Asia Pacific POS Terminals Market Size, Share, Trends & Growth Forecast Report By Type (Fixed POS Systems, Mobile POS Systems), End-user (Retail, Hospitality, Healthcare), and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific POS Terminals Market Size

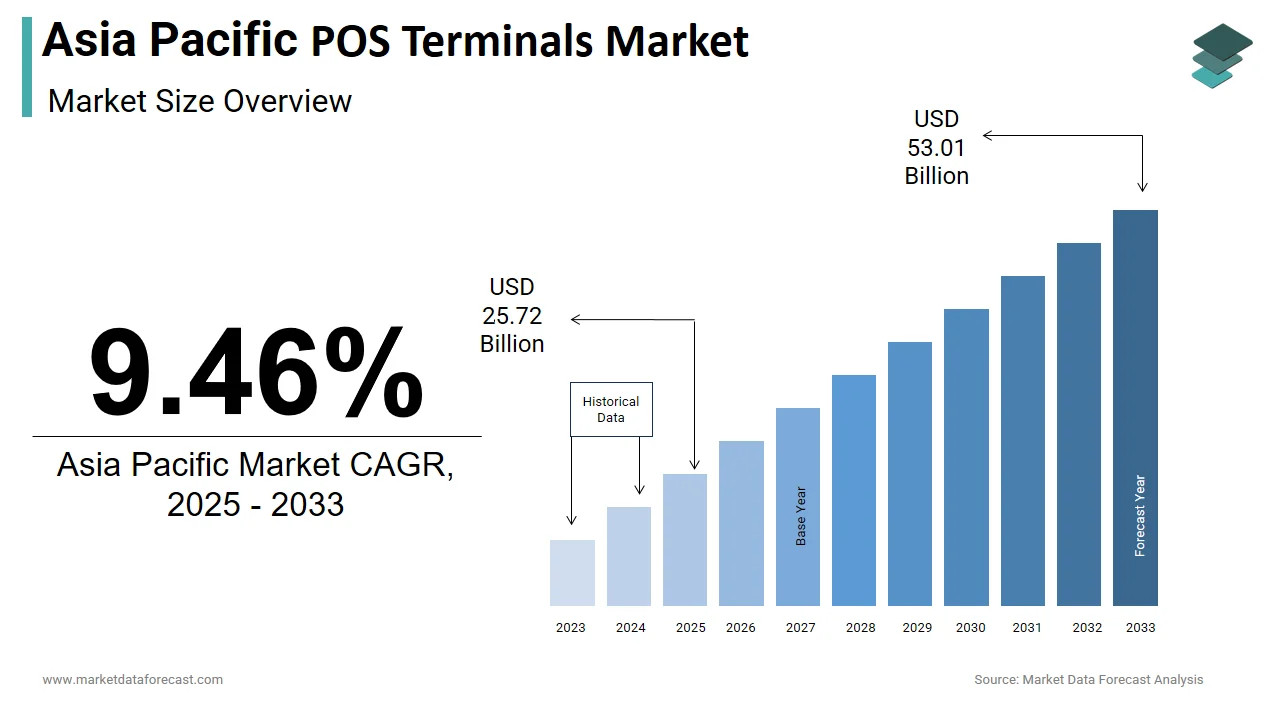

The size of the Asia Pacific POS terminals market was worth USD 23.5 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 9.46% from 2025 to 2033 and be worth USD 53.01 billion by 2033 from USD 25.72 billion in 2025.

POS terminals are sophisticated systems used to facilitate transactions, manage inventory, and enhance customer experiences through seamless integration with digital platforms. The region's rapid urbanization, coupled with a growing preference for cashless payments, has positioned POS terminals as indispensable tools for businesses of all sizes.

MARKET DRIVERS

Rising Adoption of Cashless Payments

The increasing adoption of cashless payment methods serves as a primary driver for the POS terminals market in Asia Pacific. According to the Asian Development Bank, the volume of digital transactions in the region expanded notably between 2020 and 2023, driven by government policies promoting financial inclusion and consumer preference for convenience. For instance, Singapore’s Smart Nation initiative has encouraged businesses to adopt POS systems capable of processing QR code-based payments, resulting in an increase in merchant participation in 2023. Also, the proliferation of mobile wallets like Paytm and GrabPay has amplified the need for POS terminals that support multiple payment modes. As per Visa, a large share of consumers in urbanized areas of Asia Pacific now prefer using digital payment methods over cash, showing the critical role of POS terminals in facilitating these transactions.

Growing Demand in the Retail Sector

The retail sector’s rapid expansion in Asia Pacific serves as another significant driver for the POS terminals market. Like, the food retail industry in the region is projected to grow significantly, creating immense demand for advanced POS systems that streamline operations and improve customer service. Besides, the rise of omnichannel retailing has increased the adoption of POS terminals that enable seamless integration between online and offline sales channels. The McKinsey Global Institute highlights that businesses adopting POS-driven analytics witnessed a improvement in customer retention rates, underscoring the value of these systems in enhancing retail performance.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

One of the key restraints affecting the POS terminals market in Asia Pacific is the high initial cost of procurement and ongoing maintenance expenses. Plus, the capital expenditure required for installing advanced POS systems can be prohibitive for small and medium-sized enterprises (SMEs), particularly in emerging economies. These costs include not only the purchase price but also expenses related to software licensing, hardware upgrades, and employee training. Apart from these, the complexity of modern POS systems often necessitates specialized maintenance, which can strain operational budgets. For instance, retailers commonly reported that maintenance costs for POS terminals account for a considerable portion of their annual operational expenses. This financial burden limits the adoption of POS systems among smaller players, thereby restricting market growth.

Limited Awareness and Technical Expertise

Another significant restraint is the lack of awareness and technical expertise regarding the optimal use of POS terminals. As per the United Nations Industrial Development Organization, many small businesses in rural areas of Asia Pacific lack access to training programs and technical resources needed to operate advanced POS systems effectively. This knowledge gap often leads to suboptimal usage or premature equipment failure, discouraging further investment. Additionally, the absence of standardized guidelines for POS usage across industries exacerbates the problem, making it challenging for businesses to adopt best practices.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of POS terminals with emerging technologies presents a transformative opportunity for the Asia Pacific market. According to PwC, the adoption of artificial intelligence (AI) and machine learning in retail operations is expected to grow significantly, driven by advancements in data analytics and customer behavior tracking. POS systems equipped with AI-driven analytics capabilities can significantly enhance operational efficiency and customer engagement. Furthermore, the ability to integrate these systems with cloud-based platforms enables remote monitoring and scalability, making them ideal for decentralized retail operations.

Expansion into Rural and Untapped Markets

The expansion of POS terminals into rural and untapped markets offers immense potential for growth in the Asia Pacific region. Companies like Paytm and Gojek have begun targeting these regions by offering affordable POS solutions tailored to local needs. For example, Paytm reported a increase in merchant registrations in rural India after launching low-cost POS devices in 2023. Moreover, government initiatives promoting financial inclusion have created opportunities for POS providers to partner with local banks and microfinance institutions.

MARKET CHALLENGES

Cybersecurity Threats and Data Privacy Concerns

Cybersecurity threats and data privacy concerns pose significant challenges to the POS terminals market in Asia Pacific. For instance, a major retail chain in South Korea reported a data breach in 2023 that compromised over 1 million customer records, leading to reputational damage and financial losses. Also, the growing emphasis on data protection regulations, such as the Personal Data Protection Act in Singapore, has increased compliance costs for businesses. As per the International Association of Privacy Professionals, companies spent more on cybersecurity measures in 2023 to safeguard POS transactions, straining operational budgets.

Intense Competition and Price Wars

The Asia Pacific POS terminals market is highly competitive, with numerous players vying for market share. While this strategy attracts cost-sensitive consumers, it exerts downward pressure on profit margins for premium brands. Also, the entry of Chinese manufacturers into Southeast Asia has further fragmented the market, making it challenging for incumbents to differentiate their offerings. Companies must innovate to justify premium pricing while addressing affordability concerns.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Ingenico Group (Worldline), Shenzhen Xinguodu Technology Co., Ltd., Shenzhen Itron Electronics Co., Ltd., Fujian Newland Payment Technology Co., Ltd. (Newland Technology Group), Beijing Shenzhou Anfu Technology Co. Ltd., and others. |

SEGMENTAL ANALYSIS

By Type Insights

The fixed point-of-sale systems dominate the Asia Pacific POS terminals market by holding a market share of 65.8% in 2024. This leading position is driven by their widespread adoption in industries such as retail, hospitality, and healthcare, where reliability and high transaction volumes are critical. A key factor behind this dominance is the growing complexity of retail operations, which necessitates robust systems capable of handling inventory management, customer data, and payment processing simultaneously. Moreover, the increasing emphasis on omnichannel retailing has amplified the need for fixed POS systems that enable real-time synchronization between online and offline sales channels. The McKinsey Global Institute highlights that businesses adopting fixed POS-driven analytics witnessed a increase in customer retention rates, underscoring the value of these systems in enhancing retail performance.

The mobile/portable point-of-sale systems segment is the fastest-growing in the Asia Pacific POS terminals market, with a projected CAGR of 12.5%. This rapid expansion is caused by their versatility and suitability for small and medium-sized enterprises (SMEs), particularly in emerging economies. Like, SMEs account for a major share of businesses in the region, creating immense opportunities for mobile POS systems that offer affordability and ease of use. For example, street vendors in Vietnam reported a increase in daily transactions after adopting portable POS devices in recent years. Apart from these, the rise of gig economy platforms like Grab and Gojek has increased the adoption of mobile POS systems among delivery services and micro-merchants. As per Mastercard, contactless payments via mobile POS systems accounted for a notable portion of all transactions in urbanized areas of Asia Pacific in 2023, showing their growing popularity. A further point is the increasing penetration of smartphones and digital wallets, which complements the functionality of mobile POS systems.

By End-user Insights

The retail industry segment exhibited the largest end-user in the Asia Pacific POS terminals market, i.e. 45.7% of total demand in 2024. This dominance is driven by the region’s position as a global hub for consumer goods and e-commerce. Moreover, a large percentage of the region’s population resides in urban areas, where digital payment adoption is highest. Retailers rely heavily on POS terminals to streamline operations, manage inventory, and enhance customer experiences. Besides, the proliferation of omnichannel retailing has amplified the need for POS terminals that enable seamless integration between online and offline sales channels.

The hospitality sector is quickly accelerating end-user segment in the Asia Pacific POS terminals market, with a CAGR of 13.2%. This progress is propelled by the increasing adoption of POS systems in hotels, restaurants, and cafes to improve service efficiency and customer satisfaction. Moreover, the hospitality industry in Asia Pacific is projected to surged notably, driven by rising tourism and urbanization trends. For example, luxury hotels in Singapore reported an increase in operational efficiency after adopting cloud-based POS systems in 2023. Also, the rise of food delivery platforms like Zomato and DoorDash has increased the adoption of POS systems among small eateries and cafes. Further factor is the increasing emphasis on personalized customer experiences, which necessitates advanced POS systems capable of tracking customer preferences and behavior.

COUNTRY LEVEL ANALYSIS

China commanded the Asia Pacific POS terminals market by accounting for a 30.5% of regional sales in 2024. The country’s dominance is driven by its robust retail and e-commerce sectors, which rely heavily on advanced POS systems to manage high transaction volumes. Like, China’s e-commerce market grew substantially in 2023, creating immense demand for POS solutions that support both online and offline sales channels. Also, government initiatives promoting financial inclusion, such as the expansion of mobile payment platforms like Alipay and WeChat Pay, have spurred the adoption of POS terminals among small retailers. For instance, Alibaba reported an increase in merchant participation in rural areas after launching affordable POS devices in 2023.

Japan is experiencing a rise in the market. The country’s growth is attributed to its strong presence in the retail and hospitality sectors, which prioritize efficiency and customer satisfaction. Like, Japanese businesses invest heavily in automation and precision technologies, driving demand for advanced POS systems. For example, convenience stores in Tokyo adopted AI-driven POS systems in 2023, achieving an improvement in checkout efficiency. Besides, the government’s focus on promoting cashless payments has increased the adoption of POS terminals across various industries.

India seeing a strong expansion in the market which is driven by its rapidly expanding retail and financial sectors. According to the Reserve Bank of India, the volume of digital transactions in the country grew between 2020 and 2023, creating significant demand for POS systems. For instance, Paytm reported an increase in merchant registrations after launching low-cost POS devices tailored to small retailers in 2023. Also, government initiatives like the Unified Payments Interface (UPI) have encouraged businesses to adopt POS terminals, further boosting market growth.

South Korea has a significant position in the market that is supported by its world-class technology infrastructure and high adoption of cashless payments. Moreover, the country ranks among the top five globally for smartphone penetration, driving demand for mobile POS systems. For example, small businesses in Seoul reported an increase in daily transactions after adopting portable POS devices in 2023. Apart from these, the government’s push for smart city initiatives has increased the adoption of advanced POS systems in retail and hospitality sectors.

Australia & New Zealand is witnessing considerable rise in the market. This is supported by their strong focus on retail innovation and financial inclusion. Additionally, the region’s strict data protection regulations have driven demand for secure and reliable POS solutions.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC POS terminals market profiled in this report are Ingenico Group (Worldline), Shenzhen Xinguodu Technology Co., Ltd., Shenzhen Itron Electronics Co., Ltd., Fujian Newland Payment Technology Co., Ltd. (Newland Technology Group), Beijing Shenzhou Anfu Technology Co. Ltd., and others.

TOP LEADING PLAYERS IN THE MARKET

Verifone

Verifone is a global leader in the POS terminals market, renowned for its innovative solutions tailored to industries such as retail, hospitality, and financial services. The company’s contribution to the global market lies in its ability to deliver secure, scalable, and user-friendly systems that support both traditional and emerging payment methods. Verifone has consistently focused on integrating advanced technologies like AI and cloud computing into its products, enabling businesses to enhance operational efficiency and customer experiences.

Ingenico

Ingenico is a key player in the POS terminals market, offering a diverse portfolio of products designed to meet the needs of businesses across various sectors. The company’s global influence stems from its commitment to innovation and reliability, particularly in industries like retail and healthcare. Ingenico has played a pivotal role in advancing POS technology, addressing the growing demand for omnichannel capabilities and contactless payments.

PAX Technology

PAX Technology has established itself as a trusted name in the POS terminals market, leveraging its expertise in hardware design and software integration. The company’s global impact is evident in its ability to provide cost-effective yet high-performance solutions for emerging markets. PAX’s focus on affordability and functionality has led to widespread adoption among small and medium-sized enterprises (SMEs) in Asia Pacific.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC POS TERMINALS MARKET

Product Innovation and Customization

Key players in the Asia Pacific POS terminals market are heavily investing in research and development to introduce innovative products tailored to specific industry needs. Companies like Verifone and Ingenico have focused on enhancing the versatility of their POS systems, particularly for applications in omnichannel retailing and contactless payments.

Strategic Partnerships and Collaborations

To strengthen their market presence, leading companies are forming strategic partnerships with regional e-commerce platforms and financial institutions. For instance, collaborations with payment service providers allow brands to integrate their POS systems into larger ecosystems, enhancing value for end-users.

Expansion of Regional Footprint

Another major strategy involves expanding manufacturing and distribution networks across Asia Pacific. Players like PAX Technology and NCR Corporation have established local facilities and partnered with distributors to improve accessibility and reduce lead times.

COMPETITION OVERVIEW

The Asia Pacific POS terminals market is characterized by intense competition, driven by the presence of global leaders like Verifone, Ingenico, and PAX Technology, alongside emerging regional players. The market’s dynamics are shaped by the rapid adoption of cashless payments, the expansion of e-commerce, and the increasing complexity of retail operations. Global players leverage their expertise in advanced technologies and secure payment solutions to maintain dominance, while regional manufacturers focus on cost-effective solutions tailored to local needs. The growing emphasis on omnichannel retailing and financial inclusion has intensified rivalry, prompting companies to differentiate themselves through innovation and customization. Additionally, the rise of mobile POS systems and cloud-based platforms has created opportunities for integrating IoT-enabled solutions, further elevating competition.

RECENT MARKET DEVELOPMENTS

- In April 2024, Verifone launched a next-generation AI-driven POS system in Japan. This innovation aimed to enhance personalized customer experiences in the hospitality sector and solidify Verifone’s leadership in advanced payment solutions.

- In July 2023, Ingenico partnered with a major e-commerce platform in India to develop POS terminals tailored for omnichannel retailing. This collaboration positioned Ingenico as a key enabler of digital transformation in the region.

- In September 2023, PAX Technology expanded its manufacturing facility in Malaysia to meet the rising demand for affordable POS systems among small retailers. This move strengthened PAX’s supply chain and market presence in Southeast Asia.

- In November 2022, NCR Corporation acquired a local distributor in South Korea to streamline its distribution network and improve customer accessibility. This acquisition enhanced NCR’s ability to serve the Korean retail market effectively.

- In February 2024, Square introduced a mobile POS system with IoT integration for small businesses in Indonesia. This launch addressed the region’s growing focus on financial inclusion and real-time inventory management.

MARKET SEGMENTATION

This Asia Pacific POS terminals market research report is segmented and sub-segmented into the following categories.

By Type

- Fixed Point-of-sale Systems

- Mobile/Portable Point-of-sale Systems

By End-user

- Retail

- Hospitality

- Healthcare

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific POS terminals market?

The Asia Pacific POS terminals market is driven by rapid urbanization, rising adoption of cashless payments, retail sector growth, and government initiatives promoting digital financial inclusion and smart cities.

2. What challenges affect the Asia Pacific POS terminals market?

The Asia Pacific POS terminals market faces high initial and maintenance costs, lack of technical expertise in rural areas, cybersecurity threats, and fragmented regulations that hinder widespread adoption.

3. What opportunities exist in the Asia Pacific POS terminals market?

The Asia Pacific POS terminals market sees opportunities in AI and cloud integration, expansion into rural and untapped markets, affordable mobile POS solutions, and partnerships with fintech and e-commerce platforms.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]