Asia Pacific Sodium Sulfide Market Size, Share, Growth, Trends, and Forecast Report – Segmented By Product Type (Regular Grade, High Purity Grade), Application, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis from 2025 to 2033

Asia Pacific Sodium Sulfide Market Size

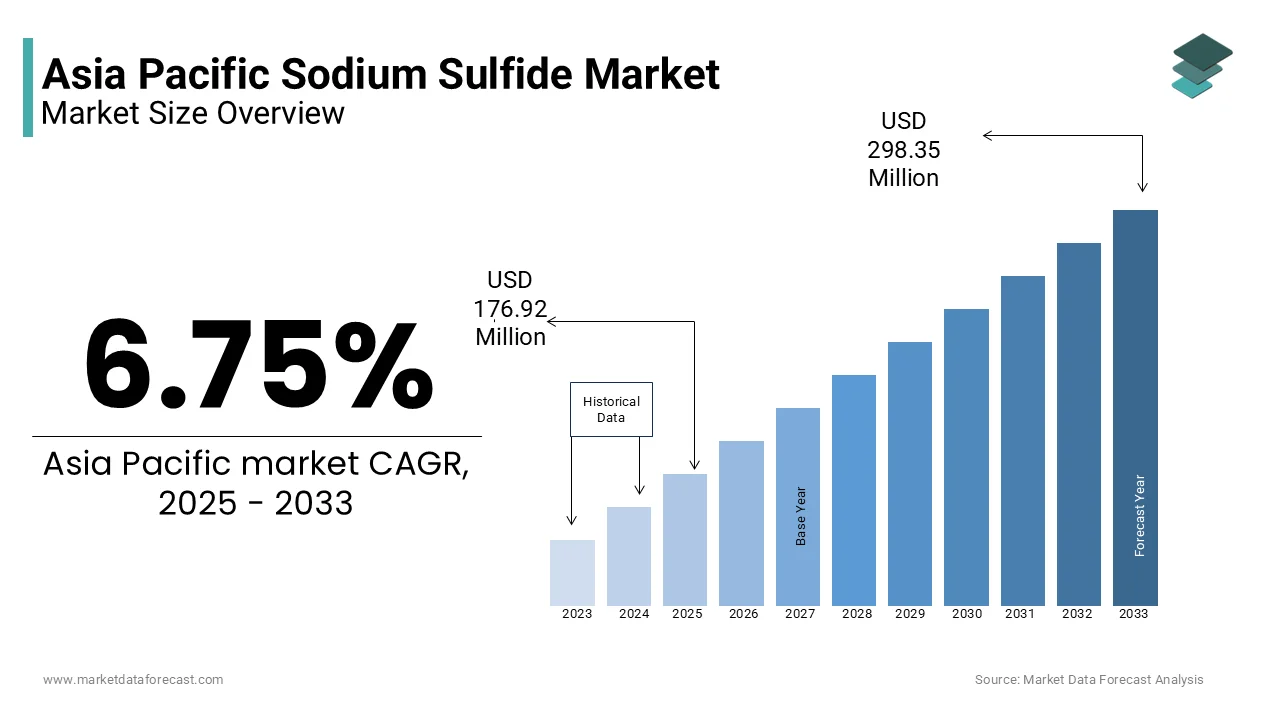

Asia Pacific Sodium Sulfide market size was valued at USD 165.73 million in 2024, and the market size is expected to reach USD 298.35 million by 2033 from USD 176.92 million in 2025. The market's promising CAGR for the predicted period is 6.75%.

The sodium sulfide is a key inorganic chemical compound primarily used in industrial processes such as pulp and paper manufacturing, water treatment, textile dyeing, and mineral processing. Available in various forms including flakes, liquid, and pellets, sodium sulfide plays a crucial role in reducing agents, sulfidation processes, and chemical synthesis across diverse sectors.

A defining characteristic of this market is its deep integration into resource-intensive industries, particularly in countries like China and India where large-scale pulp mills, tanneries, and mining operations drive consistent demand. According to the China National Pulp and Paper Research Institute, sodium sulfide remains indispensable in the Kraft pulping process due to its ability to break down lignin efficiently without compromising fiber quality.

MARKET DRIVERS

Growth in the Pulp & Paper Industry

One of the primary drivers of the Asia Pacific sodium sulfide market is the expansion of the pulp and paper industry, particularly in China and India, where rising consumption of packaging materials and tissue products has led to increased production capacity. Sodium sulfide is a vital component in the Kraft pulping process, where it acts as a delignifying agent is helping separate cellulose fibers from lignin while maintaining fiber strength.

Moreover, the shift toward sustainable forestry practices and recycling of waste paper has reinforced the need for chemical recovery systems that utilize sodium sulfide derivatives. As per the Japan Paper Association, many Japanese mills have reintroduced sulfide-based recovery boilers to improve process economics and reduce environmental impact.

Expansion of Mining and Mineral Processing Activities

Another significant driver shaping the Asia Pacific sodium sulfide market is the increasing demand from the mining and mineral extraction industry, where sodium sulfide is extensively used in froth flotation to recover valuable metal ores such as copper, nickel, and gold. As reported by the Geological Survey of India, the country’s mineral output grew by nearly 8% in 2023, with sodium sulfide playing a key role in selective flotation of complex sulfide ores in Jharkhand and Odisha-based mines. In addition, Australian mining firms have been leveraging sodium sulfide in hydrometallurgical processes to treat polymetallic concentrates. As per the Commonwealth Scientific and Industrial Research Organisation (CSIRO), several new mineral processing plants established in Western Australia in 2023 incorporated advanced sulfide-based flotation circuits to maximize extraction yields.

MARKET RESTRAINTS

Environmental Regulations and Toxicity Concerns

A major restraint affecting the Asia Pacific sodium sulfide market is the growing scrutiny surrounding its environmental impact and handling risks due to its toxicity and potential for hydrogen sulfide gas emissions when exposed to acidic conditions. Governments across the region are implementing stricter regulations on industrial effluent discharge and chemical storage, which increases compliance costs and operational complexities for manufacturers and end-users.

Furthermore, in India, the Central Pollution Control Board issued revised norms requiring all tanneries and chemical processors to implement real-time monitoring of sulfide concentrations in effluents. As per the Confederation of Indian Industry, these requirements have led to increased investment in neutralization technologies and closed-loop systems, adding financial pressure on small and mid-sized users. These regulatory shifts, though beneficial for long-term sustainability, pose short-term challenges for market expansion.

Volatility in Raw Material Prices and Supply Chain Disruptions

Another significant challenge restraining the Asia Pacific sodium sulfide market is the volatility in raw material prices and supply chain disruptions affecting sulfur and caustic soda—two primary inputs in sodium sulfide production. Since sodium sulfide is typically manufactured through the reaction of sodium hydroxide with elemental sulfur or hydrogen sulfide, fluctuations in feedstock availability directly impact production costs and pricing stability.

The environmental crackdowns on chemical manufacturing zones in China and India have led to periodic plant shutdowns, exacerbating raw material shortages. As per the China Chlor-Alkali Industry Association, over 25% of domestic caustic soda suppliers faced temporary closures in 2023 due to non-compliance with emissions standards. These supply-side instabilities make it difficult for sodium sulfide producers to maintain consistent pricing and long-term contracts, dampening investment confidence in the sector.

MARKET OPPORTUNITIES

Increasing Use in Textile Dyeing and Leather Processing

An emerging opportunity in the Asia Pacific sodium sulfide market is the rising adoption of sodium sulfide in textile dyeing and leather processing applications, particularly in India, Bangladesh, and Vietnam. The compound is widely used as a reducing agent in sulfur dye formulations and in chrome liquor reduction for environmentally compliant leather tanning.

According to the India Organic Chemicals Association, over 40% of synthetic dyes produced in India incorporate sodium sulfide-based intermediates, driven by the country's dominance in cotton fabric exports. Additionally, in Bangladesh, the Bangladesh Knitwear Manufacturers and Exporters Association reported that local textile mills consumed over 50,000 metric tons of sodium sulfide in 2023 for vat dyeing and color fixation processes.

Integration in Wastewater Treatment Processes

The expanding wastewater treatment sector presents a significant opportunity for the Asia Pacific sodium sulfide market in industrial cities where sulfide-based precipitation techniques are employed to remove heavy metals such as mercury, cadmium, and lead from effluents. According to the Singapore Environment Agency, over 80% of industrial parks in the country now employ sodium sulfide-based metal scavenging systems to ensure compliance with ultra-low heavy metal discharge limits. In addition, in Thailand, the Pollution Control Department has mandated the use of sulfide reagents in selected metal finishing clusters to improve metal recovery and reduce landfill burden.

MARKET CHALLENGES

Technological Complexity in Safe Handling and Storage

One of the foremost challenges confronting the Asia Pacific sodium sulfide market is the technological complexity involved in ensuring safe handling, transportation, and storage of the compound. According to the Korea Occupational Safety and Health Agency, over 15 incidents involving sodium sulfide were reported in industrial settings between 2021 and 2023 with the need for improved worker training and protective equipment. In Malaysia, the Department of Occupational Safety and Health emphasized the importance of sealed container storage and inert atmosphere handling, which adds to capital expenditure for downstream users.

Moreover, in Indonesia, the Ministry of Industry mandates that all chemical importers and distributors comply with GHS labeling and emergency response protocols, which can delay customs clearance and affect just-in-time manufacturing models. As per the Indian Chemical Council, compliance with these regulations has increased operational costs by up to 10%, discouraging smaller-scale adopters from entering the market.

Availability of Alternative Reducing Agents

Another significant challenge restraining the Asia Pacific sodium sulfide market is the availability of alternative reducing agents such as sodium hydrosulfide (NaSH), ferrous sulfate, and organic thiol compounds, which offer comparable performance with lower handling risks and regulatory burdens.

According to Frost & Sullivan, NaSH has gained traction in mineral processing and water treatment applications due to its safer handling profile and lower propensity to generate hydrogen sulfide gas. In China, the Jiangsu Chemical Industry Association reported that over 20% of pulp mills have partially replaced sodium sulfide with NaSH in their pulping operations to improve workplace safety and reduce odor-related complaints from nearby communities.

Fragmented Regulatory Enforcement Across Countries

The Asia Pacific sodium sulfide market faces regulatory fragmentation, with varying national and local laws governing chemical handling, transportation, and industrial use. While some countries enforce strict emission controls and occupational health standards, others lack comprehensive oversight, creating an uneven playing field that complicates cross-border trade and compliance strategies. According to the Philippines’ Department of Environment and Natural Resources, new chemical safety regulations introduced in 2023 imposed stricter limits on sulfide-containing discharges from textile and tannery units by compelling processors to invest in pre-treatment facilities. Meanwhile, in Indonesia, enforcement remains inconsistent, which is leading to disparities in chemical control effectiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.75% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

afine Group International Co., Ltd., Chaitanya Chemicals, Sankyo Kasei Co., Ltd., Anmol Chemicals Group, Hebei Xinji Chemical Group Co., Ltd., Shaanxi Fuhua Chemical Co., Ltd, Shengli Limited, and, Longfu Group, and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The regular grade sodium sulfide segment was the largest by occupying a prominent share of the Asia Pacific sodium sulfide market share in 2024. One major driver behind this segment’s leadership is the extensive reliance on regular grade sodium sulfide in the Kraft pulping process across China and India. According to the China National Pulp and Paper Research Institute, over 80% of domestic pulp mills continue to utilize regular grade sodium sulfide due to its cost-effectiveness and compatibility with existing recovery boilers.

Additionally, in the leather industry, regular grade sodium sulfide remains the preferred choice for sulfide-based unhairing and chrome reduction processes. Moreover, the mining sector in Indonesia and Australia utilizes regular grade variants for base metal flotation, where reagent efficiency outweighs the need for ultra-pure compositions. These combined factors reinforce regular grade sodium sulfide as the most widely consumed product type in the region.

The high purity grade sodium sulfide is lucratively to register a CAGR of 6.4% in the next coming years. This growth is driven by increasing demand from specialty chemical synthesis, electronic-grade water treatment, and advanced mineral processing operations that require minimal impurities and higher reaction efficiency.

A primary growth catalyst is the expansion of high-end chemical manufacturing in Japan and South Korea, where high purity sodium sulfide is used in pharmaceutical intermediates, fine chemicals, and catalytic reactions requiring controlled sulfur content. Moreover, in Singapore and Malaysia, the rise of semiconductor and microelectronics fabrication has led to greater adoption of high purity sodium sulfide in wastewater treatment systems designed to remove trace heavy metals from ultra-clean manufacturing environments.

By Application Insights

The pulp and paper industry held the 35.4% of the Asia Pacific sodium sulfide market share in 2024. According to the China Pulp and Paper Association, over 75% of the country’s pulp mills rely on sodium sulfide to facilitate lignin breakdown while preserving fiber integrity. In 2023 alone, Chinese paper production exceeded 120 million metric tons by reinforcing the continued dependence on this chemical. Indian mills have also invested in chemical recovery systems that regenerate sodium sulfide from spent liquor, enhancing process economics and sustainability.

The water treatment segment is anticipated to grow with a CAGR of 7.1% in the next coming years. This rapid expansion is driven by increasing regulatory pressure to meet stringent discharge standards for industrial effluent, particularly in urban centers facing water pollution challenges. A key growth driver is the use of sodium sulfide in heavy metal removal from electroplating, semiconductor, and textile dyeing wastewaters. In addition, in Thailand, the Pollution Control Department mandated the use of sulfide reagents in selected industrial clusters to enhance metal recovery and reduce sludge volume compared to conventional lime-based treatments. As per the Thai Textile and Apparel Industry Association, several dyeing factories in Bangkok have begun integrating sodium sulfide into their wastewater management protocols to improve purification efficiency.

REGIONAL ANALYSIS

China led the Asia Pacific sodium sulfide market with 38.5% of share in 2024. One of the main growth drivers is the country’s strong presence in the global pulp and paper industry. According to the China National Pulp and Paper Research Institute, over 90% of Chinese pulp mills utilize sodium sulfide in the Kraft process, ensuring consistent consumption despite fluctuating raw material costs.

Additionally, the mining sector in Inner Mongolia and Yunnan provinces continues to be a major consumer, especially in copper and zinc flotation operations. As per the China Nonferrous Metal Industry Association, sodium sulfide usage in mineral processing rose by 5% in 2023 due to increased exploration activity.

India sodium sulfide market was accounted in holding 22.3% of the share in 2024. The country’s market expansion is fueled by its large-scale leather processing, textile dyeing, and pulp and paper industries, all of which rely heavily on sodium sulfide for chemical reduction and color fixation.

A major growth factor is the leather industry, concentrated in states like Tamil Nadu and West Bengal, where sodium sulfide is extensively used in unhairing and chrome recovery processes. According to the Council for Leather Exports, India exported over USD 3.5 billion worth of leather goods in 2023, much of which was processed using sodium sulfide-based formulations.

Japan is likely to grow with a dominant CAGR throughput the forecast period. One of the key strengths of Japan’s market is its integration of sodium sulfide in advanced wastewater treatment systems.

South Korea sodium sulfide market is attributed in having a prominent growth with the robust demand from the electronics, chemical processing, and municipal wastewater treatment sectors. The country’s compact yet highly developed industrial ecosystem enables swift adoption of advanced chemical treatments and process optimization strategies.

A major growth driver is the electronics manufacturing industry, where sodium sulfide is used in ultra-pure water treatment systems for semiconductor fabrication plants. Additionally, the Ministry of Environment has mandated stricter discharge norms for heavy metals in industrial zones, prompting increased utilization of sodium sulfide in municipal and industrial effluent treatment.

Australia sodium sulfide market is likely to have a significant growth opportunities in the next coming years with its strategic role in mineral processing and metallurgical applications. One of the main drivers is the country’s mining sector, where sodium sulfide is used as a sulfidizing agent in froth flotation circuits. In addition, environmental regulations are pushing for cleaner reagent choices in mineral processing. Australia continues to serve as a model for responsible sodium sulfide utilization in the Asia Pacific region with ongoing exploration and regulatory alignment toward sustainable mining.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

afine Group International Co., Ltd., Chaitanya Chemicals, Sankyo Kasei Co., Ltd., Anmol Chemicals Group, Hebei Xinji Chemical Group Co., Ltd., Shaanxi Fuhua Chemical Co., Ltd, Shengli Limited, and, Longfu Group are the key players in the Asia Pacific sodium sulfide market.

The competition in the Asia Pacific sodium sulfide market is shaped by a mix of global chemical giants and well-established regional manufacturers striving to capture market share through product quality, safety protocols, and supply chain reliability. As industries increasingly prioritize operational efficiency, chemical recovery, and environmental compliance, companies are under pressure to offer optimized sodium sulfide solutions that balance performance with handling safety. The market sees intense rivalry not only in pricing but also in formulation adaptability, particularly among suppliers serving the pulp & paper, leather, and mining sectors. Regulatory developments related to hazardous material management further influence competitive strategies, compelling firms to invest heavily in compliance training, transport innovations, and cleaner alternatives. Additionally, the growing presence of local producers offering cost-effective solutions intensifies the market landscape by requiring global players to continuously innovate and differentiate their offerings to maintain relevance and dominance in this essential industrial chemical sector.

TOP PLAYERS IN THE MARKET

Covestro AG

One of the leading players in the Asia Pacific sodium sulfide market is Covestro AG, a global chemical company known for its broad portfolio of industrial chemicals and reagents. The company has a strong presence across multiple industries in the region, particularly in pulp & paper and water treatment sectors where sodium sulfide plays a critical role in chemical processing and effluent purification.

Kuraray Co., Ltd

Another key player is Kuraray Co., Ltd. , recognized for its expertise in specialty chemicals and functional materials. In the Asia Pacific region, Kuraray supports various industrial applications with customized sodium sulfide formulations tailored for mineral processing and leather manufacturing, ensuring efficiency and compliance with environmental standards.

Aditya Birla Chemicals (Thailand) Limited

Aditya Birla Chemicals (Thailand) Limited is also a major participant, known for its extensive production capabilities and distribution network across Southeast Asia. With a focus on industrial-grade chemicals, the company serves diverse sectors including textiles, pulp & paper, and mining, contributing significantly to regional supply stability and formulation innovation.

TOP STRATEGIES USED BY KEY PLAYERS

A primary strategy adopted by leading companies in the Asia Pacific sodium sulfide market is product differentiation and purity customization by offering both regular and high-purity grades to cater to varied industry requirements ranging from bulk industrial use to precision chemical synthesis.

Another significant approach is expanding regional logistics and supply chain infrastructure , allowing firms to ensure timely delivery, reduce handling risks, and improve customer accessibility across remote and urban markets in countries like India, Indonesia, and Vietnam.

Companies are increasingly engaging in technical collaboration with end-use industries and research institutions to develop safer application methods, enhance process compatibility, and align with evolving regulatory expectations in wastewater and mineral extraction segments.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Covestro launched a new line of stabilized sodium sulfide solutions designed specifically for controlled-release applications in wastewater treatment, targeting semiconductor and electronics manufacturers in South Korea and Japan. This initiative aimed at improving metal scavenging efficiency while minimizing hydrogen sulfide emissions during processing.

- In June 2023, Kuraray expanded its existing facility in Osaka to include a dedicated unit for high-purity sodium sulfide production, reinforcing its ability to serve Japanese pharmaceutical and fine chemical industries that require ultra-low impurity content for catalytic and synthetic reactions.

- In November 2024, Aditya Birla Chemicals entered into a strategic partnership with a leading Indian tannery association to co-develop safer handling protocols and formulation guidelines for sodium sulfide-based unhairing processes, aligning with the country’s push for sustainable leather manufacturing practices.

- In March 2023, BASF established a regional technical service center in Singapore focused on industrial chemical applications, including sodium sulfide usage in ore flotation and heavy metal precipitation, enhancing support for customers across Southeast Asia.

- In August 2024, Mitsubishi Chemical introduced a new range of encapsulated sodium sulfide granules for use in Australian mining operations, catering to mineral processors seeking dust-free, non-hazardous reagent forms that comply with occupational health and safety regulations.

MARKET SEGMENTATION

This research report on the Asia Pacific sodium sulfide market has been segmented and sub-segmented based on the following categories.

By Product Type

- Regular Grade

- High Purity Grade

By Application

- Leather Processing

- Pulp & Paper

- Chemical Processing

- Water Treatment

- Ore Processing

- Others (Food Preservative etc.)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key opportunities in the Asia Pacific sodium sulfide market?

The increasing demand from leather processing, paper & pulp, and textile industries, along with expanding industrialization in countries like India and China, presents major growth opportunities.

2. What trends are shaping the Asia Pacific sodium sulfide market?

Growing adoption of low-iron and purified grades, rising investments in wastewater treatment, and eco-friendly chemical manufacturing are notable trends in the market.

3. What challenges does the Asia Pacific sodium sulfide market face?

Challenges include environmental concerns related to toxic emissions, strict regulatory frameworks, and fluctuations in raw material availability and prices.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com