Asia Pacific Supply Chain Analytics Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Solution, Deployment, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Supply Chain Analytics Market Size

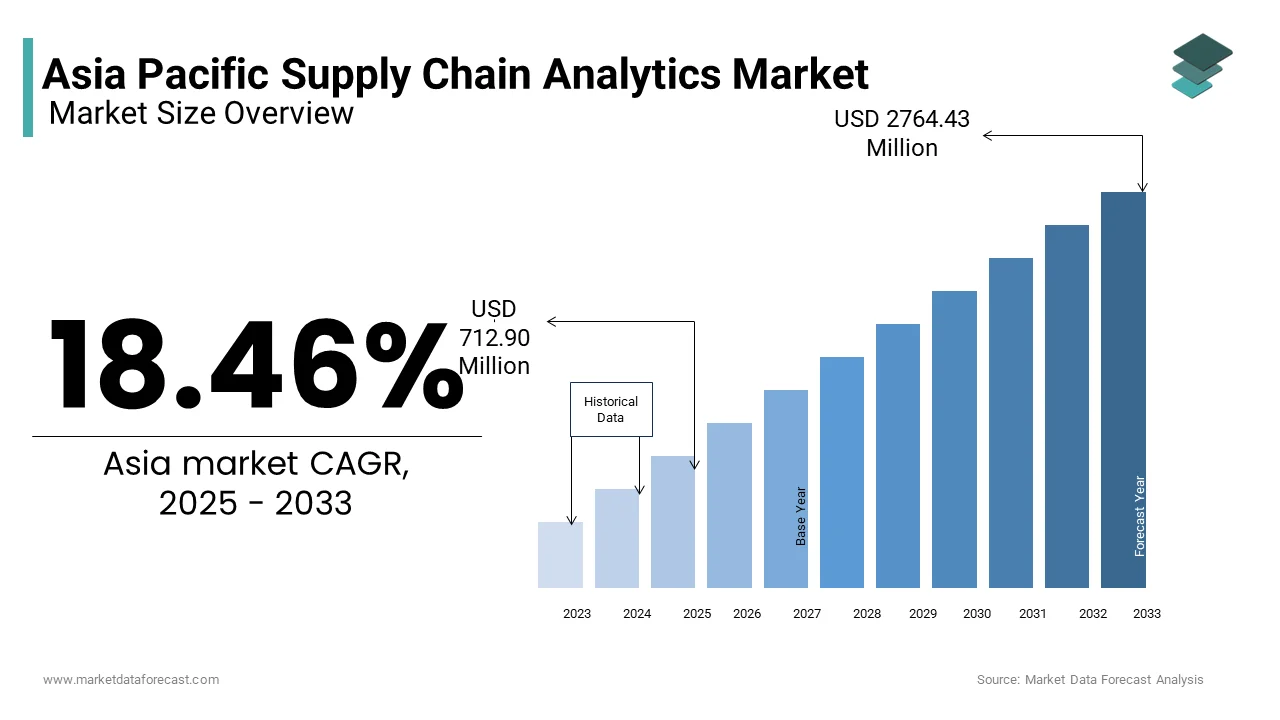

The Asia Pacific Supply chain analytics market was valued at USD 601.81 million in 2024 and is anticipated to reach USD 712.90 million in 2025 from USD 2764.43 million by 2033, growing at a CAGR of 18.46% during the forecast period from 2025 to 2033.

Supply chain analytics involves the collection, processing, and analysis of vast amounts of structured and unstructured data to improve decision-making, enhance operational efficiency, and reduce costs. According to Deloitte, over 60% of enterprises in the region have adopted some form of analytics tools to manage their supply chains, underscoring its growing importance. For instance, companies like Alibaba and Toyota are using predictive analytics to anticipate demand fluctuations and optimize inventory management. Additionally, the rise of Industry 4.0 initiatives has accelerated the adoption of technologies like IoT-enabled devices and cloud-based platforms, which generate real-time insights into supply chain performance.

MARKET DRIVERS

Rising Complexity of Global Supply Chains

The increasing complexity of global supply chains is a significant driver of the supply chain analytics market in the Asia Pacific. The region’s role as a manufacturing hub for industries like electronics, automotive, and textiles has created intricate supply networks spanning multiple countries. According to the World Economic Forum, over 50% of global trade flows pass through the Asia Pacific, making it critical for businesses to adopt analytics tools to manage cross-border logistics, regulatory compliance, and supplier relationships. For example, companies in South Korea and Japan use AI-driven analytics to monitor supplier performance and mitigate risks associated with geopolitical uncertainties or natural disasters. Additionally, the growing emphasis on just-in-time (JIT) manufacturing has amplified the need for real-time visibility into supply chain operations. A study by McKinsey & Company revealed that organizations leveraging predictive analytics can reduce supply chain disruptions by up to 30%, ensuring timely deliveries and minimizing costs.

Growing Adoption of E-Commerce Platforms

Another major driver is the exponential growth of e-commerce platforms, which rely heavily on supply chain analytics to ensure seamless order fulfillment and delivery. According to Statista, the e-commerce market in the Asia Pacific is projected to grow by 25% annually, which is creating a robust demand for advanced analytics solutions that optimize warehousing, transportation, and last-mile delivery. For instance, companies like Flipkart and JD.com are using ML algorithms to analyze consumer behavior and predict purchasing patterns, enabling them to stock products strategically and reduce delivery times. Additionally, the integration of IoT devices in logistics operations allows businesses to track shipments in real time, improving transparency and customer satisfaction.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints facing the Asia Pacific supply chain analytics market is the high cost associated with implementing advanced analytics platforms, particularly for small and medium-sized enterprises (SMEs). Deploying enterprise-grade systems requires substantial investments in hardware, software, and skilled personnel. Additionally, the shortage of professionals proficient in data science and analytics further compounds the issue. For example, a survey by KPMG revealed that over 70% of SMEs in Southeast Asia struggle to recruit qualified analysts, forcing them to rely on external consultants or managed service providers. These financial and resource constraints hinder widespread adoption in developing economies where logistics infrastructure is already underdeveloped.

Data Privacy and Security Concerns

Another significant restraint is the growing concern over data privacy and security, particularly as supply chain analytics relies heavily on sensitive business data. Cyberattacks targeting supply chain networks have become increasingly sophisticated by posing a threat to the integrity and confidentiality of information. According to Check Point Research, the logistics sector experienced a 45% increase in cyberattacks in 2022, with ransomware being the most prevalent threat. For instance, ports in Thailand and Malaysia reported breaches that disrupted operations and exposed supplier data, undermining trust in digital tools. Additionally, fragmented regulatory frameworks across the region exacerbate the issue, as countries like India and Indonesia lack comprehensive data protection laws. This inconsistency complicates compliance efforts, discouraging organizations from adopting analytics solutions due to potential legal and reputational risks.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of emerging technologies such as blockchain and edge computing presents a transformative opportunity for the Asia Pacific supply chain analytics market. Blockchain technology offers unparalleled transparency and security by creating immutable records of transactions, which is particularly valuable for tracking goods across complex supply chains. According to Deloitte, blockchain-enabled analytics can reduce fraud-related losses by up to 40% by making it highly attractive to industries like pharmaceuticals and luxury goods. For example, companies in Singapore and Australia are leveraging blockchain to ensure the authenticity of products and prevent counterfeiting. Additionally, edge computing allows for real-time data processing at the source, reducing latency and enhancing decision-making.

Expansion into Rural and Underserved Areas

Another promising opportunity lies in expanding supply chain analytics solutions to rural and underserved areas within the Asia Pacific region. Countries like Vietnam, Indonesia, and the Philippines face significant disparities in logistics infrastructure, creating a robust demand for innovative tools that address inefficiencies. According to the World Bank, over 40% of rural populations in Southeast Asia lack access to reliable transportation and warehousing facilities, amplifying the need for scalable solutions. For instance, startups in India are using AI-driven analytics to optimize last-mile delivery in remote villages, ensuring continuity of supply for essential goods. Additionally, government-led initiatives promoting rural development have further bolstered the market, encouraging investments in cost-effective and sustainable technologies. ss

MARKET CHALLENGES

Shortage of Skilled Workforce

The scarcity of skilled professionals proficient in supply chain analytics and data science poses a significant challenge to the market’s growth. According to Cybersecurity Ventures, the global shortage of data scientists and analysts is expected to reach 3.5 million unfilled positions by 2025, with the Asia Pacific accounting for nearly 40% of this deficit. In countries like Malaysia and Thailand, universities produce fewer than 500 data analytics specialists annually, far below industry requirements. This shortage forces organizations to either outsource critical functions or operate with understaffed teams, increasing the risk of inefficiencies and suboptimal outcomes. Additionally, the rapid evolution of analytics technologies necessitates continuous upskilling, which many professionals struggle to achieve due to limited access to advanced training programs. For instance, a survey by EY revealed that only 25% of supply chain practitioners in the region receive regular training updates.

Resistance to Digital Transformation Among Traditional Enterprises

Another pressing challenge is the resistance to digital transformation among traditional enterprises, particularly in rural and semi-urban areas. Many businesses underestimate the importance of adopting advanced analytics tools, viewing them as unnecessary or overly complex rather than as enablers of competitive advantage. According to Grant Thornton, over 60% of SMEs in the region do not integrate analytics into their supply chain operations. This complacency stems from limited understanding of potential risks and the perceived complexity of implementation. Furthermore, the absence of dedicated IT departments in smaller organizations exacerbates the problem, as employees often lack the technical knowledge to identify and mitigate gaps. This lack of awareness not only hampers innovation but also undermines broader efforts to create a technologically advanced ecosystem, as excluded enterprises cannot contribute to or benefit from the digital transformation of supply chains.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.46% |

|

Segments Covered |

By Solution, Deployment and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

SAP SE, Oracle Corporation, IBM Corporation, SAS Institute Inc., Manhattan Associates, Inc., MicroStrategy, Inc., Lockheed Martin Corporation, Accenture PLC, Genpact Limited, A.P. Moller - Maersk A/S SAP SE, Oracle Corporation, IBM Corporation, SAS Institute Inc., Manhattan Associates, Inc., MicroStrategy, Inc., Lockheed Martin Corporation, Accenture PLC, Genpact Limited, A.P. Moller - Maersk A/S. |

SEGMENTAL ANALYSIS

By Solution Insights

The manufacturing segment dominated the Asia Pacific supply chain analytics market with 55.4% of share in 2024. According to the World Economic Forum, over 60% of global manufacturing activities are concentrated in the Asia Pacific region by making it imperative for enterprises to adopt advanced analytics tools to enhance operational efficiency. For instance, automotive manufacturers in Japan and South Korea leverage predictive analytics to anticipate demand fluctuations and optimize just-in-time (JIT) production systems by reducing costs and minimizing waste. Another driving factor is the increasing emphasis on sustainability and compliance with environmental regulations. A study by PwC revealed that over 70% of manufacturing firms in the region prioritize analytics solutions to monitor energy consumption and carbon emissions by aligning with global sustainability goals.

The logistics analytics segment is projected to grow at CAGR of 22.3% in the next coming years. This rapid expansion is fueled by the growing complexity of logistics networks and the need for real-time visibility into supply chain operations. For example, e-commerce giants like Alibaba and Flipkart are using AI-driven analytics to optimize warehousing, transportation, and last-mile delivery, ensuring timely order fulfillment and customer satisfaction. Another contributing factor is the integration of IoT-enabled devices into logistics operations, enabling real-time tracking and monitoring of shipments.

By Deployment Insights

The on-premise deployment segment was the largest by occupying 60.5% of the Asia Pacific supply chain analytics market share in 2024 owing to the widespread adoption of on-premise solutions among large enterprises, particularly in industries like manufacturing and healthcare, where data security and control are paramount. According to the International Data Corporation (IDC), over 70% of large organizations in the region prefer on-premise systems to manage sensitive supply chain data, ensuring compliance with stringent regulatory requirements. For instance, automotive manufacturers in Japan and South Korea rely on on-premise analytics platforms to maintain complete control over their data, which is mitigating risks associated with cyberattacks and data breaches.

Another driving factor is the growing complexity of IT infrastructures. As organizations expand their digital footprints, they require adaptable solutions that can integrate seamlessly with existing systems.

The cloud deployment segment is likely to grow with a CAGR of 24.5% in the next coming years. This rapid expansion is fueled by the increasing affordability and scalability of cloud-based platforms, which enable businesses to access real-time analytics without significant upfront investments. For instance, small and medium-sized enterprises (SMEs) in India and Southeast Asia are adopting cloud-based solutions to enhance supply chain visibility and optimize operations. Another contributing factor is the integration of AI and machine learning into cloud platforms by enabling predictive and prescriptive analytics.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China was the top performer in the Asia Pacific supply chain analytics market with 35.4% of the share in 2024. The country’s massive manufacturing base and complex logistics networks have created a fertile ground for analytics adoption. Enterprises across industries like electronics, automotive, and textiles rely heavily on advanced analytics tools to manage cross-border supply chains and mitigate risks. According to the National Bureau of Statistics of China, over 60% of large manufacturers have integrated analytics solutions into their operations. Government initiatives promoting Industry 4.0 technologies have further accelerated investments in scalable and cost-effective solutions, solidifying China’s position as the market leader.

Japan was positioned second with 18.6% of the Asia Pacific supply chain analytics market share in 2024. The country’s advanced technological infrastructure and emphasis on precision have positioned it as a leader in adopting AI-driven analytics solutions. Japanese corporations prioritize efficiency and innovation, particularly in industries like automotive and electronics. According to the Japan External Trade Organization, over 70% of large enterprises use analytics platforms to enhance operational efficiency and compliance. Additionally, the integration of robotics and automation into supply chain operations has gained traction by enabling seamless and scalable solutions.

India’s booming population and rapid urbanization are major drivers of the Asia Pacific supply chain analytics market growth. Indian enterprises are increasingly leveraging analytics tools to address mounting logistics challenges, such as inefficiencies in last-mile delivery and warehousing. According to the Ministry of Commerce and Industry, over 50% of urban municipalities promote analytics solutions as part of their smart city initiatives, encouraging businesses to adopt innovative technologies. Additionally, government-led programs promoting digital transformation have further bolstered the market by ensuring steady growth.

South Korea’s focus on innovation and digital transformation has driven the adoption of advanced analytics solutions. South Korean enterprises, particularly in the electronics and automotive sectors, rely on analytics platforms to manage complex supply chains while ensuring environmental compliance. According to the Korea Chamber of Commerce and Industry, over 50% of large corporations have implemented analytics systems to enhance operational efficiency and sustainability. These innovations position South Korea as a key player in the regional market.

Australia’s strong emphasis on regulatory compliance and corporate governance are prompting the growth of the Asia pacific supply chain analytics market growth. Australian enterprises spend significant resources on developing analytics tools to meet stringent environmental and safety standards. According to the Australian Department of Industry, Science, and Resources, over 40% of legal disputes arise from poorly managed supply chains, incentivizing businesses to adopt advanced analytics solutions.

KEY MARKET PLAYERS

SAP SE, Oracle Corporation, IBM Corporation, SAS Institute Inc., Manhattan Associates, Inc., MicroStrategy, Inc., Lockheed Martin Corporation, Accenture PLC, Genpact Limited, A.P. Moller - Maersk A/S. are the market players that are dominating the Asia Pacific supply chain analytics market.

Top Players in the Market

SAP

SAP is a global leader in the supply chain analytics market, which is offering robust solutions that integrate seamlessly with enterprise resource planning (ERP) systems. Its platforms enable organizations to manage complex supply chains by providing real-time insights, predictive analytics, and automation. SAP’s emphasis on sustainability and ethical governance aligns with the growing demand for transparent and accountable business practices. Its focus on innovation and scalability positions it as a trusted partner for multinational corporations seeking standardized analytics solutions globally.

IBM

IBM specializes in AI-driven supply chain analytics platforms that cater to industries like manufacturing, retail, and healthcare. Its solutions emphasize advanced capabilities such as machine learning, IoT integration, and blockchain-enabled transparency, empowering organizations to optimize operations and mitigate risks effectively. IBM has strengthened its presence in the Asia Pacific by investing in cloud-based tools and fostering collaborations with startups and academic institutions.

Oracle

Oracle offers cloud-based supply chain analytics platforms that provide end-to-end visibility across operations, ensuring alignment with global and regional regulations. Enterprises leverage Oracle’s tools to streamline processes such as inventory management, demand forecasting, and supplier collaboration. Oracle has deepened its engagement in the Asia Pacific by tailoring its offerings to meet local needs, such as data privacy laws in Japan and Australia. Its emphasis on sustainability and cutting-edge research reinforces its dominance in the global supply chain analytics ecosystem.

Top Strategies Used By Key Players In The Market

Integration of Artificial Intelligence and Machine Learning

Leading players are increasingly incorporating artificial intelligence (AI) and machine learning (ML) into their supply chain analytics platforms to enhance functionality and adaptability. These technologies enable predictive analytics, real-time decision-making, and automation, addressing complex challenges in areas such as demand forecasting and risk management. For instance, AI-driven systems can analyze vast datasets to identify patterns, predict disruptions, and recommend corrective actions, ensuring alignment with evolving market dynamics. This strategy not only improves operational efficiency but also differentiates vendors in a competitive market, positioning them as innovators in the supply chain analytics space.

Expansion Through Strategic Partnerships

Strategic partnerships with local enterprises, governments, and industry bodies have become a cornerstone of success in the Asia Pacific supply chain analytics market. Collaborations with public sector organizations help promote awareness campaigns and regulatory compliance initiatives, fostering trust among stakeholders. Additionally, partnerships with technology firms facilitate the integration of advanced tools, ensuring scalability and reliability. These alliances enable companies to expand their reach and influence across diverse markets by catering to the unique needs of industries such as manufacturing, retail, and logistics.

Focus on Localization and Customization

Key players are prioritizing localization and customization to address the unique needs of businesses in the Asia Pacific region. This approach not only enhances user experience but also fosters brand loyalty. Additionally, customization allows companies to adapt their solutions to specific industries, such as rural logistics and e-commerce, ensuring relevance and applicability in diverse operational contexts. By tailoring their offerings to local regulations and cultural nuances, players can strengthen their market position and drive sustainable growth.

COMPETITION OVERVIEW

The Asia Pacific supply chain analytics market is characterized by intense competition, driven by a mix of global giants and regional innovators striving to capture market share. Established players like SAP, IBM, and Oracle bring extensive resources and technological expertise, enabling them to dominate key segments such as AI-driven analytics and cloud-based platforms. At the same time, regional companies leverage their deep understanding of local cultures and regulatory frameworks to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements, which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies, particularly in emerging markets. Additionally, the rise of digital transformation initiatives has created new opportunities for differentiation, as companies strive to offer seamless and scalable solutions. This interplay of innovation, localization, and strategic positioning ensures that the market remains vibrant and highly contested.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, SAP launched a new AI-powered module tailored to address the growing complexity of cross-border logistics in Southeast Asia. This initiative aims to enhance its market presence by offering region-specific solutions that align with local regulatory frameworks.

- In June 2023, IBM partnered with a leading retail chain in Australia to integrate its supply chain analytics platform with the firm’s existing ERP systems. This collaboration seeks to streamline inventory management and improve operational efficiency for end-users.

- In September 2023, Oracle introduced a blockchain-enabled feature to ensure tamper-proof records for supply chain transactions in India. This move strengthens its prominence in ethical governance practices and addresses growing concerns about transparency.

- In February 2024, SAP acquired a regional startup specializing in AI-driven predictive analytics for logistics networks. This acquisition allows SAP to expand its capabilities in proactive risk management, catering to the evolving needs of enterprises in the Asia Pacific region.

- In November 2023, IBM collaborated with a government agency in Singapore to promote the adoption of supply chain analytics tools among small and medium-sized enterprises (SMEs). This initiative aims to foster digital resilience and increase market penetration among underserved segments.

MARKET SEGMENTATION

This research report on the Asia Pacific supply chain analysis market is segmented and sub-segmented int the following categories.

By Solutions

- Sales & Operations Analytics

- Logistics Analytics

- Manufacturing Analytics

- Planning & Procurement

- Visualization & Reporting

By Deployment

- Cloud

- On-Premise

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How are regional trade agreements influencing supply chain visibility and analytics adoption in APAC?

Agreements like RCEP and CPTPP are pushing companies to use advanced analytics for real-time shipment tracking and regulatory compliance across borders, enhancing efficiency and transparency.

What role does cloud-based analytics play in transforming legacy supply chains in emerging APAC economies?

Cloud platforms enable scalable, low-cost analytics deployment in countries like Indonesia, Vietnam, and the Philippines, offering access to predictive insights without heavy infrastructure investment.

Which key KPIs are APAC organizations focusing on with modern supply chain analytics tools?

Top KPIs include lead time reduction, fill rate, cost-to-serve, and supplier performance—all increasingly tracked in real time through dashboards and integrated ERP analytics.

How are sustainability goals shaping analytics priorities in APAC’s supply chains?

Companies are leveraging carbon tracking, route optimization, and waste analytics to align with ESG mandates and consumer pressure—particularly in markets like Japan, Australia, and South Korea.

Why is demand forecasting becoming a top priority for supply chain analytics in APAC?

Due to volatile consumer behavior, geopolitical shifts, and climate risks, APAC firms are increasingly adopting AI-driven forecasting to reduce inventory costs and prevent stockouts, especially in sectors like retail and electronics.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]