Asia Pacific Small Off-Road Engines Market Size, Share, Trends & Growth Forecast Report By Engine Type (Four-Stroke Engines, Two-Stroke Engines), Application, Displacement Capacity, Type, End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Small Off-Road Engines Market Size

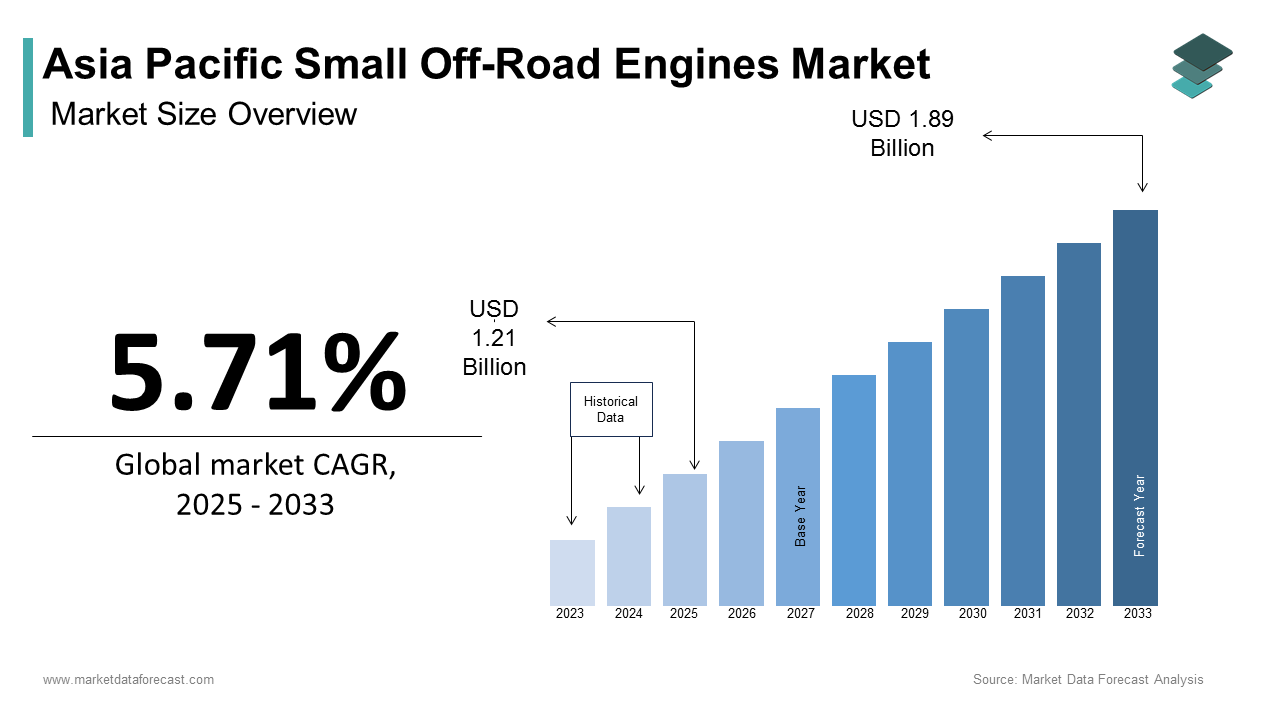

The Asia Pacific small off-road engines market size was calculated to be USD 1.15 billion in 2024 and is anticipated to be worth USD 1.89 billion by 2033, from USD 1.21 billion in 2025, growing at a CAGR of 5.71% during the forecast period.

Small off-road engines, typically defined as internal combustion engines with displacements under 25 horsepower, are integral to powering equipment like lawnmowers, chainsaws, generators, and compact tractors. These engines are valued for their portability, efficiency, and ability to operate in challenging terrains, making them indispensable in both rural and urban settings.

MARKET DRIVERS

Expansion of Urban Green Spaces

The proliferation of urban green spaces is a significant driver of the small off-road engine market in the Asia Pacific. As cities expand, there is a growing emphasis on maintaining parks, gardens, and recreational areas, which rely heavily on SORE-powered equipment like lawnmowers, leaf blowers, and trimmers. According to the Asian Development Bank, significant investments in urban greening projects were made in 2022, with countries like Singapore and South Korea leading the charge.

For example, Singapore’s "City in Nature" initiative allocates substantial resources to develop sustainable green spaces, requiring advanced landscaping equipment powered by efficient small engines. Similarly, in China, the government’s "Sponge City" program aims to create permeable urban landscapes, driving demand for compact tractors and irrigation systems.

Growth of Mechanized Agriculture

Another key driver is the increasing mechanization of agriculture in the region. Like, the adoption of mechanized farming practices in the Asia Pacific grew notably over the past decade, driven by the need to boost productivity and meet rising food demands. Small off-road engines power essential equipment such as tillers, harvesters, and water pumps, enabling farmers to achieve higher yields with reduced labor costs.

In India, the Ministry of Agriculture reports that a large share of rural households now utilize mechanized tools, supported by government subsidies for agricultural equipment. Similarly, in Vietnam, the transition from manual to mechanized farming has resulted in a major increase in crop output, as reported by the Vietnamese Farmers’ Association.

MARKET RESTRAINTS

Stringent Emission Regulations

Stringent emission regulations pose a significant restraint to the small off-road engine market in the Asia Pacific. Governments across the region are implementing stricter environmental policies to reduce greenhouse gas emissions and improve air quality. For instance, as per the Australian Department of Climate Change, Energy, the Environment, and Water, all small engines sold in the country must comply with Euro 5 emission standards, requiring manufacturers to invest heavily in research and development to meet these benchmarks.

This regulatory push increases production costs, particularly for smaller firms unable to afford advanced emission control technologies. In India, the Ministry of Environment, Forest and Climate Change mandates the use of catalytic converters in small engines, adding to the financial burden on manufacturers. Besides, the lack of standardized testing protocols in some countries creates compliance challenges, deterring potential market entrants and slowing down innovation.

High Maintenance Costs

Another major restraint is the high maintenance costs associated with small off-road engines, particularly in rural and remote areas where access to skilled technicians and spare parts is limited. According to the Confederation of Indian Industry, a considerable percentage of small engine users in rural India face difficulties in obtaining timely repairs, resulting in prolonged downtime and reduced productivity. This issue is exacerbated by the prevalence of counterfeit or substandard components flooding markets in countries like Indonesia and the Philippines. A study by the Federation of Malaysian Manufacturers revealed that a major share of small engine repairs fail due to the use of low-quality spare parts. Furthermore, the complexity of modern engines, equipped with advanced features like fuel injection systems, requires specialized expertise, further inflating maintenance expenses.

MARKET OPPORTUNITIES

Adoption of Battery-Powered Engines

The growing adoption of battery-powered small off-road engines presents a significant opportunity for the market in the Asia Pacific. Battery-powered engines offer advantages such as zero emissions, reduced noise pollution, and lower operational costs, making them ideal for urban applications like landscaping and municipal maintenance.

For instance, in Japan, companies are introducing lithium-ion battery-powered lawnmowers and chainsaws, aligning with the country’s commitment to carbon neutrality by 2050. Similarly, in Australia, the Renewable Energy Target promotes the use of eco-friendly appliances, spurring demand for electric-powered gardening tools. This shift toward electrification not only enhances brand reputation but also opens new revenue streams for manufacturers, positioning them as pioneers in sustainable technologies.

Expansion into Emerging Markets

The expansion into emerging markets offers another lucrative opportunity for the small off-road engines market. According to the World Bank, the middle-class population in Southeast Asia is expected to double by 2030, creating a vast consumer base for affordable and reliable equipment. Countries like Vietnam, Indonesia, and Thailand are witnessing rapid urbanization and infrastructure development, driving demand for SORE-powered machinery in construction and landscaping.

MARKET CHALLENGES

Counterfeit and Substandard Products

A pressing challenge facing the small off-road engine market in the Asia Pacific is the prevalence of counterfeit and substandard products, which undermine trust and compromise safety. These products often fail to meet international performance and safety standards, increasing the likelihood of malfunctions or accidents during operation.

The influx of counterfeit goods is fueled by weak enforcement mechanisms and inadequate quality control measures in certain regions. For instance, a 2021 investigation by the Malaysian Consumer Protection Association revealed that a significant share of imported small engines tested did not comply with required benchmarks. This issue is further exacerbated by price-sensitive buyers who prioritize cost over quality, inadvertently supporting the proliferation of substandard products.

Limited Awareness of Advanced Technologies

Another significant challenge is the limited awareness and technical understanding of advanced small off-road engine technologies among end-users. Many consumers in the region are unfamiliar with the benefits of modern innovations, such as fuel-efficient designs and emission-reducing features, opting instead for traditional models due to their perceived reliability. Like, a small portion of rural households in Southeast Asia are aware of the long-term cost savings associated with energy-efficient engines.

This knowledge gap is compounded by inadequate marketing efforts and insufficient training programs for installers and retailers. Furthermore, the lack of accessible financing options for premium products discourages adoption, particularly among small-scale farmers and businesses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.71% |

|

Segments Covered |

By Engine Type, Application, Displacement Capacity, Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Briggs & Stratton, Honda Motor Co. Ltd., Kohler Co., Yamaha Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Kubota Corporation, Loncin Motor Co. Ltd., Lifan Power, Generac Power Systems, Subaru Industrial Power Products |

SEGMENTAL ANALYSIS

By Engine Type Insights

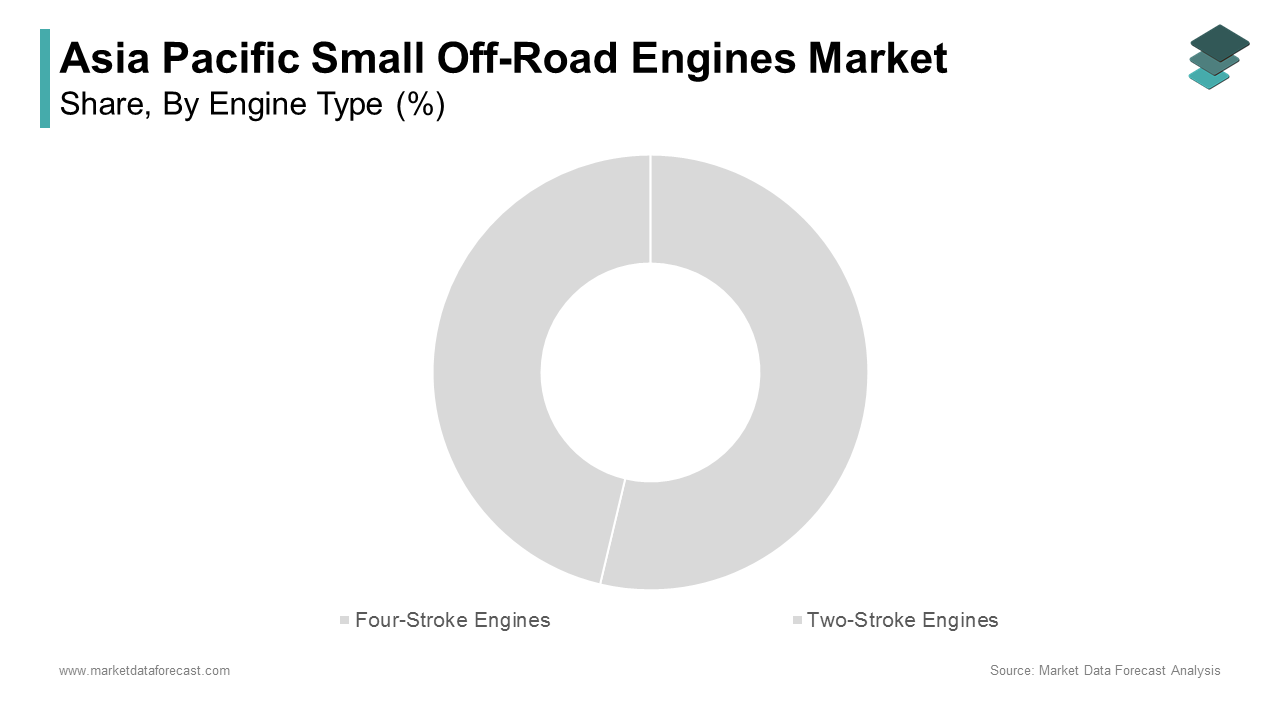

The four-stroke engine segment dominated the Asia Pacific small off-road engines market by holding a market share of 65.5% in 2024. This leading position is driven by their superior fuel efficiency, lower emissions, and quieter operation compared to two-stroke engines. According to the International Energy Agency, a large majority of small engine applications in urban areas now utilize four-stroke technology, reflecting its alignment with environmental regulations. A key factor propelling this segment's dominance is the growing emphasis on sustainability. Similarly, in Australia, the Renewable Energy Target promotes the use of low-emission machinery, spurring adoption in sectors like agriculture and construction. Also, advancements in engine design have improved durability and performance, making four-stroke engines ideal for heavy-duty applications such as compact tractors and generators. Another driving force is the rise of smart city initiatives.

The two-stroke engines segment is the fastest-growing in the Asia Pacific small off-road engines market, with a CAGR of 8%. This is fueled by their lightweight design and affordability, making them ideal for recreational vehicles and portable equipment. Also, the demand for two-stroke engines in applications like chainsaws and jet skis grew notably between 2020 and 2022, driven by rising disposable incomes and leisure activities. The surge in outdoor recreation is a significant driver. Countries like Thailand and Indonesia, where adventure sports like off-roading and water skiing are gaining popularity, are witnessing increased adoption of two-stroke engines. Government policies also play a role. In India, subsidies for small-scale manufacturers encourage the production of affordable two-stroke engines, ensuring accessibility for rural consumers.

By Application Insights

The ATVs segment held the largest share of the Asia Pacific small off-road engines market i.e. 50.6% of total sales in 2024. This influence is due to their versatility and widespread use in agriculture, forestry, and recreational activities. A key driver is the mechanization of agriculture. For example, in Vietnam, the transition from manual labor to mechanized farming has increased crop output. ATVs, powered by efficient small engines, enable farmers to achieve higher productivity while reducing labor costs. Also, their rugged design makes them suitable for challenging terrains, amplifying demand in mountainous regions like Nepal and Bhutan. Recreational use further amplifies adoption. In Australia, the rise of adventure tourism has spurred demand for ATVs, with an annual increase in ATV rentals for activities like off-roading and trail exploration.

UTVs segment is the fastest-growing application in the Asia Pacific small off-road engines market, with a CAGR of 14%. This progress is propelled by their utility-focused design and ability to perform diverse tasks in construction, landscaping, and emergency services. Urbanization trends amplify demand. For instance, in China, the proliferation of suburban housing projects has increased the need for compact vehicles capable of transporting materials and tools. Technological advancements also play a crucial role. Manufacturers like Yamaha and Polaris are introducing UTVs equipped with advanced features like GPS navigation and remote diagnostics, enhancing user convenience and driving adoption.

By Displacement Capacity Insights

The engines with a displacement capacity of 50cc to 125cc prevailed in the Asia Pacific small off-road engines market by holding a market share of 45.7%. This is attributed to their balance of power, efficiency, and affordability, making them suitable for a wide range of applications. Like, a large share of small-scale agricultural equipment in India utilizes engines within this displacement range, reflecting their popularity among rural users. A key factor driving this segment is the growing demand for compact and portable machinery. Government subsidies also play a pivotal role. In Vietnam, financial assistance for small-scale farmers encourages the adoption of affordable machinery powered by these engines, ensuring accessibility for lower-income households.

Engines with a displacement capacity below 50cc are quickly emerging in the market, with a CAGR of 12%. This development is caused by their lightweight design and suitability for recreational and household applications. The surge in urbanization is another significant driver. As per the United Nations Department of Economic and Social Affairs, the urban population in the region is projected to grow by 2050, creating demand for lightweight machinery in landscaping and municipal maintenance. For instance, in Singapore, the "City in Nature" initiative allocates substantial resources to develop sustainable green spaces, requiring advanced equipment powered by below 50cc engines.

In addition, advancements in battery-powered technology have enhanced the appeal of these engines, aligning with global sustainability goals and ensuring sustained growth for the segment.

By Type Insights

The gasoline-powered engines segment commanded the Asia Pacific small off-road engines market by holding a substantial share in 2024. This performance is because of their widespread availability and cost-effectiveness, particularly in rural and semi-urban areas. According to the International Energy Agency, a significant portion of households in Southeast Asia rely on gasoline for small engine applications, making it a natural choice due to its affordability and ease of use. A key driver is the lack of reliable alternatives in certain regions. For instance, in Indonesia and the Philippines, where electricity infrastructure is underdeveloped, gasoline-powered engines provide a dependable solution for tasks like irrigation and transportation. The Confederation of Indian Industry reports that gasoline engine sales grew notably in rural India between 2020 and 2022, reflecting their popularity among small-scale farmers and businesses. Government subsidies also support this trend.

The diesel-powered engines segment is rapidly advancing in the market, with a CAGR of 10%. This development is caused by their superior fuel efficiency and durability, making them ideal for heavy-duty applications in agriculture and construction. Like, diesel engine adoption in the APAC grew significantly over the past decade, driven by the mechanization of farming practices. Countries like China and India are leading this trend. For example, India’s Ministry of Agriculture reports that a large majority of rural households now utilize diesel-powered machinery, supported by government subsidies for agricultural equipment. Similarly, in Vietnam, the transition from manual to mechanized farming has increased crop output. Infrastructure development further amplifies demand.

By User Insights

The segment of commercial use segment prevailed in the Asia Pacific small off-road engines market by holding a market share of 60% in 2024. This is driven by the widespread adoption of small engines in industries such as agriculture, construction, and landscaping. According to the Food and Agriculture Organization, a considerable portion of small-scale farming equipment in the region is utilized for commercial purposes, underscoring its critical role in boosting productivity and meeting food demands.

A main factor is the increasing mechanization of agriculture. For instance, in Vietnam, the transition from manual labor to mechanized farming has increased crop output. Small engines power essential equipment such as tillers, harvesters, and water pumps, enabling farmers to achieve higher yields with reduced labor costs. Besides, their rugged design makes them suitable for challenging terrains, amplifying demand in mountainous regions like Nepal and Bhutan. Government policies also play a pivotal role. In India, subsidies for small-scale farmers encourage the adoption of affordable machinery powered by small engines, ensuring accessibility for lower-income households.

The residential use segment is the fastest-growing end-user in the Asia Pacific small off-road engines market, with a CAGR of 12%. This progress is developed by the proliferation of urban green spaces and the rise of suburban housing projects, which require efficient machinery for landscaping and maintenance. The surge in smart city initiatives amplifies demand. For instance, in Singapore, the "City in Nature" initiative allocates substantial resources to develop sustainable green spaces, requiring advanced equipment powered by small engines. Technological advancements also play a crucial role. Manufacturers are introducing eco-friendly and energy-efficient engines, aligning with global sustainability goals and ensuring sustained growth for the residential segment.

REGIONAL ANALYSIS

China led the Asia Pacific small off-road engines market by commanding a market share of 40%. This dominance is underpinned by the country’s massive manufacturing capabilities and rapid urbanization. A key factor is the government’s push for agricultural modernization. Besides, China’s export-oriented manufacturing sector ensures a steady demand for small engines in global markets, strengthening its leadership in the regional and global arenas.

India is growing notably in the market. The country’s growing middle class and mechanized farming practices are driving demand for small engines. The rise of suburban housing projects further amplifies demand. In cities like Mumbai and Delhi, the proliferation of green spaces has increased the need for efficient machinery in landscaping and municipal maintenance. Apart from these, India’s manufacturing prowess enables cost-effective production, making small engines accessible to a wide demographic.

Japan holds a significant position in the market. The country’s advanced technology and emphasis on sustainability drive the adoption of energy-efficient small engines. Cold winters in regions like Hokkaido amplify the demand for advanced heating solutions. Also, the government’s Top Runner Program incentivizes manufacturers to innovate, ensuring Japan remains a leader in the global market.

South Korea is witnessing a positive rise in the market and is driven by its focus on smart home integration and energy efficiency. The country’s emphasis on innovation is evident in its AI-enabled water heaters, which optimize energy usage. Government policies promoting renewable energy further enhance adoption, ensuring sustained growth for the segment.

Australia contributes small yet important to the market, with a strong emphasis on sustainability. Government schemes like the Small-scale Renewable Energy Scheme provide incentives for eco-friendly appliances, driving adoption. Also, the rise of net-zero buildings amplifies demand for energy-efficient water heating solutions, positioning Australia as a key player in the regional market.

LEADING PLAYERS IN THE ASIA PACIFIC SMALL OFF-ROAD ENGINES MARKET

Honda Motor Co., Ltd.

Honda is a global leader in the small off-road engines market, renowned for its innovative and fuel-efficient engine technologies. The company’s expertise lies in developing lightweight, durable, and eco-friendly engines that cater to diverse applications such as landscaping, agriculture, and recreational vehicles. Honda’s commitment to sustainability is evident in its low-emission models, which align with stringent environmental regulations across the Asia Pacific region.

Yamaha Corporation

Yamaha Corporation is a dominant player in the Asia Pacific small off-road engines market, specializing in high-performance engines for ATVs, UTVs, and marine applications. The company’s focus on reliability and versatility has earned it a strong reputation among both commercial and residential users. Yamaha’s emphasis on innovation is reflected in its development of compact and energy-efficient engines, designed to meet the demands of urbanization and mechanized farming.

Kubota Corporation

Kubota Corporation is a key contributor to the small off-road engines market, offering a wide range of products tailored to agricultural, construction, and landscaping needs. The company’s portfolio includes diesel-powered engines known for their durability and fuel efficiency, making them ideal for heavy-duty applications. Kubota’s dedication to innovation is evident in its development of eco-friendly solutions that align with sustainability goals.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product Innovation and Customization

Leading companies in the Asia Pacific small off-road engines market are heavily investing in product innovation to address specific regional challenges. For instance, manufacturers are developing compact, energy-efficient models tailored for urban and rural applications. By introducing eco-friendly solutions like low-emission engines and battery-powered alternatives, these firms cater to growing environmental consciousness.

Strategic Partnerships and Collaborations

To strengthen their market presence, key players are forming strategic partnerships with distributors, local governments, and technology firms. These collaborations enable companies to expand their reach in untapped markets and integrate advanced features like GPS navigation and remote diagnostics into their products. For example, partnering with smart city ecosystem providers allows firms to offer integrated solutions that appeal to tech-savvy consumers.

Focus on Sustainability and Energy Efficiency

Promoting sustainability is another critical strategy adopted by market leaders. Companies are emphasizing the development of energy-efficient appliances that reduce carbon footprints and lower operational costs. By aligning with government incentives and certification programs, such as Australia’s Renewable Energy Target, firms enhance their credibility and attract environmentally conscious consumers. In addition, educational campaigns highlighting the benefits of renewable energy solutions help build trust and drive adoption, positioning these companies as pioneers in eco-friendly technologies.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific small off-road engines market include Briggs & Stratton, Honda Motor Co. Ltd., Kohler Co., Yamaha Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Kubota Corporation, Loncin Motor Co. Ltd., Lifan Power, Generac Power Systems, Subaru Industrial Power Products.

The Asia Pacific small off-road engines market is characterized by intense competition, driven by the presence of both multinational corporations and regional players striving to capture market share. Leading companies leverage their technological expertise and extensive distribution networks to maintain dominance, while smaller firms focus on niche applications to carve out a foothold. The market’s competitive landscape is shaped by the growing emphasis on energy efficiency, sustainability, and smart integration, necessitating continuous innovation and compliance with international standards. Urbanization trends further amplify rivalry, as firms compete to meet the diverse needs of densely populated cities and rural areas.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Honda Motor Co., Ltd. launched a new line of eco-friendly small engines specifically designed for landscaping equipment in Japan. This move aimed to address the growing demand for low-emission solutions and enhance compliance with environmental regulations.

- In June 2023, Yamaha Corporation partnered with a leading distributor in India to expand its reach in rural markets. This collaboration was intended to increase accessibility for farmers and small-scale businesses, ensuring steady growth for the segment.

- In August 2023, Mahindra & Mahindra established a training center in Thailand to educate installers and retailers on the latest advancements in diesel-powered small engines. This initiative underscored the company’s commitment to promoting sustainable technologies in Southeast Asia.

- In November 2023, Kubota Corporation acquired a local manufacturer in Vietnam to strengthen its product portfolio and supply chain in the region. This acquisition enabled Kubota to tap into the growing demand for affordable agricultural machinery powered by small engines.

- In January 2024, Polaris Inc. introduced a new range of UTVs equipped with advanced GPS navigation systems in Australia. This launch positioned Polaris as a leader in integrating cutting-edge technologies into utility vehicles, aligning with the country’s smart city initiatives.

MARKET SEGMENTATION

This research report on the Asia Pacific Small Off-Road Engines Market has been segmented and sub-segmented based on engine type, application, displacement capacity, type, end user, and region.

By Engine Type

- Four-Stroke Engines

- Two-Stroke Engines

By Application

- ATVs (All-Terrain Vehicles)

- UTVs (Utility Task Vehicles)

By Displacement Capacity

- 50cc to 125cc

- Below 50cc

By Type

- Gasoline

- Diesel

By End User

- Commercial Use

- Residential Use

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. Who are the major players in the Asia Pacific small off-road engines market?

Key players include Honda Motor Co. Ltd., Briggs & Stratton, Yamaha Motor Co. Ltd., Kohler Co., and Kawasaki Heavy Industries Ltd.

2. Which end-use sectors drive demand for small off-road engines in the Asia Pacific region?

Agriculture, construction, lawn and garden care, and industrial applications are the main sectors fueling demand.

3. What are small off-road engines typically used for?

They are commonly used in lawnmowers, tillers, generators, pressure washers, and other portable or non-road equipment.

4. How is technological advancement impacting small off-road engines?

Advancements such as electronic fuel injection and hybrid models are improving engine performance and fuel efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]