Asia Pacific Stylus Pen Market Size, Share, Trends & Growth Forecast Report By Product (Capacitive Stylus, Active Stylus), Distribution Channel, Application, End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Stylus Pen Market Size

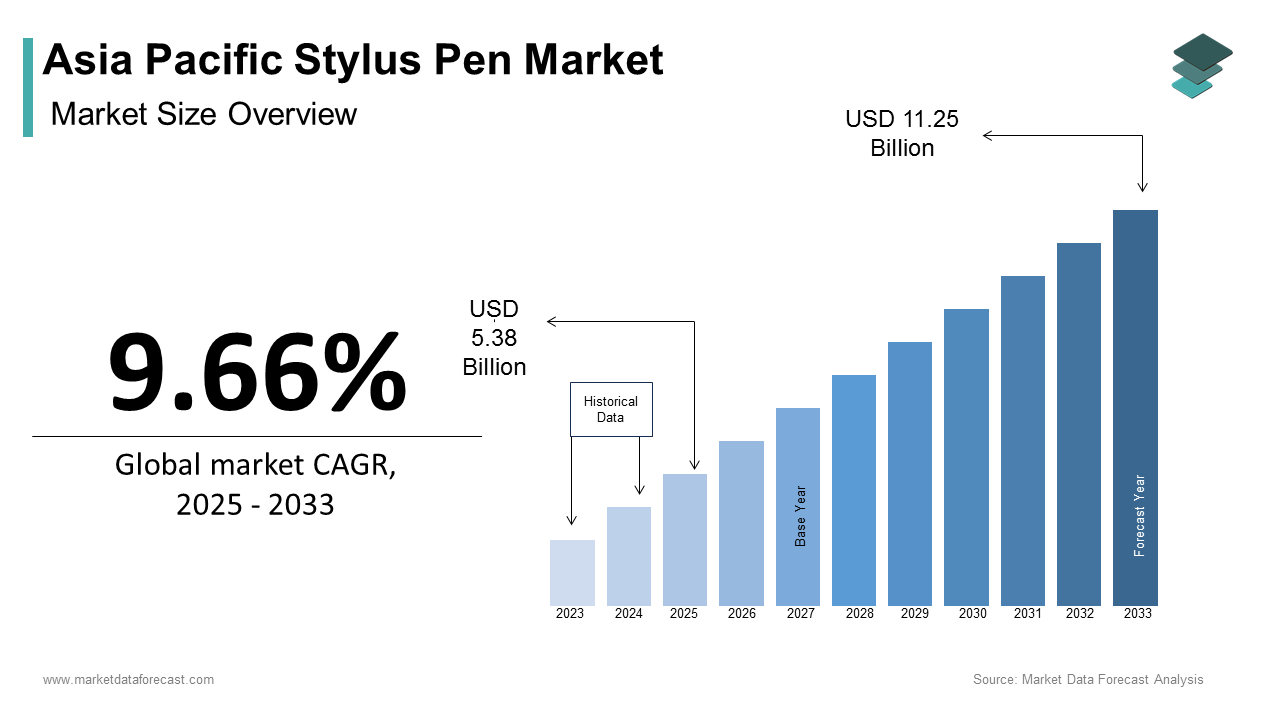

The Asia Pacific Stylus Pen Market size was calculated to be USD 4.91 billion in 2024 and is anticipated to be worth USD 11.25 billion by 2033, from USD 5.38 billion in 2025, growing at a CAGR of 9.66% during the forecast period.

The Asia Pacific stylus pen market growth is driven by the rising adoption of touchscreen devices across educational, professional, and creative sectors thereby boosting demand for precise and user-friendly digital writing tools such as stylus pens. These tools have become increasingly integral across professional creative fields, educational institutions, and personal productivity applications. The region has emerged as a major growth hub due to the o rising adoption of smart devices along with expanding education technology initiatives and growing content creation ecosystems. Singapore and South Korea have implemented nationwide classroom digitization initiatives which significantly increased demand for stylus-compatible learning devices and supported the integration of digital tools in education. Over 120 million students have been enrolled in digitally supported learning programs since 2022. In Japan, the procurement of digital art tablets for vocational training programs has increased particularly in design and animation schools. Additionally, consumer electronics manufacturers like Samsung, Xiaomi, and Huawei have integrated active stylus support into their flagship tablet models which further stimulates regional demand.

MARKET DRIVERS

Expansion of Digital Education Initiatives

The rapid expansion of digital education and e-learning platforms is one of the primary drivers fueling the Asia Pacific stylus pen market. Governments across the region are investing heavily in equipping schools, colleges, and vocational training centers with digital infrastructure that supports interactive learning through tablets and stylus-compatible software. In India, the Ministry of Education’s "Digital India" initiative has led to the distribution of over 50 million tablets to students in government-run schools since 2021. More than 60.98% of these devices are used in conjunction with stylus pens to facilitate note-taking, diagram drawing, and handwriting recognition tasks. In Indonesia, the Ministry of Education and Culture has partnered with local tech firms to deploy stylus-enabled tablets in rural schools to improve engagement and accessibility.

Surge in Creative Content Creation and Remote Work

The boom in digital content creation and remote work environments is another powerful catalyst behind the growth of the stylus pen market in the Asia Pacific. Stylus pens have evolved from artistic tools to essential peripherals in everyday workflows as more professionals engage in digital illustration, graphic design, video editing, and virtual collaboration. The number of freelance creators and remote workers increased by nearly 40.43% between 2020 and 2023. Many of these individuals rely on stylus pens for precise input on drawing tablets and convertible laptops. In Japan, Wacom and Huion have seen significant uptake in their premium stylus offerings among small studios and independent designers. Meanwhile, Vietnamese and Filipino freelancers contributing to global gig economy platforms are increasingly purchasing stylus-compatible tablets to improve their competitiveness.

MARKET RESTRAINTS

High Cost of Premium Stylus Pens

The high cost of premium stylus pens which are equipped with advanced features like pressure sensitivity, tilt detection, and palm rejection remains a key restraint to the growth of the Asia Pacific stylus pen market thereby limiting accessibility for cost-sensitive consumers and educational institutions. Over 70.92% of potential buyers found branded active styluses priced above USD 50 to be prohibitively expensive compared to passive or generic alternatives. In India, despite the rising availability of stylus-compatible tablets, many consumers opt for cheaper capacitive styluses that lack precision and functionality. Chinese e-commerce platform data from Taobao indicated a 45.05% higher sales volume for sub-USD 20 stylus options compared to high-end brands. Affordability will remain a critical limitation to broader market penetration in the region until pricing becomes more accessible and differentiation in performance is communicated.

Compatibility and Ecosystem Fragmentation

Fragmentation in device compatibility and ecosystem-specific stylus requirements presents another significant challenge for the Asia Pacific stylus pen market. Stylus pens often rely on proprietary protocols to function optimally with specific hardware brands, unlike universal input devices such as keyboards which limit cross-device usability and increase overall costs for users. This fragmentation restricts consumer choice and creates switching barriers for users who own multiple devices from different manufacturers. In Australia and New Zealand, educators within multi-platform school districts face logistical difficulties in managing stylus inventory due to differing specifications. In addition, smaller hardware vendors struggle to integrate stylus support without licensing fees from larger ecosystem providers. The lack of standardized communication protocols hampers market growth and prevents third-party innovation while keeping the stylus pen market concentrated primarily around dominant device manufacturers rather than fostering broader ecosystem interoperability.

MARKET OPPORTUNITIES

Integration with Augmented Reality (AR) and Virtual Whiteboarding Tools

An emerging opportunity shaping the Asia Pacific stylus pen market is its integration with augmented reality (AR) applications and virtual whiteboarding solutions. Stylus pens are evolving beyond traditional input tools to become precision instruments for spatial interaction as businesses, educators and creatives adopt AR-driven platforms for collaborative design, remote teaching, and immersive training. In Japan, startups like Tactile Studio and Dentsu have developed AR-based drawing interfaces that allow architects and product designers to sketch directly in three-dimensional space using stylus-enabled tablets and headsets. In South Korea, enterprise collaboration platforms such as Zepeto Workspace and Naver Z have incorporated stylus-driven annotation and ideation features to enhance remote team interactions. Meanwhile, Indian edtech firms are experimenting with stylus-assisted AR tutorials for engineering and medical students.

Rise of Hybrid Learning and Remote Collaboration Devices

The growing prevalence of hybrid learning and remote collaboration setups has created a strong opportunity for the Asia Pacific stylus pen market. Schools, universities,s, and corporate entities are increasingly adopting digital whiteboards, convertibles, and dual-screen notebooks that support stylus input while elevating the importance of stylus pens in both educational and business environments. In Thailand, they launched a pilot program integrating stylus-enabled smartbooks into public secondary schools to enhance student participation. In corporate settings, multinational companies headquartered in Sydney and Melbourne reported a doubling in stylus pen procurement for virtual meetings and brainstorming sessions. Lenovo and Huawei introduced new lines of enterprise-grade stylus pens tailored for multitasking across split-screen presentations and handwritten notes. These developments represent how the shift toward flexible, digital-first learning and working environments is reinforcing the position of stylus pens as indispensable tools in modern productivity ecosystems.

MARKET CHALLENGES

Rapid Technological Obsolescence and Limited Lifespan

Rapid technological obsolescence and limited product lifespan pose a significant challenge to the Asia Pacific stylus pen market as they erode long-term consumer confidence and discourage repeat purchases. Stylus pens, especially active models equipped with internal sensors and batteries often become outdated quickly due to frequent hardware and software updates, unlike more durable input devices such as keyboards and mice. This attrition rate contributes to low replacement cycles and apprehension among consumers about making recurring investments. In resource-constrained markets like India and the Philippines, limited education budgets make it challenging for institutions to replace non-functional styluses while adding to the financial strain and hindering widespread adoption. Moreover, the absence of widespread repair networks and spare parts availability further exacerbates the problem. Unless manufacturers introduce modular designs or extend service life spans through firmware enhancements these technological perishability will continue to act as a drag on market growth in the region.

Lack of Standardized Input Recognition Across Platforms

Lack of standardized input recognition across operating systems and device categories is another pressing challenge confronting the Asia Pacific stylus pen market. Different manufacturers use proprietary technologies to implement stylus functionality which leads to inconsistent performance and feature variations that confuse end-users and hinder widespread adoption. Android, I, OS, and Windows devices interpret stylus inputs differently thus affecting factors such as latency, pressure sensitivity levels, and gesture commands. This inconsistency makes it difficult for users to switch between devices without experiencing variations in responsiveness and accuracy. In Malaysia and Indonesia educators utilizing mixed-device classrooms face technical challenges when deploying stylus-based assessments due to incompatible handwriting recognition engines. Additionally, app developers must invest extra resources to optimize stylus functionality across fragmented platforms along with slowing down software support and reducing overall user experience uniformity. The stylus pen market may struggle to achieve seamless cross-compatibility and mass appeal across the Asia Pacific region without industry-wide efforts to harmonize input standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.66% |

|

Segments Covered |

By Product, Distribution Channel, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific |

|

Market Leaders Profiled |

Wacom Co., Ltd., XP-PEN Technology Co., Ltd., Samsung Electronics Co., Ltd., Apple Inc., Microsoft Corporation, Adonit, Huion Animation Technology Co., Ltd., Lenovo Group Limited, Dell Technologies Inc., HP Inc., STAEDTLER Mars GmbH & Co. KG, Anoto Group AB, Hanvon Technology Co., Ltd., Logitech International S.A., Gaomon Technology Corporation, Parblo Tech Co., Ltd., UGREEN, Toshiba Corporation, Sony Corporation, Chuwi Innovation Limited |

SEGMENTAL ANALYSIS

By Product Type Insights

The capacitive stylus segment was the largest in the Asia Pacific stylus pen market capturing 48.41% of the total share in 2024. This dominance is primarily due to the widespread adoption of capacitive touchscreens across consumer electronics especially in smartphones and tablets. Capacitive styluses offer superior precision, pressure sensitivity,y, and palm rejection features making them ideal for creative professionals, students, and general users. The growth of digital art, e-learning platforms, and remote work culture has further fueled demand. Additionally, companies like Samsung and Apple have integrated stylus compatibility into flagship devices such as Galaxy Tab S9 and iPad Pro respectively. UNESCO reported that over 260 million students were engaged in digital learning in APAC as of 2023. Governments in countries like India and Indonesia have launched tablet-based education programs which further amplify the need for stylus pens.

The active stylus segment is anticipated to witness a CAGR of 13.5% from 2025 to 2033. Active styluses are equipped with built-in electronics and offer advanced features such as pressure sensitivity, tilt detection,n, and programmable buttons while making them ideal for professional-grade applications like graphic design, animation, and CAD modeling. One of the key drivers behind this growth is the surge in demand for high-end tablets and hybrid devices that support active stylus functionality. Moreover, the rise in remote working and digital content creation has spurred the use of active styluses. Education institutions are also integrating active styluses into digital classrooms. Another critical driver is the development of low-latency technologies. Wacom, a key player in the stylus industry has increased its sales of its active stylus products across APAC in 2023 which is driven by innovations reducing latency to less than 2ms thereby enhancing real-time responsiveness for creatives.

By Distribution Channel Insights

The online distribution channel segment dominated the Asia Pacific stylus pen market by capturing 56.59% of the total market share in 2024. This trend reflects the broader shift in consumer behavior towards e-commerce platforms for purchasing tech accessories. E-commerce giants like Amazon, Flipkart, and Lazada have made stylus pens more accessible to a vast customer base across both urban and rural areas. Retail e-commerce sales in APAC reached $3.1 trillion in 2023 and accounted for nearly 62% of global online retail sales thereby indicating robust digital infrastructure and consumer trust in online shopping. Brands such as Adonit and Wacom have seen a 30–40% revenue increase from their online stores in APAC markets during the same period. Online channels also offer consumers the convenience of product comparisons, reviews, and competitive pricing. Platforms like TikTok Shop and Shopee have introduced live-streamed product demos and flash sales which influence purchase decisions among younger demographics.

The offline distribution channel segment is predicted to witness the highest CAGR of 11.2% during 2025 and 2033. This resurgence is largely attributed to the preference for tactile experiences and immediate availability in certain regions. In many parts of South Asia and Southeast Asia where digital literacy remains low consumers still favor brick-and-mortar stores to physically examine and test stylus pens before purchasing. In India, over 60.99% of first-time tech accessory buyers preferred offline stores in 2023. Educational institutions and B2B sectors continue to be major contributors to offline sales. Schools and colleges often procure stylus pens in bulk through local educational supply vendors or electronics distributors. In Indonesia, over 1.2 million stylus-compatible tablets via local dealers in 2023 thereby supporting the revitalization of offline channels. Moreover, brand presence through company-owned retail outlets and authorized resellers is growing. Samsung and Apple operate more than 500 combined retail stores across APAC many of which feature in-store demonstrations of stylus pens thus driving impulse purchases and brand loyalty. In countries like Vietnam and Thailand stylus pens are often sold alongside phones and tablets as bundled accessories. Local telecom shops report that up to 25.98% of smartphone buyers opted for stylus pens at the point of sale.

By Application Insights

The tablets segment held 42.2% of the Asia Pacific stylus pen market share in 2024. This is primarily due to the increased integration of stylus support in mainstream tablet models and their extensive usage across multiple sectors. Tablets are widely used in education, healthcare, design,n, and enterprise environments which benefit from stylus-based input for note-taking, sketching, and annotation. In China, the Ministry of Education launched a national initiative in 2023 to equip every primary and secondary school student with a digital learning device with over 60.51% of these being tablets compatible with stylus pens. Moreover, the popularity of creative applications such as Adobe Fresco, Autodesk SketchBoo,k, and Clip Studio Paint has driven the demand for stylus pens among digital artists and designers. Over 30 million creative professionals were using stylus-compatible software on tablets in APAC as of late 202 3. Companies in Japan and South Korea have adopted stylus-enabled tablets for field operations, digital documents, ion, and customer service. Fujitsu and Panasonic's ruggedized tablets with stylus support have seen double-digit growth in corporate procurement in these markets. Furthermore, the expansion of tablet-as-a-laptop alternatives has boosted stylus adoption. Devices like the iPad Pro and Samsung Galaxy Tab S9 have been marketed as productivity tools which are often bundled with styluses.

The interactive whiteboard segment is estimated to register a CAGR of 15.8% from 2025 to 2033. This rapid growth is closely linked to the digital transformation of classrooms and corporate meeting rooms across the region. Interactive whiteboards require precise input tools making stylus pens the most effective medium for annotation, drawing, and navigation. In schools, interactive whiteboards are being deployed under smart education programs. Corporate sectors in countries like Singapore and Australia are also adopting interactive whiteboards for collaborative meetings, presentations, and training sessions. Major technology firms such as SMART Technologies, Promethean, and BenQ have tailored their whiteboard offerings for APAC markets which are often bundling them with EMR (ElectroMagnetic Resonance) styluses. Moreover, the post-pandemic focus on hybrid learning and teleconferencing has led to a surge in demand for stylus-compatible whiteboards. In China, Huawei and Hisense jointly launched stylus-integrated whiteboards for remote classroom use and are selling over 150,000 units within six months of release.

By End-User Insights

The OEM (Original Equipment Manufacturer) segment was the largest segment in the Asia Pacific stylus pen market and held 65.71% of the total market share in 2024. This dominance is driven by the increasing integration of stylus pens as standard accessories in smartphones, tablets, and other touchscreen devices. Major electronics manufacturers such as Samsung, Apple,e, and Lenovo include stylus pens either as bundled accessories or optional add-ons when launching premium devices. Over 80.96% of stylus pens sold in APAC were distributed through OEM partnerships, ps especially in countries like China, Japan, and South Korea where consumer trust in branded devices is high. Additionally, educational and enterprise segments are increasingly purchasing devices with pre-installed stylus support thereby reducing the need for separate aftermarket purchases. In Japan, every student receives a tablet with a stylus thereby resulting in over 10 million units distributed nationwide in 2023. Furthermore, OEMs are investing in stylus innovation to enhance user experience. Wacom’s partnership with HP and Dell to integrate its EMR (ElectroMagnetic Resonance) technology into laptops and 2-in-1 devices has increased the demand for OEM-integrated styluses in the business sector.

The retail segment is swiftly emerging with a CAGR of 14.1% during the forecast period. This growth is fueled by the increasing demand from individual consumers seeking stylus upgrades, replacements, or niche-use options outside of OEM bundles. The rise of the gig economy and remote work has led to a surge in independent artists, designers, educators, and freelancers who require specialized stylus pens for creative and professional tasks. Aftermarket stylus manufacturers such as Adonit, XP-Pen, and Gaomon are capitalizing on this demand by offering affordable yet feature-rich alternatives to OEM pens. Additionally, rising awareness of stylus benefits beyond basic note-taking such as pressure sensitivity, programmable buttons, and Bluetooth connectivity are attracting a wider consumer base. Another contributing factor is the increasing availability of stylus pens in local electronics markets and online platforms.

REGIONAL ANALYSIS

China was the top performer in the stylus pen market and accounted for 28.92% in 2024. China drives both the production and consumption of stylus pens as a global manufacturing hub for electronics and a leader in digital innovation. The country’s massive domestic market coupled with the presence of leading OEMs like Huawei, Xiaomi, and Lenovo contributes significantly to stylus pen demand. Huawei alone sold over 2.8 million stylus-compatible tablets in the second half of 2023. The country’s creative industry is also booming with over 15 million digital artists and designers operating in China as of 2023. E-commerce platforms like Alibaba and JD.com have further enabled widespread retail distribution thereby allowing both OEM and aftermarket stylus pens to reach consumers efficiently. Moreover, the rapid growth of remote work and digital note-taking in corporate environments has reinforced the utility of stylus pens in daily life.

India was positioned second in holding the dominant share of the Asia Pacific stylus pen market in 2024. The country’s growing emphasis on digital education, increasing smartphone and tablet penetratio,n, and a youthful demographic are key factors propelling growth. The Indian government’s "National Education Policy 2020" and various state-sponsored digital learning initiatives have led to a surge in tablet-based education. Under the Samagra Shiksha Abhiyan program, over 1.5 million tablets were distributed to students in rural and semi-urban areas in 2023. India added over 1.2 million freelancers in the digital arts and design fields in 2023 who rely on stylus pens for their work. India’s stylus pen market is poised for continued expansion as digital literacy rises and affordability improves.

Japan’s stylus pen market is likely to grow wita h a healthy CAGR in the coming years. Japan has consistently integrated stylus pens into education, enterprise, and creative industries. The Japanese government’s "GIGA School" initiative launched in 2020 was aimed to provide every student with a personal tablet and stylus. By early 2023, over 10 million devices had been distributed nationwide. This large-scale rollout significantly boosted stylus pen adoption in K-12 education. In addition to education, Japan’s aging population has led to increased use of stylus pens in healthcare and elderly care settings for digital documentation and patient communication. Hospitals and clinics are increasingly replacing paper records with stylus-based digital systems for ease of use and accuracy. Moreover, Japan’s rich tradition in digital art and manga has cultivated a strong market for premium stylus pens. Wacom reported a 20.16% increase in domestic sales of its Intuos and Cintiq stylus tablets in 2023.

South Korea’s stylus pen market is likely to have significant growth opportunities during the forecast period. The country’s technologically advanced infrastructure, high internet penetration, and strong education system contribute to steady growth in stylus adoption. The country’s education system is increasingly incorporating digital tools with many schools using tablets and stylus pens for interactive learning. The Korean Ministry of Education plans to digitize 80.44% of classrooms by 2025. Leading studios like NCSoft and Nexon utilize stylus pens in game design processes thereby contributing to sustained demand.

Australia’s stylus pen market growth is likely to have the fastest growth opportunities in the coming years. Australia’s market is characterized by high consumer spending, strong education standards, and a digitally adept workforce. The New South Wales Department of Education rolled out over 250,000 stylus-compatible tablets to students in 2023 as part of its Digital Learning Innovation Program. Digital device usage in tertiary education increased by 22.74% in 2023. The Australian Government’s push for electronic health records has led hospitals to adopt stylus-based tablets for patient charting and diagnostics.

LEADING PLAYERS IN THE ASIA PACIFIC STYLUS PEN MARKET

Wacom Co., Ltd.

Wacom is a leading name in digital pen technologies and has been instrumental in shaping the stylus pen ecosystem globally. This company is renowned for its premium product lines like Intuos and Bambosetts industry benchmarks in pressure sensitivity and precision. In the Asia Pacific market, the company maintains a strong presence through dedicated R&D centers in Japan and China thus enabling localized innovation tailored to diverse consumer needs. Wacom’s partnerships with major device manufacturers help integrate its stylus technology into tablets and PCs thereby reinforcing its global influence and enhancing user experience across creative and professional domains.

Samsung Electronics Co., Ltd.

Samsung plays a pivotal role in popularizing stylus pens through its S Pen series that accompanies Galaxy Note smartphones and Galaxy Tab devices. The company has successfully embedded stylus functionality into mainstream mobile computing which makes it a differentiator in competitive markets. In the Asia Pacific region, Samsung leverages its manufacturing base and distribution networks to dominate South Korea and expand aggressively into emerging markets like India and Southeast Asia. Its continuous innovation in stylus features such as low latency and air commands has significantly influenced global trends and raised consumer expectations.

Huion Group (XP-Pen, UGEE)

Huion, operating under brands like XP-Pen and UGEE has rapidly emerged as a formidable competitor by offering cost-effective yet high-performance stylus products. Huion targets both casual users and professional creators with a wide range of stylus pens compatible across platforms with a strong foothold in China and growing traction in other APAC countries. The company’s aggressive pricing strategy and focus on product accessibility have enabled it to challenge established players. Huion contributes significantly to expanding the global stylus pen user base by investing heavily in online marketing and global e-commerce.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product innovation and differentiation is one of the primary strategies employed by key players in the Asia Pacific stylus pen market. Companies are continuously enhancing stylus features such as pressure sensitivity, tilt recognition, and battery-free operation to cater to evolving consumer demands. These innovations help firms stand out in a competitive landscape while addressing niche requirements in design, education,n and enterprise applications.

Another significant approach is strategic partnerships and collaborations. Leading companies often collaborate with hardware manufacturers to integrate their stylus technology directly into devices like tablets, laptops, and smartphones. These alliances ensure compatibility and increase adoption rates thereby creating a seamless user experience that strengthens brand loyalty and market penetration across the region.

Expansion into emerging markets through localized offerings is a critical growth tactic. Firms are tailoring their product portfolios to suit regional preferences, language support,t, and price points in countries like India, Indonesia, and Vietnam. This strategy enables wider reach and deeper engagement with new customer segments thereby fueling long-term sustainable growth in the dynamic Asia Pacific region.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Asia Pacific stylus pen market include Wacom Co., Ltd., XP-PEN Technology Co., Ltd., Samsung Electronics Co., Ltd., Apple Inc., Microsoft Corporation, Adonit, Huion Animation Technology Co., Ltd., Lenovo Group Limited, Dell Technologies Inc., HP Inc., STAEDTLER Mars GmbH & Co. KG, Anoto Group AB, Hanvon Technology Co., Ltd., Logitech International S.A., Gaomon Technology Corporation, Parblo Tech Co., Ltd., UGREEN, Toshiba Corporation, Sony Corporation, Chuwi Innovation Limite.d

The Asia Pacific stylus pen market is marked by intense competition driven by rapid technological advancements and increasing consumer demand for precision input tools. A mix of established global players and emerging regional brands coexist where each strives to capture market share through innovation, strategic alliances, and targeted marketing. Giants like Wacom and Samsung maintain dominance with premium offerings and integrated ecosystems while companies such as Huion and Adonit are gaining traction by providing cost-competitive alternatives without compromising performance. This competitive diversity fosters continuous product development and feature enhancement. Additionally, the rise of local manufacturers in China and India further intensifies rivalry while pushing well-established firms to refine their strategies. As end-user preferences evolve across application areas like education, design,n and enterprise where the race to deliver superior user experiences becomes more pronounced. Competitive dynamics are also shaped by the integration of stylus support in mainstream devices thereby prompting companies to align closely with original equipment manufacturers. This multi-layered environment ensures sustained innovation and growth within the Asia Pacific stylus pen market.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Wacom launched a new line of stylus pens designed specifically for educational institutions in the Asia Pacific region.

- In March 2024, Samsung expanded its S Pen integration to include more budget-friendly Galaxy Tab models and targeting a broader audience in emerging markets across Southeast Asia.

- In June 2024, Huion introduced a direct-to-consumer e-commerce platform tailored for the Indian market while improving local accessibility and after-sales service.

- In September 2024, XP-Pen announced a partnership with a leading Chinese tablet manufacturer to embed its stylus technology into a new lineup of Android-based drawing tablets.

- In November 2024, Adonit unveiled a refreshed suite of stylus-compatible apps optimized for note-taking and digital annotation thereby targeting professionals and students in Australia and Japan.

MARKET SEGMENTATION

This research report on the Asia Pacific Stylus Pen Market has been segmented and sub-segmented based on product, distribution channel, application, end user, and region.

By Product

- Capacitive Stylus

- Active Stylus

By Distribution Channel

- Online

- Offline

By Application

- Tablets

- Interactive Whiteboard

By End User

- Oem (Original Equipment Manufacturer)

- Retail

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the stylus pen market in the Asia Pacific region?

The market is driven by increasing demand for touchscreen devices, growing adoption of digital learning and remote work, and advancements in stylus technology offering enhanced precision and pressure sensitivity.

2. Which countries contribute significantly to the Asia Pacific stylus pen market?

Major contributors include China, Japan, South Korea, India, and Taiwan due to their strong electronics manufacturing base and high consumer adoption rates.

3. Who are the major players in this market?

Key players include Wacom, XP-PEN, Samsung, Apple, Microsoft, Lenovo, and Huion, among others.

4. How is the stylus pen market segmented?

It is segmented by product type (active, passive), application (smartphones, tablets, PCs), end-user (individual, commercial, educational), and region.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com