Asia Pacific Maritime Information Market Size, Share, Trends & Growth Forecast Report By Application (Maritime Information Analytics, Maritime Information Provision , Vessel Tracking, AIS (Automatic Identification System)), End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Maritime Information Market Size

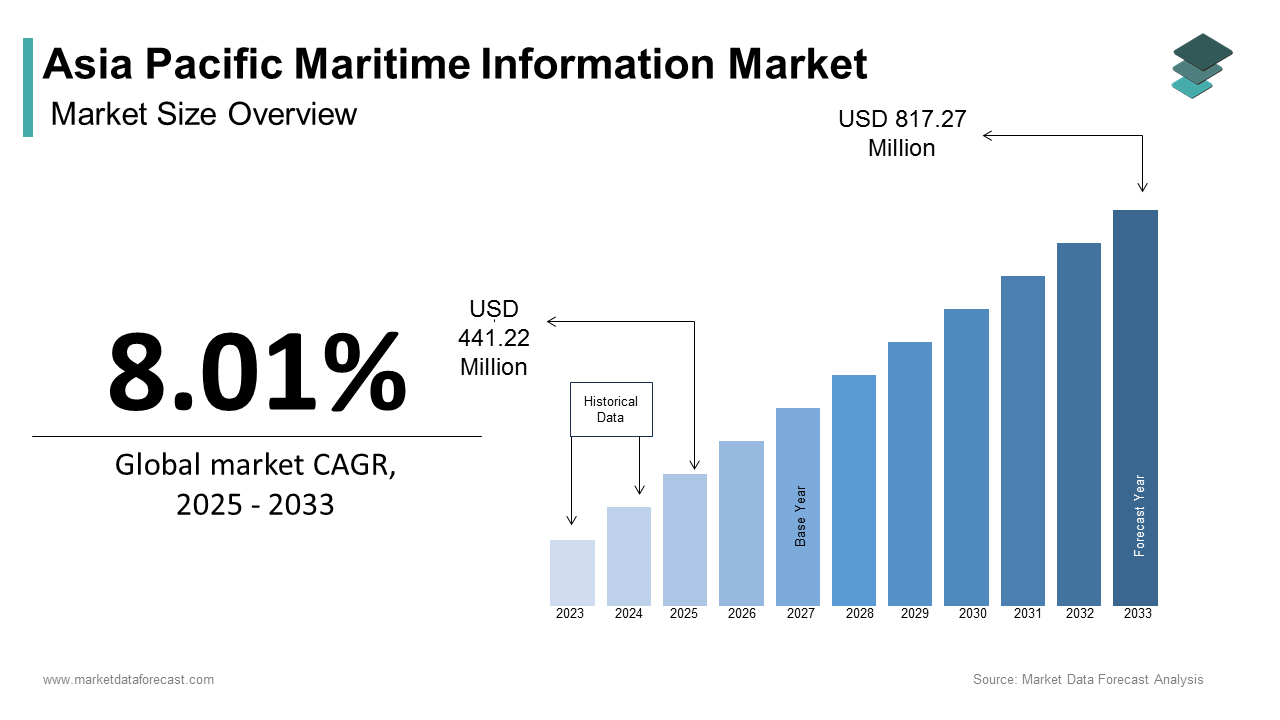

The Asia Pacific maritime information market size was calculated to be USD 408.50 million in 2024 and is anticipated to be worth USD 817.27 million by 2033, from USD 441.22 million in 2025, growing at a CAGR of 8.01% during the forecast period.

Maritime information systems integrate advanced technologies such as satellite communications, IoT, artificial intelligence (AI), and big data analytics to provide real-time insights into vessel tracking, weather forecasting, cargo management, and port operations. The region’s rapid industrialization, urbanization, and increasing reliance on digital infrastructure have further fueled demand for maritime information solutions. Similarly, Australia’s Department of Infrastructure, Transport, Regional Development, and Communications emphasizes the role of maritime information in reducing carbon emissions and enhancing disaster response capabilities.

MARKET DRIVERS

Rising Trade Volumes and Maritime Connectivity

The exponential rise in trade volumes and maritime connectivity is a primary driver of the Asia Pacific maritime information market. According to the World Trade Organization, trade volumes in the region are projected to increase by 30% by 2030, which is creating a pressing need for efficient and transparent maritime operations. For example, China’s Ministry of Commerce reports that over 70% of its international trade is conducted via maritime routes, necessitating advanced vessel tracking and port optimization systems to ensure timely deliveries. These trends demonstrate how globalization and trade growth are propelling the adoption of maritime information technologies tailored to meet diverse logistical needs.

Growing Adoption of AI and IoT Technologies

Another significant driver is the growing adoption of AI and IoT technologies, which enhance the accuracy and efficiency of maritime information systems. As per South Korea’s Ministry of Oceans and Fisheries, over 60% of maritime operators are integrating IoT-enabled sensors to monitor vessel performance and predict maintenance needs, which is reducing downtime by up to 30%. Similarly, India’s Ministry of Shipping emphasizes the role of AI-driven analytics in optimizing route planning and fuel consumption by aligning with global sustainability goals. Moreover, the integration of cloud-based platforms enables real-time data sharing and collaboration among stakeholders by ensuring steady growth in demand for maritime information technologies.

MARKET RESTRAINTS

High Implementation Costs

High implementation costs pose a significant restraint to the maritime information market, particularly regarding the deployment of advanced systems like satellite communication networks and AI-driven platforms. The Federation of Indian Chambers of Commerce and Industry notes that implementing a fully integrated maritime information system can cost several million dollars, deterring smaller players from adopting these innovations. Additionally, the lack of economies of scale in emerging economies exacerbates this issue, limiting the ability of smaller operators to compete effectively.

Cybersecurity Threats and Data Privacy Concerns

Cybersecurity threats and data privacy concerns also act as restraints, particularly regarding the protection of sensitive operational data. The Australian Cyber Security Centre warns that cyberattacks targeting maritime information systems have increased by over 40% annually, undermining public trust in these technologies. Similarly, Japan’s Ministry of Internal Affairs and Communications reports that over 60% of maritime operators are hesitant to adopt digital solutions due to fears of data breaches and system vulnerabilities. Moreover, the absence of standardized cybersecurity measures across the region complicates implementation, forcing companies to invest heavily in securing their systems. These challenges limit the seamless adoption of maritime information, particularly among risk-averse stakeholders.

MARKET OPPORTUNITIES

Integration of Autonomous Vessels and Smart Ports

The integration of autonomous vessels and smart ports presents transformative opportunities for the maritime information market. Autonomous vessels leverage AI and IoT technologies to optimize navigation, reduce human error, and enhance safety. According to McKinsey & Company, autonomous shipping could generate economic value of up to $1 trillion annually in the Asia Pacific region by 2030.

Similarly, Australia’s Bureau of Meteorology emphasizes the role of smart ports in improving cargo handling efficiency and reducing environmental impacts. These advancements position autonomous vessels and smart ports as key enablers of innovation in the maritime information market.

Expansion into Emerging Economies

Emerging economies in the Asia Pacific offer untapped potential for maritime information, driven by industrialization and infrastructure development. The Asian Development Bank reports that over $1 trillion is being invested annually in port modernization projects across Southeast Asia, creating demand for scalable and efficient solutions.

MARKET CHALLENGES

Regulatory Fragmentation Across Countries

Regulatory fragmentation across countries represents a pressing challenge for the maritime information market, particularly regarding cross-border operations and data sharing. The International Maritime Organization states that many countries in the region have stringent regulations governing data localization, which is limiting the adoption of unified platforms. For instance, South Korea’s Ministry of Oceans and Fisheries mandates strict guidelines for environmental compliance, complicating implementation for multinational operators.

Additionally, the absence of harmonized standards across the region creates operational inefficiencies. These challenges increase operational costs and reduce the efficiency of maritime information solutions.

Limited Accessibility in Remote Areas

Limited accessibility in remote areas also acts as a challenge, particularly regarding internet connectivity and infrastructure. Malaysia’s Ministry of Communications and Multimedia reports that over 30% of coastal regions lack reliable internet access, hindering the adoption of maritime information services. According to India’s Ministry of Rural Development, only 25% of rural ports have access to stable electricity, further complicating the deployment of digital solutions.

These infrastructural gaps force companies to invest heavily in offline systems, such as edge computing, to cater to underserved populations. These factors collectively limit the ability of maritime information providers to achieve universal coverage and inclusivity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.01% |

|

Segments Covered |

By Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Thales Group, Saab AB, Furuno Electric Co. Ltd., Garmin Ltd., ORBCOMM Inc., Raytheon Technologies Corporation, exactEarth Ltd., L3Harris Technologies Inc., Northrop Grumman Corporation, BAE Systems plc |

SEGMENTAL ANALYSIS

By Application Insights

The vessel tracking segment was the largest and held 40.3% of the Asia Pacific maritime information market share in 2024. One major factor is the growing emphasis on real-time vessel monitoring. According to China’s Ministry of Transport, over 70% of commercial vessels in the region rely on vessel tracking systems to improve navigation accuracy and reduce operational risks. Another factor is the focus on environmental sustainability. Japan’s Ministry of Land, Infrastructure, Transport, and Tourism notes that vessel tracking enables operators to monitor fuel consumption and emissions by aligning with global decarbonization goals.

The maritime information analytics segment is lucratively growing with a CAGR of 12.8% in the coming years. This growth is fueled by the increasing adoption of AI and big data technologies to derive actionable insights from maritime data. As per South Korea’s Ministry of Oceans and Fisheries, over 60% of maritime operators use analytics platforms to predict maintenance needs and optimize fleet performance, reducing downtime by up to 25%. Australia’s Department of Infrastructure, Transport, Regional Development, and Communications emphasizes the role of analytics in improving port efficiency and cargo handling. Another factor is the focus on innovation.

By End User Insights

The commercial sector dominated the Asia Pacific maritime information market share in 2024 with the maritime information in optimizing trade logistics, which is enhancing operational efficiency, and ensuring profitability for businesses operating in the region. Over 80% of commercial shipping companies rely on maritime information systems to streamline supply chain operations and reduce costs. Similarly, China’s Ministry of Commerce notes that these solutions improve delivery times by up to 20%, further solidifying their position as the largest end-user segment.

The government sector is likely to grow with a CAGR of 9.5% in the coming years. This growth is fueled by the increasing emphasis on maritime security, environmental compliance, and disaster management. According to Japan’s Ministry of Defense, over 60% of government agencies use maritime information systems to enhance border security and combat illegal activities such as smuggling and piracy. Similarly, Australia’s Bureau of Meteorology emphasizes the role of these systems in predicting natural disasters and improving recovery rates.

REGIONAL ANALYSIS

China led the Asia Pacific maritime information market with 25.4% of the share in 2024 due to its status as a global leader in maritime trade and industrialization, supported by robust investments in digital infrastructure and IoT technologies. The Chinese Academy of Sciences reports that over 70% of the country’s ports have adopted advanced vessel tracking and analytics systems to enhance operational efficiency. Additionally, China’s Belt and Road Initiative promotes cross-border maritime collaboration by creating demand for scalable and innovative maritime information solutions tailored to diverse markets.

Japan was positioned second with 18.7% of the Asia Pacific maritime information market share in 2024. The country’s rapid adoption of maritime information is driven by its advanced technological expertise and reliance on efficient logistics for imports and exports. According to Japan’s Ministry of Land, Infrastructure, Transport, and Tourism, over 60% of vessels operating in Japanese waters use AIS and vessel tracking systems to ensure safety and compliance. Furthermore, Japan’s focus on sustainability has accelerated the adoption of AI-driven analytics platforms by ensuring steady growth in demand.

South Korea accounts maritime information market growth is substantially growing with its robust shipbuilding and electronics industries. The Ministry of Oceans and Fisheries emphasizes the adoption of smart port technologies to streamline cargo handling and reduce environmental impacts. Additionally, South Korea’s emphasis on innovation ensures widespread adoption of maritime information technologies by aligning with global standards.

Australia maritime information market growth is likely to grow with its focus on environmental sustainability and disaster management driving maritime information adoption. The use of maritime systems to predict weather patterns and improve recovery rates. Additionally, Australia’s vast coastline necessitates scalable solutions to ensure safe and efficient operations in remote areas.

India maritime information market growth is driven by its growing maritime trade and shipping sectors. The commercial operators use maritime information systems to optimize logistics and reduce operational costs. Additionally, India’s focus on affordable and scalable solutions has fueled the transition to cloud-based platforms that will further boost the demand.

LEADING PLAYERS IN THE ASIA PACIFIC MARITIME INFORMATION MARKET

Kongsberg Digital

Kongsberg Digital is a global leader in maritime information solutions, with a significant presence in the Asia Pacific market. The company’s contribution to the global market lies in its advanced vessel tracking and analytics platforms, which enhance operational efficiency, safety, and sustainability for maritime operators. Kongsberg’s focus on innovation ensures that its solutions align with evolving customer needs, such as real-time data sharing and environmental compliance. Its commitment to integrating IoT and AI technologies has positioned it as a trusted partner for organizations seeking scalable and reliable maritime information systems.

Wärtsilä Corporation

Wärtsilä Corporation plays a pivotal role in advancing maritime information through its comprehensive suite of smart port and vessel optimization solutions. Known for its robust portfolio of analytics-driven tools, Wärtsilä empowers industries such as shipping, logistics, and defense to enhance decision-making and reduce operational costs. The company’s emphasis on integrating cloud-based platforms enhances accessibility and collaboration among stakeholders.

Inmarsat Global Limited

Inmarsat Global Limited is renowned for its innovative approach to maritime information, making it a key player in the Asia Pacific market. Through its satellite communication networks, Inmarsat offers real-time vessel tracking, weather forecasting, and cybersecurity solutions tailored to diverse maritime operations. The company’s dedication to improving connectivity and data security has strengthened its global reputation.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC MARITIME INFORMATION MARKET

Strategic Partnerships and Collaborations

Key players frequently engage in partnerships with government agencies, shipping companies, and research institutions to co-develop tailored solutions. These collaborations help address specific regional challenges, such as optimizing port operations and enhancing maritime safety.

Investment in AI and IoT Technologies

To meet the dynamic needs of end-users, companies are investing heavily in integrating artificial intelligence (AI) and the Internet of Things (IoT) into their platforms. For instance, manufacturers are developing AI-driven predictive analytics systems and IoT-enabled sensors to monitor vessel performance and predict maintenance needs. This focus on innovation not only differentiates brands but also aligns with the growing demand for efficient and scalable solutions in the region.

Expansion into Emerging Markets

Players are increasingly targeting emerging economies within the Asia Pacific region, such as Vietnam, Indonesia, and Thailand, where industrialization and trade volumes are driving adoption. By establishing local data centers and distribution networks, companies aim to reduce costs and improve accessibility. This strategy allows them to capture untapped opportunities and solidify their presence in high-growth markets.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific maritime information market include Thales Group, Saab AB, Furuno Electric Co. Ltd., Garmin Ltd., ORBCOMM Inc., Raytheon Technologies Corporation, exactEarth Ltd., L3Harris Technologies Inc., Northrop Grumman Corporation, BAE Systems plc.

The Asia Pacific maritime information market is characterized by intense competition, with both global giants and regional players vying for dominance. Global leaders like Kongsberg Digital, Wärtsilä Corporation, and Inmarsat leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements, with companies striving to integrate AI, IoT, and cloud computing into their offerings. Additionally, stringent regulatory frameworks governing environmental compliance have compelled manufacturers to innovate continuously. Supply chain disruptions and cybersecurity threats add complexity, forcing players to adopt agile strategies. As a result, the market fosters an environment of constant evolution, where differentiation through innovation, customer-centric approaches, and strategic expansion becomes critical for sustained success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Kongsberg Digital launched a new AI-driven platform specifically designed for vessel performance optimization in South Korea. This move aimed to capitalize on the country’s growing focus on smart shipping, enhancing Kongsberg’s market presence in the region.

- In June 2023, Wärtsilä Corporation partnered with a leading Australian port authority to develop smart port solutions for cargo handling and logistics optimization. This collaboration strengthened Wärtsilä’s visibility in the region’s maritime sector and expanded its customer base.

- In September 2023, Inmarsat Global Limited acquired a local satellite communication startup in Singapore to expand its production capabilities for real-time vessel tracking solutions. This acquisition enabled the company to better serve Southeast Asia’s burgeoning maritime trade market and increase its regional footprint.

- In January 2024, IB, a U.S.-based technology provider, introduced a suite of cloud-based maritime analytics tools tailored for disaster management in Japan. This initiative aligned with the country’s push toward enhanced maritime safety, allowing IBM to position itself as a leader in innovative maritime technologies.

- In November 2023, SAP SE, a German software provider, signed an agreement with a Philippine logistics company to develop specialized maritime information tools for supply chain optimization. This partnership reinforced SAP’s dominance in precision logistics technology and expanded its application portfolio.

MARKET SEGMENTATION

This research report on the Asia Pacific maritime information market has been segmented and sub-segmented based on application, end user, and region.

By Application

- Maritime Information Analytics

- Maritime Information Provision

- Vessel Tracking

- AIS (Automatic Identification System)

By End User

- Government

- Commercial

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. How is technology driving the maritime information market?

Advanced technologies like AIS (Automatic Identification System), satellite communication, and big data analytics are enabling real-time tracking and improved decision-making in maritime operations.

2. What factors are driving the growth of the maritime information market in the Asia Pacific region?

Key drivers include increasing maritime trade, rising security concerns, advancements in communication technologies, and growing government investments in maritime surveillance infrastructure.

3. Which technologies are prominent in the maritime information market?

Technologies such as Automatic Identification Systems (AIS), GPS tracking, satellite communication, and maritime analytics platforms are widely adopted.

4. Who are the major players operating in the Asia Pacific Maritime Information Market?

Prominent players include Thales Group, Saab AB, BAE Systems, Furuno Electric Co., Ltd., and ORBCOMM Inc.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]