Asia Pacific Industrial Heat Pump Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product, Capacity, Application, Temperature, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Industrial Heat Pump Market Size

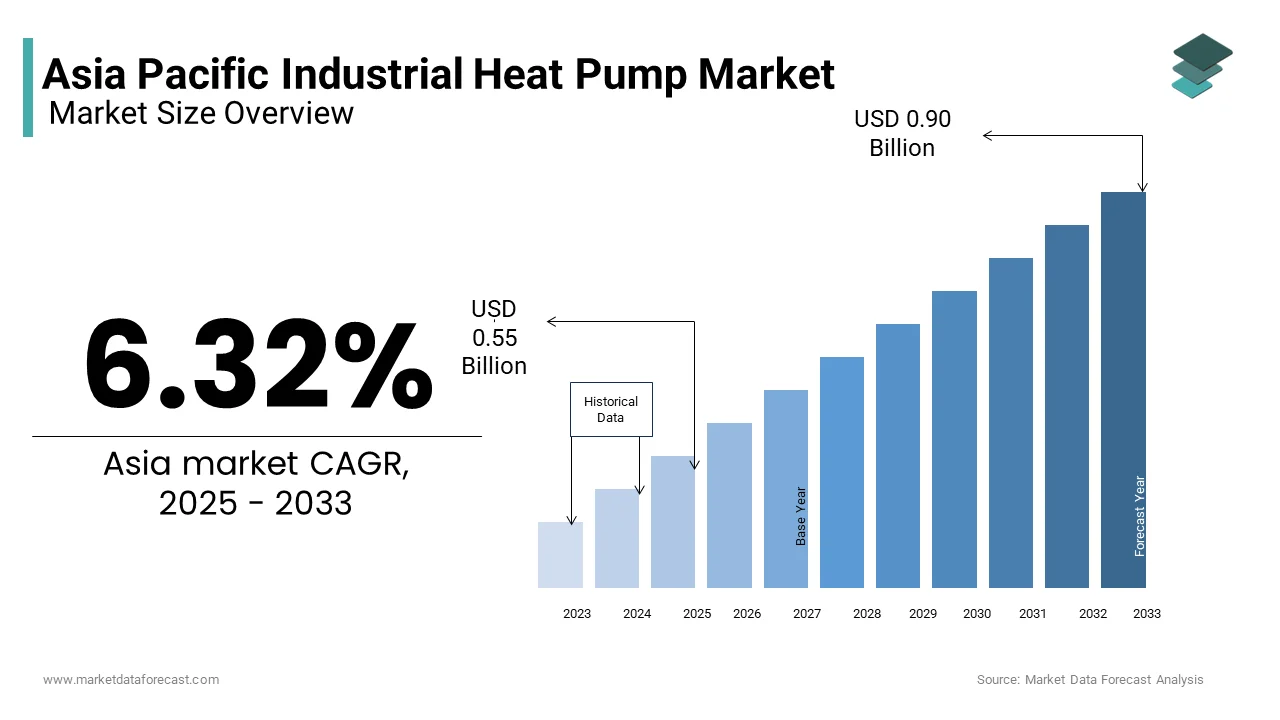

The Asia Pacific industrial pump market was valued at USD 0.52 billion in 2024 and is anticipated to reach USD 0.55 billion in 2025 from USD 0.90 billion by 2033, growing at a CAGR of 6.32% during the forecast period from 2025 to 2033.

Industrial heat pumps are pivotal in achieving energy efficiency and sustainability within industrial processes, offering a viable solution for converting low-grade waste heat into usable thermal energy. The Asia Pacific region, characterized by its rapid industrialization and escalating energy demands, has emerged as a critical hub for the adoption of industrial heat pump technologies. According to the International Energy Agency, industrial energy consumption in the region accounts for over 40% of global energy usage, with significant potential for energy recovery systems like heat pumps.

MARKET DRIVERS

Stringent Environmental Regulations

Stringent environmental regulations are a key driver propelling the adoption of industrial heat pumps in the Asia Pacific region. Governments are implementing policies to curb greenhouse gas emissions and promote energy-efficient technologies. For instance, South Korea’s Green New Deal, launched in 2020, aims to reduce carbon emissions by 24.4% by 2030, as stated by the Presidential Committee on Carbon Neutrality. Industrial heat pumps play a crucial role in achieving these targets by enabling industries to recover and reuse waste heat, thereby minimizing energy wastage. In Australia, the National Energy Productivity Plan mandates a 40% improvement in energy productivity by 2030, encouraging industries to adopt innovative solutions like heat pumps.

Rising Energy Costs

Escalating energy costs are another major driver boosting the demand for industrial heat pumps. According to the Asian Development Bank, electricity prices in the Asia Pacific region have increased by an average of 5% annually over the past decade. This trend compels industries to seek cost-effective alternatives to traditional heating systems. Industrial heat pumps offer a compelling solution by providing up to 60% energy savings compared to conventional methods, as per the International Renewable Energy Agency. For example, in India, the textile industry has adopted heat pumps to reduce operational expenses associated with steam generation. Similarly, Singapore’s food processing sector leverages heat pumps to lower energy bills while maintaining product quality.

MARKET RESTRAINTS

High Initial Investment Costs

A significant barrier to the widespread adoption of industrial heat pumps is their high initial investment costs. These systems often require substantial upfront capital for installation and integration into existing industrial processes. According to the World Bank, small and medium-sized enterprises (SMEs) in the Asia Pacific region face financial constraints that limit their ability to invest in advanced technologies. For instance, in Indonesia, SMEs account for over 97% of total businesses but lack access to affordable financing options for energy-efficient upgrades. Additionally, the complexity of retrofitting heat pumps into legacy systems increases costs, deterring potential adopters. The initial expenditure remains a deterrent in developing economies where budget allocations prioritize immediate operational needs over sustainable investments.

Limited Awareness and Technical Expertise

Another restraint is the limited awareness and technical expertise surrounding industrial heat pumps among end-users. Many industries in the Asia Pacific region are unfamiliar with the operational benefits and application potential of these systems. According to a study by the Institute of Electrical and Electronics Engineers, only 28% of industrial operators in Southeast Asia possess adequate knowledge about heat pump technologies. This knowledge gap impedes adoption, especially in rural areas where access to technical training is scarce. Furthermore, misconceptions about maintenance requirements and system compatibility persist, discouraging potential buyers. For example, in Vietnam, manufacturers hesitate to adopt heat pumps due to perceived risks associated with system integration. Bridging this awareness gap requires targeted educational campaigns and demonstrations to showcase the advantages of industrial heat pumps effectively.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Integration

The integration of renewable energy sources presents a significant opportunity for the industrial heat pump market in the Asia Pacific region. Solar and geothermal energy can be combined with heat pump systems to enhance efficiency and reduce reliance on grid electricity. According to the International Renewable Energy Agency, renewable energy capacity in the region exceeded 1,000 gigawatts in 2022, creating a conducive environment for hybrid solutions. For instance, in Thailand, solar-assisted heat pumps are being deployed in the agricultural sector to dry crops sustainably. Similarly, New Zealand’s geothermal resources are being harnessed to power industrial heat pumps in food processing plants. These innovations not only lower operational costs but also align with regional sustainability goals by positioning industrial heat pumps as a cornerstone of renewable energy strategies.

Growth in Smart Manufacturing Initiatives

The rise of smart manufacturing initiatives offers another promising opportunity for industrial heat pumps. As per the Global Smart Manufacturing Market Report, the Asia Pacific region leads global investments in Industry 4.0 technologies, accounting for 45% of total spending. Industrial heat pumps equipped with IoT-enabled sensors and predictive analytics can optimize energy consumption and improve process efficiency. For example, in Japan, Mitsubishi Electric has integrated smart heat pumps into its manufacturing facilities to monitor and adjust thermal loads in real-time. Similarly, China’s Made in China 2025 initiative promotes the adoption of intelligent systems, including heat pumps, to enhance industrial competitiveness.

MARKET CHALLENGES

Technological Limitations in High-Temperature Applications

One of the primary challenges facing the industrial heat pump market is the technological limitation in achieving high-temperature outputs required for certain industrial processes. According to the American Society of Heating, Refrigerating, and Air-Conditioning Engineers, most industrial heat pumps currently operate efficiently up to 120°C, which is insufficient for applications like metal processing or petrochemical refining. This limitation restricts their adoption in sectors that demand temperatures exceeding 200°C. For instance, in Australia, the mining industry relies heavily on high-temperature processes, where heat pumps have yet to demonstrate viability. Research efforts are ongoing to develop advanced compressors and refrigerants capable of delivering higher temperatures, but these innovations remain costly and commercially unproven. Overcoming this challenge is essential to unlocking the full potential of industrial heat pumps across diverse applications.

Infrastructure Constraints in Remote Areas

Infrastructure constraints in remote and rural areas pose another significant challenge to the adoption of industrial heat pumps. According to the Asian Development Bank, approximately 30% of the Asia Pacific population resides in regions with underdeveloped energy grids, which is limiting access to reliable electricity. Industrial heat pumps require a stable power supply and robust infrastructure to function optimally, making their deployment challenging in such areas. For example, in the Philippines, many manufacturing facilities in remote islands struggle to integrate heat pumps due to frequent power outages and voltage fluctuations. Additionally, logistical barriers hinder the transportation and installation of large-scale heat pump systems in these regions. Addressing these infrastructure gaps is crucial to ensuring equitable access to energy-efficient technologies and expanding the market reach of industrial heat pumps.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.32% |

|

Segments Covered |

By Product, Capacity, Application, Temperature, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Atlas Copco AB, Carrier, Dalrada Climate Technology, Daikin Applied Europe S.p.A., Emerson Electric Co., GEA Group Aktiengesellschaft, Johnson Controls, MAN Energy Solutions, Oilon Group Oy, OCHSNER, Piller Blowers & Compressors GmbH, Qvantum Energi AB, Siemens Energy, Swegon Ltd, Trane Technologies International Limited, Turboden S.p.A. |

SEGMENTAL ANALYSIS

By Product Insights

The air source heat pumps segment accounted in holding 45.3% of the Asia Pacific industrial heat pump market share in 2024 due to their cost-effectiveness and ease of installation compared to other types of heat pumps. Air source systems are particularly popular in urbanized regions like China and India, where space constraints limit the feasibility of ground or water source installations.

Another critical factor is energy efficiency improvements. Modern air source heat pumps can achieve a coefficient of performance (COP) of up to 4.5, as stated by the American Society of Heating, Refrigerating, and Air-Conditioning Engineers. This makes them an attractive option for industries aiming to reduce energy consumption. For instance, South Korea’s Green New Deal emphasizes the adoption of energy-efficient technologies, with air source heat pumps being a key focus due to their ability to recover waste heat effectively.

The closed cycle absorption heat pumps segment is likely to grow with a CAGR of 10.8% in the coming years, owing to the advancements in refrigerant technology and increasing demand for low-temperature applications. For example, Japan’s Ministry of Economy, Trade, and Industry has allocated $2 billion for research into eco-friendly refrigerants, which are integral to the performance of absorption heat pumps. These innovations have expanded their applicability in sectors like food processing and textiles.

Another contributing factor is the push for renewable energy integration. Thailand’s Alternative Energy Development Plan aims to increase renewable energy usage to 30% by 2036, creating opportunities for absorption heat pumps powered by solar thermal energy. Additionally, industries in Australia are adopting these systems to meet sustainability goals, as they produce minimal greenhouse gas emissions.

By Capacity Insights

The 500 kW to 2 MW capacity segment was the largest by occupying 50.4% of the Asia Pacific industrial heat pump market share, owing to the versatility of this capacity range, which caters to medium-scale industries such as food processing, textiles, and pharmaceuticals. In Vietnam, for instance, over 60% of manufacturing facilities fall within this capacity bracket, according to the Vietnamese Ministry of Industry and Trade. These industries benefit from the balance between cost-efficiency and operational flexibility offered by mid-range heat pumps. Another factor is the growing emphasis on energy recovery. For example, Indonesia’s palm oil industry has adopted these systems to recover heat from steam processes, reducing reliance on external energy sources.

The > 5 MW capacity segment is lucratively growing with a CAGR of 12.3% in the coming years, with large-scale industrial projects requiring high-capacity heat pumps for process heating. China’s State Grid Corporation, for instance, has invested $50 billion in ultra-high-voltage transmission systems, which necessitates robust heat pump solutions for cooling and heating applications.

Another driving factor is the expansion of district heating networks. South Korea’s District Heating Act mandates the integration of renewable energy sources, encouraging utilities to adopt high-capacity heat pumps. According to the Korean District Heating Corporation, these systems can supply thermal energy to over 10,000 households per unit, enhancing scalability. Additionally, Australia’s mining sector leverages > 5 MW heat pumps for ore processing, as they offer superior performance in high-temperature environments. These trends position the > 5 MW segment as the fastest-growing category.

By Temperature Insights

The 80–100°C temperature range segment accounted in holding 40.3% of the Asia Pacific industrial heat pumps market share in 2024 due to its widespread applicability in low-temperature industrial processes, such as drying, pasteurization, and space heating. For example, India’s textile industry relies heavily on heat pumps operating in this range to dry fabrics efficiently, as stated by the Confederation of Indian Textile Industry. The energy savings achieved through these systems are significant, with reductions of up to 30% compared to conventional methods.

Another factor is regulatory support for low-temperature applications. Japan’s Ministry of Agriculture, Forestry, and Fisheries promotes the use of heat pumps in agricultural drying processes, citing their ability to maintain product quality while minimizing energy costs. According to the Japanese Agricultural Machinery Manufacturers Association, over 70% of agricultural drying systems now incorporate heat pumps. These dynamics ensure the 80–100°C segment remains the largest in the market.

The 150–200°C temperature range segment is expected to grow with a CAGR of 11.5% during the forecast period, with the advancements in compressor technology, enabling higher temperature outputs without compromising efficiency. For instance, Australia’s chemical manufacturing sector has adopted these systems for polymer processing, as they provide the precise temperature control required for material synthesis.

By Application Insights

The industrial applications segment held the dominant share of the Asia Pacific industrial heat pump market in 2024, with rapid industrialization and the need for energy-efficient heating solutions. For example, China’s industrial sector consumes over 60% of the country’s total energy, as stated by the National Bureau of Statistics. Industrial heat pumps play a crucial role in reducing this consumption by recovering waste heat and repurposing it for various processes. Another factor is the diversity of applications. In India, the food processing industry uses heat pumps for milk pasteurization and spice drying, achieving energy savings of up to 40%, according to the Food Safety and Standards Authority of India. Similarly, Japan’s automotive sector employs heat pumps for paint curing, ensuring consistent quality while lowering operational costs.

The district heating segment is deemed to witness a CAGR of 13.2% in the coming years. This growth is fueled by urbanization and the expansion of centralized heating networks. South Korea’s District Heating Corporation plans to connect an additional 5 million households by 2030 by creating a surge in demand for industrial heat pumps.

Another driving factor is the integration of renewable energy. According to Denmark’s Ministry of Climate, Energy, and Utilities, combining heat pumps with geothermal energy can reduce district heating costs by 25%. Australia’s cities are also adopting similar models, leveraging heat pumps to supply thermal energy to residential and commercial buildings. These initiatives position district heating as the fastest-growing application segment.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China was the top performer in the Asia Pacific industrial heat pump market, with a 40.4% share in 2024, with its aggressive push toward energy efficiency and carbon neutrality. With over 1,000 gigawatts of renewable energy capacity, as stated by the National Energy Administration, China has integrated heat pumps into various industries to optimize energy usage. Another factor is the government’s investment in green technologies.

Japan's industrial heat pump market held 15.3% of the share in 2024, with a growing focus on sustainability and technological innovation. Japan’s Green Growth Strategy aims to reduce greenhouse gas emissions by 46% by 2030, which is driving the adoption of heat pumps in industries like food processing and electronics. Additionally, Japan’s aging infrastructure is being upgraded with energy-efficient systems.

South Korea is expected to grow at a faster rate in the Asia Pacific industrial heat pump market. The country’s growth is fueled by its commitment to renewable energy and smart city initiatives. South Korea’s Green New Deal allocates $65 billion for sustainable urban development, including the integration of heat pumps in district heating systems. Moreover, the chemical and petrochemical industries leverage heat pumps for process heating by ensuring consistent demand for these systems.

Australia and New Zealand are expected to promote new growth opportunities for the Asia-Pacific industrial heat pump market. Their growth is driven by renewable energy integration and environmental regulations. Australia’s mining sector adopts heat pumps for ore processing, while New Zealand’s dairy industry uses them for milk pasteurization. Additionally, both countries emphasize sustainability by aligning with global trends.

India’s industrial heat pump market growth is driven by industrialization and government initiatives like the National Mission for Enhanced Energy Efficiency. Industries such as textiles and food processing rely on heat pumps to reduce energy costs by ensuring steady market growth.

KEY MARKET PLAYERS

Atlas Copco AB, Carrier, Dalrada Climate Technology, Daikin Applied Europe S.p.A., Emerson Electric Co., GEA Group Aktiengesellschaft, Johnson Controls, MAN Energy Solutions, Oilon Group Oy, OCHSNER, Piller Blowers & Compressors GmbH, Qvantum Energi AB, Siemens Energy, Swegon Ltd, Trane Technologies International Limited, and Turboden S.p.A. are the market players that are dominating the Asia Pacific industrial heat pump market.

Top Players in the Market

Mitsubishi Electric Corporation

Mitsubishi Electric is a leading player in the Asia Pacific industrial heat pump market, renowned for its innovative and energy-efficient solutions. The company’s heat pumps are widely used in industries such as food processing, textiles, and district heating, offering high reliability and sustainability. Mitsubishi Electric contributes to the global market by integrating advanced technologies like IoT and AI into its systems by enabling real-time monitoring and optimization. Its commitment to research and development has positioned it as a pioneer in hybrid heat pump systems that combine renewable energy sources.

Daikin Industries Ltd.

Daikin Industries is another key player, known for its cutting-edge air source and water source heat pump technologies. The company leverages its expertise in HVAC systems to deliver customized solutions tailored to industrial needs. Daikin’s contribution to the global market lies in its ability to provide scalable systems that cater to diverse applications, from low-temperature drying to high-temperature process heating. Its focus on expanding its product portfolio and entering emerging markets ensures sustained growth and innovation in the industrial heat pump sector.

Viessmann Group

Viessmann Group stands out for its closed-cycle absorption heat pumps, which are designed for high-temperature applications in industries like chemical manufacturing and pharmaceuticals. The company’s global presence is bolstered by its commitment to quality and customer-centric solutions. Viessmann contributes to the market by promoting renewable energy integration, particularly through solar-assisted heat pump systems. Its emphasis on reducing carbon footprints and improving energy efficiency resonates with environmentally conscious industries.

Top Strategies Used by Key Market Participants

Product Innovation and Technological Advancements

Key players in the Asia Pacific industrial heat pump market prioritize innovation to stay ahead of competitors. Companies invest heavily in developing next-generation heat pumps capable of achieving higher temperatures and greater energy efficiency. For instance, advancements in compressor technology and refrigerant formulations have enabled systems to operate in previously challenging environments. These innovations not only expand the range of applications but also enhance the overall performance of heat pumps.

Strategic Partnerships and Collaborations

Collaborations with regional stakeholders, including governments, utilities, and research institutions, are a cornerstone of market strategies. These partnerships allow companies to gain insights into local requirements and develop tailored solutions. For example, joint ventures with renewable energy providers enable the integration of solar or geothermal energy with heat pump systems. Such alliances also facilitate knowledge sharing and enhance brand credibility, creating long-term value for all parties involved.

Focus on Sustainability and Compliance

Sustainability has become a key strategic focus for players in the industrial heat pump market. Companies emphasize eco-friendly practices, from sourcing raw materials to end-of-life disposal, to comply with stringent environmental regulations. By adopting green technologies and promoting recycling initiatives, they demonstrate their commitment to reducing their carbon footprints. This focus on sustainability not only enhances their reputation but also positions them favorably in markets where environmental concerns are paramount. Aligning with global sustainability goals ensures that companies remain relevant and competitive in the long term.

COMPETITION OVERVIEW

The Asia Pacific industrial heat pump market is characterized by fierce competition, driven by the presence of both global giants and regional players. Established companies leverage their technological expertise and extensive distribution networks to maintain their dominance, while smaller firms focus on niche segments like high-temperature applications or renewable energy integration. The market’s competitive landscape is shaped by rapid industrialization, urbanization, and the growing emphasis on sustainability, all of which create opportunities for innovation. Companies strive to differentiate themselves through product quality, pricing strategies, and sustainability initiatives. Regulatory pressures further intensify competition, as players race to develop compliant solutions. Additionally, the rise of smart manufacturing and district heating projects has heightened demand for advanced heat pumps, prompting companies to invest in research and development. This dynamic environment fosters collaboration and rivalry alike, which is ensuring that the market remains vibrant and responsive to emerging trends.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Mitsubishi Electric Corporation launched a new line of IoT-enabled heat pumps designed for industrial applications in Southeast Asia. This move aimed to enhance operational efficiency and provide real-time performance analytics to customers.

- In June 2023, Daikin Industries Ltd. partnered with a leading Australian utility provider to integrate its water source heat pumps into a large-scale district heating project. This collaboration reinforced Daikin’s presence in Oceania while showcasing its expertise in renewable energy integration.

- In August 2023, Viessmann Group expanded its production facility in Thailand to meet rising demand for high-temperature absorption heat pumps in the chemical and pharmaceutical industries. This expansion promoted the company’s commitment to serving the Asia Pacific region.

- In November 2023, Johnson Controls introduced a next-generation air source heat pump tailored for the Indian textile industry. This product launch promoted the company’s focus on addressing specific industrial needs while promoting energy efficiency.

- In January 2024, Carrier Global Corporation acquired a stake in a Japanese heat pump recycling initiative to promote circular economy practices. This investment aligned with Carrier’s broader sustainability goals and strengthened its position in the domestic market.

MARKET SEGMENTATION

This research report on the Asia Pacific Industrial Heat Pump market is segmented and sub-segmented into the following categories.

By Product

- Air Source

- Ground Source

- Water Source

- Closed Cycle Mechanical Heat Pump

- Open Cycle Mechanical Vapor Compression Heat Pump

- Open Cycle Mechanical Thermocompression Heat Pump

- Closed Cycle Absorption Heat Pump

By Capacity

- 500 kW

- 500 kW to 2 MW

- 2 MW - 5 MW

- > 5 MW

By Temperature

- 80 – 100 °C

- 100 – 150 °C

- 150 – 200 °C

- > 200 °C

By Application

- Industrial

- Paper

- Food & Beverages

- Chemical

- Iron & Steel

- Machinery

- Non-Metallic minerals

- Other industries

- District heating

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the primary drivers accelerating industrial heat pump adoption in Asia-Pacific's decarbonization initiatives?

Explore how national carbon neutrality targets, such as Japan’s 2050 goal and China’s 2060 pledge,e are fueling demand for industrial heat pumps as a low-carbon alternative to fossil-fuel-based thermal systems.

How are industrial heat pump applications evolving across different sectors like food processing, chemicals, and textiles in APAC?

Understand sector-specific use cases, such as low-temperature waste heat recovery in food processing in Thailand, or high-temperature process integration in chemical manufacturing hubs in South Korea and India.

What are the technical and infrastructural barriers to scaling high-temperature industrial heat pumps in developing APAC economies?

Identify challenges like outdated industrial boiler systems, unstable electricity grids, and lack of skilled technicians in regions like Southeast Asia and South Asia.

How do government subsidies, carbon pricing, and energy-efficiency mandates influence heat pump deployment across APAC markets?

Gain insights into financial incentives in countries like South Korea and Australia, and how these policies are shaping return on investment (ROI) and accelerating adoption.

What is the role of renewable energy integration in boosting the efficiency and sustainability of industrial heat pump systems in APAC?

Explore how pairing heat pumps with solar or wind power is being piloted in energy-intensive industries in China and Japan, and the impact on cost savings and emissions reduction.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]