Asia Pacific Male Grooming Products Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product Type, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Male Grooming Products Market

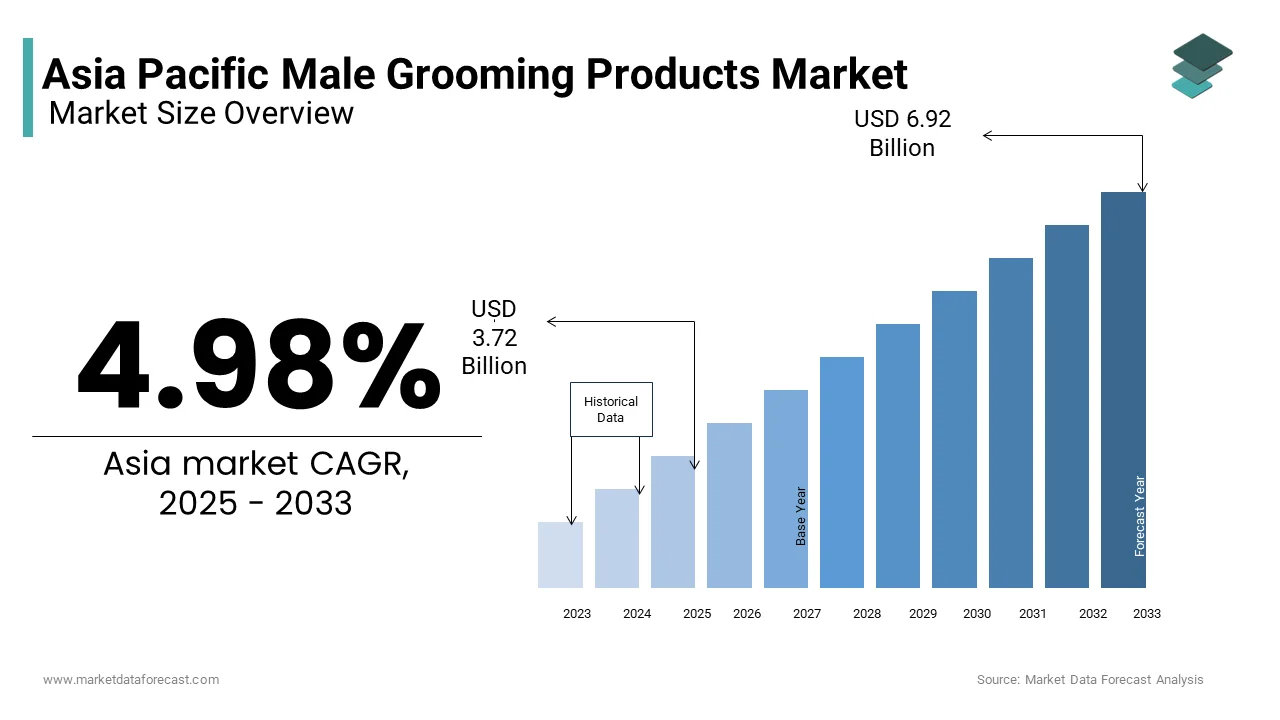

The Asia Pacific male grooming products market was valued at USD 3.50 billion in 2024 and is anticipated to reach USD 3.72 billion in 2025 from USD 6.92 billion by 2033, growing at a CAGR of 4.98% during the forecast period from 2025 to 2033.

The Asia Pacific male grooming products market is driven by growing demand for personal care products specifically designed for men and encompassing a wide range of items such as shaving essentials, hair styling products, skincare formulations, deodorants, and premium fragrances. This market has undergone significant transformation in recent years due to evolving perceptions of masculinity and the growing influence of celebrity culture and digital media. The market is now a thriving sector within the broader beauty and personal care industry. Social shifts in urban centers across India, South Korea, China, and Australia have contributed to a cultural shift toward self-expression through grooming. There has been a noticeable uptick in young Asian men’s willingness to invest in appearance-enhancing products with a strong emphasis on quality and brand image. Additionally, increasing participation of men in social media platforms such as Instagram, TikTok, and Xiaohongshu has led to greater exposure to grooming trends and product awareness. Brands are responding by launching gender-neutral or masculine-specific formulations that cater to distinct skin types and lifestyles. The rise of e-commerce platforms like Amazon India, Flipkart, and Alibaba has also made these products more accessible in tier-2 and tier-3 cities, where awareness was previously limited.

MARKET DRIVERS

Changing Social Norms and the Rise of Metrosexuality

One of the most powerful drivers fueling the growth of the Asia Pacific male grooming products market is the gradual dismantling of rigid gender norms around personal appearance. Traditional views that once linked grooming exclusively to femininity are rapidly being replaced by a more inclusive understanding of self-care. In particular, the concept of metrosexuality in men openly embracing fashion, skincare, and grooming has gained traction across major metropolitan hubs in countries like Japan, South Korea, and Australia. About 40.09% of men aged 18-35 in Singapore and Australia believe that grooming enhances their confidence and professional opportunities. This shift is even more pronounced in the younger demographic, where peer influence and digital content creators play a crucial role in shaping consumer behavior. For instance, YouTube tutorials and influencer-led reviews from male beauty gurus have normalized the use of facial cleansers, moisturizers, and even makeup among men. Moreover, corporate environments in cities like Shanghai and Sydney are increasingly valuing well-groomed appearances, thereby further reinforcing the need for men to maintain polished looks.

Expansion of E-commerce and Digital Marketing Platforms

The rapid proliferation of online shopping platforms and digital marketing strategies has played a critical role in expanding the reach of male grooming products across the Asia Pacific region. Countries like India, Indonesia, and the Philippines have seen exponential growth in internet penetration and smartphone adoption and allowing brands to engage consumers through personalized advertising, influencer partnerships, and direct-to-consumer sales models. Searches for men's skincare products increased by over 40.87% compared to the previous year, hencerepresentingn a rising interest in at-home grooming solutions. Digital-first brands such as Ustraa in India and Lab Series in Australia have leveraged this environment by investing heavily in SEO-driven content, mobile apps, and subscription-based services tailored to male users. These strategies have enabled them to bypass traditional retail limitations and create dedicated communities around male grooming. Additionally, the integration of AI-powered chatbots and virtual try-on features on e-commerce sites has enhanced customer experience and reduced hesitation around product selection.

MARKET RESTRAINTS

Persistent Cultural Stigma and Gender Stereotypes

Persistent cultural stigma and gender stereotypes remain one of the most significant restraints facing the Asia Pacific male grooming products market,,t despite progress in certain urban areas, as traditional views continue to discourage male vanity and appearance-focused behavior. In many rural and semi-urban regions of countries like Vietnam, Thailand, and parts of India, traditional masculinity norms discourage men from engaging in grooming activities beyond basic hygiene. This perception is particularly strong among older generations who often associate grooming with effeminacy or superficiality. In China, while younger urban males are increasingly open to skincare routines, parents and educators still rarely encourage grooming education as part of daily life. Middle school curricula in provincial towns are far less likely to include lessons on personal hygiene or skincare for boys compared to those in major cities like Beijing and Shanghai. This lack of normalization at formative stages continues to limit market penetration in large swaths of the population.

Limited Product Availability in Tier-2 and Tier-3 Cities

Limited product availability across different geographic tiers remains a major challenge hindering the growth of the Asia Pacific male grooming products market. While premium grooming products are readily accessible in capital cities and commercial hubs like Melbourne, Jakarta, and Seoul but they remain scarce in smaller towns and rural regions. Retail infrastructure in tier-2 and tier-3 cities often lacks specialized stores or trained personnel to guide consumers about male grooming options. Furthermore, supply chain inefficiencies and logistical constraints make it difficult for multinational and even domestic brands to establish consistent shelf presence outside major urban centers. Many manufacturers hesitate to invest in extensive distribution networks without clear evidence of sustained demand, nd thereby creating a cycle of limited exposure and low consumer engagement. Although e-commerce is helping bridge this gap yet issues such as low digital literacy, payment hesitancy, and inconsistent delivery services persist. The market may struggle to grow uniformly across all segments of the Asia Pacific region without a deliberate push to enhance offline retail presence alongside online accessibility.

MARKET OPPORTUNITIES

Rising Demand for Premium and Natural Ingredients-Based Male Grooming Products

A notable opportunity emerging within the Asia Pacific male grooming products market is the increasing preference for premium and naturally derived formulations. Consumers, especially those in urban centers, are becoming more conscious of ingredient transparency, sustainability, and ethical sourcing when selecting grooming essentials. Nearly half of male consumers in Australia and New Zealand now consider natural ingredients as an essential factor before purchasing grooming products, which signals a shift away from synthetic-heavy formulations. Brands emphasizing organic botanicals, cruelty-free testing, and eco-friendly packaging are gaining traction among environmentally aware buyers. In India and Southeast Asia, companies like The Man Company and Beardo have successfully tapped into this demand by offering ayurvedic-based beard oils, herbal face scrubs and sulfate-free shampoos tailored to men’s skin and hair needs. These products leverage indigenous herbs such as neem, tuls, and aloe ve, which resonate well with local consumer preferences. Simultaneously, luxury skincare brands are entering the fray by launching high-end men’s lines featuring marine extracts, fermented ingredients, and probiotic-infused formulas. Skincare-savvy consumers in Japan and South Korea are willing to pay a premium for products that promise long-term benefits beyond immediate freshness.

Integration of Smart Technology in Male Grooming Devices

The integration of smart technology into male grooming devices represents a transformative opportunity for the Asia Pacific market and is driven by the convergence of the beauty and tech industries. Consumers are showing increasing interest in connected grooming tools that offer precision, customization, and real-time feedback. Men are adopting smart grooming mirrors, Bluetooth-enabled razors, and AI-powered skincare analysts, especially in tech-forward markets like South Korea, Singapore, and Australia. These devices allow users to track shaving efficiency along with monitoring skin health,,h and receive tailored product recommendations via mobile applications. Companies are recognizing this shift and investing in R&D to develop intelligent grooming solutions. Xiaomi has launched a line of smart hair clippers and IPL hair removal devices specifically targeting male consumers seeking convenience and performance.

MARKET CHALLENGES

Intense Brand Competition and Market Saturation in Urban Areas

The Asia Pacific male grooming products market has experienced rapid growth, but one of its biggest challenges is the intense competition among brands vying for dominance in major urban centers. In cities like Tokyo, Sydney, and Mumbai, the market is becoming saturated with a multitude of established global players and emerging local startups, where each striving to capture consumer attention and loyalty. The average urban male consumer in these cities is exposed to over 20 different male grooming brands per month, thus leading to decision fatigue and fragmented brand allegiance. Established giants such as Gillette, Nivea and L’Oréal compete fiercely against agile D2C (direct-to-consumer) brands like Beardo, Ustraa and Manscaped which leverage digital marketing for faster scalability. This oversupply of options makes differentiation difficultultimatelyly promptingaggressive pricingg strategies and frequent promotional campaigns that can erode profit margins. Additionally, replicating successful business models has resulted in a homogenized product offer, which is reducing the ability of newer entrants tcarve outuniqueuee identities.

Regulatory Hurdles and Quality Standardization Issues

Regulatory complexities and inconsistent quality standards across different Asia Pacific countries pose a significant challenge for brands attempting to scale their male grooming product lines across the region. Each country has its own set of cosmetic regulations as well as labeling requirements and safety certifications, which makes cross-border expansion cumbersome and resource-intensive.In 2023, the Australian Therapeutic Goods Administration (TGA) introduced stricter guidelines for skincare products containing active ingredients that require additional clinical trials before approval. Meanwhile, in India, the Bureau of Indian Standards (BIS) updated its formulation restrictions for fragrance-based products, thereby compelling brands to reformulate their offerings to comply with local laws. These regulatory variations add operational complexity for small and medium-sized enterprises that lack the legal and compliance infrastructure to navigate multiple regulatory frameworks simultaneously. Moreover, inconsistent enforcement of counterfeit product controls in certain markets leads to brand dilution and consumer mistrust. In the absence of harmonized regulatory policies and ensuring consistent product launches and maintaining brand integrity across diverse jurisdictions continues to be a significant barrier to widespread market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.98% |

|

Segments Covered |

By Product Type, Distribution Channel, And By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

The Procter & Gamble Company, Unilever Plc, The Man Company, Bombay Shaving Company, Beiersdorf AG, Emami Group, Colgate-Palmolive Company, Vi-John Group, Shiseido Company, Limited, L'Oreal SA, Villain Lifestyle, Nourish Pvt. Ltd., Gentlemen's Crew, Maaj Holding (Uno). |

SEGMENTAL ANALYSIS

By Product Type Insights

The skincare products segment was the largest in the Asia Pacific male grooming market by capturing 37.98% of the total market share in 2024. This dominance is driven by a paradigm shift in how men perceive personal care, moving beyond basic hygiene to include targeted solutions for acne, aging, hyperpigmentation, and sun protection. Growing awareness around preventive skin care among young and working professionals is driving the market growth. In South Korea, over 50.71% of men aged 18–40 use at least two skincare products daily, with anti-pollution creams and sunscreen being top choices due to high urban pollution levels. Brands like L’Oréal Men Expert and Kiehl’s have capitalized on this insight by launching gender-specific lines with active ingredients such as hyaluronic acid and niacinamide. Moreover, dermatological validation adds another layer of trust. Consumers are increasingly confident in purchasing complex formulations like serums and toners tailored for male skin types, which tend to be oilier and thicker than female skin, as more brands collaborate with skin experts and conduct clinical trials.

The hair care segment is projected to witness the highest CAGR of 11.8% from 2025 to 2033. This rapid ascent is fueled by rising concerns over hair loss, dandruff, and styling demands among younger populations in emerging markets. In India, studies have indicated that a significant proportion of urban males experience hair fall at a relatively young age, which drives demand for shampoos, conditioners, and serums focused on hair strengthening and scalp health. The rise of short hairstyles that require grooming pastes, waxes, and sprays has further diversified the product landscape. Social media plays a pivotal role in shaping preferences. Platforms like TikTok and Instagram have made hairstyle trends highly visible and aspirational among Gen Z consumers in China, Japan, and the Philippines. Additionally, there has been a noticeable shift toward premium and natural ingredient-based formulations. Ayurvedic shampoos, keratin treatment, ts, and biotin-infused oils are gaining traction not only for their functional benefits but also for their alignment with the broader clean beauty movement sweeping across the region.

By Distribution Channel

The online retail stores segment was the largest in the Asia Pacific male grooming products market by capturing 39.09% of the total market share in 204 . This growth trajectory is primarily attributed to the expanding penetration of smartphones, affordable internet,n the convenience of doorstep delivery in densely populated countries like India and Indonesia. E-commerce platforms such as Amazon India, Flipkart RTT, and JD.com have invested heavily in digital marketing campaigns tailored specifically to male grooming categories. Availability of detailed product information and customer reviews helps overcome initial skepticism. Male consumers in urban areas prefer to read reviews and watch tutorial videos before making a purchase, showing the growing importance of digital transparency in the buying process. Further enhancing online appeal is the integration of AI-powered virtual try-ons and personalized recommendations. E-retailers are leveraging data analytics to offer customized regimens, thereby creating a seamless and informed shopping experience that traditional outlets often struggle to match.

The specialty stores segment is anticipated to witness the fastest CAGR of 10.4% from 2025 to 2033. Barbershops, male salons, and brand-owned concept stores are witnessing a revival and are driven by consumers' growing demand for immersive and expert-led grooming experiences. A key contributor to this growth is the resurgence of barber culture in Australia, South Korea, and Singapore, where modern barbershops blend grooming with lifestyle offerings such as coffee lounges and grooming consultations. These stores often serve as discovery points for niche or premium products that may not be available through mass retailers. In Japan, department store beauty counters see high footfall from men seeking advice on skincare routine,,s which leads to cross-purchase behavior and brand loyal ty. Additionally, these outlets provide a space for male bonding and community building, offering a contrast to the impersonal nature of online shopping. Specialty stores are transforming into cultural hubs rather than mere transaction points as experiential consumption rises and driving sustained growth.

COUNTRY-LEVEL ANALYSIS

India outperformed other regions in the Asia Pacific male grooming products market and accounted for 22.5% of regional market share in 2024. India is witnessing a seismic shift in consumer attitudes and is driven by youth demographics and aggressive digital penetration. Urban centers like Mumbai, Delhi, and Bangalore are home to a digitally savvy generation that actively engages with influencers and content creators who promote grooming as part of a holistic self-care routine. The Indian government’s push for digital payments and infrastructure development has also enabled greater access to e-commerce platforms.

China was positioned second in holding the dominant share of the Asia Pacific male grooming market in 2024. The country stands out for its advanced technological integration into grooming habits, where smart devices and AI-assisted diagnostics are becoming commonplace in men’s beauty routines. Chinese consumers in Tier-1 cities like Shanghai and Guangzhou are early adopters of premium skincare and high-performance shaving systems. Furthermore, collaborations between tech firms and beauty brands are introducing innovations such as skin-scanning mirrors and app-connected skincare tools.

Japan’s male grooming products market is likely to have significant growth opportunities during the forecast period while maintaining a mature yet evolving grooming ecosystem that blends tradition with innovation. Japan’s male grooming culture extends beyond basic hygiene to include multi-step skincare rituals and precision haircare. Japanese men are known for their preference for subtle and high-quality formulations that address specific concerns such as sebum control, hydration, and aging. Additionally, vending machines equipped with men’s deodorants and cooling lotions are common in train stations and office buildings, thereby catering to quick grooming needs.

South Korea’s male grooming products market is likely to grow with a healthy CAGR in the coming years. The nation continues to set global benchmarks in male grooming innovation and is largely influenced by the pervasive reach of K-pop and K-drama culture. Korean men exhibit high grooming engagement, which often involves adopting ten-step skincare routines similar to those followed by women. Brands like Lab Series, TonyMoly Men, and Neogen Dermalogy have capitalized on this enthusiasm by launching sleek and minimalist packaging that appeals to both style-conscious and performance-oriented users.

Australia's market growth is driven by a strong demand for premium and wellness-oriented male grooming products. This country prioritizes high-quality and ethically produced essentials reflecting consumer preferences for sustainability and luxury in personal care. Australian men are particularly drawn to natural and organic formulations. This preference has led to the success of local brands like Aesop and Frank Body, which emphasize botanical extracts and recyclable packaging. Wellness culture in Australia also intersects with fitness and sport, thereby encouraging men to prioritize skincare and post-workout grooming. The popularity of men’s spas and holistic grooming retreats underlines the evolving perception of grooming as a self-care practice rather than just a hygiene necessity.

KEY MARKET PLAYERS

The Procter & Gamble Company, Unilever Plc, The Man Company, Bombay Shaving Company, Beiersdorf AG, Emami Group, Colgate-Palmolive Company, Vi-John Group, Shiseido Company, Limited, L'Oreal SA, Villain Lifestyle, Nourish Pvt. Ltd., Gentlemen's Crew, Maaj Holding (Uno). These are the market players that are dominating the Asia Pacific male grooming products market.

Top Players in the Market

Unilever PLC

Unilever plays a pivotal role in shaping the Asia Pacific male grooming products market through its extensive portfolio of brands such as Axe/Lynx, Dove Men+Care, and TRESemmé. The company has successfully tailored its product offerings to align with evolving consumer perceptions around masculinity and self-care. Its strong distribution network across both urban and rural markets makes its products widely accessible in high-growth countries like India and Indonesia. Unilever continues to lead the transformation of male grooming from hygiene to holistic well-being through consistent innovation and brand storytelling.

Procter & Gamble (P&G)

P&G remains a dominant force in the Asia Pacific male grooming sector through flagship brands like Gillette, Old Spice, and Head & Shoulders. P&G has consistently elevated consumer expectations in terms of performance and sophistication. In the Asia Pacific region, the company has focused on adapting global innovations to suit local preferences in markets where beard care and scalp health have gained prominence. P&G has effectively redefined how men perceive personal care with strategic marketing campaigns that blend tradition with modernity.

L’Oréal S.A.

L’Oréal has emerged as a game-changer in the male grooming space by leveraging its deep understanding of skincare science and beauty technology. The company has introduced a new era of precision-driven grooming through brands like L’Oréal Paris Men Expert and Kiehl’s. L’Oréal's ability to merge luxury aesthetics with clinical efficacy has attracted a discerning demographic seeking high-performance products without compromising authenticity. The company has also embraced digital innovation by launching AI-powered skin diagnostics and personalized skincare recommendations tailored to men.

Top Strategies Used by Key Market Participants

One key strategy employed by leading players is intensive product personalization and customization. Brands are increasingly offering tailor-made solutions based on skin type, hair texture, and lifestyle factors to enhance consumer engagement and loyalty. This includes introducing modular product lines, mobile-based diagnostic tools, and subscription services that adapt to individual needs over time.

Another major approach is leveraging influencer marketing and content-driven branding. Companies are collaborating with male celebrities, fitness personalities, and digital creators to build relatable narratives around grooming. These partnerships help break down traditional gender barriers and position grooming as a confidence-boosting activity rather than a vanity-driven practice.

Expanding omnichannel retail ecosystems has become crucial for market leaders. By integrating offline and online experiences such as virtual consultations, click-and-collect services, and AI-enabled customer support, these brands are enhancing accessibility and convenience. This allows them to cater to diverse consumer preferences while ensuring seamless engagement across touchpoints in both metropolitan and emerging markets.

COMPETITIVE OVERVIEW

The competitive landscape of the Asia Pacific male grooming products market is highly dynamic, characterized by rapid product innovation, aggressive branding, and shifting consumer expectations. A diverse mix of global giants, regional incumbents, and digitally native startups is vying for dominance in what has become one of the fastest-evolving segments within the beauty and personal care industry. Multinational corporations offer financial strength along with well-established distribution networks and decades of R&D expertise,e, while domestic brands are gaining momentum by leveraging localized cultural insights and affordabilit . Innovation has become a central battleground with companies racing to introduce next-generation formulations that combine functionality with aesthetic appeal. There is a noticeable shift toward clean beauty, sustainability, and multi-benefit products that cater to time-conscious consumers. Marketing strategies have also evolved beyond traditional advertising with influencer-led advocacy and immersive digital experiences playing a critical role in shaping purchasing decisions. Retail channels are another key differentiator as brands strive to optimize presence across physical stores, specialty outlets, and e-commerce platforms. Additionally, the rise of private label and direct-to-consumer models has intensified pricing pressure and forced established players to rethink their positioning.

RECENT HAPPENIGS IN THE MARKET

- In February 2024, Unilever launched a dedicated men's grooming line under the Dove Men+Care brand in South Korea, focusing on lightweight and fast-absorbing formulations tailored to Asian skin types.

- In May 2024, Procter & Gamble expanded its Gillette SkinGuard Sensitive Razor range across Southeast Asia while targeting men who experience irritation after shaving.

- In August 2024, L’Oréal partnered with a leading tech startup in Singapore to develop an AI-powered skin analysis app specifically designed for men.

- In October 2024, Shiseido introduced a new line of Japanese-inspired men’s grooming products in India, including scalp toners as well as oil-control lotions and travel-friendly kits.

- In December 2024, Beardo, an Indian men’s grooming brand had opened its first flagship store in Sydney signaling its intent to expand into the Australian market.

MARKET SEGMENTATION

This research report on the Asia Pacific male grooming products market is segmented and sub-segmented into the following categories.

By Product Type

- Skincare Products

- Face Wash

- Moisturizers

- Oil-Free Creams

- Other Skincare Products

- Haircare Products

- Shampoo

- Conditioners

- Styling Products

- Waxes

- Other Haircare Products

- Shaving Products

- Pre-Shave

- Shaving Cream

- Pre-Shave Oil

- Shaving Soap

- Other Pre-Shave Products

- Post-Shave

- After-Shave

- Balms

- Other Post-Shave Products

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Specialty Stores

- Online Retail Stores

- Other Distribution Channels

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What’s fueling the growth of male grooming products in Asia-Pacific?

Rising disposable income, urbanization, and growing awareness of personal appearance, especially among Gen Z and millennials, are driving rapid expansion in countries like India, China, and South Korea.

Which product categories are growing fastest in the region?

Beard care, skincare (especially anti-aging and oil control), and multifunctional grooming kits are surging, with demand for natural and K-beauty-inspired products leading innovation.

How is e-commerce influencing male grooming product sales in APAC?

Online platforms now dominate distribution in markets like China and Southeast Asia, offering personalized recommendations, influencer marketing, and access to niche grooming brands.

What cultural shifts are impacting male grooming habits in APAC?

The normalization of self-care among men, changing gender norms, and increased social media influence have made grooming a part of everyday lifestyle rather than just occasional use.

How are brands addressing skin and hair diversity across APAC markets?

Localized formulations that cater to different skin tones, humidity levels, and hair types especially in tropical climates—are becoming key to product success and customer loyalty

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com