Asia Pacific Silica Flour Market Size, Share, Growth, Trends, And Forecasts Research Report, Segmented By Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Silica Flour Market Size

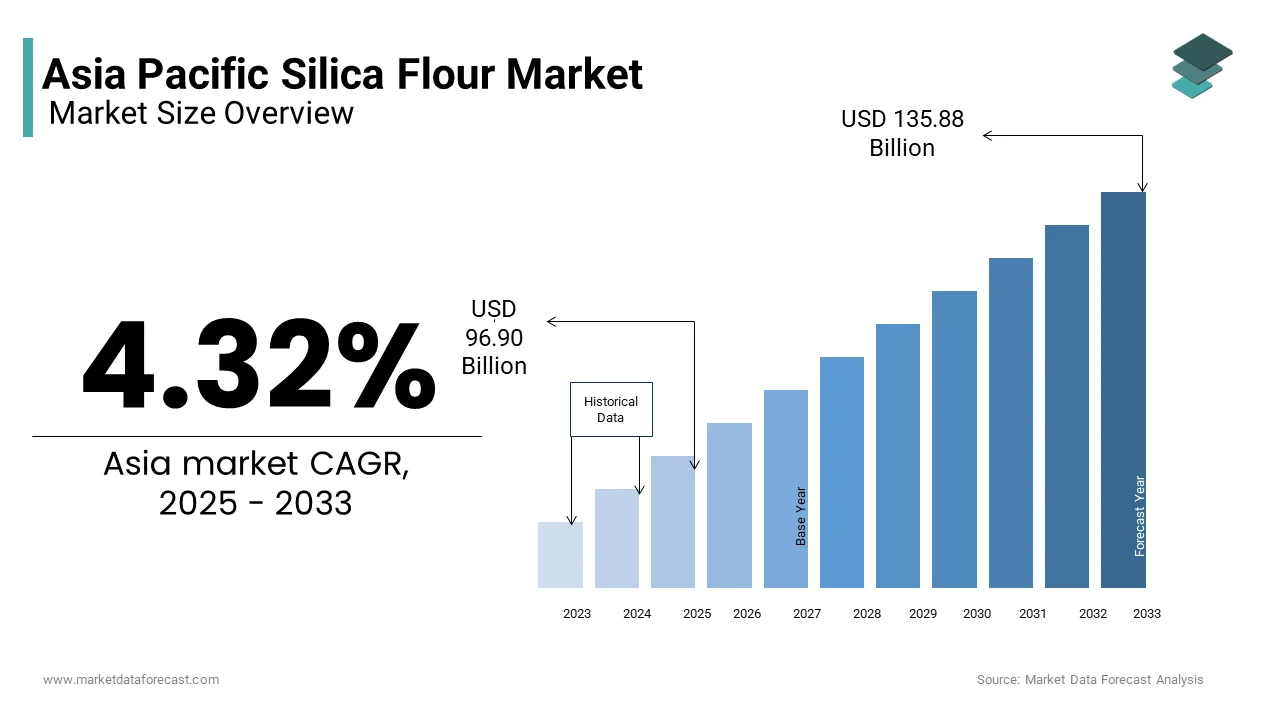

The Asia Pacific silica flour market was valued at USD 92.87 billion in 2024 and is anticipated to reach USD 96.90 billion in 2025 from USD 135.88 billion by 2033, growing at a CAGR of 4.32% during the forecast period from 2025 to 2033.

Silica flour is a finely ground form of silicon dioxide derived from quartz or other silica-rich minerals. It is extensively used across industries such as construction, foundry, electronics, glass manufacturing, and polymer composites due to its high thermal resistance, chemical inertness, and reinforcing properties. In the Asia Pacific region, silica flour plays a crucial role in supporting infrastructure development, industrial production, and technological innovation. Its application extends to filler materials in rubber and plastics, mold-making in metal casting, and raw material for semiconductor-grade silicon.

The market has seen steady growth driven by increasing demand for advanced materials in both traditional and high-tech sectors. According to the ASEAN Industrial Minerals Association, silica flour consumption increased significantly in Southeast Asia between 2021 and 2023 due to expansion in ceramic and glass manufacturing units. Similarly, in India, the Department of Industrial Policy and Promotion reported a surge in silica-based refractory usage in steel plants, reflecting broader industrial activity.

MARKET DRIVERS

Expansion of the Foundry and Metal Casting Industry

One of the primary drivers of the Asia Pacific silica flour market is the rapid expansion of the foundry and metal casting industry, particularly in countries like India, China, and Vietnam. Silica flour is a critical component in making molds and cores for ferrous and non-ferrous metal casting due to its high refractoriness, low thermal expansion, and excellent flowability.

The Ministry of Industry and Information Technology also noted a 14% increase in foundry investments in 2023, driven by rising automotive and machinery production.

As industrialization accelerates across the Asia Pacific, particularly in emerging economies, the demand for high-quality casting materials will continue to drive silica flour consumption, reinforcing its position as a foundational material in metallurgical applications.

Growth in Electronics and Semiconductor Manufacturing

Another significant driver of the Asia Pacific silica flour market is the rapid growth of electronics and semiconductor manufacturing, which requires ultra-pure silica flour as a raw material for producing silicon wafers, optical fibers, and electronic components. High-purity silica flour is essential for fabricating quartz crucibles used in single-crystal silicon ingot production, a core process in semiconductor manufacturing. According to the Japan Electronics and Information Technology Industries Association (JEITA), Asia Pacific accounts for a significant share of global semiconductor production capacity, with China, South Korea, and Taiwan leading in fabrication plant expansions.

In China, the Ministry of Science and Technology reported that government incentives under the Made in China 2025 initiative spurred an increase in domestic semiconductor production between 2021 and 2023. This growth directly translated into higher demand for electronic-grade silica flour, prompting companies like SICCAS-Glass and CNPC to invest in purification technologies.

India is also emerging as a regional hub for electronics manufacturing. As governments across the Asia Pacific continue to prioritize technology self-reliance, the demand for high-purity silica flour is expected to grow significantly.

MARKET RESTRAINTS

Environmental Regulations and Mining Restrictions

A major restraint affecting the Asia Pacific silica flour market is the increasing stringency of environmental regulations and restrictions on silica mining operations. Governments across the region are implementing stricter guidelines to control dust emissions, land degradation, and water contamination associated with silica extraction and processing. According to the United Nations Environment Programme (UNEP) Asia-Pacific Division, several countries, including Indonesia, Thailand, and Vietnam, introduced new mining sustainability laws in 2023 aimed at reducing ecological damage.

Similarly, in China, the State Council issued revised mineral resource management policies mandating environmental impact assessments before approving new silica mining projects, slowing down expansion plans for several producers.

These regulatory pressures, while necessary for environmental protection, pose challenges to market participants seeking to maintain consistent supply chains and cost efficiency across industrial sectors reliant on silica flour.

Fluctuations in Raw Material Prices and Logistics Costs

Another key restraint impacting the Asia Pacific silica flour market is the volatility in raw material prices and transportation costs, which affects production economics and end-user affordability. Silica flour production depends heavily on energy-intensive processes such as crushing, grinding, and calcination, all of which are influenced by fluctuations in electricity and fuel prices. As global trade dynamics remain uncertain, these logistical and cost-related challenges are likely to persist, constraining market growth in the near term.

MARKET OPPORTUNITY

Increasing Demand in Polymer and Composite Applications

One of the most promising opportunities for the Asia Pacific silica flour market lies in its growing use as a reinforcing filler in polymer and composite materials. Silica flour enhances mechanical strength, thermal stability, and abrasion resistance in rubber, thermoplastics, and epoxy resins, making it highly valuable in automotive, aerospace, and electrical insulation applications.

In India, the Plastics Export Promotion Council reported an increase in exports of engineering plastic parts incorporating silica fillers, particularly to European and North American markets that require superior durability and heat resistance.

With advancements in nanotechnology and functional coatings, silica flour is being optimized for even greater performance in lightweight composites. As industries across the Asia Pacific seek stronger, lighter, and more durable materials, the demand for silica flour in polymer applications is poised for sustained growth.

Adoption of Renewable Energy Infrastructure

Another emerging opportunity for the Asia Pacific silica flour market is its increasing adoption in renewable energy infrastructure, particularly in solar panel manufacturing and wind turbine components. Silica flour serves as a key raw material in producing high-purity silicon for photovoltaic cells and structural composites for turbine blades.

In China, the National Energy Administration reported that domestic polysilicon production increased in 2023 to meet surging demand for solar panels, directly boosting silica flour consumption in upstream purification processes. With renewable energy investments accelerating across the Asia Pacific, the silica flour market stands to benefit from long-term demand driven by clean energy transitions and sustainable infrastructure development.

MARKET CHALLENGES

Technological Limitations in Ultra-Purification Processes

A major challenge facing the Asia Pacific silica flour market is the technological limitations in achieving ultra-high purity levels required for semiconductor, optical fiber, and specialty glass applications. Producing electronic-grade silica flour necessitates complex purification techniques such as acid leaching, flotation, and high-temperature calcination to remove trace impurities like iron, aluminum, and titanium. However, many regional producers still rely on conventional beneficiation methods that fall short of international standards.

According to the China National Engineering Research Center for Non-Metallic Minerals, only about 15% of existing silica processing plants in China can consistently produce 99.99% pure silica flour, limiting the domestic supply for high-end applications.

As global demand for high-purity materials intensifies, overcoming these technical barriers through R&D investment and process innovation will be critical for regional players to compete effectively in premium segments.

Supply Chain Disruptions and Import Dependency

Another significant challenge impeding the growth of the Asia Pacific silica flour market is the ongoing issue of supply chain disruptions and reliance on imported high-purity grades from Europe and the United States. While the region possesses ample silica reserves, many countries face logistical bottlenecks, inconsistent raw material quality, and limited refining capacities, compelling them to depend on external sources for specialized applications.

Similarly, in India, the Directorate General of Foreign Trade noted prolonged customs clearance times for imported silica, affecting production schedules in the electronics and fiber optics sectors.

As global trade uncertainties persist, ensuring resilient and efficient logistics networks will be essential for maintaining stable production and meeting growing demand across the Asia Pacific region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.32% |

|

Segments Covered |

By Application, And Region. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

U.S. Silica Holdings, Inc. (U.S.), Sibelco (Belgium), AGSCO Corporation (U.S.), Fineton Industrial Minerals Limited (Hong Kong), Sil Industrial Minerals (Canada), Hoben International Ltd. (UK), Adwan Chemical Industries Co., Ltd. (Saudi Arabia), Capital Sand Company (U.S.), Finore Minerals LLP (India), Euroquarz GmbH (Germany), Al Salam Al Ma’asi Co. (Saudi Arabia), Delmon Group (Saudi Arabia). |

COUNTRY LEVEL ANALYSIS

China held the largest market share, accounting for 39.3% of the Asia Pacific silica flour market in 2024, driven by its massive industrial base, extensive mining operations, and growing downstream applications in glass, foundry, and electronics manufacturing. As the world’s largest producer and consumer of silica flour, China benefits from abundant quartz reserves and a well-established mineral processing industry. With ongoing industrialization and technological advancements, China remains the dominant force in the regional silica flour landscape.

India held a key position in 2024, supported by rapid urbanization, infrastructure development, and expanding industrial sectors such as steel, ceramics, and glass manufacturing. The country’s rich silica sand reserves, particularly in Rajasthan, Odisha, and Tamil Nadu, provide a strong foundation for domestic production. With growing investments in infrastructure and green energy, India is positioned for continued expansion in the silica flour market.

Japan occupies a notable market share of the Asia Pacific silica flour market, driven by its advanced industrial ecosystem and high demand for ultra-pure silica in electronics, optical fibers, and precision casting. Also, Japanese manufacturers prioritize high-quality silica flour for semiconductor wafers, quartz crucibles, and specialized glass components, leveraging cutting-edge refining technologies to meet stringent international standards. Furthermore, the Japanese Foundry Association reported an increase in precision metal casting using silica-enhanced molds, particularly in the automotive and aerospace sectors. With continuous R&D investments and a focus on technological excellence, Japan remains a key market for premium silica flour products.

South Korea remained a notable player in the Asia Pacific silica flour market, bolstered by its strong presence in semiconductor manufacturing, electronics, and industrial foundries. The country’s emphasis on high-tech industries has led to increased demand for ultra-pure silica flour used in quartz crucibles and silicon wafer production. The Ministry of Trade, Industry and Energy also introduced tax incentives for companies investing in clean technology, including silica-based insulation and composite materials. With strong policy support and industrial sophistication, South Korea is well-positioned for sustained growth in the silica flour market.

Australia & New Zealand collectively hold a decent market share in the Asia Pacific silica flour market, driven by mining activities, construction demand, and increasing use in renewable energy applications. In Australia, silica flour is extensively used in glass manufacturing, foundry operations, and solar panel production. According to the Australian Bureau of Resources and Sciences, silica sand production rose in 2023, with Western Australia and Queensland serving as key supply hubs. With rising investments in green technologies and infrastructure development, Australia & New Zealand represent a niche but growing market for silica flour in the region.

KEY MARKET PLAYERS

U.S. Silica Holdings, Inc. (U.S.), Sibelco (Belgium), AGSCO Corporation (U.S.), Fineton Industrial Minerals Limited (Hong Kong), Sil Industrial Minerals (Canada), Hoben International Ltd. (UK), Adwan Chemical Industries Co. Ltd. (Saudi Arabia), Capital Sand Company (U.S.), Finore Minerals LLP (India), Euroquarz GmbH (Germany), Al Salam Al Ma’asi Co. (Saudi Arabia), Delmon Group (Saudi Arabia). are the market players that are dominating the Asia Pacific silica flour market.

Top Players in the Market

One of the leading players in the Asia Pacific silica flour market is Sibelco, a global leader in industrial minerals with a strong presence in the region. The company supplies high-purity silica flour for applications ranging from glass manufacturing to the foundry and electronics industries. Sibelco’s vertically integrated operations, including mining, processing, and logistics, allow it to offer tailored solutions that meet international quality standards. Its investment in sustainable extraction technologies positions it as a key contributor to responsible mineral sourcing in the Asia Pacific.

Another major player is U.S. Silica Holdings, Inc., which has expanded its footprint in the Asia Pacific through strategic partnerships and supply agreements. Known for its expertise in producing high-performance industrial sand and silica-based products, the company serves critical sectors such as oil and gas, construction, and semiconductor manufacturing. U.S. Silica supports global demand by supplying ultra-pure silica flour to regional markets where domestic production falls short of technical specifications required for advanced applications.

Imerys S.A., a French multinational with significant operations across Asia, plays a crucial role in the silica flour industry. Imerys specializes in refining and functionalizing silica for use in polymers, coatings, and specialty glass. With dedicated R&D centers in Japan and Singapore, the company enhances product innovation and application development, making it a trusted supplier for high-end industrial clients across the Asia Pacific.

Top Strategies Used By Key Market Participants

A primary strategy adopted by key players in the Asia Pacific silica flour market is product differentiation through advanced purification and customization. Companies are investing in state-of-the-art beneficiation technologies to produce ultra-high-purity silica flour tailored for specialized applications in semiconductors, optical fibers, and solar panels. This allows them to cater to high-value markets where standard grades may not suffice.

Another key approach is expanding regional supply chain networks and establishing local processing facilities. By setting up satellite plants or joint ventures in high-demand countries like India, Vietnam, and Indonesia, companies can reduce lead times, lower transportation costs, and ensure compliance with regional environmental regulations while improving customer responsiveness.

Lastly, strategic collaborations with downstream industries have become increasingly important. By partnering with glassmakers, foundries, and renewable energy firms, silica flour suppliers can align their product development with evolving industry needs, ensuring long-term contracts and stronger market positioning within niche but growing segments of the Asia Pacific economy.

COMPETITIVE OVERVIEW

The competitive landscape of the Asia Pacific silica flour market is shaped by a combination of global mineral giants and emerging regional producers striving to capture market share through technological advancement, localized production, and value-added services. While multinational corporations maintain dominance in high-end applications such as semiconductor-grade silica and specialty glass manufacturing, domestic players in China, India, and Southeast Asia are rapidly expanding their capabilities to serve growing industrial demand. The market remains moderately fragmented, with numerous small-scale miners and processors competing alongside large, well-established firms, particularly in commodity-driven sectors like construction and foundry applications.

Innovation continues to be a key differentiator, especially in developing ultra-pure grades for electronics and renewable energy infrastructure. Additionally, regulatory pressures around sustainable mining practices and dust exposure limits are prompting companies to adopt greener production methods and invest in worker safety protocols. As competition intensifies, players are focusing on vertical integration, customer-specific formulations, and operational agility to strengthen their foothold in this evolving market. Strategic alliances and technology licensing are also becoming more common as companies seek to enhance their technical capabilities without heavy capital investments.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Sibelco launched a new silica flour processing facility in Malaysia to support rising demand from the region’s glass and solar panel manufacturers, aiming to improve regional supply chain efficiency and reduce dependency on imported raw materials.

- In June 2024, U.S. Silica announced a long-term supply agreement with a leading South Korean semiconductor manufacturer to provide ultra-pure silica flour for quartz crucible production, reinforcing its presence in the high-tech electronics sector.

- In August 2024, Imerys S.A. partnered with a Japanese research institute to develop next-generation silica-based composite materials designed for high-temperature insulation and optical fiber applications, enhancing its technological leadership in the region.

- In October 2024, a joint initiative between Hindustan Silica Limited and the Indian Institute of Technology (IIT) led to the launch of an indigenous ultra-purification system for silica flour, reducing reliance on imported high-purity grades and supporting domestic semiconductor development efforts.

- In December 2024, Qinghai Salt Lake Industry Co., Ltd. introduced a digital B2B platform for silica flour distribution in China, offering real-time inventory tracking, customized formulation options, and technical support to streamline procurement for industrial clients.

MARKET SEGMENTATION

This research report on the Asia Pacific silica flour market is segmented and sub-segmented into the following categories.

By Application

- Paints & Coatings

- Adhesives

- Polymers

- Glass

- Ceramics

- Sanitary Ware

- Tiles

- Others

- Fused Silica

- Countertops

- Rubbers

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the projected CAGR of the Asia Pacific Silica Flour Market from 2025 to 2033?

The Asia Pacific silica flour market is expected to grow at a CAGR of 4.32% from 2025 to 2033, driven by rising demand from glass, foundry, polymer composites, and electronics manufacturing sectors across key economies.

Which country leads in silica flour consumption in the Asia-Pacific region?

China accounts for over 45% of total silica flour consumption in the region, primarily due to its dominance in glass manufacturing, foundry operations, and growing semiconductor production in cities like Shanghai and Shenzhen.

How much silica flour is consumed annually in the glass industry across Asia-Pacific?

Over 1.8 million metric tons of silica flour is used annually in flat and container glass manufacturing across countries like India, Japan, and South Korea, where ultra-pure grades (SiO₂ > 99%) are critical for optical clarity and thermal resistance.

Which industrial sector is the fastest-growing consumer of silica flour in Asia-Pacific?

The electronics and semiconductor industry is emerging as the fastest-growing segment, particularly in Taiwan and South Korea, where silica flour is used in epoxy molding compounds (EMCs) for chip packaging, with demand rising by over 9% annually.

What percentage of foundries in India use silica flour in core and mold making?

Approximately 72% of medium- to large-scale foundries in India use silica flour-based binders for casting ferrous and non-ferrous metals, especially in automotive and machinery component manufacturing clusters like Pune and Ahmedabad.

How has environmental regulation affected silica flour sourcing in Japan?

Stricter emissions standards under the Ministry of Economy, Trade and Industry (METI) have increased demand for low-iron, high-purity silica flour to reduce impurities in ceramic filters and refractory materials used in green manufacturing.

Which states in India are major production hubs for silica flour?

Odisha, Rajasthan, and Andhra Pradesh dominate silica flour production in India due to abundant quartz deposits and favorable mining policies, contributing to over 60% of national output in 2024.

How is silica flour being used in polymer composites in Southeast Asia?

In countries like Vietnam and Thailand, silica flour is increasingly added to polymer composites for automotive interiors and electrical insulation, improving mechanical strength and flame retardancy, with usage rising by 11% year-over-year.

What is the average price range of silica flour in the Asia-Pacific region?

The price of silica flour varies between $180–$450 per metric ton, depending on purity level, particle size, and application, with ultra-fine grades for electronics commanding premium pricing in markets like Singapore and Japan.

How is e-commerce influencing the procurement of silica flour in Asia-Pacific?

Digital B2B platforms such as Alibaba, Indiamart, and TradeKey have seen a 30% increase in silica flour transactions since 2022, especially among small and mid-sized manufacturers seeking competitive pricing and technical datasheets online.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com