Asia Pacific SLI Battery Market Research Report – Segmented By Type (Flooded Battery, VRLA Battery, EBF Battery), End-User, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific SLI Battery Market Size

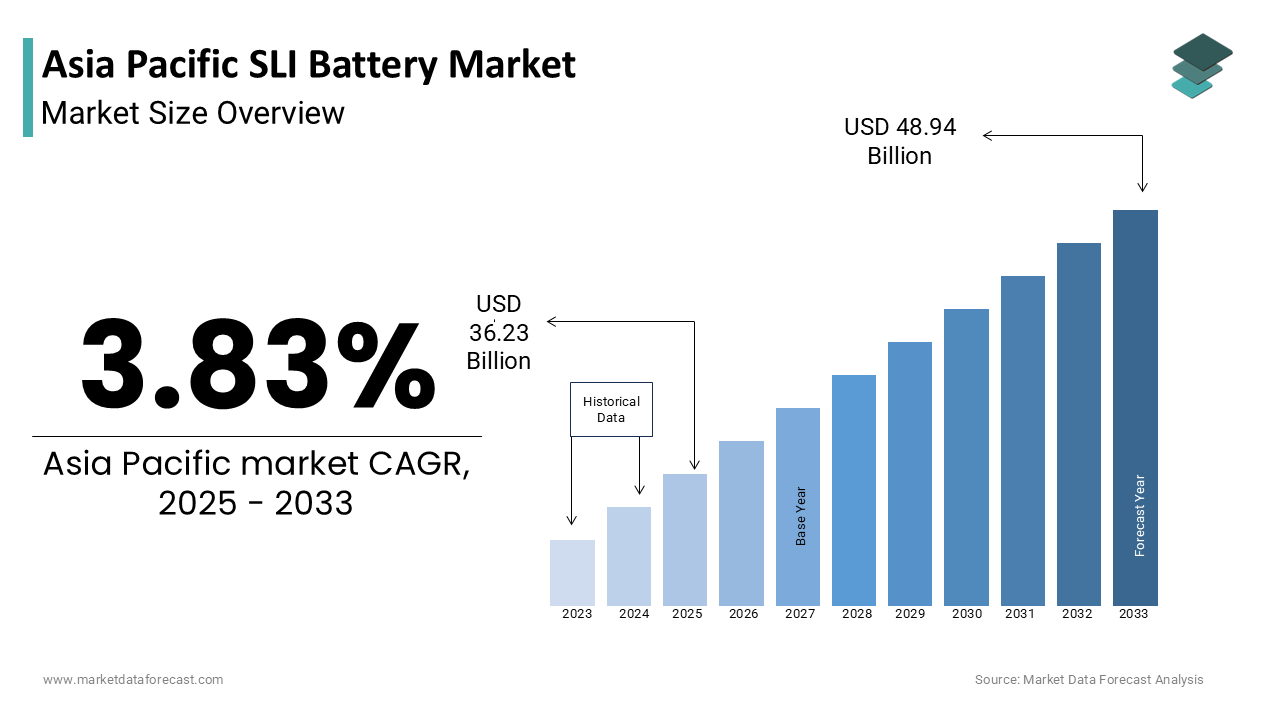

The Asia Pacific SLI Battery Market was worth USD 34.89 billion in 2024. The Asia Pacific market is expected to reach USD 48.94 billion by 2033 from USD 36.23 billion in 2025, rising at a CAGR of 3.83% from 2025 to 2033.

The SLI batteries are used primarily in internal combustion engine vehicles for automotive purposes. These lead-acid or advanced AGM/VRLA batteries are essential components that provide electric power for vehicle ignition, lighting systems, and auxiliary functions when the engine is not running. With the region's vast automotive sector, including both passenger and commercial vehicles, the demand for reliable SLI batteries remains robust.

According to the International Energy Agency (IEA), the Asia Pacific region accounts for over 60% of global vehicle production, due to its significance in the automotive supply chain. Despite the growing shift toward electric vehicles, a substantial portion of the existing vehicle fleet still relies on SLI batteries for operational functionality. In countries like India and Indonesia, where two-wheelers and three-wheelers dominate urban mobility, SLI battery adoption remains high due to their integral role in ignition systems.

Moreover, as per data from the Japan Automobile Manufacturers Association (JAMA), even hybrid and electric vehicles incorporate SLI batteries alongside high-voltage traction batteries to support onboard electronics and emergency functions. This dual usage continues to sustain demand across various transportation segments.

MARKET DRIVERS

Expansion of Automotive Production and Vehicle Fleet Growth

One of the primary drivers of the Asia Pacific SLI battery market is the continuous expansion of automotive manufacturing and the growth of the regional vehicle fleet. According to the International Organization of Motor Vehicle Manufacturers (OICA), Asia Pacific accounted for more than 58% of global vehicle production in 2023, with China, India, and Thailand being key contributors. The proliferation of new car sales and rising ownership rates in developing economies have significantly increased the installed base of vehicles requiring SLI batteries for ignition and electrical systems.

In India, the Society of Indian Automobile Manufacturers (SIAM) reported that domestic automobile sales grew by 12% year-on-year in 2023, driven largely by two-wheeler and compact car segments, both of which rely heavily on SLI batteries. Similarly, in Indonesia, the Indonesian Automotive Industry Association (Gaikindo) noted a 9% increase in vehicle registrations, which is reinforcing the sustained demand for SLI batteries across both new and replacement markets.

Moreover, the continued operation of legacy internal combustion engine (ICE) vehicles especially in rural and semi-urban areas that ensures a steady requirement for SLI battery replacements. As per the Australian Bureau of Infrastructure, Transport and Regional Economics (BITRE), even in developed markets like Australia and Japan, over 70% of vehicles on the road remain ICE-based by ensuring ongoing relevance for SLI battery suppliers. This combination of expanding vehicle production and a large existing fleet underpins strong demand for SLI batteries across the Asia Pacific region.

Rising Demand for Advanced and Maintenance-Free SLI Batteries

Another significant driver shaping the Asia Pacific SLI battery market is the increasing consumer preference for advanced and maintenance-free battery technologies such as Absorbent Glass Mat (AGM) and Valve Regulated Lead-Acid (VRLA) variants. These batteries offer superior performance, longer life cycles, and enhanced reliability compared to conventional flooded lead-acid models, making them highly desirable in modern automotive applications.

Furthermore, changing consumer behavior and increasing disposable incomes in emerging economies are encouraging vehicle owners to opt for premium battery solutions rather than cost-effective but less durable alternatives. Additionally, government initiatives promoting energy-efficient automotive components have indirectly supported the uptake of advanced SLI batteries. For instance, in Malaysia, the Ministry of Investment, Trade and Industry encouraged the adoption of eco-friendly vehicle parts through tax incentives by contributing to higher penetration of high-performance SLI batteries.

MARKET RESTRAINTS

Increasing Penetration of Electric Vehicles (EVs)

A major restraint affecting the Asia Pacific SLI battery market is the rapid rise in electric vehicle (EV) adoption, which diminishes reliance on traditional SLI batteries. Unlike internal combustion engine (ICE) vehicles that require SLI batteries for ignition and auxiliary functions, EVs primarily operate using high-voltage lithium-ion traction batteries by reducing the need for conventional lead-acid or AGM SLI units.

According to BloombergNEF, Asia Pacific accounted for over 60% of global EV sales in 2023, with China alone representing nearly half of that share. The Chinese Ministry of Industry and Information Technology reported that EV registrations surpassed 9 million units in 2023 by marking a 35% year-on-year increase. Moreover, government policies incentivizing EV adoption, such as subsidies, tax exemptions, and emission regulations, are accelerating this shift.

Stringent Environmental Regulations and Recycling Challenges

Another critical constraint impeding the Asia Pacific SLI battery market is the tightening regulatory environment concerning lead-acid battery production, disposal, and recycling. Governments across the region are enforcing stricter environmental norms to mitigate the adverse effects of lead contamination and improper waste handling associated with conventional SLI batteries.

As per the United Nations Environment Programme (UNEP), lead-acid batteries account for approximately 80% of global lead consumption, with improper recycling posing severe health and environmental risks. In response, several countries have introduced mandatory compliance frameworks for battery producers. For instance, the Chinese Ministry of Ecology and Environment implemented a battery recycling responsibility system in 2021 by requiring manufacturers to ensure environmentally sound collection and processing of end-of-life units.

In India, the Central Pollution Control Board (CPCB) mandated a 40% increase in recycling efficiency standards for lead-acid batteries starting in 2023 , compelling companies to invest in compliant infrastructure. These regulatory pressures, while beneficial for sustainability, have increased operational costs and compliance burdens for SLI battery manufacturers. Smaller players, particularly in Southeast Asia, struggle to meet these requirements, leading to market consolidation and reduced entry opportunities.

MARKET OPPORTUNITIES

Integration of SLI Batteries in Hybrid Electric Vehicles (HEVs)

A promising opportunity emerging in the Asia Pacific SLI battery market is the integration of these batteries in hybrid electric vehicles (HEVs), which continue to gain popularity as a transitional solution toward full electrification. Unlike fully electric vehicles (EVs), HEVs retain an internal combustion engine alongside an electric motor by necessitating the use of both a high-voltage traction battery and a conventional SLI battery for ignition and auxiliary functions.

According to the International Energy Agency (IEA), HEV sales in the Asia Pacific region grew by over 20% in 2023, with Japan, South Korea, and Thailand witnessing the highest adoption rates. In Japan, the Japan Automobile Manufacturers Association (JAMA) reported that more than 50% of new passenger cars sold in 2023 were HEVs, many of which utilized advanced AGM SLI batteries to support stop-start technology and regenerative braking systems.

Moreover, automakers are increasingly opting for high-performance SLI batteries such as AGM and VRLA variants in HEVs due to their ability to withstand frequent charge-discharge cycles and deliver stable power output. In South Korea, Hyundai and Kia have incorporated dual-battery systems in several of their hybrid models, which reinforces the necessity of efficient SLI units alongside main traction batteries.

Additionally, governments in emerging markets like India and Indonesia are promoting HEVs as a cleaner alternative to conventional ICE vehicles without the immediate infrastructure demands of full EV adoption.

Growing Aftermarket Demand for High-Quality Replacement SLI Batteries

Another significant opportunity within the Asia Pacific SLI battery market lies in the expanding aftermarket segmentdriven by the increasing number of aging vehicles requiring periodic battery replacements. As the regional automotive fleet matures in countries with high vehicle ownership rates, the demand for reliable and durable replacement SLI batteries has surged.

Furthermore, the shift toward premium SLI battery types such as AGM and gel-cell variants in the aftermarket has been fueled by rising awareness regarding battery longevity and performance. In China, the China Automotive Battery Innovation Alliance observed a 25% increase in sales of premium SLI batteries through independent retailers and online platforms, indicating a strong consumer inclination toward quality-driven purchases. Additionally, e-commerce platforms and digital retailing have made it easier for consumers to access a wide range of SLI battery options, facilitating informed purchasing decisions based on brand reputation and product specifications.

MARKET CHALLENGES

Volatility in Raw Material Prices and Supply Chain Disruptions

One of the foremost challenges confronting the Asia Pacific SLI battery market is the persistent volatility in raw material prices, particularly for lead, sulfuric acid, and polypropylene are key components in battery manufacturing. Fluctuations in global commodity markets directly impact production costs and profit margins, which creates uncertainty for manufacturers operating in the region.

According to the U.S. Geological Survey (USGS), international lead prices surged by over 25% in early 2023 due to supply constraints from major mining regions and increased industrial demand. This spike had a cascading effect on SLI battery producers across Asia, where lead constitutes nearly 60–70% of battery weight. In India, the All India Battery Manufacturers Association (AIBMA) reported that domestic manufacturers faced a 20% increase in input costs during 2023 by forcing many to raise retail prices and absorb margin pressures.

Beyond price fluctuations, supply chain disruptions caused by geopolitical tensions, trade restrictions, and logistical bottlenecks further exacerbate the challenges. Additionally, environmental regulations restricting lead mining and refining activities have constrained raw material availability in certain countries. In China, the Ministry of Industry and Information Technology imposed stricter emissions controls on secondary lead smelters, limiting domestic supply and increasing dependence on imports.

Technological Shift Toward Lithium-Ion Alternatives and Reduced Dependence on SLI Batteries

Another pressing challenge facing the Asia Pacific SLI battery market is the gradual technological shift toward lithium-ion alternatives and the corresponding reduction in dependency on conventional SLI batteries, particularly in newer vehicle architectures. Automakers are increasingly exploring lightweight, high-efficiency power sources that can integrate seamlessly with advanced electrical systems, thereby diminishing the role of traditional lead-acid or AGM-based SLI units.

According to McKinsey & Company, lithium-ion battery adoption in low-voltage applications such as 12V and 48V systems is projected to increase significantly by 2030, owing to the improvements in energy density, cycle life, and recyclability. In Japan, Toyota and Honda have begun testing lithium iron phosphate (LFP) cells as drop-in replacements for SLI batteries in select hybrid models by aiming to reduce weight and enhance energy efficiency.

Moreover, advancements in vehicle electrification architecture, including integrated energy management systems and smart alternators, are enabling automakers to eliminate standalone SLI batteries. In South Korea, Hyundai’s latest hydrogen fuel cell electric vehicle prototype demonstrated a fully decentralized power distribution model, which relies solely on the main traction battery for all electrical functions. Additionally, startups and research institutions across the region are investing in solid-state and supercapacitor-based alternatives that promise faster charging, longer lifespans, and greater thermal stability compared to traditional SLI configurations. In Singapore, a government-backed R&D initiative launched in 2023 aims to develop ultra-compact lithium-based auxiliary power units for next-generation vehicles.

SEGMENTAL ANALYSIS

By Type Insights

The flooded battery segment was the largest share of the Asia Pacific SLI battery market with 52.3% of share in 2024. Flooded lead-acid batteries remain widely used due to their cost-effectiveness, ease of manufacturing, and compatibility with a broad range of internal combustion engine (ICE) vehicles.

The continued reliance on traditional automotive systems in emerging economies, where affordability remains a key purchasing factor will also promote the growth of the segment. According to data from the International Energy Agency (IEA), over 70% of vehicles on the road in Southeast Asia are ICE-based, many of which utilize flooded batteries due to their lower upfront cost and widespread availability. Additionally, extensive aftermarket demand for replacement flooded batteries further reinforces their market position. The Federation of Automobile Dealers Associations (FADA) reported that aftermarket flooded battery sales in India grew by 12% year-on-year in 2023, driven by an aging vehicle fleet and limited access to premium alternatives in rural areas.

The VRLA (Valve Regulated Lead-Acid) battery segment is projected to grow with a CAGR of 8.4% during the forecast period. This accelerated expansion is attributed to increasing adoption of maintenance-free and spill-proof battery solutions in modern passenger cars, hybrid electric vehicles (HEVs), and high-end commercial transport.

One significant driver of VRLA battery growth is the rising integration of start-stop technology in new vehicles, especially in urban mobility applications aimed at reducing fuel consumption and emissions. According to the Japan Automobile Manufacturers Association (JAMA), over 40% of new cars launched in Japan in 2023 featured start-stop systems, which require advanced VRLA or AGM batteries to support frequent cycling without degradation. Moreover, government initiatives promoting energy-efficient automotive components have contributed to the uptake of VRLA batteries. In China, the Ministry of Industry and Information Technology encouraged automakers to adopt sealed battery technologies under its Green Vehicle Development Plan, resulting in a 20% increase in VRLA battery installations in new passenger vehicles between 2021 and 2023 Additionally, e-commerce platforms and digital retail channels have expanded consumer access to branded VRLA batteries, enhancing awareness and adoption among vehicle owners seeking longer-lasting, low-maintenance power solutions.

By End-User Insights

The automotive end-user segment accounted for a prominent share of the Asia Pacific SLI battery market. This overwhelming dominance is primarily due to the vast number of internal combustion engine (ICE) vehicles still in operation across both developed and developing economies in the region.

A key factor driving this segment’s prominence is the persistent dependence on ICE vehicles despite growing EV adoption in countries with large rural populations and underdeveloped charging infrastructure. According to the International Energy Agency (IEA), over 80% of vehicles registered in Southeast Asia in 2023 were conventional gasoline or diesel-powered models, each requiring an SLI battery for ignition and electrical functions. In Indonesia, the Indonesian Automotive Industry Association (Gaikindo) reported that only 5% of new vehicle registrations in 2023 were fully electric, with the continued relevance of SLI batteries in mainstream automotive applications.

The other end-user segment is lucratively growing with a CAGR of 7.8% during the forecast period. One major factor propelling growth in this segment is the expansion of recreational boating and marine activities, particularly in coastal regions of Australia, Thailand, and the Philippines. According to the Australian Boating Industry Association (ABIA), domestic boat ownership increased by 15% between 2021 and 2023, with most vessels relying on SLI batteries for onboard electronics and auxiliary functions.

Another significant driver is the growing deployment of off-grid and mobile industrial equipment, including construction machinery, agricultural tractors, and emergency power generators. In China, the China Construction Machinery Association recorded a 12% rise in sales of construction equipment fitted with SLI batteries in 2023, driven by infrastructure development projects in rural areas. Additionally, governments in countries like Vietnam and Malaysia have initiated programs to modernize agricultural fleets by encouraging the use of SLI batteries in farm equipment.

REGIONAL ANALYSIS

China was the largest share of the Asia Pacific SLI battery market by accounting for approximately 34% of total regional demand, according to estimates from the China Automotive Battery Innovation Alliance. According to the China Association of Automobile Manufacturers (CAAM), domestic vehicle production reached over 27 million units in 2023 by reinforcing the need for a robust supply chain of automotive batteries. Moreover, China’s well-established battery recycling ecosystem supports sustainable production cycles by making it a dominant force in both manufacturing and distribution across the Asia Pacific region.

India was positioned second by holding 22.3% of the Asia Pacific SLI battery market share in 2024 with its expanding automotive sector and rising vehicle ownership rates. According to the Society of Indian Automobile Manufacturers (SIAM), India produced over 25 million vehicles in 2023 , with two-wheelers accounting for nearly 80% of total sales. These vehicles predominantly utilize SLI batteries, making them a critical component of the domestic automotive supply chain. According to the Federation of Automobile Dealers Associations (FADA), replacement battery sales grew by 14% year-on-year, which indicates a strong aftermarket presence. Furthermore, the Indian government’s push toward electrification has not yet significantly impacted SLI battery demand, as hybrid models and entry-level cars continue to incorporate these units for auxiliary functions. Companies such as Amara Raja Batteries and Exide Industries have capitalized on this trend by expanding production capacities and introducing maintenance-free variants to cater to evolving consumer preferences.

Japan SLI battery market growth is likely to be distinguished by its focus on high-performance and technologically advanced battery solutions. According to the Japan Automobile Manufacturers Association (JAMA), nearly 5 million vehicles were produced in Japan in 2023, with a majority incorporating either AGM or VRLA SLI batteries designed for hybrid and start-stop applications. The country’s emphasis on fuel efficiency and emission reduction has led to widespread adoption of advanced battery technologies, particularly in Toyota and Honda hybrid models. The Ministry of Economy, Trade and Industry (METI) has also supported research into next-generation SLI battery designs, aiming to improve durability and reduce environmental impact. Additionally, Japan’s well-established automotive aftermarket ensures steady demand for premium replacement batteries, with companies like GS Yuasa and Panasonic maintaining a strong presence.

South Korea is expected to grow with the adoption of hybrid vehicles and export-driven automotive manufacturing. According to the Korea Automobile Manufacturers Association (KAMA), South Korea exported over 2.5 million vehicles in 2023, with a significant portion featuring advanced SLI battery configurations to meet international standards. Hyundai and Kia have increasingly incorporated VRLA and AGM batteries in their global models, particularly those targeting European and North American markets where start-stop technology is mandated. Additionally, the Korean government has promoted the integration of SLI batteries in hybrid electric vehicles (HEVs) through tax incentives and fuel economy regulations, indirectly supporting market growth.

Australia SLI battery market growth is attributed to be driven by stable demand from both automotive and non-automotive sectors. Beyond passenger vehicles, there is significant usage in recreational boats, agricultural machinery, and mining equipment in remote regions where reliable starting power is essential.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

GS Yuasa Corporation, Exide Technologies, Amara Raja Energy & Mobility Limited, EnerSys, Leoch International Technology Limited, Camel Energy Inc., Crown Battery Manufacturing Company, AtlasBX Co. Ltd., Power Sonic Corporation, and Johnson Controls are some of the key market players.

The Asia Pacific SLI battery market is characterized by intense competition among domestic and international players striving to capture market share in a rapidly evolving industry. While global brands bring advanced technologies and strong R&D capabilities, regional manufacturers leverage cost advantages, localized expertise, and extensive distribution networks to maintain competitiveness. The market remains highly fragmented, particularly in countries with large informal sectors, where small-scale producers coexist alongside well-established firms. As demand shifts toward higher-performing and environmentally compliant battery solutions, companies are under pressure to innovate while maintaining affordability. This dynamic environment encourages continuous investment in product development, sustainability initiatives, and strategic partnerships aimed at securing long-term growth. Additionally, increasing regulatory scrutiny around lead content and recycling practices is reshaping competitive strategies, pushing companies to adopt cleaner production methods and invest in closed-loop recycling infrastructure.

Top Players in the Asia Pacific SLI Battery Market

One of the leading players in the Asia Pacific SLI battery market is Exide Industries Limited, an Indian multinational corporation specializing in energy storage solutions. Exide plays a significant role in both OEM and aftermarket segments by offering a wide range of flooded and maintenance-free SLI batteries tailored to the region’s diverse vehicle fleet. The company’s strong distribution network and focus on innovation have made it a trusted name across South and Southeast Asia.

Another key player is GS Yuasa Corporation, a Japanese manufacturer known for its high-performance AGM and VRLA SLI batteries. GS Yuasa has established a strong presence in the Asia Pacific region by supplying advanced battery technologies to automotive OEMs and hybrid vehicle manufacturers. Its emphasis on quality and reliability has positioned it as a preferred partner for major automakers seeking efficient power solutions.

The third major player is Amara Raja Batteries Limited, an Indian company recognized for its premium automotive and industrial battery offerings. Amara Raja has significantly contributed to the growth of the SLI battery sector by introducing technologically superior products that meet evolving consumer preferences and regulatory standards across the Asia Pacific.

Top Strategies Used by Key Market Participants

A primary strategy employed by key players in the Asia Pacific SLI battery market is product diversification and technological innovation, where companies continuously develop advanced battery chemistries such as AGM and VRLA to cater to modern vehicle requirements, including start-stop systems and hybrid applications. This approach allows them to differentiate their offerings and align with global automotive trends.

Another crucial strategy is expansion into emerging markets through localized production and distribution networks, enabling companies to serve growing vehicle populations in countries like India, Indonesia, and Vietnam more efficiently. By establishing regional manufacturing units and forging partnerships with local dealers, companies enhance accessibility and after-sales service, strengthening brand loyalty.

Strategic collaborations with automobile manufacturers and government-backed initiatives help key players secure long-term supply contracts and influence policy direction regarding battery standards and recycling regulations. These alliances not only improve market penetration but also support sustainable business practices aligned with environmental compliance frameworks across the Asia Pacific region.

REGIONAL ANALYSIS

- In February 2024, Exide Industries announced the expansion of its manufacturing facility in West Bengal to increase production capacity for maintenance-free SLI batteries. This move was intended to meet rising domestic and export demand while reinforcing the company’s prominent position in the South Asian automotive battery segment.

- In April 2024, GS Yuasa launched a new line of high-efficiency AGM SLI batteries specifically designed for hybrid vehicles in the Japanese and South Korean markets. This product rollout reflected the company's commitment to supporting the transition toward fuel-efficient mobility while maintaining compatibility with existing automotive electrical systems.

- In June 2023, Amara Raja Batteries entered into a strategic partnership with a leading Indonesian battery distributor to strengthen its regional supply chain and after-sales service network. The collaboration was aimed at enhancing market access and customer engagement in one of Southeast Asia’s fastest-growing automotive markets.

- In September 2023, Panasonic introduced a digital battery health monitoring system integrated with select SLI battery models for commercial vehicle fleets in Australia and New Zealand. This initiative was part of the company’s broader push to offer smart, connected battery solutions that improve performance tracking and predictive maintenance capabilities.

- In May 2024, Yuasa Battery (Thailand) inaugurated a new R&D center focused on developing climate-resilient SLI battery designs suited for tropical conditions. The facility was expected to accelerate product customization efforts tailored to Southeast Asian markets and support the company’s expansion strategy in the region.

MARKET SEGMENTATION

This research report on the Asia Pacific SLI battery market is segmented and sub-segmented into the following categories.

By Type

- Flooded Battery

- VRLA Battery

- EBF Battery

By End-User

- Automotive

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the SLI battery market in Asia Pacific?

Growth is driven by the expanding automotive industry, rising vehicle ownership, increasing demand for reliable vehicle power systems, and government support for industrial manufacturing.

What challenges are faced by the SLI battery market?

Key challenges include environmental concerns related to lead-acid batteries, the rise of alternative battery technologies (like lithium-ion), and increasing raw material costs.

How does the rise of electric vehicles (EVs) affect the SLI battery market?

While EVs primarily use lithium-ion batteries, many still use low-voltage SLI batteries for auxiliary functions. However, the long-term shift to full electric systems may reduce reliance on traditional SLI batteries.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com