Asia Pacific Rechargeable Battery Market Size, Share, Growth, Trends, and Forecast Report – Segmented By Type (Lead-Acid Batteries, Li-ion Batteries, NiMH Batteries, NiCd Batteries, and Others), Capacity, Application, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis from 2025 to 2033

Asia Pacific Rechargeable Battery Market Size

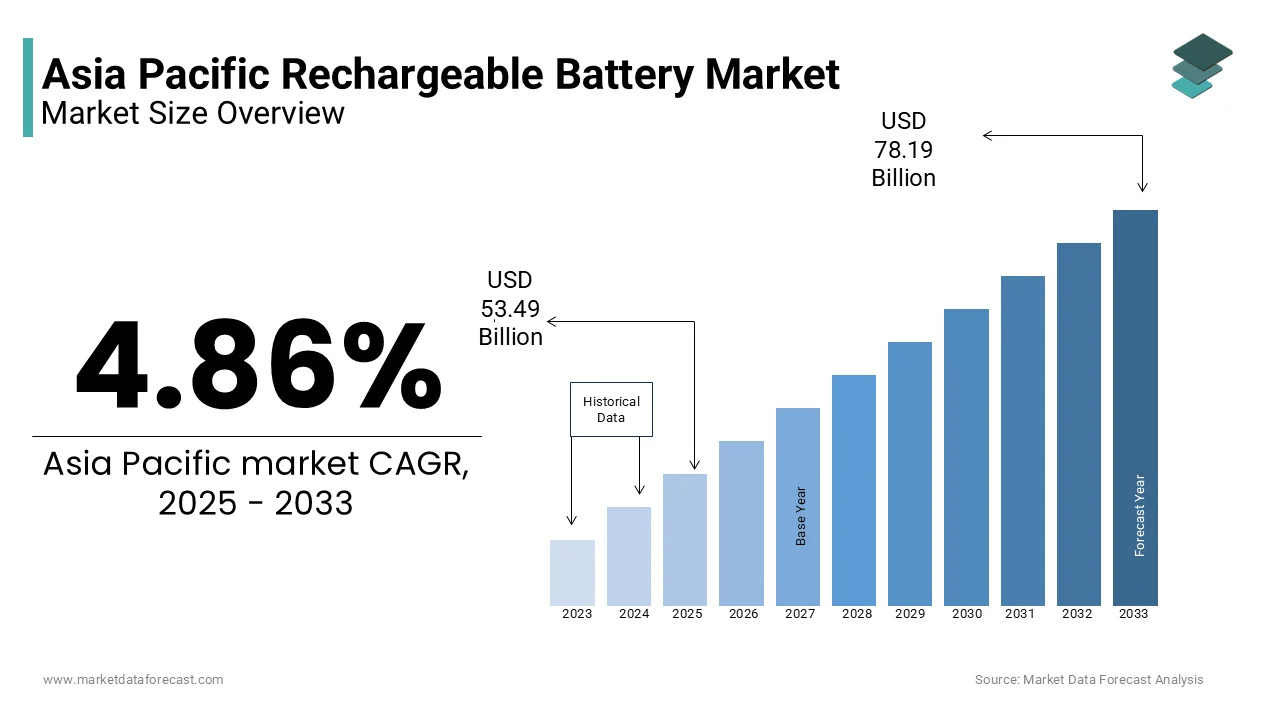

Asia Pacific Rechargeable Battery market size was valued at USD 51.01 billion in 2024, and the market size is expected to reach USD 78.19 billion by 2033 from USD 53.49 billion in 2025. The market's promising CAGR for the predicted period is 4.86%.

The Asia Pacific rechargeable battery market refers to the production, distribution, and utilization of secondary batteries capable of being recharged and reused multiple times. These batteries are widely employed across a range of applications including consumer electronics, electric vehicles (EVs), industrial equipment, renewable energy systems, and grid storage solutions. The region is at the forefront of global rechargeable battery innovation, manufacturing, and deployment, driven by its robust industrial base, high technology adoption rates, and increasing focus on sustainable energy.

MARKET DRIVERS

Surge in Electric Vehicle (EV) Demand Across the Region

The rapid expansion of the electric vehicle industry is one of the most influential drivers of the Asia Pacific rechargeable battery market. Governments across the region have introduced aggressive emission reduction targets and financial incentives to promote EV adoption. According to BloombergNEF, EV sales in the Asia Pacific accounted for over 60% of global volumes in 2023 , with China leading the charge as the single largest market. China's Ministry of Industry and Information Technology reported that domestic EV sales surpassed 9 million units in 2023 , reinforcing the country's position as a dominant force in the sector. In response to this growing demand, Chinese battery manufacturers like CATL and BYD have significantly expanded their production capacities to meet the needs of both domestic and international automakers. India has also accelerated its EV transition under programs like FAME II and PLI schemes, resulting in a notable uptick in rechargeable battery consumption. Similarly, Southeast Asian countries such as Thailand and Indonesia are investing in EV manufacturing and charging infrastructure to support long-term sustainability goals.

Expansion of Consumer Electronics and Portable Devices Sector

Expansion of Consumer Electronics and Portable Devices Sector

The thriving consumer electronics industry serves as another key driver for the Asia Pacific rechargeable battery market. With rising disposable incomes and digital transformation sweeping through the region, there is an unprecedented increase in the usage of smartphones, laptops, tablets, wearables, and home automation devices—all of which rely heavily on rechargeable battery technology. According to the Consumer Technology Association, Asia Pacific accounted for a large share of global consumer electronics shipments in 2023 , driven primarily by markets in China, India, and South Korea. The region’s vast population and urbanization trends further amplify the demand for compact, lightweight, and high-energy-density batteries. In China, major tech companies continue to innovate in wearable and mobile device categories, increasing reliance on lithium-ion cells. South Korea remains a global hub for premium electronics manufacturing, with brands like Samsung and LG introducing new product lines annually that require superior rechargeable power solutions.

MARKET RESTRAINTS

Volatility in Raw Material Prices and Supply Chain Disruptions

One of the primary constraints affecting the Asia Pacific rechargeable battery market is the volatility in raw material prices and recurring supply chain disruptions. Key materials such as lithium, cobalt, nickel, and graphite are subject to fluctuating global commodity prices, geopolitical tensions, and logistical bottlenecks, all of which impact production costs and profitability.

Like, lithium prices experienced a sharp spike in 2022, reaching over USD 80,000 per metric ton , before declining in early 2023 due to increased supply from Australia and Argentina. However, such unpredictability makes it difficult for manufacturers to maintain stable pricing structures or secure long-term contracts. Cobalt, predominantly sourced from the Democratic Republic of Congo, is particularly vulnerable to political instability and ethical sourcing concerns. The London Metal Exchange noted that cobalt prices saw year-on-year fluctuations exceeding 30% in 2023 , influencing procurement strategies among battery producers. In addition, maritime logistics challenges—such as port congestion and container shortages—have delayed raw material imports into China, South Korea, and Japan.

Environmental and Regulatory Compliance Challenges

Environmental and Regulatory Compliance Challenges

Environmental regulations and compliance requirements pose a significant challenge to the growth of the Asia Pacific rechargeable battery market. While governments encourage electrification and digital transformation, they also impose stringent rules regarding battery recycling, waste management, and carbon footprint transparency. Compliance with these evolving standards increases operational complexity and costs for manufacturers. Similarly, India’s Bureau of Indian Standards (BIS) has introduced draft norms requiring battery performance certifications, testing procedures, and traceability measures. In Southeast Asia, regulatory inconsistencies between countries complicate cross-border operations. For instance, Indonesia and Malaysia have different import clearance requirements for battery components, creating delays and inefficiencies.

MARKET OPPORTUNITIES

Integration with Renewable Energy Storage Systems

A significant opportunity emerging in the Asia Pacific rechargeable battery market is the integration of rechargeable batteries into renewable energy storage systems. As nations strive to reduce dependence on fossil fuels and achieve net-zero commitments, the demand for reliable energy storage solutions to complement solar and wind farms is rapidly growing.

Like, the Asia Pacific added over 170 GW of renewable energy capacity in 2023, with solar PV and wind constituting the majority of new installations. However, the intermittent nature of these energy sources necessitates large-scale storage solutions to ensure grid stability and optimal utilization. In Japan, the Ministry of Economy, Trade and Industry has actively promoted the use of lithium-ion and sodium-ion batteries for grid-scale applications, funding pilot projects that integrate second-hand EV batteries into municipal power systems. In India, state-run organizations like NTPC and SECI are conducting tenders for hybrid solar-plus-storage projects that rely heavily on rechargeable battery technologies.

Growth of Industrial Automation and Robotics

Growth of Industrial Automation and Robotics

Another expanding opportunity for the Asia Pacific rechargeable battery market lies in the increasing adoption of industrial automation and robotics. Manufacturing, logistics, and service industries across the region are transitioning toward autonomous systems that rely on high-performance, long-lasting rechargeable batteries to power robotic arms, automated guided vehicles (AGVs), and warehouse drones. Like, the Asia Pacific accounts for a significant portion of global industrial robot installations, with countries like China, South Korea, and Japan leading in automation investments. These machines require compact, high-energy-density batteries that offer rapid charging and consistent performance, making lithium-ion and solid-state batteries ideal candidates. As industries across the Asia Pacific continue to modernize and digitize, the demand for efficient and durable rechargeable batteries in automation and robotics will remain a strong growth driver.00A0

MARKET CHALLENGES

Technological Limitations in Battery Performance and Durability

One of the critical challenges facing the Asia Pacific rechargeable battery market is the persistent technological limitations related to battery performance and durability. Despite advancements in lithium-ion technology, issues such as cycle life degradation, thermal instability, and limited energy density continue to hinder widespread adoption in high-demand applications. In tropical climates prevalent across Southeast Asia, elevated temperatures further accelerate battery degradation, impacting efficiency and longevity. Solid-state and next-generation chemistries like sodium-ion and lithium-sulfur hold promise but are still in early commercialization phases. Moreover, differences in battery chemistry compatibility across applications create technical barriers to modular design and standardization, complicating integration into diverse end-use sectors.

Intense Competitive Pressure and Intellectual Property Barriers

Intense Competitive Pressure and Intellectual Property Barriers

The Asia Pacific rechargeable battery market is characterized by intense competitive pressure, with major players striving to secure dominance through proprietary technologies, cost optimization, and vertical integration. This fierce competition creates entry barriers for new market participants, especially those lacking access to advanced R&D capabilities or established supply chain networks. Companies like CATL, LG Energy Solution, and Panasonic hold extensive patent portfolios covering cell chemistry, battery management systems, and manufacturing processes, limiting opportunities for independent innovators to enter the market without licensing agreements. In China, the consolidation of battery manufacturing under large-scale industrial clusters enhances economies of scale, allowing domestic producers to undercut international competitors on price. This dynamic pressures foreign firms attempting to penetrate the regional market unless they bring highly differentiated products or form joint ventures with local partners. Furthermore, trade restrictions and export controls on critical battery materials exacerbate market segmentation, restricting access for smaller enterprises and start-ups aiming to scale up.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.86% |

|

Segments Covered |

By Type, Capacity, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Samsung Electronics Co., Ltd. (Samsung Group) (Samsung SDI Co., Ltd.), 3M Company, Koninklijke Philips N.V., Motorola Solutions, Inc., Toshiba Corporation, Fujifilm Holdings Corporation, Olympus Corporation, Nikon Corporation, Sony Corporation, and LiPol Battery Co., Ltd, and others |

SEGMENTAL ANALYSIS

By Type Insights

The lithium-ion (Li-ion) batteries segment dominated the Asia Pacific rechargeable battery market by accounting for a 58.9% of total market share in 2024. This dominance is primarily attributed to their superior energy density, longer cycle life, and lighter weight compared to other rechargeable technologies.

According to BloombergNEF, a large share of global Li-ion battery production capacity is concentrated in the Asia Pacific , with China alone contributing more than half of that output. The rapid growth of electric vehicles, consumer electronics, and renewable energy storage systems has significantly increased demand for Li-ion technology. China’s Ministry of Industry and Information Technology reported that domestic EV sales surpassed 9 million units in 2023 , directly boosting Li-ion battery consumption. In India, rising smartphone and laptop penetration—exceeding 80% in urban areas as per the Telecom Regulatory Authority—has further reinforced this segment’s expansion. South Korea and Japan continue to lead in R&D investments, introducing advanced chemistries such as lithium iron phosphate (LFP) and solid-state variants. These innovations enhance performance while reducing dependency on rare materials like cobalt.

The "Others" segment, which includes emerging technologies such as solid-state and sodium-ion batteries, is projected to grow at the fastest CAGR of 14.3% through 2033. This strong growth is driven by increasing research efforts and pilot-scale commercialization initiatives aimed at overcoming the limitations of conventional lithium-ion cells. Companies like Toyota and Panasonic are actively testing prototypes for integration into next-generation EVs and grid storage applications. In China, CATL launched the world's first mass-producible sodium-ion battery in 2023, targeting cost-sensitive markets where lithium scarcity remains a constraint. Australia and South Korea are also investing in material science innovation to support these new battery types, particularly in industrial automation and off-grid power sectors.

By Capacity Insights

The 3000–4000 mAh capacity range held the largest share of the Asia Pacific rechargeable battery market at 28% and is propelled by its widespread use in mid-range smartphones, laptops, and portable consumer electronics. This segment aligns with the optimal balance between battery longevity and device compactness, making it highly preferred among manufacturers and consumers alike. In China alone, the China Academy of Information and Communications Technology recorded over 280 million smartphone shipments in 2023 , most of which featured batteries within this capacity bracket. Additionally, wearable electronics and smart home gadgets—such as security cameras and health trackers—are increasingly designed around this battery capacity to ensure multi-day operation without bulky form factors.

The “More than 10,000 mAh” battery capacity segment is experiencing the highest growth rate in the Asia Pacific rechargeable battery market, with a projected CAGR of 15.7%. This surge is mainly fueled by the rising demand for high-capacity energy solutions in electric vehicles, industrial equipment, and large-format consumer electronics. According to the China Passenger Car Association, EV models with battery packs exceeding 100 Ah became the fastest-selling vehicle category in 2023 , with companies like BYD, NIO, and XPeng leading the trend. These vehicles require high-capacity rechargeable modules to deliver extended driving ranges, pushing battery manufacturers to scale up production accordingly. Simultaneously, Southeast Asian economies are witnessing a boom in ultra-large power banks, solar-powered home inverters, and uninterruptible power supply (UPS) systems tailored for small businesses and residential users. Industrial automation and robotics sectors in countries like Japan and South Korea are also adopting high-capacity battery systems to power autonomous machines and logistics drones.

By Application Insights

The consumer electronics application segment possessed the biggest share of the Asia Pacific rechargeable battery market at 44.9% in 2024. This is caused by the region’s massive population, digital transformation initiatives, and rising disposable incomes. Smartphones, laptops, tablets, wearables, and home automation devices collectively represent the primary consumers of rechargeable battery power. South Korea continues to drive innovation in premium electronics, with companies like Samsung and LG launching new product lines annually that integrate advanced lithium-ion cells. Meanwhile, emerging markets such as Vietnam and the Philippines are witnessing growing demand for budget-friendly rechargeable gadgets. As consumer preferences shift toward wireless, fast-charging, and durable power solutions, the rechargeable battery industry is evolving alongside the ever-expanding consumer electronics ecosystem in the Asia Pacific.

The automobile applications segment is expanding at the highest rate in the Asia Pacific rechargeable battery market, projected to grow at a CAGR of 16.2%. This acceleration is basically driven by the rapid electrification of the automotive sector, government policy support, and increasing consumer acceptance of electric vehicles (EVs).India’s Ministry of Heavy Industries noted a fourfold increase in EV registrations between 2020 and 2023 , spurred by subsidies under the FAME II and PLI schemes. Thailand and Indonesia have also introduced financial incentives and local manufacturing plans to attract EV investment and reduce reliance on fossil fuels. Japanese automakers, including Toyota and Honda, have intensified their focus on hybrid and plug-in hybrid models, utilizing nickel-metal hydride (NiMH) and lithium-ion chemistry.

REGIONAL ANALYSIS

China maintained the largest market position in the Asia Pacific rechargeable battery sector by holding a 41.5% of the regional market share in 2024. As the world’s largest producer and consumer of rechargeable batteries, China plays a central role in shaping global supply chains and technological advancements. According to the China Automotive Technology and Research Center, domestic EV sales exceeded 9 million units in 2023 , significantly boosting demand for lithium-ion battery packs. Also, China produces over half of the world’s consumer electronics , requiring vast quantities of rechargeable cells for smartphones, laptops, and wearables. Major Chinese battery manufacturers such as Contemporary Amperex Technology Co. Limited (CATL), BYD, and SVOLT have expanded production capacities to meet both domestic and international demand. The Chinese government continues to support battery-related industries through policies such as the "Made in China 2025" initiative and subsidies for EV manufacturers.

Japan is securing its position as a key player in advanced battery technologies. The country is renowned for its high-tech manufacturing capabilities and longstanding expertise in battery chemistry and design. The Ministry of Economy, Trade and Industry (METI) has been instrumental in promoting innovation through targeted funding programs. Japanese firms such as Panasonic, Sony Energy Devices, and GS Yuasa continue to be major suppliers of lithium-ion and nickel-metal hydride (NiMH) batteries for automotive and consumer electronics applications. Also, Japan plays a critical role in supporting energy storage for smart cities and microgrid projects.

South Korea is consolidating its status as a global leader in battery technology and exports. The country is home to some of the world’s most prominent battery manufacturers, including LG Energy Solution, Samsung SDI, and SK On, all of which supply major automakers in North America and Europe. The Korean Ministry of Trade, Industry & Energy has implemented comprehensive strategies to strengthen the battery ecosystem, allocating significant funds to research institutions and private enterprises. South Korea is also accelerating its domestic EV transition. According to the Korea Automobile Manufacturers Association, EV sales grew by over 40% in 2023 , necessitating increased battery production capacity. Major battery firms have expanded their facilities in response to rising demand. Moreover, the country is actively developing standardized protocols for battery reuse and second-life applications, working closely with utility providers to deploy used battery modules into frequency regulation and peak shaving systems.

India is rapidly emerging as a key growth center due to its expanding EV sector and government-backed electrification policies. Although domestic battery manufacturing is still developing, India is witnessing a surge in demand driven by rising EV adoption and digital transformation. The government’s FAME II and Production-Linked Incentive (PLI) schemes have incentivized both automakers and battery producers to invest in localized manufacturing ecosystems. State-run organizations like BHEL and private companies such as Exicom and Okaya Power are ramping up rechargeable battery production for energy storage and transportation applications. Indian startups are also exploring innovative business models, including battery swapping and subscription-based services, to overcome upfront cost barriers. In addition, India is strengthening its presence in battery raw material processing and recycling. Research institutions like IIT Madras and CSIR are conducting studies on sodium-ion and lithium-sulfur technologies to diversify future battery supply chains.

Australia is playing a strategic role in resource extraction, research, and energy storage applications. While the country’s domestic EV adoption remains modest, Australia contributes significantly to the global battery supply chain by exporting critical raw materials such as lithium, cobalt, and nickel. Australian mining firms like Albemarle, Orocobre, and Pilbara Minerals supply raw materials to major battery manufacturers in China, Japan, and South Korea. Beyond raw materials, Australia is investing in battery research and deployment. In addition, universities and energy firms are piloting stationary storage projects using both new and repurposed EV batteries. A Better Routeplanner, in collaboration with Energy Estate, has deployed Tesla-based battery modules for behind-the-meter applications, demonstrating scalable solutions for commercial customers.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Samsung Electronics Co., Ltd. (Samsung Group) (Samsung SDI Co., Ltd.), 3M Company, Koninklijke Philips N.V., Motorola Solutions, Inc., Toshiba Corporation, Fujifilm Holdings Corporation, Olympus Corporation, Nikon Corporation, Sony Corporation, and LiPol Battery Co., Ltd. are the key players in the Asia Pacific rechargeable battery market.

The competition in the Asia Pacific rechargeable battery market is intense, shaped by a convergence of well-established industrial conglomerates, emerging tech-driven startups, and government-backed national champions. The region's dominance in battery production stems from decades of technological expertise, extensive manufacturing infrastructure, and deep-rooted supply chain networks, particularly in China, Japan, and South Korea. As demand surges across electric mobility, consumer electronics, and renewable energy storage, companies are continuously striving to differentiate themselves through innovation, scale, and strategic positioning.

Market leaders leverage their early mover advantages by expanding production capacities, forming global alliances, and investing in next-generation chemistries to maintain their technological edge. However, increasing competition from domestic players—especially in China and India—is reshaping the dynamics, pushing even the largest firms to recalibrate pricing models and re-evaluate intellectual property strategies. Additionally, the push for localized battery ecosystems and environmental compliance is compelling companies to rethink sourcing, manufacturing, and end-of-life management approaches.

TOP PLAYERS IN THE MARKET

Contemporary Amperex Technology Co. Limited (CATL)

CATL is a leading global manufacturer of lithium-ion batteries and a dominant force in the Asia Pacific rechargeable battery market. Headquartered in China, CATL supplies major automotive and electronics companies worldwide with high-performance battery solutions. The company contributes significantly to the global shift toward electric mobility by providing scalable, efficient, and cost-competitive battery packs. CATL’s focus on innovation, vertical integration, and sustainable manufacturing practices has positioned it as a key player not only in battery production but also in recycling and second-life applications, shaping industry standards across the region.

Panasonic Corporation

Panasonic Corporation

Panasonic plays a crucial role in advancing rechargeable battery technologies through its leadership in lithium-ion and nickel-metal hydride (NiMH) battery development. Based in Japan, the company has been a long-time supplier to Tesla and various hybrid vehicle manufacturers, contributing to the global rise in electrified transportation. Panasonic continues to invest heavily in R&D, particularly in solid-state battery technology, which promises enhanced safety and performance. Its commitment to quality and technological excellence, combined with strategic partnerships and manufacturing capabilities, ensures its strong presence and influence in both regional and global rechargeable battery markets.

LG Energy Solution

LG Energy Solution

LG Energy Solution is a South Korean leader in advanced rechargeable battery systems, serving global automotive and consumer electronics industries. The company has established itself as a preferred supplier for electric vehicles, partnering with major automakers in North America, Europe, and Asia. LGES emphasizes innovation in cell chemistry, thermal management, and production scalability to meet growing demand. Its investments in gigafactories and long-term battery supply contracts reinforce its competitive edge. With a strong research foundation and forward-looking strategies, LG Energy Solution is playing an instrumental role in driving battery electrification and energy storage transitions across the Asia Pacific and beyond.

TOP STRATEGIES USED BY KEY PLAYERS

One of the primary strategies employed by key players in the Asia Pacific rechargeable battery market is vertical integration across the supply chain . Companies are acquiring or investing in upstream raw material suppliers, cathode producers, and recycling facilities to ensure stable sourcing and reduce dependency on external vendors. This approach allows for greater control over production costs, quality assurance, and sustainability efforts, all of which are critical in a resource-sensitive industry.

Another significant strategy involves strategic collaborations with automotive and technology firms . Battery manufacturers are entering into long-term supply agreements and joint ventures with electric vehicle makers, consumer electronics brands, and energy storage developers. These alliances help align product development with end-user requirements while securing future revenue streams and fostering innovation tailored to specific applications.

Lastly, expanding R&D initiatives focused on next-generation battery technologies is a common approach among leading participants. Firms are directing substantial resources toward solid-state, sodium-ion, and silicon-based anode developments to enhance performance, safety, and cost-efficiency. By investing in cutting-edge research and pilot-scale production, companies aim to maintain a competitive advantage and shape the future landscape of the rechargeable battery market in the Asia Pacific and globally.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Contemporary Amperex Technology Co. Limited (CATL) announced a joint venture with a leading Chinese automaker to develop dedicated battery modules for next-generation electric vehicles. This initiative aims to enhance supply chain efficiency and accelerate the deployment of customized battery solutions tailored to evolving mobility needs.

- In July 2024, Panasonic introduced a new line of solid-state battery prototypes developed in collaboration with a Japanese research institute. This move positions Panasonic as a front-runner in next-generation battery innovation, offering higher energy density and improved thermal stability for both automotive and industrial applications.

- In October 2024, LG Energy Solution expanded its manufacturing facility in South Korea to increase production capacity for high-nickel NMC cells aimed at premium EVs. This expansion supports growing international orders and strengthens LGES’s foothold in the high-performance rechargeable battery segment.

- In December 2024, Samsung SDI partnered with a Vietnamese electronics manufacturer to co-develop compact, high-capacity lithium-ion batteries for smartphones and wearables. This alliance enhances Samsung SDI’s reach in Southeast Asia’s booming consumer electronics market.

- In February 2025, BYD opened a state-of-the-art battery recycling center in Guangdong Province to support circular economy goals. This facility is designed to recover valuable materials from end-of-life batteries, reinforcing BYD’s sustainability commitments and reducing reliance on raw material imports.

MARKET SEGMENTATION

This research report on the Asia Pacific rechargeable battery market has been segmented and sub-segmented based on the following categories.

By Type

- Lead-Acid Batteries

- Li-ion Batteries

- NiMH Batteries

- NiCd Batteries

- Others

By Capacity

- 150 - 1000 mAh

- 1300 - 2700 mAh

- 3000 - 4000 mAh

- 4000 - 6000 mAh

- 6000 - 10000 mAh

- More than 10000 mAh

By Application

- Consumer Electronics

- Industrial Applications

- Automobile Applications

- Defence

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving growth in the Asia Pacific rechargeable battery market?

Key growth drivers include increased demand for electric vehicles (EVs), renewable energy storage, and expanding consumer electronics usage.

2. What technologies dominate the Asia Pacific rechargeable battery market?

Lithium-ion batteries are currently the most dominant due to their high energy density and recharge efficiency.

3. What challenges does the Asia Pacific rechargeable batter market face?

Major challenges include supply chain constraints for raw materials, environmental concerns related to battery disposal, and fluctuations in material pricing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]