Asia Pacific Light Tower Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Light Type, Fuel Type, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Light Tower Market Size

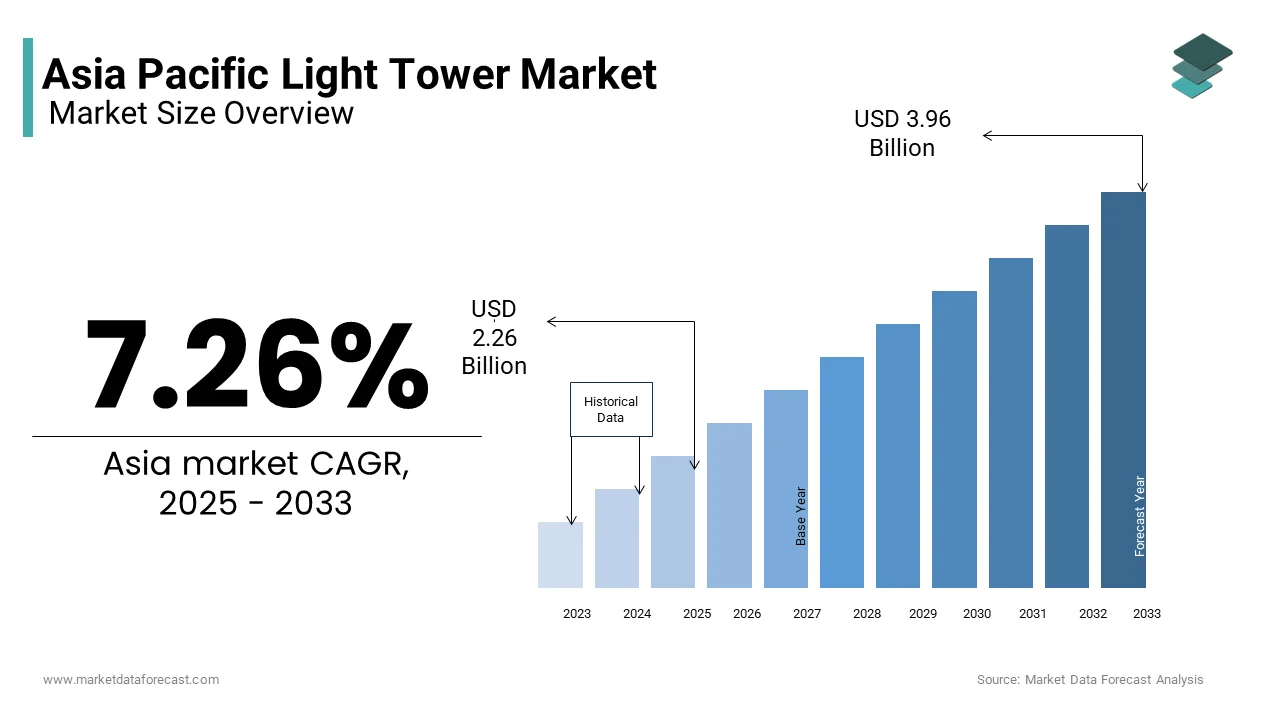

The Asia Pacific light tower market was valued at USD 2.11 billion in 2024 and is anticipated to reach USD 2.26 billion in 2025, from USD 3.96 billion by 2033, growing at a CAGR of 7.26% during the forecast period from 2025 to 2033.

Light towers, which are mobile units equipped with high-intensity lights powered by generators or renewable energy sources, have become indispensable in scenarios where permanent lighting infrastructure is unavailable or impractical. The region’s rapid urbanization and industrialization have significantly increased the need for reliable illumination in remote and challenging environments. Additionally, the region’s vulnerability to natural disasters.

MARKET DRIVERS

Expansion of Construction and Infrastructure Projects

The expansion of construction and infrastructure projects across the Asia Pacific region serves as a significant driver for the light tower market. With governments prioritizing urban development and connectivity, large-scale initiatives such as highways, airports, and smart city projects are underway, creating a surge in demand for temporary lighting solutions. For example, India’s Smart Cities Mission aims to develop 100 smart cities, with construction activities often extending into nighttime hours to meet deadlines. This necessitates the use of light towers to ensure safe and productive working conditions. Similarly, China’s Belt and Road Initiative has spurred infrastructure development not only domestically but also across neighboring countries, further amplifying the need for portable lighting systems. These developments are complemented by advancements in light tower technology, such as energy-efficient LED lights and solar-powered units, which align with sustainability goals. The integration of smart features, such as remote monitoring and automated brightness control, enhances operational efficiency, making light towers even more appealing to contractors.

Rising Demand in Mining and Oil & Gas Sectors

The mining and oil & gas sectors represent another major driver for the Asia Pacific light tower market, fueled by the region’s abundant natural resources and growing energy needs. Australia, for instance, is one of the world’s largest producers of coal and iron ore, with mining operations often located in remote areas lacking access to grid electricity. Light towers are essential for ensuring visibility and safety during extraction and processing activities, particularly during nighttime shifts. Similarly, countries like Indonesia and Malaysia are expanding their oil and gas exploration efforts, with offshore drilling platforms requiring specialized lighting solutions to operate efficiently. According to the International Energy Agency, the Asia Pacific region accounts for a significant portion of global energy consumption, underscoring the critical role of these industries in meeting regional demands. Besides, the increasing adoption of automation and digitalization in mining operations has created a need for advanced lighting systems capable of supporting sophisticated machinery and sensors. Innovations in light tower design, such as hybrid models that combine diesel generators with solar panels, offer cost-effective and environmentally friendly alternatives for remote sites.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

One of the primary restraints affecting the Asia Pacific light tower market is the high initial cost associated with purchasing and maintaining these units. Advanced light towers, particularly those equipped with energy-efficient LED lights or hybrid power systems, often come with a premium price tag due to their complex manufacturing processes and sophisticated components. For instance, hybrid light towers that integrate solar panels and battery storage systems require significant upfront investment, which can be prohibitive for small and medium-sized enterprises (SMEs). In addition, the maintenance costs of light towers, including routine servicing of generators, batteries, and lighting fixtures, add to the financial burden. This challenge is further exacerbated in developing nations within the region, where limited financial resources often prioritize cost-effective alternatives over advanced technologies.

Environmental and Regulatory Compliance Challenges

Another significant restraint impacting the Asia Pacific light tower market is the complexity of adhering to stringent environmental and regulatory standards. Governments across the region have implemented rigorous regulations to minimize the environmental impact of industrial equipment, including light towers. For example, emissions from diesel-powered generators used in traditional light towers are subject to strict limits under policies aimed at reducing air pollution. Complying with these regulations often requires manufacturers to invest in cleaner technologies, such as low-emission engines or fully electric models, which increase production costs. Apart from these, the lack of harmonized regulatory frameworks across the region creates operational inefficiencies for multinational companies. For instance, a light tower certified for use in Australia may not meet the specifications required in Japan, necessitating costly modifications.

MARKET OPPORTUNITY

Integration of Renewable Energy Solutions

The integration of renewable energy solutions presents a transformative opportunity for the Asia Pacific light tower market. With growing concerns about climate change and rising fuel costs, there is a heightened focus on developing sustainable alternatives to traditional diesel-powered light towers. Solar-powered and hybrid light towers, which combine solar panels with battery storage systems, are gaining traction due to their ability to reduce carbon emissions and operating costs. For instance, researchers at the National University of Singapore have pioneered advancements in photovoltaic technology, enabling the creation of lightweight and durable solar panels ideal for light tower applications. These innovations align with regional sustainability goals, such as Australia’s commitment to achieving net-zero emissions by 2050. Like, the Asia Pacific region leads the world in renewable energy capacity additions, with solar energy accounting for a significant share. Apart from these, the declining cost of solar panels and batteries makes renewable-powered light towers increasingly accessible, further unlocking growth potential in the market.

Expansion into Emerging Markets

The expansion into emerging markets represents another lucrative opportunity for the Asia Pacific light tower market. Countries like Vietnam, Bangladesh, and Myanmar are experiencing rapid economic growth, accompanied by a surge in infrastructure development and industrial activities. These developments create a fertile ground for light tower manufacturers to establish a foothold in untapped markets. Besides, regional trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) facilitate cross-border collaborations and reduce trade barriers, enabling companies to expand their reach more efficiently.

MARKET CHALLENGES

Competition from Alternative Lighting Solutions

Competition from alternative lighting solutions poses a formidable challenge to the Asia Pacific light tower market. Traditional fixed lighting systems, such as streetlights and floodlights, are increasingly being adopted in construction and mining sites due to their lower operational costs and ease of installation. For instance, permanent lighting systems powered by grid electricity are often preferred for long-term projects, as they eliminate the need for fuel or battery replacements. In addition, the emergence of drone-based lighting systems, which provide aerial illumination for short durations, is gaining popularity in emergency response and event management scenarios. According to a report by the Global Lighting Association, the adoption of alternative lighting solutions is expected to grow notably annually through 2030, driven by advancements in LED technology and wireless connectivity. These alternatives not only compete with light towers on cost but also offer greater flexibility in certain applications.

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity represent another critical challenge for the Asia Pacific light tower market. The production of high-quality light towers relies heavily on specialized raw materials such as aluminum, copper, and advanced polymers, which are often sourced from geographically concentrated regions. For example, China dominates the global supply of rare earth elements, which are integral to the manufacture of certain types of LED lights used in light towers. However, geopolitical tensions and trade restrictions have occasionally disrupted the availability of these materials, as noted by the International Monetary Fund. These disruptions are further compounded by the increasing demand for raw materials driven by other industries, such as automotive and electronics, leading to heightened competition and price volatility. For instance, the price of copper, a key component in electrical wiring, surged by over 40% in 2021 due to supply shortages, as reported by industry analysts. Such fluctuations create uncertainty for manufacturers, who must navigate these challenges while maintaining product quality and meeting customer expectations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.26% |

|

Segments Covered |

By Type, Light Type, Fuel Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Allmand Bros., Aska Equipments, Atlas Copco, Caterpillar, Doosan Portable Power, Generac Power Systems, Inmesol Gensets, J.C. Bamford Excavators, Larson Electronics, Multiquip, Trime, Wacker Neuson. |

SEGMENTAL ANALYSIS

By Type Insights

The sales segment dominated the Asia Pacific light tower market by capturing 60.9% of the total share in 2024. This dominance is driven by the region’s robust industrialization and infrastructure development, which necessitate long-term investments in durable equipment like light towers. A key factor fueling this leadership is the preference for ownership among large-scale industries, such as mining and construction, where operational control and customization are critical. For instance, Australia’s mining sector, which accounts for a major share of the country’s GDP, often opts for purchasing light towers to ensure reliability during extended projects. Also, government initiatives promoting rural electrification and disaster preparedness have spurred direct purchases of light towers. India’s Rural Electrification Corporation reports that a large number of rural households were connected to the grid under the Saubhagya Scheme, requiring temporary lighting solutions during installation phases.

The rental segment is emerging as the fastest-growing category in the Asia Pacific light tower market by registering a CAGR of 8.5% through 2033. This rapid expansion is fueled by the growing preference for cost-effective and flexible solutions among small and medium-sized enterprises (SMEs). Also, a pivotal driver is the rise of short-term projects, such as event management and disaster response, where renting light towers offers greater flexibility compared to outright purchases. For example, Southeast Asia’s booming tourism industry, which contributes majorly to the region’s GDP, frequently relies on rented light towers for outdoor events and festivals. Also, advancements in rental service models, such as pay-per-use and subscription-based offerings, have made light towers more accessible to smaller businesses. Moreover, intra-regional trade and collaboration have facilitated the growth of rental networks, enabling companies to expand their reach efficiently. Another contributing factor is the increasing adoption of hybrid and solar-powered light towers, which are often rented due to their high upfront costs.

By Light Type Insights

The metal halide light towers segment prevailed in the Asia Pacific market by commanding a share of 55% in 2024. This prominence stems from their widespread use in applications requiring high-intensity illumination, such as mining and construction. One critical driver is the established presence of metal halide technology, which has been the industry standard for decades. For instance, China’s Belt and Road Initiative has spurred infrastructure projects across Asia, many of which rely on metal halide light towers due to their proven reliability and affordability. Besides, the mining sector’s demand for robust lighting solutions further bolsters this segment’s dominance. According to the International Energy Agency, the Asia Pacific region accounts for a notable share of global mining activities, creating a steady demand for metal halide light towers. Another factor is the lower initial cost of metal halide systems compared to LED alternatives, making them attractive for budget-constrained projects. Despite the growing popularity of LEDs, metal halide remains a preferred choice for applications where upfront investment is a primary consideration.

The LED light towers segment is experiencing the highest growth rate, with a projected CAGR of 10.2%. This progress is propelled by the increasing emphasis on energy efficiency and sustainability. A key driver is the declining cost of LED technology, which has made it more accessible to a broader range of industries. For instance, the Bloomberg New Energy Finance reports that the cost of LED lights has decreased considerably since 2010, accelerating their adoption in sectors like construction and oil & gas. Also, the integration of smart features, such as remote monitoring and automated brightness control, enhances operational efficiency, making LED light towers more appealing to modern users. According to the United Nations Environment Programme, LED adoption aligns with regional sustainability goals, such as Japan’s commitment to achieving net-zero emissions by 2050. Furthermore, the growing demand for portable lighting solutions in urban areas, where space constraints limit permanent installations, drives the need for compact and energy-efficient LED light towers.

By Fuel Type Insights

The diesel-powered light towers segment represented the largest category in the Asia Pacific market by holding a market share of 50.8% in 2024. This leading position is attributed to their reliability and widespread availability, particularly in remote areas lacking access to grid electricity. A primary driver is the mining and oil & gas sectors, which require high-performance lighting solutions capable of operating in challenging environments. For example, Indonesia’s coal mining industry heavily relies on diesel-powered light towers due to their durability and ease of maintenance. In addition, the affordability of diesel fuel in many parts of the region makes these light towers a cost-effective choice for long-term projects. Another factor is the lack of infrastructure for alternative power sources in rural areas, where diesel generators serve as the primary energy source for light towers.

The solar/hybrid light towers segment is emerging as the swiftest advancing category, with a CAGR of 12.3%. This expansion is supported by the increasing focus on sustainability and reducing carbon footprints. A key factor is the declining cost of solar panels and battery storage systems, which has made hybrid solutions more economically viable. Besides, government policies promoting renewable energy adoption, such as Australia’s Renewable Energy Target, have accelerated the deployment of solar/hybrid light towers. According to Bloomberg New Energy Finance, the Asia Pacific region leads the world in renewable energy capacity additions, with solar energy accounting for a significant share. Furthermore, the versatility of hybrid systems, which combine solar power with diesel backup, makes them ideal for remote sites where reliability is critical.

By End-User Insights

The construction sector exhibited the largest end-user in the Asia Pacific light tower market by capturing a 40.8% of the total share in 2024. This influence is backed by the region’s rapid urbanization and infrastructure development, which necessitate extensive nighttime operations. A main aspect is the expansion of megaprojects, such as highways, airports, and smart cities, where construction timelines often extend into nighttime hours to meet deadlines. Apart from these, the increasing adoption of advanced construction techniques, such as prefabrication and modular building, requires consistent lighting to ensure precision and quality.

The events and sports segment is poised to become the fastest-growing end-user in the Asia Pacific light tower market, with a CAGR of 9.8% through 2033. This development is caused by the booming tourism and entertainment industries, which frequently host outdoor events and festivals requiring temporary lighting solutions. A key driver is Southeast Asia’s emergence as a global hub for concerts, sporting events, and cultural festivals. Also, advancements in event management technologies, such as wireless connectivity and smart lighting systems, enhance the appeal of light towers for event organizers. Like, international tourist arrivals in the region are projected to grow significantly annually through 2030, driving demand for innovative lighting solutions.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China stood as the leader in the Asia Pacific light tower market by commanding a 30.9% share in 2024. This is driven by its massive industrial base and infrastructure development initiatives. A key factor is the Belt and Road Initiative, which has spurred large-scale construction projects across Asia, creating a surge in demand for light towers. In addition, the country’s mining sector relies heavily on light towers for extraction and processing activities. The International Energy Agency highlights that China’s energy consumption patterns drive the adoption of efficient lighting solutions, further strengthening mmarketplace

India is a major market and is driven by its rapid urbanization and government-led infrastructure programs. A primary factor is the Smart Cities Mission, which aims to develop many smart cities by 2030, creating a steady demand for temporary lighting solutions. Additionally, the rural electrification drive under the Saubhagya Scheme has increased the need for portable lighting systems during grid installation phases.

Australia commands a notable share of the Asia Pacific light tower market. It is propelled by its thriving mining and oil & gas sectors. A key factor is the country’s abundant natural resources, which necessitate reliable lighting solutions for remote operations. Also, mining companies invested a substantial amount in equipment procurement in recent years, with light towers being a significant component. In addition, the government’s focus on renewable energy adoption has spurred the deployment of solar/hybrid light towers, aligning with sustainability goals. The Australian Renewable Energy Agency notes that a significant portion of the country’s energy mix comes from renewable sources, showing the importance of innovative lighting solutions.

Japan holds a significant position in the Asia Pacific light tower market. It is backed by its emphasis on technological innovation and disaster preparedness. A main factor is the country’s vulnerability to earthquakes and typhoons, which necessitates the deployment of portable lighting systems for emergency response. Like, the country experiences over 1,500 seismic events annually, creating a steady demand for light towers. Also, Japan’s commitment to achieving net-zero emissions by 2050 has accelerated the adoption of LED and solar-powered light towers.

South Korea accounts for a smaller share in the Asia Pacific light tower market, which is driven by its advanced manufacturing base and focus on sustainable energy solutions. A key factor is the country’s place in semiconductor and electronics manufacturing, which requires reliable power supply systems supported by high-quality light towers. In addition, South Korea’s push toward renewable energy integration, particularly in the solar and wind sectors, is driving demand for specialized lighting solutions. The International Renewable Energy Agency reports that South Korea’s renewable energy capacity grew notably over the past five years, further propelling market growth.

KEY MARKET PLAYERS

Allmand Bros., Aska Equipments, Atlas Copco, Caterpillar, Doosan Portable Power, Generac Power Systems, Inmesol Gensets, J.C. Bamford Excavators, Larson Electronics, Multiquip, Trime, and Wacker Neuson are the market players that are dominating the Asia Pacific light tower market.

Top Players in the Market

Atlas Copco

Atlas Copco is a global leader in the light tower market, renowned for its innovative and energy-efficient solutions tailored to diverse industrial needs. The company’s contribution to the global market lies in its ability to deliver high-performance light towers that cater to sectors such as mining, construction, and disaster response. Atlas Copco’s focus on sustainability is evident in its development of solar-powered and hybrid light towers, which align with global trends toward renewable energy adoption. By leveraging advanced technologies like LED lighting and remote monitoring systems, Atlas Copco ensures its products meet the stringent demands of modern applications.

Caterpillar Inc.

Caterpillar Inc. plays a pivotal role in shaping the Asia Pacific light tower market through its robust portfolio of durable and versatile lighting solutions. The company’s contributions to the global market stem from its expertise in designing light towers capable of withstanding harsh environmental conditions, making them ideal for mining and oil & gas operations. Caterpillar’s emphasis on innovation is reflected in its integration of fuel-efficient engines and advanced lighting technologies, ensuring optimal performance while minimizing environmental impact. By fostering partnerships with regional stakeholders and participating in large-scale infrastructure projects, Caterpillar continues to expand its influence.

Generac Power Systems

Generac Power Systems is a prominent player in the Asia Pacific light tower market, known for its customer-centric approach and cutting-edge product offerings. The company’s contributions to the global market are driven by its ability to provide cost-effective and scalable lighting solutions for industries such as construction, events, and emergency services. Generac’s focus on technological advancements, including hybrid power systems and smart connectivity features, enhances operational efficiency and user convenience. By expanding its manufacturing capabilities and localizing production, Generac ensures timely delivery and customization to meet regional preferences.

Top Strategies Used by Key Market Participants

Product Diversification and Innovation

Key players in the Asia Pacific light tower market are increasingly focusing on product diversification and innovation to address the unique demands of various industries. By developing specialized light towers, such as solar-powered units for remote sites or compact models for urban events, companies ensure their solutions cater to specific applications. Innovations like energy-efficient LED lights, hybrid power systems, and smart monitoring features enhance product appeal and functionality.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations have become a cornerstone for strengthening market positions. Companies are teaming up with regional governments, utilities, and private enterprises to supply light towers for large-scale infrastructure projects and disaster response initiatives. These alliances enable players to tap into emerging markets, gain insights into local requirements, and establish long-term relationships.

Expansion of Manufacturing and Service Networks

To meet the growing demand in the Asia Pacific region, key players are expanding their manufacturing facilities and service networks. Establishing localized production hubs reduces logistical costs and ensures faster delivery, which is critical for time-sensitive projects. Additionally, expanding service networks allows companies to provide timely maintenance and technical support, improving the overall customer experience.

COMPETITION OVERVIEW

The Asia Pacific light tower market is characterized by intense competition, driven by the presence of both global giants and regional players striving to capture market share. Leading companies leverage their technological expertise and extensive distribution networks to maintain dominance, while smaller firms focus on niche segments to carve out their positions. The competitive landscape is shaped by the rapid adoption of advanced technologies, such as solar-powered and hybrid systems, and the increasing demand for sustainable solutions. Innovation plays a central role, with companies investing heavily in R&D to differentiate their offerings. Additionally, collaborations with governments and industries are becoming increasingly common, enabling players to align with regional electrification goals. As environmental concerns and regulatory standards grow stricter, manufacturers are compelled to adopt sustainable practices, further intensifying competition.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Atlas Copco launched a new range of solar-powered light towers specifically designed for remote mining sites in Australia. This move underscored the company’s commitment to sustainability and its focus on meeting the unique needs of the mining sector.

- In May 2023, Generac Power Systems partnered with a leading construction firm in India to supply hybrid light towers for a major highway project. This collaboration strengthened Generac’s presence in the Indian market and highlighted its ability to deliver innovative solutions tailored to large-scale infrastructure projects.

- In July 2023, Wacker Neuson expanded its manufacturing facility in Thailand to cater to the growing demand for compact light towers in Southeast Asia. This expansion enabled the company to localize production and reduce delivery times for its regional customers.

- In September 2023, Caterpillar Inc. introduced a next-generation LED light tower with enhanced energy efficiency and durability. This innovation was targeted at the oil and gas sector, showcasing the company’s dedication to pushing technological boundaries and addressing industry-specific challenges.

- In November 2023, Doosan Portable Power signed an agreement with a government agency in the Philippines to supply light towers for disaster response initiatives. This partnership highlighted Doosan’s focus on contributing to regional resilience while expanding its customer base in the Asia Pacific region.

MARKET SEGMENTATION

This research report on the Asia Pacific light tower market is segmented and sub-segmented into the following categories.

By Type

- Sales

- Rental

By Light Type

- Metal Halide

- LED

By Fuel Type

- Diesel

- Solar/Hybrid

- Direct Power

By End-User

- Oil & Gas

- Mining

- Construction

- Events & Sports

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How are smart city and infrastructure projects boosting light tower demand in APAC?

Smart city rollouts and large-scale infrastructure initiatives—like India’s Bharatmala highways and Southeast Asia’s urban metro systems—require extended nighttime operations. This increases demand for mobile, high-lumen light towers to ensure worker safety and project continuity under low-light conditions.

What emission and energy standards are shifting the market toward LED and hybrid towers?

Tighter regulations on diesel emissions (e.g., Australia’s Tier 4 Final norms and Japan’s environmental codes) are pushing manufacturers and contractors toward LED, solar-hybrid, and battery-powered light towers. These solutions offer lower fuel consumption, longer runtime, and compliance with green building mandates.

How is rental growth driving innovation in light tower design and fleet use?

The rise in equipment rental—especially in mining-heavy regions like Australia and Indonesia—is leading to demand for durable, easy-to-transport light towers with features like auto start/stop, fuel monitoring, and telematics. Rental-friendly models reduce downtime and require minimal maintenance.

What deployment challenges exist in remote or rugged APAC regions?

Remote areas face issues like poor road access, lack of grid power, and extreme weather. This requires light towers that are compact, weatherproof, and capable of operating off-grid for extended periods, especially for oil & gas, mining, and emergency applications.

How is IoT improving efficiency and monitoring in modern light towers?

IoT integration enables real-time tracking of fuel levels, engine hours, GPS location, and maintenance schedules. This helps contractors reduce operational costs, avoid breakdowns, and optimize asset utilization, vital for large projects spanning multiple remote job sites.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]