Asia Pacific Laboratory Automation Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Equipment, and Software, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Laboratory Automation Market Size

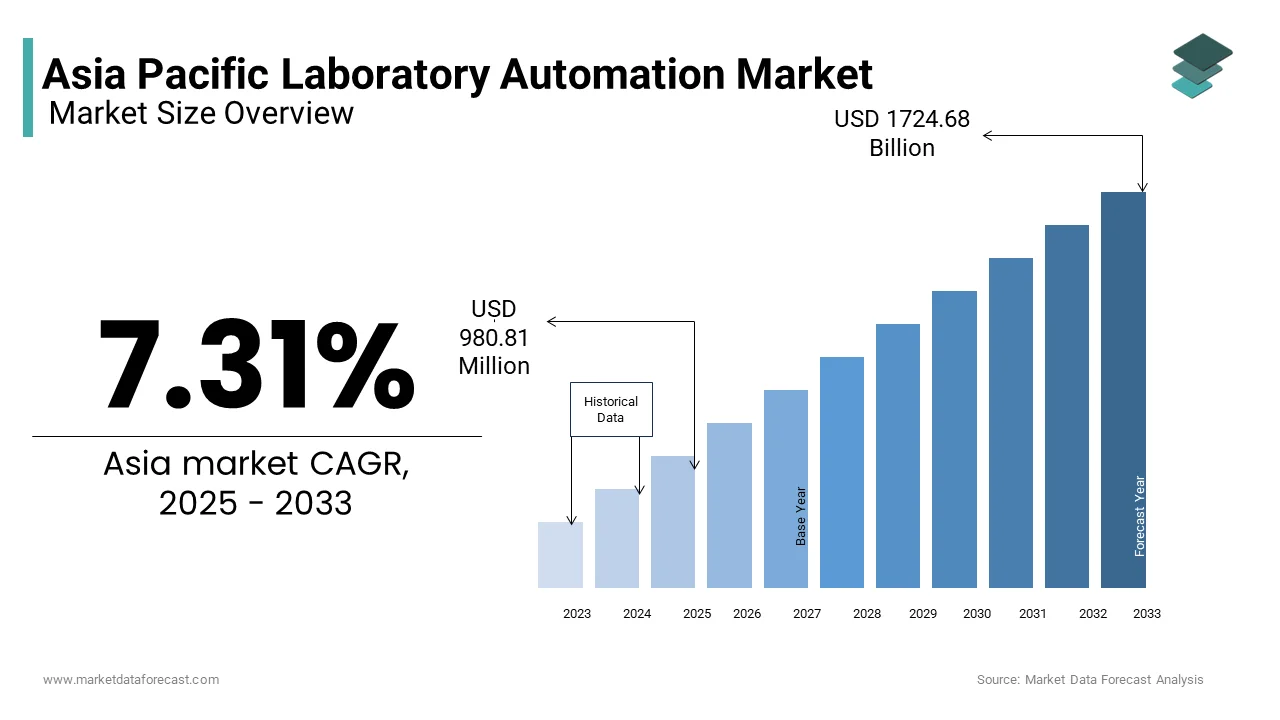

The Asia Pacific laboratory automation market size was valued at USD 914 million in 2024 and is anticipated to reach USD 980.81 million in 2025 from USD 1724.68 million by 2033, growing at a CAGR of 7.31% during the forecast period from 2025 to 2033.

Current Scenario of the Asia Pacific Laboratory Automation Market

Laboratory automation involves the use of automated systems and software to perform repetitive tasks, manage data, and improve accuracy in research, diagnostics, and industrial testing. According to the World Health Organization, over 60% of diagnostic laboratories in the region are adopting automation to reduce human error and improve efficiency. The region’s rapid industrialization, urbanization, and increasing focus on healthcare innovation have further fueled demand for laboratory automation. Similarly, Australia’s Department of Industry, Science and Resources emphasizes the role of automation in reducing operational costs and enhancing research capabilities.

MARKET DRIVERS

Rising Demand for Precision Medicine

The exponential rise in demand for precision medicine is a primary driver of the Asia Pacific laboratory automation market. According to the International Agency for Research on Cancer, cancer cases in the region are projected to increase by 50% by 2030, which is creating a pressing need for accurate and efficient diagnostic tools. Similarly, China’s National Health Commission highlights that automation enhances the reproducibility of test results, reducing errors and improving patient outcomes. These trends demonstrate how the growing focus on precision medicine is propelling the adoption of laboratory automation technologies tailored to meet diverse healthcare needs.

Increasing Research and Development Activities

Another significant driver is the growing emphasis on research and development (R&D) across industries such as pharmaceuticals, biotechnology, and agriculture. According to India’s Department of Biotechnology, over 60% of R&D facilities are integrating automated systems to accelerate drug discovery and development processes. Similarly, Japan’s Ministry of Education, Culture, Sports, Science and Technology emphasizes the use of robotics in high-throughput screening to analyze thousands of samples simultaneously, reducing time and costs. Moreover, the rise of collaborative research initiatives has further fueled demand for scalable automation solutions. These drivers ensure laboratory automation remains a key enabler of innovation in scientific research.

MARKET RESTRAINTS

High Initial Investment Costs

High initial investment costs pose a significant restraint to the laboratory automation market, particularly regarding the deployment of advanced systems like robotic workstations and AI-driven platforms. The Federation of Indian Chambers of Commerce and Industry notes that implementing a fully automated laboratory can cost several million dollars, deterring smaller players from adopting these innovations. Additionally, the lack of economies of scale in emerging economies exacerbates this issue, limiting the ability of smaller operators to compete effectively. These financial barriers hinder the widespread adoption of laboratory automation solutions in price-sensitive markets.

Limited Skilled Workforce

The limited availability of a skilled workforce also acts as a restraint regarding the operation and maintenance of advanced automated systems. Malaysia’s Ministry of Education reports that over 60% of laboratories in the region struggle to find employees trained in robotics and AI technologies. This mismatch between available skills and industry needs delays the adoption of innovative solutions, further complicating the transition process. These factors collectively limit the ability of companies to fully leverage the potential of laboratory automation in driving operational excellence.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) presents transformative opportunities for the laboratory automation market. AI-driven analytics can process vast amounts of experimental data to deliver actionable insights, enhancing decision-making and operational efficiency. For instance, China’s Ministry of Science and Technology highlights the use of ML algorithms to predict experimental outcomes and optimize workflows, reducing downtime by up to 30%. Similarly, Australia’s Department of Industry, Science and Resources emphasizes the role of AI in enhancing genomic research and improving recovery rates.

Expansion into Emerging Economies

Emerging economies in the Asia Pacific offer untapped potential for laboratory automation, driven by industrialization and infrastructure development. The Asian Development Bank reports that over $1 trillion is being invested annually in healthcare and research infrastructure projects across Southeast Asia, creating demand for scalable and efficient solutions. Similarly, Vietnam’s growing biotechnology sector relies on automated systems to enhance research and development capabilities. These trends amplify the vast opportunities for laboratory automation providers to expand their footprint in high-growth markets.

MARKET CHALLENGES

Regulatory Fragmentation Across Countries

Regulatory fragmentation across countries represents a pressing challenge for the laboratory automation market regarding cross-border operations and data sharing. The International Laboratory Automation Standards Organization states that many countries in the region have stringent regulations governing data localization, which is limiting the adoption of unified digital platforms. For instance, South Korea’s Ministry of Environment mandates strict guidelines for environmental compliance by complicating implementation for multinational operators. Additionally, the absence of harmonized standards across the region creates operational inefficiencies. Japan’s Ministry of Justice highlights the need for regional collaboration to facilitate seamless cross-border operations and enhance regulatory compliance. These challenges increase operational costs and reduce the efficiency of laboratory automation solutions.

Cybersecurity Threats and Data Privacy Concerns

Cybersecurity threats and data privacy concerns also act as restraints, particularly regarding the protection of sensitive experimental data. The Australian Cyber Security Centre warns that cyberattacks targeting automated laboratories have increased by over 40% annually, which is undermining public trust in these technologies. Similarly, Japan’s Ministry of Internal Affairs and Communications reports that over 60% of operators are hesitant to adopt digital solutions due to fears of data breaches and system vulnerabilities. Moreover, the absence of standardized cybersecurity measures across the region complicates implementation, forcing companies to invest heavily in securing their systems. These challenges limit the seamless adoption of laboratory automation among risk-averse stakeholders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.31% |

|

Segments Covered |

By Type, Equipment and Software, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

QIAGEN (Germany), Thermo Fisher Scientific Inc. (U.S.), Siemens Healthineers AG (Germany), Danaher Corporation (U.S.), Agilent Technologies, Inc. (U.S.), Eppendorf SE (Germany), Hudson Lab Automation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Hamilton Company (U.S.), BMG LABTECH GmbH (Germany). |

SEGMENTAL ANALYSIS

By Type Insights

The modular automation dominated the Asia Pacific laboratory automation market by holding 60.4% of the total share in 20,24, owing to its flexibility, scalability, and cost-effectiveness by making it an ideal choice for laboratories with diverse operational needs. One major factor is the growing demand for customizable solutions. China’s Ministry of Science and Technology highlights that over 70% of biotechnology companies prefer modular systems to integrate into existing workflows without requiring a complete overhaul. Similarly, India’s Department of Biotechnology reports that modular automation reduces setup costs by up to 30% by enabling smaller facilities to adopt advanced technologies.

The whole lab automation segment is lucratively growing with a CAGR of 12.5% in txt coming years. This growth is fueled by the increasing need for fully integrated systems to handle complex workflows in high-throughput environments. A key factor is the rise of large-scale research initiatives. Japan’s Ministry of Education, Culture, Sports, Science and Technology highlights that over 50% of pharmaceutical companies are adopting whole lab automation to accelerate drug discovery processes. Similarly, South Korea’s Ministry of Health and Welfare emphasizes the role of these systems in reducing human error and improving reproducibility in clinical diagnostics.

By Equipment and Software Type Insights

The automated clinical laboratory systems segment held 45.3% of the largest share of the Asia Pacific laboratory automation market in 2024. One key factor is the rising burden of chronic diseases. The International Agency for Research on Cancer reports that cancer cases in the region are projected to increase by 50% by 2030, which is creating a pressing need for faster and more accurate diagnostic tools. According to Thailand’s Ministry of Public Health, automated systems reduce processing times for medical tests by up to 40%, which is improving patient outcomes. Another factor is the focus on cost optimization.

The automated drug discovery laboratory systems segment is expected to grow with a CAGR of 14.2% during the forecast period. This growth is fueled by the increasing emphasis on accelerating drug development processes to meet global healthcare demands. A significant factor is the rise of precision medicine. According to South Korea’s Ministry of Food and Drug Safety, over 60% of pharmaceutical companies are integrating automated systems to analyze genetic and molecular data, enabling personalized treatment plans. Similarly, Australia’s National Health and Medical Research Council emphasizes the use of robotics in high-throughput screening to test thousands of compounds simultaneously, reducing time and costs. Another factor is the focus on innovation. Vietnam’s Ministry of Science and Technology reports that automated drug discovery systems enhance R&D capabilities, which is boosting demand in emerging economies.

By End User Insights

The biotechnology and pharmaceutical companies segment accounted in holding 50.4% of the Asia Pacific laboratory automation market share in 202,4, with automation accelerating drug discovery, development, and production processes. One key factor is the exponential growth of the biopharmaceutical industry. According to China’s National Health Commission, over 70% of biotech firms are adopting automated systems to streamline research workflows and improve productivity. Similarly, India’s Department of Pharmaceuticals reports that automation reduces errors in drug formulation by up to 25% by ensuring compliance with regulatory standards. Another factor is the focus on innovation. Japan’s Ministry of Economy, Trade and Industry notes that automated systems enable companies to bring new drugs to market faster by enhancing competitiveness and profitability.

The research and academic institutes segment is projected to grow with a CAGR of 13.8% in the coming years. This growth is fueled by the increasing emphasis on scientific research and collaboration across industries. A significant factor is the rise of government-funded research initiatives. According to Australia’s Department of Education, over 60% of universities are investing in automated systems to enhance research capabilities and attract global talent. Similarly, Singapore’s Agency for Science, Technology and Research emphasizes the role of automation in supporting interdisciplinary projects, further accelerating adoption.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China led the Asia Pacific laboratory automation market with 30.4% of the share in 202,4, with its status as a global leader in biotechnology and pharmaceutical research, supported by robust government funding and innovation policies. The Chinese Academy of Sciences reports that over 70% of biotech companies in the country have adopted automated systems to streamline workflows and improve efficiency. Additionally, China’s Belt and Road Initiative promotes cross-border research collaborations by creating demand for scalable and advanced laboratory automation solutions.

Japan laboratory automation market held 20.3% of the share in 2024. The country’s rapid adoption of laboratory automation is driven by its advanced technological expertise and aging population, which necessitates innovative healthcare solutions. Japan’s Ministry of Health, Labour and Welfare highlights that over 60% of clinical laboratories use automated systems to enhance diagnostic accuracy and reduce processing times. Furthermore, Japan’s focus on precision medicine has accelerated the adoption of AI-driven automation technologies by ensuring steady growth in demand.

South Korea's laboratory automation market is expected to grow with its robust electronics and healthcare industries. The Ministry of Food and Drug Safety emphasizes the adoption of automated drug discovery systems to accelerate pharmaceutical research and development. Additionally, South Korea’s emphasis on reducing operational costs and improving efficiency ensures widespread adoption of laboratory automation technologies by aligning with global standards. Australia's laboratory automation market growth is driven by its focus on healthcare innovation and environmental sustainability, driving laboratory automation adoption. The Department of Industry, Science and Resources highlights the use of automated systems to reduce resource consumption and waste in research facilities. Additionally, Australia’s vast network of universities and research institutes necessitates scalable solutions to ensure safe and efficient operations in remote areas. The Indiana laboratory automation market is expected to grow with the biotechnology and pharmaceutical sectors. According to the Department of Biotechnology, over 50% of R&D facilities are integrating automated systems to accelerate drug discovery and development processes. Additionally, India’s focus on affordable healthcare solutions has fueled the transition to cost-effective and scalable automation systems, further boosting demand.

KEY MARKET PLAYERS

QIAGEN (Germany), Thermo Fisher Scientific Inc. (U.S.), Siemens Healthineers AG (Germany), Danaher Corporation (U.S.), Agilent Technologies, Inc. (U.S.), Eppendorf SE (Germany), Hudson Lab Automation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Hamilton Company (U.S.), BMG LABTECH GmbH (Germany). Are the market players that are dominating the Asia Pacific laboratory automation market?

Top Players in the Market

Thermo Fisher Scientific

Thermo Fisher Scientific is a global leader in laboratory automation, with a significant presence in the Asia Pacific market. The company’s contribution to the global market lies in its advanced automated systems and software solutions, which cater to diverse industries such as biotechnology, pharmaceuticals, and healthcare. Thermo Fisher’s focus on innovation ensures that its solutions align with regulatory standards while meeting customer demands for efficiency and accuracy. Its commitment to sustainability and technological advancement has positioned it as a trusted partner for organizations seeking scalable and reliable laboratory automation technologies.

Agilent Technologies

Agilent Technologies plays a pivotal role in advancing laboratory automation through its comprehensive suite of equipment and software solutions. Known for its robust portfolio of automated clinical and drug discovery systems, Agilent empowers laboratories in the Asia Pacific region to enhance productivity and reduce operational costs. The company’s emphasis on integrating AI-driven analytics enhances decision-making and operational efficiency.

PerkinElmer Inc.

PerkinElmer Inc. is renowned for its innovative approach to laboratory automation, making it a key player in the Asia Pacific market. Through platforms like automated liquid handling and high-throughput screening systems, PerkinElmer offers tailored solutions for research and diagnostic applications. The company’s dedication to improving workflow efficiency and reducing human error has strengthened its global reputation.

Top Strategies Used by Key Players in the Market

Strategic Partnerships and Collaborations

Key players in the market frequently engage in partnerships with research institutions, healthcare providers, and government agencies to co-develop tailored solutions. These collaborations help companies address specific regional challenges, such as precision medicine and drug discovery. By leveraging local expertise and resources, firms can enhance their product offerings and strengthen their market position by ensuring alignment with regional priorities.

Investment in AI and IoT Technologies

To meet the dynamic needs of end-users, companies are investing heavily in integrating artificial intelligence (AI) and the Internet of Things (IoT) into their platforms. For instance, manufacturers are developing AI-driven predictive maintenance systems and IoT-enabled devices to monitor equipment performance and prevent failures. This focus on innovation not only differentiates brands but also aligns with the growing demand for efficient and sustainable solutions in the region.

Expansion into Emerging Markets

Players are increasingly targeting emerging economies within the Asia Pacific region, such as Vietnam, Indonesia, and Thailand, where industrialization and healthcare demands are driving adoption. By establishing local manufacturing facilities and distribution networks, companies aim to reduce costs and improve accessibility.

COMPETITION OVERVIEW

The Asia Pacific laboratory automation market is characterized by intense competition, with both global giants and regional players vying for dominance. Global leaders like Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements, with companies striving to integrate AI, IoT, and cloud computing into their offerings. Additionally, stringent regulatory frameworks governing data privacy have compelled manufacturers to innovate continuously. Supply chain disruptions and cybersecurity threats add complexity, forcing players to adopt agile strategies. As a result, the market fosters an environment of constant evolution, where differentiation through innovation, customer-centric approaches, and strategic expansion becomes critical for sustained success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Thermo Fisher Scientific launched a new AI-driven platform specifically designed for genomic research in South Korea. This move aimed to capitalize on the country’s growing focus on precision medicine by enhancing Thermo Fisher’s market presence in the region.

- In June 2023, Agilent Technologies partnered with a leading Australian biotech firm to develop automated drug discovery systems for cancer research. This collaboration strengthened Agilent’s visibility in the region’s pharmaceutical sector and expanded its customer base.

- In September 2023, PerkinElmer Inc. acquired a local robotics startup in Singapore to expand its production capabilities for high-throughput screening solutions. This acquisition enabled the company to better serve Southeast Asia’s burgeoning research market and increase its regional footprint.

- In January 2024, Roche Diagnostics, a Swiss healthcare provider, introduced a suite of automated clinical laboratory systems tailored for hospitals in Japan. This initiative aligned with the country’s push toward faster diagnostics, allowing Roche to position itself as a leader in innovative healthcare technologies.

- In November 2023, Beckman Coulter, a U.S.-based laboratory automation provider, signed an agreement with a Philippine university to develop specialized research tools for academic institutes. This partnership reinforced Beckman Coulter’s dominance in precision research technology and expanded its application portfolio.

MARKET SEGMENTATION

This research report on the Asia Pacific laboratory automation market is segmented and sub-segmented into the following categories.

By Type

- Modular Automation

- Whole Lab Automation

By Equipment and Software Type

- Automated Clinical Laboratory Systems

- Workstations

- LIMS (Laboratory Information Management Systems)

- Sample Transport Systems

- Specimen Handling Systems

- Storage Retrieval Systems

- Automated Drug Discovery Laboratory Systems

- Plate Readers

- Automated Liquid Handling Systems

- LIMS (Laboratory Information Management Systems)

- Robotic Systems

- Storage Retrieval Systems

- Dissolution Testing Systems

By End User:

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How is the demand for high-throughput testing and precision diagnostics driving automation adoption in APAC clinical and research labs?

Examine how rising healthcare needs, especially post-pandemic, and advancements in genomics are pushing labs in countries like Japan, South Korea, and India to adopt robotics and workflow automation.

What regulatory and quality assurance frameworks impact laboratory automation system implementation across different APAC countries?

Explore how compliance with standards such as ISO 15189 (medical labs), IVD directives, and local healthcare regulations affects system validation, data logging, and instrument integration.

How are APAC laboratories addressing interoperability challenges in integrating legacy instruments with next-gen automation platforms?

Understand the technical and operational complexities of harmonizing LIS/LIMS systems with robotic devices and smart analyzers in both public and private sector labs.

In what ways is automation helping laboratories in emerging APAC economies overcome workforce shortages and reduce human error?

Analyze the impact of automation on accuracy, turnaround time, and workforce reallocation in resource-constrained environments like Indonesia, Thailand, and Bangladesh.

How are sustainability goals influencing the design and procurement of automated lab systems in the Asia-Pacific region?

Delve into how green lab initiatives, energy-efficient automation, and waste-reduction protocols are reshaping purchasing decisions in countries with aggressive ESG targets like Australia and Singapore.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]