Asia Pacific Minimally Invasive Surgery Market Research Report – Segmented By Product Type (Surgical Devices, Monitoring and Visualization Devices) Application, End User and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis from 2025 to 2033

Asia Pacific Minimally Invasive Surgery Market Size

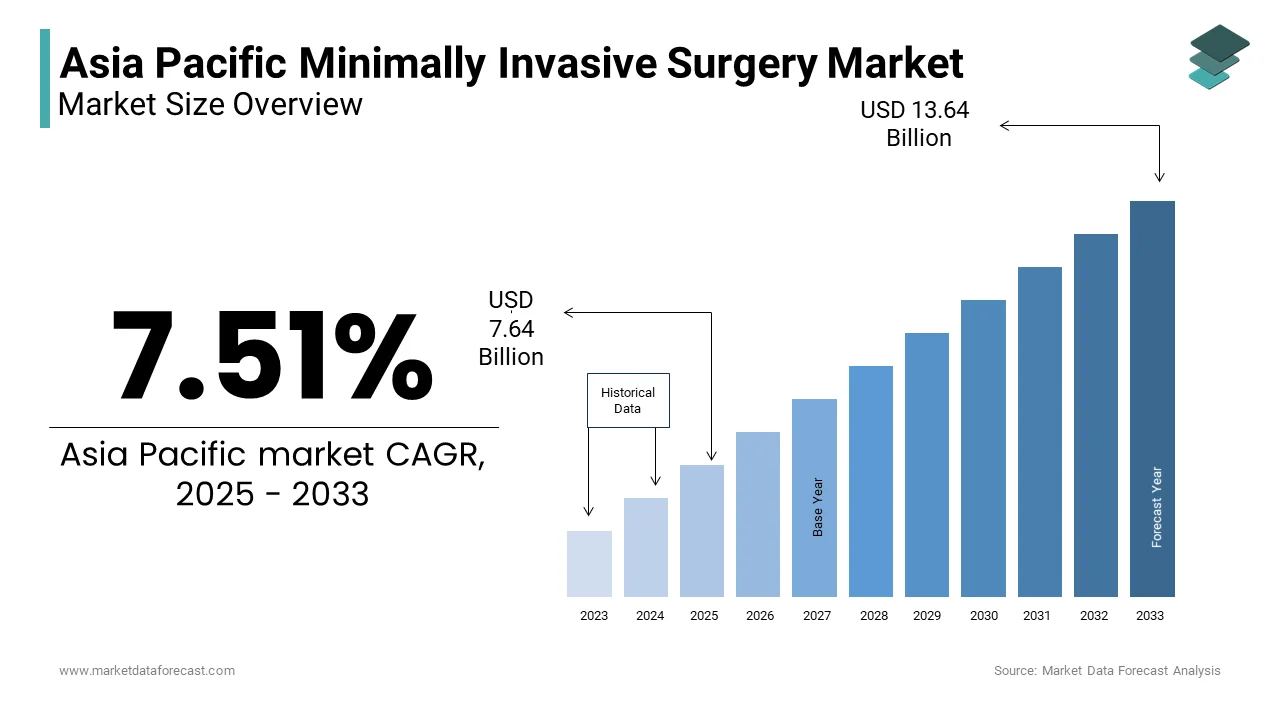

The Asia Pacific Minimally Invasive Surgery Market Size was valued at USD 7.11 billion in 2024. The Asia Pacific Minimally Invasive Surgery Market Size is expected to have 7.51 % CAGR from 2025 to 2033 and be worth USD 13.64 billion by 2033 from USD 7.64 billion in 2025.

The Asia Pacific minimally invasive surgery (MIS) market growth is driven by advancements in surgical techniques that focus on minimizing tissue damage, reducing hospital stays and accelerating patient recovery. This market encompasses a wide range of procedures that leverage cutting-edge technology to enhance precision, improve patient outcomes and optimize healthcare efficiency across the region. These include laparoscopic, endoscopic, robotic-assisted and other image-guided interventions used across specialties such as gastroenterology, gynecology, cardiology, orthopedics and general surgery. The market is witnessing strong momentum due to rising healthcare expenditure and growing burden of chronic diseases along with increasing adoption of technologically superior surgical systems. Non-communicable diseases now account for over 60.91% of total deaths in the region, thereby fueling demand for less invasive treatment options. Life expectancy has increased significantly in recent decades where Japan’s average life expectancy now exceeds 84 years which leads to a surge in age-related conditions requiring surgical intervention. Additionally, rapid urbanization and improved access to insurance schemes are enabling more patients to opt for MIS procedures over conventional open surgeries.

MARKET DRIVERS

Surge in Chronic Disease Prevalence Requiring Surgical Intervention

Escalating prevalence of chronic diseases that necessitate surgical treatment is one of the key drivers of the Asia Pacific minimally invasive surgery market. Conditions such as obesity, cardiovascular diseases, gastrointestinal disorders and cancers are increasingly being diagnosed in rapidly aging populations across Japan, South Korea and China. Nearly 5 million new cancer cases were reported in the Asia Pacific region in 2023 many of which required surgical intervention through minimally invasive techniques for early-stage tumor removal. In India, over 100 million people suffer from diabetes which often leads to complications that require vascular or bariatric surgeries. Moreover, the rise in sedentary lifestyles and changing dietary patterns has led to a spike in metabolic disorders which further boost the need for laparoscopic and endoscopic procedures. Hospitals and ambulatory surgical centers across the region are increasingly adopting these techniques as they allow faster patient turnover and lower infection risks and reinforce their appeal among both clinicians and healthcare providers.

Technological Advancements and Adoption of Robotic-Assisted Surgery

Technological innovation stands as another pivotal force driving the expansion of the Asia Pacific minimally invasive surgery market. The introduction of robotic-assisted platforms, high-definition imaging systems and smart surgical instruments has transformed the landscape of modern surgical care. Countries like South Korea, Singapore and Australia have been at the forefront of integrating robotic systems into clinical practice. Robotic thyroidectomy and colorectal procedures accounted for over 25.42% of all MIS surgeries performed in South Korea in 2023. In Japan, the Ministry of Health, Labour and Welfare approved several new robotic surgical devices between 2020 and 2023 to enhance precision and reduce human error. Additionally, local manufacturers such as Olympus and HOYA Corporation have developed next-generation endoscopes equipped with AI-based diagnostics and real-time imaging enhancements. These advancements not only improve procedural success but also attract medical tourists seeking cutting-edge surgical solutions thus further strengthening the market's growth trajectory.

MARKET RESTRAINTS

High Cost of Advanced MIS Equipment and Procedures

A major constraint impeding the widespread adoption of minimally invasive surgery across the Asia Pacific region is the significant cost associated with advanced surgical equipment and procedure execution. Robotic surgical systems can cost hospitals millions of dollars in initial investment with recurring expenses for maintenance, software upgrades and specialized consumables. The average installation cost of a single robotic surgical system in Australia exceeds AUD 3 million while making it financially prohibitive for smaller hospitals and rural clinics. Only top-tier private institutions can afford to deploy these technologies extensively even in countries with well-developed healthcare infrastructures such as Singapore and Malaysia. Public hospitals in Indonesia and the Philippines face additional budget constraints thereby limiting access to basic laparoscopic tools. Many public hospitals still lack access to fully equipped minimally invasive surgery (MIS) operating theaters. The lack of comprehensive reimbursement policies for robotic or advanced endoscopic procedures further discourages patient uptake thereby acting as a significant barrier to market growth.

Shortage of Skilled Professionals and Training Infrastructure

The Asia Pacific minimally invasive surgery market faces a critical shortage of trained professionals and structured training programs necessary to operate advanced surgical systems effectively. Minimally invasive techniques require extensive hands-on experience for robotic-assisted procedures that involve complex maneuvering and real-time decision-making. Only 30.76% of general surgeons in India have formal training in laparoscopic techniques thereby limiting the scalability of MIS services even where equipment is available. Similarly, in Vietnam and Thailand there is a dearth of certified simulation labs and mentorship programs for young surgeons interested in MIS specialization. Australia itself faces a 20.08% shortfall in trained robotic surgeons despite having one of the most advanced healthcare systems in the region. This gap is even more pronounced in rural areas where skilled specialists are reluctant to relocate due to limited professional development opportunities. The pace of technology adoption will remain constrained across much of the region without significant investments in education and workforce development.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Surgical Consultations

The proliferation of telemedicine and remote consultation platforms presents a substantial opportunity for the Asia Pacific minimally invasive surgery market to reach broader patient demographics. More patients are accessing preoperative consultations, postoperative follow-ups and second opinions without needing to travel long distances with digital health initiatives gaining traction across the region. Telehealth usage for surgical consultations in Australia increased by 40.92% compared to the previous year which is driven by policy reforms and greater internet penetration. This shift enables better patient triaging and increased awareness about minimally invasive alternatives. Additionally, teleconsultation networks between urban centers and rural hospitals are allowing expert MIS surgeons to guide local practitioners in identifying suitable candidates for laparoscopic or endoscopic procedures. AI-backed triage systems integrated with surgical referral apps have improved the identification of minimally invasive surgery (MIS) cases thereby indicating strong potential for future market expansion.

Growing Medical Tourism for Advanced Surgical Treatments

Medical tourism has emerged as a significant growth driver for the Asia Pacific minimally invasive surgery market by attracting international patients seeking high-quality, cost-effective surgical interventions. Countries like Thailand, Singapore, South Korea and India have established themselves as global medical tourism hubs thereby offering state-of-the-art facilities, experienced surgeons and streamlined visa processes for foreign patients. Bangkok’s Bumrungrad Hospital alone treated over 1.2 million international patients in 2023 many of whom opted for minimally invasive procedures ranging from bariatric to urological surgeries. Governments in these countries actively promote medical tourism through dedicated agencies. For instance, Malaysia’s Healthcare Travel Council offers tailored packages for overseas patients seeking MIS treatments. Medical tourists in Asia spend up to 70.73% less on comparable procedures than in Western countries while making the region an attractive destination. This influx not only boosts revenue for healthcare institutions but also encourages continuous technological upgrades and infrastructure development.

MARKET CHALLENGES

Regulatory Hurdles and Approval Delays for New Devices

Regulatory hurdles and lengthy approval timelines for innovative surgical devices are significant challenges impeding the growth of the minimally invasive surgery market in the Asia Pacific region.The Asia Pacific region continues to face challenges due to the absence of a unified regulatory framework while regions like the European Union and North America benefit from regulatory harmonization that streamlines market entry.Each country has distinct standards enforced by national regulatory bodies such as Japan’s Pharmaceuticals and Medical Devices Agency (PMDA), Australia’s Therapeutic Goods Administration (TGA) and India’s Central Drugs Standard Control Organization (CDSCO) among others. It takes an average of 18–24 months for a new MIS device to receive market approval in Southeast Asia compared to 12 months in the United States. China introduced stricter clinical data requirements that delayed the launch of several robotic surgical components. Companies entering these markets must navigate multiple registration processes, language barriers and post-market surveillance obligations along with increasing time-to-revenue and limiting competitive agility for smaller firms.

Limited Access to MIS Technologies in Rural and Underdeveloped Regions

Another pressing challenge facing the Asia Pacific minimally invasive surgery market is the uneven distribution of surgical technologies in rural and underdeveloped areas where access to basic healthcare remains inadequate. Metropolitan hospitals in Australia, Japan and South Korea boast world-class MIS capabilities while rural clinics in Bangladesh, Papua New Guinea and parts of India continue to rely on outdated surgical methods. Nearly 60.98% of the population in low-income Asia Pacific countries lives in rural areas yet fewer hospitals in these regions possess the necessary infrastructure for laparoscopic or endoscopic procedures. In Nepal, only 5.8% of district-level hospitals had access to functional MIS equipment limiting treatment options for residents. The situation is exacerbated by unreliable electricity supply, lack of trained personnel and insufficient operating budgets. Many rural health centers in Indonesia resort to emergency referrals to urban centers due to unavailability of even basic laparoscopic tools. Bridging this gap requires targeted government investments, mobile surgical units and public-private partnerships to ensure equitable access to MIS technologies across the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.51 % |

|

Segments Covered |

By Product Type, Application ,End User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Medtronic PLC, Siemens Healthineers AG ADR, Johnson & Johnson, DePuy Synthes |

SEGMENTAL ANALYSIS

By Product Type Insights

The surgical devices segment held the leading share of 42.85% of the Asia Pacific minimally invasive surgery market in 2024. This dominance is primarily attributed to the extensive range of tools used across various procedures, including staplers, graspers, dissectors and energy-based instruments that are essential for laparoscopic and robotic-assisted surgeries. Over 75.74% of all minimally invasive abdominal surgeries performed in Japan involve reusable or disposable surgical devices representing their necessity in clinical settings. China has seen a notable rise in the number of registered surgical device brands in recent years reflecting strong domestic growth and increasing interest from international manufacturers. Additionally, with rising adoption of single-use devices for infection control many hospitals are increasing procurement volumes. The growing number of bariatric and colorectal interventions has further fueled demand thus reinforcing the segment’s leading position.

The monitoring and visualization devices segment is projected to witness the fastest CAGR of 14.53% during the forecast period and is driven by the increasing reliance on high-resolution imaging and real-time data integration in minimally invasive procedures. New operating theaters in South Korea were equipped with 4K ultra-HD endoscopy systems reflecting a broader trend toward advanced visualization technologies. In Australia,over 25.16% rise in procedures using fluorescence imaging for vascular mapping which enhances surgical precision and reduces complication rates. Moreover, AI-enabled endoscopic platforms introduced by Olympus and HOYA Corporation have improved early-stage cancer detection in gastrointestinal and pulmonary interventions. As per MedTech Dive, AI-assisted visualization software has been adopted in over 40 hospitals across Singapore and Malaysia thereby signaling a shift toward smarter and more integrated imaging solutions that are accelerating this segment’s growth trajectory.

By Application Insights

The gynaecological surgery segment dominated the Asia Pacific minimally invasive surgery market by capturing 28.03% of total market share in 2024 and is driven by the widespread prevalence of reproductive health issues and rising awareness regarding minimally invasive treatment alternatives. Conditions such as uterine fibroids, endometriosis and ovarian cysts are commonly managed through laparoscopic hysterectomies and myomectomies which offer shorter recovery times compared to traditional open procedures. Over 200 million women in the Asia Pacific region suffer from gynaecological disorders annually thus creating sustained demand for MIS interventions. In India, the Janani Suraksha Yojana program expanded access to maternal and reproductive healthcare which directly contributed to increased adoption of minimally invasive gynaecological procedures.

The bariatric surgery segment is anticipated to witness the fastest CAGR of nearly 15.61% during the forecast period and propelled by the escalating obesity epidemic and growing acceptance of weight-loss interventions across both developed and emerging economies in the Asia Pacific. Over 200 million adults in the region were classified as obese in 2023 with countries like Australia, China, and Thailand experiencing rapid increases in metabolic disorders linked to excess body weight. In South Korea, over 35.76% surge in sleeve gastrectomy procedures performed using laparoscopic techniques representing a shift toward less invasive surgical options. Additionally, government-backed insurance schemes in Singapore and Japan have started covering bariatric surgery for qualifying patients while reducing financial barriers. Private healthcare providers in Indonesia and the Philippines are also promoting laparoscopic bariatric centers as part of wellness tourism strategies. Public awareness campaigns and digital consultations have increased preoperative inquiries for bariatric surgery in Southeast Asia thereby fueling the rapid expansion of this segment.

By End User Insights

Hospitals segment was the largest in Asia Pacific minimally invasive surgery market by capturing 68.07% of total market share in 2024 and owing to their well-established infrastructure, availability of trained professionals and ability to perform complex surgical interventions. These institutions serve as primary centers for elective and emergency MIS procedures ranging from laparoscopic cholecystectomies to robotic-assisted cardiac surgeries. Hospital bed density in Japan exceeds 13 beds per 1,000 population which is significantly higher than the global average thus supporting large-scale adoption of advanced surgical systems. Furthermore, hospitals remain the preferred choice for high-risk procedures requiring immediate postoperative care and critical monitoring. Over 90.65% of complex gynaecologic and oncologic MIS cases in India are performed in tertiary care hospitals thereby emphasizing the indispensable role of institutional settings in driving this dominant segment.

The clinics segment is likely to experience a fastest CAGR of 12.74% during the forecast period. Governments across the Asia Pacific are increasingly recognizing ASCs as viable alternatives for low- to moderate-risk procedures thereby encouraging private investment and regulatory support. The number of accredited outpatient surgical clinics in Australia grew by 18.69% in 2023 and offered services such as endoscopic procedures and minor orthopedic interventions. In South Korea, the Ministry of Health and Welfare streamlined licensing protocols for day-care surgical centers resulting in a 25.09% increase in clinic-based MIS procedures . Additionally, in rapidly urbanizing markets like Singapore and Malaysia consumers are shifting toward premium medical aesthetic and diagnostic clinics that integrate minimally invasive treatments. Clinic-based surgical case volume rose by over 30.8% in urban Southeast Asia thereby emphasizing the growing consumer preference for efficient and patient-centric surgical care models.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific minimally invasive surgery market and accounted for 26.98% of total market share in 2024 and is driven by its expanding middle-class population, increasing healthcare expenditure and aggressive government investments in medical infrastructure. The country is witnessing a surge in chronic diseases such as obesity, diabetes and cancer thereby necessitating advanced surgical interventions. Over 2.5 million minimally invasive procedures were performed nationwide in 2023 spanning disciplines from gastroenterology to cardiothoracic surgery. The National Medical Products Administration has expedited approvals for foreign-made robotic surgical systems thus enhancing technology penetration. Additionally, domestic manufacturers such as MicroPort Scientific and Lepu Medical are producing locally adapted MIS devices while improving affordability. The Ministry of Science and Technology launched the “Digital Surgery Development Plan” in 2022 thereby aiming to integrate AI-driven surgical navigation tools into public hospitals which further propelled market growth.

Japan was positioned second in holding the dominant share of the Asia Pacific minimally invasive surgery market in 2024 and is distinguished by its highly sophisticated healthcare system, aging population and early adoption of robotic and image-guided surgical technologies. Japan faces a high incidence of age-related conditions such as degenerative spine disease, cardiovascular ailments and cancers which require minimally invasive interventions. Public health insurers cover a significant portion of MIS costs while making these procedures more accessible. The country’s emphasis on medtech innovation ensures sustained demand for next-generation surgical tools.

India’s minimally invasive surgery market is likely to have significant growth opportunities during the forecast period. The country’s rising burden of lifestyle diseases coupled with increasing health insurance coverage and growing medical tourism which is fueling demand for advanced surgical treatments. The Ayushman Bharat scheme has expanded access to surgical care in rural areas where mobile surgical units are being deployed. Private hospital chains such as Apollo and Fortis are investing heavily in hybrid operating theaters equipped with robotic platforms.

Australia’s minimally invasive surgery market growth is driven by robust healthcare policies, high per capita income and widespread adoption of technologically superior surgical systems. The country has one of the most developed healthcare infrastructures in the Asia Pacific with a strong presence of global medical device manufacturers and research institutions. The Therapeutic Goods Administration is facilitating faster approvals for innovative MIS products while Medicare provides partial reimbursement for laparoscopic and robotic procedures. The University of Sydney’s surgical robotics lab is pioneering advancements in AI-assisted interventions thereby attracting international collaboration.

South Korea’s minimally invasive surgery market is likely to grow at a healthy CAGR in the next coming years. The country boasts a high concentration of robotic surgery centers in Seoul and Busan where medical tourism and public-private partnerships drive demand. The Ministry of Health and Welfare supports MIS adoption through national training programs and subsidies for hospitals integrating AI-enhanced surgical platforms. Local companies such as Medtronic Korea and LG Life Sciences are developing specialized endoscopes and imaging software tailored for minimally invasive applications.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific Minimally Invasive Surgery Market are Medtronic PLC, Siemens Healthineers AG ADR, Johnson & Johnson, DePuy Synthes, GE HealthCare Technologies Inc Common Stock, Abbott Laboratories, NuVasive, Zimmer Biomet Holdings Inc

The competition in the Asia Pacific minimally invasive surgery market is marked by the presence of globally established medical device manufacturers alongside rapidly emerging domestic players seeking to capture market share. Multinational corporations leverage their extensive product portfolios, technological expertise and robust distribution networks to maintain dominance particularly in developed economies such as Japan, Australia and South Korea. At the same time, local and regional firms are gaining traction by offering cost-effective alternatives and tailoring products to suit specific clinical needs in emerging markets like India, China and Southeast Asia. The market is highly dynamic and is driven by continuous innovation, evolving surgical preferences and increasing investment in healthcare infrastructure. Strategic collaborations, mergers and acquisitions are frequently employed to strengthen regional footholds and expand product offerings. Additionally, companies face intense pressure to differentiate themselves through enhanced product features, integrated digital solutions and superior customer support. The competitive landscape is expected to intensify further with a growing focus on affordability, training and seamless integration of MIS technologies into mainstream surgical care as governments continue to prioritize healthcare modernization and surgical access.

Top Players in the Market

Medtronic (Ireland-based)

Medtronic is a global leader in medical technology and holds a strong presence in the Asia Pacific minimally invasive surgery market. The company offers a comprehensive portfolio of surgical devices, robotic-assisted platforms and visualization systems tailored for laparoscopic and endoscopic procedures. Its commitment to innovation has led to the development of intelligent surgical tools that integrate with AI-driven platforms. Medtronic actively collaborates with regional healthcare providers and regulatory bodies to ensure widespread adoption of its technologies. The company continues to influence clinical practices across multiple surgical specialties while reinforcing its top position in the global market by focusing on training programs and digital health integration.

Johnson & Johnson (United States-based)

Johnson & Johnson plays a pivotal role in shaping the Asia Pacific minimally invasive surgery landscape. The company specializes in advanced energy devices, suturing systems and robotic platforms designed to improve surgical outcomes and reduce recovery times. Its focus on research and development has resulted in next-generation laparoscopic instruments that offer superior ergonomics and safety. Johnson & Johnson strengthens its regional footprint by forming strategic alliances with local distributors and investing in education initiatives for surgeons. The company’s emphasis on patient-centric solutions and continuous product evolution ensures its sustained relevance in both hospital and ambulatory surgical settings across the Asia Pacific region.

Olympus Corporation (Japan-based)

Olympus, now part of Evident Corporation, remains a dominant force in endoscopy and visualization equipment while making it a key player in the Asia Pacific minimally invasive surgery market. The company has pioneered innovations in high-definition imaging, endoscopic ultrasound and fluorescence-guided surgery thereby enabling early disease detection and precise interventions. Olympus maintains a strong brand reputation in Japan and is expanding aggressively into emerging markets such as India, China and Southeast Asia.

Top Strategies Used by Key Market Participants

Product innovation and technological integration is one of the primary strategies adopted by leading players in the Asia Pacific minimally invasive surgery market. Companies are prioritizing R&D investments to develop smart surgical tools, AI-enhanced imaging systems and robotic platforms that deliver greater precision and improved patient outcomes. These advancements align with the growing demand for efficient, less painful and faster-recovery surgical options.

Another crucial approach involves expanding regional distribution networks and strengthening local partnerships. Market leaders are collaborating with hospitals, clinics and government agencies to enhance product availability and after-sales support. This includes setting up regional service hubs while offering specialized training and engaging with local distributors to penetrate underserved markets effectively.

Companies are increasingly investing in surgeon education and clinical training programs to bridge skill gaps and promote wider adoption of minimally invasive techniques. Firms ensure that healthcare professionals are proficient in using advanced surgical technologies by organizing hands-on workshops, simulation labs and certification courses thereby increasing device utilization and long-term market penetration.

RECENT HAPPENINGS IN THE MARKET

In March 2023, Medtronic launched an AI-integrated robotic surgery platform in Singapore aimed at enhancing surgical precision and supporting complex minimally invasive procedures.

In July 2023, Johnson & Johnson expanded its partnership with a major Indian hospital chain to establish dedicated minimally invasive surgery training centers.

In November 2023, Olympus (now Evident) introduced a new line of ultra-slim endoscopes in Japan which is specifically developed for early-stage cancer detection and outpatient endoscopic procedures.

In February 2024, B. Braun entered into a joint venture with a South Korean medtech firm to co-develop reusable laparoscopic instruments tailored for high-volume surgical settings.

In September 2024, Stryker acquired a Singapore-based surgical navigation startup to enhance its digital surgery capabilities.

MARKET SEGMENTATION

This research report on the asia pacific minimally invasive surgery market has been segmented and sub-segmented into the following.

By Product Type

- Surgical Devices

- Monitoring and Visualization Devices

By Application

- Bariatric Surgery

- Gynaecological Surgery

By End User

- Hospitals

- Clinics and Others

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the Asia Pacific Minimally Invasive Surgery (MIS) Market?

The Asia Pacific MIS Market refers to the regional market focused on surgical procedures that use minimal incisions, reducing recovery time and complications. It includes tools, technologies, and services used in such procedures.

What challenges does the Asia Pacific MIS market face?

High cost of advanced surgical systems Limited access in rural and underdeveloped areas Lack of trained professionals Regulatory hurdles in some countries

Which companies dominate the MIS market in Asia Pacific?

Key players include are Medtronic Johnson & Johnson (Ethicon) Stryker Olympus Corporation Intuitive Surgical Karl Storz

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com