Asia Pacific Peracetic Acid (PAA) Market Research Report – Segmented By Grade (PAA - Below 5%, PAA - 5% to 15%, PAA - Above 15%), Application, End-Use, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Peracetic Acid (PAA) Market Size

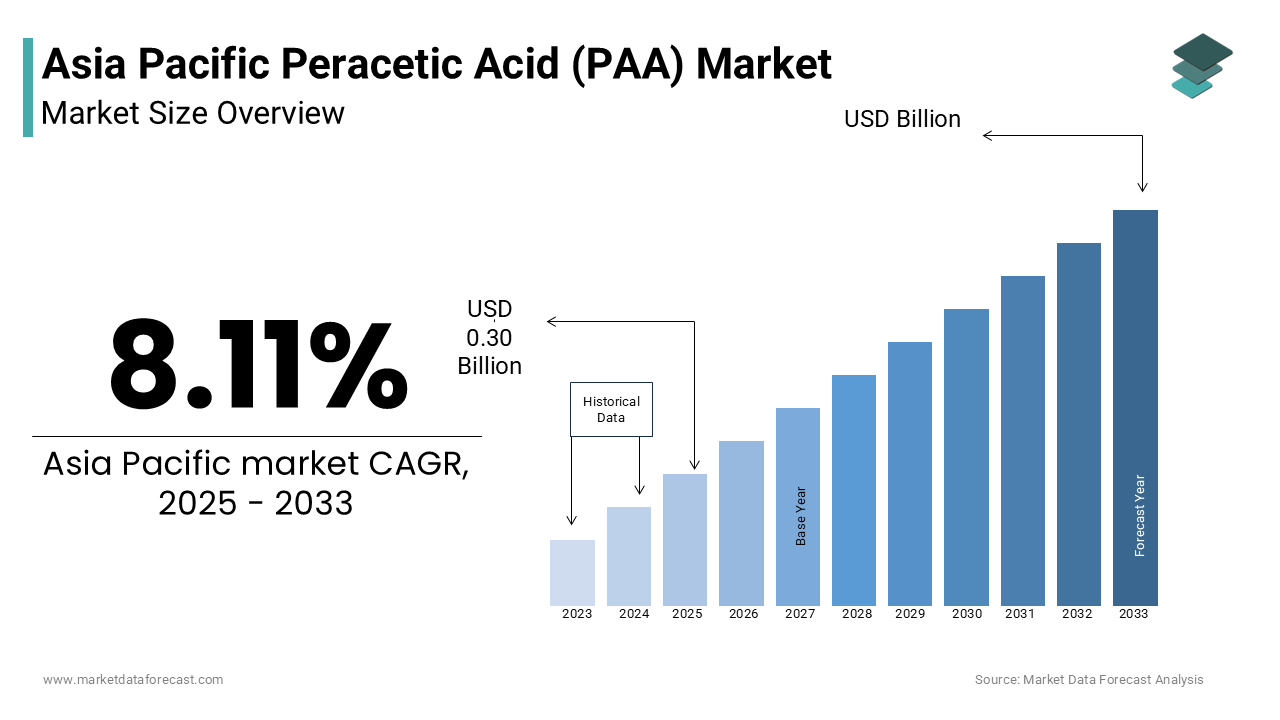

The Asia Pacific Peracetic Acid (PAA) Market was worth USD 0.28 billion in 2024. The Asia Pacific market is expected to reach USD 0.57 billion by 2033 from USD 0.30 billion in 2025, rising at a CAGR of 8.11% from 2025 to 2033.

Peracetic acid (PAA), also known as peroxyacetic acid, is a strong oxidizing agent formed by the reaction of acetic acid and hydrogen peroxide. It is widely used for its potent disinfectant properties in various industries such as food processing, healthcare, water treatment, and agriculture. In the Asia Pacific region, PAA has gained prominence due to increasing regulatory emphasis on hygiene and sanitation standards, particularly following global health concerns and environmental awareness campaigns. The compound’s biodegradability into non-hazardous components like water, oxygen, acetic acid, and carbon dioxide makes it an environmentally preferable alternative to chlorine-based disinfectants. As per the Food Safety Standards Authority of India, the number of food processing units increased by over 18% between 2020 and 2023, which is directly influencing demand for effective microbial control agents. Similarly, according to the Ministry of Ecology and Environment in China, wastewater treatment compliance levels improved significantly, with nearly 95% of municipal plants adopting advanced oxidation processes, including PAA-based systems.

MARKET DRIVERS

Rising Demand from the Food & Beverage Industry

The growing demand from the food and beverage industry for sanitization and microbial decontamination is primarily driving the growth of the Asia Pacific peracetic acid (PAA) market. PAA is extensively used for surface disinfection, equipment sterilization, and direct food contact applications due to its efficacy against a broad spectrum of microorganisms without leaving toxic residues. According to the Asian Food Regulation Research Centre, food safety regulations across Southeast Asia have been tightened, with Indonesia and Vietnam introducing mandatory disinfection protocols for all export-oriented food processing units since 2022.

The expansion of the packaged food sector has further intensified the need for reliable disinfectants. This surge in production volume necessitates higher usage of antimicrobial agents like PAA to maintain hygiene standards. Additionally, the Australian Department of Agriculture, Fisheries and Forestry noted that meat processing facilities increased their use of PAA-based solutions by 22% in 2023 compared to the previous year, citing its effectiveness in eliminating pathogens such as Salmonella and E. coli. The demand for PAA in the food & beverage sector is expected to remain robust across the Asia Pacific region with rising consumer awareness regarding food safety and stringent government mandates.

Expansion of Water Treatment Infrastructure

The second major driver of the Asia Pacific peracetic acid (PAA) market is the rapid expansion of water treatment infrastructure, driven by increasing urbanization and stricter environmental regulations. PAA is increasingly being adopted as an advanced oxidation agent in municipal and industrial wastewater treatment due to its ability to effectively remove organic pollutants, viruses, and bacteria without generating harmful by-products. China has also witnessed significant investment in upgrading its water treatment capabilities. This initiative has led to a notable increase in the deployment of PAA in tertiary treatment stages. Moreover, in South Korea, the Ministry of Environment mandated the use of non-chlorinated disinfectants in drinking water treatment by 2025, encouraging utilities to adopt PAA-based alternatives.

MARKET RESTRAINTS

High Handling and Storage Costs

A significant restraint impacting the growth of the Asia Pacific peracetic acid (PAA) market is the high handling and storage costs associated with the chemical. PAA is inherently unstable and requires specialized containment solutions, including corrosion-resistant tanks, temperature-controlled environments, and strict adherence to safety protocols. These requirements substantially increase logistical expenses for manufacturers and end-users alike. According to the Chemical Regulatory Affairs Authority of Thailand, companies utilizing PAA must invest up to 30% more in storage infrastructure compared to conventional disinfectants such as sodium hypochlorite.

Moreover, transportation of PAA is subject to stringent regulations due to its classification as a hazardous substance under the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). As per a 2023 report by the Japan Industrial Safety and Health Association, logistics-related expenditures for PAA accounted for nearly 18% of total operational costs in disinfectant-dependent sectors such as pharmaceuticals and food processing. These financial burdens deter smaller enterprises from adopting PAA despite its superior performance characteristics, thereby limiting market penetration in certain segments across the Asia Pacific.

Availability of Alternative Disinfectants

Another critical restraint affecting the Asia Pacific peracetic acid (PAA) market is the widespread availability and lower cost of alternative disinfectants such as chlorine-based compounds and quaternary ammonium salts. These substitutes are often preferred in price-sensitive markets where budget constraints outweigh considerations of long-term efficiency or environmental impact. According to the ASEAN Center for Sustainable Development, chlorine remains the most commonly used disinfectant in municipal water treatment across Indonesia, Malaysia, and the Philippines due to its low procurement cost and established supply chains.

Additionally, in India, the Ministry of Chemicals and Fertilizers observed that over 65% of small-scale food processing units continue to rely on chlorine-based sanitizers owing to their affordability and ease of procurement. While PAA offers advantages in terms of residue-free degradation and broader antimicrobial action, its relatively higher price point discourages adoption among cost-conscious operators. Despite regulatory support for safer disinfectants, economic viability remains a dominant decision-making factor in developing economies within the Asia Pacific, thereby constraining the growth potential of the PAA market.

MARKET OPPORTUNITIES

Growth in the Healthcare Sector

One of the most promising opportunities for the Asia Pacific peracetic acid (PAA) market lies in the expanding healthcare sector, which is witnessing increased demand for high-level disinfectants due to rising hospital-acquired infections (HAIs) and stringent infection control policies. PAA is widely recognized for its sporicidal, virucidal, and bactericidal properties by making it an ideal choice for sterilizing medical devices, surgical instruments, and healthcare surfaces. In response, countries like Singapore and South Korea have implemented comprehensive hospital hygiene programs that prioritize the use of advanced disinfectants. As reported by the Singapore Health Services Group, hospital procurement of PAA-based disinfectants rose by 28% in 2023 compared to the previous year.

Adoption in Organic Farming and Agrochemical Applications

Another emerging opportunity for the Asia Pacific peracetic acid (PAA) market is its increasing adoption in organic farming and agrochemical applications as a sustainable biocide and disinfectant. With growing consumer demand for organic produce and increasing regulatory pressure to reduce synthetic pesticide usage, farmers are turning to eco-friendly alternatives for crop protection and soil sanitation. PAA serves as an effective antimicrobial agent for seed treatment, irrigation water disinfection, and post-harvest preservation without leaving harmful residues.

According to the International Federation of Organic Agriculture Movements (IFOAM) Asia, the organic farmland area in the region expanded by 12% between 2021 and 2023, with China, India, and Australia leading in certified organic acreage. In China, the Ministry of Agriculture and Rural Affairs launched the Green Agricultural Inputs Initiative in 2022 by promoting the use of bio-based disinfectants in greenhouse cultivation and hydroponic systems.

MARKET CHALLENGES

Regulatory Complexity Across Countries

A major challenge facing the Asia Pacific peracetic acid (PAA) market is the varying and often complex regulatory frameworks governing its production, distribution, and use across different countries. Unlike in more mature markets such as Europe and North America, where harmonized guidelines exist, the Asia Pacific region lacks a unified regulatory approach, leading to inconsistencies in approval timelines, permissible concentrations, and labeling requirements. According to the ASEAN Chemicals Sub-sector Working Group, discrepancies in registration procedures delay market entry by an average of 6–12 months in countries like Vietnam, Thailand, and the Philippines.

For example, in Japan, the Ministry of Health, Labour and Welfare enforces stringent concentration limits on PAA-based products intended for food contact applications, requiring extensive documentation and testing before approval. Meanwhile, in Australia, the Australian Pesticides and Veterinary Medicines Authority mandates separate registrations for each formulation variant, increasing compliance costs for manufacturers. In China, the Ministry of Emergency Management introduced revised hazardous chemical management rules in 2023, which impose additional licensing requirements on PAA producers, further complicating supply chain logistics. These fragmented regulations create barriers to market expansion, especially for multinational suppliers seeking to scale operations across multiple jurisdictions in the Asia Pacific.

Limited Awareness and Technical Expertise

Another significant challenge impeding the growth of the Asia Pacific peracetic acid (PAA) market is the limited awareness and technical expertise regarding its optimal application methods and benefits, particularly among small and medium-sized enterprises (SMEs). Many businesses, especially in rural and semi-urban areas, lack access to adequate training and technical support, leading to suboptimal utilization or reluctance to adopt PAA-based solutions. According to the United Nations Industrial Development Organization (UNIDO) Asia-Pacific Division, less than 40% of SMEs in the food and beverage sector in Indonesia and Cambodia were aware of PAA’s disinfection advantages over traditional chemicals as of 2023.

Furthermore, misconceptions about PAA’s handling of risks and perceived complexity contribute to resistance among facility managers and procurement officers. In addition, distributors often lack the technical knowledge required to guide customers on appropriate dosing, compatibility with existing systems, and storage conditions. This knowledge gap hampers effective market penetration, especially in regions where extension services and chemical education programs are underdeveloped.

SEGMENTAL ANALYSIS

By Grade Insights

The 5%–15 % grade segment held the largest market share by accounting for 58.3% of the Asia Pacific PAA market in 2024. The growth of the segment is attributed to its widespread use across industries that require moderate-strength disinfectants without compromising safety or efficacy. The 5%–15 % concentration range strikes a balance between potency and handling feasibility by making it ideal for applications in food processing, healthcare, and water treatment.

In China, the National Center for Food Safety Risk Assessment noted a 24% increase in PAA-based sanitizers within beverage bottling units between 2021 and 2023, citing the 12% concentration variant as the most commonly used formulation. These systems offer consistent microbial control while minimizing manual intervention and chemical exposure risks. Additionally, South Korea's Environment Industry Technology Institute reported that wastewater treatment plants using PAA at concentrations around 10% achieved a 98% reduction in fecal coliform bacteria compared to traditional chlorine treatments.

The >15% grade PAA segment is projected to grow with a CAGR of 12.3% from 2025 to 2033 by increasing demand for high-purity, high-concentration PAA in specialized applications such as advanced oxidation processes (AOPs), chemical synthesis, and industrial sterilization, where rapid microbial kill rates are essential. The rising deployment of PAA in tertiary water treatment and industrial effluent management in countries like China and Australia is propelling the growth of the segment. According to the Chinese Ministry of Ecology and Environment, over 120 new industrial parks launched in 2023 mandated the use of >15% PAA in closed-loop water recycling systems to meet zero-liquid discharge (ZLD) compliance standards. Another significant driver is the expansion of the biopharmaceutical and semiconductor manufacturing sectors, which rely on ultra-pure disinfectants.

By Application Insights

The disinfectant segment was the largest and held 52.4% of the Asia Pacific PAA market in 2024. This dominance is primarily driven by the extensive utilization of PAA-based disinfectants across municipal water treatment, industrial cleaning, and surface sanitation in both public and private infrastructure.

The increasing emphasis on municipal wastewater treatment compliance in densely populated urban centers across China and India is likely to propel the growth of the market. According to the National Development and Reform Commission of China, over 90% of cities with populations exceeding 1 million had upgraded their wastewater treatment facilities to include PAA-based disinfection protocols by the end of 2023. This shift was largely prompted by the State Council’s directive to reduce residual chlorine emissions into natural water bodies. Another major contributing factor is the integration of PAA-based disinfectants in large-scale commercial and institutional facilities, including schools, hospitals, and transit hubs. In Japan, the Ministry of Land, Infrastructure, Transport, and Tourism found that nearly 60% of Tokyo’s metro stations implemented PAA-based fogging systems in 2023 to enhance pathogen control in enclosed spaces.

The sterilant application segment is swiftly emerging with a CAGR of 13.1% from 2025 to 2033. This rapid expansion is primarily fueled by rising demand in high-purity environments such as pharmaceutical manufacturing, medical device sterilization, and biotechnology research labs, where stringent sterility requirements necessitate the use of sporicidal agents.

The surge in pharmaceutical and biotech facility construction across Southeast Asia in Thailand, Malaysia, and Vietnam is also leveraging the growth of the market. According to the ASEAN Pharmaceutical Industry Forum, capital investments in drug manufacturing infrastructure in the region grew by 18% in 2023, with over 70% of new facilities incorporating PAA-based sterilization systems for cleanroom decontamination. In Thailand, the Department of Medical Sciences confirmed that 45% of all registered contract development and manufacturing organizations (CDMOs) now rely on PAA vaporization technology to meet Good Manufacturing Practice (GMP) compliance. Another significant factor is the adoption of PAA as a low-residue sterilant in medical device reprocessing in hospitals and ambulatory surgical centers.

By End Use Insights

The food & beverages sector accounted in holding the dominant share of the Asia Pacific PAA market in 2024, with the widespread use in microbial control across food processing, packaging, and beverage bottling operations, where maintaining hygiene and ensuring product safety are paramount. The stringent food safety regulations enforced across the region in rapidly industrializing economies such as India and Indonesia are also enhancing the growth of the segment. According to the Food Safety and Standards Authority of India (FSSAI), the number of certified food processing units in India grew by 21% between 2021 and 2023, mandating the use of effective, non-residual disinfectants like PAA.

Additionally, the expansion of cold-chain logistics and ready-to-eat food markets has further intensified demand for PAA in antimicrobial washes and surface disinfection. Moreover, in Japan, the Ministry of Agriculture, Forestry, and Fisheries noted a 19% increase in seafood exporters adopting PAA wash treatments in 2023 to meet export quality standards imposed by the European Union and the United States.

The water treatment segment is anticipated to grow at the fastest rate in the Asia Pacific peracetic acid (PAA) market by registering a CAGR of 12.8% from 2025 to 2033. This acceleration is driven by increasing investments in upgrading municipal and industrial wastewater infrastructure to meet stricter environmental discharge norms and public health mandates.

One of the key factors propelling this growth is the intensified focus on reducing chlorine by-products in drinking water and effluent streams in urbanized regions such as China and South Korea. According to the Ministry of Housing and Urban-Rural Development in China, over 85% of new water treatment plants commissioned in 2023 incorporated PAA-based disinfection systems to minimize trihalomethane (THM) formation.

Another crucial driver is the expansion of industrial water reuse initiatives, particularly in sectors such as textiles, electronics, and chemicals, where water conservation is becoming increasingly vital. In India, the National Green Tribunal mandated that all textile clusters in Tamil Nadu implement zero-liquid discharge (ZLD) practices by 2025, leading to a surge in PAA adoption for final-stage disinfection in recycled water loops.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific PAA market with 32.2% of the share in 2024, owing to its massive industrial base and aggressive environmental policy reforms. As the world’s largest manufacturer and exporter, China has been expanding its use of PAA in food processing, water treatment, and pharmaceutical applications to align with global hygiene standards. According to the China Chlor-Alkali Industry Association, domestic PAA production capacity surged by 18% in 2023, reaching over 280,000 metric tons annually. The Ministry of Ecology and Environment mandated that all new wastewater treatment plants incorporate non-chlorinated disinfectants, accelerating PAA adoption. Furthermore, the National Medical Products Administration encouraged the use of PAA-based sterilants in medical device manufacturing, with over 60% of Class III device producers transitioning to PAA in 2023. As industrial modernization progresses, China will continue to be the dominant force in the regional PAA landscape.

India was positioned second in the Asia Pacific PAA market with a share of 15.3% in 2024toy rapid urbanization, food safety reforms, and government-led sanitation drives. The Indian government’s Swachh Bharat Mission and Jal Jeevan Mission have spurred investment in water purification infrastructure, boosting PAA demand. According to the Central Pollution Control Board, over 40% of newly established sewage treatment plants in 2023 opted for PAA-based disinfection due to its biodegradability. The pharmaceutical industry also contributed significantly, with the Department of Pharmaceuticals noting that 35% of new sterile injectable facilities incorporated PAA-based sterilization protocols.

The Japan PAA market is likely to be driven by its highly regulated industrial and healthcare ecosystems. Japanese industries prioritize high-purity, low-residue disinfectants, which makes PAA a preferred choice in pharmaceutical, semiconductor, and food processing applications. According to the Ministry of Economy, Trade and Industry (METI), Japan’s pharmaceutical exports grew by 9.5% in 2023, necessitating advanced sterilization methods like PAA vaporization. The Ministry of Health, Labour and Welfare also mandated the use of PAA-based disinfectants in dialysis centers and intensive care units to curb hospital-acquired infections.

South Korea's PAA market growth is bolstered by its advanced industrial and healthcare infrastructure. The country’s emphasis on high-tech manufacturing, particularly in semiconductors and biopharmaceuticals, has led to increased reliance on PAA for cleanroom sterilization and equipment disinfection. According to the Korea Evaluation Institute of Industrial Technology, South Korea’s semiconductor exports reached USD 63 billion in 2023, with over 75% of fabrication plants adopting PAA-based disinfection to prevent contamination in microchip production.

Australia & New Zealand’s market is likely to be driven by stringent food safety laws, environmental consciousness, and advanced healthcare systems. In Australia, the Department of Agriculture, Fisheries and Forestry reported that over 60% of meat processing facilities adopted PAA-based sanitizers in 2023 to comply with export hygiene standards set by the European Union and Middle Eastern markets. The Australian Water Association noted that several desalination plants in Perth and Sydney integrated PAA into their final disinfection stages to improve membrane longevity and reduce biofouling.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Evonik Industries AG, Solvay SA, Ecolab Inc., Kemira Oyj, Mitsubishi Gas Chemical Company Inc., Jubilant Pharmova Limited, Aditya Birla Chemicals, Airedale Chemical Holdings Limited, Acuro Organics Limited, Diversey Holdings Ltd. (Solenis LLC), Lenntech B.V., California Soda Company, Enviro Tech Chemical Services Inc., Christeyns, SEITZ GmbH, and National Peroxide Limited.

The competition in the Asia Pacific peracetic acid (PAA) market is characterized by a mix of global chemical giants and regional specialty chemical producers striving to capture market share through differentiation and strategic expansion. As demand for sustainable and high-performance disinfectants grows across industries, companies are increasingly focusing on innovation, application-specific formulations, and supply chain optimization. The market remains moderately consolidated, with a few dominant players holding significant influence due to their extensive product portfolios, technological expertise, and established distribution networks. However, rising environmental awareness and stricter regulatory standards are encouraging new entrants and smaller regional players to invest in greener alternatives and niche applications. This evolving landscape fosters continuous product development and strategic alliances aimed at securing long-term contracts with key end-users. Additionally, companies are emphasizing technical support and training to enhance customer adoption and address concerns related to handling and application complexity.

Top Players in the Asia Pacific Peracetic Acid (PAA) Market

One of the leading players in the Asia Pacific peracetic acid market is Evonik Industries AG. The company has a strong global footprint and offers a wide range of specialty chemicals, including PAA-based disinfectants and biocides. In the Asia Pacific region, Evonik has been actively expanding its presence through strategic collaborations and localized production facilities. Its focus on innovation and sustainable chemistry has positioned it as a preferred supplier for industries such as healthcare, food processing, and water treatment. The company’s commitment to regulatory compliance and product safety has further strengthened its reputation among end-users across the region.

Another key player is Solvay S.A., a multinational chemical company with significant expertise in green chemistry solutions. Solvay has been instrumental in promoting the use of peracetic acid as an eco-friendly alternative to chlorine-based disinfectants. The company has invested heavily in R&D to develop advanced PAA formulations tailored to the needs of the Asia Pacific market. With a growing emphasis on environmental sustainability and industrial hygiene, Solvay has enhanced its regional distribution networks and technical support services, enabling seamless integration of PAA into various applications such as surface disinfection, wastewater treatment, and pharmaceutical manufacturing.

Percopharm GmbH, a subsidiary of the Mitsubishi Chemical Group, is also a major contributor to the Asia Pacific PAA market. Known for its high-purity PAA products, Percopharm serves niche markets including healthcare sterilization, biotechnology, and semiconductor manufacturing. The company has established a strong foothold in Japan and South Korea by aligning with local regulatory standards and providing customized disinfection solutions. Percopharm’s focus on precision and quality control has made it a trusted name among high-tech and life science industries, where reliability and sterility are critical.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by key players in the Asia Pacific peracetic acid (PAA) market is product innovation and formulation customization. Companies are investing heavily in research and development to create specialized PAA blends that cater to specific industry requirements, such as low-residue disinfection in healthcare or high-stability solutions for industrial water treatment. This approach allows manufacturers to differentiate their offerings and meet evolving regulatory and performance expectations across diverse sectors.

Another crucial strategy is expanding regional production and distribution capabilities. To ensure a reliable supply and reduce logistical complexities associated with handling PAA, leading companies are setting up localized manufacturing units and strengthening partnerships with regional distributors. These moves enable faster delivery, better after-sales service, and improved compliance with country-specific chemical regulations, enhancing overall market penetration.

The strategic collaborations and partnerships with end-use industries play a vital role in strengthening the market position. These alliances not only drive adoption but also foster long-term customer loyalty in the competitive Asia Pacific landscape.

RECENT MARKET DEVELOPMENTS

- In February 2024, Evonik Industries launched a new line of stabilized peracetic acid formulations specifically designed for the food and beverage sector in Southeast Asia. The move was aimed at addressing the growing demand for residue-free disinfectants that comply with stringent food safety regulations in the region.

- In May 2024, Solvay announced the expansion of its distribution network in India by partnering with a leading local chemical distributor to improve accessibility and after-sales support for PAA-based products used in water treatment and healthcare applications.

- In July 2024, Percopharm GmbH established a dedicated technical service center in South Korea to provide on-site support for pharmaceutical and semiconductor manufacturing clients using high-purity PAA for sterilization and cleaning processes.

- In September 2024, Mitsubishi Chemical, parent company of Percopharm, acquired a minority stake in a Japanese biotech firm specializing in microbial control solutions, aiming to integrate PAA technology into advanced sterilization protocols for life sciences applications.

- In November 2024, a joint initiative between BASF and a Singapore-based water treatment company led to the deployment of PAA-based oxidation systems in several industrial parks across Malaysia, enhancing wastewater recycling efficiency and supporting zero-liquid discharge goals.

MARKET SEGMENTATION

This research report on the Asia Pacific peracetic acid (PAA) market is segmented and sub-segmented into the following categories.

By Grade

- PAA - Below 5%

- H₂O₂ less than 20%

- H₂O₂ greater than 20%

- PAA - 5% to 15%

- H₂O₂ less than 20%

- H₂O₂ greater than 20%

- PAA - Above 15%

- H₂O₂ less than 20%

- H₂O₂ greater than 20%

By Application

- Disinfectant

- Sanitizer

- Others

By End Use

- Food & Beverage

- Healthcare

- Water Treatment

- Pulp & Paper

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of the Asia Pacific PAA market?

The key growth drivers include rising environmental awareness, increasing demand for non-toxic

What is the future outlook of the Asia Pacific Peracetic Acid market?

The future outlook for the Asia Pacific Peracetic Acid market is positive, with continued expansion expected due to increasing demand for eco-friendly disinfectants, especially in water treatment, healthcare, and food safety applications.

What challenges are faced by the PAA market in this region?

Challenges include high production and transportation costs, the handling complexities of a reactive and corrosive chemical, and competition from alternative disinfectants.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com