Asia Pacific Soda Ash Market Research Report - Segmented By Application (Glass, Soaps and Detergents, Chemicals, Metallurgy, Pulp and paper, and Others), and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Soda Ash Market Size

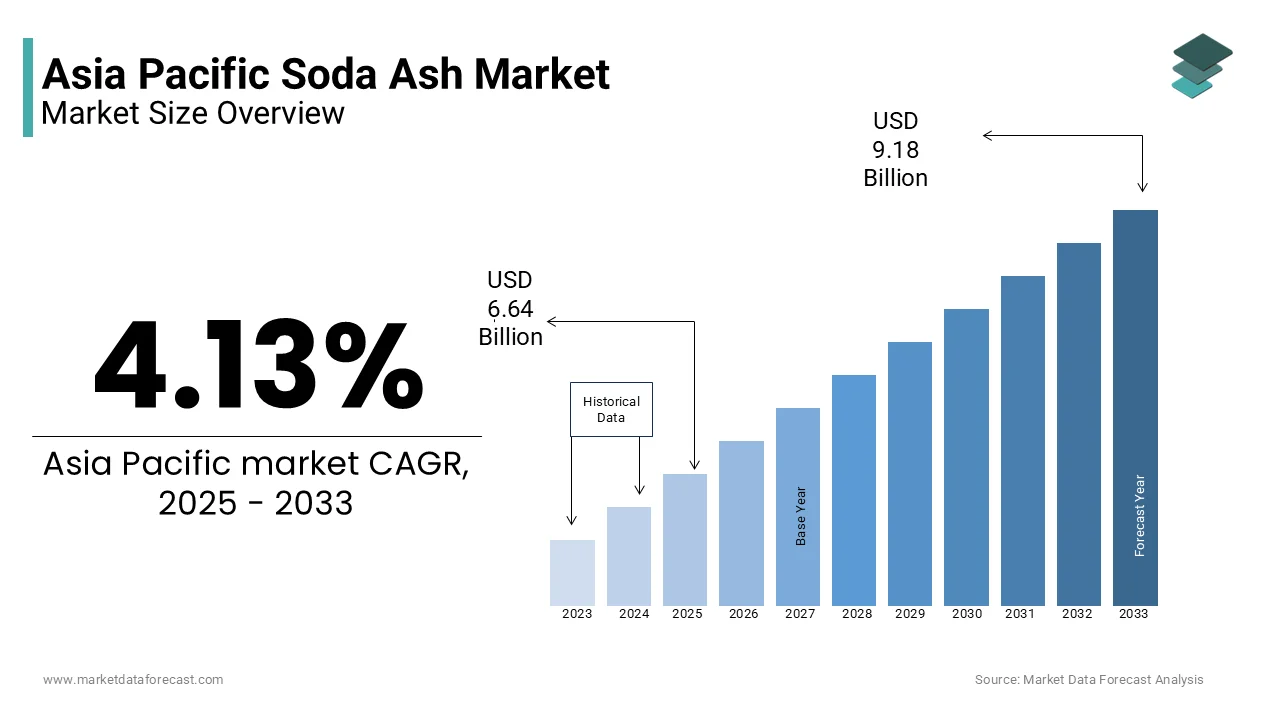

Asia Pacific Soda Ash market size was valued at USD 6.38 billion in 2024, and the market size is expected to reach USD 9.18 billion by 2033 from USD 6.64 billion in 2025. The market's promising CAGR for the predicted period is 4.13%.

Soda ash, also known as sodium carbonate, is valued for its versatility, purity, and ability to enhance the efficiency of various industrial processes.

MARKET DRIVERS

Rising Demand in the Glass Manufacturing Industry

The escalating demand for glass products has emerged as a primary driver for the Asia Pacific Soda Ash Market. Soda ash, being a key raw material for glass production, is extensively used in flat glass, container glass, and specialty glass applications, aligning with regulatory mandates aimed at promoting green architecture and energy-efficient building practices. A key factor driving this trend is the increasing focus on renewable energy infrastructure. High-purity soda ash is critical for producing photovoltaic glass, which enhances the efficiency of solar panels. Also, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of high-performance glass products.

Expansion of the Detergent Industry

The rapid expansion of the detergent industry in the Asia Pacific region has significantly bolstered the demand for soda ash, which is a critical ingredient in the formulation of cleaning agents. A major driver of this growth is the increasing adoption of powder detergents, particularly in rural areas where washing machines are less prevalent. Similarly, adopting eco-friendly detergents has amplified the demand for bio-based soda ash formulations that minimize environmental impact. Moreover, the shift toward improved hygiene practices has increased investments in detergent production, further boosting the demand for soda ash.

MARKET RESTRAINTS

Stringent Environmental Regulations

One of the most significant restraints affecting the Asia Pacific Soda Ash Market is the stringent environmental regulations governing the extraction and processing of soda ash. However, as per the Biotechnology Innovation Organization, the average time required to secure regulatory approval for new mining and processing projects can exceed five years, accompanied by substantial operational expenditures. This prolonged timeline poses significant challenges for manufacturers aiming to meet the growing demand for soda ash while adhering to environmental standards. Moreover, discrepancies between national and international regulations often lead to fragmented compliance requirements, complicating distribution efforts.

Volatility in Raw Material Availability

Another critical restraint stems from the volatility in raw material availability, particularly in regions prone to geological and logistical challenges. According to the World Bank, fluctuations in mining output have surged in recent years due to geopolitical tensions and supply chain disruptions. This instability creates challenges for soda ash manufacturers, who must navigate rising input costs while maintaining competitive pricing for their products. Such price volatility disproportionately affects small-scale producers who operate on tight margins and lack the resources to absorb sudden cost increases. Larger enterprises, though more resilient, also face pressure to balance input expenses against market dynamics. Also, the complexity of sourcing high-purity trona deposits or synthetic soda ash often requires additional investments in exploration and extraction technologies, further inflating operational costs.

MARKET OPPORTUNITIES

Adoption of Sustainable Extraction Technologies

A burgeoning opportunity lies in the adoption of sustainable extraction technologies, driven by growing consumer demand for environmentally friendly products. As per the United Nations Environment Programme (UNEP), the Asia Pacific region is projected to account for over 60% of global green product consumption by 2030, creating significant demand for soda ash sourced through eco-friendly methods. These sustainable practices not only reduce reliance on traditional mining techniques but also align with regulatory frameworks aimed at promoting circular economies.

Simultaneously, the rise of regenerative practices presents a novel avenue for innovation. For instance, low-impact mining technologies are effective in reducing greenhouse gas emissions during extraction, as reported by the University of Queensland.

Growth in Renewable Energy Infrastructure

The advent of renewable energy infrastructure presents a transformative opportunity for the Asia Pacific Soda Ash Market. Soda ash is critical for producing photovoltaic glass, which enhances the efficiency of solar panels and supports the transition to clean energy.For example, advancements in nano-soda ash formulations enable manufacturers to achieve superior thermal and optical properties, directly impacting energy efficiency. Additionally, as per the Asian Development Bank, adopting sustainable energy practices has amplified the demand for soda ash in wind turbine components and battery storage systems.

MARKET CHALLENGES

Resistance to the Adoption of New Technologies

A persistent challenge facing the Asia Pacific Soda Ash Market is the resistance to adoption of new technologies exhibited by traditional miners entrenched in conventional practices. This reluctance is particularly pronounced among older generations who prioritize tried-and-tested methods over experimental approaches.

Furthermore, cultural and regional disparities exacerbate this issue. For example, rural areas in Southeast Asia tend to have lower adoption rates compared to technologically progressive regions like Japan and South Korea, where large-scale operations dominate. According to the Asian Development Bank, addressing these gaps necessitates tailored communication strategies that resonate with local contexts and priorities.

Concerns Over Environmental Impact and Regulation

Environmental concerns pose another formidable challenge for the Asia Pacific Soda Ash Market, especially regarding pollution and resource depletion. Traditional mining practices, despite their efficiency, are often scrutinized for their potential contribution to these issues if not managed responsibly. Such sentiments place immense pressure on manufacturers to develop low-impact alternatives while adhering to complex regulatory frameworks. For example, China’s Ministry of Ecology and Environment imposes strict limits on wastewater and air emissions, creating additional hurdles for companies operating nationwide. Also, misinformation spread via social media platforms amplifies public distrust, creating reputational risks for brands associated with controversial mining practices.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.13% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Solvay S.A., Tata Chemicals, Ciech S.A., Shandong Haihua Group, OCI Chemical Corporation, Nirma Limited, Soda Sanayii, and China National Petroleum Corporation (CNPC), and others |

SEGMENTAL ANALYSIS

By Application Insights

The glass segment dominated the Asia Pacific Soda Ash Market by holding a 40.5% of the share in 2024. This influence is driven by the region's booming glass production sector, which supplies materials for flat glass, container glass, and specialty glass applications such as solar panels and automotive windshields. According to the United Nations Industrial Development Organization (UNIDO), over 50% of global glass production occurs in the Asia Pacific region, creating immense demand for soda ash.

A key factor driving this dominance is the increasing focus on renewable energy infrastructure. High-purity soda ash is critical for producing photovoltaic glass, which enhances the efficiency of solar panels. Additionally, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of energy-efficient glass products.

The chemicals segment represented the fastest-growing category in the Asia Pacific Soda Ash Market, with a projected CAGR of 9.5%. This rapid expansion is fueled by the increasing adoption of soda ash in chemical manufacturing processes, particularly in the production of sodium-based compounds like sodium bicarbonate and sodium silicate, which are integral to industries such as detergents, water treatment, and pharmaceuticals.

A major driver of this growth is the rising demand for eco-friendly chemical solutions. As per the United Nations Environment Programme (UNEP), adopting sustainable chemical practices has amplified the demand for bio-based soda ash formulations that minimize environmental impact.

REGIONAL ANALYSIS

China led the Asia Pacific Soda Ash Marketby commanding a 35% of the regional share in 2024. This dominance is caused by the country's vast industrial base, which supports large-scale production of soda ash for diverse applications, including glass manufacturing, detergents, and chemical production. A key driver of this leadership is the presence of advanced mining technologies. Also, stringent environmental regulations enforced by the Ministry of Ecology and Environment have accelerated the adoption of eco-friendly mining practices, ensuring compliance with global standards.

India is quickly moving ahead in the market. This is due to the strong emphasis on sustainable practices has positioned it as a hub for eco-friendly soda ash solutions. According to the Indian Bureau of Mines, a large portion of soda ash manufacturers in India have adopted green technologies to reduce carbon emissions and water pollution. Another factor driving India's prominence is its thriving detergent and glass industries. Apart from these, government incentives for adopting renewable energy sources have spurred the use of soda ash in solar panel manufacturing, further bolstering the market's growth.

Japan is a key player of the regional market share. The country's focus on innovation and precision manufacturing has created a fertile ground for high-purity soda ash used in advanced applications like electronics, ceramics, and water treatment. A key driver of this growth is the increasing adoption of specialty soda ash formulations, facilitated by investments in R&D. Besides, efforts to modernize mining processes through government-funded programs have encouraged small-scale producers to invest in premium soda ash solutions, contributing to Japan's steady market expansion.

South Korea accounts for notanble portion of the market share. Also, the country is witnessing gradual adoption of soda ash due to its growing focus on export-oriented industries. For instance, South Korea's semiconductor exports have surged annually, driven by investments in advanced soda ash formulations. Another factor influencing this segment's growth is the influx of foreign expertise and technology. The Korea Institute of Industrial Technology reports that partnerships with international organizations have introduced cost-effective soda ash solutions tailored to local conditions.

Australia and New Zealand represent a niche yet emerging player in the Asia Pacific Soda Ash Market which is contributing marginally to the overall share. Recent bushfires have underscored the need for fortified soda ash materials to mitigate production losses. A key driver of this progress is the adoption of bio-based soda ash mining, which safeguards environmental health during adverse weather conditions. The University of Queensland notes that these products have increased energy efficiency in local buildings. Also, government subsidies aimed at revitalizing rural economies have incentivized builders to invest in advanced soda ash solutions, fostering incremental growth in the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Solvay S.A., Tata Chemicals, Ciech S.A., Shandong Haihua Group, OCI Chemical Corporation, Nirma Limited, Soda Sanayii, and China National Petroleum Corporation (CNPC) are the key players in the Asia Pacific soda ash market.

The Asia Pacific Soda Ash Market is characterized by intense competition, driven by the presence of established multinational corporations and emerging niche players. Companies strive to differentiate themselves through innovation, sustainability, and customer-centric strategies, creating a dynamic and rapidly evolving landscape. Leaders like Tata Chemicals Limited, Solvay S.A., and Nirma Limited dominate the market by leveraging their extensive R&D capabilities and global reach to deliver high-performance solutions. At the same time, smaller firms focus on specialized products that cater to specific industrial segments or address unique challenges such as toxicity and environmental impact. Regulatory pressures and shifting consumer preferences further intensify competition, compelling companies to adopt sustainable practices and transparent labeling.

TOP PLAYERS IN THE MARKET

Tata Chemicals Limited

Tata Chemicals Limited is a global leader in the Asia Pacific Soda Ash Market, renowned for its high-quality soda ash solutions tailored to meet diverse industrial needs. The company specializes in producing premium-grade soda ash with exceptional purity and consistency, making it indispensable for applications like glass manufacturing, detergents, and chemical production. Tata Chemicals’ commitment to sustainability has positioned it as a pioneer in adopting eco-friendly mining practices that align with stringent environmental regulations.

Solvay S.A.

Solvay S.A. plays a pivotal role in the Asia Pacific Soda Ash Market by offering specialized soda ash products designed for niche applications like water treatment, metallurgy, and pulp and paper. Solvay’s emphasis on reducing carbon footprints aligns with its efforts to promote circular economies, making its products a preferred choice for eco-conscious industries.

Nirma Limited

Nirma Limited is a prominent player in the Asia Pacific Soda Ash Market, specializing in the production of advanced soda ash systems for detergents, glass, and chemical manufacturing. Nirma’s vertically integrated business model allows it to maintain control over the entire supply chain, ensuring traceability and compliance with international standards. By prioritizing customer-centric solutions and investing in next-generation soda ash technologies, Nirma continues to strengthen its position as a trusted partner for industrial manufacturers.

TOP STRATEGIES USED BY KEY PLAYERS

Strategic Acquisitions and Partnerships

Key players in the Asia Pacific Soda Ash Market have prioritized strategic acquisitions and partnerships to expand their product portfolios and strengthen their market presence. By acquiring smaller firms specializing in niche soda ash formulations or forming alliances with research institutions, these companies gain access to cutting-edge technologies and innovative solutions.

Investment in Sustainable Practices

Sustainability has emerged as a cornerstone of competitive strategy in the soda ash market. Leading companies are investing heavily in the development of eco-friendly mining practices that reduce environmental impact, improve resource efficiency, and align with regulatory standards.

Emphasis on Research and Development

R&D is a critical driver of innovation in the Asia Pacific Soda Ash Market. Key players are channelling significant resources into exploring novel formulations and advanced extraction processes that improve soda ash performance and application versatility.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Tata Chemicals Limited launched a new line of eco-friendly soda ash products designed to reduce environmental impact. This move aims to address growing concerns about pollution in the Asia Pacific region.

- In June 2023, Solvay S.A. partnered with a leading renewable energy company to develop high-purity soda ash for solar panel manufacturing. This collaboration underscores Solvay’s commitment to advancing sustainable energy practices through innovation.

- In January 2023, Nirma Limited acquired a startup specializing in nano-soda technology. This acquisition strengthens Nirma’s ability to offer high-performance solutions for detergents and chemical applications.

- In September 2022, Aditya Birla Chemicals introduced a range of low-emission soda ash extraction methods aimed at supporting the construction and infrastructure sectors. This initiative aligns with consumer preferences for durable and environmentally friendly products.

- In November 2022, Ciner Group expanded its production facilities in India to increase the supply of high-purity soda ash. This expansion supports the company’s goal of meeting rising demand in the Asia Pacific Soda Ash Market.

MARKET SEGMENTATION

This research report on the Asia Pacific soda ash market has been segmented and sub-segmented based on the following categories.

By Application

- Glass

- Soaps and Detergents

- Chemicals

- Metallurgy

- Pulp and paper

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key opportunities in the Asia Pacific Soda Ash market?

Opportunities lie in the expanding demand for soda ash in industries such as glass manufacturing, chemicals, detergents, and environmental applications across the region.

2. What trends are influencing the growth of the Asia Pacific Soda Ash market?

Key trends include increasing industrialization, the shift toward eco-friendly production methods, and higher demand for soda ash in construction and glass industries.

3. What challenges does the Asia Pacific Soda Ash market face?

Challenges include fluctuating raw material prices, environmental concerns related to production processes, and competition from alternative materials in certain applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]