Asia Pacific Laboratory Filtration Market Size, Share, Trends & Growth Forecast Report By Technology, Product, End User and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Laboratory Filtration Market Size

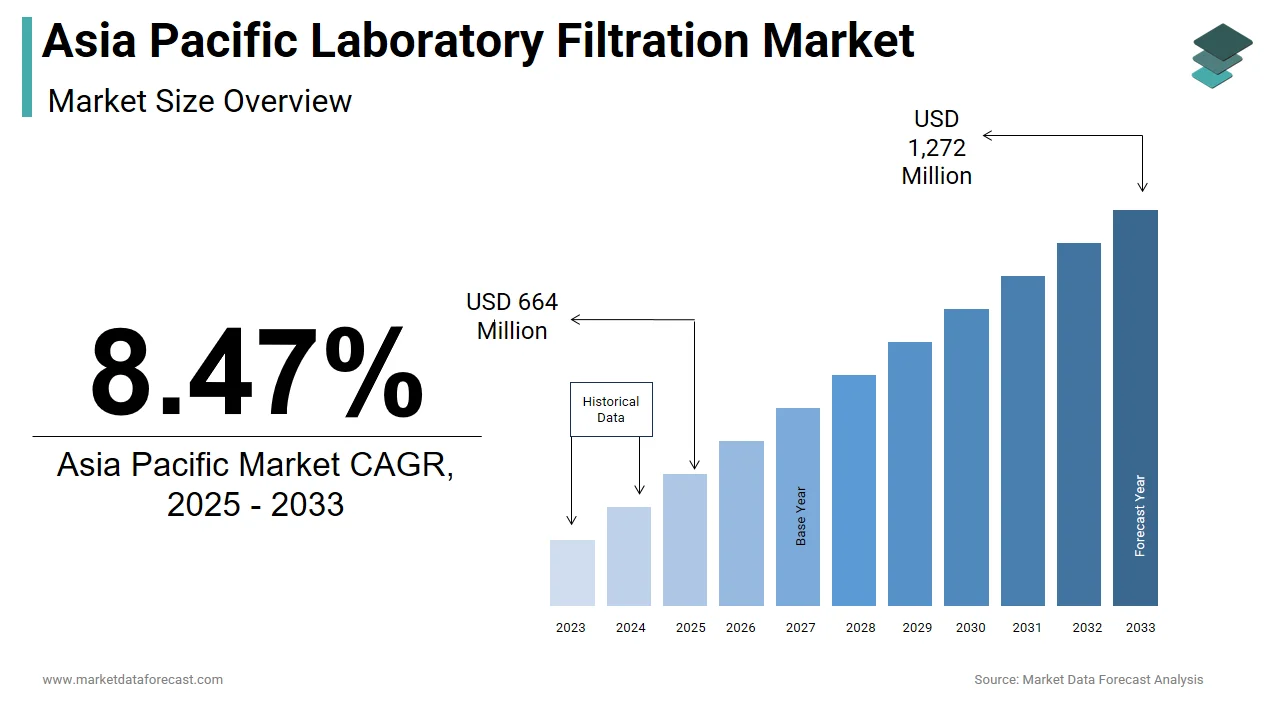

The size of the Asia Pacific laboratory filtration market was worth USD 612 million in 2023. The Asia Pacific market is anticipated to grow at a CAGR of 8.47% from 2025 to 2033 and be worth USD 1,272 million by 2033 from USD 664 million in 2025.

MARKET DRIVERS

Increased Research and Technological Advancements Boosting Market Growth

An increase in the research activities in pharmaceuticals and biotechnology research and development and research and academic institutes is driving the market growth for laboratory filtration. Also, the rise infiltration used in clinical laboratories is expected to drive the market growth of laboratory filtration.

The demand for laboratory filtration is increasing significantly over the past two decades. The increase in the new developments and innovation in the technology and products also plays a massive role in increasing the market growth. In addition, the increase in the usage of filtration in clinical labs due to technological developments has and will always experience significant changes. Furthermore, many novel laboratory filtrations and new techniques have been introduced due to illness research and fundamental pathophysiology.

Increased Use of Filtration Methods and Microfiltration Driving Market Growth

Furthermore, laboratory workers are educated to focus on technical performance and achieve and maintain the highest quality test findings provided in laboratories. As a result, the increased use of filtering methods in clinical labs is propelling the market expansion of laboratory filtration.

Furthermore, microfiltration has led the APAC laboratory filtration market. It is widely employed in different sectors for cold sterilization of enzymes and other ingredients and the separation of solid-liquid phases. Microfiltration has a high separation capacity and does not require any extra solvents, making the process more straightforward to use and maintain. Chemical resistance and excellent thermal stability factors driving microfiltration adoption in the industry analyzed.

MARKET RESTRAINTS

Regulatory Challenges and High Costs Restricting Market Growth

The approval process for the filtration process is too tedious and time-consuming. In addition, the stringent government policies make the product's entry more difficult and limit the market growth. Also, the increase in the high costs of the specialized filters with the reusable filters affects the development of the laboratory filtration market.

GEOGRAPHICAL ANALYSIS

Geographically, the Asia Pacific market is the fastest-growing market in laboratory filtration. It is estimated to have a significant increase in the forecasted years due to the rise in government and non-government initiatives and funding’s for the research activities. Moreover, influential pharmaceutical and biotech R&D organizations and essential research and academic institutes, which are significant users of filtration products, are expanding the market growth. China, Japan, and India are the region's most important contributors.

China's laboratory filtration market is expected to have the highest share of the laboratory filtration market during the projected period. The market is predicted to expand due to increased discoveries and breakthroughs in lab filtration products that are simple to implement and maintain, driving demand. Also, filtering product manufacturers have been established, such as pharmaceutical and biotechnology firms, the food and beverage sector, hospitals and diagnostic laboratories, and academic and research organizations are the end-users of this market.

KEY MARKET PLAYERS

Top Companies dominating the Asia Pacific Laboratory Filtration Market Profiled in the Report are Merck Millipore and Pall Corporation, GE Healthcare, Sartorius Group, 3M Purification Inc., Thermo Fisher Scientific Inc., Cantel Medical Corporation, Cuno, Dow Water & Process Solutions, FilmTec Corporation, GE Healthcare, and Sigma-Aldrich Corporation.

MARKET SEGMENTATION

This Asia Pacific laboratory filtration market research report is segmented and sub-segmented into the following categories.

By Technology

- Ultrafiltration

- Microfiltration

- Nano filtration

- Reverse Osmosis

By Product

- Assembly

- Filter Paper

- Membrane

- Syringe Filters

- Filtration Microplate

- Accessories

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Academic & Research Institutes

- Food & Beverage Companies

- Hospital & Diagnostic Laboratories

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com