Asia Pacific Lancet and Pen Needles Market Research Report – Segmented By Type (Standard Pen Needles, Safety Pen Needles), Length, Setting, Application, Mode of Purchase, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Lancet and Pen Needles Market Size

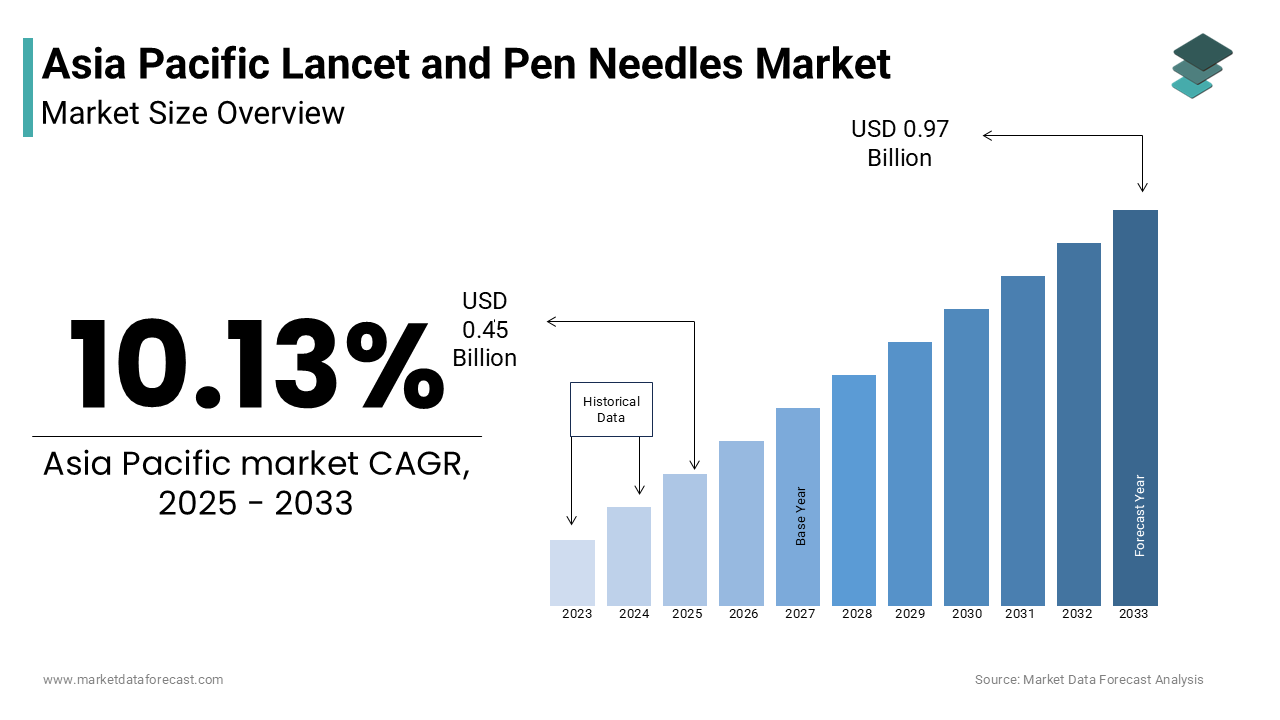

The Asia Pacific lancet and pen needles market was worth USD 0.41 billion in 2024. The Asia Pacific market is expected to reach USD 0.97 billion by 2033 from USD 0.45 billion in 2025, rising at a CAGR of 10.13% from 2025 to 2033.

Lancets are small and sharp devices designed to puncture the skin for capillary blood sampling while pen needles are ultra-thin and short needles attached to insulin pens for self-administration of insulin doses. These tools are integral components of daily diabetes management and play a crucial role in enabling patient autonomy, convenience and adherence to treatment regimens. India alone accounts for more than 74 million diabetic individuals thereby necessitating widespread use of blood glucose monitoring systems and insulin delivery devices. In China, over 141 million adults suffer from diabetes thus further amplifying the demand for lancets and pen needles. Japan's aging demographic has also contributed significantly with the National Institute for Health and Nutrition estimating that over 11 million Japanese citizens require insulin therapy. The usage of lancets and pen needles continues to grow across urban and rural healthcare settings in the Asia Pacific region with rising awareness around glycemic control and increasing adoption of home-based care models.

MARKET DRIVERS

Surge in Prevalence of Diabetes Across Urban and Rural Populations

Exponential rise in diabetes prevalence is one of the primary drivers of the Asia Pacific lancet and pen needles market which directly correlates with increased demand for self-monitoring of blood glucose (SMBG) and insulin injection tools. The Asia Pacific region accounts for nearly 50.35% of the global diabetic population with countries like India, China and Indonesia witnessing alarming increases in both type 1 and type 2 diabetes cases. In Indonesia, the number of diabetes patients rose from 10 million in 2018 to over 16 million in 2023 thereby creating a substantial need for regular lancet and pen needle usage. Similarly, in the Philippines, one out of every ten adults now suffers from diabetes hence reinforcing the necessity for frequent blood sugar testing and insulin administration. The proliferation of community-based screening programs and mobile health initiatives has further facilitated early diagnosis and long-term disease management thereby driving sustained consumption of these essential diabetic care accessories across the Asia Pacific.

Heightened Awareness and Adoption of Self-Care Management Tools Among Diabetic Patients

Growing emphasis on diabetes self-management education and home-based care solutions is another significant driver shaping the growth of the Asia Pacific lancet and pen needles market. Public health campaigns, digital health platforms and government-backed initiatives have played a pivotal role in promoting patient empowerment through self-monitoring and self-injection practices. In Thailand, the Ministry of Public Health launched the "Diabetes Smart Living" program in 2022 encouraging patients to adopt SMBG techniques using lancets and portable glucometers. Similarly, in South Korea, the Korean Diabetes Association partnered with telehealth providers to distribute self-care kits containing pen needles and glucose monitors thereby contributing to a notable rise in home-based insulin administration. In Vietnam, the Ministry of Health endorsed mobile clinics equipped with free lancets and training for patients where hospital access remains a challenge in rural areas. This initiative has led to improved disease control and increased product uptake. In Malaysia, over 60.33% of diabetic patients in urban centers now prefer managing their condition at home which is supported by accessible and affordable lancet and pen needle supplies.

MARKET RESTRAINTS

Limited Reimbursement Policies and High Out-of-Pocket Expenditures in Lower-Income Countries

Inadequate reimbursement structure and high personal financial burden significantly hinder the growth of the Asia Pacific lancet and pen needles market. In several emerging economies such as the Philippines, Bangladesh and Myanmar public health insurance schemes offer minimal or no coverage for consumables like lancets and pen needles thus forcing patients to bear the entire cost themselves. Over 60.19% of healthcare expenses in Indonesia are paid out-of-pocket thereby limiting access to essential diabetes supplies. The Indonesian Diabetes Association found that many patients resort to reusing lancets or skipping insulin injections due to financial constraints. Similarly, in Nepal over 20.23% of diabetic patients can afford regular lancet and pen needle replacements which led to compromised hygiene and increased risk of infections. The procurement of lancets and pen needles is often not included under basic coverage even in semi-urban regions of India where government health insurance schemes exist. The Indian Journal of Endocrinology and Metabolism states that cost barriers severely restrict glycaemic control in lower-income groups while hampering the overall growth potential of this market in resource-constrained settings across the Asia Pacific.

Regulatory Hurdles and Stringent Quality Control Standards for Medical Device Approval

The complex regulatory landscape governing medical device approval and distribution is another major constraint affecting the Asia Pacific lancet and pen needles market. Several countries in the region impose rigorous compliance requirements thereby causing delays in product registration and market entry for manufacturers. In China, the National Medical Products Administration mandates multi-tiered clinical evaluations and quality audits before approving new lancets or pen needles which delays commercialization by up to 18 months. In South Korea, the Ministry of Food and Drug Safety requires foreign manufacturers to conduct additional trials even if products are already approved in other jurisdictions thus discouraging smaller players from entering the market. India still faces bottlenecks in regulatory processing despite recent reforms. One-fifth of lancet and pen needle applications face rejection due to non-compliance with updated safety regulations. These procedural complexities hinder innovation diffusion and limit patient access to diverse product options across the Asia Pacific region which ultimately constrains market expansion.

MARKET OPPORTUNITIES

Expansion of E-Commerce Platforms for Medical Devices Distribution

Rapid growth of e-commerce platforms specializing in medical devices and consumables is an emerging opportunity driving the Asia Pacific lancet and pen needles market. Digital health startups, online pharmacies and logistics networks are increasingly facilitating easy access to lancets and pen needles in remote and underserved regions. In India, platforms like PharmEasy and 1mg reported a 300.45% increase in lancet and pen needle sales during the pandemic thereby indicating strong consumer preference for home delivery services. Similarly, in Indonesia, the Ministry of Health collaborated with Gojek and Tokopedia to enhance last-mile delivery of chronic care supplies including insulin needles. In Japan, MedTech firm Terumo expanded its direct-to-consumer model via Amazon Japan resulting in a significant uptick in retail-level pen needle sales. These developments reflect a broader shift toward digital-first healthcare access while offering manufacturers an alternative route to scale their reach and meet the growing demand for lancets and pen needles across the Asia Pacific.

Rising Demand for Needle-Free and Minimally Invasive Alternatives Driving Innovation

A compelling opportunity shaping the Asia Pacific lancet and pen needles market is the growing interest in needle-free and minimally invasive alternatives for blood glucose monitoring and insulin administration. Conventional lancets and pen needles remain dominant but advancements in microneedle technologies, continuous glucose monitors (CGMs) and jet injectors are influencing market dynamics and prompting traditional manufacturers to innovate. In Singapore, biomedical research institutions have been actively developing microarray patches for glucose sensing supported by funding from the Agency for Science, Technology and Research (A*STAR). In South Korea, companies like Celltrion and SillaJen have invested in wearable insulin delivery systems that reduce reliance on disposable needles. Additionally, in Australia Dexcom’s expansion of CGM technology into the Asia Pacific has prompted a parallel evolution in complementary devices thereby including precision lancets optimized for ease of use. More than 45.31% of surveyed diabetics in Japan expressed willingness to adopt needle-free alternatives if they improve comfort and accuracy. This evolving landscape presents an opportunity for existing players to integrate smart technologies as well as refine product designs and cater to changing patient preferences while ensuring continued relevance and growth in the Asia Pacific lancet and pen needles market.

MARKET CHALLENGES

Patient Non-Compliance Due to Fear of Pain and Discomfort

One of the foremost challenges affecting the Asia Pacific lancet and pen needles market is patient reluctance to perform routine blood glucose testing and insulin injections due to fear of pain and discomfort. Technological improvements in needle design have made many users especially children and elderly patients are experience anxiety related to repeated skin punctures. Over 35.39% of diabetic patients in Malaysia admitted to skipping glucose tests because of pain associated with traditional lancets. In Indonesia, the Indonesian Diabetes Association reported that fear of needles was a primary reason for poor adherence to insulin therapy among newly diagnosed patients. In Japan, where the aging population is substantial the elderly patients frequently reuse lancets to avoid frequent finger pricks thereby increasing the risk of infection and suboptimal readings. Moreover, in Australia over 40.3% of respondents preferred needle-free alternatives if available.

Environmental Concerns and Medical Waste Disposal Issues Associated with Single-Use Lancets and Pen Needles

Growing concern over environmental impact and improper disposal of single-use sharps is a significant challenge facing the Asia Pacific lancet and pen needles market. The volume of biohazardous waste generated has become a pressing public health and ecological issue with millions of diabetic patients relying on daily lancets and insulin injections. Improper disposal of medical sharps including used lancets and pen needles has contributed to contamination of landfills and water bodies in densely populated cities such as Jakarta, Mumbai and Manila. In response, some governments have introduced stricter waste management regulations. In South Korea, the Ministry of Environment mandated new guidelines for safe disposal of home-generated sharps thus increasing logistical burdens for consumers. Similarly, in Australia the Department of Health initiated public awareness campaigns urging proper segregation and recycling of lancet containers. However, these measures complicate user experience and may discourage consistent use of lancets and pen needles unless manufacturers develop more sustainable and eco-friendly alternatives tailored to the Asia Pacific market.

SEGMENTAL ANALYSIS

By Type Insights

The standard pen needles segment dominated the Asia Pacific lancet and pen needles market by capturing 62.3% of total market share in 2024. The continued dominance of this segment is primarily due to its widespread availability, cost-effectiveness and long-standing adoption across both urban and rural diabetic patient populations. These economies rely heavily on budget-conscious healthcare solutions where access to advanced alternatives remains limited among lower-income groups. Similarly, public hospitals prescribe standard pen needles in second and third-tier cities where medical expenditure is closely monitored. Moreover, manufacturers have not aggressively pushed for safety needle adoption in many parts of the region due to regulatory inertia and pricing constraints. Only 20.84% of diabetic patients in Southeast Asia are currently using safety pen needles due to a lack of awareness and higher price points compared to standard variants. This entrenched preference for conventional products continues to sustain the top position of the standard pen needles category.

The safety pen needles segment is projected to witness a fastest CAGR of 11.8% between 2025 and 2033. This accelerated growth is driven by increasing awareness around injection-related injuries, regulatory emphasis on safer diabetes care practices along with rising physician advocacy for patient and caregiver protection. In Japan, the Ministry of Health, Labour and Welfare has mandated the gradual replacement of standard needles with safety-engineered versions in clinical settings thus prompting a surge in product demand. Over 60.71% of new insulin prescriptions now include recommendations for safety pen needles thereby reflecting strong institutional backing. Additionally, in Australia, the Therapeutic Goods Administration has endorsed safer injection practices leading to increased procurement by both public and private health facilities. In South Korea, companies like Ypsomed and BD have launched educational campaigns targeting healthcare providers and caregivers which further boost adoption. Newly diagnosed patients are increasingly opting for these safer and slightly more expensive alternatives because of rising disposable incomes and expanding insurance coverage.

By Length Insights

The 8mm pen needles segment was the largest in the Asia Pacific lancet and pen needles market by capturing 55.09% of total market share in 2024. 8mm variants remain widely used among adult populations requiring deep subcutaneous fat penetration for effective insulin absorption even as the trend toward shorter needles continues to grow. A significant proportion of insulin-dependent adults in China and Thailand continue to use 8mm needles due to familiarity and ease of handling. In Malaysia, over 70.35% of insulin users have no discomfort using 8mm needles thus reinforcing their continued usage. In India, only 15.19% of diabetic patients receive formal training on insulin administration and with rising obesity rates and low awareness of optimal injection techniques this contributes to continued reliance on traditional long needles. Additionally, generic manufacturers in countries like Vietnam and Indonesia continue to produce and distribute 8mm needles at competitive prices while making them more accessible to cost-sensitive consumers. This combination of historical prescribing habits which are limited clinician intervention and affordability ensures that the 8mm segment retains its dominant position in the regional market.

The 5mm pen needles segment is estimated to register the fastest CAGR of 12.5% between 2025 to 2033. Shorter needle lengths are gaining rapid traction due to their proven safety profile as well as reduced pain perception and suitability for pediatric and elderly patients. In Japan, the Japanese Diabetes Association has actively promoted the use of 5mm needles to minimize lipohypertrophy and ensure accurate dosing. In South Korea, the Korean Diabetes Association conducted nationwide awareness programs showcasing the benefits of shorter needles thus resulting in a notable increase in adoption. Insulin injection errors decreased by 22.57% after switching to 5mm needles. In Australia healthcare providers are encouraging patients to adopt smaller-gauge shorter needles for convenience and comfort as digital health platforms provide real-time glucose monitoring integration. These behavioral and clinical shifts are driving robust growth in the 5mm pen needles segment across the Asia Pacific region.

By Setting Insights

The home care setting accounts segment held the leading share of 70.98% of the Asia Pacific lancet and pen needles market in 2024. This dominance is driven from the chronic nature of diabetes which necessitates daily self-monitoring and insulin administration outside of clinical environments. Over 90.23% of all insulin injections and blood glucose tests in the Asia Pacific are performed at home thereby emphasizing the critical role of home-based management in disease control. In India, over 60 million individuals manage diabetes independently at home thus relying on regular supplies of lancets and pen needles. Moreover, government initiatives promoting home-based care models have gained momentum. In China, the National Health Commission introduced guidelines in 2022 advocating for greater patient independence in managing metabolic disorders thereby boosting home supply chain distribution. In Japan and Australia, telehealth services now routinely include home delivery options for consumables thereby ensuring consistent access for aging populations. The home care segment continues to consolidate its dominance in the Asia Pacific lancet and pen needles market with increasing digitalization and mobile health support.

While the home care setting segment is likely to experience a fastest CAGR of 11.3% from 2025 to 2033. This dual distinction reflects a confluence of factors including enhanced patient education, technological advancements in home-use devices and expanded digital health infrastructure. A key driver behind this growth is the rising number of community-based diabetes management programs. In Singapore, the Ministry of Health launched the "Healthier SG" initiative in 2023 thereby encouraging home-based care and regular self-monitoring which has led to an increase in lancet and pen needle prescriptions issued directly to households. Similarly, in South Korea, the Korean Centers for Disease Control emphasized telemedicine-driven follow-ups which reduces clinical visits and increase reliance on home testing kits. Another contributing factor is the proliferation of e-pharmacy platforms and direct-to-consumer medical device sales. In Indonesia, Gojek Health partnered with local suppliers to enable doorstep delivery of lancets and insulin needles thereby significantly improving accessibility in rural areas. Online sales of diabetes consumables in Southeast Asia doubled between 2021 and 2023 thus indicating a structural shift toward home-based care.

By Application Insights

The application of lancets and pen needles in Glucagon-Like Peptide-1 (GLP-1) therapy constitutes a rapidly emerging segment within the Asia Pacific market though it does not yet represent the largest overall application area. However, it is witnessing strong uptake due to the surging adoption of GLP-1 receptor agonists for diabetes and weight management purposes. Prescriptions for GLP-1 analogues such as semaglutide and liraglutide grew by nearly 150.23% in the Asia Pacific region between 2021 and 2023 which is directly influencing demand for associated delivery systems. In Japan, the Pharmaceuticals and Medical Devices Agency approved multiple GLP-1 therapies thereby prompting a corresponding increase in pen needle usage. Over 30.16% of new diabetes prescriptions in urban clinics now include GLP-1-based injectables many of which require precise and repeatable delivery mechanisms. In Australia the Department of Health noted a spike in pen needle sales aligned with the increased prescription of GLP-1 receptor agonists particularly among younger demographics as Ozempic and Wegovy gained popularity beyond their original therapeutic indications. Moreover, private insurers and pharmacy benefit managers have started covering related consumables thus further facilitating adoption.

The GLP-1 therapy application segment is predicted to witness the highest CAGR of 14.2% between 2025 and 2033. This remarkable growth trajectory is fueled by the expanding off-label use of GLP-1 receptor agonists for weight loss coupled with increasing approvals and commercialization of biologic treatments across the region. In South Korea where demand for aesthetic and metabolic health interventions is particularly high sales of GLP-1 analogues tripled in 2023. This spike in drug consumption has naturally translated into the heightened need for complementary injection tools such as pen needles. Similarly, in Singapore, the Ministry of Health observed a notable rise in prescriptions for semaglutide-based therapies thereby prompting major pharmaceutical brands to launch bundled packages including dosage pens and compatible needles. In China, where the prevalence of obesity and prediabetes is climbing rapidly and major hospital chains have incorporated GLP-1 therapy into their diabetes treatment protocols which is further normalizing injectable interventions. The GLP-1 therapy-linked lancet and pen needles market is positioned for exponential growth with global pharma giants investing heavily in APAC expansion and digital marketing strategies targeting middle-class consumers seeking weight management solutions.

By Mode of Purchase Insights

The over-the-counter (OTC) purchase segment was the largest segment and held 58.97% of the Asia Pacific lancet and pen needles market share in 2024. This dominance is attributed to the widespread presence of retail pharmacies along with longstanding consumer trust in physical purchasing channels and the absence of stringent prescription requirements for these consumables in several countries. In Indonesia, lancet and needle purchases occur at neighborhood pharmacies where customers prefer immediate access without waiting for online deliveries. Moreover, in China many older diabetic patients continue to buy medical supplies in person despite the rise of digital commerce and cite reliability concerns regarding online vendors. Only 30.18% of consumers aged above 60 years prefer purchasing lancets online thereby reinforcing the enduring relevance of physical outlets. The OTC segment remains the cornerstone of the regional market for lancets and pen needles with government initiatives supporting decentralized healthcare access and a strong retail footprint across tier-2 and tier-3 cities.

The online purchase segment is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 13.4% between 2025 to 2033. This accelerated growth is being driven by the rapid expansion of e-health platforms as well as increased smartphone penetration and the convenience offered by doorstep delivery services. In India, e-pharmacy registrations grew by 90.71% in 2023 thereby coinciding with a surge in online orders for regular-use medical supplies like lancets and pen needles. Platforms such as 1mg, Netmeds and PharmEasy have introduced subscription models enabling patients to receive monthly deliveries thus enhancing adherence to self-care routines. Similarly, in South Korea where digital health infrastructure is highly developed and teleconsultation apps now integrate automatic reordering systems for diabetes consumables thereby streamlining access and reinforcing repeat purchases. In addition, cross-border e-commerce is playing a role in expanding access in markets like Malaysia and Thailand, where imported brands of lancets and safety needles are becoming more accessible through platforms like Amazon and Alibaba.

REGIONAL ANALYSIS

India was the top performer in the Asia Pacific lancet and pen needles market and accounted for 24.61% of the regional market share in 2024. The demand for blood glucose monitoring and insulin administration tools remains consistently high with a staggering diabetic population exceeding 74 million. The Central Ministry of Health has recognized diabetes as a national priority under the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) which has facilitated increased distribution of lancets and pen needles through subsidized channels. Furthermore, the rise in private healthcare spending and the proliferation of affordable glucometer brands have encouraged more patients to adopt regular self-monitoring.

China was positioned second in holding the dominant share of the Asia Pacific lancet and pen needles sector market in 2024. A rapidly aging population combined with a high incidence of lifestyle-related diseases has fueled the demand for diabetes management tools. Over 141 million Chinese citizens suffer from diabetes with a large proportion requiring regular blood glucose testing and insulin injections. The government’s push towards universal health coverage has resulted in increased reimbursement for consumables although coverage for lancets and pen needles remains inconsistent across provinces. China remains a formidable force shaping the regional market dynamics with the rollout of smart city initiatives integrating diabetes care into primary health services.

Japan’s lancet and pen needles market is likely to grow at a healthy CAGR in next coming years. Japan experiences a disproportionately high burden of diabetes with over 11 million individuals on insulin therapy. The country’s well-developed healthcare system ensures broad access to diagnostic and therapeutic tools which are supported by national policies that promote early detection and continuous disease management. The Ministry of Health, Labour and Welfare has actively endorsed the use of integrated diabetes care systems which include lancets and pen needles as essential components. Furthermore, Japan’s universal health insurance scheme provides partial reimbursement for consumables thereby encouraging regular usage among diabetic patients.

Australia’s lancet and pen needles market growth is driven by its well-established healthcare infrastructure and high prevalence of diabetes. Over 1.3 million Australians require insulin therapy thereby making lancets and pen needles integral to daily disease management. The country’s robust reimbursement framework ensures that patients have access to subsidized supplies and contributing to consistent market growth. Additionally, Australia’s proactive approach to diabetes education and prevention has led to increased adoption of self-monitoring techniques particularly among younger and tech-savvy populations.

South Korea’s lancet and pen needles market growth is likely to have the fastest growth opportunities in the next coming years. Propelled by its advanced healthcare ecosystem, rising diabetic prevalence and strong policy support for home-based care. Over 5 million South Koreans live with diabetes and the number has been steadily increasing due to changing dietary habits and sedentary lifestyles. The Korean Diabetes Association has been instrumental in promoting standardized self-management guidelines which include routine blood glucose testing and insulin administration using lancets and pen needles.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

BD (Becton, Dickinson and Company), Novo Nordisk A/S, Ypsomed Holding AG, B. Braun Melsungen AG, HTL-STREFA S.A., Terumo Corporation, Artsana S.p.A., Owen Mumford Ltd., Allison Medical, Inc., UltiMed, Inc., Medtronic Plc, ARKRAY Inc., Nipro Corporation, Hindustan Syringes and Medical Devices Ltd., Jiangsu Huida Medical Instruments Co., Ltd., Nanchang Yili Medical Instrument Co., Ltd., Phoenix Healthcare Solution LLC, and Cardinal Health.

The competition in the Asia Pacific lancet and pen needles market is marked by the coexistence of global giants and an increasing number of regional manufacturers while creating a dynamic and multi-layered competitive landscape. International players such as BD, Roche and Terumo dominate due to their strong brand recognition along with technological expertise and established supply chains. However, emerging domestic firms are gaining traction by offering cost-effective alternatives tailored to the affordability and accessibility needs of local populations. In developed markets like Japan and Australia competition revolves around product innovation as well as enhanced safety features and integration with digital health solutions. Companies strive to differentiate themselves through ergonomic designs, reduced pain perception and compatibility with smart glucometers and insulin delivery systems. In contrast, in emerging economies such as India and Indonesia price sensitivity remains a critical factor thereby prompting both global and local brands to introduce budget-friendly options without compromising quality. Additionally, the rise of e-commerce and direct-to-consumer sales channels has intensified rivalry among players seeking to expand their reach beyond traditional retail outlets. Ongoing investments in marketing, regulatory compliance and localized customer support further contribute to the evolving nature of this highly fragmented market. As demand for diabetes management tools continues to grow competitiveness will hinge on a blend of technological advancement, which is pricing strategy and effective market penetration techniques.

Top Players in the Asia Pacific Lancet and Pen Needles Market

BD (Becton, Dickinson and Company) is one of the leading players in the Asia Pacific lancet and pen needles market. The company maintains a strong presence across multiple countries in the region by offering a diverse range of high-quality lancets and pen needles designed for patient comfort and ease of use. BD is known for its emphasis on safety-engineered products that reduce needle-stick injuries and align with global healthcare standards. Its extensive distribution network and continuous investment in product innovation have enabled BD to maintain a dominant position while catering to both clinical and home-care settings.

Another key player is Terumo Corporation, a Japanese multinational medical device manufacturer with deep regional expertise. Terumo's product portfolio includes ultra-thin pen needles and precision-engineered lancets tailored for diabetic patients who require frequent self-monitoring and insulin injections. The company’s strategic focus on user-centric design combined with its long-standing relationships with healthcare providers in Japan and neighboring markets which has allowed Terumo to capture a substantial share of the APAC market. It also collaborates with local governments and institutions to promote safer injection practices.

F. Hoffmann-La Roche Ltd, commonly known as Roche, plays a vital role in shaping the Asia Pacific lancet and pen needles market through its integration of diagnostic and therapeutic solutions. Roche supplies compatible lancets and pen needles that are designed to work seamlessly with its monitoring devices. The company’s commitment to diabetes care ecosystems ensures that its lancet and needle offerings remain integral components of its broader health management strategy. Roche leverages its global R&D capabilities and digital health initiatives to enhance consumer engagement and improve patient adherence to treatment regimens across the Asia Pacific region.

Top Strategies Used by Key Market Participants

Product differentiation through advanced design and usability enhancements is a key strategy employed by major players in the Asia Pacific lancet and pen needles market. Companies are continuously innovating to develop thinner, shorter and less painful needles that cater to the evolving needs of diabetic patients. These improvements not only enhance user experience but also encourage better compliance with regular blood glucose monitoring and insulin administration.

Another notable approach is expanding distribution networks through partnerships with local distributors and e-commerce platforms. Given the vast and diverse nature of the Asia Pacific region many manufacturers are collaborating with regional healthcare providers and online retailers to ensure widespread availability of lancets and pen needles. This strategy enables them to penetrate remote and underserved markets more effectively.

Investing in diabetes awareness programs and clinician education initiatives has become a crucial tactic for sustaining long-term growth. Leading companies engage in training sessions, workshops and public campaigns to educate both healthcare professionals and patients on the benefits of using high-quality lancets and pen needles. By fostering trust and improving knowledge which strengthens brand loyalty and drives greater adoption across the region.

RECENT MARKET DEVELOPMENTS

- In March 2024, BD (Becton, Dickinson and Company) launched a dedicated lancet and pen needle manufacturing facility in Malaysia.

- In May 2024, Terumo Corporation introduced a new line of ultra-short pen needles in South Korea specifically designed for pediatric and elderly diabetic patients.

- In July 2024, Roche Diabetes Care partnered with a leading Indian telehealth platform to integrate lancet and pen needle prescriptions into virtual consultation workflows.

- In September 2024, Novo Nordisk expanded its collaboration with local pharmacies in Vietnam to increase awareness and availability of branded pen needles.

- In November 2024, Ypsomed entered into a strategic agreement with a major Australian pharmacy chain to distribute its next-generation pen needles directly to consumers.

MARKET SEGMENTATION

This research report on the Asia Pacific lancet and pen needles market is segmented and sub-segmented into the following categories.

By Type

- Standard Pen Needles

- Safety Pen Needles

By Length

- 8mm Pen Needles

- 5mm Pen Needles

By Setting

- Home Care Settings

By Application

- Glucagon-Like Peptide-1 (GLP-1) Therapy

By Mode of Purchase

- Over-the-Counter (OTC) Purchase

- Online Purchase

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the growth outlook for the Asia Pacific lancet and pen needles market?

The market is expected to experience significant growth due to rising diabetes prevalence, increased self-monitoring practices, and growing awareness of minimally invasive devices.

What trends are driving this market forward?

Key trends include rising adoption of insulin pens, increasing demand for painless and safety-engineered lancets, and government programs for diabetes care and screening.

What is the competitive outlook for this market?

The market is becoming increasingly competitive with the entry of local low-cost manufacturers, as well as multinational companies investing in product innovation and distribution partnerships.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com