Asia Pacific Polyurethane Market Size, Share, Trends & Growth Forecast Report By Raw Material (Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, Polyols), Product (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers), Application (Furniture and Interiors, Construction, Electronics & Appliances, Automotive, Footwear, Packaging), and Country (India, China, Japan, South Korea, Australia, New Zealand, Rest of Asia Pacific) – Industry Analysis From 2025 to 2033.

Asia Pacific Polyurethane Market Size

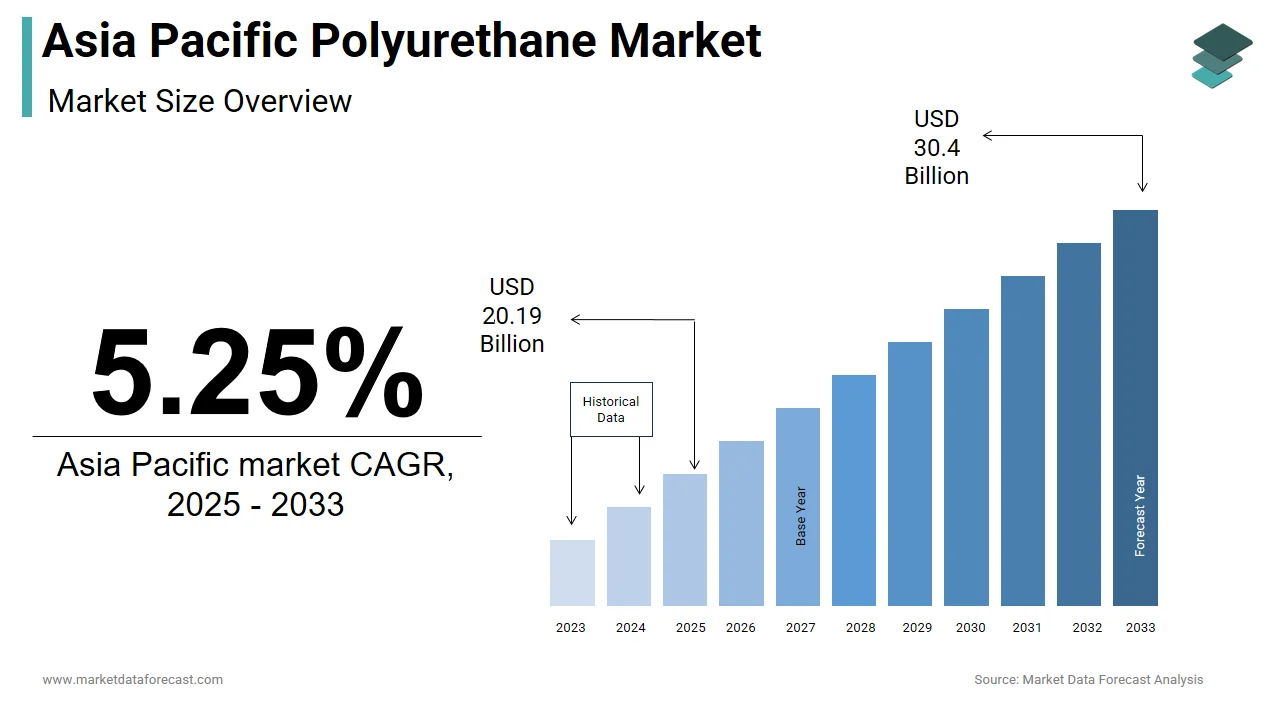

The size of the Asia Pacific polyurethane market was worth USD 19.18 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 5.25% from 2025 to 2033 and be worth USD 30.4 billion by 2033 from USD 20.19 billion in 2025.

Polyurethane, a versatile polymer, is widely used in the form of foams, coatings, adhesives, sealants, and elastomers due to its exceptional durability, flexibility, and insulating properties.

MARKET DRIVERS

Rising Demand in the Construction Industry

The escalating demand for energy-efficient and sustainable building materials has emerged as a primary driver for the Asia Pacific Polyurethane Market. Polyurethane-based insulation materials, such as spray foam and rigid panels, are extensively used to enhance thermal efficiency and reduce energy consumption in buildings, aligning with regulatory mandates aimed at promoting green architecture. A key factor driving this trend is the increasing focus on reducing carbon footprints in urban areas. Also, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of high-performance polyurethane products.

Expansion of the Automotive Sector

The rapid expansion of the automotive industry in the Asia Pacific region has significantly bolstered the demand for polyurethane-based materials used in vehicle manufacturing. According to the International Organization of Motor Vehicle Manufacturers (OICA), the region produces a significant portion of global automobiles annually, creating immense demand for lightweight and durable components such as seating foams, dashboards, and insulation panels made from polyurethane. A major driver of this growth is the increasing adoption of electric vehicles (EVs), which rely heavily on lightweight materials to improve energy efficiency and extend battery life. Moreover, as per the Asian Development Bank, the shift toward sustainable mobility has amplified the demand for bio-based polyurethane formulations that minimize environmental impact.

MARKET RESTRAINTS

Stringent Environmental Regulations

One of the most significant restraints affecting the Asia Pacific Polyurethane Market is the stringent environmental regulations governing the use of certain raw materials and manufacturing processes. The European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) impose strict guidelines on permissible levels of volatile organic compounds (VOCs) and isocyanates, which are often mirrored by regional authorities. This prolonged timeline poses significant challenges for manufacturers aiming to introduce innovative solutions tailored to emerging industry needs.

Volatility in Raw Material Prices

Another critical restraint stems from the volatility in raw material prices, particularly for key inputs like crude oil derivatives and isocyanates, which impacts production costs and profitability. This instability creates challenges for polyurethane manufacturers, who must navigate rising input costs while maintaining competitive pricing for their products.

MARKET OPPORTUNITIES

Adoption of Bio-Based Polyurethane Formulations

A burgeoning opportunity lies in the adoption of bio-based polyurethane formulations, driven by growing consumer demand for environmentally friendly products.

Simultaneously, the rise of regenerative practices presents a novel avenue for innovation. For instance, polyurethane foams derived from castor oil are effective in reducing greenhouse gas emissions during production, as reported by the University of Queensland.

Growth in Lightweight Materials for Electric Vehicles (EVs)

The advent of electric vehicles (EVs) presents a transformative opportunity for the Asia Pacific Polyurethane Market. Polyurethane-based components, such as seating foams, structural reinforcements, and thermal insulation, play a critical role in improving energy efficiency and extending battery life.

For example, advancements in nano-polyurethane formulations enable manufacturers to achieve superior strength-to-weight ratios, directly impacting vehicle performance. Apart from these, as per the Asian Development Bank, adopting sustainable mobility practices has amplified the demand for bio-based polyurethane formulations that minimize environmental impact.

MARKET CHALLENGES

Resistance to the Adoption of New Technologies

A persistent challenge facing the Asia Pacific Polyurethane Market is the resistance to adoption of new technologies exhibited by traditional manufacturers entrenched in conventional practices

Furthermore, cultural and regional disparities exacerbate this issue. For example, rural areas in Southeast Asia tend to have lower adoption rates compared to technologically progressive regions like Japan and South Korea, where large-scale operations dominate.

Concerns Over Environmental Impact and Regulation

Environmental concerns pose another formidable challenge for the Asia Pacific Polyurethane Market, especially regarding pollution and resource depletion. As per findings, a major share of industrial emissions in the region are attributed to chemical manufacturing, including polyurethane production, prompting stricter regulations on chemical discharges. Traditional polyurethane formulations, despite their efficiency, are often scrutinized for their potential contribution to these issues if not managed responsibly.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Raw Material, Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Dow, Inc.; BASF SE; Covestro AG; Huntsman International LLC; Eastman Chemical Company; Mitsui & Co. Plastics Ltd.; Mitsubishi Chemical Corporation; Reticel NV/SA; Woodbridge; DIC Corporation; RTP Company; The Lubrizol Corporation; RAMPH Holding GmbH & Co. KG; Tosoh Corporation, and others. |

SEGMENTAL ANALYSIS

By Raw Material Insights

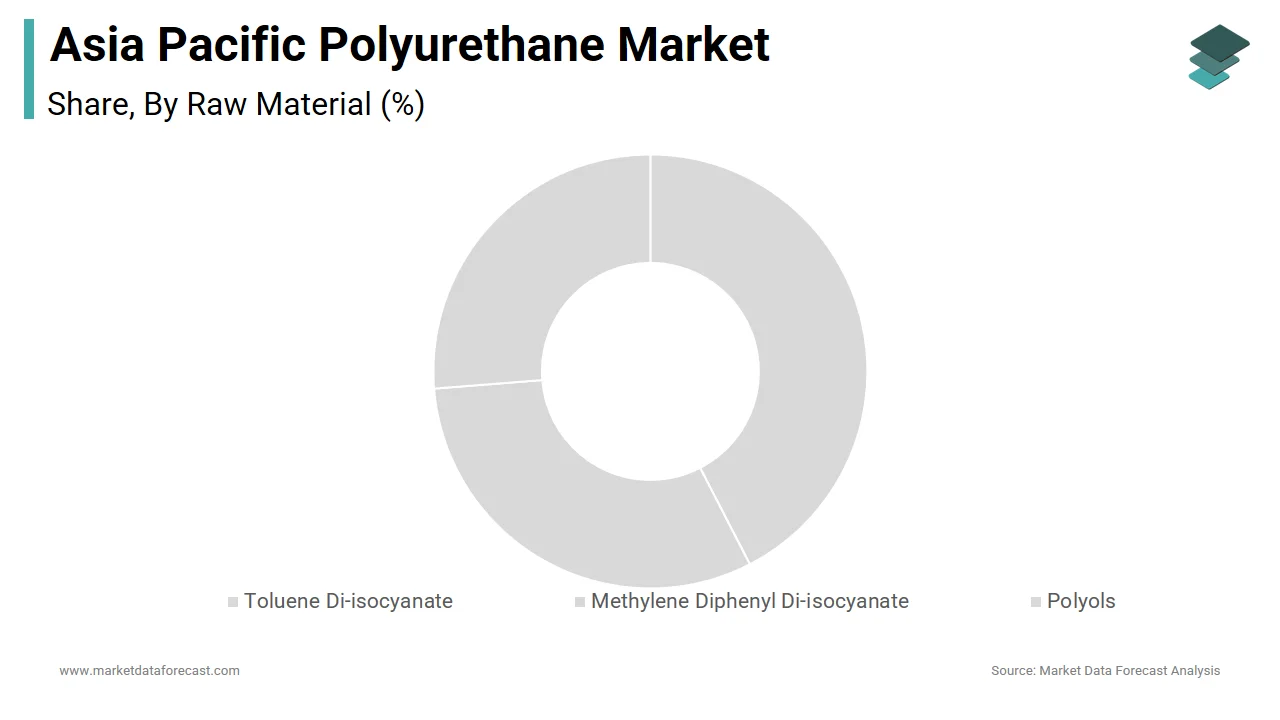

The Methylene Diphenyl Di-isocyanate (MDI) segment dominates the Asia Pacific Polyurethane Market by holding a 45.5% of the market share in 2024. This leading position is propelled by its widespread use in rigid foam applications, which are critical for insulation in construction and refrigeration industries. A key factor driving this dominance is MDI's superior thermal insulation properties compared to other raw materials. In addition, advancements in formulation technologies have enabled the development of eco-friendly MDI variants that align with stringent environmental regulations.

Bio-based polyols segment represented the fastest-growing segment in the Asia Pacific Polyurethane Market, with a projected CAGR of 9.8%. This rapid expansion is fueled by the increasing demand for sustainable and renewable raw materials in polyurethane production. For example, plant-derived polyols, such as those sourced from castor oil and soybean oil, are gaining traction due to their reduced carbon footprint and compatibility with circular economy principles. A major driver of this growth is the rising adoption of bio-based polyols in industries like furniture and automotive, where sustainability is becoming a key differentiator.

By Product Insights

The flexible foam segment commanded the Asia Pacific Polyurethane Market by capturing a 35.4% of the total share in 2024. This prominence is attributed to its widespread use in furniture, bedding, and automotive seating, where comfort, durability, and lightweight properties are critical. A key factor driving this leadership is the ability of flexible foam to enhance product aesthetics and functionality. Also, the growing emphasis on sustainable manufacturing practices has accelerated the adoption of recycled and bio-based flexible foam formulations, ensuring compliance with global standards.

The coatings, adhesives, and sealants segment emerged as the quickest accelerating one, with a CAGR of 8.5% propelled by the increasing demand for durable and protective solutions in industries like construction, automotive, and electronics. According to the International Energy Agency (IEA), the adoption of energy-efficient building practices has amplified the demand for polyurethane-based coatings that enhance thermal performance and structural integrity. A major driver of this growth is the rising adoption of advanced manufacturing technologies.

By Application Insights

The construction segment prevailed in the Asia Pacific Polyurethane Market by holding a 30.5% of the market share in 2024. This is because of the region's booming infrastructure development sector, which requires durable and energy-efficient materials for residential, commercial, and industrial projects. A key factor driving this leadership is the ability of polyurethane to enhance thermal efficiency and reduce energy consumption in buildings. Also, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of high-performance polyurethane products.

The automotive sector represents the fastest-growing segment, with a CAGR of 10.2% , driven by the increasing adoption of lightweight materials in vehicle manufacturing. A major driver of this growth is the rise of electric vehicles (EVs), which rely heavily on lightweight materials to improve energy efficiency and extend battery life. Additionally, as per the Asian Development Bank, adopting sustainable mobility practices has amplified the demand for bio-based polyurethane formulations that minimize environmental impact.

COUNTRY LEVEL ANALYSIS

China commanded the Asia Pacific Polyurethane Market by commanding a 40.5% of the regional share in 2024. This prevalence is rooted in the country's vast industrial base, which supports large-scale production of polyurethane for diverse applications, including construction, automotive, and electronics. A key driver of this leadership is the presence of advanced manufacturing technologies. Apart from these, stringent environmental regulations enforced by the Ministry of Ecology and Environment have accelerated the adoption of eco-friendly polyurethane products, ensuring compliance with global standards.

India is a lucrative market. The country's strong emphasis on sustainable practices has positioned it as a hub for eco-friendly polyurethane solutions. Another factor driving India's prominence is its thriving construction and automotive industries. In addition, government incentives for adopting renewable energy sources have spurred the use of bio-based polyurethane, further bolstering the market's growth.

Japan is a key player in the market. The country's focus on innovation and precision manufacturing has created a fertile ground for high-performance polyurethane used in advanced applications like electronics, automotive, and aerospace. A main driver of this growth is the increasing adoption of specialty polyurethane formulations, facilitated by investments in R&D. The National Institute of Advanced Industrial Science and Technology reports that nano-polyurethane formulations have gained traction due to their ability to enhance durability and aesthetic appeal. Further, efforts to modernize manufacturing processes through government-funded programs have encouraged small-scale producers to invest in premium polyurethane solutions, contributing to Japan's steady market expansion.

South Korea accounts for a notable market share, encompassing smaller economies like Thailand and Vietnam. Also, the country is witnessing gradual adoption of polyurethane due to its growing focus on export-oriented industries.

Australia and New Zealand represent a niche yet emerging player in the Asia Pacific Polyurethane Market, contributing marginally to the overall share. Recent bushfires have underscored the need for fortified polyurethane materials to mitigate production losses. A key driver of this progress is the adoption of bio-based polyurethane, which safeguards environmental health during adverse weather conditions. In addition, government subsidies aimed at revitalizing rural economies have incentivized builders to invest in advanced polyurethane solutions, fostering incremental growth in the market.

KEY MARKET PLAYERS

Some of the noteworthy companies in the Asia Pacific polyurethane market profiled in this report are Dow, Inc.; BASF SE; Covestro AG; Huntsman International LLC; Eastman Chemical Company; Mitsui & Co. Plastics Ltd.; Mitsubishi Chemical Corporation; Reticel NV/SA; Woodbridge; DIC Corporation; RTP Company; The Lubrizol Corporation; RAMPH Holding GmbH & Co. KG; Tosoh Corporation, and others.

TOP LEADING PLAYERS IN THE MARKET

Covestro AG

Covestro AG is a global leader in the Asia Pacific Polyurethane Market, renowned for its innovative and sustainable polyurethane solutions tailored to meet the diverse needs of industries such as construction, automotive, and electronics. The company specializes in producing high-performance raw materials like MDI and polyols, which are integral to applications ranging from insulation foams to coatings. Covestro’s commitment to research and development has positioned it as a pioneer in creating eco-friendly formulations that align with stringent environmental regulations.

BASF SE

BASF SE plays a pivotal role in the Asia Pacific Polyurethane Market by offering specialized polyurethane solutions designed for niche applications like automotive components, footwear, and packaging. The company focuses on developing bio-based and low-VOC polyurethane products that cater to evolving consumer preferences for sustainability and innovation. BASF’s emphasis on green chemistry aligns with its efforts to reduce carbon emissions and promote circular economies, making its products a preferred choice for eco-conscious industries.

Huntsman Corporation

Huntsman Corporation is a prominent player in the Asia Pacific Polyurethane Market, specializing in the production of advanced polyurethane systems for coatings, adhesives, and elastomers. The company emphasizes sustainable sourcing practices and invests heavily in developing specialty formulations that enhance product durability and functionality. Huntsman’s vertically integrated business model allows it to maintain control over the entire supply chain, ensuring traceability and compliance with international standards.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Acquisitions and Partnerships

Key players in the Asia Pacific Polyurethane Market have prioritized strategic acquisitions and partnerships to expand their product portfolios and strengthen their market presence. By acquiring smaller firms specializing in niche polyurethane formulations or forming alliances with research institutions, these companies gain access to cutting-edge technologies and innovative solutions. Such collaborations enable them to address unmet needs in the industrial sector while enhancing their competitive edge.

Investment in Sustainable Solutions

Sustainability has emerged as a cornerstone of competitive strategy in the polyurethane market. Leading companies are investing heavily in the development of eco-friendly polyurethane products that reduce environmental impact, improve resource efficiency, and align with regulatory standards. By focusing on reducing carbon footprints and promoting circular economies, these players position themselves as champions of sustainable industrial practices.

Emphasis on Research and Development

R&D is a critical driver of innovation in the Asia Pacific Polyurethane Market. Key players are channeling significant resources into exploring novel formulations and advanced manufacturing processes that improve polyurethane performance and application versatility.

COMPETITION OVERVIEW

The Asia Pacific Polyurethane Market is characterized by intense competition, driven by the presence of established multinational corporations and emerging niche players. Leaders like Covestro AG, BASF SE, and Huntsman Corporation dominate the market by leveraging their extensive R&D capabilities and global reach to deliver high-performance solutions.

RECENT MARKET DEVELOPMENTS

- In April 2024, Covestro AG launched a new line of bio-based polyurethane systems designed to enhance sustainability and reduce environmental impact. This move aims to address growing concerns about pollution in the Asia Pacific region.

- In June 2023, BASF SE partnered with a leading automotive manufacturer to develop lightweight polyurethane components for electric vehicles. This collaboration underscores BASF’s commitment to advancing sustainable mobility practices through innovation.

- In January 2023, Huntsman Corporation acquired a startup specializing in nano-polyurethane technology. This acquisition strengthens Huntsman’s ability to offer high-performance solutions for electronics and aerospace applications.

- In September 2022, Dow Chemical introduced a range of low-VOC polyurethane coatings aimed at supporting the construction and infrastructure sectors. This initiative aligns with consumer preferences for durable and environmentally friendly products.

- In November 2022, Wanhua Chemical expanded its production facilities in China to increase the supply of MDI-based polyurethane products. This expansion supports the company’s goal of meeting rising demand in the Asia Pacific Polyurethane Market.

MARKET SEGMENTATION

This Asia Pacific polyurethane market research report is segmented and sub-segmented into the following categories.

By Raw Material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of Asia Pacific

Frequently Asked Questions

1. What drives the Asia Pacific polyurethane market?

The Asia Pacific polyurethane market is driven by booming construction and automotive industries, demand for energy-efficient insulation, and rapid urbanization in China, India, and Southeast Asia

2. What challenges affect the Asia Pacific polyurethane market?

The Asia Pacific polyurethane market faces challenges from volatile raw material prices, stringent environmental regulations on VOCs and isocyanates, and slow adoption of new technologies by traditional manufacturers

3. What opportunities exist in the Asia Pacific polyurethane market?

Key opportunities for the Asia Pacific polyurethane market include bio-based polyurethane adoption, growth in electric vehicles, and rising demand for sustainable, high-performance materials in construction and automotive sectors

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]