Asia Pacific Oil Storage Market Size, Share, Trends & Growth Forecast Report By Product (Floating Roof Tanks, Spherical Tanks), End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Oil Storage Market Size

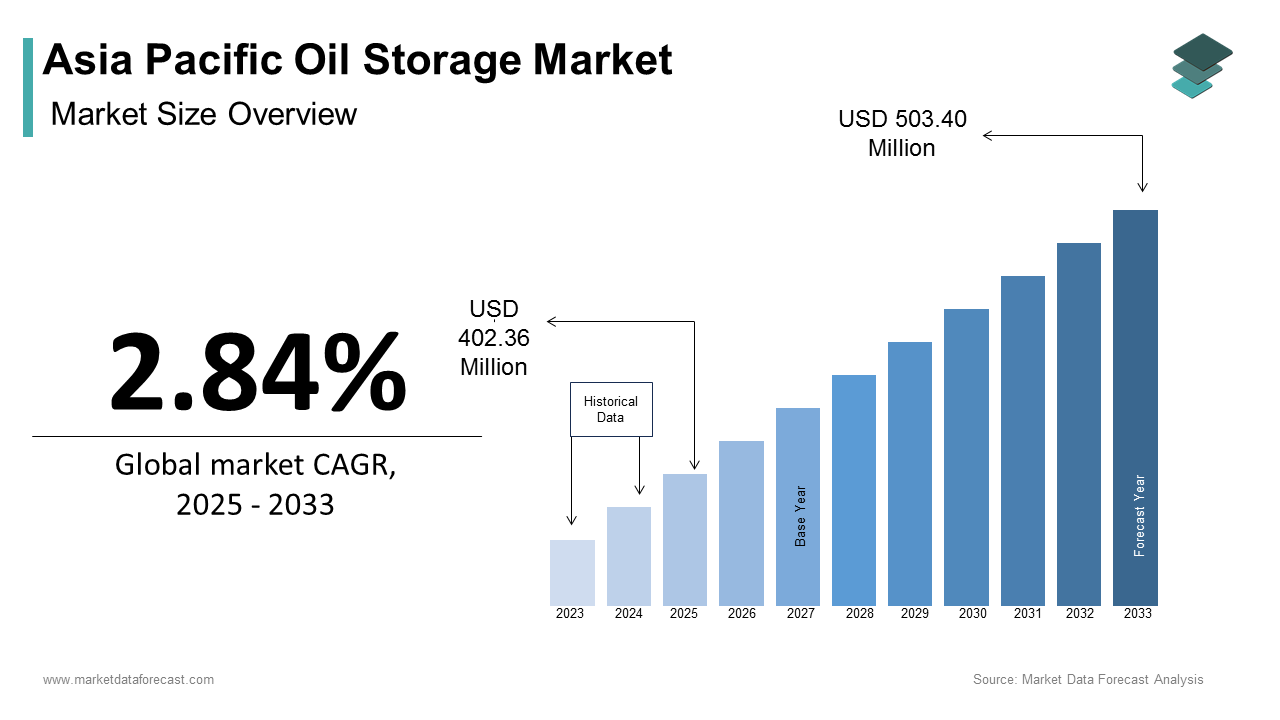

The Asia Pacific oil storage market size was calculated to be USD 391.25 million in 2024 and is anticipated to be worth USD 503.40 million by 2033, from USD 402.36 million in 2025, growing at a CAGR of 2.84% during the forecast period.

The Asia Pacific oil storage market covers a broad network of infrastructure dedicated to the safe and efficient storage of crude oil, refined petroleum products, and associated hydrocarbons. This includes above-ground tanks, underground reservoirs, floating storage units, and strategic petroleum reserves maintained by governments across the region. As energy consumption continues to rise in emerging economies such as India, Indonesia, and Vietnam, coupled with China’s sustained industrial activity, the demand for reliable oil storage infrastructure has surged.

MARKET DRIVERS

Rising Crude Oil Imports in Emerging Economies

One of the major drivers of the Asia Pacific oil storage market is the increasing dependence on crude oil imports among emerging economies such as India, Indonesia, and the Philippines. As these countries experience rapid urbanization and industrial expansion, their domestic oil production has been unable to keep pace with growing demand. For instance, India's crude oil import dependency rose to nearly 87% in fiscal year 2024, up from 79% in 2019, according to data published by the Ministry of Petroleum and Natural Gas. This surge in imports necessitates enhanced storage infrastructure at ports and refineries to manage supply fluctuations and ensure operational continuity. China, already the world’s largest crude oil importer, imported approximately 508 million metric tons of crude oil in 2023, reflecting an increase of 10% compared to the previous year, as reported by the General Administration of Customs of China. With limited indigenous reserves and growing consumption, China has been actively building additional storage facilities, including large-scale underground reserves designed to mitigate supply shocks. Similarly, Vietnam saw a significant growth in oil imports during 2023, prompting substantial investment in new tank farms near key refining centers.

Expansion of Refining Capacity Across the Region

Another significant driver of the Asia Pacific oil storage market is the ongoing expansion of refining capacity, particularly in countries like India, China, and South Korea. As these nations seek to enhance downstream self-sufficiency and support growing domestic fuel demand, they are investing heavily in new refining projects that inherently require large-scale storage infrastructure. Similarly, China’s Zhejiang Refinery, which reached full operational capacity in 2023, now ranks among the largest integrated refining hubs globally, requiring advanced tank farm systems and intermediate storage units to ensure process efficiency. South Korea, despite being a relatively mature market, is also upgrading its existing refineries to produce cleaner fuels in line with international emissions norms. These upgrades typically involve retrofitting or constructing new storage tanks to manage increased throughput volumes. Moreover, petrochemical integration within refineries demands specialized storage solutions for feedstocks and intermediates, further stimulating demand for diversified oil storage systems.

MARKET RESTRAINTS

Stringent Environmental Regulations and Permitting Delays

One of the primary restraints affecting the Asia Pacific oil storage market is the imposition of increasingly stringent environmental regulations and prolonged permitting processes across several developed markets in the region. Countries such as Australia, Japan, and South Korea have implemented rigorous environmental compliance standards that significantly delay project approvals and raise capital expenditures. According to the Organisation for Economic Co-operation and Development (OECD), environmental impact assessments (EIAs) for industrial storage projects in Asia Pacific now take more months, compared to just 12 months a decade ago. In Australia, new oil storage developments must comply with the Environment Protection and Biodiversity Conservation Act 1999, which mandates thorough scrutiny of potential ecological impacts, especially in coastal zones where many storage terminals are located. Similarly, Japan’s Ministry of the Environment requires detailed risk assessments related to air quality, water contamination, and seismic resilience before approving any new storage infrastructure. Moreover, community opposition and litigation have become recurring hurdles in multiple jurisdictions. In New Zealand, plans for a proposed fuel storage facility near Auckland were delayed for three years due to legal challenges from local environmental groups concerned about groundwater pollution and carbon emissions.

Geopolitical Tensions and Supply Chain Disruptions

Geopolitical instability and disruptions to regional supply chains represent another major restraint on the Asia Pacific oil storage market. Given the region’s heavy reliance on imported crude oil—particularly from the Middle East and Russia—any escalation in international tensions can significantly affect storage planning and inventory management strategies. The 2022 conflict in Ukraine, for example, led to a sharp realignment of global oil trade flows, forcing Asian buyers to adjust procurement strategies and expand storage facilities to accommodate newly sourced crude varieties. According to the U.S. Energy Information Administration (EIA), a significant portion of crude oil imported into Asia transits through the Strait of Hormuz, making the region highly vulnerable to maritime security risks. Any disruption in this chokepoint could impede oil deliveries, leading to surges in demand for buffer stocks and emergency reserve buildouts. However, uncertainty around such events often leads to conservative investment behavior, delaying long-term infrastructure projects. In addition, recent U.S.-China trade tensions have introduced regulatory unpredictability regarding technology exports used in storage monitoring and automation. This has impacted the deployment of digital pipeline integrity systems and remote sensing equipment in some markets. Furthermore, Japan and South Korea have had to reassess strategic petroleum reserve levels amid concerns over North Korean military activities and regional defense dynamics.

MARKET OPPORTUNITIES

Growth of Floating Storage and Offshore Terminals

A significant opportunity emerging in the Asia Pacific oil storage market is the increasing adoption of floating storage and offshore terminal solutions. With expanding offshore oil production and rising demand for flexible storage options near deep-sea ports, companies are turning to Floating Storage Units (FSUs) and Floating Storage and Regasification Units (FSRUs) to meet logistical needs efficiently. Key markets driving this trend include Singapore, Malaysia, and Indonesia, where land scarcity and high real-estate costs make offshore alternatives particularly attractive. Singapore, a major global bunkering hub, has invested heavily in floating storage infrastructure to support its strategic role in regional oil trade. The Jurong Rock Caverns, an underground storage facility extended via offshore connections, exemplifies how floating units integrate seamlessly with subterranean systems to optimize space utilization. Similarly, India is exploring floating LNG terminals to bolster gas storage capabilities along its eastern and western coasts. These installations reduce pipeline dependency and enable rapid deployment in response to fluctuating demand. In the Philippines, where domestic energy infrastructure remains fragmented, floating storage offers a cost-effective solution to serve remote islands and industrial clusters.

Digitalization and Smart Monitoring Systems in Storage Operations

The integration of digital technologies into oil storage management is creating a compelling opportunity for modernization across the Asia Pacific oil storage market. Operators are increasingly adopting smart monitoring systems, Internet of Things (IoT)-)-enabled sensors, predictive maintenance tools, and cloud-based analytics to enhance operational efficiency, safety, and regulatory compliance. In India, state-owned enterprises such as Indian Oil Corporation are deploying blockchain-based tracking mechanisms to monitor crude oil inflows and outflows in real time, minimizing pilferage and enhancing audit accuracy. Similarly, China’s Sinopec has implemented drone inspections and AI-driven fire prediction models at its Shanghai refinery, reducing manual interventions and improving turnaround time for maintenance activities. These digital enhancements not only reduce operational risks but also facilitate seamless integration with national energy grids and logistics networks.

MARKET CHALLENGES

Aging Infrastructure and High Maintenance Costs

One of the foremost challenges confronting the Asia Pacific oil storage market is the prevalence of aging infrastructure, particularly in developed economies such as Japan, Australia, and South Korea. Many storage terminals in these countries were constructed several decades ago and are now facing deterioration due to prolonged exposure to harsh environmental conditions, corrosion, and operational wear. The financial burden of maintaining and upgrading legacy infrastructure is immense. These figures are expected to rise as regulatory agencies impose stricter inspection protocols and mandate periodic fitness-for-service evaluations. Also, aging pipelines connected to storage facilities pose significant risks of leaks and spills, contributing to operational downtime and environmental liabilities.

Land Acquisition and Regulatory Hurdles in Urbanized Areas

Land availability has emerged as a critical challenge for the expansion of oil storage facilities across densely populated urban centers in the Asia Pacific region. Rapid urbanization in countries like India, China, and the Philippines has drastically reduced the availability of suitable locations for constructing new storage terminals, particularly near major ports and consumption hubs. According to the World Bank, urban population density in Asia Pacific has increased significantly since 2010, intensifying the competition for industrial land use. In cities such as Mumbai, Jakarta, and Manila, proximity to end-users makes coastal areas ideal for storage infrastructure; however, encroachment by residential and commercial developments has restricted access to viable sites. Regulatory restrictions further exacerbate the issue. In China, authorities have imposed strict zoning laws prohibiting oil storage facilities in environmentally sensitive or densely populated zones. Similar policies in Japan mandate minimum distance buffers between storage terminals and residential areas, effectively limiting expansion possibilities in metropolitan regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.84% |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Royal Vopak, Sinopec, Indian Oil Corporation, Reliance Industries, China National Offshore Oil Corporation (CNOOC), BW Group, Bumi Armada, Idemitsu Kosan, San-Ai Oil, Puma Energy, Philippine Tank Storage International, Keppel Infrastructure Trust, Metro Pacific Investments Corporation (MPIC), Berkshire Hathaway, LyondellBasell Industries, Gibson Energy, Oiltanking GmbH, McDermott International, Koch Industries, CNPC, PetroChina, Mitsui & Co., Samsung Engineering, GS Caltex, Hyundai Engineering & Construction, Tokyo Gas. |

SEGMENTAL ANALYSIS

By Product Insights

The floating roof tanks segment dominates the Asia Pacific oil storage market by capturing 35.5% of the total product segment in 2024. This dominance is attributed to their superior ability to reduce vapor losses and enhance safety in storing volatile petroleum products such as crude oil and gasoline. In China, where industrial demand for refined fuels is consistently rising, state-owned enterprises like Sinopec and CNPC have prioritized floating roof tank installations to minimize emissions. The Ministry of Ecology and Environment reported that evaporative hydrocarbon losses from fixed roof tanks can be up to 20 times higher than those with floating roofs, prompting regulatory shifts toward the latter. India has also witnessed a surge in floating roof tank deployment, particularly under its Strategic Petroleum Reserve Project. The Indian Strategic Petroleum Reserves Limited (ISPRL) expanded underground reserves but still relies heavily on surface-based floating roof systems for intermediate storage and transit. In Japan, aging infrastructure upgrades have included replacing legacy tanks with modern floating roof units to comply with stricter safety protocols set by the Ministry of Economy, Trade and Industry.

The spherical tanks are coming up as the fastest-growing segment in the Asia Pacific oil storage market, projected to expand at a CAGR of 8.1% between 2025 and 2033. This rapid rise is driven by their suitability for storing liquefied petroleum gas (LPG) and other pressurized hydrocarbons, especially in countries undergoing energy transition and industrialization. According to the International Energy Agency (IEA), LPG consumption in Asia Pacific is expected to rise by nearly 6% annually through 2030, primarily fueled by increasing residential usage and industrial feedstock applications. Countries like Indonesia and Vietnam are expanding LPG infrastructure to replace traditional biomass fuels, necessitating spherical tanks known for their structural integrity under high pressure. South Korea's push for cleaner fuel alternatives has led to extensive use of spherical tanks in petrochemical complexes such as Ulsan and Yeosu. Also,

By End Use Insights

Crude oil storage remained the largest end-use segment in the Asia Pacific oil storage market by commanding 40.3% of total capacity in 2024. This is because of the region’s status as the world’s largest crude oil importer and consumer, with China, India, and Japan collectively accounting for more than half of all crude imports in Asia Pacific. The International Energy Agency (IEA) reported that the Asia Pacific region consumed approximately 35 million barrels per day of crude oil in 2023, representing nearly 40% of global demand. To ensure supply security and buffer against geopolitical disruptions, governments, and private entities are investing heavily in strategic and commercial crude oil reserves. China leads this trend. Similarly, India’s ISPRL (Indian Strategic Petroleum Reserves Limited) maintains underground crude storage facilities with a combined capacity of 5.33 million metric tons, further reinforcing the need for large-scale crude storage infrastructure.

Liquefied Natural Gas (LNG) storage is emerging as the fastest-growing end-use segment in the Asia Pacific oil storage market, expected to grow at a CAGR of 7.8% through 2033. This progress trajectory is propelled by the region’s accelerating shift towards cleaner energy sources and the expansion of natural gas infrastructure. Countries like South Korea and Taiwan are aggressively diversifying away from nuclear and coal-based power generation, boosting LNG import and storage requirements. Singapore, already a key LNG bunkering hub, is developing floating storage and regasification units (FSRUs) to support growing marine fuel demand. The Maritime and Port Authority of Singapore (MPA) reports that LNG bunkering activities are expected to increase fivefold by 2025, necessitating expanded storage capacities near port zones. Moreover, India’s plans to expand its city gas distribution network and establish additional LNG terminals along both coasts are catalyzing investments in cryogenic storage tanks.

REGIONAL ANALYSIS

China dominated the regional market with a 30.5% share of total installed capacity in 2024. As the world’s top crude oil importer and second-largest consumer, China’s oil storage infrastructure is critical to ensuring energy security and supporting its vast industrial economy. The country is not only expanding government-controlled reserves but also witnessing significant activity from commercial operators. Independent refiners, often referred to as "teapots," have driven demand for privately owned storage solutions, especially in coastal regions such as Shandong and Zhejiang. Also, the construction of massive integrated refining hubs like the Zhejiang Refinery has spurred the development of adjacent bulk storage terminals. Environmental regulations imposed are also shaping storage technology choices, with increased adoption of floating roof tanks and digital monitoring systems.

India is a rapidly expanding market with growing strategic reserves. The country’s strategic push toward enhancing energy security and reducing import vulnerability has been a primary driver behind the expansion of its oil storage infrastructure. India’s strategic oil reserves, managed by Indian Strategic Petroleum Reserves Limited (ISPRL), have a combined capacity of 5.33 million metric tons, with plans to further expand by an additional 6.5 million metric tons over the next five years. These reserves are stored in underground rock caverns located along the eastern and western coasts to facilitate quicker access for refineries. Simultaneously, growing refining capacity is augmenting demand for commercial storage tanks. Urbanization, industrial load growth, and policy incentives are also indirectly influencing the expansion of ancillary storage infrastructure for LPG and diesel.

Japan is a mature market with a high emphasis on safety and regulation. Despite being a mature market with minimal new capacity additions, Japan maintains one of the most advanced and compliant oil storage infrastructures globally. The Ministry of Economy, Trade and Industry (METI) oversees stringent safety standards, ensuring that existing facilities meet rigorous seismic resilience and spill prevention requirements. This level of preparedness is among the highest globally and underscores Japan’s commitment to securing its energy supply chain amid geopolitical uncertainties. Commercial oil storage is largely managed by major energy companies. These firms operate a network of above-ground and underground storage facilities, many of which are transitioning to digitized monitoring systems to improve inventory accuracy and leak detection.

South Korea is known for its technologically advanced refining and petrochemical complexes, South Korea has developed highly integrated oil storage systems that cater to both domestic consumption and export-oriented production. The Korea National Oil Corporation (KNOC) manages the country’s strategic petroleum reserves, which were estimated at 104 days of net imports as of late 2023. These reserves are stored in deep-rock caverns and land-based depots strategically located near major refining clusters such as Ulsan, Yeosu, and Daesan. The push toward cleaner fuels and tighter sulfur content regulations has prompted upgrades in terminal design, including enhanced vapor recovery and improved fire suppression mechanisms. Furthermore, the country's growing interest in liquefied natural gas (LNG) has led to the development of dual-purpose storage terminals capable of handling both oil and gas derivatives.

Australia has strategic relevance amid declining domestic production. While the country’s domestic oil production has been on a steady decline, its strategic location and role in regional energy trade have elevated the importance of its storage infrastructure. Private sector participation has also surged, with companies like Viva Energy and Ampol investing in new terminal expansions and digital leak detection systems. Given Australia’s geographic proximity to key trading partners in Southeast Asia and its potential role as a regional energy transit hub, its oil storage infrastructure is expected to evolve beyond domestic needs and play a more strategic function in the broader Asia Pacific energy architecture.

LEADING PLAYERS IN THE ASIA PACIFIC OIL STORAGE MARKET

Royal Vopak (Netherlands-based, with a significant presence in Asia)

Royal Vopak is a leading independent tank storage company with an extensive footprint across Asia Pacific, particularly in Singapore, China, and India. The company operates multiple terminals dedicated to crude oil, refined products, and specialty chemicals. Its focus on sustainability, operational excellence, and strategic expansion has made it a key player in the region. Vopak’s emphasis on digitalization and green infrastructure developments supports not only regional demand but also global energy transition goals.

Indian Oil Corporation Limited (India)

As India’s largest commercial enterprise, Indian Oil Corporation plays a central role in the country’s oil storage landscape. It manages a vast network of storage facilities that support India’s refining, transportation, and distribution infrastructure. The company contributes significantly to national strategic reserves while also investing in modern terminal technologies. Its regional influence extends beyond India through collaborations and infrastructure projects aimed at enhancing supply chain efficiency.

Sinopec (China)

Sinopec is one of the world’s largest integrated energy companies and a dominant force in China’s oil storage market. Through its subsidiaries and joint ventures, Sinopec oversees massive crude and refined product storage systems essential for domestic consumption and export logistics. The company's investments in advanced storage solutions, coupled with government-backed reserve expansions, reinforce its critical position in both the regional and global oil storage ecosystem.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Asia Pacific oil storage market is expanding strategic partnerships and joint ventures. Companies are increasingly collaborating with state-owned enterprises and international logistics firms to enhance operational reach and access new markets. These alliances facilitate resource sharing, reduce capital risk, and align with national energy security policies.

Another crucial approach is investing in green and sustainable storage infrastructure With growing environmental scrutiny, leading firms are adopting low-emission storage techniques, constructing eco-friendly terminals, and integrating renewable energy into operations. This shift aligns with global decarbonization targets while ensuring compliance with stringent local regulations.

A third key strategy is adopting digital transformation and automation. Market leaders are deploying smart monitoring systems, predictive maintenance tools, and AI-driven analytics to improve asset management, safety, and inventory control.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Asia Pacific oil storage market include Royal Vopak, Sinopec, Indian Oil Corporation, Reliance Industries, China National Offshore Oil Corporation (CNOOC), BW Group, Bumi Armada, Idemitsu Kosan, San-Ai Oil, Puma Energy, Philippine Tank Storage International, Keppel Infrastructure Trust, Metro Pacific Investments Corporation (MPIC), Berkshire Hathaway, LyondellBasell Industries, Gibson Energy, Oiltanking GmbH, McDermott International, Koch Industries, CNPC, PetroChina, Mitsui & Co., Samsung Engineering, GS Caltex, Hyundai Engineering & Construction, Tokyo Gas.

The competitive landscape of the Asia Pacific oil storage market is characterized by a mix of international and regional players vying to strengthen their infrastructure and service offerings. While large multinational operators such as Royal Vopak and Oiltanking bring global expertise and standardized operational models, national oil companies like Indian Oil Corporation and Sinopec dominate due to their strategic alignment with government policies and energy security initiatives. Private sector entrants are also gaining traction by offering flexible, cost-effective storage solutions tailored to emerging industrial hubs. The competition intensifies in major trade corridors and coastal zones where proximity to refineries, ports, and pipeline networks determines market leadership. Companies are differentiating themselves through technological innovation, environmental stewardship, and rapid deployment capabilities to capture market share. Additionally, regulatory shifts and land-use constraints are pushing firms toward alternative storage formats such as underground caverns and floating units, further shaping the evolving competitive dynamics in the region.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Royal Vopak announced the development of a new multi-product storage terminal in Zhuhai, China, aimed at expanding its regional capacity and diversifying offerings in refined fuels and specialty chemicals.

- In March 2024, Indian Oil Corporation signed a strategic agreement with a leading petrochemical firm to co-develop an integrated storage and logistics complex in Visakhapatnam, enhancing downstream integration and supply chain efficiency.

- In July 2024, Sinopec initiated the construction of a deep-rock oil storage facility in Guangdong Province, designed to support national strategic reserves and ensure long-term fuel availability amid rising import dependency.

- In September 2024, Mitsui O.S.K. Lines formed a joint venture with a Japanese energy infrastructure firm to explore floating storage and regasification unit deployments along Japan’s coastlines, addressing space constraints and fuel transition needs.

- In November 2024, PTT Global Chemical launched an upgraded digital monitoring system across its storage terminals in Thailand, improving real-time inventory tracking and safety protocols to align with international standards.

MARKET SEGMENTATION

This research report on the Asia Pacific Oil Storage Market has been segmented and sub-segmented based on product, end user, and region.

By Product

- Floating Roof Tanks

- Spherical Tanks

By End User

- Crude Oil Storage

- LNG Storage

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the major factors driving growth in the Asia Pacific oil storage market?

Key drivers include rising energy demand, strategic petroleum reserves, refinery expansion, increasing imports/exports of oil, and greater investment in storage infrastructure.

2. Which countries are leading the oil storage market in the Asia Pacific region?

China, India, Japan, South Korea, and Australia are among the leading countries due to their large refining capacities, energy needs, and strategic storage initiatives.

3. Who are the key players in the Asia Pacific oil storage market?

Notable players include Royal Vopak, Sinopec, Indian Oil Corporation, CNOOC, Reliance Industries, BW Group, and Bumi Armada.

4. How does government policy impact the oil storage market?

Government policies regarding energy security, environmental regulations, and strategic petroleum reserves significantly influence storage investments and infrastructure development.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com