Asia Pacific Prebiotics Market Size, Share, Growth, Trends, and Forecast Report – Segmented By Ingredients (FOS, Inulin, GOS, MOS), Application, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis from 2025 to 2033

Asia Pacific Prebiotics Market Size

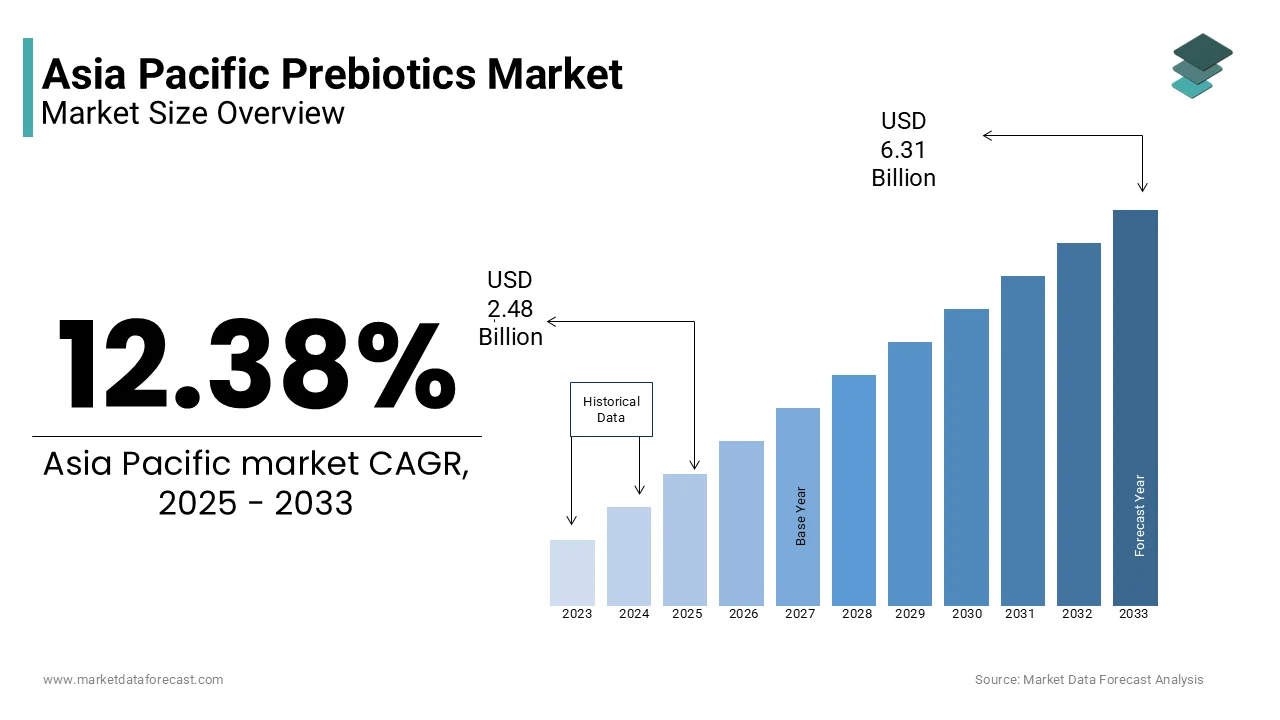

Asia Pacific Prebiotics market size was valued at USD 2.21 billion in 2024, and the market size is expected to reach USD 6.31 billion by 2033 from USD 2.48 billion in 2025. The market's promising CAGR for the predicted period is 12.38%.

Prebiotics are non-digestible food ingredients that beneficially affect the host by selectively stimulating the growth and activity of specific gut microbiota, thereby improving overall health. The Asia Pacific prebiotics market encompasses a wide range of products such as inulin, fructooligosaccharides (FOS), galactooligosaccharides (GOS), xylooligosaccharides (XOS), and other emerging oligosaccharides. These compounds are increasingly incorporated into functional foods, dietary supplements, infant formulas, and animal feed due to their role in enhancing digestive and immune health.

MARKET DRIVERS

Rising Awareness of Gut Health and Functional Nutrition

One of the primary drivers of the Asia Pacific prebiotics market is the accelerating awareness around gut health and its influence on overall well-being. Consumers across the region are becoming more informed about the role of prebiotics in fostering beneficial gut microbiota, which has led to increased demand for fiber-enriched functional foods and beverages. According to the International Probiotics Association (IPA), a significant share of consumers in China and Japan now associate dietary fiber with digestive wellness, prompting manufacturers to integrate prebiotic ingredients into everyday products. In India, where traditional diets have long included fermented foods, there is a renewed push toward scientifically validated gut health solutions. A national survey conducted by the Indian Society of Gastroenterology found that nearly 45% of urban respondents had incorporated prebiotic or probiotic supplements into their diet in the past two years. Furthermore, government-backed initiatives such as Singapore’s Health Promotion Board’s “Healthy Diet Pyramid” encourage fiber-rich eating habits, indirectly supporting prebiotic adoption.

Expansion of the Functional Food and Beverage Industry

Expansion of the Functional Food and Beverage Industry

Another major driver of the Asia Pacific prebiotics market is the rapid expansion of the functional food and beverage industry, which integrates prebiotics into everyday consumables to enhance nutritional value. The Asia Pacific region has emerged as a hotspot for fortified dairy products, plant-based alternatives, nutrition bars, and ready-to-drink health beverages incorporating prebiotic fibers. In China, major dairy companies such as Yili and Mengniu have introduced a range of prebiotic-enriched yogurts and milk drinks targeting children and aging populations. The Chinese Nutrition Society estimates that over 70 million individuals regularly consume fortified dairy products containing prebiotics. Similarly, in South Korea, the Ministry of Food, Agriculture, Forestry, and Fisheries reported a 15% year-on-year increase in prebiotic-infused snack and cereal launches between 2022 and 2023. Japanese multinational Ajinomoto has also expanded its line of amino acid-enhanced instant soups with added prebiotic fibers aimed at promoting digestive wellness. Meanwhile, in Southeast Asia, Nestlé and Danone have launched specialized infant formula blends containing GOS to support early-life gut development.

MARKET RESTRAINTS

Regulatory Heterogeneity Across Countries

A significant restraint affecting the Asia Pacific prebiotics market is the lack of standardized regulatory frameworks governing the use and labeling of prebiotic ingredients across different countries. Unlike Europe and North America, where clear guidelines exist for prebiotic claims and approvals, Asia Pacific presents a fragmented regulatory landscape that complicates product registration and marketing strategies. The Therapeutic Goods Administration (TGA) in Australia recognizes specific prebiotic claims based on clinical evidence, whereas in India, the Food Safety and Standards Authority (FSSAI) has yet to finalize comprehensive regulations for prebiotic labeling in functional foods. In China, the National Medical Products Administration (NMPA) requires extensive documentation for health supplement approvals, often delaying market entry for new prebiotic formulations. In addition, the Korean Food and Drug Administration (KFDA) mandates strict clinical trials before endorsing any prebiotic-related health assertions.

High Production Costs and Limited Raw Material Availability

The high cost of prebiotic production and the limited availability of suitable raw materials present a substantial barrier to market expansion in the Asia Pacific region. Most widely used prebiotics such as inulin, FOS, and GOS require complex enzymatic synthesis or extraction from natural sources like chicory root, sugarcane, and dairy. According to the International Sweeteners Association (ISA), the extraction and purification process for these compounds can account for up to 60% of total manufacturing expenses, making them significantly more expensive than conventional food additives. The United Nations Industrial Development Organization (UNIDO) reports that in regions such as Southeast Asia, where prebiotic sourcing relies heavily on imported raw materials, price volatility and supply chain disruptions further strain affordability. In India, despite abundant agricultural resources, the domestic cultivation of chicory remains minimal, forcing processors to depend on imports from European suppliers. Similarly, in Indonesia and Thailand, where lactose-based GOS production is attempted, fluctuating milk prices and logistical constraints pose ongoing challenges. The Indonesian Sugar Millers Association notes that erratic sugar cane yields have also affected local fructan production efforts.

MARKET OPPORTUNITIES

Integration of Prebiotics in Infant Nutrition and Pediatrics

A promising opportunity in the Asia Pacific prebiotics market lies in the increasing incorporation of prebiotics into infant nutrition and pediatric formulations. With rising parental awareness regarding early-life gut health and immunity, there is a growing shift toward premium infant milk formulas enriched with galactooligosaccharides (GOS) and fructooligosaccharides (FOS). According to the International Dairy Federation (IDF), over 60% of infant formula products launched in China and Japan in 2023 contained at least one prebiotic component to mimic the benefits of human breast milk. In India, where exclusive breastfeeding rates remain below recommended levels, the Indian Academy of Pediatrics has endorsed the inclusion of prebiotics in supplementary feeding programs to address digestive health concerns among infants. In addition, research conducted by Tokyo Women’s Medical University highlights the role of GOS in reducing infection rates among young children, reinforcing medical community support for prebiotic integration.

Surge in Demand for Plant-Based and Clean-Label Diets

The growing popularity of plant-based and clean-label diets in the Asia Pacific region presents a significant opportunity for the prebiotics market, particularly in the context of alternative protein sources and organic food products. Consumers are increasingly seeking transparent ingredient lists and naturally derived functional components, aligning with the inherent properties of prebiotic fibers. In Australia, the Clean Label Project has verified several prebiotic-enriched packaged foods for free-from synthetic additives, boosting consumer confidence. The New Zealand Food Safety Authority has also recognized prebiotic fibers as natural ingredients consistent with clean-label standards.

MARKET CHALLENGES

Lack of Consumer Understanding and Misconceptions About Prebiotics

A critical challenge facing the Asia Pacific prebiotics market is the limited consumer understanding of the distinction between prebiotics and probiotics, along with prevailing misconceptions about their functions and benefits. Many consumers conflate the two terms, leading to confusion in product selection and expectations of health outcomes. According to the International Scientific Association for Probiotics and Prebiotics (ISAPP), surveys conducted across China, India, and South Korea revealed that less than 30% of respondents could accurately differentiate between prebiotics and probiotics. In India, where digestive health concerns are widespread, a study published by the All India Institute of Medical Sciences (AIIMS) found that over half of surveyed consumers believed prebiotics were live bacteria rather than indigestible fibers that nourish existing gut flora.

Fluctuating Supply Chains and Agricultural Constraints

Fluctuating Supply Chains and Agricultural Constraints

Fluctuations in the supply chains for prebiotic raw materials and agricultural inputs pose a persistent challenge to the Asia Pacific prebiotics market. Many commonly used prebiotics such as inulin, FOS, and GOS derive from crops like chicory root, sugarcane, soybeans, and dairy sources, all of which are vulnerable to climate variability, pests, and geopolitical disruptions. Like, extreme weather events in Southeast Asia have reduced crop yields for prebiotic-source plants by up to 15% in recent years, directly impacting production timelines and pricing stability. The Thai Agricultural Research Council highlighted that irregular monsoons have affected sugarcane harvests, which are essential for fructan extraction. In India, the Indian Council of Agricultural Research (ICAR) reported lower-than-expected chicory cultivation in Himachal Pradesh due to shifting farmer preferences towards higher-value cash crops. In addition, import dependencies in countries like Indonesia and Malaysia for raw prebiotic extracts further complicate supply dynamics. Moreover, water scarcity and land-use changes threaten sustainable prebiotic agriculture, requiring strategic interventions to ensure long-term supply resilience across the Asia Pacific.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.38% |

|

Segments Covered |

By Ingredient, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

BAOLINGBAO BIOLOGY CO., LTD., Tata Chemicals Ltd., Quantum Hi-Tech (Guangdong) Biological Co., Ltd., Samyang Holdings Corporation, CJ CHEILJEDANG CORP., Meiji Holdings Co., Ltd., Layn Natural Ingredients, and Fuji Nihon Corporation, and others |

SEGMENTAL ANALYSIS

By Ingredient Insights

The Inulin segment commanded the Asia Pacific prebiotics market by accounting for a 38.6% of total consumption in 2024. This segment’s growth is associated to its widespread application in functional foods, beverages, and dietary supplements due to its natural origin and well-documented health benefits. According to the International Sweeteners Association (ISA), inulin is primarily extracted from chicory root—a source that has gained traction in food formulation for its low-calorie profile and ability to enhance fiber content without altering taste or texture. The China National Food Industry Association reported that over 40% of fortified dairy products launched in 2023 contained inulin, particularly in yogurt and plant-based milk alternatives. In Japan, where digestive wellness is deeply embedded in consumer consciousness, the Ministry of Health, Labour and Welfare noted an annual increase in inulin usage within packaged food items. The Indian Council of Medical Research noted that with rising obesity rates and metabolic disorders across urban centers, manufacturers are increasingly incorporating inulin into bakery and snack products as a clean-label alternative to synthetic bulking agents. Furthermore,

The Galactooligosaccharides (GOS) segment have emerged as the fastest-growing segment in the Asia Pacific prebiotics market, projected to expand at a CAGR of a 14.6% through 2033. One of the primary drivers behind this rapid growth is the widespread integration of GOS into infant formulas to mimic the beneficial effects of human breast milk. According to the International Dairy Federation (IDF), a significant share of premium infant formula brands in China and South Korea now include GOS to support early-life gut microbiota development. In India, the Indian Academy of Pediatrics endorsed the inclusion of GOS in supplementary infant nutrition programs, citing clinical evidence on improved immunity and digestion. In addition, GOS is gaining traction in adult dietary supplements due to its selective stimulation of bifidobacteria, which has been linked to reduced inflammation and enhanced immune function. In Australia, health authorities have observed increasing use of GOS in medical nutrition products prescribed for patients with irritable bowel syndrome (IBS).

By Application Insights

The food and beverages segment held the largest share of 52.3% of the Asia Pacific prebiotics market which is driven by the growing incorporation of prebiotic fibers into everyday consumables such as dairy products, plant-based alternatives, baked goods, and fortified juices. In China, major dairy companies like Yili and Mengniu have expanded their portfolios to include inulin- and FOS-fortified yogurts aimed at digestive wellness-conscious consumers. In Japan, where fermented foods are part of traditional diets, the Ministry of Agriculture, Forestry, and Fisheries reported a 15% year-on-year increase in prebiotic-incorporated instant soups and ready-to-drink beverages between 2022 and 2023. Similarly, in India, rising demand for fiber-rich snacks and gluten-free alternatives has prompted food processors to incorporate prebiotic fibers into flour blends and extruded snacks.

The dietary supplements segment represented as the fastest-growing segment in the Asia Pacific prebiotics market, expanding at an estimated CAGR of approximately 16.2%. This is largely attributed to increasing consumer awareness about gut health and the role of prebiotics in immunity, weight management, and overall well-being. In India, the Indian Nutraceutical Association reported a 20% increase in prebiotic supplement launches in 2023, particularly targeting urban professionals suffering from stress-induced digestive issues. In South Korea, where online health supplement retailing has surged, the Korean Health Industry Development Institute recorded a rise in prebiotic powder sales through e-commerce platforms. Meanwhile, Japan’s Ministry of Health, Labour and Welfare observed heightened interest in synbiotic combinations (prebiotics + probiotics) for managing chronic conditions like IBS and diabetes.

REGIONAL ANALYSIS

China occupied the top position in the Asia Pacific prebiotics market by contributing a 28.7% of the regional share in 2024. The country’s dominance is underpinned by its vast population, rising middle-class disposable incomes, and strong presence of domestic and multinational food and pharmaceutical companies. According to the China National Food Industry Association, a major share of fortified dairy products launched in 2023 included prebiotic ingredients such as inulin and FOS. The Ministry of Industry and Information Technology reported that infant formula production reached 900,000 metric tons in 2023, with most brands integrating GOS for digestive health benefits. In addition, E-commerce expansion and digital health awareness campaigns have further boosted prebiotic supplement sales, particularly in Tier 1 and Tier 2 cities.

Japan is a mature market with high scientific backing and is characterized by high consumer awareness, scientific validation, and a strong tradition of preventive healthcare. According to Japan’s Ministry of Health, Labour and Welfare, prebiotic-enriched foods account for a significant portion of the functional food category, which is regulated under the FOSHU (Foods for Specified Health Use) program. The Japanese Society of Nutrition and Food Science noted that clinical studies linking prebiotics with immune modulation and improved mineral absorption have significantly influenced product development. Also, daily intake of prebiotic fibers led to measurable increases in bifidobacteria levels among elderly consumers, reinforcing government-backed dietary recommendations.

India is rapidly emerging market with government support. The country’s growth is fueled by rising health consciousness, government support for nutraceutical development, and increasing prevalence of lifestyle diseases such as diabetes and obesity. The Ministry of Ayush has integrated prebiotics into traditional medicine-based formulations, enhancing mainstream acceptance.

The Indian Nutraceutical Association reported a 20% increase in prebiotic supplement launches in 2023, particularly in combination with probiotics for digestive wellness. Major players like Patanjali and Dabur have introduced fiber-enriched digestive aids using inulin and FOS. In addition, the Food Safety and Standards Authority of India (FSSAI) is in the process of finalizing regulations to standardize prebiotic labeling and claims, which could further boost consumer trust.

South Korea captures a descent portion of the Asia Pacific prebiotics market, distinguished by its emphasis on product innovation and scientific validation. According to the Korean Health Industry Development Institute (KHIDI), the country saw a record number of prebiotic-infused food and beverage launches in 2023, particularly in the areas of yogurt, energy drinks, and ready-to-eat meals. The Ministry of Food and Drug Safety (MFDS) actively supports clinical trials assessing prebiotic efficacy in digestive and immune health, resulting in multiple approved health claims.

Australia is known for its robust regulatory environment and strong medical community backing. The Therapeutic Goods Administration (TGA) ensures rigorous evaluation of prebiotic-related health claims, fostering consumer confidence. Private healthcare providers and general practitioners frequently recommend prebiotic supplements alongside probiotics for patients with digestive imbalances. Universities such as Deakin and Monash are conducting leading-edge research on prebiotic impact on gut-brain axis functions, further strengthening market legitimacy.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

BAOLINGBAO BIOLOGY CO., LTD., Tata Chemicals Ltd., Quantum Hi-Tech (Guangdong) Biological Co., Ltd., Samyang Holdings Corporation, CJ CHEILJEDANG CORP., Meiji Holdings Co., Ltd., Layn Natural Ingredients, and Fuji Nihon Corporation are the key players in the Asia Pacific prebiotics market.

The competition in the Asia Pacific prebiotics market is highly dynamic, driven by increasing consumer awareness, product innovation, and strategic alliances among industry participants. While multinational ingredient suppliers dominate the high-value segments, regional manufacturers are gaining traction with cost-effective, locally adapted formulations. The market is witnessing a shift towards cleaner labels, higher functionality, and scientifically backed claims, compelling companies to invest in clinical research and formulation expertise. Brand differentiation is becoming essential, with firms emphasizing proprietary technologies, sustainable sourcing, and application-specific solutions. Mergers and acquisitions are also common, allowing companies to consolidate their market presence and access new customer bases. Regulatory engagement plays a crucial role, as varying approval processes across countries dictate how quickly players can launch new products. Overall, competition is intensifying as both domestic and international players seek to capture a larger share of this rapidly growing sector.

TOP PLAYERS IN THE MARKET

BENEO (Europe-based but major player in APAC)

BENEO is a leading global supplier of functional ingredients, including prebiotic fibers such as inulin and oligofructose. The company has strengthened its presence in the Asia Pacific region by partnering with local food manufacturers and health-focused brands. BENEO actively engages in scientific research and collaborates with universities and medical institutions across Japan, Australia, and India to validate the digestive and metabolic benefits of its prebiotic ingredients. Its commitment to clean-label solutions and sustainable sourcing from chicory root makes it a preferred partner for functional food and infant nutrition producers in the region.

Ganeden Biotech (now part of Kerry Group)

Ganeden Biotech, now integrated into Kerry Group, plays a significant role in the Asia Pacific prebiotics market through its innovative strain-specific probiotic and prebiotic formulations. The company has focused on developing synergistic synbiotic blends that enhance gut health, immunity, and digestion. In the APAC region, Ganeden’s acquisition by Kerry Group has expanded its distribution network and enabled co-formulation opportunities with regional dairy and supplement companies. Its emphasis on clinically backed formulations has earned trust among healthcare professionals and consumers alike, particularly in South Korea and Australia.

Royal FloraHolland (through its subsidiary Cosucra)

Royal FloraHolland, through its subsidiary Cosucra, is a key player in natural plant-based prebiotic ingredients, especially inulin and chicory root extracts. In the Asia Pacific, Cosucra has positioned itself as a premium supplier for clean-label and organic food markets. The company has established strategic collaborations with food technologists and functional food manufacturers in China and India to develop fiber-enriched products tailored to local dietary preferences. With a focus on sustainability and traceability, Cosucra supports regional trends toward plant-based nutrition and digestive wellness, making it a strong contender in the growing prebiotics landscape.

TOP STRATEGIES USED BY KEY PLAYERS

One major strategy adopted by key players in the Asia Pacific prebiotics market is product diversification, where companies expand their portfolios beyond traditional prebiotic types like inulin and FOS to include novel fibers such as xylooligosaccharides (XOS) and mannan-oligosaccharides (MOS). This allows them to cater to evolving consumer needs and differentiate themselves in a competitive environment. Companies are also investing heavily in partnerships with academic institutions and research bodies to generate clinical evidence supporting the health benefits of their ingredients. These studies not only strengthen marketing claims but also build credibility with regulatory authorities and healthcare professionals. Additionally, major firms are enhancing their supply chain resilience by establishing local sourcing networks and production facilities within the region, reducing dependency on imports and ensuring consistent quality and availability of raw materials to meet rising demand.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, BENEO announced a strategic collaboration with a leading Japanese food manufacturer to develop fiber-enriched functional beverages targeting digestive wellness, reinforcing its foothold in the premium health drink segment.

- In May 2024, Kerry Group launched an innovation center in Singapore dedicated to microbiome research and prebiotic formulation development, aiming to support regional food and supplement brands with customized gut health solutions.

- In August 2024, Cosucra expanded its distribution network in India by partnering with a national nutraceutical distributor to improve accessibility of its chicory-based inulin in dietary supplements and fortified food products.

- In October 2024, Yakult Honsha entered into a joint development agreement with an Australian biotech firm to explore next-generation prebiotic compounds that selectively nourish beneficial gut bacteria associated with immune function.

- In December 2024, DuPont Nutrition & Biosciences initiated a pilot program with Chinese dairy processors to integrate its branded prebiotic fibers into school milk programs, aligning with government initiatives on childhood nutrition and gut health education.

MARKET SEGMENTATION

This research report on the Asia Pacific prebiotics market has been segmented and sub-segmented based on the following categories.

By Ingredients

- Fructo-oligosaccharide (FOS)

- Inulin

- Galacto-oligosaccharides (GOS)

- Mannan-oligosaccharide (MOS)

- Others (Oligosaccharides, Chicory Fructans, HMO, XOS)

By Application

- Prebiotic Food & Beverages

- Dairy Products

- Cereals

- Baked Food

- Fermented Meat Products

- Dry Food Prebiotics

- Others

- Prebiotic dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Nutrients

- Infant Foods

- Animal Feed Prebiotics

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is the projected growth of the Asia Pacific prebiotics market?

The market is expected to grow from USD 2.48 billion in 2025 to USD 6.31 billion by 2033.

2. What are the main drivers of growth in this market?

Key growth drivers include increasing health awareness, growing demand for functional foods, and a rising focus on gut health among consumers.

3. What are the challenges faced by the Asia Pacific prebiotics market?

Challenges include high production costs, limited consumer awareness in rural areas, and regulatory hurdles in certain countries.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]