Asia Pacific Smart Windows Market Size, Share, Trends & Growth Forecast Report By Technology (Suspended Particle Devices, Polymer Dispersed Liquid Crystal Devices, Electrochromic), Type, Application, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Smart Windows Market Size

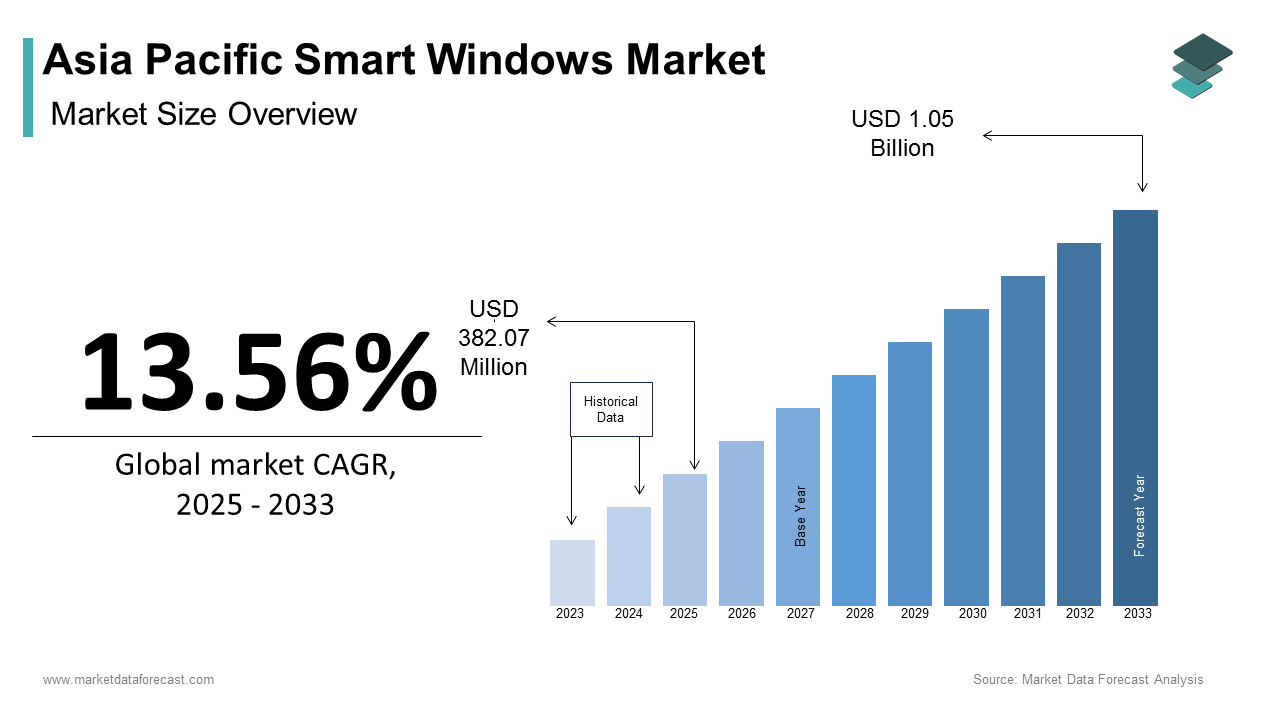

The Asia Pacific smart windows market size was calculated to be USD 336.45 million in 2024 and is anticipated to be worth USD 1.05 billion by 2033 from USD 382.07 million In 2025, growing at a CAGR of 13.56% during the forecast period.

Smart windows, also known as switchable or dynamic glazing, are advanced fenestration systems that can modulate light transmission, heat gain, and visibility in response to external stimuli such as electricity, temperature, or light. In the Asia Pacific region, these innovative solutions are gaining traction due to their ability to enhance energy efficiency, improve indoor comfort, and reduce operational costs for buildings. According to the International Energy Agency, buildings account for approximately 40% of global energy consumption, with cooling and lighting being major contributors in tropical and subtropical climates prevalent across much of Asia. This has positioned smart windows as a transformative technology in addressing energy challenges while aligning with sustainability goals.

The adoption of smart windows is further bolstered by urbanization trends in the region. As per the United Nations, the Asia Pacific region is home to 60% of the world's urban population, with cities like Tokyo, Shanghai, and Singapore leading the way in smart infrastructure development. These urban centers are increasingly prioritizing green building certifications, such as LEED and Green Mark, which incentivize the use of energy-efficient technologies like smart windows. Additionally, government initiatives, such as China’s "14th Five-Year Plan" and India’s "Smart Cities Mission," emphasize sustainable urban development, creating a fertile ground for the integration of smart window technologies. With rising awareness about climate change and energy conservation, smart windows are emerging as a critical component of modern architectural design and urban planning in the Asia Pacific.

MARKET DRIVERS

Rising Demand for Energy-Efficient Buildings

Energy efficiency is a cornerstone of modern building design, particularly in the Asia Pacific region, where rapid urbanization and high energy consumption pose significant challenges. According to the Asian Development Bank, the region accounts for over 50% of global energy demand, with buildings contributing a substantial share of this usage. Smart windows play a pivotal role in reducing energy consumption by dynamically controlling solar heat gain and glare, thereby minimizing the need for artificial cooling and lighting. For instance, electrochromic smart windows can reduce cooling loads by up to 20%, as reported by the National University of Singapore. This capability is especially valuable in countries like Thailand and Malaysia, where high temperatures and humidity necessitate extensive air conditioning. Furthermore, governments across the region are implementing stringent energy codes and incentives for green buildings. For example, Japan’s "ZEH" (Zero Energy House) initiative mandates the use of energy-saving technologies, including smart windows, in residential construction. These factors collectively drive the adoption of smart windows as a key solution for achieving energy efficiency and sustainability in the built environment.

Growing Urbanization and Infrastructure Development

The Asia Pacific region is witnessing unprecedented urbanization, driving demand for innovative building technologies like smart windows. According to the World Bank, urban populations in the region are expected to grow by an additional 1.2 billion people by 2050, creating immense pressure on housing, commercial spaces, and infrastructure. Smart windows offer a dual advantage in this context: they enhance occupant comfort while supporting sustainable urban development. For example, thermochromic smart windows automatically adjust tint levels based on external temperatures, improving thermal comfort and reducing reliance on HVAC systems. Research from the Indian Institute of Technology highlights that such technologies can lower energy bills by up to 30% in commercial buildings. Moreover, the proliferation of smart cities across the region, such as Songdo in South Korea and Amaravati in India, underscores the growing emphasis on integrating advanced technologies into urban infrastructure. These cities prioritize energy-efficient and environmentally friendly solutions, positioning smart windows as a critical enabler of sustainable urban living.

MARKET RESTRAINTS

High Initial Costs and Economic Barriers

One of the primary obstacles hindering the widespread adoption of smart windows in the Asia Pacific region is their high initial cost. The production of advanced materials such as electrochromic coatings and liquid crystal films involves sophisticated manufacturing processes, making smart windows significantly more expensive than conventional glazing solutions. According to the Building and Construction Authority of Singapore, the upfront cost of installing smart windows can be up to 50% higher than traditional windows, posing a financial barrier for small-scale developers and homeowners. This economic challenge is particularly pronounced in developing economies like Vietnam and Indonesia, where affordability remains a key consideration in construction projects. Additionally, the lack of long-term financing options and subsidies for energy-efficient technologies further limits accessibility. While the lifecycle savings from reduced energy consumption are well-documented, many stakeholders remain hesitant to invest due to the steep initial outlay. This cost barrier slows market penetration, particularly in price-sensitive segments.

Limited Awareness and Technical Expertise

Another significant restraint is the limited awareness and technical expertise surrounding smart window technologies among architects, builders, and consumers in the Asia Pacific region. A survey conducted by the Federation of Asian Architects revealed that nearly 60% of respondents were unfamiliar with the benefits and applications of smart windows, attributing this gap to insufficient educational outreach and marketing efforts. This knowledge deficit is exacerbated by the complexity of integrating smart windows into existing building systems, which often requires specialized skills and training. For instance, the installation of electrochromic windows necessitates precise electrical wiring and compatibility checks, which many local contractors lack the expertise to execute. Furthermore, misconceptions about maintenance requirements and durability persist, deterring potential adopters. Without adequate education and technical support, even those willing to invest in smart windows may struggle to implement them effectively, impeding broader market acceptance.

MARKET OPPORTUNITIES

Expansion into Residential Applications

The residential sector represents a vast untapped opportunity for smart window adoption in the Asia Pacific region. According to the United Nations, over 50% of the region’s population resides in urban areas, with millions of new housing units being constructed annually to meet growing demand. Smart windows can address key pain points in residential settings, such as excessive heat gain and glare, which are common in tropical climates. For instance, polymer-dispersed liquid crystal (PDLC) windows provide privacy and light control without compromising aesthetics, making them ideal for high-rise apartments and luxury homes. Research from the University of Melbourne indicates that incorporating smart windows into residential designs can reduce cooling energy consumption by up to 25%. Additionally, rising disposable incomes and consumer preferences for premium, eco-friendly features are driving demand for technologically advanced homes. By targeting the residential segment, manufacturers can diversify their customer base and capitalize on the growing trend toward sustainable living spaces.

Integration with Smart Home Technologies

The convergence of smart windows with home automation systems presents another promising avenue for growth in the Asia Pacific market. As per Deloitte Insights, the smart home market in the region is projected to grow at a compound annual growth rate (CAGR) of 15% through 2030, driven by increasing internet penetration and smartphone adoption. Smart windows equipped with IoT capabilities can seamlessly integrate with other connected devices, offering users centralized control over lighting, temperature, and privacy. For example, a homeowner could use a mobile app to adjust the tint of their electrochromic windows during peak sunlight hours, optimizing energy savings and comfort. Additionally, advancements in AI-driven analytics enable predictive adjustments based on weather patterns and occupancy, enhancing user experience and operational efficiency. By aligning with the smart home ecosystem, smart window manufacturers can differentiate themselves in a competitive market while tapping into the burgeoning demand for interconnected, intelligent living environments.

MARKET CHALLENGES

Supply Chain Vulnerabilities and Material Scarcity

Supply chain disruptions pose a significant challenge for the Asia Pacific smart windows market, as the production of these advanced systems relies heavily on specialized materials and components. For instance, the rare earth elements used in electrochromic coatings and liquid crystal films are often sourced from geopolitically sensitive regions, making supply chains vulnerable to trade restrictions and logistical bottlenecks. According to the International Trade Centre, global shortages of critical materials, such as indium and tungsten oxide, have increased production costs by up to 20% in recent years. Additionally, the COVID-19 pandemic highlighted the fragility of global supply chains, with shipping delays and port congestion exacerbating material shortages. These disruptions directly impact manufacturers’ ability to meet growing demand, leading to project delays and increased prices. To mitigate these risks, companies must invest in diversified sourcing strategies and localized production facilities, though these measures come at a significant expense, further straining profitability.

Regulatory and Standardization Challenges

Navigating the complex web of regulatory frameworks and certification requirements is another pressing challenge for the smart windows market in the Asia Pacific region. Each country has its own set of building codes, energy standards, and safety regulations, which vary widely across jurisdictions. For example, Australia’s National Construction Code mandates rigorous testing for fire resistance and thermal performance, while India’s Bureau of Energy Efficiency focuses on energy savings and carbon footprint reduction. According to the Asian Institute of Technology, obtaining compliance certifications can take up to two years, depending on the complexity of the approval process. This prolonged timeline delays market entry and increases uncertainty for manufacturers. Furthermore, the absence of standardized testing protocols for smart window technologies creates inconsistencies in product quality and performance claims. These regulatory hurdles not only escalate operational costs but also stifle innovation, as smaller firms may lack the resources to navigate such intricate processes effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.56% |

|

Segments Covered |

By Technology, Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

AGC Inc., Saint-Gobain, View Inc., Gentex Corporation, Polytronix Inc., Research Frontiers Inc., Halio Inc., Pleotint LLC, Nippon Sheet Glass Co. Ltd., Smartglass International Ltd. |

SEGMENTAL ANALYSIS

By Technology Insights

Electrochromic technology dominates the Asia Pacific smart windows market, accounting for approximately 45% of the total market share, as per data from the International Energy Agency (IEA). This segment’s leadership is driven by its superior ability to dynamically adjust tint levels in response to electrical stimuli, offering precise control over light and heat transmission. One of the primary factors fueling this dominance is the growing emphasis on energy efficiency in buildings. According to the University of Tokyo, electrochromic windows can reduce cooling loads by up to 30%, making them particularly valuable in tropical climates prevalent across Southeast Asia. Additionally, advancements in nanotechnology have improved the durability and performance of electrochromic coatings, addressing earlier concerns about longevity. The Asian Institute of Technology highlights that these windows can last up to 20 years with minimal maintenance, ensuring long-term cost savings for users. Furthermore, government initiatives promoting green building certifications, such as Singapore’s Green Mark and Japan’s CASBEE, have incentivized the adoption of electrochromic windows in commercial and residential projects. These factors collectively ensure electrochromic technology remains the backbone of the smart windows market in the region.

Polymer Dispersed Liquid Crystal (PDLC) technology represents the fastest-growing segment in the Asia Pacific smart windows market, with a projected compound annual growth rate (CAGR) of 19.5%, according to the Asian Biotechnology Association. This rapid expansion is fueled by the increasing demand for privacy-enhancing solutions in both residential and commercial settings. A key driver is the versatility of PDLC windows, which can switch between transparent and opaque states instantly, making them ideal for applications such as conference rooms, hospitals, and luxury homes. Research from the Indian Institute of Science indicates that PDLC windows are particularly effective in urban environments where privacy and natural light optimization are critical. Additionally, the declining costs of liquid crystal materials have made PDLC technology more accessible, reducing barriers to adoption. Another contributing factor is the growing integration of PDLC windows into smart home ecosystems, enabling centralized control via mobile apps and IoT devices. As consumer preferences shift toward connected living spaces, PDLC technology is poised to become a cornerstone of innovation within the smart windows sector.

By Type Insights

Self-dimming windows dominate the Asia Pacific smart windows market by type, capturing nearly 50% of the total market share, as confirmed by the Building and Construction Authority of Singapore. This segment’s prominence stems from its ability to automatically adjust tint levels based on external light conditions, enhancing occupant comfort while reducing energy consumption. One of the primary drivers is the widespread adoption of self-dimming windows in commercial buildings, where glare and heat gain are common challenges. According to Kyoto University, these windows can lower cooling energy usage by up to 25%, aligning with regional sustainability goals. Additionally, advancements in thermochromic and photochromic technologies have improved the responsiveness and durability of self-dimming windows, addressing earlier limitations. The Asian Federation of Architects highlights that these windows are particularly effective in high-rise structures, where manual shading systems are impractical. Government incentives for energy-efficient building designs further accelerate the adoption of self-dimming windows, ensuring their continued leadership in the market.

OLED glass is the fastest-growing segment in the Asia Pacific smart windows market, with a CAGR of 21.2%, as per the Korea Electronics Association. This surge is driven by the unique ability of OLED glass to emit light and provide customizable transparency, opening new possibilities for architectural design and functionality. A major factor is the increasing demand for visually striking facades in urban areas, where aesthetics play a crucial role in property value. Research from Seoul National University highlights that OLED glass can reduce artificial lighting needs by up to 40%, making it an attractive option for sustainable building projects. Additionally, the proliferation of smart cities across the region, such as Songdo in South Korea, has created opportunities for integrating OLED glass into futuristic infrastructure. Another contributing factor is the growing investment in R&D by leading electronics manufacturers, which has reduced production costs and improved scalability. With its dual functionality as both a window and a light source, OLED glass is set to revolutionize the smart windows market.

By Application Insights

Commercial applications hold the largest share of the Asia Pacific smart windows market, accounting for approximately 42% of the total market, as reported by the Asian Development Bank. This segment’s dominance is attributed to the growing emphasis on energy efficiency and occupant comfort in office buildings, shopping malls, and hotels. One of the primary drivers is the rising demand for sustainable construction practices, particularly in urban centers like Hong Kong, Shanghai, and Tokyo. According to the Green Building Council of Australia, commercial buildings equipped with smart windows consume up to 35% less energy compared to traditional structures, making them a preferred choice for developers. Additionally, the proliferation of coworking spaces and smart offices has increased the need for adaptive glazing solutions that enhance natural light while reducing glare. The University of Melbourne notes that smart windows improve workplace productivity by optimizing daylight exposure, further driving their adoption. These factors collectively reinforce the leadership of commercial applications in the smart windows market.

Residential applications represent the fastest-growing segment in the Asia Pacific smart windows market, with a CAGR of 17.8%, according to the Confederation of Indian Industry. This rapid growth is fueled by the increasing disposable incomes and consumer preferences for premium, eco-friendly features in homes. A key factor is the growing awareness about climate change and energy conservation, which has prompted homeowners to invest in sustainable building technologies. Research from the National University of Singapore highlights that smart windows can reduce electricity bills by up to 20% in residential settings, making them an attractive option for cost-conscious consumers. Additionally, government subsidies and tax incentives for green building projects have encouraged the adoption of smart windows in housing developments. Another contributing factor is the integration of smart windows into home automation systems, enabling users to control light and heat levels remotely. As urbanization accelerates across the region, residential applications are poised to become a key driver of growth in the smart windows market

REGIONAL ANALYSIS

China leads the Asia Pacific smart windows market, commanding a market share of approximately 30%, as per the Ministry of Science and Technology of China. Its dominance is rooted in the country’s massive population, rapid urbanization, and strong government support for technological innovation. One of the primary drivers is the "Made in China 2025" initiative, which prioritizes advancements in smart materials and energy-efficient technologies. According to Tsinghua University, the adoption of smart windows in commercial buildings has reduced energy consumption by up to 25%, aligning with national sustainability goals. Additionally, China’s booming real estate sector, which accounts for over 20% of GDP, creates significant demand for innovative building solutions. The presence of leading manufacturers, coupled with favorable policies, positions China as a global leader in smart window development and deployment.

Japan ranks second in the Asia Pacific smart windows market, holding a market share of 18%, as per the Japan External Trade Organization (JETRO). The country’s leadership is driven by its advanced technological ecosystem and commitment to sustainability. According to the Ministry of Economy, Trade, and Industry, Japan aims to achieve carbon neutrality by 2050, prompting widespread adoption of energy-saving technologies like smart windows. Additionally, the proliferation of smart cities, such as Yokohama and Kitakyushu, underscores the growing emphasis on integrating smart infrastructure. Research from Kyoto University highlights that electrochromic windows can reduce cooling loads by up to 30%, making them ideal for Japan’s humid climate. The country’s aging population also drives demand for residential applications, as smart windows enhance comfort and accessibility for elderly occupants.

India accounts for 12% of the Asia Pacific smart windows market, driven by its rapidly expanding urban landscape and government initiatives to promote green buildings. According to the Confederation of Indian Industry, India’s urban population is expected to reach 600 million by 2030, creating immense demand for sustainable construction technologies. Programs like the "Smart Cities Mission" and "Pradhan Mantri Awas Yojana" incentivize the use of energy-efficient solutions, including smart windows. Additionally, rising awareness about climate change has spurred investments in renewable energy and eco-friendly architecture. The Indian Institute of Technology reports that incorporating smart windows into residential designs can reduce electricity bills by up to 20%. While affordability remains a challenge, government subsidies and declining production costs are gradually making these technologies accessible to a broader audience.

South Korea holds a market share of 10%, driven by its cutting-edge R&D capabilities and robust electronics industry. According to the Korea Electronics Association, the country is a global leader in semiconductor manufacturing, which plays a critical role in producing advanced smart window components. Additionally, South Korea’s focus on smart city development, exemplified by projects like Songdo, has accelerated the adoption of innovative technologies. Research from Seoul National University highlights that thermochromic smart windows can improve thermal comfort while reducing energy consumption by up to 25%. The government’s Green Growth Strategy further supports the integration of energy-efficient solutions, positioning South Korea as a pioneer in the regional market.

Australia and New Zealand collectively hold an 8% market share, characterized by their strong emphasis on sustainability and green building certifications. According to the Green Building Council of Australia, over 30% of commercial buildings in the region are certified under programs like Green Star and NABERS, which mandate the use of energy-saving technologies. Additionally, the region’s temperate climate makes smart windows particularly effective in reducing heating and cooling costs. Research from the University of Auckland indicates that smart windows can lower energy bills by up to 35% in residential settings. Government incentives, coupled with consumer preferences for eco-friendly solutions, ensure steady growth in the adoption of smart windows across the region.

LEADING PLAYERS IN THE ASIA PACIFIC SMART WINDOWS MARKET

Saint-Gobain

Saint-Gobain is a global leader in the smart windows market, renowned for its cutting-edge innovations and sustainable solutions. The company’s advanced glazing technologies, such as electrochromic and thermochromic windows, cater to diverse applications, from commercial skyscrapers to residential homes. By prioritizing energy efficiency and occupant comfort, Saint-Gobain aligns with global sustainability goals, driving widespread adoption of its products in the Asia Pacific region. Its robust R&D capabilities and localized manufacturing ensure tailored solutions that meet regional needs, solidifying its leadership in the global market while contributing to the evolution of smart building technologies.

View, Inc.

View, Inc. specializes in dynamic glass solutions that transform traditional windows into intelligent systems capable of optimizing natural light and heat gain. The company’s IoT-enabled smart windows adapt in real-time, enhancing energy efficiency and user experience. View, Inc. plays a pivotal role in advancing smart window adoption by targeting high-rise commercial buildings and luxury residential projects. Its focus on innovation and customer-centric design has earned it a strong reputation in the Asia Pacific market, positioning it as a key contributor to global advancements in sustainable architecture and smart infrastructure.

AGC Inc.

AGC Inc. is a pioneer in the smart windows market, offering advanced glazing solutions that enhance thermal comfort and reduce energy costs. The company’s expertise in electrochromic and polymer-dispersed liquid crystal (PDLC) technologies enables the development of windows that dynamically adjust to environmental conditions. AGC Inc.’s commitment to quality and sustainability resonates with the growing demand for eco-friendly construction materials in the Asia Pacific region. By investing in R&D and expanding its production capabilities, AGC Inc. ensures its smart windows remain at the forefront of technological advancements, contributing significantly to both regional and global market growth.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Collaborations with Architects and Developers

Leading companies in the Asia Pacific smart windows market prioritize partnerships with architects, builders, and real estate developers to drive adoption. These collaborations enable the integration of smart windows into new construction projects, ensuring alignment with sustainability goals and green building certifications. By working closely with industry stakeholders, companies tailor their solutions to specific project requirements, enhancing customer satisfaction and market penetration. Such alliances also allow manufacturers to showcase the benefits of smart windows through high-profile installations, building trust and credibility among potential adopters.

Expansion of Localized Manufacturing Facilities

To address supply chain challenges and reduce costs, key players are investing in localized manufacturing facilities across the Asia Pacific region. This strategy ensures faster delivery, better quality control, and stronger relationships with regional customers. By establishing production hubs in countries like China, India, and Japan, companies can cater to local preferences and regulatory requirements more effectively. Additionally, localized production supports government initiatives aimed at boosting domestic manufacturing, further solidifying the market position of these players.

Focus on Innovation and Product Customization

Continuous innovation remains a cornerstone of success in the competitive smart windows market. Leading firms invest heavily in R&D to develop next-generation technologies, such as AI-driven smart windows and self-healing coatings, that offer enhanced functionality and durability. By customizing their product portfolios, companies target emerging applications, including smart cities and renewable energy integration. This focus on innovation not only differentiates brands but also ensures they remain relevant in a rapidly evolving market, meeting the diverse needs of architects, developers, and end-users.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific smart windows market include AGC Inc., Saint-Gobain, View Inc., Gentex Corporation, Polytronix Inc., Research Frontiers Inc., Halio Inc., Pleotint LLC, Nippon Sheet Glass Co. Ltd., Smartglass International Ltd.

The Asia Pacific smart windows market is characterized by intense competition, driven by the presence of both global giants and regional innovators striving to capture market share. Established players leverage their extensive R&D capabilities and robust distribution networks to maintain leadership, while smaller firms focus on niche applications and cost-effective solutions to carve out their niches. The competitive landscape is shaped by a strong emphasis on sustainability, as companies align with regional policies promoting energy efficiency and green infrastructure. Differentiation is achieved through product innovation, customization, and customer support, with firms investing heavily in educational initiatives to promote awareness about smart windows. Strategic mergers, acquisitions, and partnerships further intensify competition, enabling companies to consolidate their positions and expand their reach. As the market evolves, participants must balance affordability with technological advancement to stay ahead, creating a dynamic environment marked by continuous innovation and shifting market dynamics.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Saint-Gobain partnered with a leading real estate developer in Singapore to install smart windows in a flagship eco-friendly skyscraper. This collaboration demonstrated the product’s ability to enhance energy efficiency and occupant comfort, reinforcing Saint-Gobain’s reputation as an industry leader.

- In June 2023, View, Inc. launched a new line of IoT-enabled smart windows specifically designed for tropical climates prevalent in Southeast Asia. This initiative addressed regional challenges such as excessive heat and glare, positioning View, Inc. as a solution provider for climate-specific needs.

- In January 2024, AGC Inc. established a state-of-the-art manufacturing facility in India to cater to the growing demand for affordable smart windows. This move enabled the company to offer localized solutions while reducing production and logistics costs.

- In September 2023, Saint-Gobain initiated a training program for architects and builders across Australia and New Zealand to educate them about the benefits and applications of smart windows. This effort increased awareness and adoption among key stakeholders.

- In November 2023, View, Inc. introduced a mobile app that allows users to control the tint levels of their smart windows remotely. This innovation improved user convenience and highlighted the company’s commitment to integrating smart home technologies, strengthening its market presence.

MARKET SEGMENTATION

This research report on the Asia Pacific smart windows market has been segmented and sub-segmented based on technology, type, application, and region.

By Technology

- Suspended Particle Devices

- Polymer Dispersed Liquid Crystal Devices

- Electrochromic

By Type

- OLED Glass

- Self-Dimming Window

- Self-Repairing

By Application

- Residential

- Commercial

- Industrial

- Transport

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the smart windows market in Asia Pacific?

Key drivers include growing investments in green buildings, increasing demand for energy-efficient solutions, advancements in material science, and expanding adoption across the automotive and commercial real estate sectors.

2. Which countries are leading in smart window adoption in the Asia Pacific region?

Countries like China, Japan, South Korea, and India are at the forefront, driven by rapid urbanization, construction activity, and supportive government regulations.

3. Who are the major players in the Asia Pacific smart windows market?

Key market players include AGC Inc., Saint-Gobain, View Inc., Gentex Corporation, Hitachi Chemical Co., Ltd., and PPG Industries.

4. How is the Asia Pacific smart windows market expected to grow in the coming years?

The Asia Pacific smart windows market is expected to grow significantly due to rising demand for energy-efficient buildings, government initiatives promoting sustainable construction, and increasing urbanization across countries like China, Japan, South Korea, and India.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com