Asia Pacific LiDAR Market Size, Share, Trends & Growth Forecast Report By Type (Airborne, Terrestrial, Mobile & UAV), Application, Component, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific LiDAR Market Size

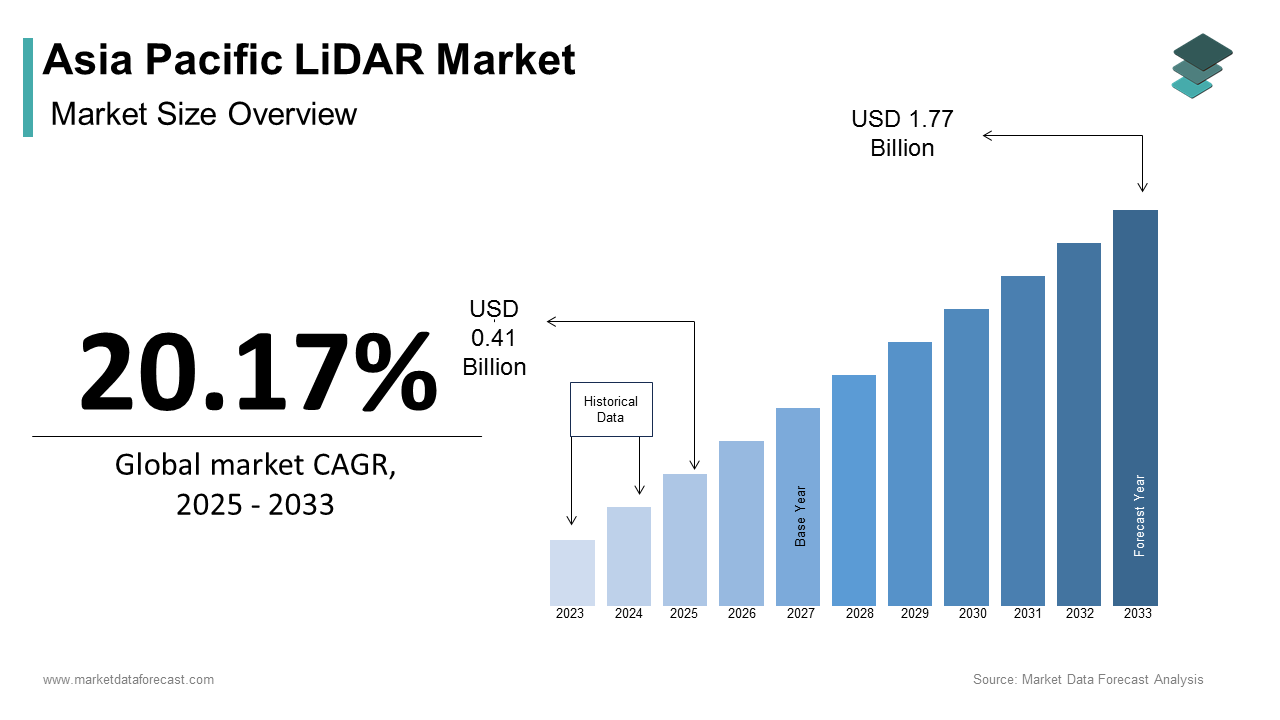

The Asia Pacific LiDAR market size was calculated to be USD 0.34 billion in 2024 and is anticipated to be worth USD 1.77 billion by 2033, from USD 0.41 billion in 2025, growing at a CAGR of 20.17% during the forecast period.

The Asia Pacific LiDAR market is experiencing robust growth, driven by its applications in urban planning, agriculture, and autonomous vehicles. Additionally, the rise of precision agriculture is amplifying demand. Furthermore, advancements in drone technology are propelling airborne LiDAR systems. These trends reflect the strong presence of the market amid escalating technological and industrial needs.

MARKET DRIVERS

Expansion of Smart Cities

The proliferation of smart cities is a primary driver of the Asia Pacific LiDAR market and is fueled by the need for precise geospatial data. Like, a substantial amount has been invested in smart city projects across the region, with LiDAR playing a pivotal role in urban mapping and infrastructure development. For example, Singapore’s Smart Nation initiative relies on LiDAR for 3D city modeling, ensuring efficient resource allocation and disaster management. Government mandates further amplify adoption. In India, the Smart Cities Mission has mandated LiDAR-based surveys for over 100 cities, reducing project timelines by 40%, according to the Ministry of Housing and Urban Affairs. Additionally, advancements in mobile LiDAR systems have made them cost-effective for urban planners, driving widespread use.

Adoption of Autonomous Vehicles

The growing demand for autonomous vehicles is another key driver, with LiDAR being integral to navigation and obstacle detection.

For instance, Baidu’s Apollo project in China integrates LiDAR sensors for real-time mapping. Similarly, South Korea’s Hyundai Motor Group has partnered with LiDAR manufacturers to enhance its autonomous driving capabilities.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

One of the primary restraints hindering the Asia Pacific LiDAR market is the high upfront cost of advanced systems. This financial barrier is particularly pronounced in countries like Bangladesh and Myanmar, where government budgets for geospatial projects are limited. Additionally, private sector investments are constrained by long payback periods. These challenges create bottlenecks in market expansion, despite the availability of subsidies aimed at mitigating initial expenses.

Limited Awareness and Technical Expertise

Another significant restraint is the lack of awareness and technical expertise among end-users, particularly in Tier-II and Tier-III cities. A significant portion of businesses in these regions lack knowledge about LiDAR applications, resulting in underutilization or improper implementation. For example, in Vietnam, a notable share of LiDAR projects fail due to incorrect data interpretation or inadequate training. This issue is compounded by a shortage of skilled professionals capable of operating advanced systems. According to the Global Geospatial Industry Outlook, the absence of standardized training programs in emerging markets exacerbates the problem. Such gaps in awareness and expertise hinder widespread adoption, limiting the market’s growth potential.

MARKET OPPORTUNITIES

Integration with Artificial Intelligence

The integration of LiDAR with artificial intelligence (AI) presents a transformative opportunity for the Asia Pacific market. For instance, Japan’s National Institute of Advanced Industrial Science and Technology uses AI-enhanced LiDAR for disaster prediction, reducing response times. Similarly, the rise of smart agriculture is driving demand for AI-integrated LiDAR systems. Like, such systems can improve crop yield predictions, making them attractive for large-scale farming operations. These advancements position AI integration as a key avenue for expanding LiDAR adoption.

Expansion into Emerging Economies

Emerging economies like Vietnam, Indonesia, and the Philippines offer untapped opportunities for LiDAR manufacturers. Also, these countries are experiencing notable urbanization rates annually, creating demand for precise geospatial data. For example, Vietnam’s Ministry of Construction reports that a significant portion of new infrastructure projects now require LiDAR-based surveys to ensure accuracy and efficiency. Additionally, government initiatives to improve rural connectivity are driving demand for affordable LiDAR solutions.

MARKET CHALLENGES

Data Privacy and Security Concerns

Data privacy and security concerns pose a significant challenge to the Asia Pacific LiDAR market, particularly in densely populated urban areas. For instance, Australia’s Privacy Act mandates strict guidelines for geospatial data collection, increasing compliance costs for companies, as per the Office of the Australian Information Commissioner. Additionally, public skepticism about data misuse complicates project execution. A notable percentage of urban residents in Japan and South Korea are concerned about the confidentiality of LiDAR-derived data. These issues not only delay project timelines but also increase operational expenses, posing a critical barrier to market growth.

Supply Chain Disruptions and Raw Material Volatility

Supply chain disruptions and volatility in raw material prices represent another critical challenge for the Asia Pacific LiDAR market. According to the World Economic Forum, the ongoing semiconductor shortage has impacted the production of advanced LiDAR sensors, delaying deliveries and increasing costs. Similarly, fluctuations in rare earth elements, essential for sensor manufacturing, have created uncertainty. These challenges are compounded by geopolitical tensions and trade restrictions, which disrupt supply chains further. For instance, the U.S.-China trade war has led to tariff impositions on critical components, forcing manufacturers to seek alternative suppliers at higher costs. Such disruptions strain customer relationships and erode trust in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.17% |

|

Segments Covered |

By Type, Application, Component, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of Asia-Pacific |

|

Market Leaders Profiled |

Velodyne Lidar Inc., Trimble Inc., Teledyne Technologies Incorporated, FARO Technologies Inc., Leica Geosystems AG (Hexagon AB), RIEGL Laser Measurement Systems GmbH, Quanergy Systems Inc., Ouster Inc., Innoviz Technologies Ltd., RoboSense (Suteng Innovation Technology Co. Ltd.), Hesai Technology, Luminar Technologies Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The airborne LiDAR segment dominated the Asia Pacific market by capturing a 60.2% share in 2024. This leading position is due to its versatility in large-scale applications such as urban planning, disaster management, and environmental monitoring. For instance, China’s Ministry of Emergency Management relies on airborne LiDAR for flood risk assessments, achieving a substantial accuracy in mapping flood-prone areas. The proliferation of drone technology has further amplified adoption. Additionally, government initiatives like India’s Smart Cities Mission mandate airborne surveys for infrastructure projects, reducing project timelines. These factors collectively reinforce the segment's dominance in the market.

Terrestrial LiDAR is the fastest-growing segment, with a projected CAGR of 28% from 2025 to 2033. This growth is fueled by its precision in applications like autonomous vehicles and archaeology. For example, South Korea’s Hyundai Motor Group integrates terrestrial LiDAR for real-time obstacle detection in autonomous driving systems, achieving millimeter-level accuracy, as per the Korea Automotive Technology Institute. Similarly, Japan’s National Institute of Advanced Industrial Science and Technology uses terrestrial LiDAR for cultural heritage preservation, scanning ancient structures with unparalleled detail. Like, advancements in solid-state LiDAR sensors have reduced costs, making terrestrial systems more accessible. These innovations position terrestrial LiDAR as the segment with the highest growth potential.

By Application Insights

The engineering applications segment prevailed in the Asia Pacific LiDAR market, accounting for 55.4% of the share in 2024. This dominance is driven by the need for precise geospatial data in infrastructure development and urban planning. For instance, Singapore’s Land Transport Authority uses LiDAR for road network expansion, reducing project delays, according to the Urban Redevelopment Authority. Government mandates further amplify adoption. Additionally, the rise of smart cities has increased demand for engineering-grade LiDAR systems. A notable share of new urban infrastructure projects in Southeast Asia now rely on LiDAR for site planning, underscoring its critical role in shaping the market.

The environmental applications segment is the quickest surging category with a CAGR of 32%. This growth is driven by the increasing focus on climate change mitigation and natural resource management. Similarly, Vietnam employs LiDAR for soil erosion analysis, improving land management practices. A report notes that environmental LiDAR applications have grown annually in emerging economies, supported by international funding and sustainability goals. These trends position environmental applications as the segment with the highest growth trajectory.

By Component Insights

GPS systems was the top performer in the Asia Pacific LiDAR market by holding a 45.6% share in 2024. This is due to their critical role in ensuring accurate georeferencing for LiDAR data collection. Advancements in multi-frequency GPS technology have further enhanced adoption. Plus, modern GPS systems reduce geospatial errors, making them indispensable for large-scale projects. Additionally, the rise of autonomous vehicles has increased demand for high-precision GPS components.

The segment of navigation systems is emerging as a most lucrative category, with a projected CAGR of 35%. This growth is fueled by their integration into autonomous vehicles and drones. A study reveals that navigation-enabled LiDAR systems reduce operational costs, making them attractive for commercial applications. These advancements position navigation systems as the segment with the highest growth potential.

REGIONAL ANALYSIS

China led the Asia Pacific LiDAR market by commanding a 40.6% share in 2024. This dominance is driven by massive investments in smart city projects, with substantial amount allocated annually. Additionally, the rise of autonomous vehicles is amplifying demand for advanced LiDAR systems, positioning China as a key innovator in the region.

India contributes majorly to the regional market and is propelled by initiatives like the Smart Cities Mission and Pradhan Mantri Gram Sadak Yojana. According to the Ministry of Housing and Urban Affairs, over 100 cities now require LiDAR-based surveys for infrastructure projects, reducing timelines. Moreover, the adoption of precision agriculture is driving demand for affordable LiDAR solutions, attracting private sector investments.

Japan holds a notable market share which is driven by its focus on environmental and engineering applications. Like, a significant portion of national mapping projects integrate LiDAR for geospatial accuracy. Additionally, the country’s aging infrastructure has increased demand for LiDAR in renovation projects.

South Korea is propelled by its Green New Deal and advancements in autonomous vehicles. Also, LiDAR integration in self-driving cars has achieved millimeter-level accuracy, boosting adoption. The country’s commitment to carbon neutrality by 2050 is accelerating investments in environmental LiDAR applications.

This region contributes notably to the market that is driven by hybrid energy systems and environmental monitoring. Similarly, LiDAR is integral to coral reef mapping and bushfire management, achieving higher accuracy. Additionally, the push for net-zero emissions is fostering growth in both engineering and environmental segments.

LEADING PLAYERS IN THE ASIA PACIFIC LIDAR MARKET

Velodyne Lidar

Velodyne Lidar is a key innovator in the Asia Pacific LiDAR market, renowned for its advanced sensor technologies tailored for autonomous vehicles and smart city applications. The company has strengthened its presence through strategic partnerships with regional governments. Additionally, the company launched its Alpha Prime sensor, offering superior range and accuracy for engineering and environmental projects.

Quanergy Systems

Quanergy Systems is a prominent player in the region, specializing in solid-state LiDAR solutions for industrial and security applications. By partnering with local utilities, Quanergy has expanded its footprint in Tier-II cities, where demand for affordable yet efficient LiDAR systems is surging. Quanergy’s focus on innovation and localization has strengthened its reputation as a leader in smart infrastructure solutions.

Trimble Inc.

Trimble Inc. has established itself as a pioneer in terrestrial LiDAR systems, catering to both engineering and environmental sectors. The company also partnered with renewable energy firms in Australia to integrate LiDAR with AI-driven analytics, enhancing resource management. Through investments in R&D, Trimble has developed advanced GPS-integrated LiDAR systems, positioning itself at the forefront of geospatial innovation. These efforts highlight Trimble’s adaptability and commitment to meeting evolving market demands.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC LIDAR MARKET

Key players in the Asia Pacific LiDAR market employ strategies such as product innovation, strategic collaborations, and sustainability initiatives. Product innovation is central, with companies launching advanced LiDAR models tailored for autonomous vehicles, smart cities, and environmental applications. Strategic partnerships with governments and industries have been pivotal, enabling tailored solutions for diverse applications. Additionally, sustainability remains a core focus, with manufacturers adopting eco-friendly materials and promoting carbon-neutral operations. These strategies collectively enhance market penetration and customer engagement.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific LiDAR market include Velodyne Lidar Inc., Trimble Inc., Teledyne Technologies Incorporated, FARO Technologies Inc., Leica Geosystems AG (Hexagon AB), RIEGL Laser Measurement Systems GmbH, Quanergy Systems Inc., Ouster Inc., Innoviz Technologies Ltd., RoboSense (Suteng Innovation Technology Co. Ltd.), Hesai Technology, Luminar Technologies Inc.

The Asia Pacific LiDAR market is highly competitive, driven by technological advancements and increasing demand for precise geospatial data. Established players like Velodyne, Quanergy, and Trimble dominate through continuous innovation, while regional manufacturers offer cost-effective alternatives. The market is witnessing a surge in airborne and terrestrial LiDAR systems, creating opportunities for differentiation. Regulatory mandates promoting smart city development and environmental monitoring further intensify rivalry, pushing companies to invest in R&D. Additionally, emerging markets like Vietnam and Indonesia are attracting investments, fostering a dynamic competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Velodyne partnered with Singapore’s Land Transport Authority to deploy LiDAR systems for traffic monitoring, enhancing urban mobility solutions.

- In June 2023, Quanergy launched its M-Series sensors, targeting perimeter security applications in Australia and Japan.

- In January 2024, Trimble unveiled its X7 3D scanning system, designed for disaster management in India and Vietnam.

- In March 2024, Leica Geosystems introduced its BLK2FLY drone-based LiDAR system, offering scalable solutions for environmental mapping.

- In May 2024, Faro Technologies expanded its terrestrial LiDAR portfolio, integrating AI-driven predictive analytics for precision agriculture in Southeast Asia.

MARKET SEGMENTATION

This research report on the Asia Pacific LiDAR market has been segmented and sub-segmented based on type, application, component, and region.

By Type

- Airborne

- Terrestrial

- Mobile & UAV

By Application

- Corridor Mapping

- Engineering

- Environment

- Exploration

- ADAS

- Others

By Component

- GPS

- Navigation (IMU)

- Laser Scanners

- Others

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of the LiDAR market in Asia Pacific?

Growing demand for autonomous vehicles, smart city projects, and increased adoption in agriculture and defense are key drivers.

2. How are advancements in autonomous vehicles impacting the LiDAR market?

The demand for high-precision LiDAR sensors is increasing as autonomous vehicles rely heavily on LiDAR for navigation and obstacle detection.

3. Which types of LiDAR systems are gaining popularity in the Asia Pacific market?

Solid-state LiDAR and aerial LiDAR systems are increasingly popular due to their efficiency and versatility.

4. Who are the major players operating in the Asia Pacific LiDAR market?

Key players include Velodyne Lidar Inc., Trimble Inc., Teledyne Technologies Incorporated, and RoboSense.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]