Asia Pacific Melt Blown Nonwovens Market Size, Share, Growth, Trends, And Forecasts Research Report, Segmented By Material, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Melt-Blown Nonwovens Market Size

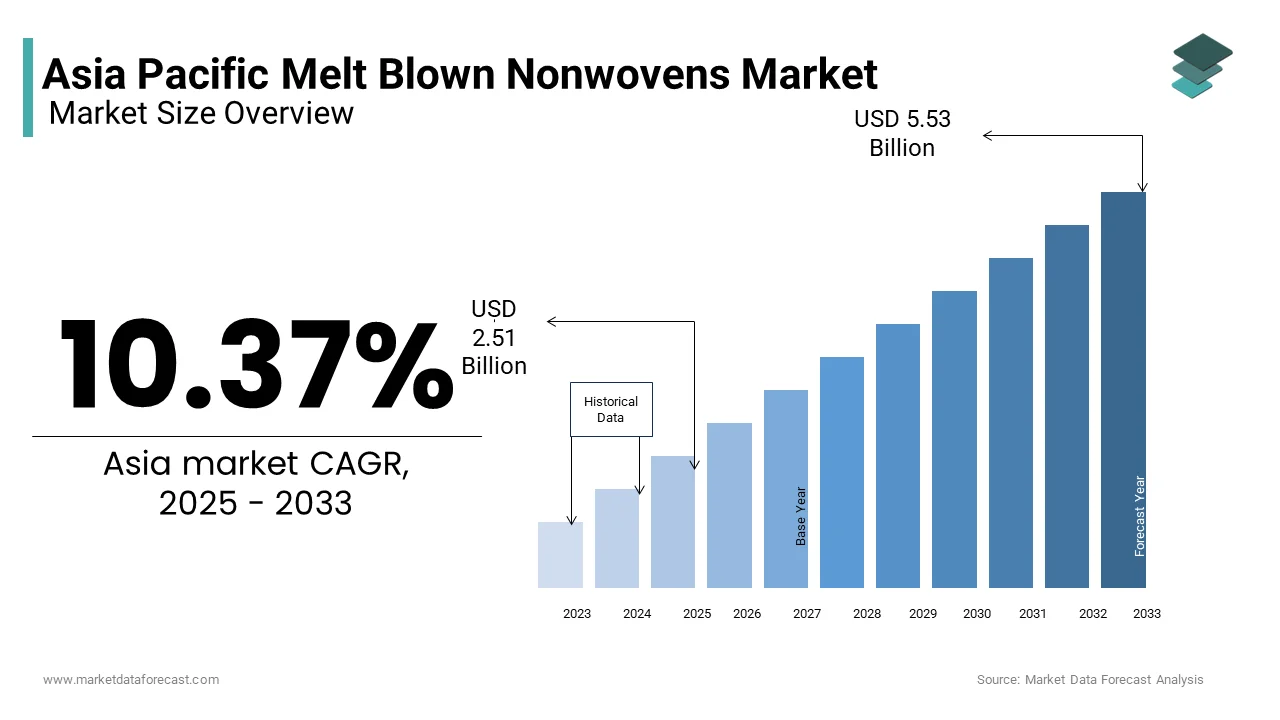

The Asia Pacific Melt blown nonwovens market size was valued at USD 2.27 billion in 2024 and is anticipated to reach USD 2.51 billion in 2025, from USD 5.53 billion by 2033, growing at a CAGR of 10.37% during the forecast period from 2025 to 2033.

Melt-blown nonwovens are ultrafine fiber-based materials produced through a specialized extrusion process that results in high surface area and fine pore structures. These characteristics make them highly effective for applications requiring filtration, barrier protection, and absorbency. The material is widely used in hygiene products, medical protective equipment, air and liquid filtration systems, and industrial wipes.

In the Asia Pacific region, the demand for melt-blown nonwovens has surged significantly due to increased health awareness, government initiatives promoting hygiene infrastructure, and the rapid expansion of healthcare and manufacturing sectors.

The market has seen substantial growth since the onset of the global health crisis, which underscored the importance of personal protective equipment (PPE) and disposable medical supplies.

MARKET DRIVERS

Surge in Demand for Personal Protective Equipment (PPE)

One of the primary drivers of the Asia Pacific melt-blown nonwovens market is the unprecedented surge in demand for personal protective equipment (PPE), especially surgical masks and N95 respirators. Melt-blown fabric serves as the critical filtration layer in these products, offering high efficiency in capturing airborne particles and pathogens.

As per the China Textile Industry Association, annual melt blown fabric output reached over 800,000 tons in 2023, up from less than 200,000 tons in 2019. This sustained emphasis on public health preparedness has ensured continued demand even after the initial pandemic-driven spike. With rising health consciousness and ongoing outbreaks of seasonal respiratory diseases, the need for protective gear remains strong, reinforcing the long-term relevance of melt-blown nonwovens in the Asia Pacific region.

Expansion of the Hygiene and Sanitary Products Sector

Another key driver of the Asia Pacific melt-blown nonwovens market is the rapid expansion of the hygiene and sanitary products sector, particularly in emerging economies such as India, Indonesia, and the Philippines. Melt blown nonwovens are integral components in baby diapers, feminine hygiene products, and adult incontinence care items due to their excellent liquid absorption and moisture management properties.

In India, the Ministry of Women and Child Development reported a significant increase in the adoption of branded sanitary napkins among women aged 15–49 years between 2015 and 2023, indicating a shift toward modern hygiene practices. This trend has spurred major manufacturers like Procter & Gamble and Unicharm to expand their production bases in South and Southeast Asia, directly boosting demand for melt-blown raw materials.

With growing investments in rural sanitation programs and expanding e-commerce distribution channels, the hygiene sector continues to serve as a powerful engine for melt-blown nonwovens consumption across the Asia Pacific.

MARKET RESTRAINTS

Volatility in Raw Material Prices

A significant restraint affecting the Asia Pacific melt-blown nonwovens market is the volatility in raw material prices, particularly polypropylene, which is the primary feedstock for melt-blown fabric production. Polypropylene is derived from petroleum, making it susceptible to fluctuations in crude oil prices and geopolitical tensions affecting global supply chains. Given the dependence on imported polymers and the lack of localized alternatives, the melt-blown nonwovens industry remains vulnerable to raw material instability, posing a persistent challenge to market expansion in the Asia Pacific.

Environmental Concerns and Regulatory Pressure

Another critical restraint impacting the Asia Pacific melt-blown nonwovens market is the growing environmental scrutiny surrounding single-use plastic-based products. Melt-blown fabrics, primarily made from polypropylene, are non-biodegradable and contribute to waste accumulation, prompting regulatory bodies and consumer advocacy groups to push for sustainable alternatives. According to the United Nations Environment Programme (UNEP) Asia-Pacific Division, over 12 countries in the region introduced stricter regulations on disposable plastics in 2023, including restrictions on non-recyclable packaging and textile products.

In India, the Ministry of Environment, Forest, and Climate Change enforced the Plastic Waste Management Amendment Rules, mandating extended producer responsibility (EPR) for manufacturers of single-use hygiene and medical products containing melt-blown layers. This has led to increased compliance costs and the need for investments in recycling infrastructure. Similarly, in China, the State Council issued guidelines encouraging the adoption of biodegradable melt-blown substitutes, urging research institutions and manufacturers to develop viable alternatives using polylactic acid (PLA) and other bio-based polymers.

While this transition supports long-term sustainability goals, it poses immediate challenges to traditional melt-blown nonwovens producers, necessitating innovation and adaptation to remain competitive in the evolving regulatory landscape.

MARKET OPPORTUNITY

Growing Demand for Air and Liquid Filtration Applications

One of the most promising opportunities for the Asia Pacific melt-blown nonwovens market lies in the growing demand for air and liquid filtration applications across residential, commercial, and industrial sectors. Melt-blown fibers offer superior filtration efficiency due to their fine diameter and high porosity, making them ideal for HVAC filters, water purification cartridges, and automotive air filters.

Similarly, in India, the Central Pollution Control Board introduced revised indoor air quality standards for schools and commercial complexes, prompting facility managers to upgrade filtration systems.

As environmental concerns and health awareness continue to rise, the filtration segment is expected to be a major growth avenue for melt-blown nonwovens in the Asia Pacific.

Adoption in Technical Textiles and Industrial Wipes

Another emerging opportunity for the Asia Pacific melt-blown nonwovens market is the increasing adoption of the material in technical textiles and industrial wipes, particularly in sectors such as automotive, electronics, and pharmaceuticals. Melt-blown nonwovens are valued for their high absorbency, low linting properties, and chemical resistance, making them suitable for precision cleaning and protective applications. According to the ASEAN Technical Textiles Association, the region’s technical textile market grew, with nonwovens accounting for a significant share of the expansion. As industries across the Asia Pacific seek higher levels of cleanliness and process efficiency, the demand for melt-blown-based industrial solutions is poised for sustained growth.

MARKET CHALLENGES

Technological Limitations in Sustainable Production

A major challenge facing the Asia Pacific melt-blown nonwovens market is the technological limitations associated with producing sustainable and biodegradable alternatives at scale. While conventional melt-blown fabrics are derived from polypropylene, a petroleum-based polymer, there is growing demand for eco-friendly substitutes that do not compromise performance. However, current biodegradable materials such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) face issues related to lower thermal stability, reduced filtration efficiency, and higher production costs.

In China, the National Engineering Research Center for Nonwovens reported that PLA-based melt-blown fabric exhibited a reduction in filtration efficiency compared to traditional variants, limiting its applicability in medical and high-performance sectors. Similarly, in India, the Council of Scientific and Industrial Research found that biodegradable melt-blown alternatives degraded unevenly under natural conditions, raising concerns about microplastic generation.

Supply Chain Disruptions and Logistics Bottlenecks

Another significant challenge impeding the growth of the Asia Pacific melt-blown nonwovens market is the ongoing issue of supply chain disruptions and logistics bottlenecks. The industry relies heavily on a complex network of raw material suppliers, machinery providers, and downstream distributors, all of which have been affected by recent geopolitical events, trade restrictions, and transportation delays.

In China, the Ministry of Transport reported that container shipping costs from the Yangtze River Delta to Southeast Asia increased by nearly 40% in early 2023 due to port closures and labor shortages. This delay impacted manufacturers who depend on just-in-time inventory models, forcing some to stockpile raw materials at additional storage costs.

As global trade dynamics continue to evolve, ensuring resilient and efficient logistics networks will be essential for maintaining stable production and meeting growing demand across the Asia Pacific region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.37% |

|

Segments Covered |

By Material, End-User, And Region. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Atex, Don & Low, DuPont, Irema Ireland, Jinan Xinghua Nonwoven Fabric, Mogul, Name, Oerlikon, PFNonwovens (Pegas Nonwovens). |

SEGMENTAL ANALYSIS

By Material Insights

The polypropylene segment had the largest market share, accounting for 65.2% of the Asia Pacific melt-blown nonwovens market in 2024. This dominance is primarily attributed to its widespread use in medical-grade masks, hygiene products, filtration systems, and industrial wipes due to its excellent balance of cost, performance, and processability.

One key driver behind the polypropylene segment’s leadership is its extensive adoption in the healthcare industry, particularly for surgical masks, N95 respirators, and sterilized gowns.

Another major factor contributing to this segment’s strong foothold is its cost-effectiveness and ease of manufacturing, which make it an ideal choice for high-volume production. As reported by the China Textile Industry Association, polypropylene resin prices remained relatively stable compared to other polymers between 2021 and 2023, allowing manufacturers to maintain competitive pricing while scaling output. With continued demand from both the medical and consumer goods sectors, polypropylene remains the dominant material in the Asia Pacific melt-blown nonwovens market.

The rayon material segment is projected to grow at the fastest rate, registering a CAGR of 11.2%, driven by increasing interest in biodegradable and sustainable alternatives to conventional petroleum-based fibers. Rayon, derived from natural cellulose sources, offers enhanced softness, breathability, and environmental compatibility, making it increasingly attractive in niche applications such as premium hygiene products, facial masks, and eco-friendly wipes.

One major driver of this growth is the rising demand for sustainable personal care and cosmetic products, particularly in countries like Japan, South Korea, and Australia, where consumer awareness regarding environmental impact is high. According to the Japan Cosmetic Industry Association, a notable share of skincare brands introduced rayon-based facial cleansing pads and mask sheets in 2023, emphasizing their compostable nature and skin-friendly texture.

Another significant contributor is the adoption of rayon melt-blown fabrics in medical and pharmaceutical applications, where biocompatibility and controlled degradation are essential. As sustainability becomes a central focus across industries, the rayon-based melt-blown nonwovens segment is poised for accelerated expansion in the Asia Pacific.

By End User Insights

The healthcare sector accounts for the largest market share, capturing 54.2% of the Asia Pacific melt-blown nonwovens market in 2024. This dominance is primarily attributed to the critical role of melt-blown fabrics in medical-grade personal protective equipment (PPE), surgical drapes, sterilization wraps, and disposable hygiene products, especially in response to heightened health consciousness and regulatory mandates.

One of the key drivers behind the healthcare segment’s leadership is the ongoing emphasis on infection control and disease prevention, particularly in hospitals, clinics, and diagnostic centers. In India, the Ministry of Health and Family Welfare mandated the use of disposable surgical gowns and sterilized packaging for medical instruments, directly boosting melt-blown fabric consumption.

Another crucial factor driving this segment’s growth is the expansion of public and private healthcare infrastructure, particularly in rapidly urbanizing regions. As governments across the Asia Pacific continue to invest in healthcare modernization and pandemic preparedness, the healthcare segment will remain the largest consumer of melt-blown nonwovens.

The textiles end-user segment is anticipated to grow at the fastest rate in the Asia Pacific melt blown nonwovens market, registering a CAGR of 10.5%, driven by increasing applications in hygiene products, technical textiles, and nonwoven apparel. Unlike traditional woven fabrics, melt-blown nonwovens offer advantages such as lightweight construction, breathability, and fluid resistance, making them suitable for disposable garments, baby diapers, feminine hygiene products, and adult incontinence care items.

One of the key drivers of this growth is the rising disposable income and changing lifestyle patterns in emerging economies such as India, Indonesia, and the Philippines, leading to higher adoption of branded hygiene and personal care products.

Another significant contributor is the growing demand for nonwoven-based workwear and protective clothing in industrial and agricultural sectors, particularly in countries like Thailand, Vietnam, and Malaysia. As consumer preferences evolve and industrial safety regulations tighten, the textiles segment is set to drive robust growth in the regional melt-blown nonwovens market.

COUNTRY-LEVEL ANALYSIS

China held the largest market share, accounting for approximately 38.2% of the Asia Pacific melt-blown nonwovens market in 2024, driven by its massive manufacturing base, government-backed initiatives, and strategic investments in medical and hygiene infrastructure. As the world’s largest producer and exporter of nonwoven materials, China has significantly expanded its melt-blown fabric capacity since the global health crisis, ensuring a stable supply chain for PPE and disposable medical products. With ongoing investments in biodegradable alternatives and automation, China remains the dominant force in the regional melt-blown nonwovens market.

India is a key player in the market, supported by rapid urbanization, rising healthcare spending, and expanding consumer hygiene markets. The country's growing middle class and increasing awareness of sanitation have led to a surge in demand for disposable hygiene products such as baby diapers, sanitary napkins, and adult incontinence care items. As the government continues to promote Make in India and Atmanirbhar Bharat initiatives, the melt-blown nonwovens industry is expected to witness sustained growth.

Japan occupies a notable market share of the Asia Pacific melt-blown nonwovens market, driven by its highly regulated healthcare system, advanced textile technologies, and strong emphasis on quality and innovation. Japanese manufacturers prioritize high-performance, multi-layered nonwovens for medical, filtration, and personal care applications, leveraging cutting-edge production techniques to ensure precision and durability. With continuous R&D investments and a strong presence of global players, Japan remains a key market for high-end melt-blown nonwovens.

South is a key player in the market, bolstered by its advanced manufacturing capabilities and growing demand from the healthcare and electronics sectors. The country’s emphasis on high-tech industries, including semiconductors and automotive components, has led to increased reliance on melt-blown wipes for precision cleaning and contamination control. With strong policy support and industrial sophistication, South Korea is well-positioned for continued growth in the melt-blown nonwovens market.

Australia & New Zealand collectively hold a considerable market share in the Asia Pacific melt-blown nonwovens market, driven by stringent hygiene regulations, environmental consciousness, and a growing focus on medical and industrial applications. With increasing investments in green technologies and regulatory alignment with European directives, Australia & New Zealand represent a niche but growing market for melt-blown nonwovens in the region.

KEY MARKET PLAYERS

Atex, Don & Low, DuPont, Irema Ireland, Jinan Xinghua Nonwoven Fabric, Mogul, Name, Oerlikon, PFNonwovens (Pegas Nonwovens). Are the market players that are dominating the Asia Pacific melt-blown nonwovens market?

Top Players In The Market

One of the leading players in the Asia Pacific melt-blown nonwovens market is Toray Industries, Inc., a Japanese multinational corporation specializing in advanced materials and textiles. Toray has played a pivotal role in advancing high-performance melt-blown technologies for filtration, medical, and hygiene applications. The company’s commitment to innovation and sustainability has positioned it as a key contributor to global advancements in nonwoven fabric development, particularly in Asia.

Another major player is Asahi Kasei Corporation, also based in Japan. Asahi Kasei is renowned for its expertise in producing high-quality melt-blown nonwovens used in healthcare and industrial applications. The company’s focus on precision engineering and material science has made it a trusted supplier for medical-grade products, including surgical masks and sterilization wraps, reinforcing its influence both regionally and globally.

SABIC, a global leader in diversified chemicals headquartered in Saudi Arabia but with a strong presence in Asia, plays a crucial role in supplying high-purity polypropylene resins used in melt-blown production. SABIC supports manufacturers across the Asia Pacific by providing raw materials that meet stringent performance and safety standards, enabling them to produce efficient filtration media and protective textiles for global markets.

Top Strategies Used by Key Market Participants

A primary strategy adopted by key players in the Asia Pacific melt-blown nonwovens market is product innovation and the development of sustainable alternatives. Companies are investing heavily in R&D to create bio-based, compostable, and recyclable melt-blown materials that align with evolving environmental regulations and consumer expectations for greener products.

Another key approach is expanding regional manufacturing capabilities and supply chain integration. Leading firms are establishing new production facilities or upgrading existing ones in high-demand markets such as India, Vietnam, and Indonesia. This not only reduces dependency on imports but also enhances responsiveness to local demand fluctuations and logistical challenges.

Lastly, strategic partnerships and collaborations with downstream industries have become increasingly common. By working closely with medical device manufacturers, filtration companies, and hygiene product brands, melt blown producers can tailor their offerings to specific application needs, ensuring long-term contracts and stronger brand positioning within specialized sectors across the Asia Pacific.

COMPETITIVE OVERVIEW

The competitive landscape of the Asia Pacific melt-blown nonwovens market is characterized by a blend of global conglomerates and dynamic regional manufacturers striving to capture market share through technological differentiation, localized production, and strategic alliances. While established players from Japan and South Korea maintain dominance in high-end applications such as medical and filtration, emerging domestic producers in China, India, and Southeast Asia are rapidly scaling up to meet growing domestic and export demand. The market remains highly fragmented, with numerous small and medium-sized enterprises competing alongside large corporations, particularly in commodity-driven segments like hygiene and disposable apparel. Innovation continues to be a key differentiator, especially in developing biodegradable alternatives and improving filtration efficiency. Additionally, regulatory pressures around waste management and sustainability are prompting companies to invest in circular economy models and green manufacturing practices. As competition intensifies, players are focusing on vertical integration, customer-specific solutions, and operational agility to strengthen their foothold in this evolving market.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Toray Industries launched a new line of bio-based melt-blown nonwovens specifically designed for facial mask applications in the Korean and Japanese beauty markets, aiming to address growing demand for eco-friendly personal care products.

- In May 2024, Asahi Kasei announced an expansion of its production facility in Thailand to increase capacity for medical-grade melt-blown fabrics, supporting rising demand from hospitals and clinics across Southeast Asia.

- In July 2024, SABIC partnered with a leading Indian polymer research institute to develop next-generation polypropylene blends optimized for high-efficiency filtration in N95 masks and HVAC filters, enhancing material performance while maintaining cost competitiveness.

- In September 2024, a joint initiative between Hyosung TNC and a major South Korean hospital led to the deployment of melt-blown-based disinfectant wipes in all patient wards, promoting infection control and reinforcing product adoption in healthcare settings.

- In November 2024, Mitsui Chemicals introduced a digital platform for B2B customers in the Asia Pacific region, offering real-time technical support, product customization options, and inventory tracking services to improve customer engagement and streamline procurement processes.

MARKET SEGMENTATION

This research report on the Asia Pacific melt-blown nonwovens market is segmented and sub-segmented into the following categories.

By Material

- Polyester

- Polypropylene

- Rayon

- Polyethylene

- Others

By End User

- Construction

- Textiles

- Healthcare

- Automotive

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the projected CAGR of the Asia Pacific Melt Blown Nonwovens Market from 2025 to 2033?

The Asia Pacific melt-blown nonwovens market is expected to grow at a CAGR of 9.58% from 2025 to 2033, driven by sustained demand in hygiene, medical, filtration, and industrial applications, especially in China and India.

Which country dominates melt blown nonwoven production in the Asia Pacific region?

China accounts for over 65% of regional output, with more than 800,000 tons of annual melt-blown nonwoven capacity, supported by strong domestic demand and export infrastructure post-pandemic.

How much melt blown fabric was produced in Asia Pacific during 2023?

In 2023, the region produced approximately 1.4 million metric tons of melt-blown nonwovens, with China contributing nearly 60% , followed by Japan, South Korea, and Vietnam.

Which application segment leads in melt blown nonwoven consumption in Asia Pacific?

Medical and protective apparel remains the largest application, accounting for over 42% of total usage, especially in face masks, surgical gowns, and sterilization wraps across hospitals and clinics

How has the decline in mask mandates affected melt blown polypropylene demand in 2024?

Despite easing mask mandates, melt blown PP demand remained stable , down only 7% from 2022 levels, due to increased adoption in air and liquid filtration media, particularly in India and Southeast Asia.

What percentage of baby diapers in Asia use melt blown nonwoven layers?

Approximately 35% of high-end disposable baby diapers now incorporate melt blown layers for improved breathability and moisture management, especially in premium brands sold in Japan, South Korea, and urban China.

Which cities in China are major hubs for melt blown nonwoven manufacturing?

Major production centers include Dongguan, Suzhou, and Shaoxing , where over 300 manufacturers operate, benefiting from proximity to polymer suppliers and logistics networks serving both domestic and export markets.

How much investment has been made in new melt blown lines in Southeast Asia since 2022?

Since 2022, Southeast Asia has seen over $450 million in new investments in melt-blown facilities, particularly in Thailand, Vietnam, and Malaysia, to support growing hygiene and healthcare product manufacturing.

What role do biodegradable polymers play in next-gen melt blown fabrics in Asia?

Biodegradable alternatives such as PLA and PBS-based melt-blown fabrics are gaining traction, with 12% of new product launches in 2023 incorporating eco-friendly materials, led by innovation in Japan and South Korea.

How is AI being used in quality control for melt blown nonwoven production in Asia?

Leading Chinese manufacturers have integrated AI-powered vision systems into production lines, reducing defect rates by up to 25% and improving consistency in fiber diameter and web uniformity.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com