Asia Pacific OTR Tire Market Research Report – Segmented By Application & Equipment (Construction & Mining, Agriculture Tractors By Power Output, Industrial Vehicle, ATVs)Type, Retreading and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific OTR Tire Market Size

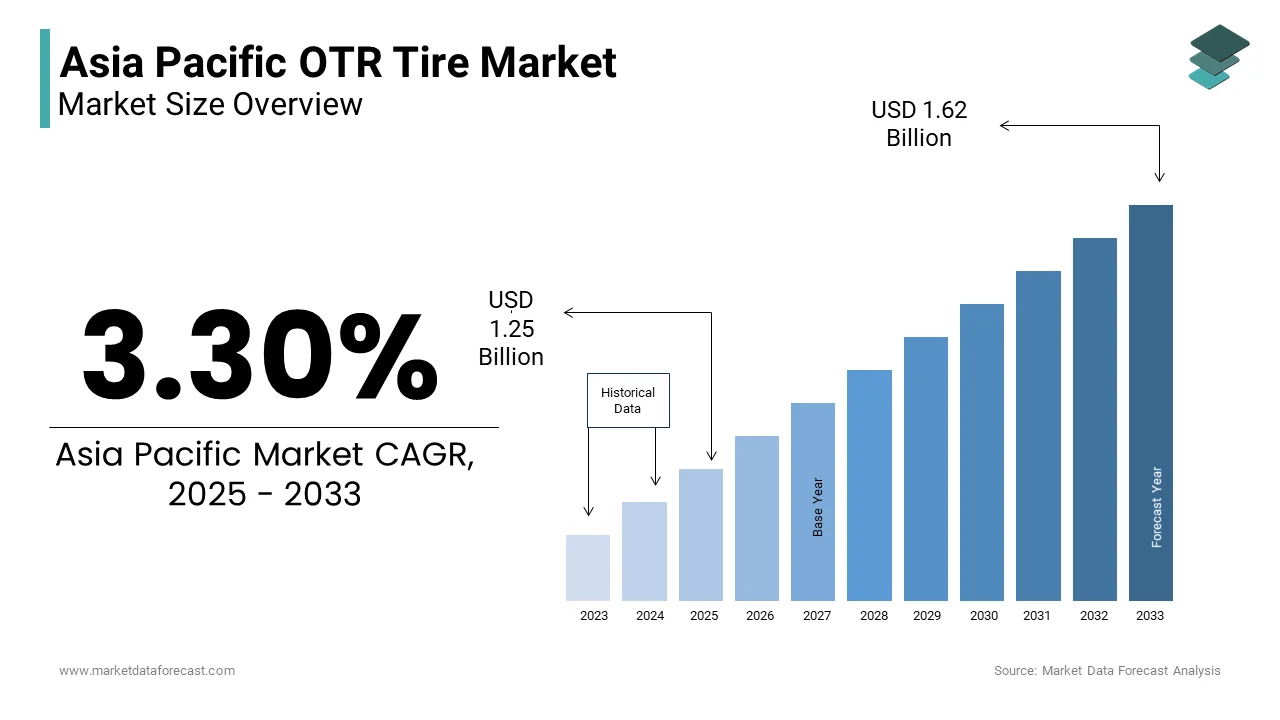

The Asia Pacific OTR Tire Market Size was valued at USD 1.21 billion in 2024. The Asia Pacific OTR Tire Market size is expected to have 3.30% CAGR from 2025 to 2033 and be worth USD 1.62 billion by 2033 from USD 1.25 billion in 2025.

The Asia Pacific OTR (Off-the-Road) tire market growth is driven by robust industrialization and infrastructure development. China, India, and Australia are pivotal contributors, with their governments investing heavily in large-scale infrastructure and resource extraction projects.

Additionally, the mining sector amplifies OTR tire demand in resource-rich nations like Indonesia and Australia. As per a report by the World Mining Congress, Asia Pacific holds over 40% of the world’s mineral reserves by necessitating durable tires for heavy machinery. The agricultural boom in countries like India further bolsters demand, as mechanized farming requires specialized tires for tractors and harvesters.

MARKET DRIVERS

Infrastructure Development

Infrastructure development stands as a cornerstone driving the Asia Pacific OTR tire market, propelled by government-led initiatives and private investments. Similarly, India’s Smart Cities Mission aims to develop 100 smart cities by requiring extensive use of earthmoving equipment and OTR tires.

Mobile cranes, bulldozers, and excavators, essential for these projects, depend on high-performance OTR tires capable of withstanding rugged terrains. Additionally, urban migration trends, as outlined by the United Nations, project that 68% of Asia’s population will reside in urban areas by 2050. This demographic shift amplifies the need for residential and commercial buildings, further bolstering OTR tire utilization.

Mining Sector Expansion

Mining sector expansion is another critical driver propelling the Asia Pacific OTR tire market in resource-rich countries like Australia, Indonesia, and India. Similarly, Indonesia’s coal mining industry, one of the largest globally, depends on heavy-duty OTR tires for efficient operations.

The rise of electric vehicles (EVs) also indirectly boosts mining activities, as the demand for lithium, cobalt, and nickel surges. Furthermore, government policies promoting sustainable mining practices encourage the use of eco-friendly OTR tires.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

Fluctuating raw material costs pose a significant restraint to the Asia Pacific OTR tire market by affecting both manufacturers and end-users. Natural rubber, a primary component in tire production, has experienced volatile pricing due to geopolitical tensions and supply chain disruptions. According to the International Rubber Study Group, natural rubber prices surged by nearly 30% in 2022 alone that is impacting tire manufacturing costs. This volatility forces manufacturers to either absorb higher expenses or pass them on to customers is leading to reduced affordability and slower adoption rates.

Moreover, the dependency on imported raw materials exacerbates the issue, particularly for countries like India and Vietnam. For instance, as per the Federation of Indian Chambers of Commerce and Industry, India imports approximately 20% of its natural rubber requirements, which is making it vulnerable to price fluctuations. These cost uncertainties create hesitancy among buyers, especially small and medium enterprises, who constitute a significant portion of the OTR tire market. Additionally, inflationary pressures compound the problem, which is reducing overall purchasing power. Consequently, fluctuating raw material costs not only hinder market growth but also disrupt the competitive landscape, which is compelling manufacturers to explore alternative materials or adopt cost-saving measures to remain viable.

Stringent Environmental Regulations

Stringent environmental regulations present another major restraint for the Asia Pacific OTR tire market, particularly as governments intensify efforts to combat climate change. According to the United Nations Environment Programme, countries like China and India have introduced strict emission norms for industrial equipment, including those used in mining and construction. For instance, China’s National VI emission standards mandate the use of cleaner technologies, compelling manufacturers to redesign existing models or invest in new technologies. This regulatory shift increases compliance costs and extends product development timelines by impacting profitability.

Furthermore, the push for sustainable practices influences customer preferences, favoring eco-friendly alternatives. While this benefits the environment, it creates barriers for traditional tire manufacturers struggling to adapt. Additionally, the lack of awareness about sustainable options among smaller players limits market penetration.

MARKET OPPORTUNITIES

Adoption of Smart Tire Technologies

The adoption of smart tire technologies presents a transformative opportunity for the Asia Pacific OTR tire market, enabling manufacturers to enhance efficiency and cater to evolving customer demands. According to PwC, the integration of IoT and AI in heavy machinery is projected to boost productivity by up to 20% by offering a competitive edge. For instance, smart OTR tires equipped with sensors and real-time monitoring systems are gaining traction in countries like Japan and South Korea, where precision and safety are paramount. These technologies enable predictive maintenance by reducing downtime and operational costs.

China, a leader in digital innovation, is spearheading the adoption of autonomous vehicles in mining and construction sites, driving regional demand for smart tires. Additionally, remote-controlled machinery is becoming essential in hazardous environments, such as mining and offshore oil rigs, enhancing worker safety. Manufacturers can tap into lucrative segments, such as automated logistics hubs and smart infrastructure projects by positioning themselves at the forefront of technological evolution while unlocking new revenue streams.

Rising Investments in Renewable Energy Projects

Rising investments in renewable energy projects offer a significant growth avenue for the Asia Pacific OTR tire market, driven by the region’s commitment to sustainability. This expansion necessitates heavy lifting equipment, particularly tower and crawler cranes, for constructing wind turbines and solar farms. For example, India’s target to achieve 500 GW of renewable energy capacity by 2030 will require extensive crane deployment, creating a robust demand pipeline.

Similarly, China’s dominance in the solar panel manufacturing sector drives the need for specialized OTR tires in production facilities. Offshore wind projects in Vietnam and Taiwan, further amplify OTR tire demand due to their complex installation requirements. OTR tire manufacturers can capitalize on these investments, fostering partnerships with energy companies and securing long-term contracts.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a formidable challenge for the Asia Pacific OTR tire market, characterized by the presence of numerous domestic and international players vying for market share. This overcrowded landscape results in price wars by eroding profit margins and straining smaller players. For instance, Chinese manufacturers dominate the market with cost-effective offerings by leveraging economies of scale to undercut competitors.

India and Southeast Asia witness similar dynamics, where local players struggle to compete with established brands. Additionally, the lack of product differentiation limits growth opportunities, forcing companies to focus on aggressive marketing strategies rather than innovation. Intellectual property disputes further complicate the scenario with allegations of design infringements being common. These competitive pressures hinder profitability and stifle technological advancements, challenging manufacturers to strike a balance between affordability and innovation to remain relevant in the market.

Skilled Labor Shortages

Skilled labor shortages represent another pressing challenge for the Asia Pacific OTR tire market, undermining operational efficiency and hindering growth. The construction and heavy machinery sector faces a deficit of skilled operators in emerging economies like India and Indonesia. For instance, a survey by the Associated Chambers of Commerce and Industry of India reveals that nearly 40% of construction projects experience delays due to a lack of trained machinery operators. This shortage is exacerbated by the rapid pace of infrastructure development, which outstrips workforce availability.

Furthermore, the complexity of modern OTR tires, equipped with advanced technologies, requires specialized training, which is often inaccessible to workers in rural areas. This scarcity not only impacts project timelines but also increases operational risks, as untrained personnel are more prone to accidents. To address this challenge, industry stakeholders must collaborate with educational institutions and government bodies to establish comprehensive training initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.30 % |

|

Segments Covered |

By Application & Equipment, Type, Retreading and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company |

SEGMENTAL ANALYSIS

By Application & Equipment Insights

Construction and mining dominated the Asia Pacific OTR tire market was accounted in holding 45% of Asia Pacific OTR Tire market share in 2024 with the region’s extensive infrastructure development and resource extraction activities. Mining operations further amplify this demand. Asia Pacific holds over 40% of the world’s mineral reserves with advanced machinery for coal, iron ore, and lithium extraction. Additionally, the rise of electric vehicles (EVs) indirectly boosts mining activities, as the demand for battery materials like lithium and cobalt surges.

The agriculture tractors is esteemed to hit a CAGR of 8.5% throughout the forecast period. This growth is fueled by the mechanization of farming practices in emerging economies like India and Vietnam. For example, India’s agricultural sector, contributing approximately 15% to its GDP, is undergoing rapid modernization owing to the driving demand for high-powered tractors equipped with specialized OTR tires. Government initiatives also play a pivotal role. As per the Ministry of Agriculture in India, subsidies for farm mechanization have increased by 20% since 2020 by encouraging farmers to adopt advanced equipment. Additionally, the rise of precision agriculture, leveraging technologies like GPS and IoT, necessitates tractors with enhanced mobility and durability.

By Type Insights

The radial tires segment was accounted in holding 60.5% of the Asia Pacific OTR tire market in 2024 with their superior performance characteristics, such as enhanced fuel efficiency, durability, and heat resistance, which is making them ideal for heavy-duty applications like mining and construction. One key factor is the increasing demand for energy-efficient solutions. For instance, China’s National VI emission standards mandate the use of low-rolling-resistance tires, favoring radial designs. Similarly, Australia’s mining sector, valued at $300 billion annually, relies heavily on radial tires for haul trucks due to their ability to withstand extreme conditions. Additionally, government policies promoting sustainable practices encourage the adoption of eco-friendly tires.

The solid tires segment is likely to register a CAGR of 9.2% in the next coming years. This growth is fueled by their suitability for industrial vehicles and forklifts operating in high-load environments. For example, the proliferation of e-commerce and warehousing hubs in countries like Singapore and Australia drives demand for solid tires, which offer puncture resistance and extended service life. Additionally, the focus on safety and operational efficiency amplifies adoption in hazardous environments like ports and manufacturing facilities.

By Retreading Insights

The application-based retreading dominated the Asia Pacific OTR tire market with a 55.5% of share in 2024 owing to its cost-effectiveness and environmental benefits, which is making it a preferred choice for industries like mining and construction. One key factor is the growing emphasis on sustainability. For instance, China’s "Green Manufacturing" initiative encourages the reuse of materials by aligning with the principles of retreading. Similarly, Australia’s mining sector leverages retreaded tires to extend the lifespan of haul truck tires, reducing waste and carbon emissions. Additionally, government incentives promote circular economy practices, further boosting adoption.

Theprocess-based retreading segment is lucratively to showcase a projected CAGR of 10.3% in the next coming years. This growth is fueled by advancements in retreading technologies by enabling higher precision and consistency. For example, the adoption of computerized tread design systems ensures uniformity by enhancing tire performance and reliability. Another key driver is the rising demand for cost-effective solutions in logistics and transportation. Additionally, collaborations between retreading companies and fleet operators streamline processes by reducing turnaround times.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific OTR tire market, holding a 35% market share in 2024. For instance, China’s Belt and Road Initiative has allocated over $900 billion for infrastructure projects, which is driving demand for OTR tires. Additionally, the country’s coal mining industry, one of the largest globally that relies heavily on durable tires for heavy machinery.

Government policies further amplify growth. According to the Ministry of Industry and Information Technology, subsidies for green manufacturing have increased by 25% since 2020 by encouraging the adoption of eco-friendly tires. Collaborations with global players like Michelin and Bridgestone strengthen its technological edge.

India was positioned second in the Asia pacific OTR tire market by holding 20.4% of share in 2024. The country’s rapid urbanization and agricultural modernization drive demand for OTR tires. According to the Ministry of Agriculture, subsidies for farm mechanization have increased by 20%, encouraging farmers to adopt high-powered tractors equipped with specialized tires.

Infrastructure development also plays a pivotal role. For instance, India’s Smart Cities Mission aims to develop 100 smart cities, requiring extensive use of earthmoving equipment. Additionally, partnerships with domestic manufacturers, such as Apollo Tyres, bolster supply chain resilience. These initiatives position India as a key player in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific OTR Tire Market are Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli C. S.p.A., Yokohama Tire Corporation, Hankook Tire & Technology Co., Ltd., Toyo Tire Corporation, Kumho Tire Co., Ltd.

The Asia Pacific OTR tire market is characterized by intense competition, driven by the presence of global giants and regional players vying for dominance. Established companies like Bridgestone, Michelin, and Goodyear leverage their technological expertise and extensive distribution networks to maintain its dominance. Meanwhile, local manufacturers compete aggressively on pricing, offering cost-effective solutions tailored to budget-conscious customers. The market’s competitive landscape is further shaped by rapid technological advancements and government initiatives aimed at boosting domestic manufacturing capabilities. To differentiate themselves, players focus on innovation, introducing cutting-edge products for mining, construction, and agriculture. Sustainability initiatives, such as low-emission designs, are also gaining traction amid stricter environmental regulations. Collaborations with governments and participation in mega-projects further escalates the strategic maneuvers undertaken by key participants. This dynamic environment fosters continuous advancements, ensuring the market remains vibrant yet challenging for stakeholders.

Top Players in the Market

Bridgestone Corporation

Bridgestone Corporation is a key player in the Asia Pacific OTR tire market, renowned for its innovative solutions and commitment to sustainability. The company specializes in high-performance radial tires designed for mining, construction, and agriculture. Recently, Bridgestone launched its "Ecopia" line of low-rolling-resistance tires, aligning with regional environmental regulations. To strengthen its presence, the company expanded its manufacturing facilities in Thailand, catering to rising demand. Additionally, partnerships with mining giants like Rio Tinto ensure the adoption of its cutting-edge products.

Michelin Group

Michelin Group plays a pivotal role in the Asia Pacific OTR tire market, offering durable and energy-efficient tires for heavy machinery. Michelin’s focus on innovation is evident in its development of XDR series tires, designed for extreme conditions in mining and construction. Recently, Michelin established a new R&D center in India to enhance product customization for local markets. The company also partnered with Komatsu to supply tires for autonomous haul trucks, driving demand in Australia’s mining sector.

Goodyear Tire & Rubber Company

Goodyear Tire & Rubber Company is a dominant force in the Asia Pacific OTR tire market, particularly in industrial and agricultural applications. Its Optitorque line of tires is widely used in mining and construction due to superior traction and durability. Recently, Goodyear introduced its "Sustainable Procurement" initiative, sourcing raw materials responsibly to meet environmental standards. The company also expanded its distribution network in Southeast Asia, enhancing accessibility for customers. Collaborations with logistics firms in Singapore and Malaysia further solidify its position.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific OTR tire market employ diverse strategies to maintain their competitive edge. Innovation and R&D investments rank among the most prominent approaches, with companies developing advanced technologies like low-rolling-resistance and smart tires. Strategic partnerships and collaborations are also widely adopted, enabling firms to tap into emerging markets and secure contracts for large-scale projects. Localization efforts, such as establishing regional manufacturing hubs, reduce costs and improve supply chain resilience. Sustainability-focused measures, such as developing eco-friendly tires, further strengthen market positioning.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Bridgestone Corporation launched its "Ecopia" line of low-rolling-resistance tires in Thailand by enhancing fuel efficiency for mining and construction vehicles.

- In May 2023, Michelin Group inaugurated a new R&D center in India, which is focusing on customizing OTR tires for regional mining and agricultural applications.

- In July 2023, Goodyear Tire & Rubber Company expanded its distribution network in Malaysia by increasing accessibility for industrial vehicle operators.

- In September 2023, Yokohama Rubber Co., Ltd. partnered with Australian mining firms to supply durable tires for autonomous haul trucks by targeting lithium extraction projects.

- In November 2023, Continental AG introduced its "ContiPressureCheck" system in South Korea by enabling real-time monitoring of tire pressure and temperature for enhanced safety.

MARKET SEGMENTATION

This research report on the asia pacific otr tire market has been segmented and sub-segmented into the following.

By Application & Equipment

- Construction & Mining

- Agriculture Tractors By Power Output

- Industrial Vehicle, ATVs

By Type

- Radial

- Solid

- Bia

By Retreading

- Application

- Process

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the Asia Pacific OTR tire market?

The Asia Pacific OTR tire market refers to the segment of tire manufacturing and sales dedicated to off-the-road vehicles used in sectors like mining, construction, agriculture, and industrial applications across Asia-Pacific countries.

Which countries dominate the Asia Pacific OTR tire market?

China, India, Japan, and Australia are among the leading countries, driven by significant construction, mining, and agricultural activities.

What is the forecast for the Asia Pacific OTR tire market?

The market is expected to grow steadily over the next 5–10 years, fueled by increasing investment in infrastructure, smart mining practices, and agricultural modernization.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com