Asia Pacific Set-Top Box Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Technology, Resolution, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Set Top Box Market Size

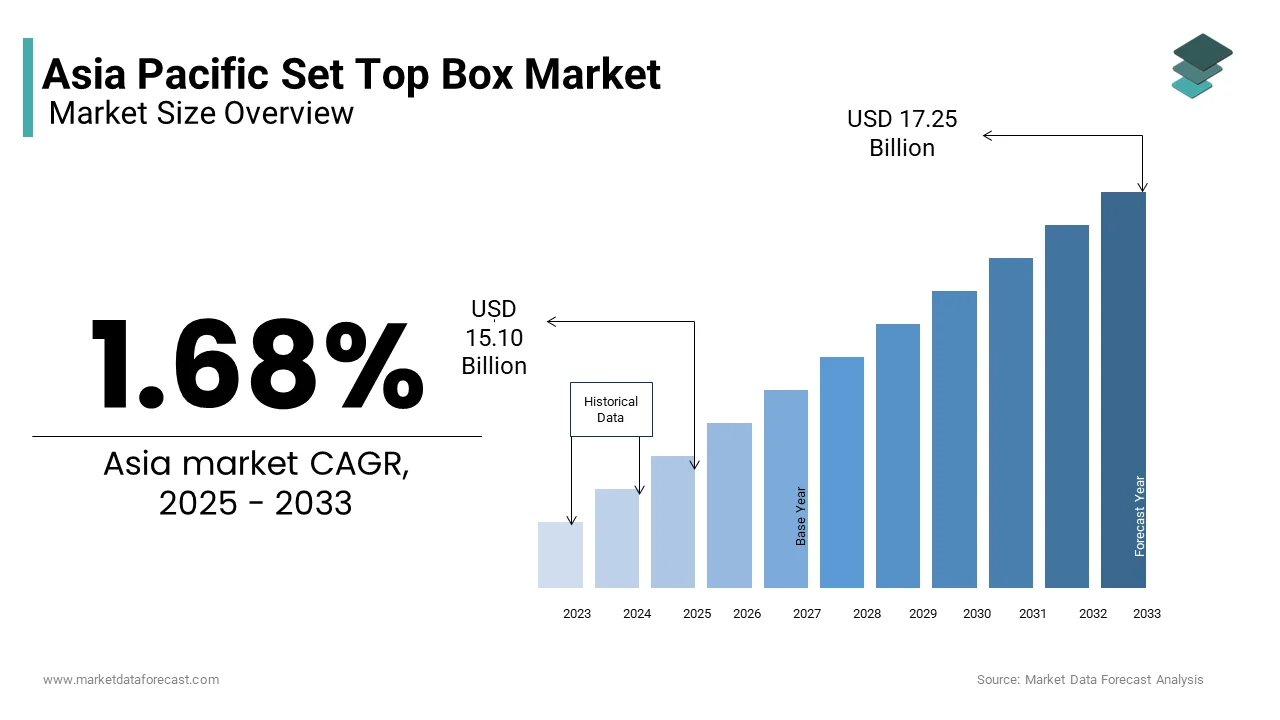

The Asia Pacific set-top box market was valued at USD 14.85 billion in 2025 and is anticipated to reach USD 15.10 billion in 2025 from USD 17.25 billion by 2033, growing at a CAGR of 1.68% during the forecast period from 2025 to 2033.

The Asia Pacific set-top box market is driven by a broad range of devices that convert digital signals into audiovisual content for television viewing. These boxes are deployed across broadcast, cable, satellite, and internet protocol (IPTV) networks, thereby allowing users to access high-definition and ultra-high-definition content, video-on-demand service,e,s and interactive features. Set-top boxes remain essential despite the rise of over-the-top (OTT) streaming platforms, particularly in regions where traditional pay-TV services are well established or where internet penetration is still developing. In India, Indonesia, and the Philippines set set-top boxes continue to be a primary gateway for households transitioning from analog to digital broadcasting. Governments across the region have mandated digitization to improve spectrum efficiency and service quality, which significantly boosts adoption. During early 2024, more than 180 million homes had adopted digital TV services and required set-top boxes for compatibility with new transmission standards. Additionally, the integration of smart functionalities such as app support, voice control, and hybrid DVB-OTT capabilities is transforming these devices from basic signal decoders into intelligent entertainment hubs.

MARKET DRIVERS

Government-Mandated Digital Migration Initiatives

Government-mandated digital migration initiatives are one of the key drivers of the Asia Pacific set-top box market, which are aimed at transitioning terrestrial television broadcasting from analog to digital formats. These initiatives not only enhance picture and sound quality but also allow for more efficient use of spectrum and the introduction of value-added services like electronic program guides and conditional access systems. India serves as a prime example of how policy can drive mass adoption of set-top boxes. Under the Phased Digital Migration Policy, the government enforced a complete switch-off of analog signals, thereby compelling millions of households to adopt digital set-top boxes. In Indonesia, the shutdown of analog terrestrial broadcasts in major cities starting mid-2023 accelerated the need for digital-ready televisions or compatible set-top boxes. In response, local telecom operators and broadcasters partnered to distribute affordable HD-capable STBs. These regulatory efforts ensure widespread deployment of set-top boxes, particularly among populations that lack access to high-speed internet or smartphones.

Integration of Smart and Hybrid Features

Integration of smart and hybrid technologies is another significant driver fueling the Asia Pacific set-top box market, as these innovations bridge the gap between traditional linear TV and modern streaming services. Consumers increasingly expect seamless access to both live TV and online content without switching between multiple devices, thereby prompting manufacturers and service providers to develop hybrid set-top boxes capable of supporting DVB and OTT platforms simultaneously. Leading telecom and cable operators in the region have begun bundling Android-based set-top boxes with their subscription plans while offering built-in access to apps such as Netflix, YouTube, and Amazon Prime Video. Moreover, advancements in AI and voice recognition have allowed for the development of voice-enabled remote controls and smart home integration, which enhance user experience and convenience. Companies like Tata Sky and Airtel Xstream in India launched smart STBs equipped with Google Assistant, consequently enabling hands-free navigation and personalized recommendations.

MARKET RESTRAINTS

Rising Popularity of Over-the-Top Streaming Platforms

The rising popularity of OTT platforms is a major restraint affecting the Asia Pacific set-top box market, as they offer consumers an alternative way to access content without relying on traditional pay-TV services or set-top boxes. With the proliferation of smartphones, tablets, smart TVs, and budget-friendly mobile data which viewers can directly access platforms such as Netflix, Disney+, and regional services like SonyLIV and MX Player. Pay-TV subscriber growth in Southeast Asia had declined by nearly 5% year-over-year, while OTT subscriptions grew at a double-digit pace. In India, over 400 million people accessed some form of OTT content regularly, resulting in reduced dependency on set-top boxes for entertainment. Furthermore, governments in several APAC countries are promoting digital literacy and internet access through initiatives such as Digital India and Indonesia’s National Broadband Plan, which have been expanding the reach of streaming services into rural and semi-urban areas. This trend is particularly impactful among younger audiences who prefer on-demand content over scheduled programming. As a result, traditional cable and satellite operators are witnessing declining subscriber bases, which directly affects the demand for set-top boxes.

Declining Consumer Interest in Multi-Pay TV Services

Declining interest in multi-pay-TV services is another key constraint on the Asia Pacific set-top box market, which is largely driven by cost concerns and changing media consumption hahabitset-top boxes are typically bundled with paid TV subscriptions, so a reduction in the uptake of these services translates directly into weaker demand for associated hardware. In several APAC markets, especially in India and the Philippines, where consumers are shifting away from expensive full-pack subscriptions in favor of free-to-air channels, s often supplemented by mobile-based entertainment. Additionally, economic pressures caused by inflation and fluctuating disposable incomes have prompted families to reassess their spending on non-essential services. In China and South Korea, where OTT penetration is well-established, many consumers find it more cost-effective to rely solely on streaming services rather than maintaining dual subscriptions to both traditional TV and online platforms. This behavioral shift has led to reduced activation rates of set-top boxes in lower-income segments.

MARKET OPPORTUNITIES

Expansion of Hybrid Set Top Boxes Supporting Multiple Platforms

Expansion of hybrid set-top boxes supporting multiple platforms is a significant opportunity shaping the future of the Asia Pacific market as they seamlessly integrate traditional broadcast services with OTT platforms. These next-generation set-top boxes enable users to access live TV, time-shifted content, and popular streaming applications all within a single interface,,e thereby addressing the growing demand for unified entertainment experiences. Manufacturers are increasingly partnering with telecom and internet service providers to bundle hybrid STBs with broadband and digital TV subscriptions. For instance, companies like Dish TV and JioCinema in India have introduced Android TV-based set-top boxes that include pre-installed OTT apps while eliminating the need for separate streaming devices. Moreover, advancements in software ecosystems and cloud-based middleware are allowing for real-time updates and feature enhancements without requiring hardware replacements. This flexibility supports better content personalization, voice-controlled navigation, and improved user engagement,t hence fostering long-term customer retention. Governments and regulators are also recognizing the benefits of hybrid technology in facilitating digital inclusion. In countries like Thailand and the Philippines, pilot programs are exploring the use of hybrid set-top boxes to deliver educational content and emergency alerts along with localized news alongside regular programming, and also expanding their utility beyond entertainment.

Growing Demand for Ultra-High Definition (UHD) and 4K Content

Growing demand for ultra-high definition (UHD) and 4K content presents another promising opportunity for the Asia Pacific set-top box market and is driven by larger screen sizes, advancements in display technology, and the expansion of premium content libraries. The need for advanced set-top boxes capable of decoding 4K signals is gaining momentum as broadcasters invest in high-resolution programming and consumers upgrade to 4 K-compatible televisions. Several national and regional broadcasters across Asia Pacific are now transmitting 4K content for sports events, movies, and documentaries. In Japan, NHK World has expanded its UHD broadcasting footprint, which requires compatible set-top boxes for reception. In India, Doordarshan and private network operators have begun rolling out 4K channels, resulting in the upgrade of STBs for uninterrupted viewing. .4K TV shipments in the Asia Pacific region accounted for over 60.08% of total television sales. This rapid adoption rate signals a corresponding increase in demand for set-top boxes that support high-bandwidth codecs and HDR (High Dynamic Range) formats. Additionally, the integration of HEVC (High-Efficiency Video Coding) compression in new set-top boxes allows for smoother streaming of 4K content over existing network infrastructures. Cable and satellite operators are leveraging this capability to upsell premium packages and attract subscribers seeking enhanced visual experiences.

MARKET CHALLENGES

Intensifying Competition from Integrated Smart TVs and Streaming Devices

Intensifying competition from integrated smart TVs and standalone streaming devices is one of the foremost challenges facing the Asia Pacific set-top box market, as these alternatives offer similar or superior functionality without the need for additional hardware. Consumers are increasingly bypassing traditional set-top boxes in favor of built-in apps and wireless connectivity options as smart TVs become more affordable and feature-rich. Major electronics manufacturers like Samsung, LG and TCL have embedded powerful processors and operating systems such as Tizen, WebOS and Android TV directly into their television sets thereby allowing users to stream content from platforms like Netflix, YouTube and Amazon Prime without a set top box. Streaming sticks and dongles such as Google Chromecast and Amazon Fire TV Stick which further compound the challenge by offering plug-and-play access to digital content at a fraction of the cost of traditional set top boxes. These devices are gaining traction even among first-time buyers in India and Southeast Asia, where affordability is a key factor influencing consumer decisions.

Supply Chain Disruptions and Component Shortages

Supply chain disruptions and semiconductor shortages pose a critical challenge to the Asia Pacific set-top box market as they impact production timelines and drive up manufacturing costs. The semiconductor crisis that began during the pandemic has persisted into 2024 while disrupting the availability of critical components such as chips, tune, rs, and memory modules used in set-top boxes. Countries like India, which import the majority of their chipsets from East Asia and the United States, have faced particular difficulties in securing consistent supplies. In addition to semiconductor constraints and logistical bottlenecks, including port congestion, container shortage, and rising freight costs,, also added pressure on manufacturers and distributors. Average vessel transit times between China and South Asia increased by nearly 15.16% due to the delivery schedules of set-top boxes to retail and distribution partners being affected. These disruptions have led to higher retail prices and delayed rollout programs in rural and underserved areas where government-led digital transition initiatives depend on timely device distribution.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By Technology, Resolution, And By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

Vantiva SA, KX INTEK INC., HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd), ZTE CORPORATION, Shenzhen Skyworth Digital Technology Co. Ltd, Sagemcom SAS, Gospell Digital Technology Co. Limited, Kaonmedia Co. Ltd, Shenzhen Coship Electronics Co. Ltd, Evolution Digital LLC, Shenzhen SDMC Technology Co. Ltd, Laxmi Remote (India) Private Limited |

SEGMENTAL ANALYSIS

By Technology Insights

The Satellite or Direct-to-Home (DTH) segment dominated the Asia Pacific set-top box market by capturing 38.18% of the total market share in 2024. This dominance is primarily attributed to the widespread adoption of DTH services across rural and semi-urban areas where terrestrial cable infrastructure is either inadequate or non-existent. In countries like India, Indonesia, and the Philippines, satellite-based broadcasting has become a preferred choice for delivering high-quality television content to remote regions with limited wired connectivity. Over 110 million Indian households rely on DTH service, thereby requiring compatible set-top boxes for access. The Indian government’s push for digital migration further ensured widespread deployment of DTH-enabled STBs. Additionally, Southeast Asian nations have seen rapid expansion in DTH subscriber bases due to aggressive marketing by operators offering bundled packages that include regional language content and sports channels. In Vietnam, over a 12.97% year-on-year increase in new DTH subscriptions, where all subscribers have set-top boxes for reception. Moreover, broadcasters are increasingly launching Ultra HD and 4K channels via satellite, which requires upgraded STB models capable of decoding these formats.

The IPTV segment is projected to witness the highest CAGR of 9.6% from 2025 to 2033. This growth is driven by the increasing availability of broadband internet and the convergence of traditional TV with IP-based streaming platforms. One of the key factors fueling this expansion is the rising adoption of fiber-optic and 5G networks, which enable seamless delivery of high-definition TV content through internet protocols. Another major driver is the integration of hybrid STB models that combine IPTV with Over-the-Top (OTT) capabilities while allowing users to switch between live TV and streaming apps without multiple devices. In South Korea, telecom providers such as SK Broadband and KT Corporation introduced Android-powered hybrid set-top boxes that support both IPTV and OTT services, thereby leading to a 20.52% increase in customer retention rates. Furthermore, governments in countries like Malaysia and Thailand are promoting smart city projects that incorporate IP-based broadcasting infrastructure, thereby accelerating the transition from analog and cable to IPTV systems. The IPTV segment is well-positioned to sustain its rapid growth trajectory across the Asia Pacific region and is driven by rising internet penetration as well as increasing consumer preference for personalized and interactive content, and supportive regulatory frameworks.

By Resolution Insights

The High Definition (HD) resolution segment held 44.96% of the Asia Pacific set-top box market share in 2024. The growth of the segment is driven by the widespread availability and affordability of HD-compatible televisions, coupled with the gradual phase-out of Standard Definition (SD) broadcasting in several countries. Governments across the region have mandated digital migration programs while prompting millions of consumers to upgrade from analog TVs to digital-ready setups. In India, the Phased Migration Policy required households to adopt digital set-top boxes which most of which were designed to output HD signals. In Indonesia, the national regulator enforced the shutdown of analog terrestrial broadcasts in major cities starting mid-2023, thereby encouraging the uptake of Digital Video Broadcasting-Terrestrial (DVB-T2) HD set-top boxes among low-income families.

The Ultra-High Definition (Ultra-HD) segment is anticipated to witness a CAGR of 12.3% from 2025 to 2033. This surge is driven by advancements in display technology, with an increase in 4K content production and growing consumer demand for superior visual experiences. One of the primary catalysts behind this growth is the rising adoption of 4K Ultra HD television, especially in urban centers across China, Japan, and South Korea. Major broadcasters and streaming platforms are also investing heavily in UHD content creation and distribution. In Japan, public broadcaster NHK World has expanded its 8K broadcasting footprint while Netflix and Disney+ Hotstar have localized 4K content libraries tailored to regional audiences. This increase in premium content is driving consumers to upgrade their viewing equipment, which includes set-top boxes. Furthermore, telecom and cable operators are bundling HEVC-encoded Ultra HD set-top boxes with premium subscription plans.

COUNTRY-LEVEL ANALYSIS

India was the top performer in the Asia Pacific set-top box market and accounted for 32.85% of the regional market share in 2024. India, the world’s second-largest television market by viewership, has undergone a significant transformation in recent years by transitioning from analog to digital broadcasting through government-led digitization mandates. The Indian government enforced a nationwide switch-off of analog signals, thereby compelling millions of households to adopt digital set-top boxes. Hybrid set-top boxes that integrate both DVB and OTT functionalities are gaining traction among consumers who seek flexibility in accessing both linear TV and streaming platforms. Operators like Airtel Xstream and Tata Sky have launched Android-based STBs with built-in access to Netflix, YouTube, and regional OTT apps, which enhance user engagement. Moreover, the Indian government’s Smart Cities Mission and Digital India initiative are supporting infrastructure upgrades that facilitate advanced TV services.

China was positioned second in holding the dominant share of the Asia Pacific set-top box market in 2024. China plays a dual role as a manufacturing hub and a key market for digital TV solutions. The country’s state-backed National Broadband Network project has significantly contributed to the proliferation of IPTV-based set-top boxes in urban areas where fiber optic and gigabit broadband infrastructure is well established. The growth of hybrid broadcast-broadband TV (HbbTV) is influencing consumer behavior, with manufacturers integrating web-based applications into conventional television experiences. China continues to expand its set-top box ecosystem with ongoing investments in smart city initiatives and rural digitization programs.

Japan’s set-top box market growth is driven by its technological sophistication and early adoption of digital broadcasting standards. Japan has maintained a mature but evolving set-top box ecosystem. The country was among the first in the region to transition to digital terrestrial broadcasting (DTT) and later pioneered Satellite Integrated Services Digital Broadcasting (ISDB-S) and 4K/8K ultra-high-definition TV transmission. Nearly 95.32% of Japanese households have digital TV access, with a majority utilizing ISDB-compliant set-top boxes. Japanese electronics firms such as Panasonic, Sony, and Sharp continue to lead in premium STB development, incorporating features such as voice-controlled interfaces, AI-enhanced upscaling, and hybrid DVB-OTT integration.

South Korea’s set-top box market is likely to have significant growth opportunities during the forecast period. The country’s strong digital infrastructure, high broadband penetration, and early adoption of advanced TV technologies contribute to its prominent position in the market. South Korean telecom and cable operators such as SK Broadband, KT, and LG Uplus have played a crucial role in shaping the set-top box landscape by introducing Android TV-based hybrid models that combine live broadcast and OTT content. These operators continue to roll out 4K Ultra HD and HDR-compatible STBs, thereby appealing to a tech-savvy audience accustomed to premium entertainment experiences. Over 90.15% of South Korean households subscribe to digital TV services, with a steady shift toward smart and converged entertainment platforms.

Australia’s set-top box market is likely to have the fastest growth opportunities in the coming years. The demand for high-quality digital broadcasting and hybrid set-top boxes remains robust while traditional pay-TV penetration has declined slightly due to the rise of OTT platforms. The country’s free-to-air digital television system (Freeview) continues to be a dominant force supported by Foxtel, Telstra, and other service providers offering enhanced digital set-top boxes with EPG, catch-up T V and multi-room DVR capabilities. Nearly 80.75% of Australian households still rely on some form of digital TV reception, with a significant portion using set-top boxes for compatibility.

KEY MARKET PLAYERS

Vantiva SA, KX INTEK INC., HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd), ZTE CORPORATION, Shenzhen Skyworth Digital Technology Co. Ltd, Sagemcom SAS, Gospell Digital Technology Co. Limited, Kaonmedia Co. Ltd, Shenzhen Coship Electronics Co. Ltd, Evolution Digital LLC, Shenzhen SDMC Technology Co. Ltd, Laxmi Remote (India) Private Limited, are the market players that are dominating the Asia Pacific set box market.

Top Players in the Market

Technicolor SA (France, with major presence in APAC)

Technicolor is a globally recognized leader in set-top box solutions and holds a strong position in the Asia Pacific market through its partnerships with major telecom and broadcasting operators. The company specializes in designing high-performance hybrid and IPTV-ready set-top boxes that support advanced features such as voice control, AI-based user interface, and multi-screen experiences. Technicolor’s strategic collaborations with regional service providers have enabled it to customize solutions tailored for the diverse digital TV ecosystems in the region.

Humax Co., Ltd. (South Korea)

Humax is a dominant player in the Asia Pacific set-top box market and is known for its governance in digital broadcast and hybrid STB technologies. Humax has leveraged its deep understanding of local and regional broadcasting standards to deliver innovative products across cable, satellite,e, and IP-based platforms. The company's focus on integrating OTT functionality into traditional TV experiences has positioned it as a preferred supplier for service operators aiming to enhance customer engagement and retention.

ZTE Corporation (China)

ZTE Corporation plays a significant role in the Asia Pacific set-top box market by offering a wide range of digital TV solutions and also including HD and Ultra HD set-top boxes compatible with IPTV, DVB-T,2, and hybrid systems. ZTE supports both domestic and international clients looking to deploy scalable and future-ready TV platforms. The company’s emphasis on next-generation technologies like AI-enhanced UI, cloud-based service,,s and smart home integration has reinforced its competitive edge.

Top Strategies Used By Key Market Participants

Product innovation focused on convergence and hybrid functionalities is one of the core strategies employed by key players in the Asia Pacific set-top box market. Companies are prioritizing the development of set-top boxes that seamlessly integrate linear TV, OTT content, and smart home features to meet evolving consumer expectations and enhance user experience.

Another important strategy is strategic partnerships with telecom and cable operators. Leading manufacturers are collaborating closely with service providers to co-develop customized set-top box solutions that align with regional broadcasting standards and consumer preferences, thereby ensuring wider adoption and long-term contracts.

Expanding localized manufacturing and supply chain networks has become essential for maintaining cost efficiency and responsiveness. Companies can better serve the growing demand while mitigating risks associated with global trade disruptions and regulatory changes by establishing production units and logistics hubs within the region.

COMPETITION OVERVIEW

The competition in the Asia Pacific set-top box market is shaped by a blend of global technology firms, regional electronics manufacturers, and emerging niche players all striving to capture market share in an evolving media landscape. Established leaders dominate in terms of technical expertise and scale, whereas smaller and mid-sized companies are gaining traction by offering cost-effective and feature-rich alternatives tailored to specific regional needs. The market is witnessing a shift from basic signal decoders to intelligent entertainment devices capable of supporting multiple platforms, including broadcast, IP-based, and streaming services. This transformation is driving innovation in user interface design, hardware performance, and integration with smart home ecosystems. Additionally, service providers are playing an increasingly influential role in shaping product requirements, which often dictate specifications and deployment timelines.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Humax launched a new line of Android TV-powered hybrid set-top boxes in partnership with leading Indian telecom operators.

- In March 2024, ZTE Corporation introduced a cloud-based set-top box solution tailored for Chinese broadband operators.

- In June 2024, Technicolor announced a strategic collaboration with a major Southeast Asian satellite TV provider to supply next-generation Ultra HD set-top boxes equipped with integrated voice assistants and AI-driven content discovery features.

- In August 2024, Skyworth, a key Chinese electronics manufacturer, expanded its set-top box manufacturing facility in Vietnam to better serve ASEAN markets.

- In October 2024, Airtel Xstream, in collaboration with Indian STB vendor Alpha Technologies, rolled out a subsidized ultra-HD set-top box program targeting rural households.

MARKET SEGMENTATION

This research report on the Asia Pacific set-top box market is segmented and sub-segmented into the following categories.

By Technology

- 7.1.1 Satellite/DTH

- 7.1.2 IPTV

- 7.1.3 Cable

- 7.1.4 Other Types (DTT)

By Resolution

- 7.2.1 SD

- 7.2.2 HD

- 7.2.3 Ultra-HD and Higher

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of set-top boxes in the Asia-Pacific region?

The transition from analog to digital broadcasting, rising demand for HD and 4K content, and government-led digitization programs (e.g., India’s Digital India) are fueling STB market growth.

Which type of set-top box is seeing the fastest adoption across APAC?

IPTV and hybrid STBs are gaining traction in urban areas due to improved broadband infrastructure and the growing popularity of OTT streaming integration with traditional TV.

How does consumer behavior influence set-top box features in APAC?

Viewers increasingly demand multi-screen access, cloud DVR, voice search, and personalized content, pushing manufacturers to enhance UX with AI-driven smart interfaces.

What are the major challenges in set-top box distribution in rural Asia-Pacific?

Limited broadband access, price sensitivity, and infrastructure constraints slow down smart STB penetration, leading to continued reliance on basic DTH and DVB-T2 models in rural areas.

How are regional governments impacting the set-top box ecosystem?

Policies promoting local manufacturing (like India’s PLI scheme) and digital migration mandates in countries like Malaysia and Thailand are reshaping supply chains and boosting domestic STB production.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com