Asia Pacific Marine Scrubber Systems Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Technology, Fuel, Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Marine Scrubber Systems Market Size

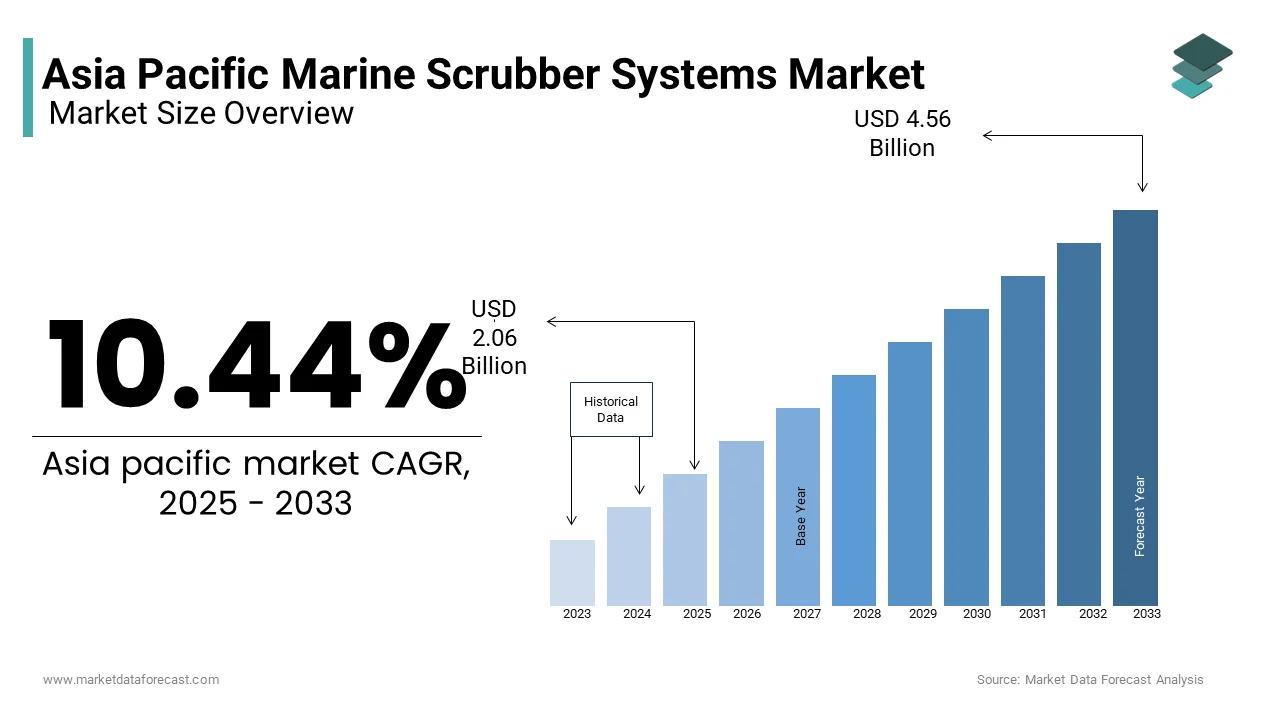

The Asia Pacific marine scrubber systems market size was valued at USD 1.87 billion in 2024 and is anticipated to reach USD 2.06 billion in 2025 from USD 4.56 billion by 2033, growing at a CAGR of 10.44% during the forecast period from 2025 to 2033.

The Asia Pacific marine scrubber systems market is a critical segment within the broader maritime industry, addressing the need for compliance with stringent environmental regulations governing sulfur emissions from ships. Marine scrubbers, also known as exhaust gas cleaning systems (EGCS), are installed on vessels to reduce sulfur oxides (SOx) emissions by cleaning exhaust gases before they are released into the atmosphere. This technology has gained prominence in the region due to its cost-effectiveness compared to alternative solutions like switching to low-sulfur fuels or adopting liquefied natural gas (LNG).

As per the International Maritime Organization (IMO), the global shipping industry contributes approximately 2.89% of global greenhouse gas emissions, with Asia being a major contributor due to its dense maritime trade routes. The region accounts for nearly 40% of global maritime trade, with countries like China, Japan, and South Korea leading shipbuilding and port operations. According to the United Nations Conference on Trade and Development (UNCTAD), Asia Pacific ports handle over 60% of global container traffic, emphasizing the region's reliance on efficient and compliant shipping solutions.

The demand for marine scrubber systems in the Asia Pacific is further fueled by the region's strategic geographic position as a hub for international trade. With increasing awareness about environmental sustainability, governments and regulatory bodies are pushing for cleaner shipping practices. For instance, China’s Ministry of Ecology and Environment enforces strict emission control areas (ECAs) along its coastal waters, compelling shipowners to adopt scrubber systems. These systems not only ensure regulatory compliance but also contribute to reducing the carbon footprint of maritime activities.

MARKET DRIVERS

Stringent Environmental Regulations

One of the primary drivers of the Asia Pacific marine scrubber systems market is the implementation of stringent environmental regulations aimed at curbing sulfur emissions. The International Maritime Organization (IMO) introduced the IMO 2020 regulation, which mandates that ships reduce their sulfur content in fuel oil to 0.5% globally, down from the previous limit of 3.5%. This regulation has compelled shipowners to adopt technologies like scrubber systems to comply with emission standards.

In addition to global regulations, regional policies have further propelled the adoption of scrubbers. For instance, the Hong Kong Maritime and Port Board has established emission control areas (ECAs) where ships must adhere to even stricter sulfur limits of 0.1%. According to a study by the Asian Development Bank, over 70% of ships operating in the Asia Pacific region are expected to comply with these regulations by 2025, creating a robust demand for scrubber installations. Furthermore, the Japanese Ministry of Land, Infrastructure, Transport, and Tourism estimates that retrofitting scrubbers on existing vessels can save up to 30% on operational costs compared to using low-sulfur fuels. This economic advantage has made scrubbers an attractive option for shipowners aiming to balance compliance with profitability.

Rising Maritime Trade in the Region

The Asia Pacific region dominates global maritime trade, accounting for nearly 40% of the world’s shipping activities. According to the United Nations Conference on Trade and Development (UNCTAD), the region’s share of global containerized trade has grown by 5% annually over the past decade. This surge in maritime activity has increased the demand for environmentally friendly shipping solutions, including scrubber systems.

China, as the world’s largest exporter, handles over 25% of global container traffic, according to the World Shipping Council. With such high volumes of trade, the country has emerged as a key adopter of scrubber systems, particularly in its busy ports like Shanghai and Ningbo-Zhoushan. Similarly, India, another major player in the region, recorded a 10% year-on-year growth in port traffic in 2022, as per the Indian Ports Association. This growth underscores the need for scalable and sustainable solutions like scrubbers to manage emissions effectively. As maritime trade continues to expand, the demand for scrubber systems is expected to grow proportionally, driven by both regulatory pressures and operational efficiency.

MARKET RESTRAINTS

High Initial Installation Costs

A significant barrier to the widespread adoption of marine scrubber systems in the Asia Pacific is the high initial installation cost, which can deter shipowners, especially small and medium-sized operators. Retrofitting scrubbers onto existing vessels involves substantial capital expenditure, with costs ranging from 2 million to 5 million per ship, depending on the vessel size and scrubber type, according to a report by the Korean Register of Shipping. For many operators in developing economies like Indonesia and Vietnam, this financial burden is prohibitive, particularly when alternative compliance methods, such as switching to low-sulfur fuels, appear more affordable in the short term.

Moreover, the complexity of the installation process often leads to extended downtime for vessels, further increasing operational costs. A study by the Australian Maritime Safety Authority highlights that the average downtime for scrubber installation can range from 30 to 60 days, translating to significant revenue losses for shipowners. This financial strain is compounded by the uncertainty surrounding long-term regulatory changes, which may render scrubbers obsolete if stricter emission standards are introduced. Consequently, many operators remain hesitant to invest in scrubber systems despite their environmental benefits.

Limited Availability of Freshwater Resources

Another critical restraint is the limited availability of freshwater resources required for operating open-loop scrubber systems. Open-loop scrubbers, which account for the majority of installations in the Asia Pacific, rely on seawater to neutralize sulfur oxides in exhaust gases. However, this process discharges washwater containing pollutants back into the ocean, raising environmental concerns.

Countries like Singapore and Malaysia have banned the use of open-loop scrubbers in their territorial waters, as per the Maritime and Port Authority of Singapore. This restriction forces shipowners to switch to closed-loop or hybrid systems, which require freshwater for operation. According to the Asian Water Development Outlook, freshwater scarcity affects over 40% of the population in the Asia Pacific region, making it challenging to allocate sufficient resources for scrubber systems. The added cost of procuring and treating freshwater further exacerbates the financial burden on shipowners, limiting the feasibility of scrubber adoption in water-stressed areas.

MARKET OPPORTUNITIES

Technological Advancements in Hybrid Scrubber Systems

The development of advanced hybrid scrubber systems presents a significant opportunity for the Asia Pacific marine scrubber systems market. Hybrid scrubbers offer greater flexibility by allowing ships to switch between open-loop, closed-loop, and hybrid modes based on regulatory requirements and environmental conditions. This adaptability addresses the limitations of traditional scrubber systems, particularly in regions with stringent discharge regulations.

According to the China Classification Society, hybrid scrubbers can reduce sulfur oxide emissions by up to 98%, making them a preferred choice for environmentally conscious shipowners. Furthermore, advancements in system design have led to a reduction in energy consumption by approximately 20%, as reported by the Japanese Ship Technology Research Association. These improvements enhance the overall efficiency of scrubber systems while minimizing operational costs. The growing emphasis on innovation is supported by government initiatives, such as South Korea’s Green Ship Program, which provides subsidies for adopting advanced maritime technologies. This convergence of technological progress and policy support creates a favorable environment for the expansion of hybrid scrubber systems in the region.

Increasing Focus on Sustainable Shipping Practices

The global push toward sustainable shipping practices offers another promising opportunity for the Asia Pacific marine scrubber systems market. As per the Global Maritime Forum, over 80% of shipping companies in the region have committed to achieving net-zero emissions by 2050, aligning with international climate goals. Scrubber systems play a crucial role in this transition by enabling ships to meet current emission standards while exploring alternative fuels like hydrogen and ammonia.

India’s National Green Hydrogen Mission, for instance, aims to produce 5 million metric tons of green hydrogen annually by 2030, as stated by the Ministry of New and Renewable Energy. This initiative underscores the potential for integrating scrubbers with emerging technologies to create a sustainable shipping ecosystem. Additionally, the rise of green financing options, such as sustainability-linked loans, has made it easier for shipowners to invest in eco-friendly solutions. According to the Asian Development Bank, green financing in the maritime sector grew by 15% in 2022, reflecting investor confidence in sustainable technologies. These developments highlight the untapped potential for scrubber systems to drive the region’s transition to greener shipping practices.

MARKET CHALLENGES

Regulatory Uncertainty and Fragmentation

A significant challenge facing the Asia Pacific marine scrubber systems market is the lack of uniformity in regulatory frameworks across the region. While the International Maritime Organization (IMO) sets global standards, individual countries often impose additional restrictions, creating a fragmented regulatory landscape. For example, Australia requires ships to adhere to specific sulfur emission limits in its Great Barrier Reef region, while Indonesia mandates the use of closed-loop scrubbers in its territorial waters, as per the Indonesian Ministry of Transportation.

This inconsistency complicates compliance for shipowners operating across multiple jurisdictions, leading to confusion and increased operational costs. According to the Federation of ASEAN Shipowners’ Associations, over 60% of shipping companies in Southeast Asia struggle to navigate the varying regulations, resulting in delays and penalties. Furthermore, the possibility of future regulatory changes adds to the uncertainty, discouraging long-term investments in scrubber systems. The absence of a cohesive regional approach undermines the effectiveness of scrubber adoption, posing a significant challenge to market growth.

Environmental Concerns Over Washwater Discharge

Another pressing challenge is the environmental impact of washwater discharge from open-loop scrubber systems. Critics argue that the untreated effluent released into the ocean contains harmful substances, including heavy metals and particulate matter, which can harm marine ecosystems. A study by the Australian Institute of Marine Science reveals that washwater discharge has contributed to a 15% increase in localized pollution levels in certain ports, raising concerns among environmental groups and policymakers.

Countries like Singapore and Malaysia have responded by banning open-loop scrubbers, forcing shipowners to adopt alternative systems that are more costly and resource-intensive. According to the Philippines Maritime Industry Authority, the shift to closed-loop or hybrid systems has increased operational expenses by 25% for local operators. This environmental backlash not only threatens the reputation of scrubber systems but also hinders their acceptance as a viable solution for emission reduction. Addressing these concerns through improved treatment technologies and transparent discharge monitoring remains a critical challenge for the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.44% |

|

Segments Covered |

By Technology, Fuel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

KwangSung, ALFA LAVAL, Damen Shipyards Group, CR Ocean Engineering, VDL AEC Maritime B.V., Langh Tech Oy Ab, Ecospray Technologies S.r.l., DuPont, Yara International ASA, Clean Marine, Fuji Electric Co., Ltd., MITSUBISHI HEAVY INDUSTRIES, LTD., Wärtsilä, SAACKE GmbH, Valmet, Shanghai Bluesoul Environmental Technology Co., Ltd, ANDRITZ. |

SEGMENTAL ANALYSIS

By Technology Insights

Wet technology dominates the Asia Pacific marine scrubber systems market, accounting for approximately 75% of the total market share as per the International Maritime Organization’s regional emission studies. This dominance is primarily driven by its cost-effectiveness and ability to handle high sulfur content in fuel oil, which aligns with the region’s reliance on heavy fuel oil (HFO) for maritime operations.

One key factor driving wet technology's dominance is its operational efficiency in reducing sulfur oxide (SOx) emissions. According to the Japanese Shipbuilding Research Association, wet scrubbers can achieve a sulfur removal rate of up to 98%, making them indispensable for compliance with IMO 2020 regulations. Additionally, the widespread adoption of open-loop scrubbers, a subset of wet technology, has been facilitated by their lower installation costs compared to dry systems. A study by the Korean Register of Shipping estimates that open-loop scrubbers are 30% cheaper to install than dry scrubbers, further solidifying their position as the preferred choice for shipowners in cost-sensitive markets like India and Vietnam.

Another contributing factor is the adaptability of wet scrubbers to diverse vessel sizes and types. As per the China Classification Society, over 60% of bulk carriers and container ships in the Asia Pacific are equipped with wet scrubber systems due to their scalability and compatibility with existing engine designs. This versatility ensures that wet technology remains the dominant segment, catering to the region’s vast maritime fleet.

Dry technology is the fastest-growing segment in the Asia Pacific marine scrubber systems market, with a projected compound annual growth rate (CAGR) of 12.5% during the forecast period, according to the Australian Maritime Safety Authority. This rapid growth is fueled by increasing environmental concerns over washwater discharge from wet scrubbers, prompting regulators to favor dry systems that eliminate liquid effluents.

A significant driver of this growth is the rising adoption of closed-loop and hybrid systems, which incorporate dry technology to address regulatory restrictions. For instance, Singapore’s ban on open-loop scrubbers has accelerated the demand for dry scrubbers, as reported by the Maritime and Port Authority of Singapore. These systems use chemical absorbents or membranes to capture pollutants, ensuring compliance with stringent environmental standards.

Moreover, advancements in dry scrubber technology have reduced operational costs, making them more competitive. According to the Indian Maritime University, recent innovations have lowered energy consumption by 15%, enhancing the economic viability of dry scrubbers. This technological progress, coupled with growing awareness about sustainable shipping practices, positions dry technology as the fastest-growing segment in the market.

By Fuel Insights

Marine Diesel Oil (MDO) commands the largest share of the Asia Pacific marine scrubber systems market, holding approximately 45% of the total market, as per the Federation of ASEAN Shipowners’ Associations. This leadership stems from its widespread use as a transitional fuel that balances cost-effectiveness with compliance requirements under IMO 2020 regulations.

One major factor driving MDO’s dominance is its compatibility with scrubber systems. According to the Japan Transport Safety Board, MDO contains sulfur levels between 0.1% and 0.5%, making it ideal for use with both open-loop and hybrid scrubbers. This compatibility reduces the need for frequent fuel switching, streamlining operations for shipowners. Furthermore, MDO’s availability across Asian ports ensures consistent supply chains, minimizing disruptions. The World Shipping Council notes that over 70% of Asia Pacific ports stock MDO, supporting its widespread adoption.

Another critical factor is the moderate pricing of MDO compared to Marine Gas Oil (MGO). As per the Indian Ports Association, MDO is priced 15-20% lower than MGO, making it an attractive option for budget-conscious operators. This affordability, combined with its environmental benefits when paired with scrubbers, cements MDO’s position as the leading fuel type in the market.

Hybrid fuel systems are emerging as the fastest-growing segment, with a CAGR of 14.2%, as reported by the South Korean Ministry of Oceans and Fisheries. This growth is driven by the increasing demand for flexible solutions that integrate multiple fuel types, enabling ships to comply with diverse regional regulations.

A primary factor propelling this growth is the rise of emission control areas (ECAs) in the Asia Pacific. According to the Hong Kong Environmental Protection Department, over 30% of vessels operating in ECAs require hybrid systems to switch between low-sulfur fuels and scrubber-compatible options seamlessly. This adaptability ensures compliance while optimizing operational costs.

Additionally, government incentives are accelerating the adoption of hybrid systems. For example, China’s Green Ship Program provides subsidies of up to $500,000 for vessels equipped with hybrid scrubber systems, as stated by the Chinese Ministry of Ecology and Environment. These initiatives, coupled with advancements in fuel blending technologies, are driving the rapid expansion of hybrid fuel systems in the region.

By Application Insights

Commercial vessels account for the largest share of the Asia Pacific marine scrubber systems market, with a market share of approximately 65%, as per the United Nations Conference on Trade and Development (UNCTAD). This dominance is attributed to the region’s status as a global hub for maritime trade, with countries like China and Japan leading shipbuilding and port operations.

A key driver of this segment’s leadership is the sheer volume of commercial shipping activities. According to UNCTAD, Asia Pacific ports handle over 60% of global container traffic, necessitating robust emission control measures. Scrubber systems are widely adopted to ensure compliance with IMO regulations while maintaining operational efficiency. The World Shipping Council highlights that over 80% of container ships in the region are equipped with scrubbers, underscoring their importance in commercial applications.

Another factor is the cost-saving potential of scrubbers for commercial operators. As per the Korean Register of Shipping, retrofitting scrubbers can reduce fuel expenses by up to 30%, making them an economically viable solution for large fleets. This financial advantage, combined with the region’s extensive maritime trade networks, solidifies the dominance of commercial vessels in the market.

Offshore vessels represent the fastest-growing application segment, with a CAGR of 13.8%, according to the Australian Petroleum Production & Exploration Association. This growth is driven by the increasing exploration and production activities in offshore oil and gas fields, particularly in Southeast Asia.

One major factor is the expansion of offshore drilling projects in countries like Malaysia and Indonesia. According to the Indonesian Ministry of Energy and Mineral Resources, offshore oil production in the region grew by 10% in 2022, necessitating advanced emission control solutions for support vessels. Scrubber systems are being deployed to minimize environmental impact while ensuring regulatory compliance.

Additionally, technological advancements are enhancing the feasibility of scrubbers for offshore applications. The Malaysian Maritime Academy reports that recent innovations have reduced installation times by 25%, making scrubbers more accessible for offshore operators. These developments, coupled with rising investments in offshore energy infrastructure, are propelling the rapid growth of this segment.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China leads the Asia Pacific marine scrubber systems market, commanding a 35% share, as per the Chinese Ministry of Ecology and Environment. The country’s dominance is rooted in its status as the world’s largest shipbuilder and busiest port operator. Shanghai and Ningbo-Zhoushan, two of the world’s top five busiest ports, handle over 50 million TEUs annually, creating a massive demand for emission control technologies.

A key driver is the government’s focus on green shipping. According to the China Classification Society, Beijing has allocated $1 billion in subsidies for eco-friendly maritime technologies, including scrubbers. This funding has spurred widespread adoption, with over 2,000 vessels retrofitted with scrubber systems in 2022 alone.

Japan holds the second-largest share, with 20% of the market, as reported by the Japanese Shipbuilding Research Association. The country’s advanced shipbuilding industry and commitment to sustainability drive its prominence. Japan’s ports, such as Yokohama and Kobe, are hubs for international trade, handling over 20% of Asia’s container traffic.

The adoption of scrubbers is supported by stringent emission regulations. According to the Japanese Ministry of Land, Infrastructure, Transport, and Tourism, over 70% of domestic vessels are equipped with scrubbers to comply with local ECA standards. This regulatory push ensures Japan’s continued leadership in the market.

South Korea accounts for 15% of the market, as per the Korean Register of Shipping. The country’s cutting-edge shipbuilding sector and focus on innovation contribute to its strong position. Hyundai Heavy Industries and Samsung Heavy Industries, two of the world’s largest shipbuilders, have integrated scrubber systems into their designs, boosting adoption rates.

Government initiatives also play a role. The South Korean Ministry of Oceans and Fisheries reports that the Green Ship Program has incentivized the installation of scrubbers on over 500 vessels since its inception. These efforts underscore South Korea’s pivotal role in the market.

India holds a 10% market share, driven by its expanding maritime trade and growing emphasis on sustainability, as stated by the Indian Ports Association. Ports like Mundra and Jawaharlal Nehru Port Trust are witnessing increased traffic, with annual growth rates exceeding 8%.

A key factor is the government’s push for cleaner shipping. According to the Indian Maritime University, New Delhi, hi has introduced tax incentives for ships equipped with scrubbers, encouraging adoption. This policy, coupled with rising trade volumes, positions India as a significant player in the market.

Australia captures 8% of the market, as per the Australian Maritime Safety Authority. The country’s strict environmental regulations and focus on sustainable practices drive scrubber adoption. Ports like Sydney and Melbourne are implementing emission control measures, requiring vessels to comply with low-sulfur standards.

The mining industry also plays a role. According to the Australian Institute of Marine Science, iron ore exports from Western Australia have surged by 12% annually, increasing maritime activity and the need for emission control solutions. These factors cement Australia’s position as a key contributor to the market.

KEY MARKET PLAYERS

KwangSung, ALFA LAVAL, Damen Shipyards Group, CR Ocean Engineering, VDL AEC Maritime B.V., Langh Tech Oy Ab, Ecospray Technologies S.r.l., DuPont, Yara International ASA, Clean Marine, Fuji Electric Co., Ltd., MITSUBISHI HEAVY INDUSTRIES, LTD., Wärtsilä, SAACKE GmbH, Valmet, Shanghai Bluesoul Environmental Technology Co., Ltd, ANDRITZ are the market players that are dominating the Asia marine scrubber systems market.

Top Players in the Market

Wärtsilä Corporation

Wärtsilä Corporation is a leading player in the Asia Pacific marine scrubber systems market, renowned for its innovative and sustainable maritime solutions. The company specializes in hybrid scrubber systems that cater to both open-loop and closed-loop operations, offering flexibility to shipowners. Wärtsilä’s contributions extend beyond the Asia Pacific, as it plays a pivotal role in shaping global emission control standards. Its focus on integrating digital technologies with scrubber systems has strengthened its reputation as a pioneer in eco-friendly shipping solutions. By collaborating with regional governments, Wärtsilä ensures compliance with local regulations while promoting cleaner maritime practices.

Alfa Laval AB

Alfa Laval AB is another key player, known for its advanced PureSOx scrubber systems designed to reduce sulfur emissions effectively. The company’s commitment to sustainability aligns with the growing demand for green shipping technologies in the Asia Pacific. Alfa Laval’s systems are widely adopted in commercial vessels, offshore platforms, and cruise ships, showcasing their versatility. Globally, the company has contributed to reducing the carbon footprint of the maritime industry by offering energy-efficient solutions. Its strategic partnerships with shipbuilders and port operators have further solidified its influence in the market.

Mitsubishi Heavy Industries, Ltd.

Mitsubishi Heavy Industries, Ltd. is a prominent name in the marine scrubber systems market, leveraging its expertise in engineering and manufacturing. The company provides robust scrubber solutions tailored to meet the diverse needs of the Asia Pacific region. Mitsubishi’s focus on R&D has enabled it to develop cutting-edge technologies that address environmental challenges. Its contributions to the global market include promoting sustainable shipping practices and supporting international regulatory frameworks. By collaborating with regional stakeholders, Mitsubishi continues to expand its footprint in the maritime sector.

Top Strategies Used by Key Market Participants

Strategic Partnerships and Collaborations

Key players in the Asia Pacific marine scrubber systems market have prioritized forming strategic partnerships with shipbuilders, port authorities, and regulatory bodies. These collaborations enable companies to align their offerings with regional requirements and ensure seamless integration of scrubber systems into existing fleets. For instance, partnerships with classification societies help streamline certification processes, enhancing customer trust and adoption rates. Such alliances also facilitate knowledge-sharing, fostering innovation in emission control technologies.

Focus on Product Innovation and Customization

Innovation remains a cornerstone strategy for strengthening market position. Leading companies invest heavily in R&D to develop advanced scrubber technologies, such as hybrid and closed-loop systems, that cater to diverse operational needs. Customization is another critical aspect, with firms offering tailored solutions for specific vessel types or regional regulations. By addressing unique challenges faced by customers, these companies enhance their competitive edge and establish themselves as leaders in the market.

Expansion of After-Sales Services

To differentiate themselves, key players emphasize comprehensive after-sales services, including maintenance, retrofitting, and technical support. These services ensure optimal performance of scrubber systems throughout their lifecycle, reducing downtime and operational costs for shipowners. By building long-term relationships with clients through reliable service networks, companies foster brand loyalty and secure repeat business. This strategy not only strengthens their market presence but also reinforces their reputation as trusted partners in the maritime industry.

COMPETITION OVERVIEW

The Asia Pacific marine scrubber systems market is characterized by intense competition, driven by the region’s strategic importance in global maritime trade and stringent environmental regulations. Key players like Wärtsilä Corporation, Alfa Laval AB, and Mitsubishi Heavy Industries dominate the landscape, leveraging their technological expertise and extensive service networks to capture market share. While Wärtsilä focuses on hybrid solutions and digital integration, Alfa Laval emphasizes energy efficiency and compliance, creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives.

Regulatory fragmentation across countries further intensifies competition, as companies strive to adapt their offerings to meet diverse requirements. Innovation serves as a key battleground, with firms investing in R&D to develop next-generation scrubber systems. Additionally, partnerships with local stakeholders and the expansion of after-sales services play a crucial role in maintaining market leadership. Despite the dominance of established players, emerging technologies and evolving customer preferences present opportunities for new entrants, ensuring a vibrant and competitive ecosystem.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Wärtsilä Corporation launched a new hybrid scrubber system tailored for the Asia Pacific market. This product was designed to meet the region’s stringent emission control area (ECA) regulations, enhancing its appeal among shipowners operating in environmentally sensitive zones.

- In June 2023, Alfa Laval AB signed a collaboration agreement with a major Chinese shipbuilder to integrate PureSOx scrubber systems into newly constructed vessels. This partnership aimed to streamline installation processes and promote compliance with IMO 2020 standards.

- In September 2023, Mitsubishi Heavy Industries announced the establishment of a dedicated service hub in Singapore. This facility focuses on providing maintenance and retrofitting services for scrubber systems, ensuring uninterrupted operations for regional clients.

- In November 2023, Yara Marine Technologies expanded its presence in India by partnering with a local port authority to offer turnkey scrubber installation services. This move addressed the growing demand for emission control solutions in South Asia’s maritime sector.

- In January 2024, Clean Marine AS introduced a closed-loop scrubber variant specifically designed for offshore vessels operating in Southeast Asia. This innovation targeted the rising exploration activities in the region’s oil and gas fields, positioning the company as a leader in niche applications.

MARKET SEGMENTATION

This research report on the Asia Pacific marine scrubber systems market is segmented and sub-segmented into the following categories.

By Technology Insights

- Wet technology

- Open loop

- Closed loop

- Hybrid

- Others

- Dry technology

By Fuel Insights

- MDO

- MGO

- Hybrid

- Others

By Application Insights

- Commercial

- Container vessels

- Tankers

- Bulk carriers

- RO-RO

- Others

- Offshore

- AHTS

- PSV

- FSV

- MPSV

- Others

- Recreational

- Cruise ships

- Ferries

- Yachts

- Others

- Navy

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the key regulatory drivers influencing the demand for marine scrubber systems in the Asia Pacific region?

The International Maritime Organization (IMO) 2020 sulfur cap has accelerated adoption across Asia Pacific, especially in regions with strict enforcement like China, Singapore, and South Korea. Localized enforcement of Emission Control Areas (ECAs), particularly around ports and shipping lanes, further propels scrubber installation. Regulatory pressure is heightened by environmental policies and national frameworks integrating carbon intensity indicators and emission trading schemes in countries like Japan and Australia.

How are regional shipping profiles and trade routes shaping the marine scrubber systems market?

Asia Pacific's dominance in global seaborne trade, with heavily trafficked routes like the Malacca Strait and South China Sea, creates a high density of vessels requiring emission compliance. The long-haul nature of many Asia-based routes makes scrubbers a cost-effective solution over low-sulfur fuel oil (LSFO) due to fuel savings over time. This operational profile is influencing retrofit decisions and newbuild specifications.

What are the main technological challenges limiting scrubber system adoption in Asia Pacific?

Challenges include the complexity of retrofitting older vessels with limited space, compliance with local discharge regulations (especially in closed-loop or hybrid systems), and rising scrutiny of open-loop discharges in territorial waters. Additionally, inconsistency in enforcement standards between ports and countries can deter investment due to operational uncertainty.

How are fluctuations in fuel price spreads impacting investment in marine scrubber systems?

The economic viability of scrubbers hinges on the spread between high-sulfur fuel oil (HSFO) and LSFO. In Asia Pacific, price volatility—often influenced by regional refinery output and geopolitical supply factors—can either boost ROI or deter installations. Shipowners closely track bunker fuel economics to determine payback periods, especially for vessels with medium- to long-term deployment horizons.

What role are shipyards and local retrofitting capabilities playing in the market’s growth across Asia Pacific?

Asia Pacific benefits from a strong shipbuilding and retrofitting ecosystem, with major yards in China, South Korea, and Japan leading global output. This domestic infrastructure enables faster and more cost-efficient scrubber installations. The availability of skilled labor and proximity to major trade hubs also reduces downtime, making adoption more attractive to regional fleet operators.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com