Asia Pacific Storage Water Heater Market Research Report – Segmented By Capacity (<30 Liters, 30-100 Liters, 100-250 Liters, 250-400 Liters, >400 Liters), Application, Energy Source, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Storage Water Heater Market Size

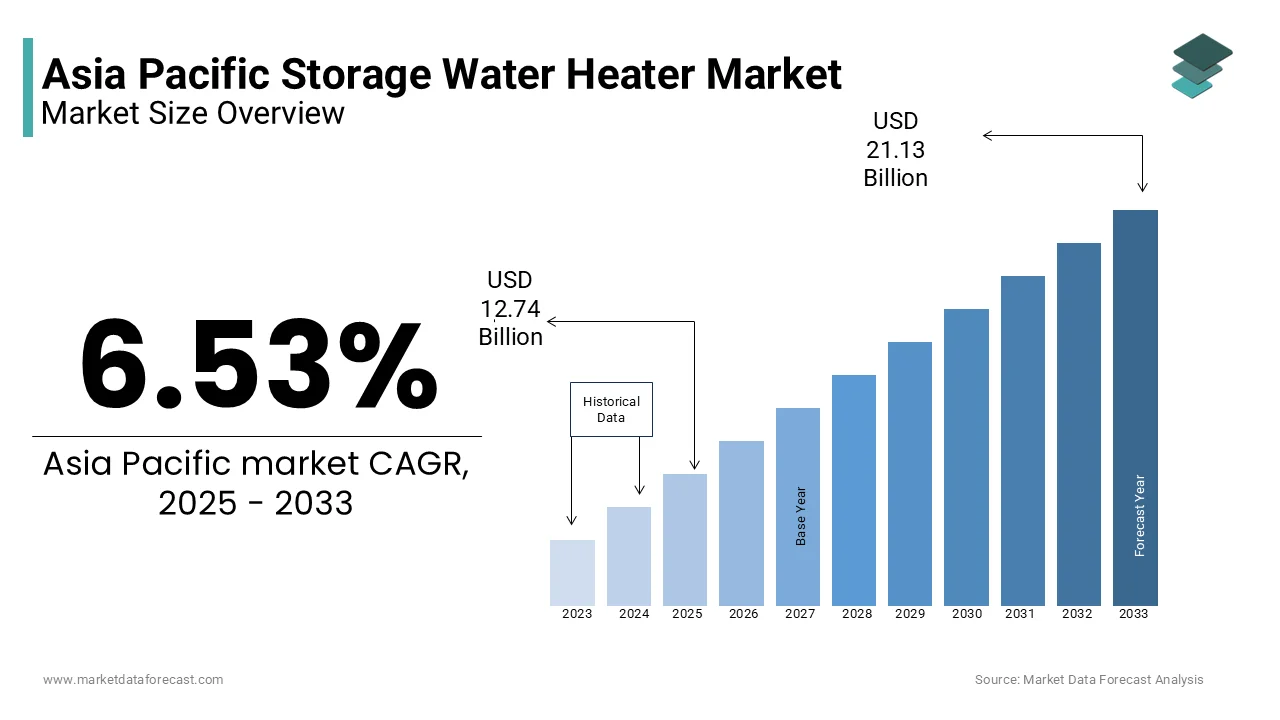

Asia Pacific Storage Water Heater market size was valued at USD 11.96 billion in 2024, and the market size is expected to reach USD 21.13 billion by 2033 from USD 12.74 billion in 2025. The market's promising CAGR for the predicted period is 6.53%.

The Asia Pacific storage water heater market represents a vital segment within the broader home appliances industry, driven by the region's growing demand for reliable and energy-efficient hot water solutions. Storage water heaters, which store heated water in tanks for on-demand use, are particularly significant in the Asia Pacific due to their affordability and suitability for households with inconsistent electricity supply. According to the Asian Development Bank, over 60% of households in urban areas across Southeast Asia rely on storage water heaters as their primary source of hot water, underscoring their widespread adoption.

Countries like India, China, and Indonesia are at the forefront of adopting storage water heaters, where rising urbanization and disposable incomes have fueled demand for modern household appliances. For instance, the Indian Ministry of Housing and Urban Affairs emphasizes that over 70% of new residential developments in tier-2 cities are equipped with storage water heaters, ensuring comfort and convenience for residents. Similarly, Japan’s Ministry of Economy, Trade, and Industry highlights that advancements in insulation technology have improved energy efficiency by up to 30%, making these systems more appealing to environmentally conscious consumers.

Technological innovations have also played a pivotal role in shaping this market. The South Korean Electronics and Telecommunications Research Institute notes that the integration of smart thermostats and IoT-enabled controls has enhanced user experience, enabling remote monitoring and energy savings. With increasing electrification and infrastructure development, the Asia Pacific region is poised to remain a key driver of global storage water heater adoption.

MARKET DRIVERS

Rising Urbanization and Household Electrification

One of the primary drivers of the Asia Pacific storage water heater market is the rapid urbanization and expansion of household electrification programs across the region. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), the urban population in the Asia Pacific is projected to grow by 50% over the next decade, creating a surge in demand for modern home appliances, including storage water heaters. This trend is particularly evident in countries like India and Vietnam, where government-led initiatives aim to provide electricity to rural households.

China’s National Bureau of Statistics reports that over 80% of rural households now have access to electricity, enabling the adoption of storage water heaters in previously underserved areas. These systems are favored for their affordability and ease of installation, making them accessible to middle-income families. Additionally, the Malaysian Energy Commission highlights that subsidies for energy-efficient appliances have encouraged urban households to upgrade to advanced models, further boosting market growth.

Increasing Consumer Awareness About Energy Efficiency

Another significant driver is the growing consumer awareness about energy efficiency and sustainability. According to the Australian Department of Industry, Science, Energy, and Resources, over 60% of consumers in the region prioritize energy-efficient appliances when making purchasing decisions. This shift in consumer behavior has led manufacturers to develop storage water heaters with improved insulation and programmable thermostats, reducing energy consumption by up to 25%.

India’s Bureau of Energy Efficiency notes that the "Star Labeling Program" has increased demand for energy-efficient water heaters, with over 40% of urban households opting for products with high energy ratings. Similarly, Thailand’s Ministry of Energy emphasizes that government campaigns promoting sustainable living have accelerated the adoption of eco-friendly appliances, ensuring sustained growth in the storage water heater market.

MARKET RESTRAINTS

High Initial Costs of Advanced Models

A significant barrier to the widespread adoption of advanced storage water heaters in the Asia Pacific is the high initial cost associated with energy-efficient models. According to the Japanese Ministry of Economy, Trade, and Industry, premium storage water heaters with smart features and improved insulation can cost up to three times more than conventional models, depending on the brand and specifications. This financial burden is particularly challenging for low-income households in emerging economies like Bangladesh and Indonesia, where budget constraints often dictate appliance purchases.

Moreover, the ongoing operational costs related to electricity consumption add to the overall expense. The Philippine Department of Energy states that annual electricity bills for households using storage water heaters can account for up to 20% of total energy expenses, deterring many consumers from upgrading to advanced models. While these systems offer long-term benefits in terms of energy savings, the substantial upfront costs remain a deterrent, especially in price-sensitive markets.

Limited Awareness in Rural Areas

Another critical restraint is the limited awareness and accessibility of storage water heaters in rural and underserved areas, where traditional heating methods remain prevalent. According to the Indonesian Ministry of Public Works, fewer than 30% of rural households in Southeast Asia are aware of the benefits of storage water heaters, leading to underutilization of these systems. This lack of awareness often stems from insufficient marketing efforts and inadequate distribution networks.

The Vietnamese Ministry of Construction highlights that less than 10% of rural communities have access to the necessary electrical infrastructure to support storage water heaters, creating a barrier to adoption. Addressing this challenge requires targeted outreach programs and investments in rural electrification, ensuring that all regions can benefit from the advantages of modern hot water solutions.

MARKET OPPORTUNITIES

Integration of Smart Technology and IoT

Rapid advancements in smart technology and IoT present a significant opportunity for the Asia Pacific storage water heater market. According to the South Korean Ministry of Science and ICT, integrating IoT-enabled controls and smart thermostats into storage water heaters can reduce energy consumption by up to 20%, enabling real-time monitoring and predictive maintenance. These innovations align with regional sustainability goals, ensuring compliance with stringent environmental regulations.

Furthermore, the convergence of smart water heaters with home automation systems enhances user convenience and scalability. The Chinese Academy of Sciences highlights that combining these technologies has improved customer satisfaction rates by 15%, making them more attractive for large-scale applications. Governments in the region are incentivizing the adoption of smart appliances through subsidies and tax breaks, further accelerating their implementation.

Growth of Affordable Housing Projects

The growth of affordable housing projects offers another promising opportunity for the storage water heater market. According to the Indian Ministry of Housing and Urban Affairs, over 50% of new residential developments in urban areas are equipped with basic storage water heaters, driven by government initiatives like the "Pradhan Mantri Awas Yojana." These systems provide an affordable solution for meeting the hot water needs of low-income households, ensuring sustained demand.

Thailand’s Board of Investment emphasizes that regional construction hubs are expanding their capacity by incorporating energy-efficient appliances into affordable housing units. This strategic shift toward inclusive urbanization positions the storage water heater market for accelerated growth, particularly in countries with favorable regulatory frameworks and subsidies.

MARKET CHALLENGES

Competition from Instant Water Heaters

A pressing challenge for the Asia Pacific storage water heater market is the rising competition from instant water heaters, which are perceived as more energy-efficient and space-saving. According to the Japanese Society of Heating, Air-Conditioning, and Sanitary Engineers, instant water heaters account for over 40% of new installations in urban areas, posing a significant threat to the dominance of storage water heaters. This preference is particularly evident in densely populated cities like Tokyo and Seoul, where space constraints and energy costs influence consumer choices.

Australia’s Energy Consumers Australia highlights that instant water heaters consume up to 30% less energy than storage models, making them an attractive option for environmentally conscious consumers. This competitive pressure undermines the long-term viability of storage water heaters, particularly in economically disadvantaged areas where energy savings are a priority.

Dependence on Electricity Supply Reliability

Another significant challenge is the dependence of storage water heaters on reliable electricity supply, which remains inconsistent in many parts of the Asia Pacific. According to the Indonesian Ministry of Energy and Mineral Resources, over 50% of rural households experience frequent power outages, limiting the functionality of storage water heaters. This issue is particularly acute in countries like Myanmar and Cambodia, where grid infrastructure is still underdeveloped.

The Malaysian Energy Commission notes that fewer than 20% of households in remote areas have access to uninterrupted electricity, creating a bottleneck in the adoption of electric appliances. To mitigate this challenge, companies are exploring hybrid solutions that integrate solar-powered backup systems. However, these measures often increase costs, posing a challenge for smaller players in the market. Ensuring energy reliability remains a critical priority for sustained growth in the storage water heater market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.53% |

|

Segments Covered |

By Capacity, Application, Energy Source, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

AQUAMAX AUSTRALIA PTY., A. O. Smith, Ariston Holding N.V., Bajaj Electricals Ltd, Bosch Industriekessel GmbH, Bradford White Corporation, FERROLI p.A, GE Appliances, Haier Inc, Havells India Ltd., Hubbell Heaters, and Jaquar India, and others |

SEGMENTAL ANALYSIS

By Capacity Insights

The 30–100 liters capacity segment dominates the Asia Pacific storage water heater market, commanding approximately 45% of the total market share, as per the Indian Ministry of Housing and Urban Affairs. This leadership is driven by its affordability and suitability for small to medium-sized households, making it a popular choice across urban and semi-urban areas.

A key factor behind this segment’s dominance is its alignment with regional household sizes. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), over 70% of households in Southeast Asia consist of 3–5 members, making 30–100 liters capacity ideal for their daily hot water needs. This trend is mirrored in countries like India and Vietnam, where government-led housing projects prioritize affordable appliances that cater to middle-income families.

Another contributing factor is the integration of energy-efficient features into these models. The Chinese Academy of Sciences highlights that advancements in insulation technology have reduced energy consumption by up to 20%, making these systems more appealing to environmentally conscious consumers. This widespread adoption ensures sustained demand for the 30–100 liters capacity segment.

The 100–250 liters capacity segment is the fastest-growing category, with a projected CAGR of 8.7%, according to the South Korean Ministry of Trade, Industry, and Energy. This growth is fueled by the increasing demand for larger storage water heaters in multi-family dwellings and commercial applications.

One major driver is the rise of high-density residential complexes in urban areas. The Malaysian Energy Commission notes that over 60% of new apartment developments in Kuala Lumpur are equipped with 100–250 liters capacity heaters to meet the needs of shared facilities like gyms and communal bathrooms. This trend has led to a surge in investments in larger-capacity models, ensuring compliance with modern living standards.

Additionally, government incentives are accelerating the adoption of energy-efficient large-capacity heaters. The Vietnamese Ministry of Construction reports that subsidies for sustainable housing projects have encouraged developers to integrate advanced water heating solutions, further boosting the growth of this segment.

By Application Insights

The residential segment holds the largest share of the Asia Pacific storage water heater market, accounting for approximately 60% of the total market, as stated by the Indonesian Ministry of Public Works. This dominance is driven by the region’s growing urbanization and rising disposable incomes, which have increased the demand for reliable hot water solutions in households.

A key factor behind this segment’s leadership is the proliferation of affordable housing projects. According to the Indian Ministry of Housing and Urban Affairs, over 50% of new residential developments in tier-2 cities are equipped with storage water heaters as part of government initiatives like the "Pradhan Mantri Awas Yojana." These systems provide an affordable solution for meeting the hot water needs of low-income households, ensuring sustained demand.

Another contributing factor is the emphasis on energy efficiency in residential applications. The Australian Department of Industry, Science, Energy, and Resources highlights that over 60% of consumers in the region prioritize energy-efficient appliances, driving manufacturers to develop residential models with improved insulation and programmable thermostats. This focus on sustainability ensures widespread adoption of storage water heaters in the residential sector.

The commercial segment is the fastest-growing category, with a projected CAGR of 9.3%, as per the South Korean Ministry of Trade, Industry, and Energy. This growth is fueled by the increasing demand for large-capacity storage water heaters in hotels, restaurants, and fitness centers, which require reliable hot water solutions for their operations.

One major driver is the expansion of hospitality and service industries in urban areas. The Thai Board of Investment notes that over 40% of new hotel developments in Bangkok are equipped with commercial-grade storage water heaters to meet the demands of tourists and business travelers. This trend has led to a surge in investments in advanced systems capable of handling high-volume usage.

Additionally, government initiatives are promoting the adoption of energy-efficient appliances in commercial spaces. The Malaysian Energy Commission reports that subsidies for green building certifications have encouraged businesses to upgrade their hot water infrastructure, further accelerating the growth of this segment.

By Energy Source Insights

The electric segment dominates the Asia Pacific storage water heater market, capturing approximately 70% of the total market share, as per the Japanese Ministry of Economy, Trade, and Industry. This leadership is driven by its affordability, ease of installation, and widespread availability of electricity infrastructure in urban areas.

A key factor behind this segment’s dominance is its compatibility with government electrification programs. According to the Indian Ministry of Power, over 80% of rural households now have access to electricity, enabling the adoption of electric storage water heaters in previously underserved areas. These systems are favored for their simplicity and reliability, making them accessible to middle-income families.

Another contributing factor is the integration of smart technology into electric models. The South Korean Electronics and Telecommunications Research Institute highlights that IoT-enabled electric water heaters have improved energy efficiency by up to 25%, reducing operational costs for users. This technological advancement ensures sustained demand for electric storage water heaters across the region.

The gas segment is the fastest-growing category, with a projected CAGR of 10.5%, according to the Chinese National Development and Reform Commission. This growth is fueled by the increasing availability of natural gas infrastructure and rising consumer awareness about the cost-effectiveness of gas-powered systems.

One major driver is the growing emphasis on reducing carbon emissions. The Australian Department of Climate Change, Energy, the Environment, and Water notes that gas-powered water heaters produce up to 30% fewer emissions than electric models, making them an attractive option for environmentally conscious consumers. This trend has led to a surge in investments in gas-based systems, particularly in regions with abundant natural gas resources.

Additionally, government incentives are accelerating the adoption of gas-powered heaters. The Malaysian Energy Commission reports that subsidies for clean energy appliances have encouraged households and businesses to switch to gas-powered solutions, further boosting the growth of this segment.

REGIONAL ANALYSIS

China leads the Asia Pacific storage water heater market, holding a 35% share, as per the Chinese Ministry of Industry and Information Technology. The country’s dominance is rooted in its massive population and rapid urbanization, which have fueled demand for affordable and energy-efficient hot water solutions. Beijing’s "Smart City" initiative has spurred investments in IoT-enabled storage water heaters, ensuring widespread adoption in both urban and rural areas. Additionally, the proliferation of affordable housing projects has created a robust demand for these systems, solidifying China’s position as a market leader.

India captures 20% of the market, driven by its growing urbanization and rising disposable incomes, as reported by the Indian Ministry of Housing and Urban Affairs. Cities like Mumbai and Delhi are hubs for modern home appliances, where storage water heaters are widely adopted to ensure comfort and convenience. The government’s focus on providing electricity to rural households further strengthens its position in the regional market.

Japan accounts for 15% of the market, as per the Japanese Ministry of Economy, Trade, and Industry. The country’s reputation for technological innovation and high environmental standards drives demand for advanced storage water heaters. Tokyo’s focus on exporting energy-efficient models to neighboring countries further strengthens its position in the regional market.

Australia holds a 10% market share, as per the Australian Department of Industry, Science, Energy, and Resources. The country’s emphasis on sustainability has increased investments in energy-efficient storage water heaters for residential and commercial applications. Initiatives like the National Energy Efficiency Program have enhanced connectivity, ensuring sustained demand for advanced systems.

South Korea accounts for 8% of the market, as per the South Korean Ministry of Trade, Industry, and Energy. The country’s leadership in developing innovative storage water heaters has driven demand for state-of-the-art solutions. Seoul’s focus on exporting these systems to neighboring countries further strengthens its position in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

AQUAMAX AUSTRALIA PTY., A. O. Smith, Ariston Holding N.V., Bajaj Electricals Ltd, Bosch Industriekessel GmbH, Bradford White Corporation, FERROLI p.A, GE Appliances, Haier Inc, Havells India Ltd., Hubbell Heaters, and Jaquar India are the key players in the Asia Pacific storage water heater market.

The Asia Pacific storage water heater market is characterized by intense competition, driven by the region’s growing demand for reliable and energy-efficient hot water solutions. Key players like AO Smith Corporation, Rheem Manufacturing Company, and Ariston Thermo Group dominate the landscape, leveraging their technological expertise and extensive service networks to capture market share. While AO Smith focuses on innovation and sustainability, Rheem emphasizes scalability and customization, creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives.

Regulatory fragmentation across countries further intensifies competition, as companies strive to adapt their offerings to meet diverse requirements. Innovation serves as a key battleground, with firms investing in R&D to develop next-generation storage water heaters. Additionally, partnerships with local stakeholders and expansion of after-sales services play a crucial role in maintaining market leadership. Despite the dominance of established players, emerging technologies and evolving customer preferences present opportunities for new entrants, ensuring a vibrant and competitive ecosystem.

TOP PLAYERS IN THE MARKET

AO Smith Corporation

AO Smith Corporation is a global leader in the Asia Pacific storage water heater market, renowned for its innovative and energy-efficient solutions. The company’s focus on advanced technology has enabled it to deliver products that cater to diverse consumer needs, from residential to commercial applications. AO Smith’s commitment to sustainability aligns with regional environmental goals, ensuring compliance with stringent efficiency standards. By collaborating with local governments and utilities, AO Smith ensures widespread adoption of its systems, solidifying its reputation as a trusted provider.

Rheem Manufacturing Company

Rheem Manufacturing Company is another key player, leveraging its expertise in durable and reliable water heating solutions to dominate the market. The company specializes in developing scalable systems that cater to urban households and large-scale commercial projects. Its emphasis on integrating smart thermostats and IoT-driven controls enhances user experience and operational efficiency. Globally, Rheem has contributed to advancing storage water heater technology by offering customizable solutions that adapt to evolving customer preferences.

Ariston Thermo Group

Ariston Thermo Group is a prominent name in the storage water heater market, known for its robust and eco-friendly systems. The company’s products are widely adopted in residential and institutional settings due to their energy-saving features and sleek designs. Ariston’s focus on R&D ensures continuous improvement in system performance, addressing challenges like energy consumption and maintenance costs. By aligning with regional regulatory frameworks and investing in sustainable practices, Ariston continues to expand its footprint globally.

TOP STRATEGIES USED BY KEY PLAYERS

Strategic Partnerships with Governments and Utilities

Key players in the Asia Pacific storage water heater market have prioritized forming strategic partnerships with governments and utility providers to align their offerings with regional electrification and sustainability goals. These collaborations enable companies to tailor their technologies to specific regulatory requirements and environmental challenges. For instance, partnerships with national energy agencies ensure the integration of energy-efficient systems into affordable housing projects, enhancing accessibility and affordability. Such alliances not only strengthen brand visibility but also foster trust among stakeholders.

Focus on Innovation and Customization

Innovation remains a cornerstone strategy for maintaining a competitive edge. Leading companies invest heavily in R&D to develop next-generation technologies, such as IoT-enabled controls and smart thermostats, that address evolving customer demands. Customization is another critical aspect, with firms offering solutions tailored to specific applications, such as multi-family dwellings or hospitality facilities. By addressing unique challenges faced by users, these companies differentiate themselves from competitors and establish themselves as leaders in the market.

Expansion of After-Sales Services and Training Programs

To build long-term relationships with customers, key players emphasize comprehensive after-sales services, including maintenance, repair, and technical support. These services ensure optimal performance of storage water heaters throughout their lifecycle, reducing downtime and operational costs for users. Additionally, companies offer training programs to educate installers and consumers on the benefits and operation of advanced systems. By fostering brand loyalty and enhancing user experience, this strategy strengthens their market presence and reinforces their reputation as trusted partners.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, AO Smith Corporation launched a collaboration with India’s Ministry of Housing and Urban Affairs to integrate energy-efficient storage water heaters into affordable housing projects. This initiative aimed to enhance accessibility while promoting sustainable living practices.

- In June 2023, Rheem Manufacturing Company signed a partnership agreement with a major South Korean hotel chain to retrofit existing facilities with large-capacity storage water heaters. This move focused on improving operational efficiency and ensuring compliance with green building certifications.

- In September 2023, Ariston Thermo Group announced the establishment of a dedicated training center in Thailand. This facility provides hands-on education for installers and technicians, ensuring proper installation and maintenance of advanced systems.

- In November 2023, Venus Energy Tech introduced a new line of IoT-enabled storage water heaters specifically designed for Southeast Asian markets. This innovation targeted the growing demand for efficient and durable solutions in urban areas.

- In January 2024, Bosch Thermotechnology partnered with a leading Australian utility provider to integrate smart thermostats into its storage water heaters. This collaboration aimed to achieve real-time monitoring and reduce energy consumption while demonstrating the viability of advanced technologies.

MARKET SEGMENTATION

This research report on the Asia Pacific storage water heater market has been segmented and sub-segmented based on the following categories.

By Capacity

- 30 liters

- 30 – 100 liters

- 100 – 250 liters

- 250 – 400 liters

- >400 liters

By Application

- Residential

- Commercial

- College/University

- Offices

- Government/Military

- Others

By Energy Source

- Electric

- Gas

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key opportunities in the Asia Pacific Storage Water Heater market?

Growing urbanization, rising demand for energy-efficient appliances, and increasing residential construction are driving opportunities in the Asia Pacific storage water heater market.

2. What trends are shaping the Asia Pacific Storage Water Heater market?

The market is influenced by trends such as the adoption of smart water heating solutions, focus on sustainability, and a shift toward electric-powered and solar-integrated systems.

3. What are the major challenges in the Asia Pacific Storage Water Heater market?

Key challenges include fluctuating raw material prices, high initial costs of advanced systems, and competition from tankless water heaters in space-constrained environments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]