Asia Pacific Outdoor Furniture Market Size, Share, Trends & Growth Forecast Report By Product (Seating Sets, Loungers), Material Type, End Use, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Outdoor Furniture Market Size

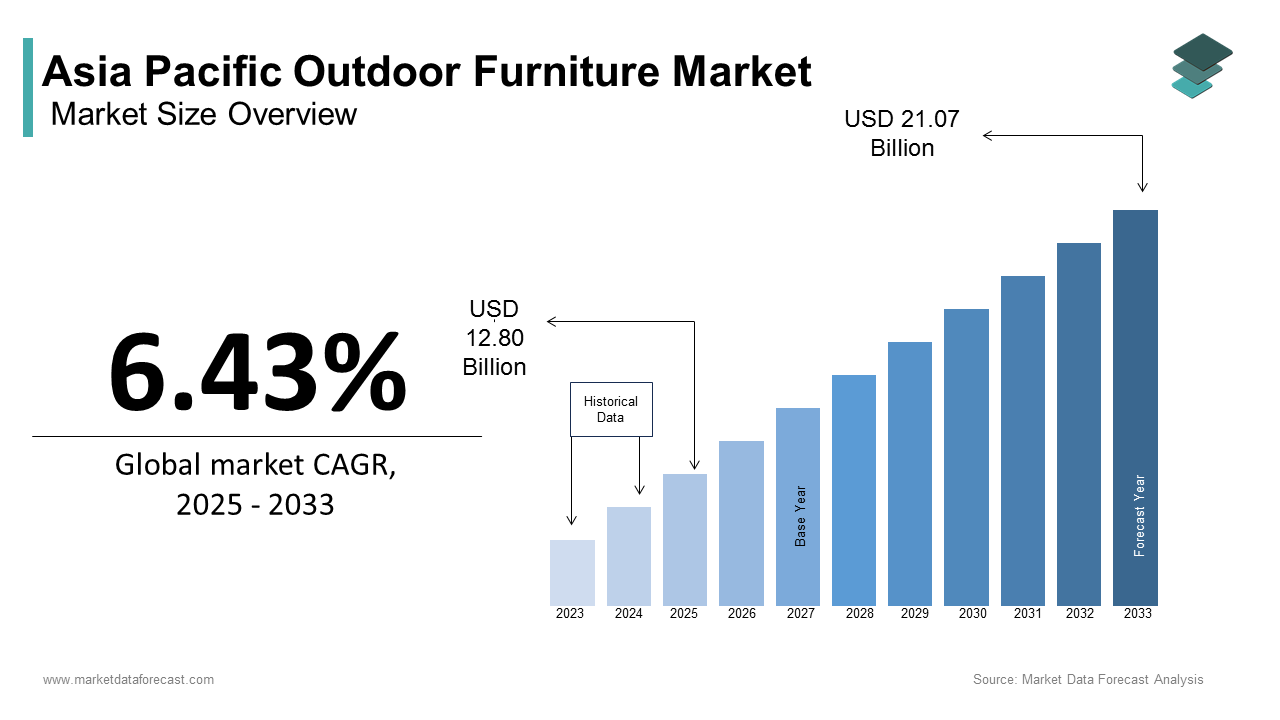

The Asia Pacific outdoor furniture market size was calculated to be USD 12.02 billion in 2024 and is anticipated to be worth USD 21.07 billion by 2033, from USD 12.80 billion in 2025, growing at a CAGR of 6.43% during the forecast period.

The Asia Pacific outdoor furniture market is experiencing steady growth. It is driven by a combination of urbanization, rising disposable incomes, and an increasing preference for outdoor living spaces. Also, the growing trend of creating functional outdoor spaces, such as gardens, balconies, and patios, has fueled demand for durable and aesthetically pleasing furniture. Additionally, the rise of hospitality and tourism sectors, particularly in Thailand and Malaysia, has created substantial demand for commercial-grade outdoor furniture. With sustainability becoming a focal point, eco-friendly materials like bamboo and recycled plastics are gaining traction, further enriching the market landscape.

MARKET DRIVERS

Rising Urbanization and Disposable Incomes

The surge in urbanization and disposable incomes across the Asia Pacific region has significantly bolstered consumer spending on outdoor furniture. According to the World Bank, the average GDP per capita in emerging economies like India and Indonesia grew between 2018 and 2022, enabling households to allocate more resources toward lifestyle enhancements. Urban centers, in particular, exhibit heightened demand, with cities like Sydney, Mumbai, and Bangkok driving sales of premium outdoor furniture. Like, urban households spend a notable percentage of their income on home improvement products, compared to rural counterparts. This trend aligns with rapid urbanization, which the Asian Development Bank projects will add 1 billion urban residents by 2050. As cities expand, so does the appetite for stylish and functional outdoor furniture, creating a fertile ground for market expansion.

Increasing Popularity of Outdoor Living Spaces

The growing popularity of outdoor living spaces is a significant driver of the Asia Pacific outdoor furniture market. Brands like IKEA and Kettal have capitalized on this trend by introducing modular designs that combine comfort, style, and durability. Apart from these, government initiatives promoting green spaces, such as India’s Smart Cities Mission, have encouraged homeowners to invest in outdoor setups. The integration of weather-resistant materials, such as teak and aluminum, enhances user experience, making outdoor furniture a preferred choice for both residential and commercial use.

MARKET RESTRAINTS

High Production Costs and Material Challenges

Rising production costs and material challenges pose significant restraints for the Asia Pacific outdoor furniture market, particularly in manufacturing hubs like China and Vietnam. According to a report by the International Labour Organization, labor costs in these regions have increased by 10-15% annually over the past five years, driven by stricter labor laws and rising wages. For instance, China’s shift toward higher-value industries has led to a shortage of skilled workers in traditional furniture manufacturing, as noted by the China National Furniture Association. This trend forces manufacturers to either absorb higher costs or pass them on to consumers, impacting affordability. Additionally, supply chain disruptions caused by geopolitical tensions and pandemics exacerbate production challenges.

Environmental Concerns and Regulatory Pressures

Environmental sustainability is another pressing challenge impacting the Asia Pacific outdoor furniture market. Like, the sector contributes to a notable portion of global deforestation, with timber-based products being a major culprit. Governments are increasingly enforcing stringent regulations to curb environmental degradation, such as Indonesia’s ban on illegal logging and China’s Green Manufacturing Standards. Compliance with these regulations often necessitates substantial financial outlays, with firms spending considerable budgets on sustainable initiatives. Also, consumer awareness about sustainable practices is growing.

MARKET OPPORTUNITIES

Expansion of E-commerce Platforms

The proliferation of e-commerce platforms presents a lucrative opportunity for the Asia Pacific outdoor furniture market and is enabling brands to reach a broader audience and enhance accessibility. China leads this charge, with e-commerce accounting for a notable share of total retail sales. This digital shift allows brands to bypass traditional distribution barriers, particularly in rural and semi-urban areas where physical stores are scarce. For example, IKEA leveraged online channels to launch affordable yet stylish outdoor furniture, capturing a key market share in India within a year, and targeting price-sensitive consumers. Besides, the integration of augmented reality (AR) tools on e-commerce sites allows customers to virtually visualize furniture in their spaces, enhancing purchasing decisions.

Growing Demand for Sustainable and Durable Products

The increasing demand for sustainable and durable outdoor furniture offers another significant opportunity for the Asia Pacific market. Similarly, a significant share of consumers in the region are willing to pay a premium for products made from eco-friendly materials and manufactured through ethical practices. Brands like Kettal and Dedon have gained traction by using renewable materials such as bamboo, rattan, and recycled plastics, appealing to environmentally conscious buyers. Also, certifications like FSC (Forest Stewardship Council) are becoming important differentiators. For instance, a significant portion of millennials in Australia and Singapore prioritize brands that demonstrate transparency in their supply chains. Furthermore, governments are incentivizing sustainable practices, with subsidies offered for green manufacturing. A report by the Asian Development Bank states that adopting circular economy models can reduce production costs, enhancing profitability while meeting consumer expectations.

MARKET CHALLENGES

Intense Price Competition and Marginal Profits

Price wars among manufacturers pose a formidable challenge to profitability in the Asia Pacific outdoor furniture market. In highly saturated markets like India and Indonesia, brands such as local manufacturers and multinational giants aggressively undercut competitors, eroding profit margins. This relentless focus on affordability often compromises product quality, leading to shorter lifespans and increased waste. Moreover, smaller players struggle to compete with established giants, resulting in market consolidation. With consumer expectations for low-cost, high-performance products rising, companies face the daunting task of balancing innovation with cost management.

Rapid Technological Obsolescence and Innovation Pressure

The pace of technological advancement in the Asia Pacific outdoor furniture market introduces the challenge of rapid obsolescence and innovation pressure. This shift is particularly pronounced in categories like modular and smart outdoor furniture, where hardware upgrades occur biannually. Apart from these, the constant need for innovation drives up R&D costs, with firms allocating considerable share of revenues to stay competitive. Consumers, accustomed to frequent upgrades, exhibit shorter brand loyalty, exacerbating the issue. Navigating this challenge requires strategic planning to extend product lifespans while maintaining relevance in a fast-evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.43% |

|

Segments Covered |

By Product, Material Type, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Brown Jordan, Dedon, Gloster, Kettal, IKEA, TUUCI, Unopiu, Tribù, Royal Botania, and Manutti |

SEGMENTAL ANALYSIS

By Product Insights

The seating sets segment dominated the Asia Pacific outdoor furniture market by capturing 35.4% of the total revenue in 2024. This control over the market is propelled by their versatility and functionality, making them a staple for outdoor spaces like gardens, patios, and balconies. In addition, the rise of multifunctional designs, such as weather-resistant and foldable options, has enhanced consumer appeal. A report by McKinsey highlights that seating sets account for a considerable of all online outdoor furniture purchases in China, underscoring their widespread popularity. The integration of sustainable materials, such as bamboo and recycled plastics, further boosts adoption rates, particularly among eco-conscious buyers.

The loungers segment is the swiftest expanding, with a projected CAGR of 9.8%. This development is caused by increasing demand for relaxation-focused outdoor furniture, particularly in affluent markets like Japan and South Korea. Urbanization trends have also contributed, with cities like Mumbai and Bangkok witnessing a surge in rooftop gardens and private patios, where loungers are often used. Also, the rise of hospitality sectors, such as luxury resorts and boutique hotels, has created substantial demand for high-end loungers. According to a report by the World Tourism Organization, hotel renovations and new property developments in Thailand and Malaysia contributed to a considerable increase in lounger sales between 2020 and 2022.

By Material Type Insights

The wooden outdoor furniture segment dominated the Asia Pacific market by contributing 40.5% of the total revenue in 2024. This dominance is attributed to its natural aesthetic appeal and durability, which resonate with consumers seeking timeless designs. For instance, a significant portion of urban households in Japan and South Korea prefer teak and mahogany furniture for their outdoor spaces due to their resistance to weather conditions. Additionally, government initiatives promoting sustainable forestry practices, such as Indonesia’s certification programs, have increased the availability of eco-friendly wood products. The integration of modern finishes, such as water-resistant coatings, enhances user experience, making wooden furniture a preferred choice for diverse demographics.

The plastic outdoor furniture segment is experiencing significant growth, with a projected CAGR of 10.5%. This progress is progress by rising demand for affordable and lightweight options, particularly in emerging markets like India and Indonesia. Also, urbanization trends have also contributed, with cities like Manila and Jakarta driving sales of durable yet stylish designs tailored for compact outdoor spaces. Additionally, the rise of recycled plastics as a sustainable alternative has attracted environmentally conscious consumers.

By End Use Insights

The segment of residential outdoor furniture dominated the Asia Pacific market by capturing 60.5% of the total revenue in 2024. This prominence is driven by the growing trend of creating functional outdoor spaces, such as gardens, balconies, and patios, particularly in urban areas. For instance, a large number of urban households in Australia and Singapore have invested in outdoor furniture to enhance their living environments. Further, the rise of home improvement platforms, such as Houzz and Pinterest, has amplified awareness, inspiring homeowners to design stylish and functional outdoor setups. A report by McKinsey notes that residential outdoor furniture accounts for a significant share of all e-commerce sales in China, showing its widespread adoption. The integration of weather-resistant materials, such as teak and aluminum, enhances user experience, making residential furniture a preferred choice for diverse demographics.

The commercial outdoor furniture segment is the fastest-growing, with a projected CAGR of 11.2% from 2025 to 2033. This is fueled by the expansion of the hospitality and tourism sectors, particularly in countries like Thailand and Malaysia. Urbanization trends have also contributed, with cities like Sydney and Tokyo witnessing a surge in rooftop restaurants and cafes, where durable and stylish furniture is essential. In addition, the rise of co-working spaces and outdoor event venues has created substantial demand for high-end commercial furniture. According to a report by PwC, over 60% of businesses in urban areas prioritize multifunctional designs, driving adoption rates.

REGIONAL ANALYSIS

China stands as the largest contributor to the Asia Pacific outdoor furniture market commanding 35.5% of the regional share in 2024. The influence of this segment is underpinned by robust manufacturing capabilities and aggressive investments in consumer education. A significant portion of urban households in cities like Shanghai and Beijing have adopted international brands, driven by campaigns promoting lifestyle enhancements. Additionally, the proliferation of e-commerce platforms like Alibaba and JD.com has made these products easily accessible, particularly in tier-2 and tier-3 cities.

Australia is witnessing positive growth in the Asia Pacific outdoor furniture market. Known for its vibrant outdoor culture, Australia excels in developing durable yet stylish furniture catering to diverse demographics. For example, brands like Fantastic Furniture and Koala Living have introduced models priced competitively to appeal to middle-class consumers. Like, a notable share of households in urban areas prefer branded outdoor furniture, driven by rising disposable incomes and urbanization. Also, government initiatives promoting green spaces, such as community gardens, have spurred investments, creating a robust ecosystem for domestic and international players.

Japan holds a pivotal position in the Asia Pacific outdoor furniture market. Renowned for its precision engineering and focus on quality, Japan excels in producing high-end furniture with advanced features like ergonomic designs and sustainable materials. For example, Asahi Wood Products has introduced models equipped with weather-resistant coatings and lightweight materials, appealing to health-conscious consumers. Additionally, the country’s aging population has increased demand for orthopedic designs.

India is a rapidly growing player in the Asia Pacific outdoor furniture market. Also, its fashion-conscious population has embraced outdoor furniture as part of its broader lifestyle agenda. Cities like Mumbai and Bangalore have witnessed a surge in demand for modular designs, integrating comfort and functionality into daily life. According to the Indian Ministry of Commerce, a significant portion of urban households prefer branded outdoor furniture, reflecting a shift toward premiumization. Additionally, government initiatives promoting local manufacturing, such as "Make in India," have spurred investments, creating a robust ecosystem for domestic and international players.

Thailand plays an important role in the Asia Pacific outdoor furniture market. The country’s hospitality sector has driven demand for commercial-grade outdoor furniture, particularly in luxury resorts and boutique hotels. A large number of hotels in Phuket and Pattaya have invested in high-end outdoor furniture, reflecting strong consumer interest. Besides, the rise of sustainable materials, such as bamboo and rattan, has captured the attention of eco-conscious users. According to the Thai Furniture Association, sustainable furniture sales grew notably in urban areas, supporting their popularity.

LEADING PLAYERS IN THE ASIA PACIFIC OUTDOOR FURNITURE MARKET

IKEA

IKEA is a global leader in the Asia Pacific outdoor furniture market, renowned for its affordable yet stylish designs tailored to urban consumers. The company’s focus on modular and multifunctional furniture has enabled it to capture a significant share of the residential segment. IKEA leverages its robust e-commerce platform and localized marketing strategies to cater to diverse demographics across the region. By addressing both affordability and eco-consciousness, IKEA maintains a strong foothold in both urban and rural markets.

Kettal

Kettal is a key contributor to the Asia Pacific outdoor furniture market, known for its premium designs and innovative use of materials like aluminum and synthetic fibers. The brand’s emphasis on luxury and durability appeals to affluent consumers seeking high-end outdoor setups. Kettal’s collaborations with renowned designers have amplified its reputation for exclusivity and style. By integrating weather-resistant and sustainable materials, Kettal reinforces its position as a responsible innovator.

Dedon

Dedon is a major player in the Asia Pacific outdoor furniture market, leveraging its expertise in crafting durable and aesthetically pleasing furniture. Dedon’s localized strategies, such as offering exclusive collections tailored to regional preferences, enable it to penetrate emerging markets like India and Indonesia. By emphasizing user-centric designs and advanced features, such as solar-powered lighting systems, Dedon enhances consumer satisfaction.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Collaborations with Designers and Architects

Key players in the Asia Pacific outdoor furniture market often collaborate with renowned designers and architects to enhance product aesthetics and functionality. For instance, brands like Kettal and Dedon partner with global design icons to create exclusive collections that resonate with affluent consumers.

Emphasis on Sustainability and Eco-Friendly Practices

Sustainability remains a cornerstone of success in the outdoor furniture sector. Leading companies invest heavily in R&D to develop eco-friendly materials, such as bamboo, rattan, and recycled plastics. For example, brands like IKEA and Dedon integrate sustainable practices into their production processes, appealing to environmentally conscious buyers. Additionally, certifications like FSC (Forest Stewardship Council) serve as important differentiators, reinforcing brand trust.

Localization and Affordability Initiatives

To resonate with Asia Pacific consumers, key players adopt localized strategies tailored to specific countries and cultures. For instance, affordable solutions are introduced in price-sensitive markets like India and Indonesia, while premium editions target affluent buyers in Japan and Australia. Brands also leverage social media influencers and regional celebrities to amplify their messaging.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific Outdoor furniture market include Brown Jordan, Dedon, Gloster, Kettal, IKEA, TUUCI, Unopiu, Tribù, Royal Botania, and Manutti

The Asia Pacific outdoor furniture market is characterized by intense competition, driven by a mix of established multinational corporations and regional players vying for dominance. Global giants like IKEA, Kettal, and Dedon compete fiercely with local manufacturers such as Godrej Interio and Koala Living, creating a dynamic landscape marked by rapid innovation and aggressive pricing strategies. The market’s diversity—spanning developed economies like Japan and Australia to emerging markets like India and Vietnam—requires companies to adopt multifaceted approaches to succeed. While larger firms leverage economies of scale and technological expertise, smaller enterprises focus on affordability and niche innovations to carve out their share. Regulatory pressures, environmental concerns, and shifting consumer behaviors further intensify rivalry, compelling brands to prioritize sustainability and digital transformation. E-commerce platforms have also leveled the playing field, enabling new entrants to disrupt traditional distribution channels.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, IKEA launched a regional campaign in collaboration with Indian interior designers to promote its latest line of modular outdoor furniture. This initiative aimed to tap into the growing trend of home improvement in tier-2 and tier-3 cities, boosting adoption rates.

- In June 2023, Kettal partnered with a leading Singapore-based architect to launch an exclusive collection of luxury loungers. This collaboration focused on highlighting style and durability, capturing the attention of affluent millennials.

- In September 2023, Dedon introduced an affordable range of weather-resistant chairs in Indonesia, priced competitively to appeal to middle-income households. This move aimed to increase penetration in rural areas and strengthen its regional presence.

- In February 2024, Godrej Interio expanded its e-commerce platform in India, offering exclusive online discounts and personalized recommendations. This strategy targeted first-time buyers and enhanced accessibility for tech-savvy consumers.

- In November 2023, Koala Living conducted a series of workshops in Australian suburbs to educate homeowners about the benefits of sustainable outdoor furniture. This initiative positioned the brand as a trusted advocate for eco-friendly living, boosting consumer trust.

MARKET SEGMENTATION

This research report on the Asia Pacific outdoor furniture market has been segmented and sub-segmented based on product, material type, end-use, and region.

By Product

- Seating Sets

- Loungers

By Material Type

- Wooden Outdoor Furniture

- Plastic Outdoor Furniture

By End Use

- Residential Outdoor Furniture

- Commercial Outdoor Furniture

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of the outdoor furniture market in Asia Pacific?

The market is driven by urbanization, rising disposable incomes, growing interest in outdoor living spaces, and increased demand from the hospitality and tourism sectors.

2. Which countries are leading the outdoor furniture market in the Asia Pacific region?

China, India, Japan, Australia, and South Korea are among the leading markets due to rising construction activities and outdoor lifestyle trends.

3. How is e-commerce influencing the outdoor furniture market in the region?

E-commerce is expanding the market reach, offering consumers a wider selection and convenient buying options, especially in urban and semi-urban areas.

4. Who are the key players in the Asia Pacific outdoor furniture market?

Key players include Brown Jordan, Dedon, Gloster, Kettal, IKEA, TUUCI, Unopiu, Tribù, Royal Botania, Manutti, HNI Corporation, Ace Hardware, Forever Patio, Ashley Furniture, and Lloyd Flanders.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]