Asia Pacific Refrigerated Transport Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Technology, Application, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Refrigerated Transport Market Size

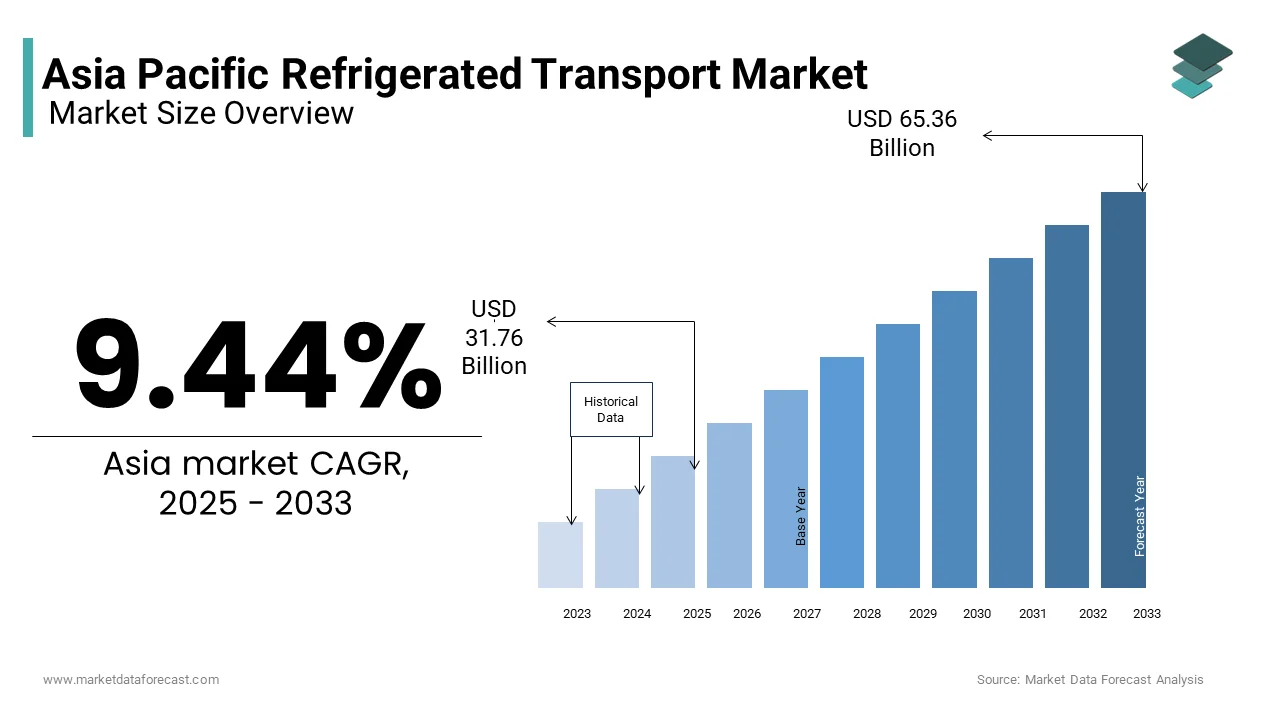

The Asia Pacific refrigerated transport market size was valued at USD 29.01 billion in 2024 and is anticipated to reach USD 31.76 billion in 2025 from USD 65.36 billion by 2033, growing at a CAGR of 9.44% during the forecast period from 2025 to 2033.

The Asia Pacific refrigerated transport market is a critical enabler of the region’s cold chain logistics, ensuring the safe and efficient movement of temperature-sensitive goods such as perishable food, pharmaceuticals, and biologics. As per the Food and Agriculture Organization (FAO), nearly 40% of all food produced in the Asia Pacific region is perishable, necessitating specialized transportation solutions to minimize spoilage. The growing urbanization and rising disposable incomes have fueled demand for fresh produce and frozen foods, creating a robust need for refrigerated transport services. Additionally, the pharmaceutical industry’s expansion in countries like India and China has amplified the requirement for temperature-controlled logistics to preserve the efficacy of vaccines and medicines.

The region’s diverse geography, ranging from tropical climates to remote rural areas, adds complexity to the refrigerated transport ecosystem. For instance, Australia’s expansive landmass requires advanced logistics networks to deliver perishables across long distances, while densely populated cities in Southeast Asia demand agile last-mile delivery solutions. Furthermore, regulatory frameworks such as the ASEAN Good Distribution Practices for medical products have set stringent standards for cold chain compliance.

MARKET DRIVERS

Rising Demand for Perishable Food Products

The escalating consumption of perishable food products is a primary driver of the Asia Pacific refrigerated transport market. Urbanization and changing dietary preferences have led to increased demand for fresh fruits, vegetables, dairy, and seafood. This trend is particularly prominent in countries like China and India, where e-commerce platforms specializing in grocery delivery have gained traction. Additionally, the rise of quick-service restaurants (QSRs) across the region has further intensified the need for reliable cold chain logistics.

Expansion of the Pharmaceutical Industry

The rapid expansion of the pharmaceutical and biotechnology sectors serves as another significant driver for the refrigerated transport market. The Asia Pacific region accounts for over 30% of global pharmaceutical production, as per the International Trade Administration, with countries like India and China emerging as manufacturing hubs. Vaccines, insulin, and other temperature-sensitive medications require precise handling throughout the supply chain to ensure efficacy. Governments and private players invested heavily in expanding refrigerated transport capabilities to meet this challenge. Additionally, the growing prevalence of chronic diseases has spurred demand for biologics, which are highly sensitive to temperature fluctuations.

MARKET RESTRAINTS

High Operational Costs

One of the most significant restraints facing the Asia Pacific refrigerated transport market is the high operational costs associated with maintaining temperature-controlled logistics. Refrigerated vehicles require specialized equipment, including multi-temperature zones, advanced cooling systems, and real-time monitoring devices, all of which contribute to elevated expenses. According to the International Energy Agency, fuel consumption for refrigerated trucks is approximately 20% higher than that of standard vehicles due to the energy demands of cooling units. Additionally, maintenance costs are substantially higher, as any failure in the cooling system can result in the complete loss of cargo. For small and medium-sized enterprises (SMEs) operating in developing economies like Indonesia and Vietnam, these costs pose a significant barrier to entry.

Infrastructure Deficiencies

Another major restraint is the inadequate infrastructure in many parts of the Asia Pacific region, particularly in rural and remote areas. Poor road conditions, limited access to electricity, and insufficient warehousing facilities create bottlenecks in the cold chain network. According to the Asian Development Bank, over 40% of rural roads in Southeast Asia remain unpaved, making it challenging to transport perishable goods efficiently. Similarly, power outages are frequent in countries like Bangladesh and Myanmar, disrupting the operation of refrigeration units and increasing the risk of product damage. The lack of standardized cold storage facilities further exacerbates the issue, as businesses often face difficulties finding suitable options for storing temperature-sensitive goods. These infrastructural deficiencies undermine the reliability of refrigerated transport services and impede market growth.

MARKET OPPORTUNITY

Adoption of IoT and Automation Technologies

The integration of Internet of Things (IoT) and automation technologies presents a transformative opportunity for the Asia Pacific refrigerated transport market. IoT-enabled sensors and telematics systems allow real-time monitoring of temperature, humidity, and vehicle location, ensuring optimal conditions for perishable goods. According to McKinsey & Company, IoT adoption in logistics can reduce spoilage rates by up to 25%, significantly enhancing supply chain efficiency. For example, companies like DHL and Kuehne+Nagel have implemented IoT solutions to track shipments across the region, enabling proactive interventions in case of deviations. Moreover, automation technologies such as automated guided vehicles (AGVs) and robotic warehousing systems streamline operations, reducing labor costs and minimizing human error. The growing emphasis on sustainability has also driven interest in energy-efficient cooling systems powered by renewable energy sources. By leveraging these innovations, businesses can not only improve service quality but also gain a competitive edge in the market.

Growth of E-Commerce Platforms

The exponential growth of e-commerce platforms specializing in grocery and perishable goods offers another promising opportunity for the refrigerated transport market. Platforms like BigBasket in India and RedMart in Singapore have revolutionized the way consumers purchase fresh produce, which is creating a surge in demand for last-mile delivery solutions. This trend is further amplified by the rise of subscription-based models, where customers receive regular deliveries of perishable items. For instance, Farm Fresh Direct, an Australian startup, delivers farm-to-table produce using refrigerated vans, ensuring freshness and convenience. Additionally, the integration of artificial intelligence (AI) and predictive analytics enables e-commerce companies to optimize delivery routes and inventory management, reducing operational inefficiencies.

MARKET CHALLENGES

Stringent Regulatory Compliance

One of the foremost challenges faced by the Asia Pacific refrigerated transport market is navigating the stringent regulatory frameworks governing cold chain logistics. Countries in the region have introduced rigorous standards to ensure the safety and quality of perishable goods in the pharmaceutical and food industries. For example, Japan’s Ministry of Health, Labour and Welfare mandates that all temperature-sensitive pharmaceuticals must be transported under controlled conditions, with detailed documentation required at every stage of the supply chain. Non-compliance can result in hefty fines or even suspension of operations, as per Ernst & Young. Similarly, Australia’s Therapeutic Goods Administration imposes strict guidelines for the transportation of vaccines, including mandatory temperature mapping and validation processes. These regulations, while necessary, place immense pressure on logistics providers to invest in compliance-driven technologies and training programs. Smaller players often struggle to meet these requirements by leading to market consolidation and reduced competition.

Environmental Sustainability Concerns

Another pressing challenge is the environmental impact of refrigerated transport operations, which contribute significantly to carbon emissions and energy consumption. According to the United Nations Environment Programme, refrigerated vehicles account for approximately 10% of total greenhouse gas emissions from the logistics sector in the Asia Pacific region. The reliance on fossil fuels and synthetic refrigerants, such as hydrofluorocarbons (HFCs), exacerbates the problem, as these substances have a high global warming potential. Governments and consumers are increasingly demanding eco-friendly alternatives, such as electric refrigerated trucks and natural refrigerants. However, the transition to sustainable practices requires substantial investment in research and development, as well as collaboration with policymakers and industry stakeholders. Balancing profitability with environmental responsibility remains a key challenge for market participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.44% |

|

Segments Covered |

By Technology, Mode of Transport, Temperature Range, End-user ,and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

C. R. England Inc., J. B. Hunt Transport Services, Inc., Schneider National, Inc., Swift Transportation Co., C.H. Robinson Worldwide, Inc., Kuehne + Nagel, Daikin Industries, Ltd., Wabash National Corporation, Great Dane LLC., Fenagy, Solar Freeze. |

SEGMENTAL ANALYSIS

By Technology Insights

The air-blown evaporators segment was the largest and held 45.3% of the Asia Pacific refrigerated transport market share in 2024. This technology is widely preferred due to its ability to maintain consistent temperatures across large cargo spaces, which is making it ideal for transporting perishable goods over long distances. A key driver of this dominance is the growing demand for fresh produce in urban areas. According to the Food and Agriculture Organization (FAO), urban populations in the Asia Pacific consume nearly 70% of all perishable goods by necessitating reliable cooling systems during transit. Air-blown evaporators are particularly effective in addressing this need, as they distribute cold air evenly throughout the vehicle by minimizing temperature fluctuations.

Another factor is the increasing adoption of multi-temperature zone vehicles, which allow logistics providers to transport goods with varying temperature requirements in a single trip. For example, companies like DHL have integrated air-blown evaporator systems into their fleets to cater to diverse client needs, such as delivering frozen foods alongside chilled dairy products. Additionally, advancements in energy efficiency have made air-blown evaporators more cost-effective.

The fully electrified refrigeration systems segment is projected to grow with a CAGR of 18.3% in the coming years. This rapid expansion is driven by the global push toward sustainability and the adoption of electric vehicles (EVs) in the logistics sector. Governments across the Asia Pacific region are incentivizing the transition to green technologies, with countries like China offering subsidies for EV-based refrigerated transport. For instance, China’s Ministry of Industry and Information Technology reported that EV sales in the logistics sector increased by 35% in 2022, reflecting the growing preference for eco-friendly solutions.

By Mode of Transport Insights

The road transport segment accounted in holding 60.5% of the Asia Pacific refrigerated transport market share in 2024 due to the flexibility and cost-effectiveness of road freight, which enables door-to-door delivery of temperature-sensitive goods. The extensive road networks in countries like India and China make road transport the preferred choice for last-mile delivery, especially in densely populated urban areas.

The sea transport segment is emerging with a CAGR of 14.2% in the coming years. This growth is fueled by the increasing volume of international trade in perishable goods, particularly seafood and pharmaceuticals. Countries like Thailand and Vietnam are major exporters of seafood, with the United Nations Conference on Trade and Development reporting that seafood exports from these nations grew by 25% in 2022. Refrigerated containers, or reefers, have become indispensable for maintaining product quality during long voyages.

Another driving factor is the expansion of regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), which facilitate cross-border shipments. Furthermore, advancements in reefer technology, such as controlled atmosphere systems, have enhanced the shelf life of perishable goods. Maersk’s investment in smart reefers equipped with IoT sensors exemplifies how innovation is driving the segment’s rapid growth.

By Temperature Range Insights

The chilled temperature range segment was the largest, with 40.4% of the Asia Pacific refrigerated transport market share in 2024. This segment caters to goods that require storage between 0°C and 8°C, including fresh fruits, vegetables, dairy, and certain pharmaceuticals. A key factor is the proliferation of supermarkets and hypermarkets, which rely on chilled logistics to stock shelves with fresh products. For example, Walmart’s expansion in India has led to increased investments in refrigerated transport to meet consumer expectations for quality. Additionally, the growing popularity of meal kit delivery services, such as HelloFresh, has further amplified demand.

The deep-frozen segment is likely to grow with a CAGR of 16.5% in the coming years. This growth is driven by the rising demand for frozen convenience foods, such as ready-to-eat meals and frozen desserts. Urbanization and changing lifestyles have led consumers to prioritize convenience, fueling the popularity of frozen products. Another factor is the expansion of the pharmaceutical industry, particularly in vaccine distribution. The World Health Organization notes that vaccines requiring storage at -70°C, such as Pfizer-BioNTech’s COVID-19 vaccine, have spurred investments in deep-freeze transport solutions. Additionally, advancements in cryogenic freezing technology have improved the efficiency of deep-frozen logistics. Linde’s development of liquid nitrogen-based freezing systems exemplifies how innovation is driving the segment’s rapid expansion.

By Application Insights

The food and beverages segment dominated the Asia Pacific refrigerated transport market with 55.4% of the share in 2024. This segment encompasses a wide range of perishable goods, including fresh produce, dairy, meat, and seafood, all of which require precise temperature control during transit. The dominance of this segment is driven by the region’s growing population and urbanization. According to the United Nations, the Asia Pacific urban population is projected to reach 2.3 billion by 2030, increasing demand for fresh and frozen foods.

A key factor is the expansion of organized retail, which relies heavily on refrigerated transport to maintain product quality. Additionally, the rise of e-commerce platforms specializing in grocery delivery has further amplified demand. As per PwC, online grocery sales in the region grew by 45% in 2022 by creating new opportunities for cold chain logistics providers.

The pharmaceuticals segment is lucratively growing with a CAGR of 17.8% in the coming years. This growth is fueled by the expansion of the healthcare industry and the increasing demand for temperature-sensitive medical products, such as vaccines and biologics. For instance, the World Health Organization estimates that over 50% of vaccines are wasted globally due to improper storage and transportation, which emphasizes the need for robust refrigerated transport.

COUNTRY ANALYSIS

Top Leading Countries in the Transport Market

China was the top performer in the Asia Pacific refrigerated transport market with a 30.4% share in 2024. The country’s vast population and booming e-commerce sector have created immense demand for cold chain logistics. Platforms like JD.com and Alibaba rely extensively on refrigerated transport to deliver fresh produce and frozen foods, particularly in urban centers like Beijing and Shanghai. Additionally, China’s status as a global manufacturing hub for pharmaceuticals has driven investments in temperature-controlled logistics.

India was positioned second by holding 19.2% of the Asia Pacific refrigerated transport market share in 2024. The country’s agricultural sector, which contributes over 15% to GDP, is a major driver of refrigerated transport demand. Perishable goods such as fruits, vegetables, and dairy require efficient cold chain solutions to minimize spoilage. For example, the Indian government’s Pradhan Mantri Kisan Sampada Yojana initiative has allocated $1.5 billion to develop cold storage facilities, boosting the market. Additionally, the expansion of e-commerce platforms like BigBasket has created new opportunities for refrigerated logistics providers by ensuring steady market growth.

Japan’s emphasis on food safety and quality has driven the adoption of advanced refrigerated transport solutions. Japan’s aging population also fuels demand for fresh produce and pharmaceuticals, both of which require precise temperature control. For instance, the Ministry of Health, Labour and Welfare mandates strict cold chain compliance for vaccines by ensuring reliability in the supply chain.

Australia’s expansive geography and reliance on agriculture have necessitated robust cold chain logistics are likely to boost the growth of the market. Australia is one of the largest exporters of beef and seafood, requiring refrigerated transport to maintain product quality during long-distance shipments.

South Korea’s advanced IT infrastructure and emphasis on innovation have positioned it as a leader in smart cold chain solutions. South Korea’s focus on exporting high-value perishable goods, such as kimchi and seafood, has driven investments in refrigerated transport. Additionally, the government’s Green Logistics Initiative promotes the adoption of eco-friendly refrigeration systems by aligning with global sustainability goals.

KEY MARKET PLAYERS

C. R. England Inc., J. B. Hunt Transport Services, Inc., Schneider National, Inc., Swift Transportation Co., C.H. Robinson Worldwide, Inc., Kuehne + Nagel, Daikin Industries, Ltd., Wabash National Corporation, Great Dane LLC., Fenagy, SolarFreeze. Are the market players that are dominating the Asia Pacific refrigerated transport market?

Top Players in the Market

DHL Supply Chain & Global Forwarding

DHL is a global leader in logistics and plays a pivotal role in the Asia Pacific refrigerated transport market. The company’s advanced cold chain solutions cater to diverse industries, including pharmaceuticals, food, and beverages. DHL’s investment in IoT-enabled temperature monitoring systems ensures real-time tracking of perishable goods, enhancing reliability and compliance with stringent regulatory standards. Its global network allows seamless cross-border transportation, making it a preferred partner for multinational corporations.

Kuehne+Nagel

Kuehne+Nagel is renowned for its expertise in managing complex supply chains, particularly in the pharmaceutical and perishable goods sectors. The company’s specialized reefer containers and controlled atmosphere systems ensure optimal conditions for temperature-sensitive products during transit. Kuehne+Nagel has strengthened its presence in the Asia Pacific by establishing dedicated cold chain hubs in key markets like China and India. Its focus on innovation, such as AI-driven demand forecasting and route optimization, has enhanced operational efficiency. Additionally, strategic collaborations with local governments and industry bodies have bolstered its reputation as a trusted logistics provider.

DB Schenker

DB Schenker has emerged as a key player in the Asia Pacific refrigerated transport market, leveraging its extensive road, rail, and sea networks to deliver end-to-end cold chain solutions. The company’s focus on digital transformation has enabled it to offer real-time visibility and predictive analytics, ensuring minimal disruptions in the supply chain. DB Schenker’s commitment to sustainability is evident in its adoption of electric refrigerated trucks and energy-efficient cooling technologies.

Top Strategies Used by Key Players in the Market

Investment in Technology and Innovation

Key players are increasingly investing in cutting-edge technologies to enhance their service offerings and operational efficiency. The integration of IoT sensors, blockchain, and AI-driven analytics enables real-time monitoring and predictive maintenance of refrigerated transport systems. For example, companies like DHL and Kuehne+Nagel have adopted smart logistics platforms that provide end-to-end visibility, ensuring compliance with temperature requirements. These innovations not only improve customer satisfaction but also reduce operational costs, which gives companies a competitive edge in the market.

Expansion of Cold Chain Infrastructure

To address the growing demand for refrigerated transport, leading players are expanding their cold chain infrastructure across the region. This includes establishing new warehousing facilities, upgrading existing fleets with advanced cooling systems, and creating dedicated cold chain hubs in key markets. For instance, DB Schenker has invested in state-of-the-art cold storage facilities in Southeast Asia to support the export of perishable goods. Such expansions enable companies to cater to diverse client needs while ensuring scalability and reliability in their operations.

Strategic Partnerships and Collaborations

Strategic partnerships with local governments, technology providers, and industry associations have become a cornerstone of success in the Asia Pacific refrigerated transport market. These collaborations help companies navigate regulatory complexities, access new markets, and adopt sustainable practices. For example, partnerships with renewable energy firms have facilitated the adoption of solar-powered refrigeration units, aligning with global sustainability goals.

COMPETITION OVERVIEW

The Asia Pacific refrigerated transport market is characterized by intense competition, driven by a mix of global giants and regional specialists vying for dominance. Multinational corporations like DHL, Kuehne+Nagel, and DB Schenker bring extensive resources and technological expertise, enabling them to capture significant market share. At the same time, regional players leverage their deep understanding of local regulations and cultural nuances to carve out niche positions. The market’s competitive dynamics are further intensified by the rapid pace of technological advancements, which compels vendors to continuously innovate. Strategic collaborations with governments and industry associations also play a crucial role in shaping competitive strategies. Additionally, the rise of e-commerce and the pharmaceutical industry has created new battlegrounds for differentiation, as vendors strive to offer seamless integration and scalability. This dynamic interplay between innovation, localization, and strategic positioning ensures that the market remains vibrant and highly contested.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, DHL launched a state-of-the-art cold chain hub in Singapore. This facility is equipped with IoT-enabled temperature monitoring systems, allowing real-time tracking of perishable goods and enhancing its prominence in the pharmaceutical logistics sector.

- In June 2023, Kuehne+Nagel partnered with a renewable energy firm in India to develop solar-powered refrigerated trucks. This initiative aims to reduce carbon emissions while addressing the growing demand for sustainable logistics solutions in the region.

- In September 2023, DB Schenker expanded its fleet of electric refrigerated vans in Australia. This move supports the company’s commitment to sustainability and positions it as a leader in eco-friendly cold chain logistics.

- In February 2024, Maersk introduced a new line of smart reefers equipped with advanced controlled atmosphere systems. These innovations ensure optimal conditions for transporting high-value perishable goods, strengthening its presence in the seafood export market.

- In November 2023, Agility Logistics acquired a regional cold chain specialist in Thailand. This acquisition enhances Agility’s capabilities in handling temperature-sensitive goods and expands its footprint in Southeast Asia’s growing logistics sector.

MARKET SEGMENTATION

This research report on the Asia Pacific refrigerated transport market is segmented and sub-segmented into the following categories.

By Technology

- Air-blown Evaporators

- Eutectic

- Hybrid

- Fully Electrified

By Mode of Transport

- Road

- Air

- Sea

- Railway

By Temperature Range

- Chilled

- Frozen

- Deep Frozen

By Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the surge in refrigerated transport demand across APAC?

Rising consumption of perishable goods—like dairy, seafood, and pharmaceuticals—alongside rapid urbanization and e-commerce growth is expanding cold chain logistics, especially in China, India, and Southeast Asia.

How are temperature compliance and safety regulations evolving in APAC markets?

Regulations such as Japan’s HACCP mandates and ASEAN harmonization efforts are tightening cold chain protocols, requiring GPS-tracked, real-time temperature monitoring and digital logbooks.

Which technologies are transforming refrigerated transport efficiency in the region?

Adoption of telematics, solar-assisted refrigeration units, and AI-based route optimization is improving energy efficiency and reducing spoilage in tropical climates and long-haul routes.

How are infrastructure gaps affecting cold transport in emerging APAC economies?

Countries like Indonesia and the Philippines face logistical challenges from poor rural connectivity and inconsistent power, driving demand for mobile, off-grid cooling solutions.

What role does sustainability play in refrigerated transport purchasing decisions today?

Eco-friendly refrigerants (like R-290), electric reefers, and carbon tracking are gaining traction among APAC fleet operators responding to ESG mandates and rising fuel costs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com