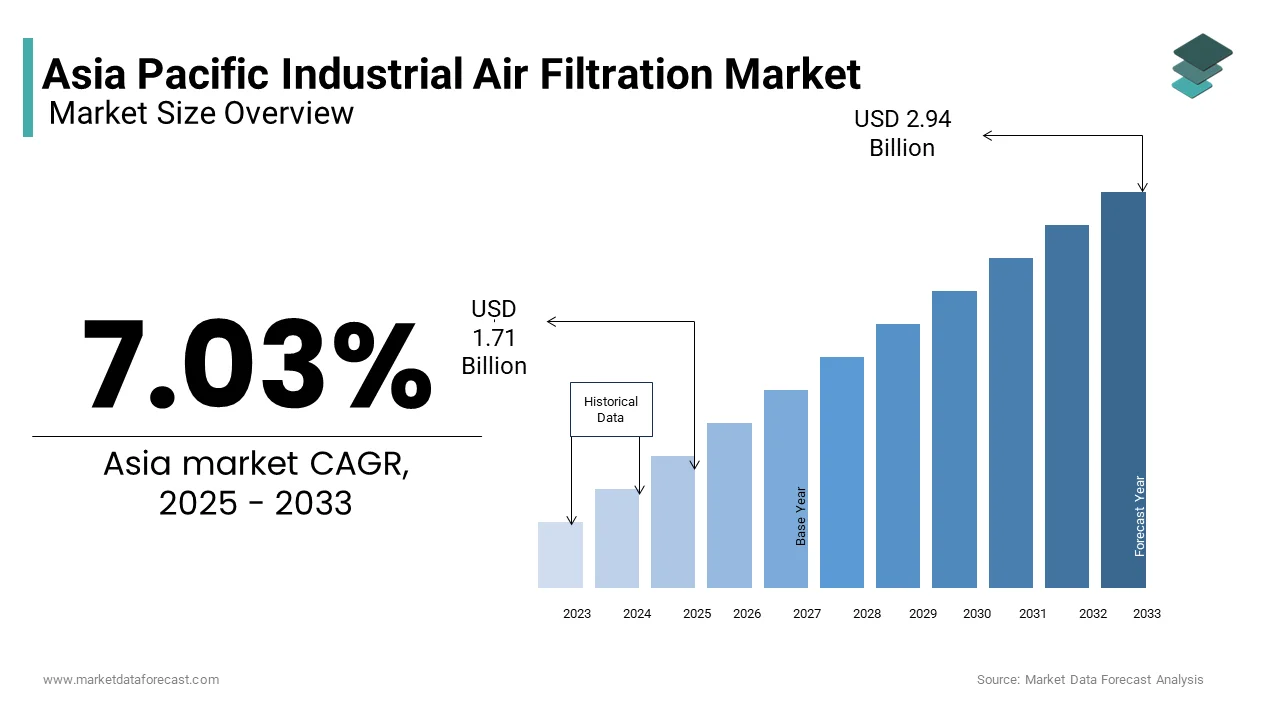

The Asia Pacific Industrial air filtration systems market size was valued at USD 1.60 billion in 2024 and is anticipated to reach USD 1.71 billion in 2025 from USD 2.94 billion by 2033, growing at a CAGR of 7.03% during the forecast period from 2025 to 2033.

Industrial air filtration systems are designed to remove particulate matter, gases, and other pollutants from indoor environments by ensuring compliance with stringent regulatory standards and safeguarding worker health. This technology is particularly significant in the Asia Pacific, where over 60% of the world’s most polluted cities are located, according to the World Health Organization (WHO). Countries like China, India, and Japan are at the forefront of adopting advanced air filtration solutions by addressing challenges posed by industrial emissions and urban smog. For instance, as per the Chinese Ministry of Ecology and Environment, over 70% of manufacturing facilities in Beijing have integrated high-efficiency air filtration systems to meet national emission control targets. Technological advancements have further shaped this market. The South Korean Institute of Environmental Technology emphasizes that innovations in HEPA and activated carbon filters have improved system efficiency by 25% by reducing operational costs and enhancing performance.

MARKET DRIVERS

Stringent Environmental Regulations

One of the primary drivers of the Asia Pacific industrial air filtration market is the implementation of stringent environmental regulations aimed at curbing industrial emissions and improving air quality. According to the Indian Central Pollution Control Board, over 80% of industrial zones in metropolitan cities exceed permissible limits for particulate matter (PM2.5 and PM10) by necessitating advanced filtration systems to ensure compliance. These regulations mandate industries to adopt high-efficiency air filtration technologies, such as HEPA and electrostatic precipitators, to reduce their environmental footprint. China’s Ministry of Ecology and Environment notes that the introduction of emission control zones (ECZs) along coastal regions has accelerated the adoption of air filtration systems in sectors like steel, cement, and chemical manufacturing.

Rising Awareness About Occupational Health

Another significant driver is the growing awareness about occupational health and safety among industrial workers. According to the Australian Institute of Occupational Hygienists, exposure to airborne pollutants causes over 30% of respiratory illnesses in industrial settings, which is prompting companies to invest in advanced air filtration systems. These systems effectively remove harmful contaminants, ensuring a safer working environment and reducing healthcare costs.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

A significant barrier to the widespread adoption of industrial air filtration systems in the Asia Pacific is the high initial investment required for installation and maintenance. Setting up an advanced air filtration system can cost up to three times more than conventional ventilation systems, which depends on the scale and complexity of the project. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs) in emerging economies like Bangladesh and Indonesia, where budget constraints often dictate infrastructure investments.

Moreover, the ongoing operational costs associated with filter replacement and system maintenance add to the overall expense. While these systems offer long-term benefits in terms of air quality and compliance, the substantial upfront costs remain a deterrent in price-sensitive markets.

Limited Awareness in Rural Industrial Zones

Another critical restraint is the limited awareness and accessibility of advanced air filtration systems in rural and semi-urban industrial zones, where traditional ventilation methods remain prevalent. This lack of awareness often stems from insufficient marketing efforts and inadequate technical support networks. According to the Vietnamese Chamber of Commerce and Industry, less than 10% of rural industries have access to the necessary expertise to install and maintain advanced filtration systems, creating a bottleneck in adoption. Addressing this challenge requires targeted outreach programs and investments in localized training initiatives by ensuring that all regions can benefit from the advantages of modern air filtration technologies.

MARKET OPPORTUNITIES

Integration of Smart Monitoring Systems

Rapid advancements in IoT and smart monitoring technologies present a significant opportunity for the Asia Pacific industrial air filtration market. These innovations align with regional sustainability goals, ensuring compliance with stringent environmental regulations. Furthermore, the convergence of air filtration systems with cloud-based analytics enhances scalability and user convenience. Governments in the region are incentivizing the adoption of smart air filtration solutions through subsidies and tax breaks, which will further amplify the growth of the market.

Growth of Green Building Initiatives

The growth of green building initiatives offers another promising opportunity for the industrial air filtration market. According to the Indian Green Building Council, over 50% of new commercial and industrial developments in urban areas are incorporating energy-efficient air filtration systems as part of their sustainability certifications. These systems play a crucial role in achieving LEED and BREEAM ratings by ensuring compliance with global environmental standards. Thailand’s Board of Investment emphasizes that regional construction hubs are expanding their capacity by integrating advanced air filtration solutions into eco-friendly buildings. This strategic shift toward sustainable infrastructure positions the industrial air filtration market for accelerated growth in countries with favorable regulatory frameworks and incentives.

MARKET CHALLENGES

Competition from Low-Cost Alternatives

A pressing challenge for the Asia Pacific industrial air filtration market is the competition from low-cost alternatives that may not meet stringent quality or performance standards. According to the Malaysian Department of Standards, over 40% of industrial filtration systems installed in Southeast Asia are imported from unregulated markets, posing risks to air quality and worker safety. This preference for cheaper options is evident in economically disadvantaged regions where cost savings take precedence over long-term efficiency. This competitive pressure challenges manufacturers to balance affordability with quality in price-sensitive markets.

Dependence on Skilled Workforce for Installation and Maintenance

Another significant challenge is the shortage of skilled professionals capable of installing and maintaining advanced industrial air filtration systems. According to the Indonesian Ministry of Manpower, fewer than 20% of local technicians receive formal training in modern air filtration technologies, creating a bottleneck in service delivery. This knowledge gap often leads to inefficiencies and underutilization of equipment in regions with limited access to technical education.

The Vietnamese Ministry of Labor, Invalids, and Social Affairs notes that over 60% of industrial facilities face challenges in integrating advanced air filtration systems due to a lack of expertise. Addressing this issue requires targeted educational initiatives and partnerships with industry stakeholders to enhance workforce capabilities. The adoption of advanced air filtration systems remains constrained because a skilled workforce is limiting the market’s growth potential.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.03% |

|

Segments Covered |

By Product, MERV Rating, End-Use, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

MANN+HUMMEL, Donaldson Company Inc., Honeywell International Inc., Daikin Industries, Ltd., Danaher, SPX FLOW, Inc., Lydall, Inc., American Air Filter Company, Inc., Industrial Air Filtration, Inc., PARKER HANNIFIN CORP, Camfil, K&N Engineering, Freudenberg SE, Testori Spa, Eaton. |

SEGMENTAL ANALYSIS

By Product Insights

The dust collection segment dominated the Asia Pacific industrial air filtration market with a significant share in 2024 due to its widespread adoption in industries like cement, metal processing, and power generation, where particulate matter emissions are a significant concern. A key factor behind this segment’s dominance is the stringent regulatory framework governing industrial emissions. Another contributing factor is the increasing focus on occupational health. Dust collection systems play a crucial role in mitigating these risks, which is making them indispensable for industries aiming to safeguard worker health while maintaining operational efficiency.

The mist collection segment is projected to grow with a CAGR of 9.8% in the coming years. This growth is fueled by the rising demand for advanced filtration solutions in sectors like food and beverage, pharmaceuticals, and metalworking, where oil mists and vapors pose significant challenges. The growing emphasis on precision manufacturing is driving the growth of the segment. The Japanese Society of Environmental Engineers notes that mist collection systems are essential for maintaining clean air in CNC machining operations, where oil mists can damage equipment and compromise product quality. This trend has led to a surge in investments in high-efficiency mist collectors, ensuring compliance with workplace safety standards. Additionally, government incentives are accelerating the adoption of mist collection systems.

By MERV Rating Insights

The 1 to 4 MERV rating segment held the Asia Pacific industrial air filtration market by accounting for 55.4% of the share in 2024. The growth of the segment is driven by its affordability and suitability for applications requiring basic filtration, such as agriculture and paper processing. According to the Philippine Department of Trade and Industry, over 60% of small-scale manufacturing units in Southeast Asia rely on low-MERV filters due to their lower upfront costs. These systems are favored for their simplicity and ease of maintenance by making them accessible to budget-conscious operators. Another contributing factor is the widespread use of low-MERV filters in rural industrial zones.

The 5 to 8 MERV rating segment is likely to register a CAGR of 10.5% in the coming years. This growth is fueled by the increasing demand for medium-efficiency filters in sectors like food and beverage, pharmaceuticals, and chemical processing, which require higher filtration performance without the premium cost of HEPA systems. The Indian Food Safety and Standards Authority notes that over 50% of food processing facilities in urban areas have upgraded to medium-MERV filters to meet hygiene standards. This trend has led to a surge in investments in scalable filtration solutions, ensuring consistent air quality and operational reliability.

Additionally, government initiatives are promoting the adoption of energy-efficient systems. The Thai Board of Investment reports that subsidies for sustainable manufacturing practices have encouraged industries to integrate medium-MERV filters, which is accelerating the growth of this segment.

By End Use Insights

The cement industry dominated the Asia Pacific industrial air filtration market by capturing 30.4% of the share in 2024. The industry’s massive scale and the significant volume of particulate emissions generated during production processes are likely to fuel the growth of the market. A key factor behind this segment’s dominance is the strict enforcement of emission control policies. According to the Indian Ministry of Environment, Forest, and Climate Change, over 80% of cement plants in India have installed advanced dust collection systems to comply with national air quality standards.

The pharmaceutical segment is lucratively growing with a CAGR of 11.2% in the coming year, with the increasing demand for sterile environments and the need to comply with stringent regulatory standards in drug manufacturing. Additionally, government incentives are accelerating the adoption of advanced filtration technologies. The Malaysian Ministry of Health reports that subsidies for pharmaceutical innovation have encouraged companies to upgrade their filtration infrastructure, further boosting the growth of this segment.

By Distribution Channel Insights

The OEM segment dominated the Asia Pacific industrial air filtration market with 60.1% of the share in 20,24, owing to the integration of air filtration systems into new industrial equipment, ensuring compliance with regulatory standards from the outset. A key factor behind this segment’s dominance is the growing emphasis on energy-efficient design. According to the Chinese Ministry of Industry and Information Technology, over 70% of new industrial machinery in China is equipped with OEM-installed air filtration systems, enhancing system efficiency and reducing operational costs.

The aftermarket segment is lucratively growing with a CAGR of 12.3% in txt coming years. The growth of the segment is fueled by the increasing demand for retrofitting existing systems to meet stricter environmental regulations and improve operational efficiency. The aging industrial infrastructure in many countries will also boost the growth of the segment. The Australian Department of Industry, Science, Energy, and Resources notes that over 60% of industrial facilities in Sydney have upgraded their filtration systems through the aftermarket channel to comply with updated emission standards.

COUNTRY ANALYSIS

Top Leading Countries In The Market

China was the top performer in the Asia Pacific industrial air filtration market with a 35.4% share in 2024. The country’s dominance is rooted in its massive industrial base and stringent emission control policies, which have spurred investments in advanced air filtration systems. Beijing’s "Blue Sky Action Plan" has accelerated the adoption of high-efficiency filtration technologies by ensuring widespread implementation in sectors like cement, steel, and power generation.

Japan accounted in holding 20.3% of the Asia Pacific industrial air filtration market share, with its reputation for technological innovation and high environmental standards. Tokyo and Osaka are hubs for advanced air filtration systems, where industries widely adopt these technologies to ensure compliance with stringent air quality regulations. The government’s focus on exporting cutting-edge filtration solutions to neighboring countries further strengthens its position in the regional market.

India’s rapid industrialization and growing emphasis on air quality management have increased investments in industrial air filtration systems for sectors like cement, food processing, and pharmaceuticals. Initiatives like the National Clean Air Programme have ensured wider accessibility to advanced filtration solutions by ensuring sustained growth in the market.

Australia's industrial air filtration market is driven by its emphasis on sustainability has increased investments in air filtration systems for green building initiatives and industrial applications. Initiatives like the Emissions Reduction Fund have enhanced connectivity by ensuring sustained demand for advanced air filtration systems.

South Korea’s dominance in developing innovative air filtration technologies has driven demand for state-of-the-art solutions. Seoul’s focus on exporting these systems to neighboring countries further strengthens its position in the regional market.

KEY MARKET PLAYERS

MANN+HUMMEL, Donaldson Company Inc., Honeywell International Inc., Daikin Industries, Ltd., Danaher, SPX FLOW, Inc., Lydall, Inc., American Air Filter Company, Inc., Industrial Air Filtration, Inc., PARKER HANNIFIN CORP, Camfil, K&N Engineering, Freudenberg SE, Testori Spa, Eaton. Are the market players that are dominating the Asia Pacific industrial air filtration market?

Top Players in the Market

Donaldson Company, Inc.

Donaldson Company, Inc. is a global leader in the Asia Pacific industrial air filtration market, renowned for its innovative and high-performance filtration solutions. The company specializes in developing advanced dust and mist collection systems tailored to industries like cement, food processing, and pharmaceuticals. Its commitment to sustainability aligns with regional environmental goals by ensuring compliance with stringent emission standards.

Camfil AB

Camfil AB is another key player, leveraging its expertise in air quality management to dominate the market. The company focuses on delivering energy-efficient and scalable filtration solutions that cater to diverse applications, from power generation to metal processing. Its emphasis on integrating smart monitoring technologies enhances operational efficiency and system reliability. Globally, Camfil has contributed to advancing industrial air filtration by offering customizable solutions that adapt to evolving customer needs.

Mann+Hummel Group

Mann+Hummel Group is a prominent name in the industrial air filtration market, known for its robust and durable filtration systems. The company’s products are widely adopted in sectors like automotive, agriculture, and chemical processing due to their superior performance and cost-effectiveness. Mann+Hummel’s focus on R&D ensures continuous improvement in system efficiency, addressing challenges like maintenance costs and regulatory compliance.

Top Strategies Used by Key Market Participants

Strategic Partnerships with Governments and Industries

Key players in the Asia Pacific industrial air filtration market have prioritized forming strategic partnerships with governments and industrial organizations to align their offerings with regional environmental and health goals. These collaborations enable companies to tailor their technologies to specific regulatory requirements and industry challenges. For instance, partnerships with national environmental agencies ensure the integration of advanced filtration systems into large-scale industrial projects by enhancing air quality and worker safety. Such alliances not only strengthen brand visibility but also foster trust among stakeholders.

Focus on Innovation and Customization

Innovation remains a cornerstone strategy for maintaining a competitive edge. Leading companies invest heavily in R&D to develop next-generation technologies, such as IoT-enabled monitoring and predictive maintenance tools, that address evolving customer demands. Customization is another critical aspect, with firms offering solutions tailored to specific applications, such as sterile environments in pharmaceuticals or heavy-duty filtration in cement production.

Expansion of After-Sales Services and Training Programs

To build long-term relationships with customers, key players emphasize comprehensive after-sales services, including maintenance, repair, and technical support. These services ensure optimal performance of air filtration systems throughout their lifecycle by reducing downtime and operational costs for users. Additionally, companies offer training programs to educate operators on the benefits and operation of advanced technologies.

COMPETITION OVERVIEW

The Asia Pacific industrial air filtration market is characterized by intense competition, driven by the region’s growing emphasis on air quality management and occupational health. Key players like Donaldson Company, Inc., Camfil AB, and Mann+Hummel Group dominate the landscape, leveraging their technological expertise and extensive service networks to capture market share. While Donaldson focuses on innovation and sustainability, Camfil emphasizes energy efficiency and scalability, creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives.

Regulatory fragmentation across countries further intensifies competition, as companies strive to adapt their offerings to meet diverse requirements. Innovation serves as a key battleground, with firms investing in R&D to develop next-generation air filtration technologies. Additionally, partnerships with local stakeholders and the expansion of after-sales services play a crucial role in maintaining market prominence.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Donaldson Company launched a collaboration with China’s Ministry of Ecology and Environment to integrate IoT-enabled air filtration systems into industrial zones. This initiative aimed to enhance real-time monitoring while promoting sustainable manufacturing practices.

- In June 2023, Camfil AB signed a partnership agreement with an Indian pharmaceutical conglomerate to retrofit existing facilities with HEPA filtration systems. This move focused on improving compliance with ISO cleanroom standards and positioning Camfil as a leader in sterile air solutions.

- In September 2023, Mann+Hummel Group announced the establishment of a dedicated training center in Thailand. This facility provides hands-on education for technicians, ensuring proper installation and maintenance of advanced filtration systems.

- In November 2023, Parker Hannifin introduced a new line of energy-efficient mist collectors specifically designed for Southeast Asian markets. This innovation targeted the growing demand for cost-effective solutions in the metalworking and food processing industries.

- In January 2024, Freudenberg Filtration Technologies partnered with a major Australian utility provider to integrate predictive maintenance tools into its air filtration operations. This collaboration aimed to achieve proactive system upkeep and reduce operational costs while demonstrating the viability of advanced filtration technologies.

MARKET SEGMENTATION

This research report on the Asia Pacific industrial air filtration market is segmented and sub-segmented into the following categories.

By Product

- Dust Collection Filters

- Cartridge Collectors & Filters

- Baghouse Filters

- Other Filters

- Mist Collection Filters

- Fume Collection Filters

- HEPA Filters

- Others

By End Use

- Cement

- Food & Beverage

- Metal

- Power

- Pharmaceutical

- Chemical & Petrochemical

- Paper & Wood Processing

- Agriculture

- Others

By Distribution Channel

- OEM

- Aftermarket

By MERV Rating

- 1 to 4 MERV

- 5 to 8 MERV

- 9 to 12 MERV

- 13 to 16 MERV

- Above 17 MERV

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Which industries drive air filtration demand in Asia Pacific?

Pharma, food, cement, and electronics lead due to strict hygiene and dust control needs.

How do regulations impact air filtration investments?

Tougher air quality laws push industries to adopt high-efficiency, compliant systems.

What new technologies are shaping the market?

Smart filters, nanofiber media, and IoT-enabled systems are replacing older tech.

Why is energy efficiency a key buying factor?

Low-energy, high-performance filters help cut costs while meeting green targets.

What are the main adoption challenges in the asia pacific air industrial filtration market ?

High costs, integration with old systems, and lack of awareness in smaller markets.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]