Asia Pacific Preclinical In-vivo Imaging Market Research Report – Segmented By Modality(Optical Imaging, Nuclear Imaging, Micro-MRI, Micro-CT, Micro-ultrasound, Photoacoustic, Magnetic Particle Imaging Systems), Reagent & By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From 2025 to 2033

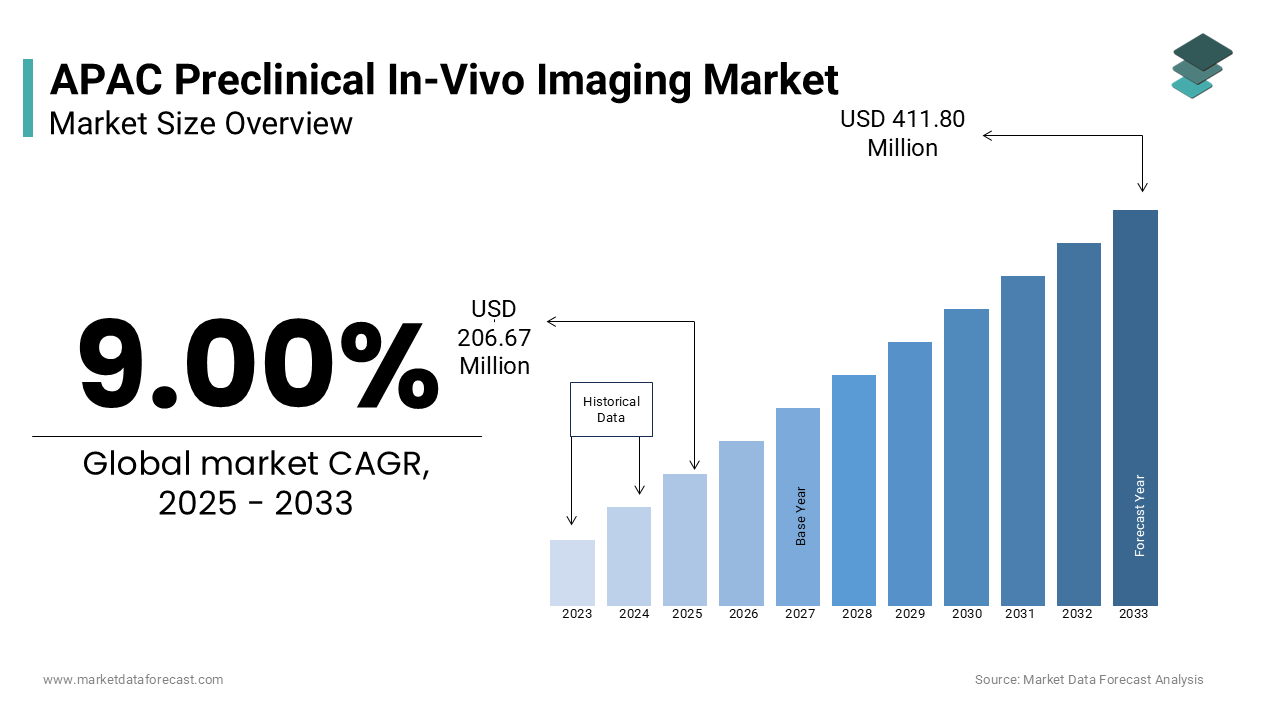

APAC Preclinical In-Vivo Imaging Market Size

The Asia Pacific preclinical in-vivo imaging market size was valued at USD 189.61 million in 2024. The Asia Pacific market has been estimated at USD 206.67 million in 2025. It is projected to reach USD 411.80 million by 2033, at a CAGR of 9.00% during the forecast period.

The market for preclinical In-vivo imaging in the APAC region is primarily driven by the increasing burden of cardiovascular diseases, cancer, and other diseases.

Also, the growing demand for effective diagnosis and real-time monitoring treatment efficiency is expected to boost the market growth. In addition, the ever-increasing population with the rise in the ever-increasing elderly population is significantly influencing the In-vivo imaging market. The senior population is more prone to various chronic diseases such as cancer, cardiovascular, and other conditions driving the market growth.

On the other hand, the increasing initiatives and investments by the government for infrastructure development, research and development activities, and medical tourism for creating awareness among the people are expected to encourage market growth. In addition, other factors such as raising awareness about the imaging and screening tests available in the market, increasing demand for non-invasive imaging and diagnosing purposes are accelerating the preclinical in-vivo imaging market growth during the forecast period.

Furthermore, the rise in technological advancements in the preclinical in-vivo imaging market for developing better molecular imaging modalities and methods for testing samples, as well as the rise in growing acceptance for development tools of preclinical imaging as a legitimate drug, are most likely to provide lucrative growth opportunities to the market preclinical in-vivo imaging market growth in this region. Moreover, the key market players are implementing various market strategies to gain a competitive advantage over the marketplace. The strategies include installations, acquisitions, and mergers.

However, the high cost of equipment, rising installation, and operational costs for preclinical imaging systems hamper the APAC preclinical in-vivo imaging market growth. On the other hand, the approval procedure for preclinical imaging equipment is lengthy and time-consuming, and strict government restrictions make product entrance more challenging. As a result, fewer companies enter the market, limiting APAC market development in preclinical in-vivo imaging.

REGIONAL ANALYSIS

Geographically, the Asia Pacific is one of the fastest-growing regions globally in the preclinical in-vivo imaging market. However, it is estimated to show significant market share during the forecast period. The regional market growth is projected to be fuelled by the Improving healthcare sectors, increasing population with the rise in the geriatric population, and favorable reimbursement. In addition, emerging countries such as China, Japan, and India are significantly contributing to the APAC regional market growth.

China is predicted to dominate the APAC Preclinical in-vivo imaging market over the forecast period, and it is anticipated to account for the predominant share during the forecast period. This is because China has witnessed technological advancements in the healthcare sector. Also, the growing geriatric population and increasing prevalence of chronic diseases are propelling the market growth in the country. In addition, growing awareness and adoption of non-invasive imaging tests as the test or this non-invasive approach consist lower risk of infections compared to traditional ones with less recovery time is expected to fuel the market growth.

India is one of the fastest-growing countries in the Asia Pacific. India is anticipated to witness a promising in the preclinical In-vivo imaging market in the coming years. Increasing chronic disorders, improving healthcare sectors, and supportive government policies are expected to expand the market growth.

KEY MARKET PLAYERS

A few notable players in the APAC Preclinical in-vivo imaging market profiled in this report are Aspect Imaging, Biospace Lab S.A., Bruker Corporation, LI-COR Biosciences, Mediso Ltd., MILabs B.V., MR Solutions Ltd, PerkinElmer, Inc., TriFoil Imaging, and FUJIFILM VisualSonics, Inc.

MARKET SEGMENTATION

This research report on the Asia Pacific preclinical in-vivo imaging market has been segmented and sub-segmented into the following categories.

By Modality

- Optical Imaging

- Nuclear Imaging

- Micro-MRI

- Micro-CT

- Micro-ultrasound

- Photoacoustic

- Magnetic Particle Imaging Systems

By Reagent

- Optical Imaging Reagents

- Nuclear Imaging Reagents

- MRI Contrast Agents

- Ultrasound Contrast Agents

- CT Contrast Agents

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com